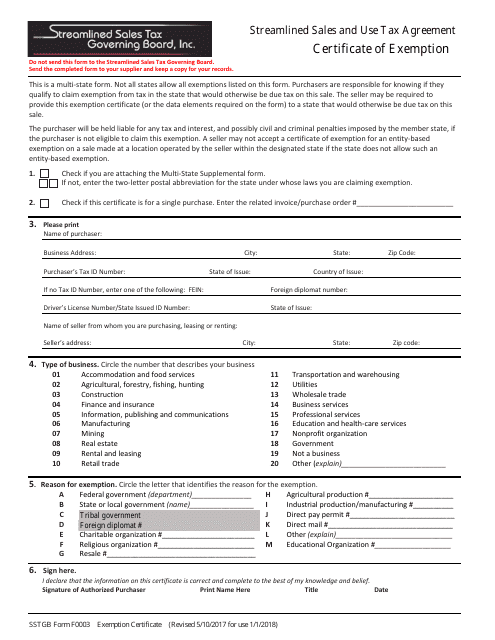

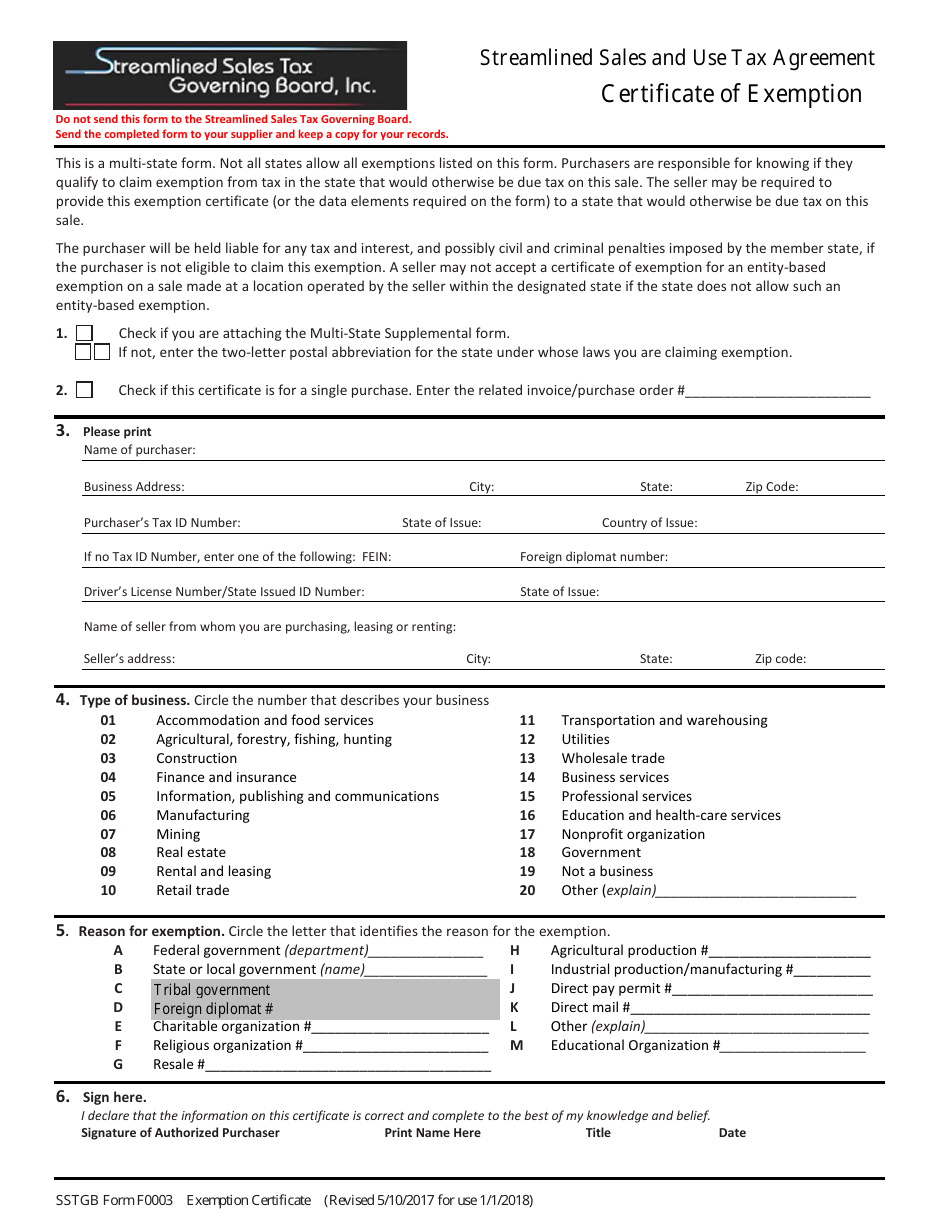

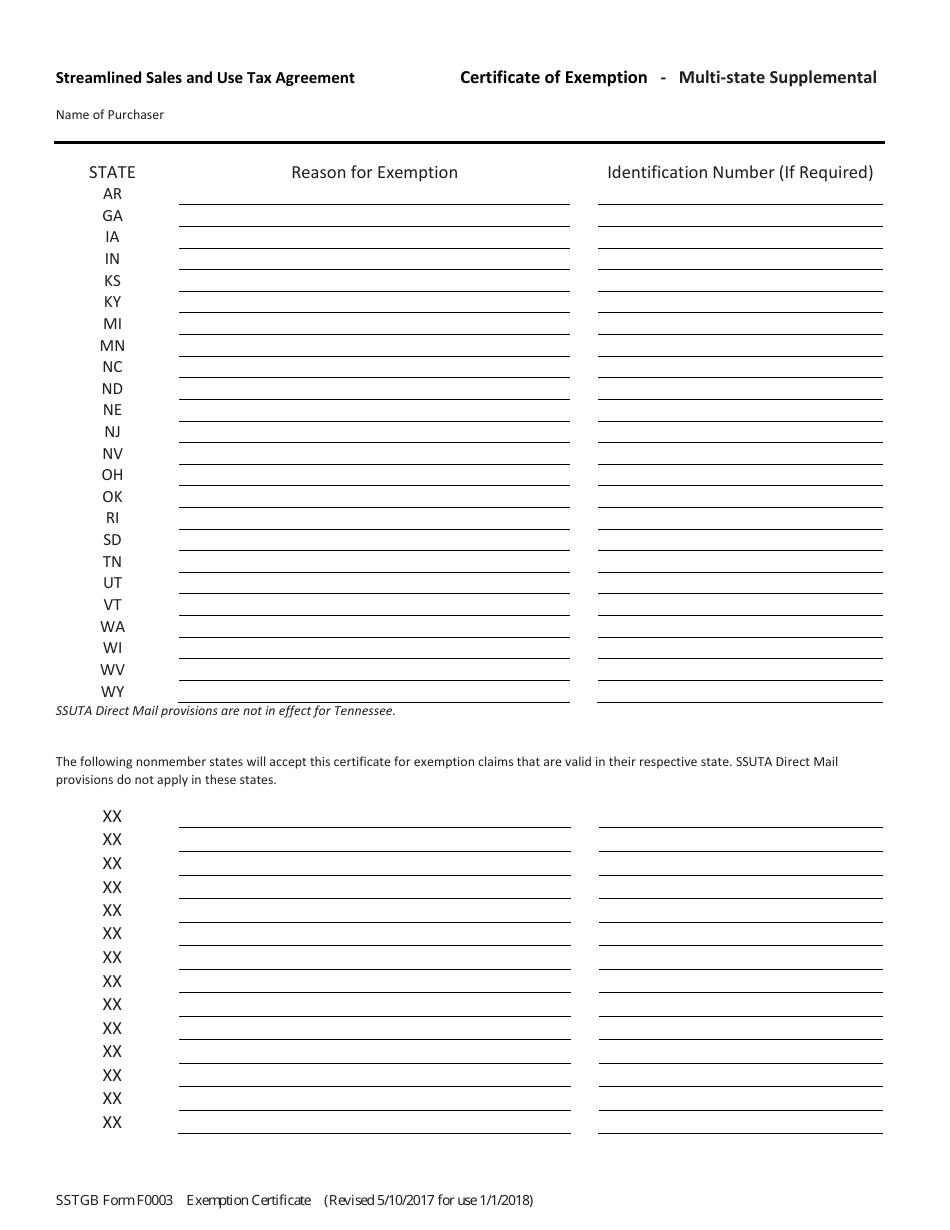

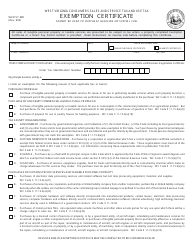

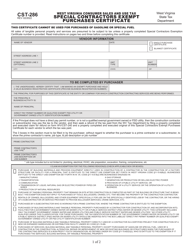

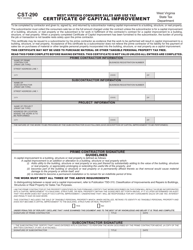

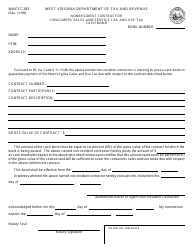

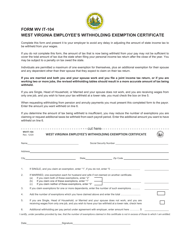

Form F003 Certificate of Exemption - Streamlined Sales and Use Tax Agreement - West Virginia

What Is Form F003?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form F003?

A: Form F003 is the Certificate of Exemption - Streamlined Sales and Use Tax Agreement in West Virginia.

Q: What is the purpose of Form F003?

A: The purpose of Form F003 is to claim exemption from sales and use taxes in West Virginia under the Streamlined Sales and Use Tax Agreement.

Q: Who can use Form F003?

A: Form F003 can be used by businesses and individuals who qualify for exemption from sales and use taxes under the Streamlined Sales and Use Tax Agreement in West Virginia.

Q: What information is required on Form F003?

A: Form F003 requires basic information about the taxpayer or business, as well as specific details about the exemption being claimed.

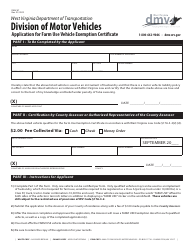

Q: Are there any filing fees for Form F003?

A: No, there are no filing fees for submitting Form F003.

Q: When should Form F003 be submitted?

A: Form F003 should be submitted to the West Virginia State Tax Department at least 10 business days before the first sale for which the exemption is claimed.

Q: What happens after Form F003 is submitted?

A: After Form F003 is submitted, it will be reviewed by the West Virginia State Tax Department, and if approved, the taxpayer or business will receive a Certificate of Exemption.

Form Details:

- Released on May 10, 2017;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F003 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.