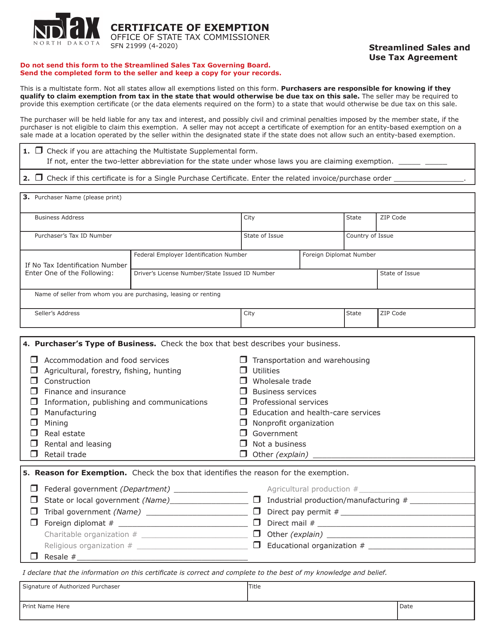

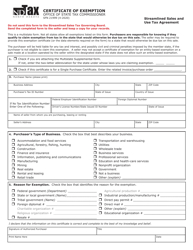

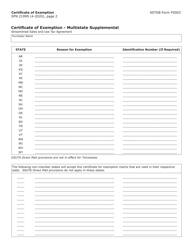

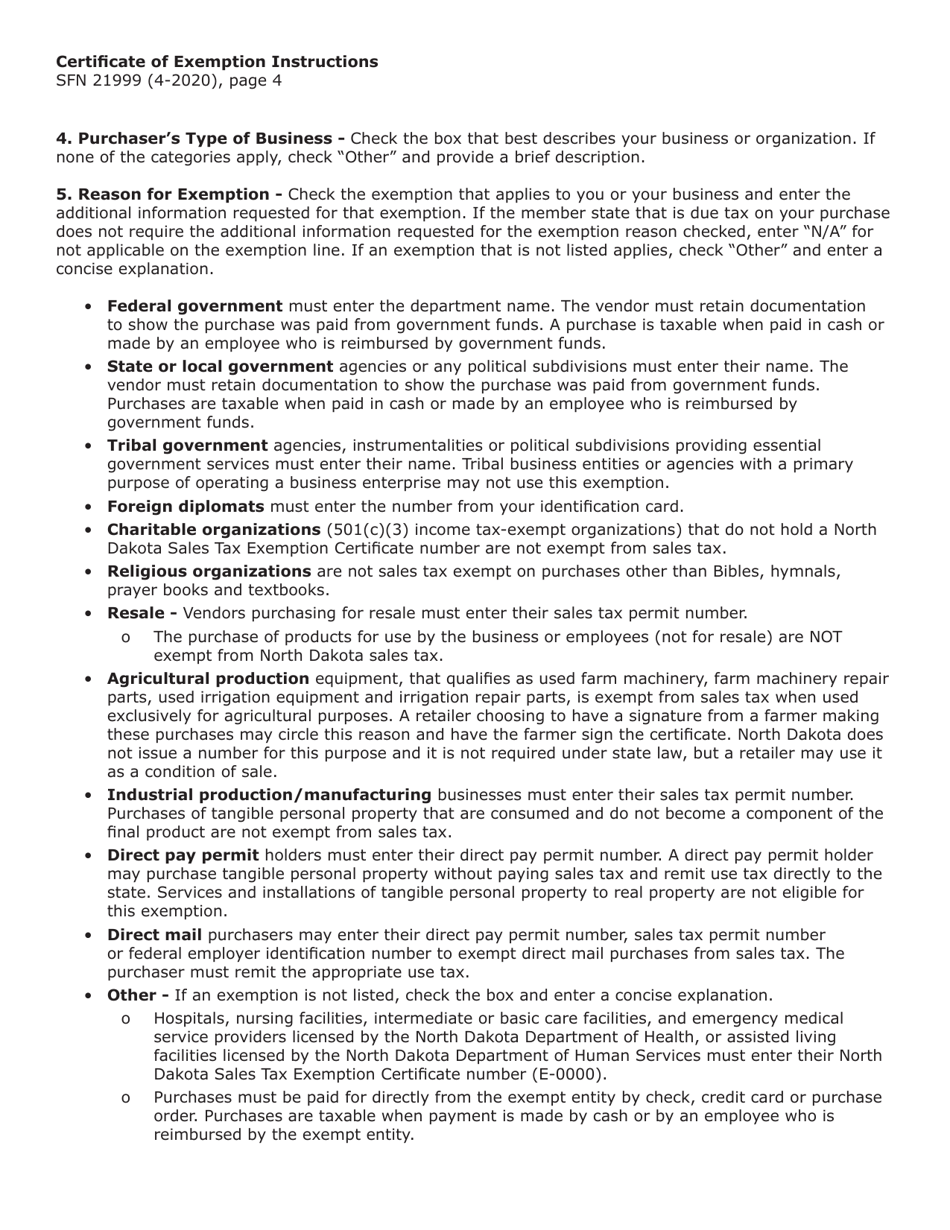

Form SFN21999 Streamlined Sales and Use Tax Agreement Certificate of Exemption - North Dakota

What Is Form SFN21999?

