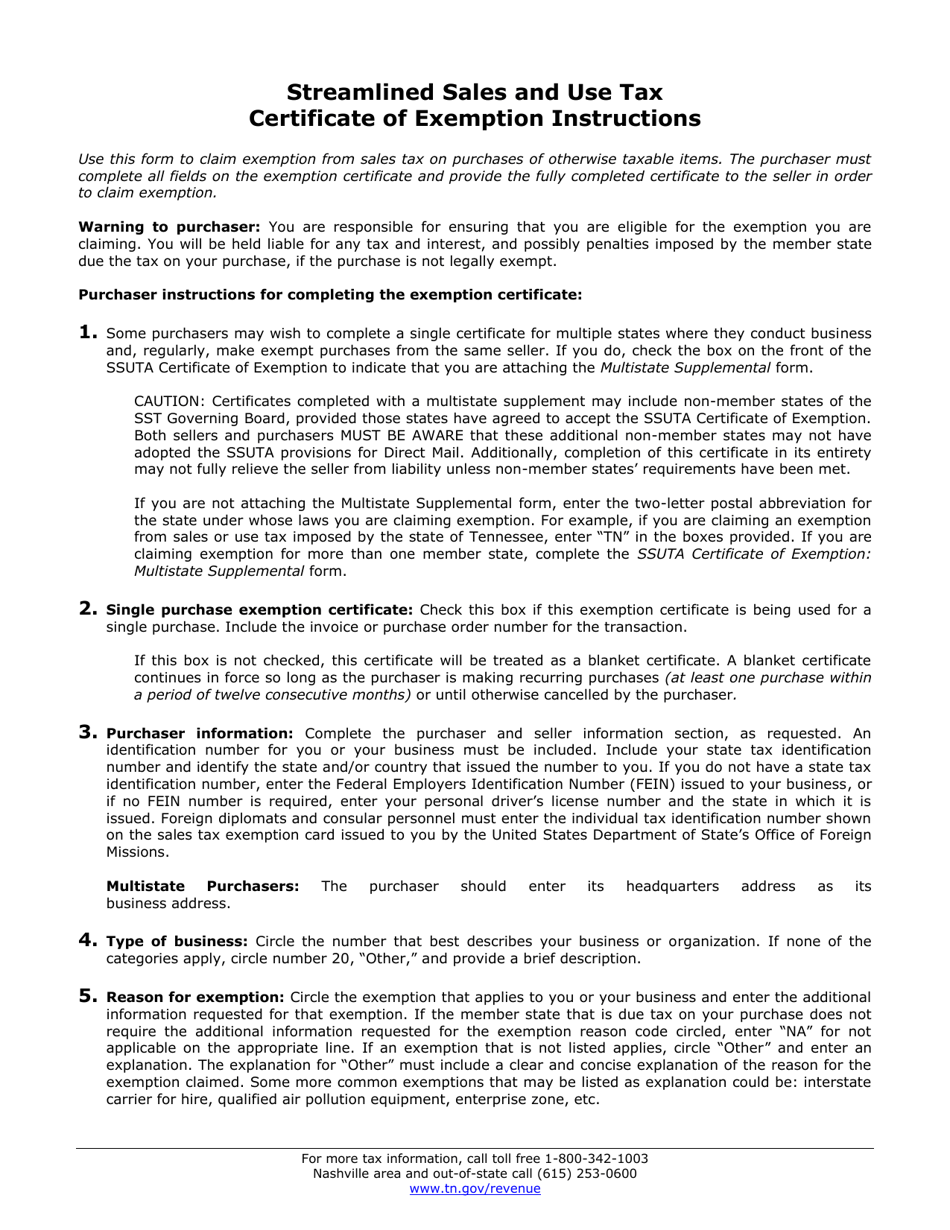

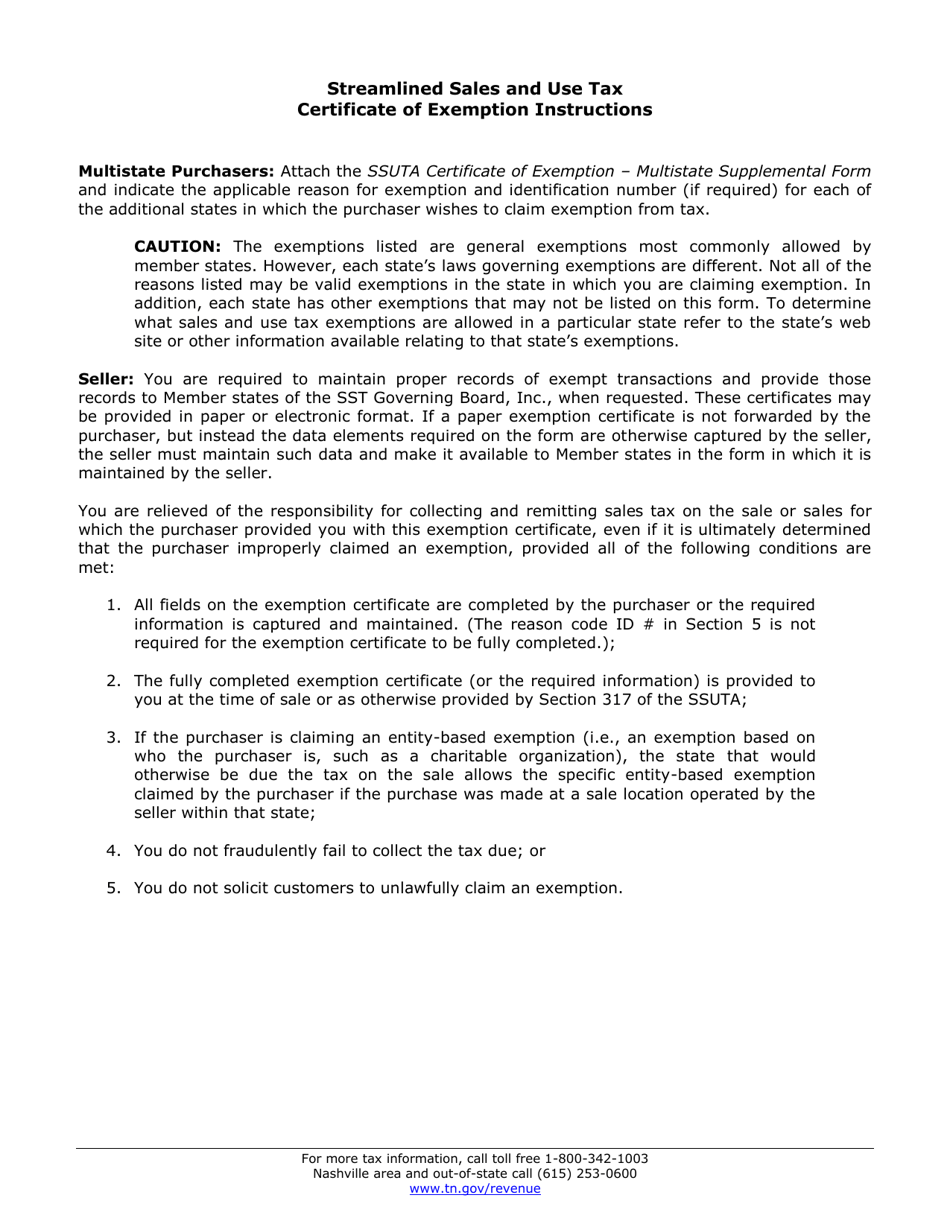

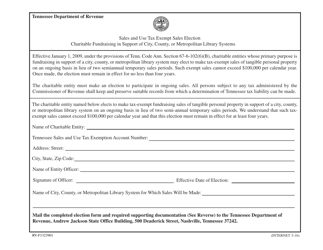

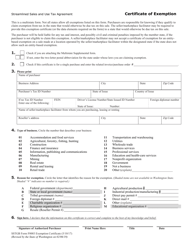

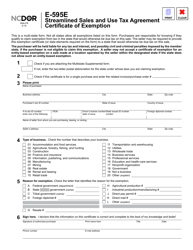

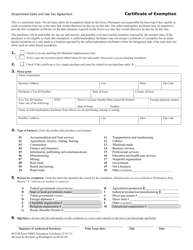

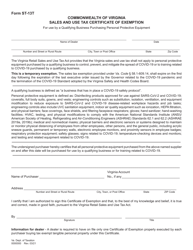

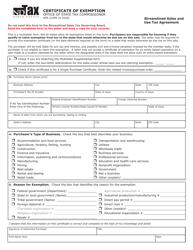

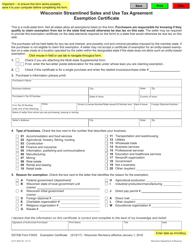

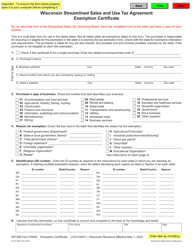

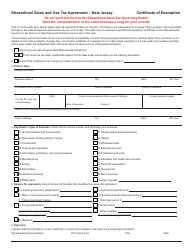

Instructions for SSTGB Form F0003 Streamlined Sales and Use Tax Agreement Certificate of Exemption - Tennessee

This document contains official instructions for SSTGB Form F0003 , Streamlined Sales and Use Tax Agreement Certificate of Exemption - a form released and collected by the Tennessee Department of Revenue.

FAQ

Q: What is the SSTGB Form F0003?

A: The SSTGB Form F0003 is the Streamlined Sales and Use Tax Agreement Certificate of Exemption for Tennessee.

Q: What is the purpose of the SSTGB Form F0003?

A: The purpose of the SSTGB Form F0003 is to certify that a purchase is exempt from sales or use tax under the Streamlined Sales and Use Tax Agreement.

Q: Who needs to fill out the SSTGB Form F0003?

