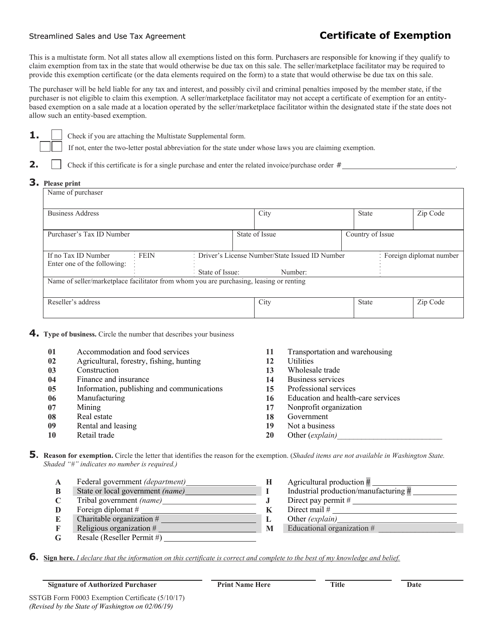

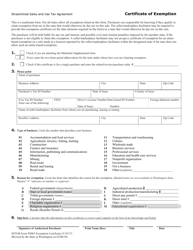

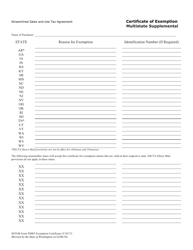

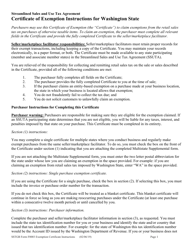

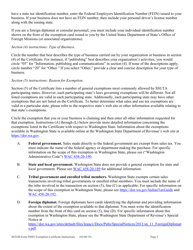

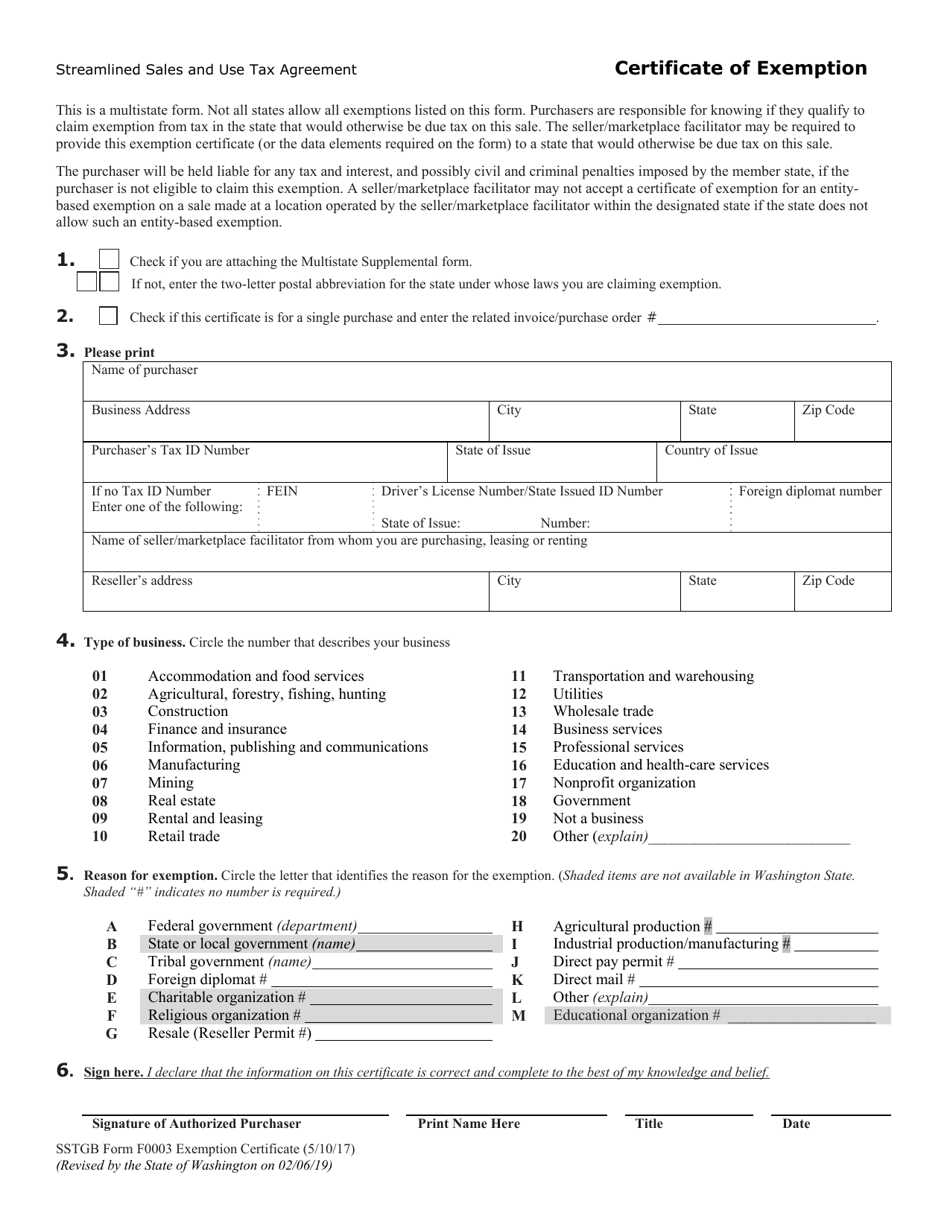

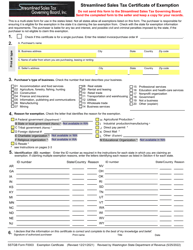

SSTGB Form 0003 Streamlined Sales and Use Tax Certificate of Exemption - Washington

What Is SSTGB Form 0003?

