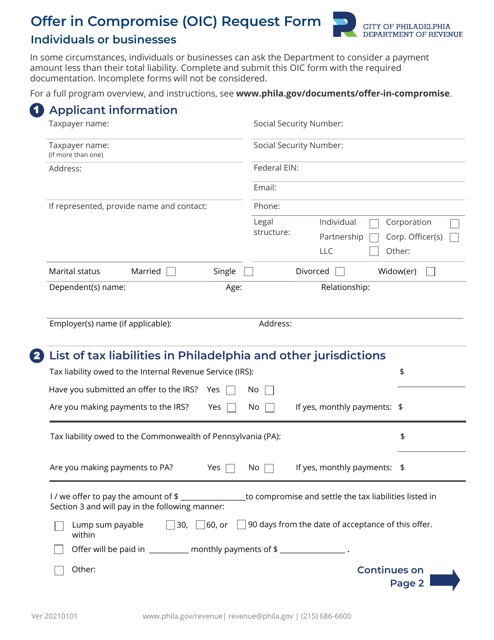

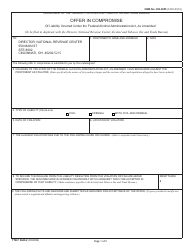

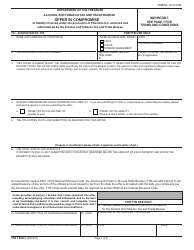

Offer in Compromise (OIC) Request Form - City of Philadelphia, Pennsylvania

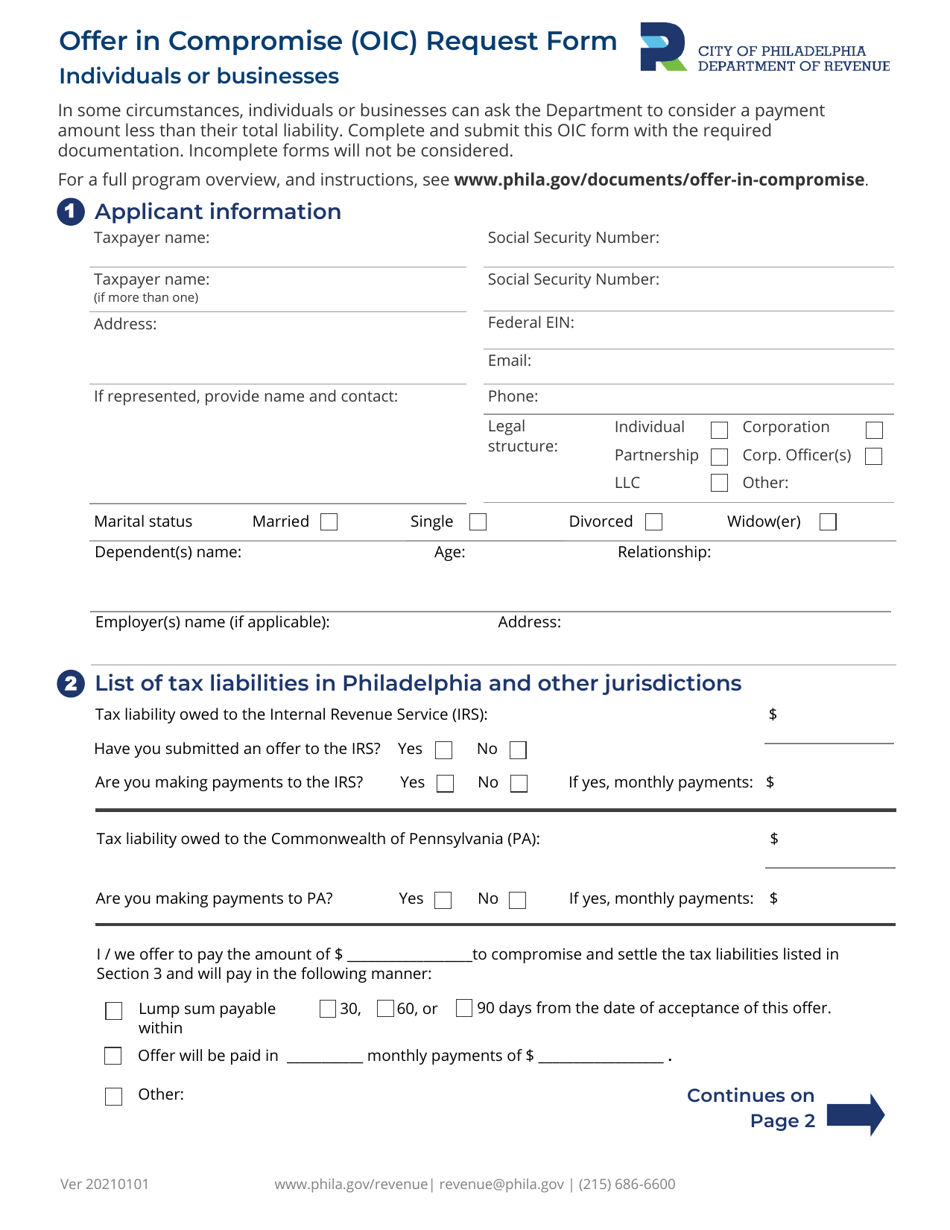

Offer in Compromise (OIC) Request Form is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is an Offer in Compromise (OIC)?