A: Anyone making a purchase that is eligible for a sales or use tax exemption under the Streamlined Sales and Use Tax Agreement needs to fill out the SSTGB Form F0003.

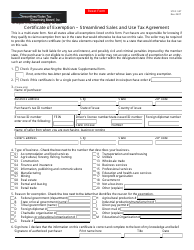

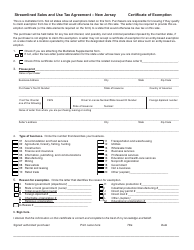

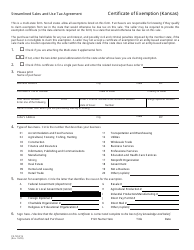

Q: What information should be included in the SSTGB Form F0003?

A: The SSTGB Form F0003 requires information such as the purchaser's name, address, and exemption reason, as well as the seller's name and address.

Q: How do I submit the SSTGB Form F0003?

A: The SSTGB Form F0003 should be given to the seller at the time of purchase, who will then retain it for record-keeping purposes.

Q: Is the SSTGB Form F0003 valid for all purchases?

A: No, the SSTGB Form F0003 is only valid for purchases that qualify for a sales or use tax exemption under the Streamlined Sales and Use Tax Agreement.

Q: Can the SSTGB Form F0003 be used in other states?

A: No, the SSTGB Form F0003 is specific to Tennessee and the Streamlined Sales and Use Tax Agreement. Other states may have their own exemption certificates.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Tennessee Department of Revenue.