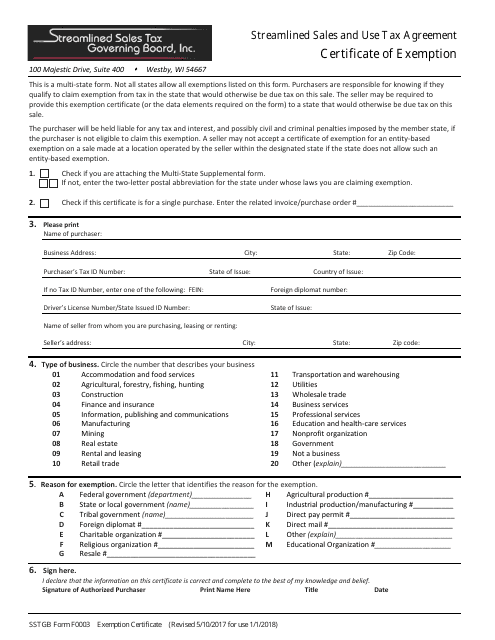

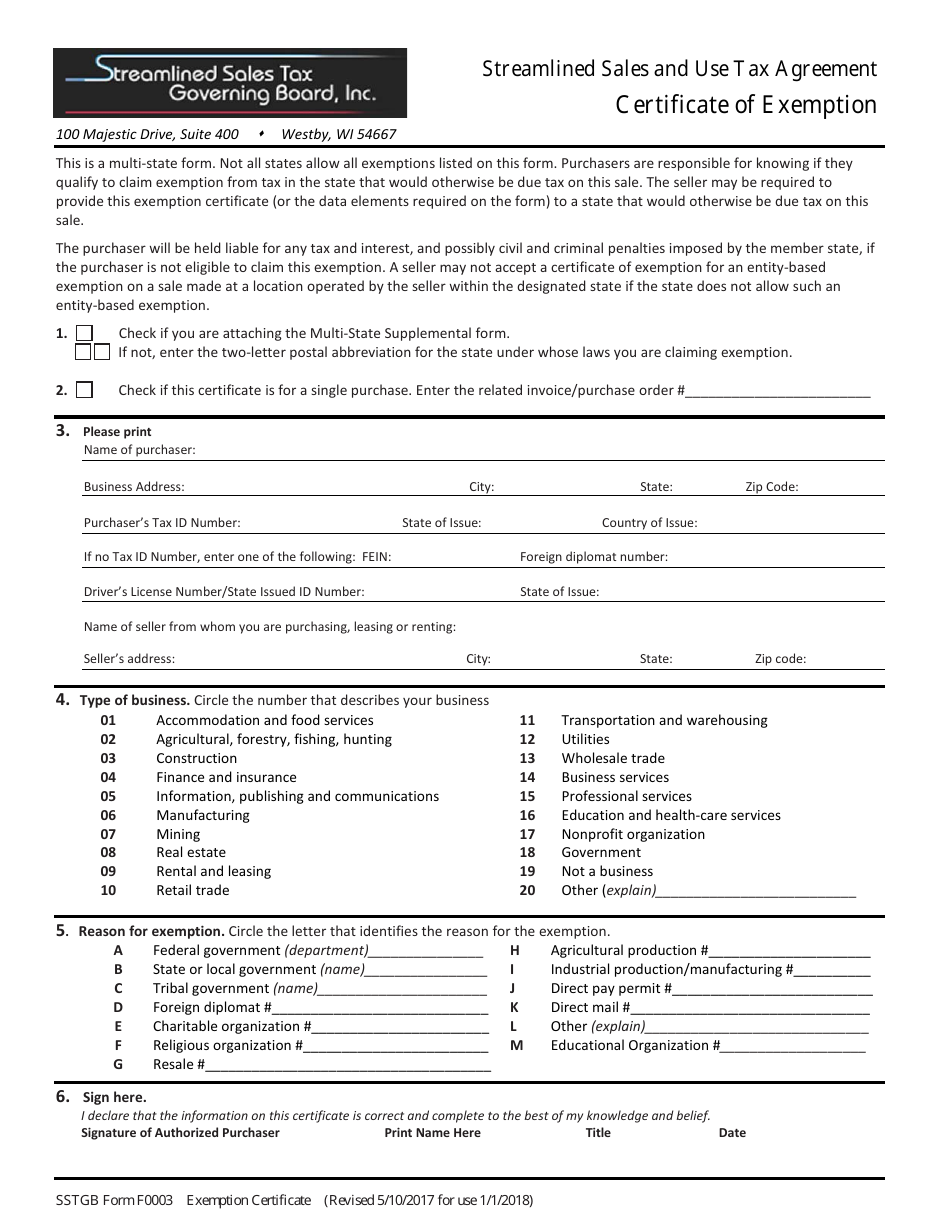

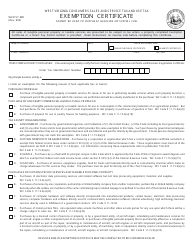

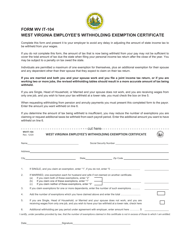

Form F0003 Certificate of Exemption - Streamlined Sales and Use Tax Agreement - West Virginia

What Is Form F0003?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F0003?

A: Form F0003 is the Certificate of Exemption for the Streamlined Sales and Use Tax Agreement in West Virginia.

Q: What is the purpose of Form F0003?

