Form FTB4905 PIT Offer in Compromise Application Form - California

What Is Form FTB4905 PIT?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

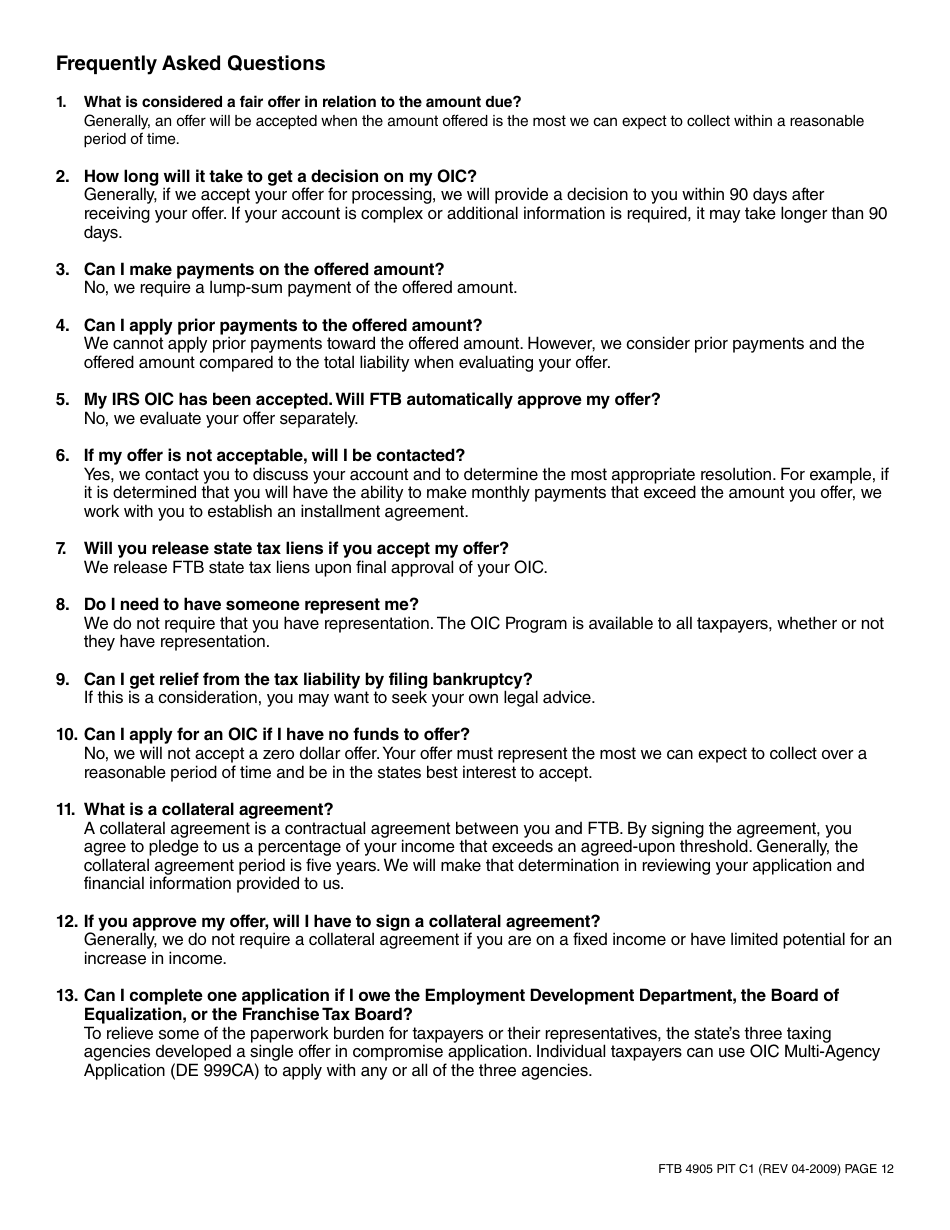

Q: What is Form FTB 4905 PIT?

A: Form FTB 4905 PIT is the Offer in Compromise Application Form used for individuals in California who are seeking to settle their tax debt with the Franchise Tax Board (FTB).

Q: What is an Offer in Compromise?

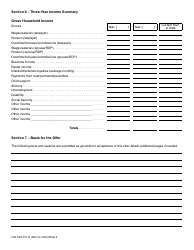

A: An Offer in Compromise is a program offered by the FTB that allows taxpayers to settle their tax debt for less than the full amount owed. It is based on the taxpayer's ability to pay.

Q: Who can use Form FTB 4905 PIT?

A: Form FTB 4905 PIT is specifically designed for individuals who owe personal income tax to the FTB in California.

