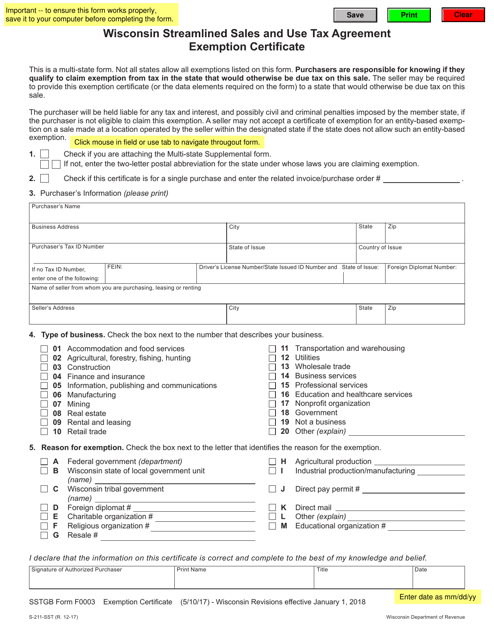

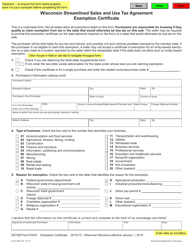

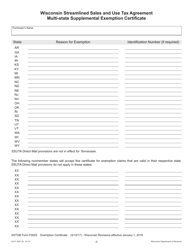