A: It is a request made to the City of Philadelphia, Pennsylvania to settle a tax debt for less than the full amount.

Q: Who can submit an Offer in Compromise (OIC) request?

A: Any individual or business with outstanding tax debt to the City of Philadelphia, Pennsylvania.

Q: What is the purpose of the Offer in Compromise (OIC) Request Form?

A: To provide the necessary information for the City of Philadelphia, Pennsylvania to consider the request for a tax debt settlement.

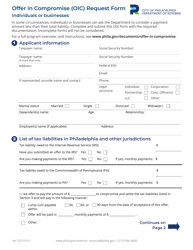

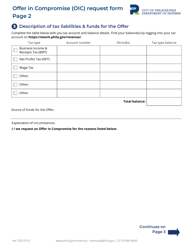

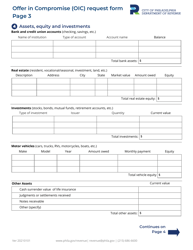

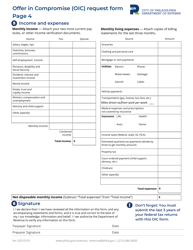

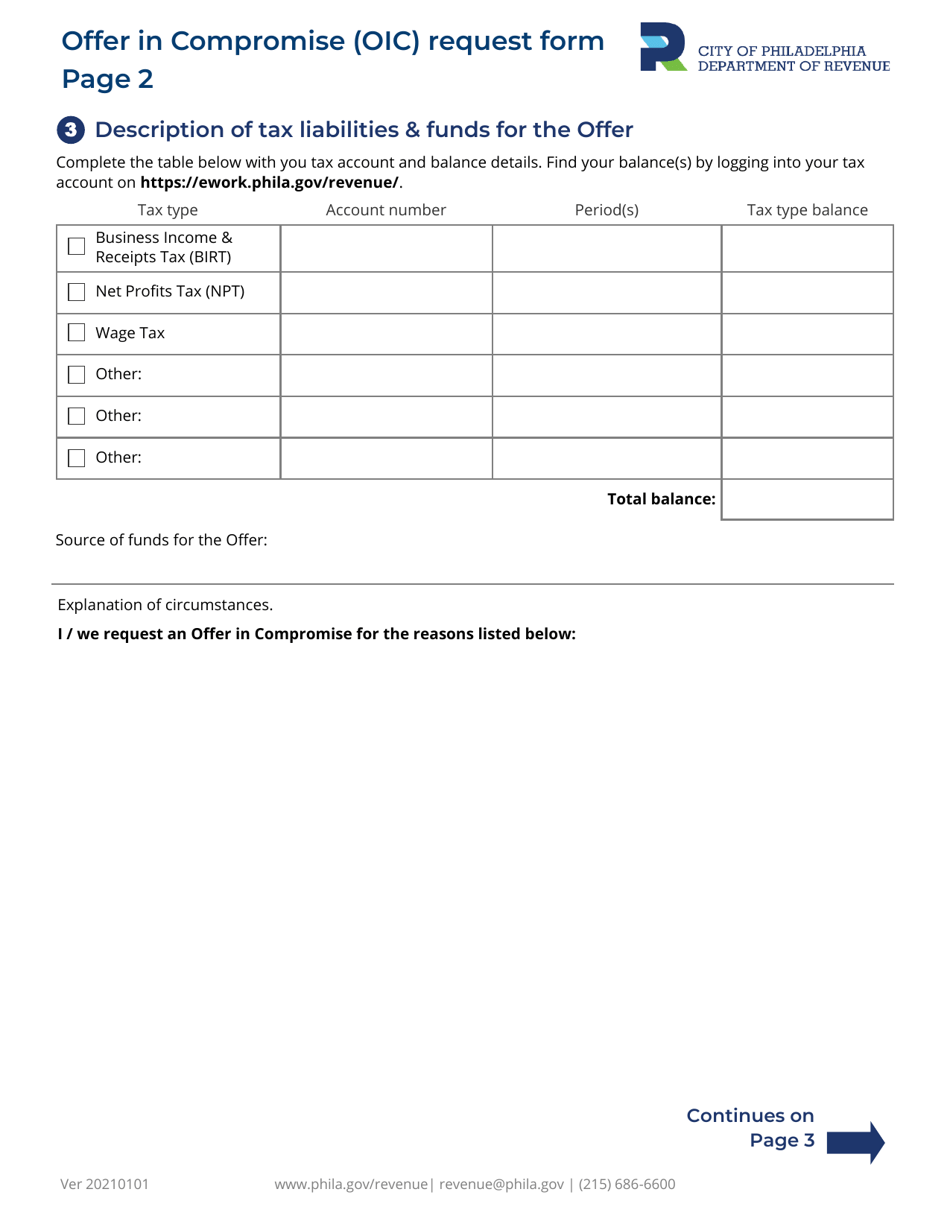

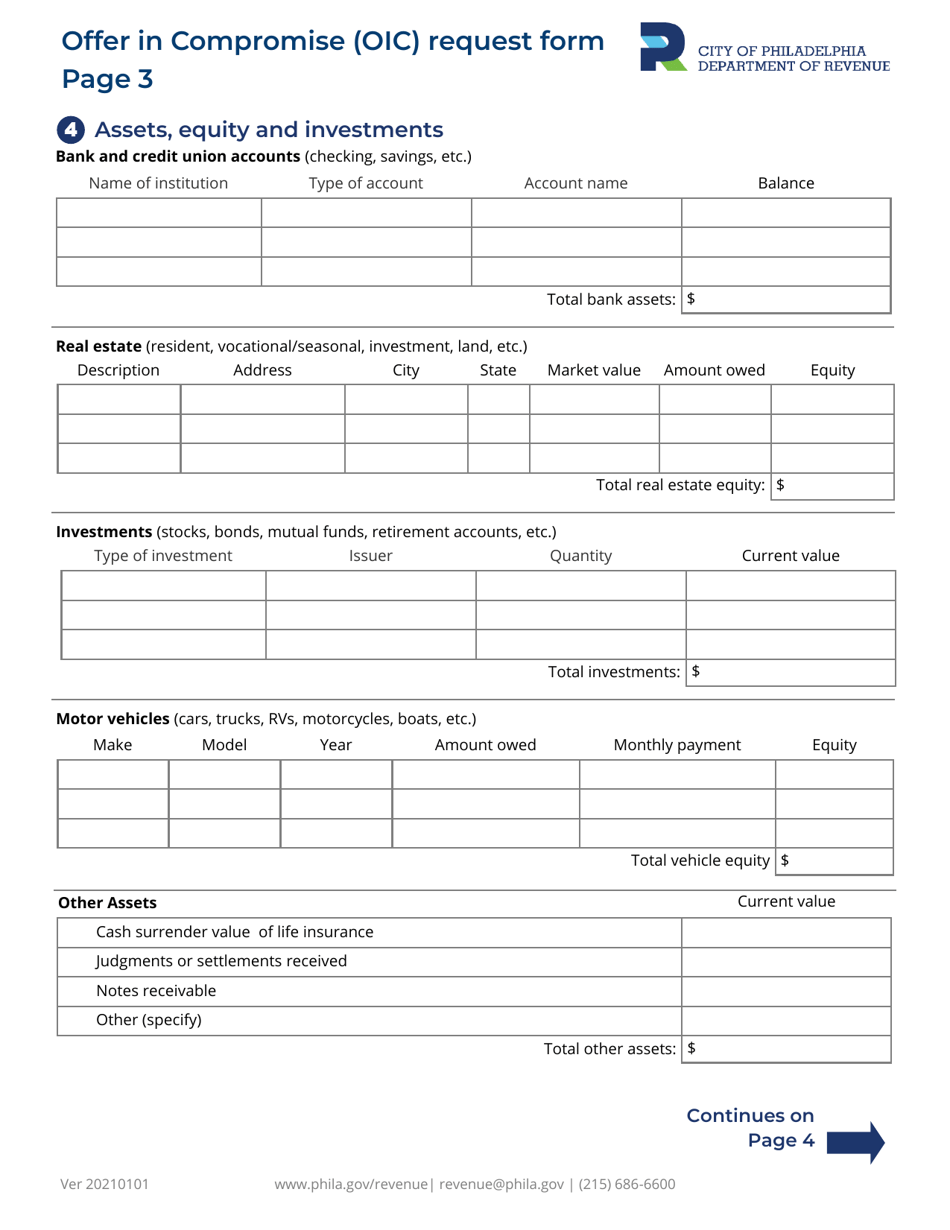