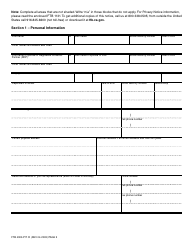

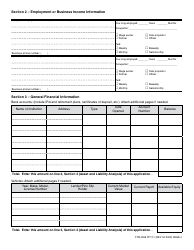

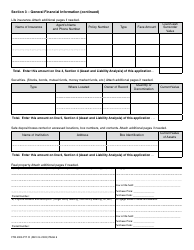

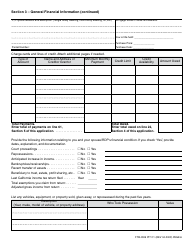

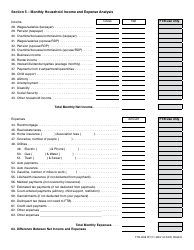

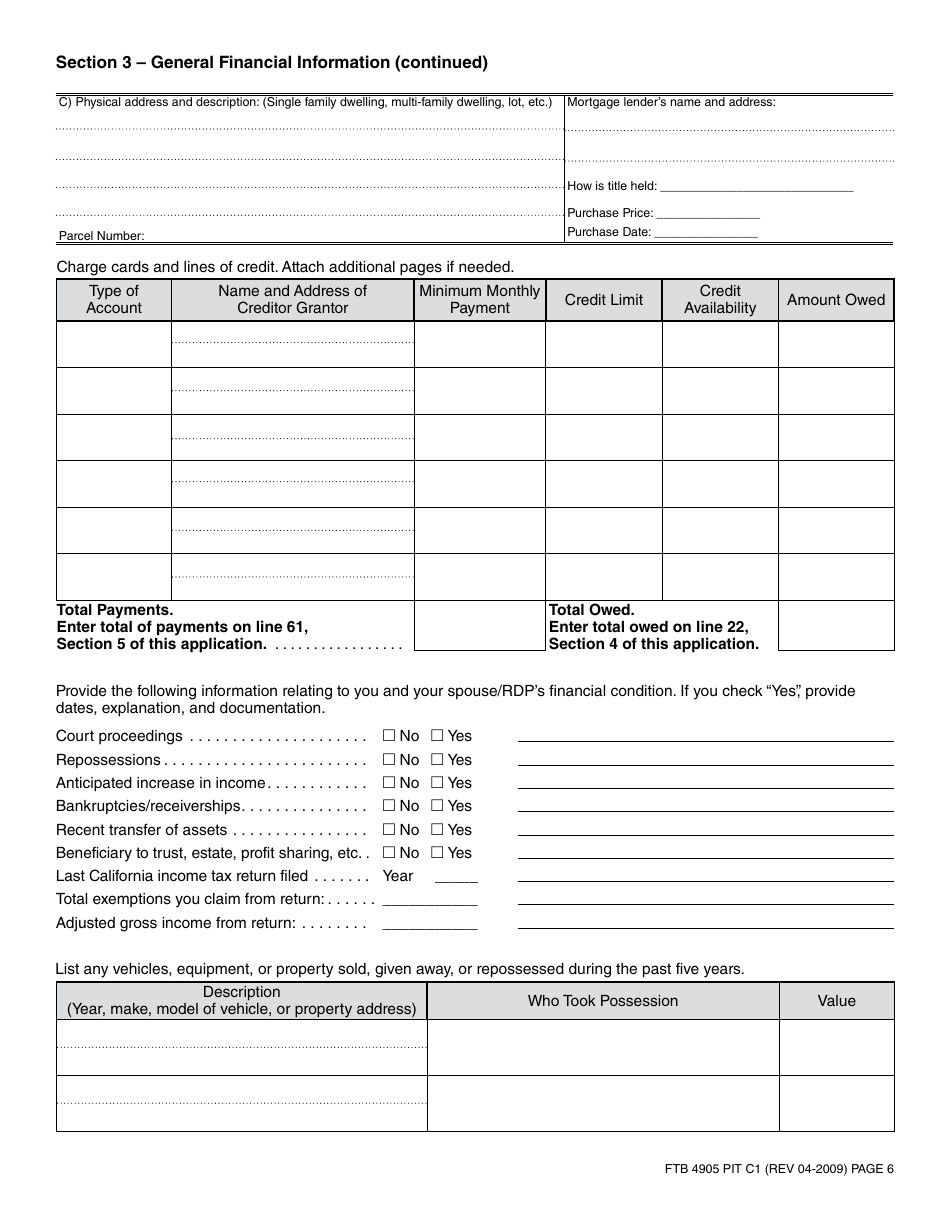

