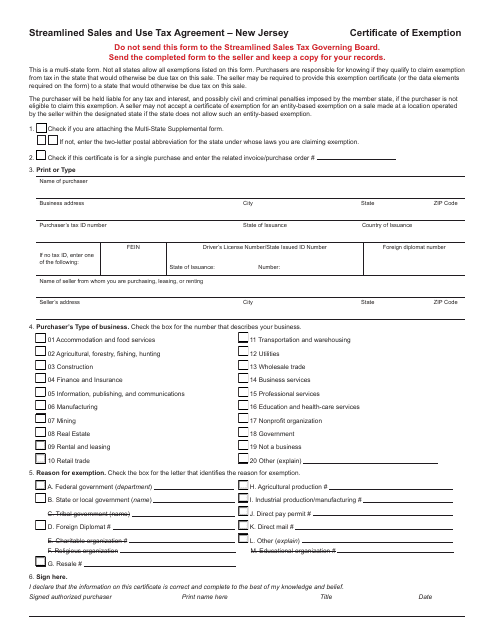

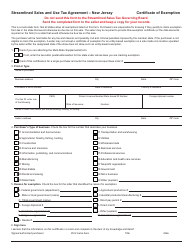

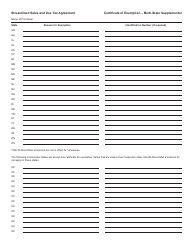

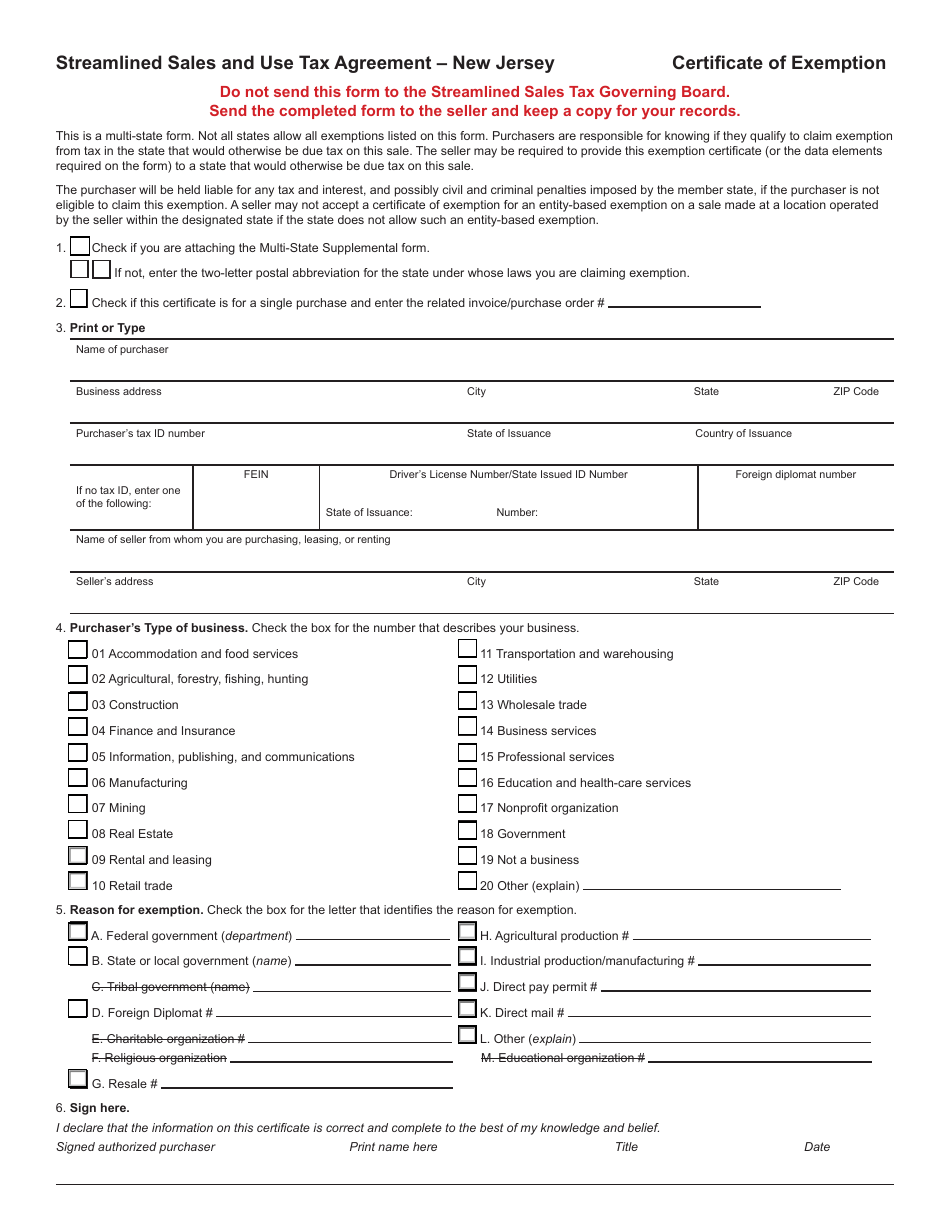

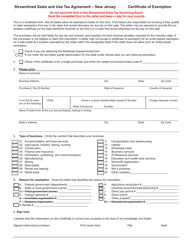

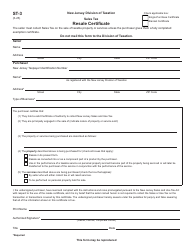

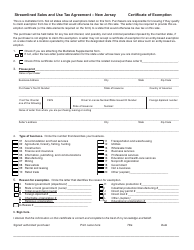

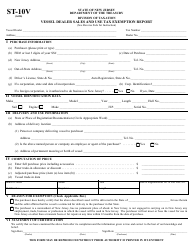

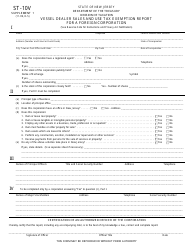

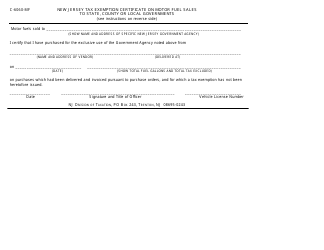

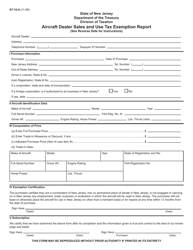

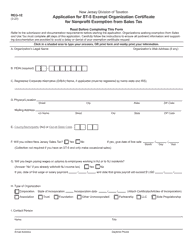

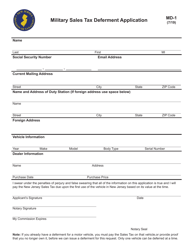

Streamlined Sales and Use Tax Agreement - Certificate of Exemption - New Jersey

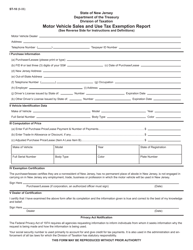

Streamlined Sales and Use Tax Agreement - Certificate of Exemption is a legal document that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.

FAQ

Q: What is the Streamlined Sales and Use Tax Agreement?