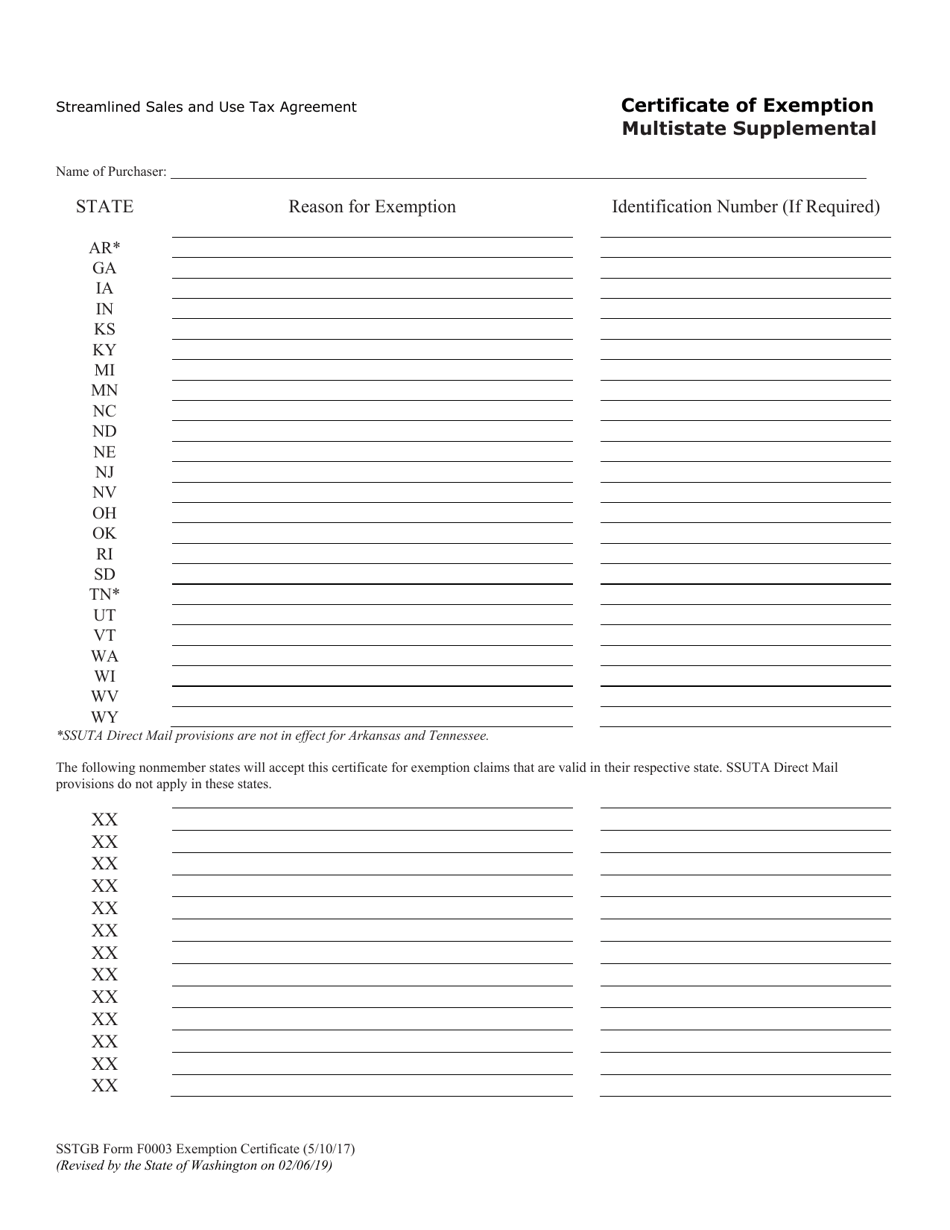

This is a legal form that was released by the Washington State Department of Revenue - Streamlined Sales TaxGoverning Board - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SSTGB Form 0003?

A: SSTGB Form 0003 is a Streamlined Sales and Use Tax Certificate of Exemption.

Q: What is it used for?

A: It is used in Washington to claim exemption from sales and use tax.

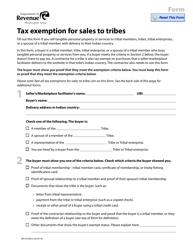

Q: Who can use this form?

A: This form can be used by businesses and organizations that are eligible for sales and use tax exemption in Washington.

Q: What is the purpose of the Streamlined Sales and Use Tax Certificate of Exemption?

A: The purpose is to provide proof of exemption from sales and use tax for qualifying transactions.

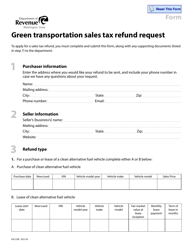

Q: What information is required on the form?

A: The form requires information such as the purchaser's name, address, and taxpayer identification number, as well as a description of the items being purchased.

Q: How long is the certificate valid for?

A: The certificate is valid for one year from the date it is issued, unless a shorter validity period is specified.

Q: Is this form applicable for all types of purchases?

A: No, the form is specific to purchases that qualify for exemption from sales and use tax in Washington.

Q: What should I do with the completed form?

A: The completed form should be given to the seller or vendor at the time of purchase to claim the exemption.

Q: What if my exemption certificate expires?

A: If your certificate expires, you will need to submit a new form to continue claiming the exemption.

Form Details:

- Released on February 6, 2019;

- The latest edition provided by the Washington State Department of Revenue - Streamlined Sales Tax Governing Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SSTGB Form 0003 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue - Streamlined Sales Tax Governing Board.