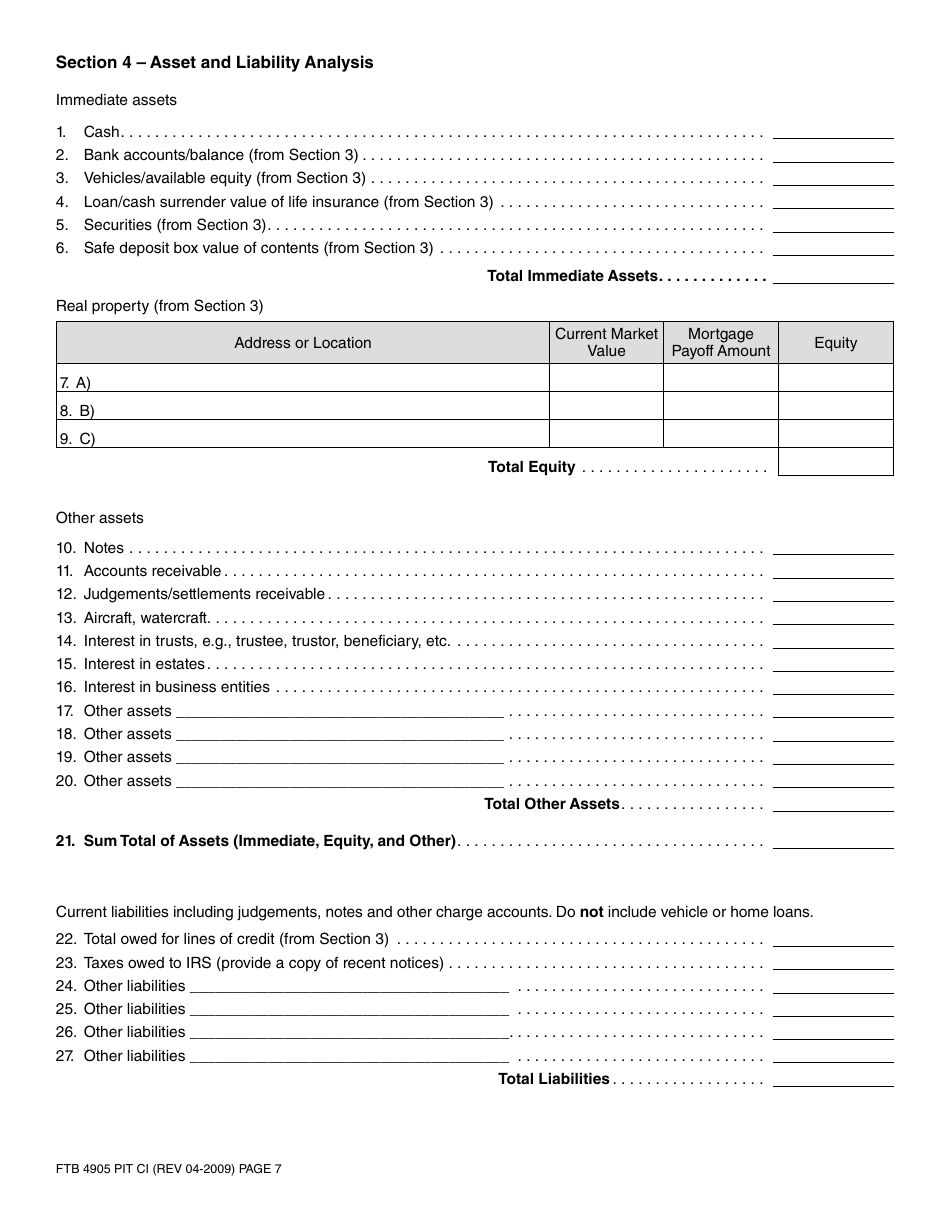

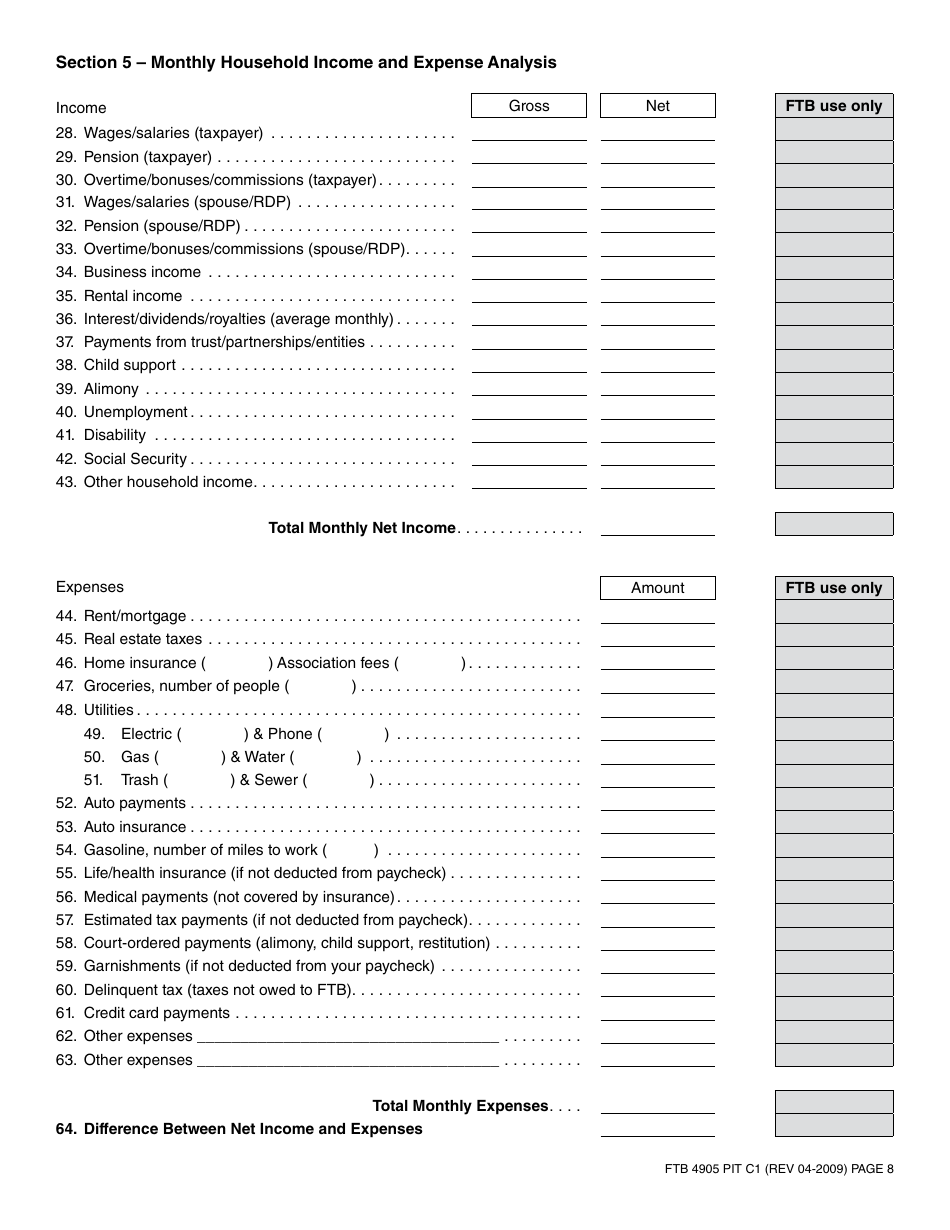