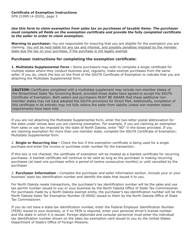

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

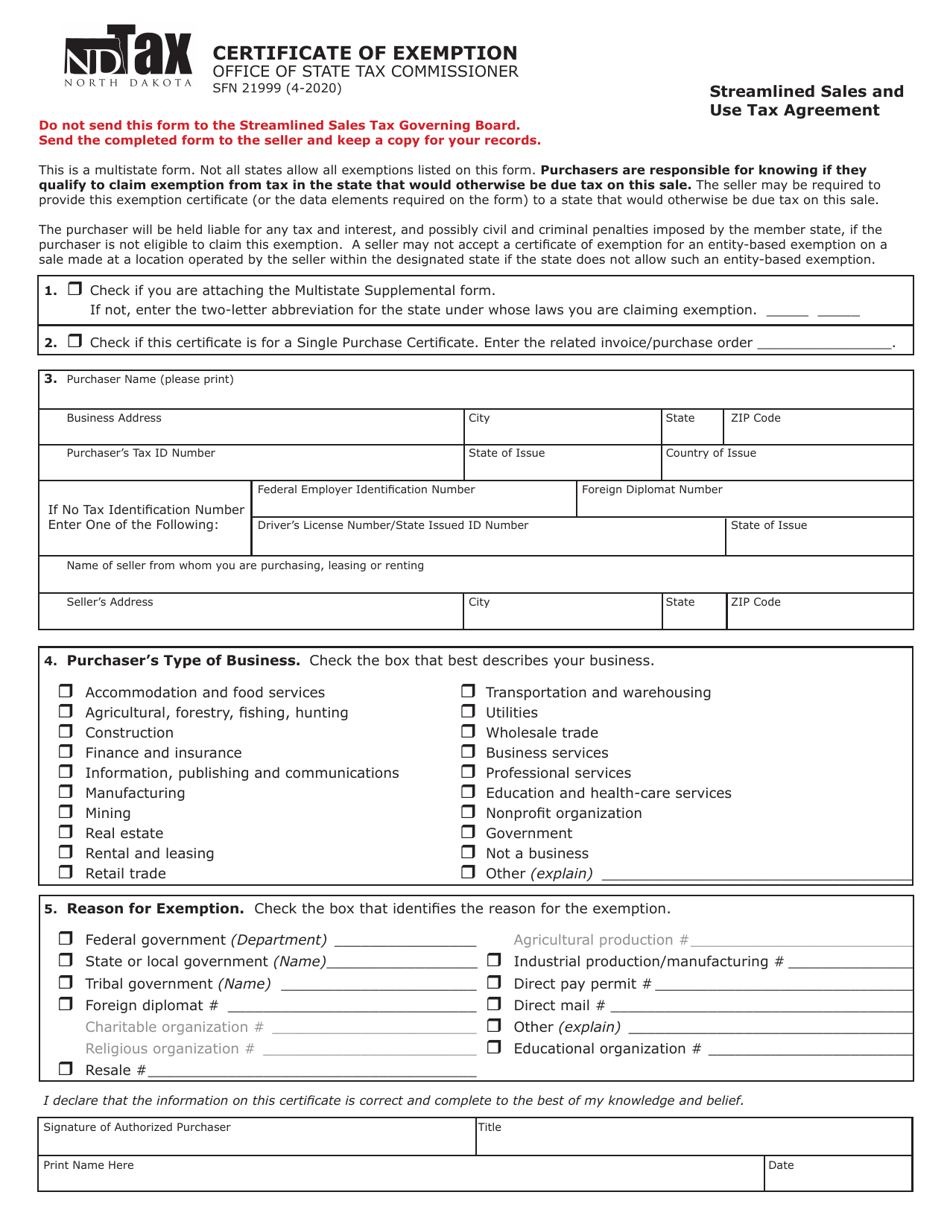

Q: What is SFN21999?

A: SFN21999 is the form for Streamlined Sales and Use Tax Agreement Certificate of Exemption in North Dakota.

Q: What is the purpose of SFN21999?

A: The purpose of SFN21999 is to claim exemption from sales and use tax in North Dakota.

Q: Who should use SFN21999?