A: The purpose of Form F0003 is to claim exemption from sales and use tax in West Virginia under the Streamlined Sales and Use Tax Agreement.

Q: Who can use Form F0003?

A: Form F0003 can be used by individuals and businesses who qualify for exemption under the Streamlined Sales and Use Tax Agreement in West Virginia.

Q: Can I use Form F0003 for all types of exemptions?

A: No, Form F0003 is specifically for exemptions under the Streamlined Sales and Use Tax Agreement in West Virginia. Other types of exemptions may require different forms.

Q: What information do I need to provide on Form F0003?

A: You will need to provide your name, address, tax identification number, and the reason for claiming exemption.

Q: Do I need to attach any documentation to Form F0003?

A: Depending on the specific exemption you are claiming, you may need to attach supporting documentation to Form F0003. Check the instructions for the form or consult with the West Virginia State Tax Department for more information.

Q: Is there a fee to submit Form F0003?

A: No, there is no fee to submit Form F0003.

Q: How long does it take to process Form F0003?

A: Processing times may vary, but the West Virginia State Tax Department typically processes forms within a few weeks of receipt.

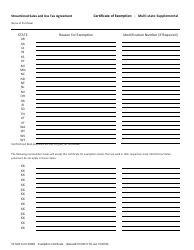

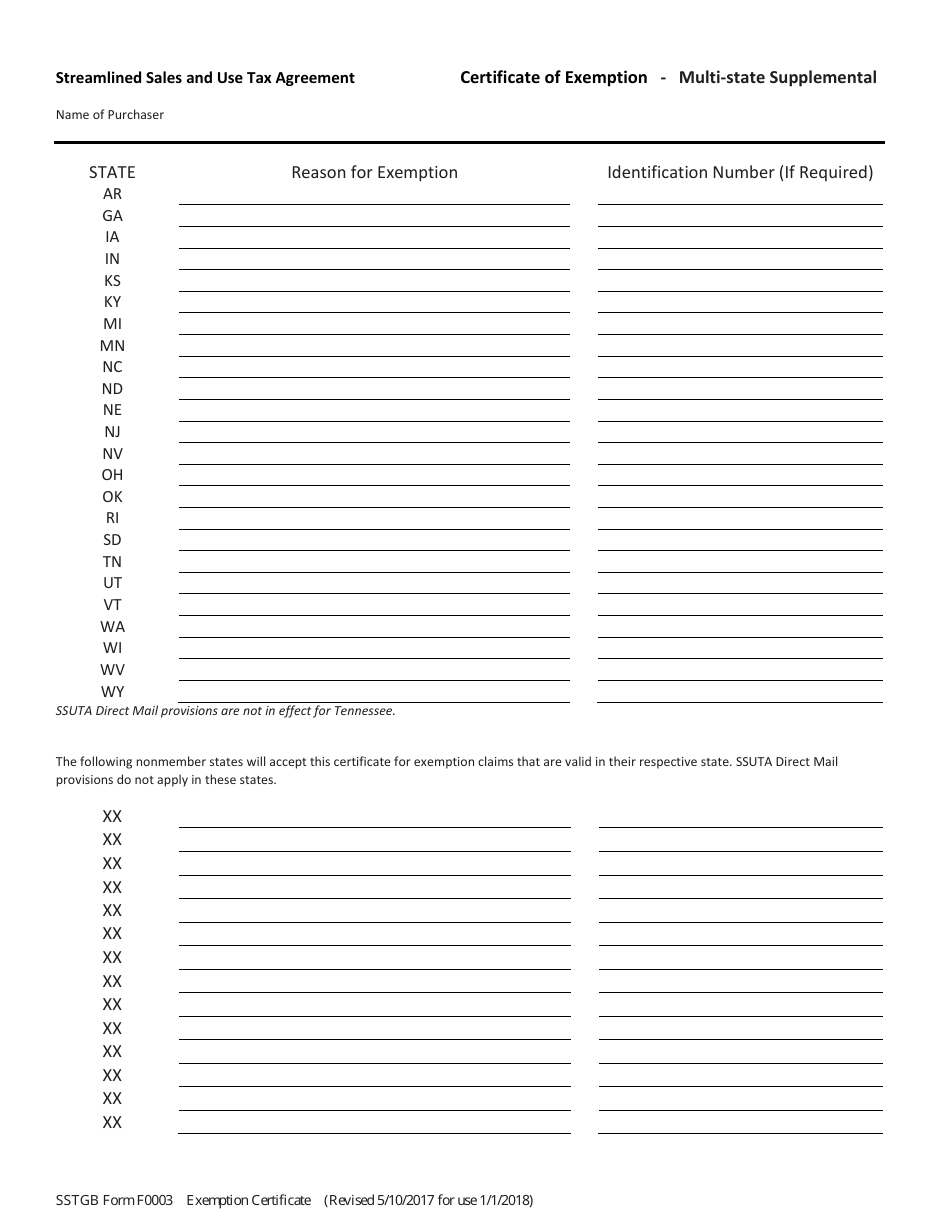

Q: Can I use Form F0003 for other states?

A: No, Form F0003 is specific to claiming exemption under the Streamlined Sales and Use Tax Agreement in West Virginia. Other states may have their own forms and requirements for exemptions.

Q: What should I do if I have more questions about Form F0003?

A: If you have more questions about Form F0003, you should contact the West Virginia State Tax Department for assistance.

Form Details:

- Released on May 10, 2017;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F0003 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.