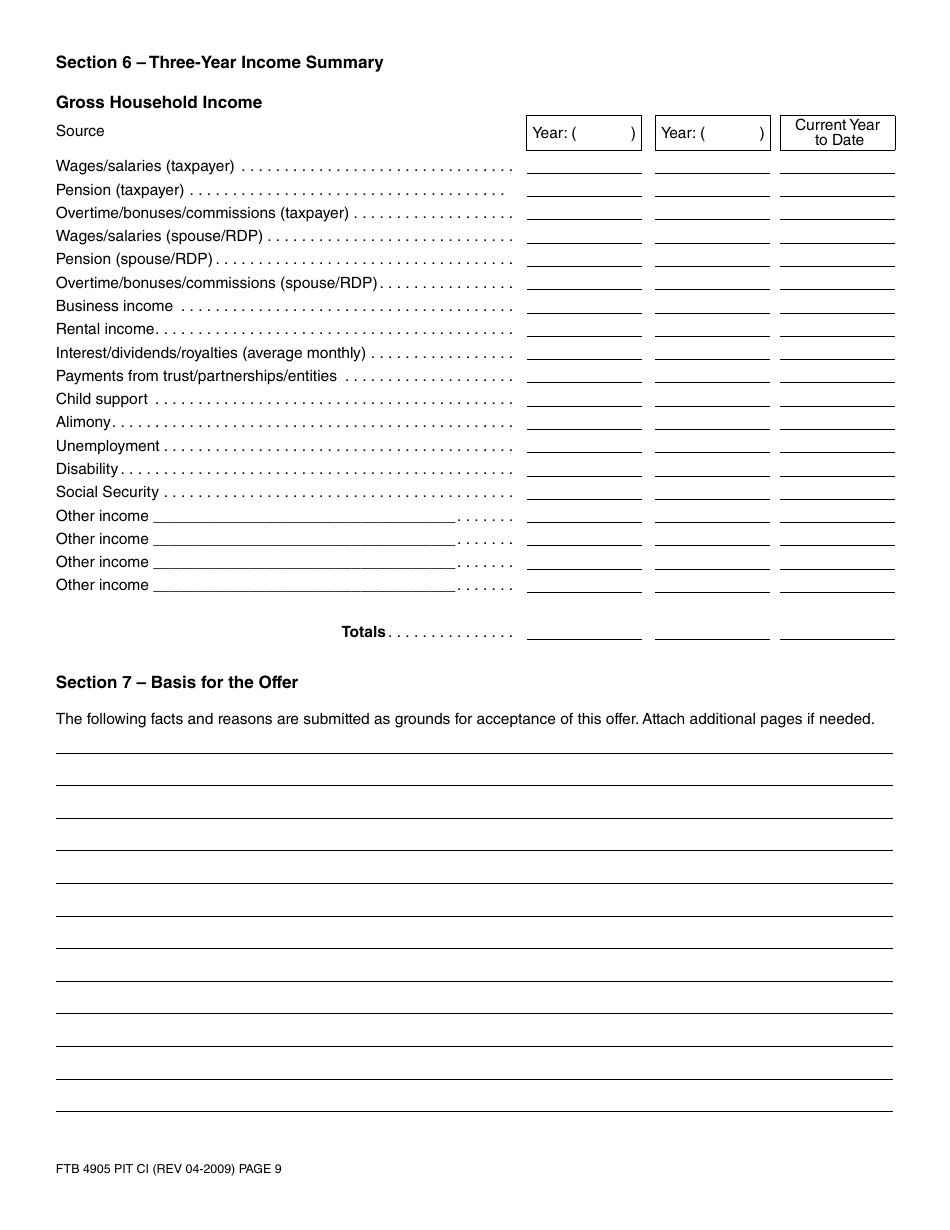

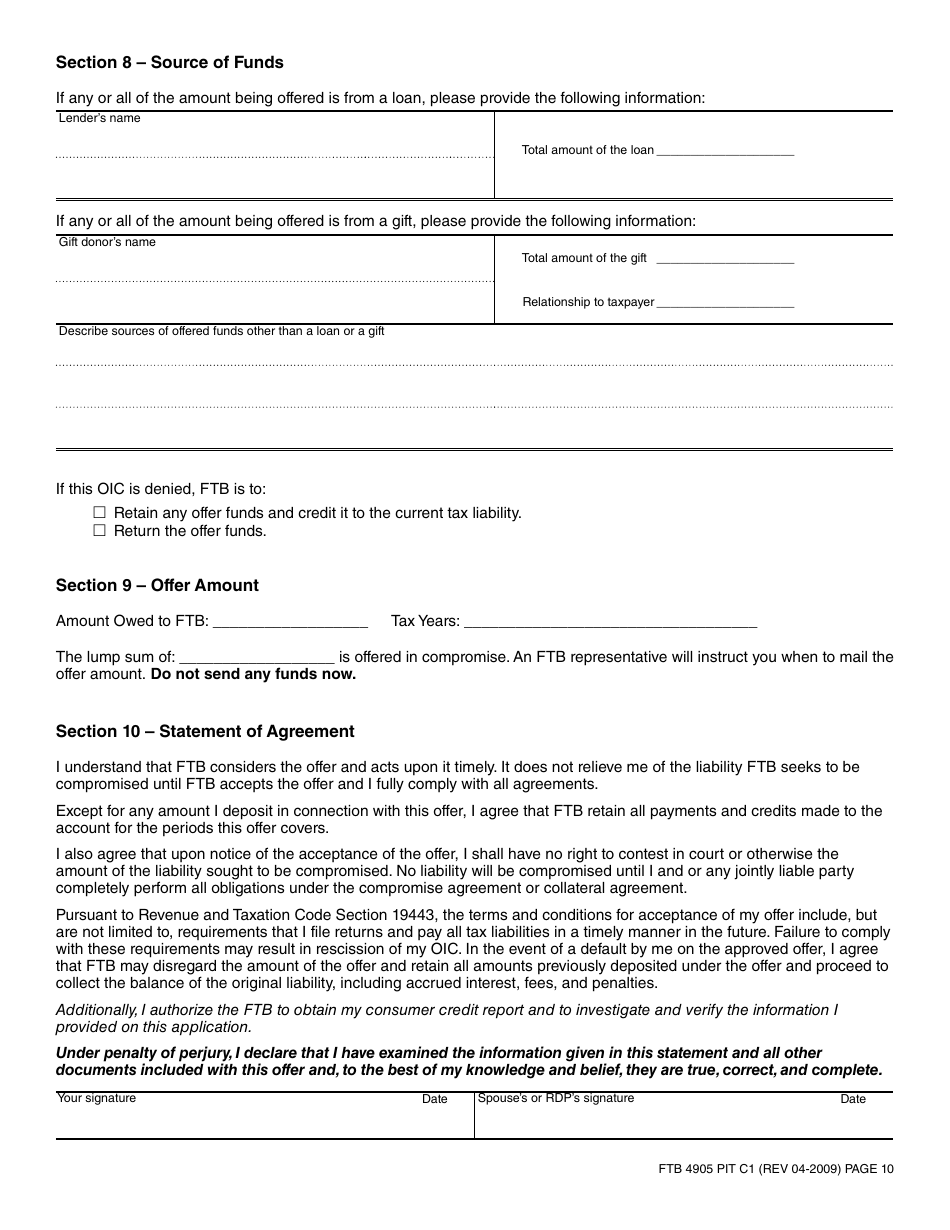

Q: What information is required on Form FTB 4905 PIT?