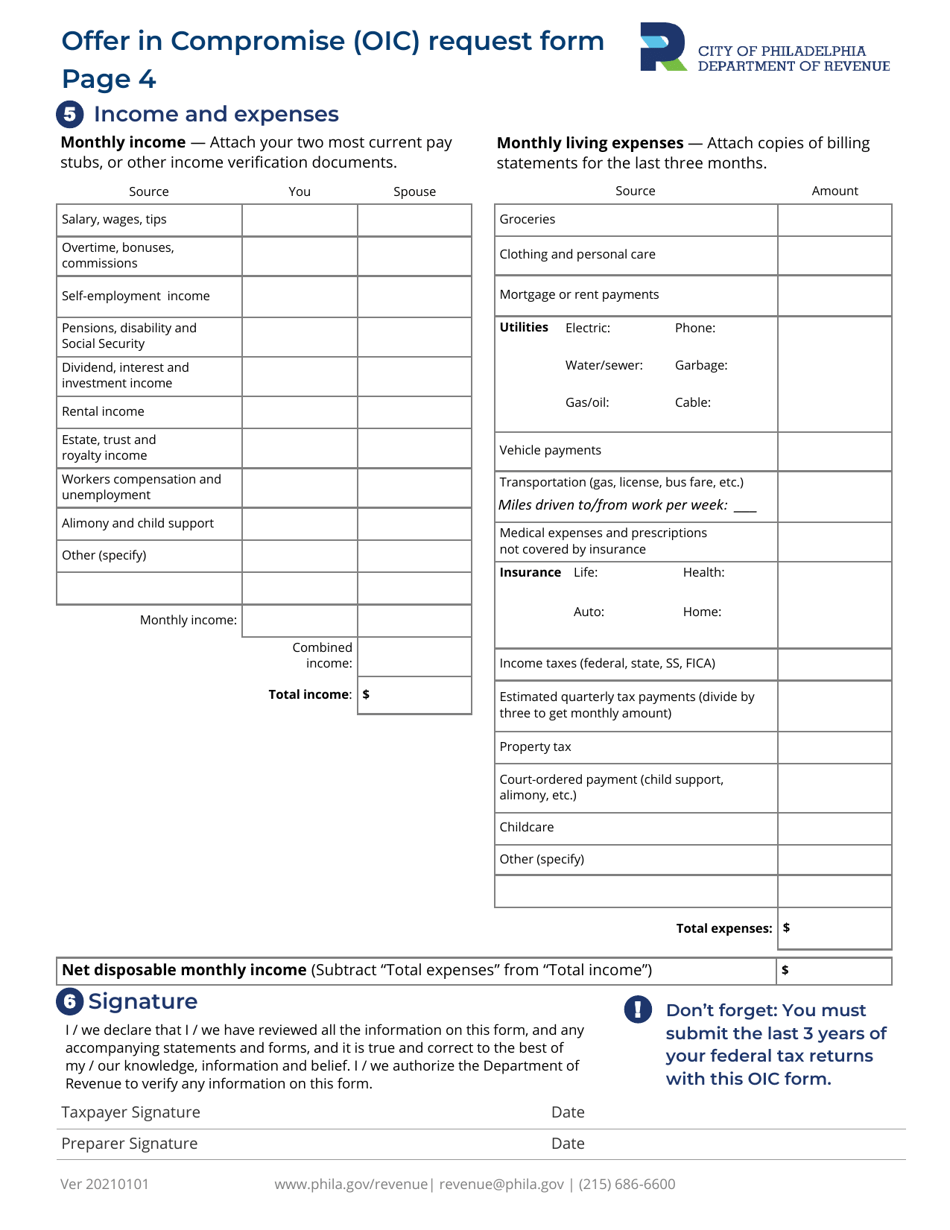

Q: What information is required on the Offer in Compromise (OIC) Request Form?

A: The form typically asks for personal or business information, details of the tax debt, and financial information.

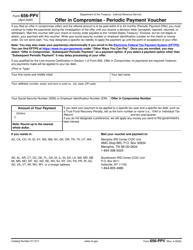

Q: Is there a fee to submit an Offer in Compromise (OIC) request?

A: Yes, there is usually a non-refundable fee that must be paid when submitting the request.

Q: How long does the City of Philadelphia, Pennsylvania take to process an Offer in Compromise (OIC) request?

A: The processing time can vary, but it may take several months for the City to review and make a decision on the request.

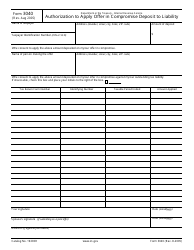

Q: What happens if the Offer in Compromise (OIC) request is accepted?

A: If the request is accepted, the City of Philadelphia, Pennsylvania will settle the tax debt for the agreed-upon amount, and any remaining balance will be forgiven.

Q: What happens if the Offer in Compromise (OIC) request is rejected?

A: If the request is rejected, the taxpayer will still be responsible for the full amount of the tax debt and must explore other payment options.

Q: Are there any alternatives to an Offer in Compromise (OIC) for resolving tax debt?

A: Yes, taxpayers can consider installment payment plans or other options offered by the City of Philadelphia, Pennsylvania to satisfy their tax debt.

Form Details:

- Released on January 1, 2021;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.