A: SFN21999 should be used by individuals or businesses seeking to claim exemption from sales and use tax in North Dakota.

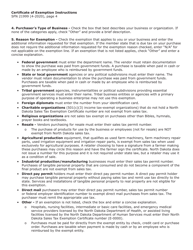

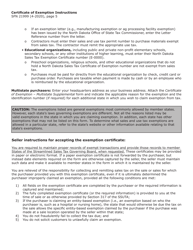

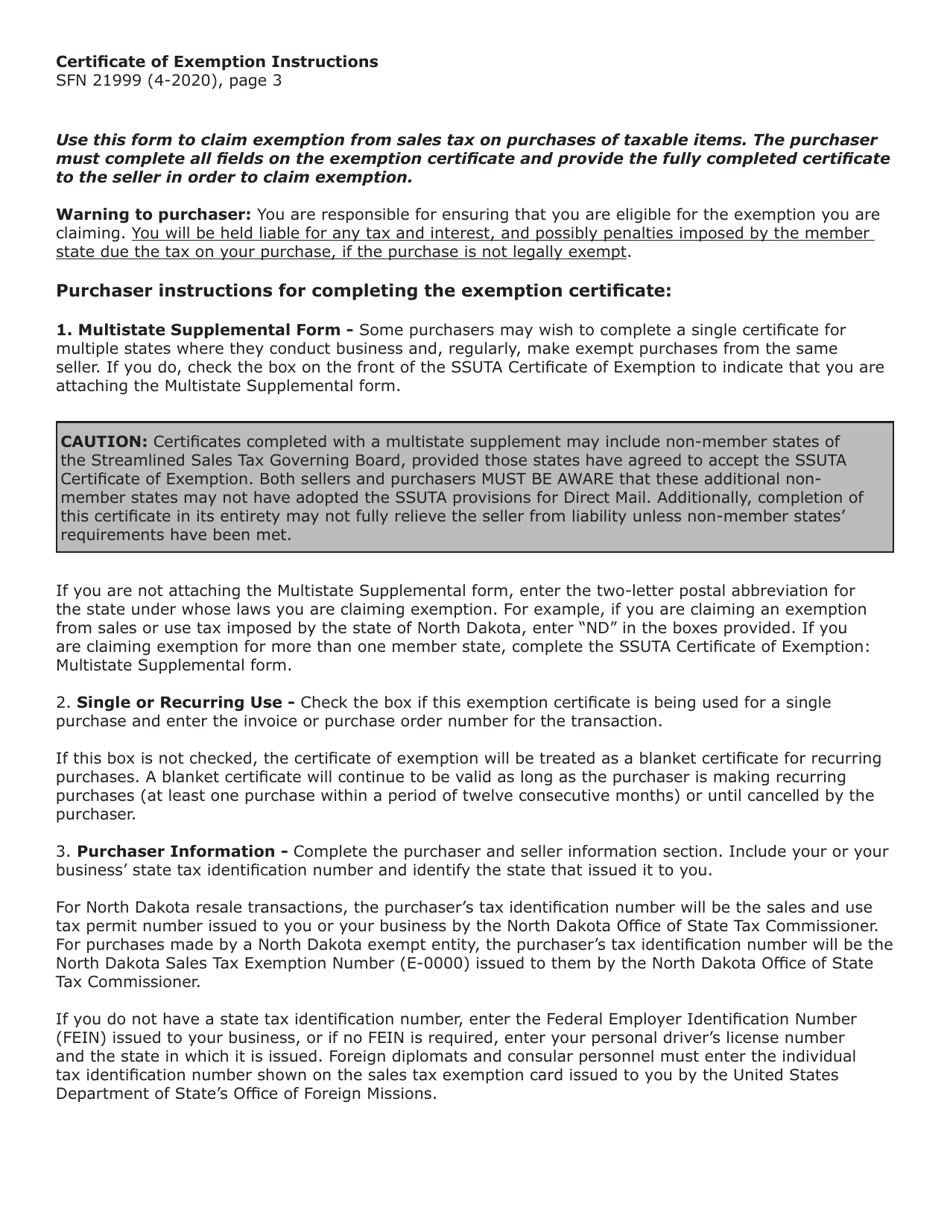

Q: What information is required on SFN21999?

A: SFN21999 requires information such as the taxpayer's name, address, tax identification number, and details of the exemption.

Q: Are there any fees associated with SFN21999?

A: No, there are no fees associated with SFN21999.

Q: How long is SFN21999 valid?

A: SFN21999 is valid until it is either revoked or the circumstances of the exemption change.

Q: What should I do if there are changes to my exemption status?

A: If there are changes to your exemption status, you should notify North Dakota's Department of Revenue and update your SFN21999 form accordingly.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN21999 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.