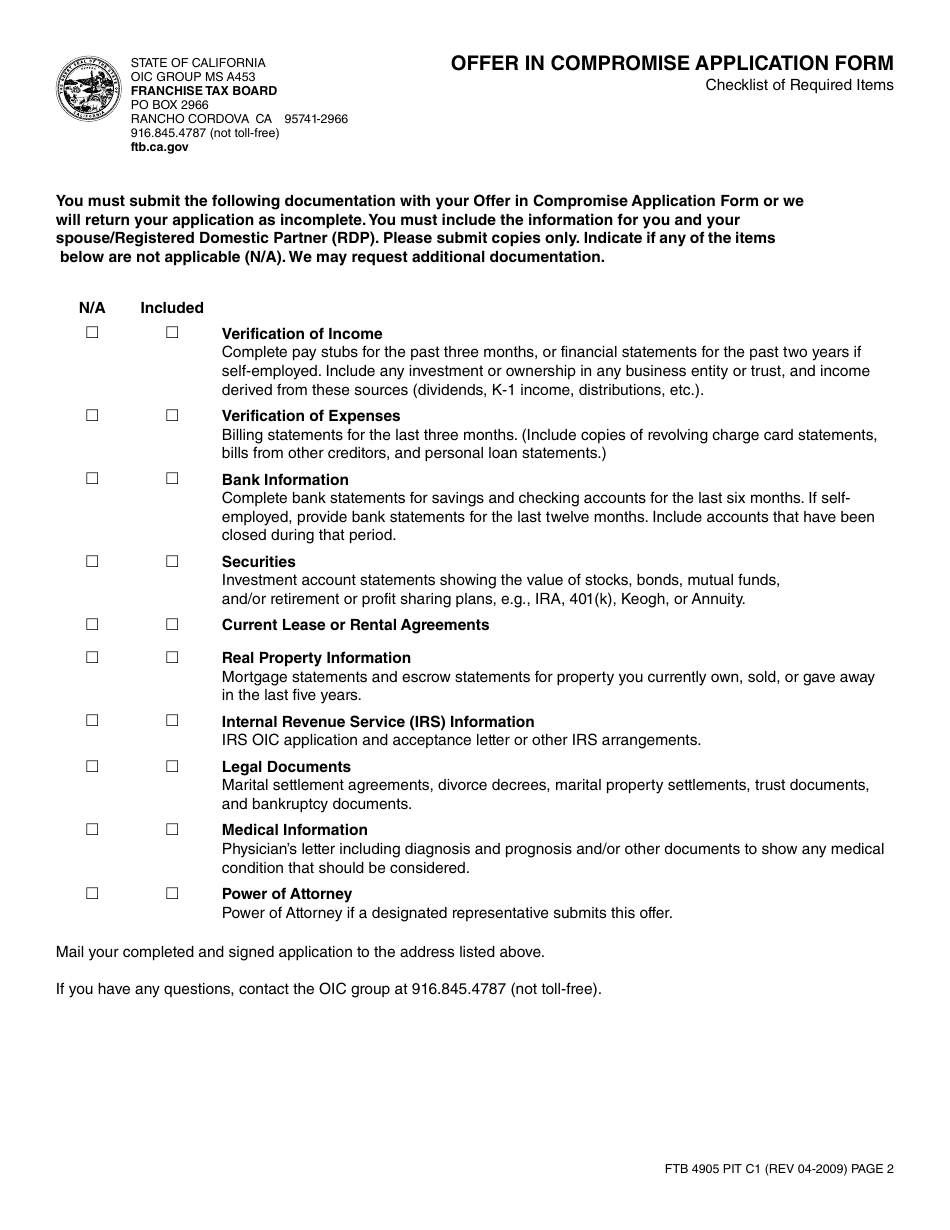

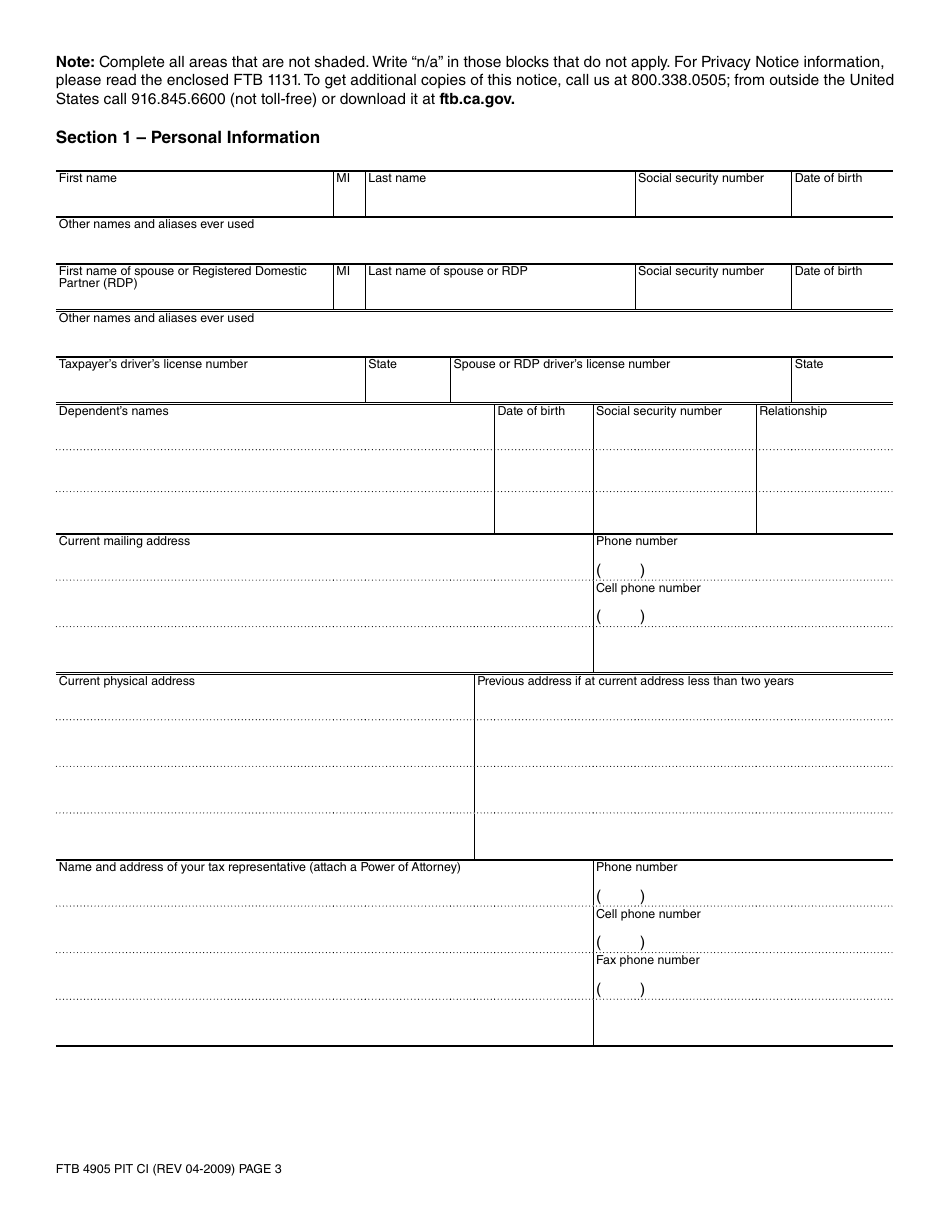

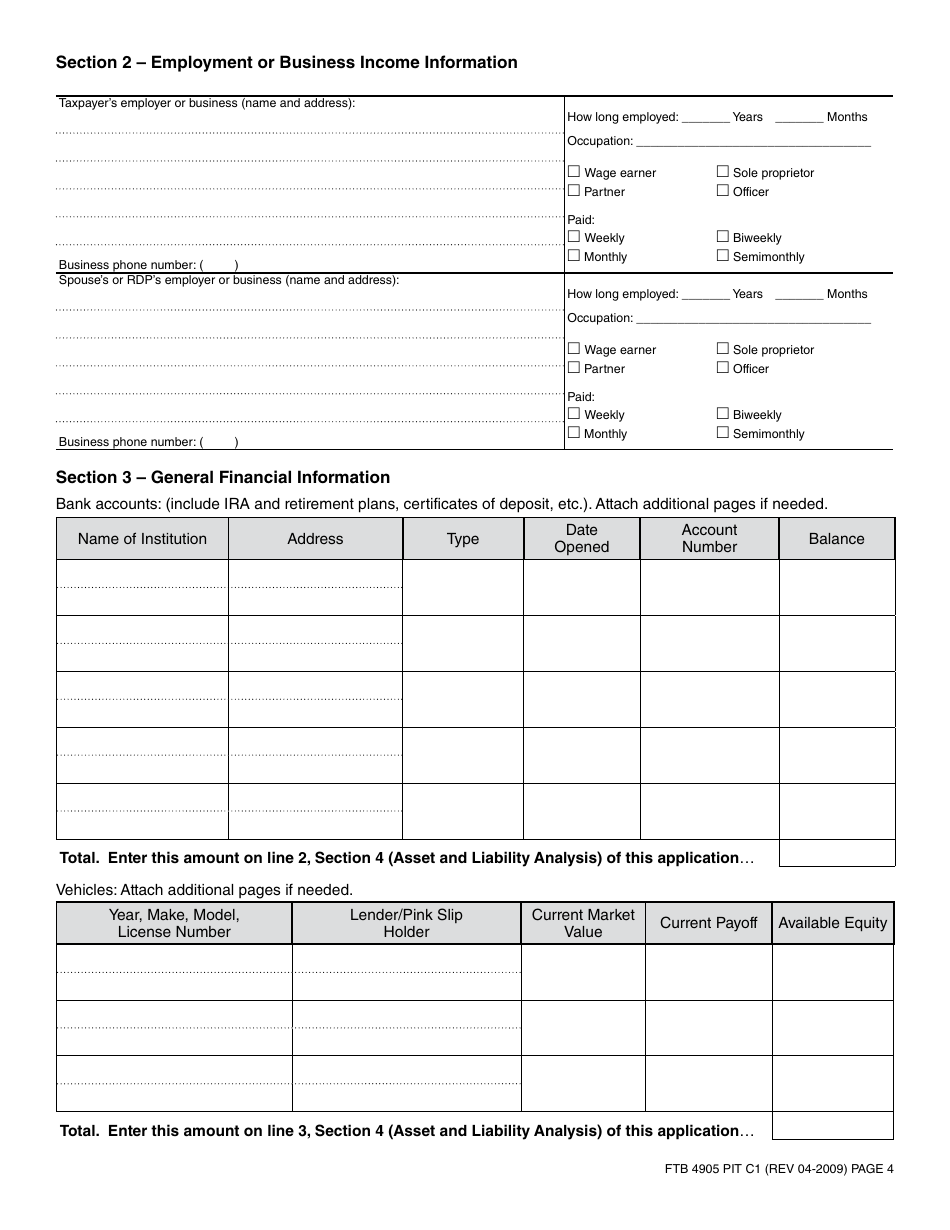

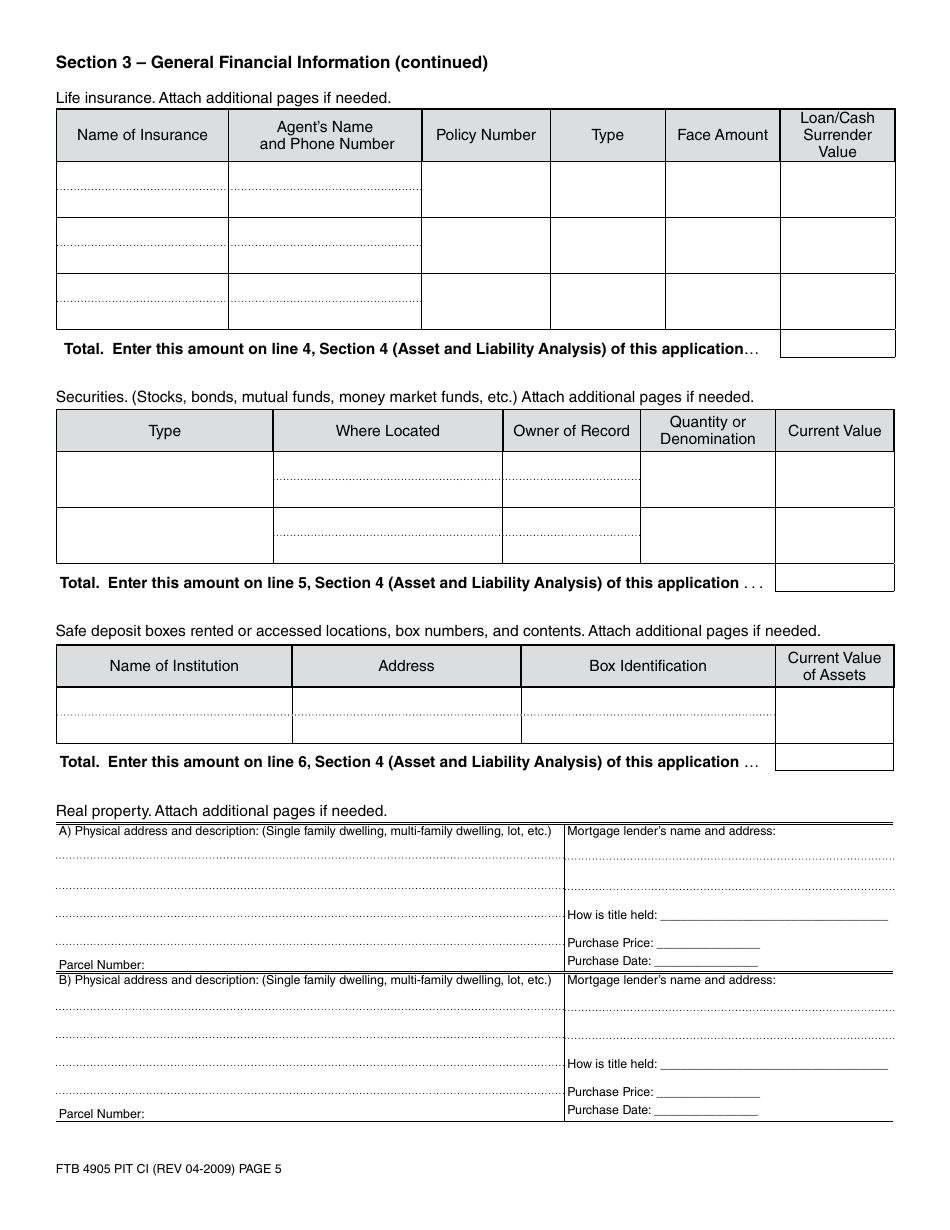

A: The form requires detailed financial information, including income, expenses, assets, debts, and other financial obligations. It also requires supporting documentation to substantiate the taxpayer's financial situation.

Form Details:

- Released on April 1, 2009;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB4905 PIT by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.