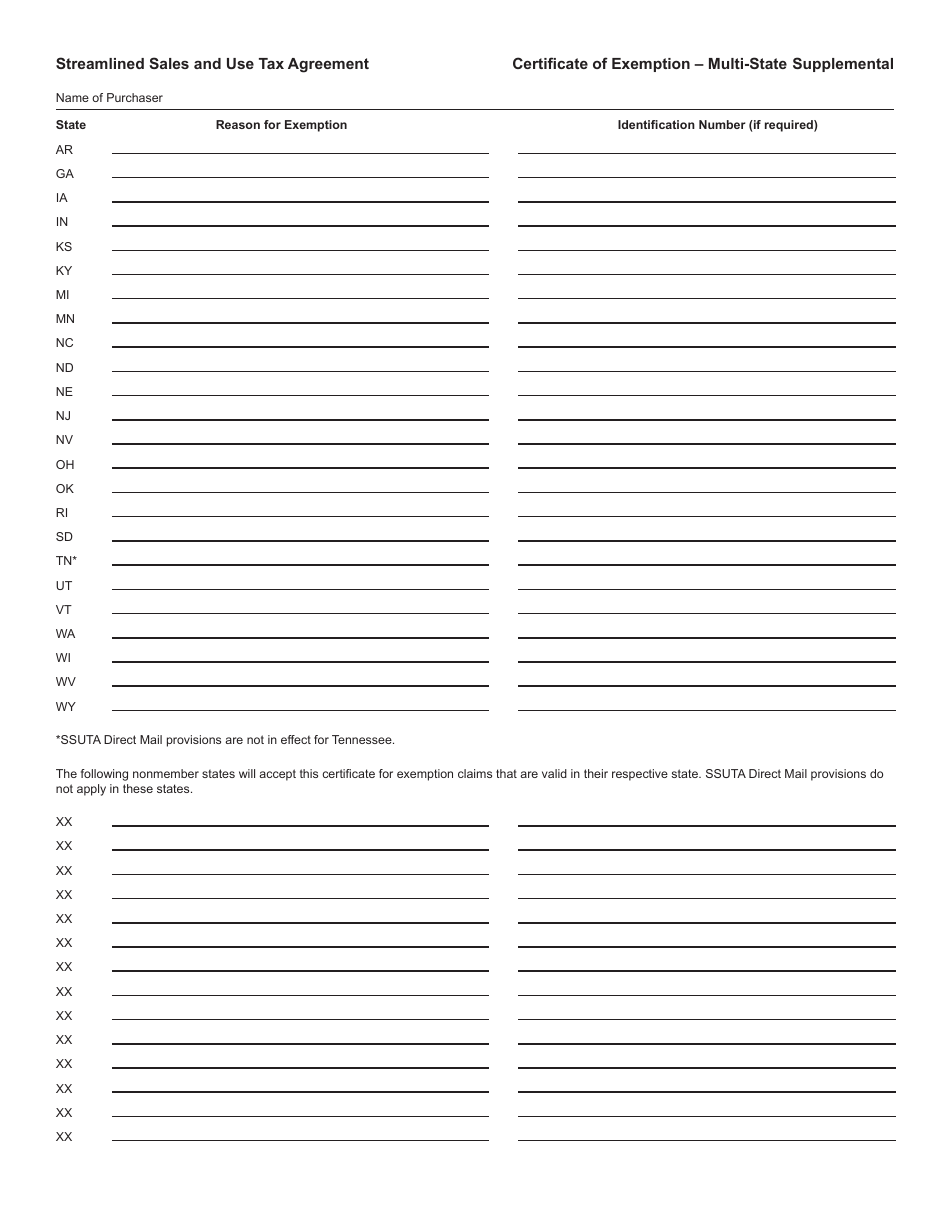

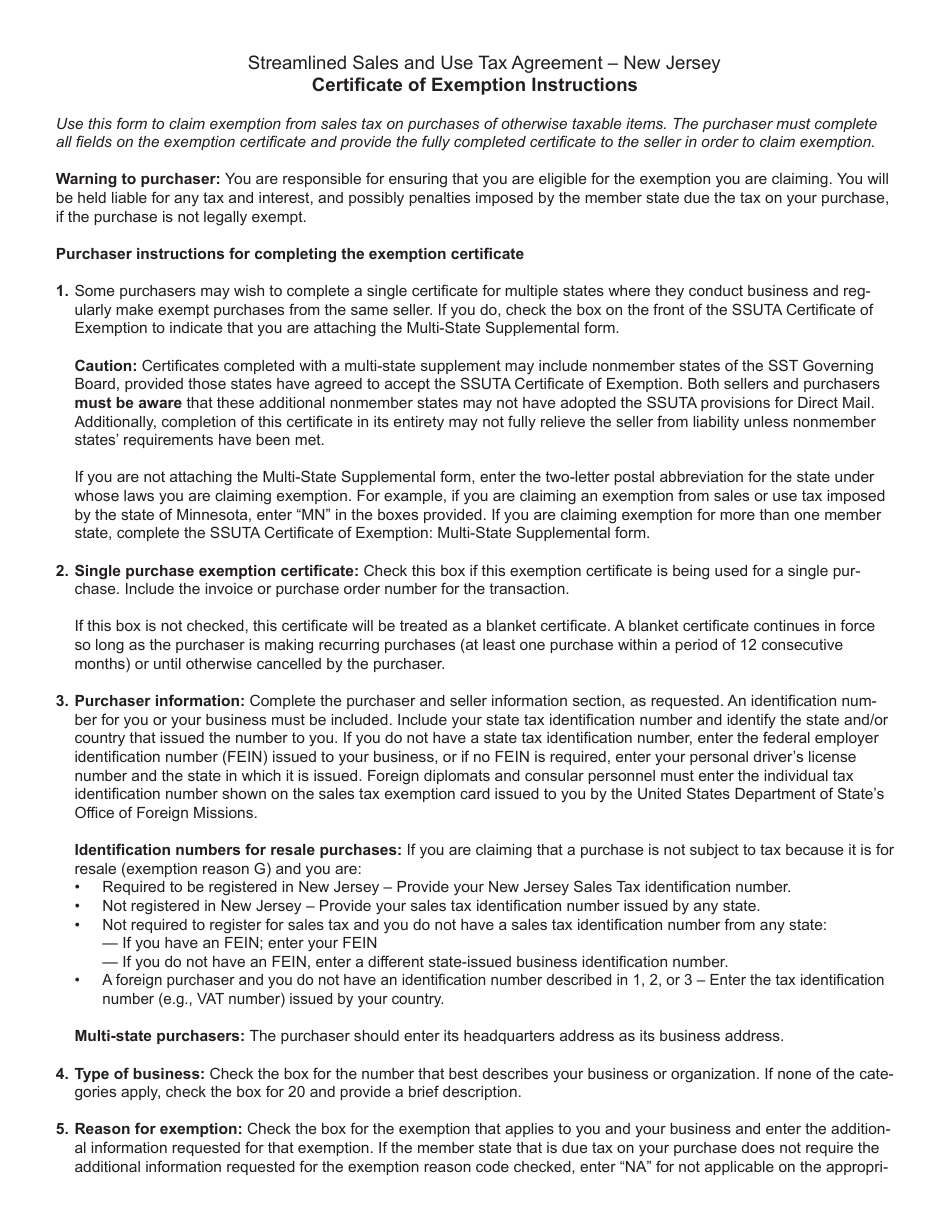

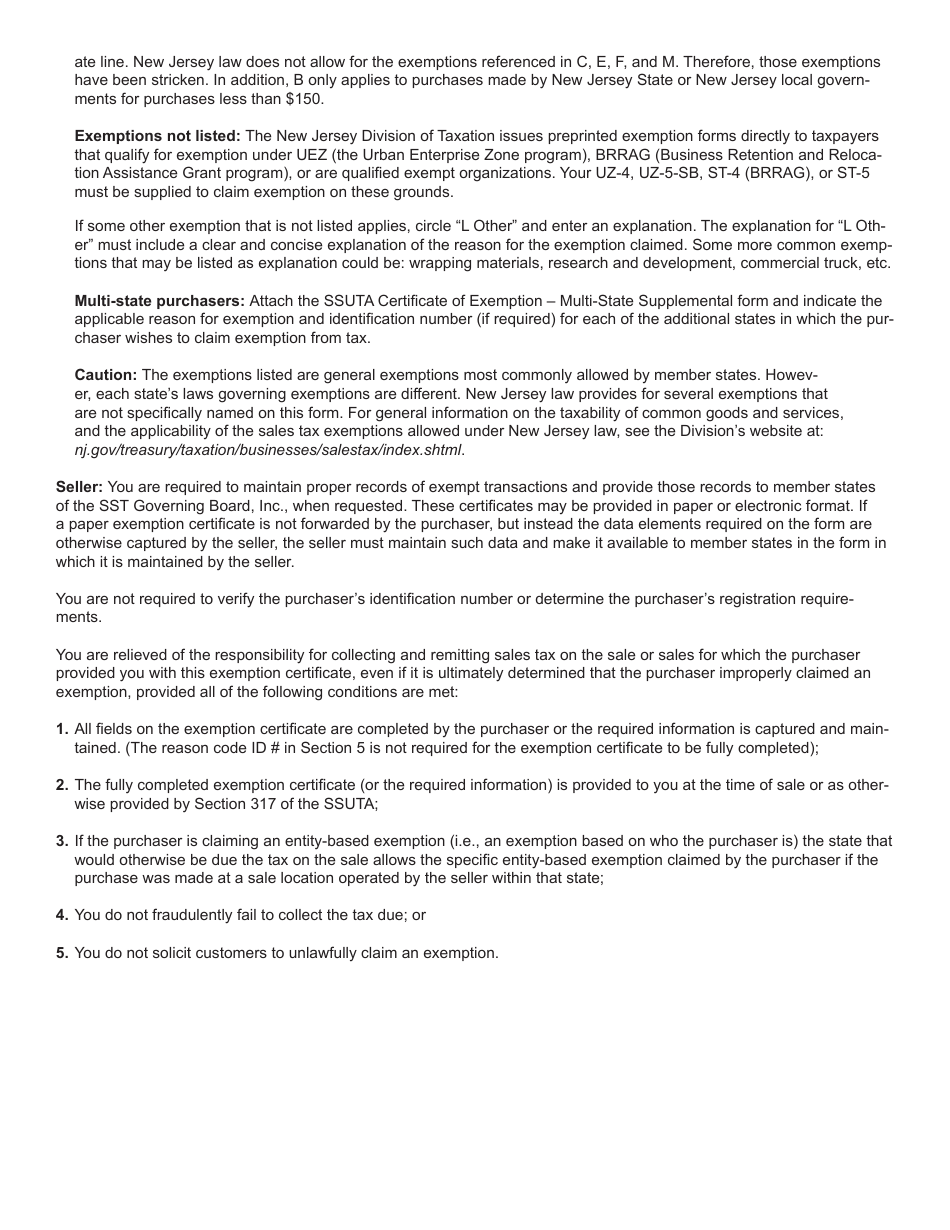

A: The Streamlined Sales and Use Tax Agreement (SSUTA) is an effort to simplify and standardize sales tax laws across multiple states.

Q: What is a Certificate of Exemption?

A: A Certificate of Exemption is a document that allows certain individuals or entities to make purchases without paying sales tax.

Q: What is the purpose of a Certificate of Exemption?

A: The purpose of a Certificate of Exemption is to provide proof that a transaction is exempt from sales tax.

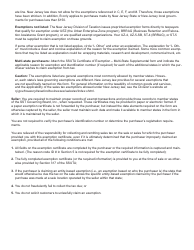

Q: Who can use a Certificate of Exemption in New Jersey?

A: Certain individuals and entities, such as government organizations, non-profit organizations, and resellers, can use a Certificate of Exemption in New Jersey.

Q: How can I obtain a Certificate of Exemption in New Jersey?

A: You can obtain a Certificate of Exemption in New Jersey by completing and submitting a specific form to the New Jersey Division of Taxation.

Q: What purchases are exempt from sales tax in New Jersey?

A: Certain purchases, such as food, clothing, and prescription drugs, are generally exempt from sales tax in New Jersey.

Q: Are all non-profit organizations exempt from sales tax in New Jersey?

A: No, not all non-profit organizations are exempt from sales tax in New Jersey. Only certain types of non-profit organizations qualify for tax exemption.

Q: What is the role of the Streamlined Sales Tax Governing Board?

A: The Streamlined Sales Tax Governing Board is responsible for overseeing and implementing the Streamlined Sales and Use Tax Agreement.

Q: Does the Streamlined Sales and Use Tax Agreement apply to all states?

A: No, participation in the Streamlined Sales and Use Tax Agreement is voluntary for states. However, many states have chosen to participate in the agreement.

Form Details:

- The latest edition currently provided by the New Jersey Department of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.