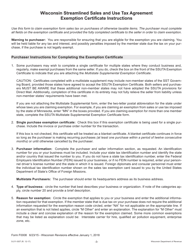

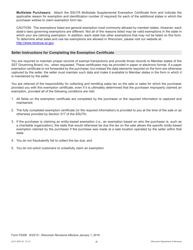

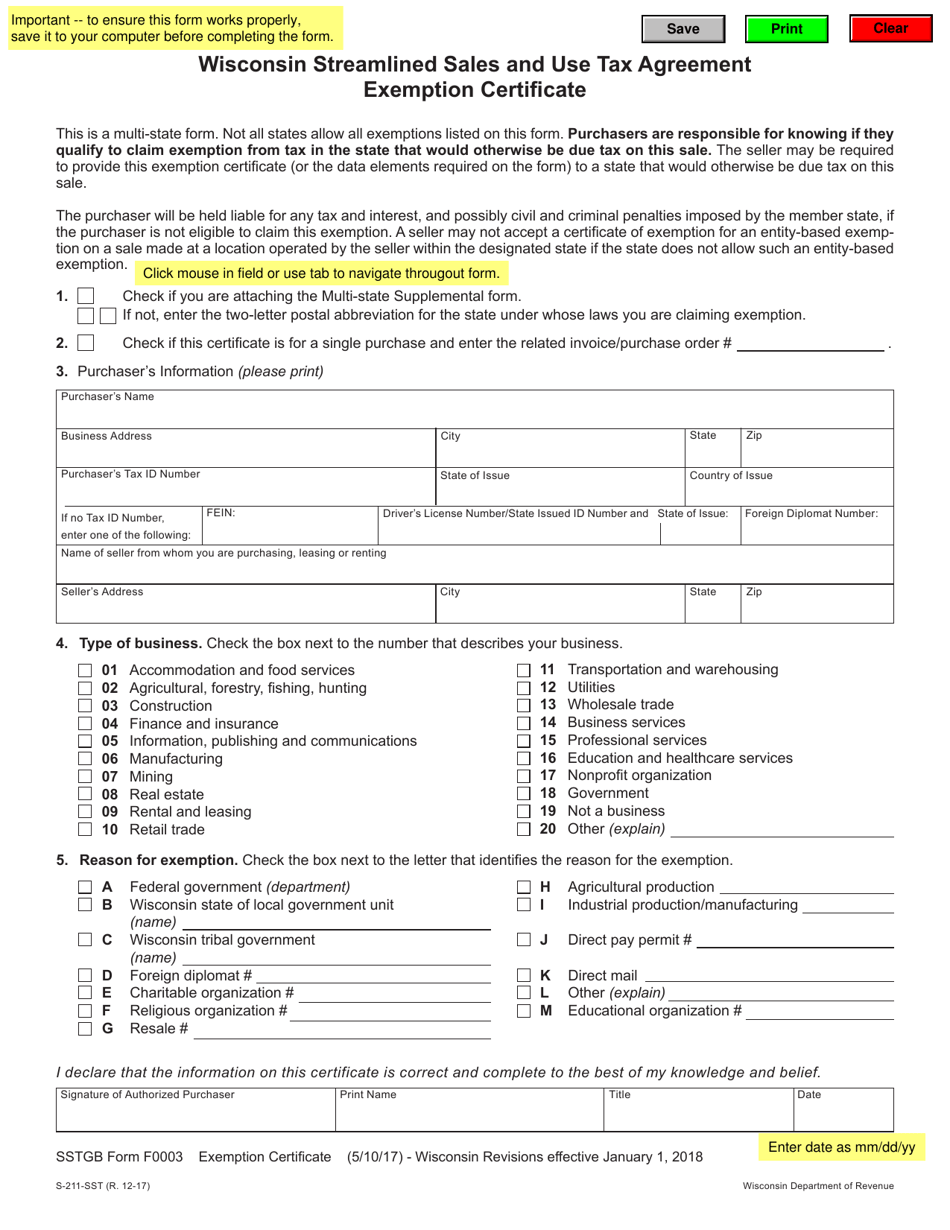

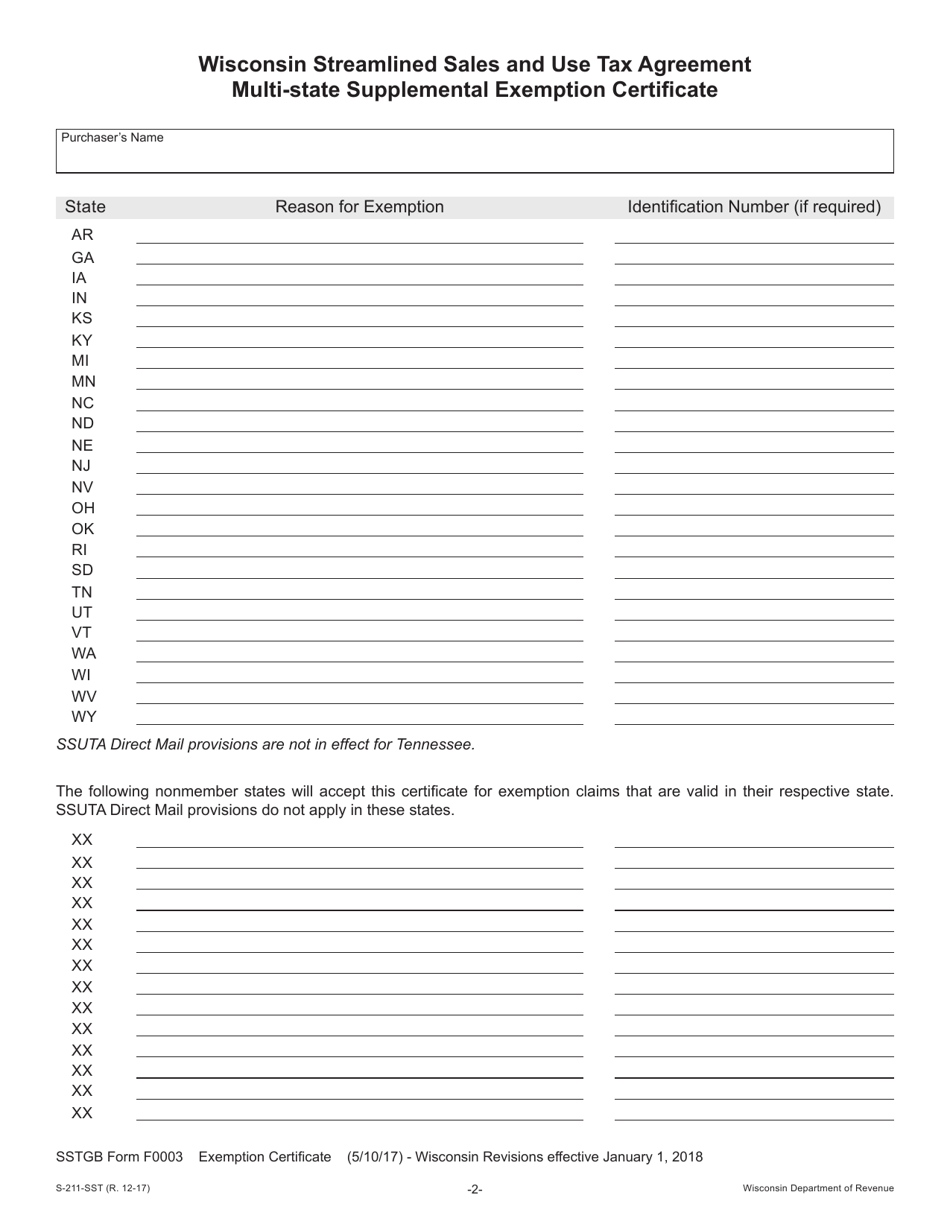

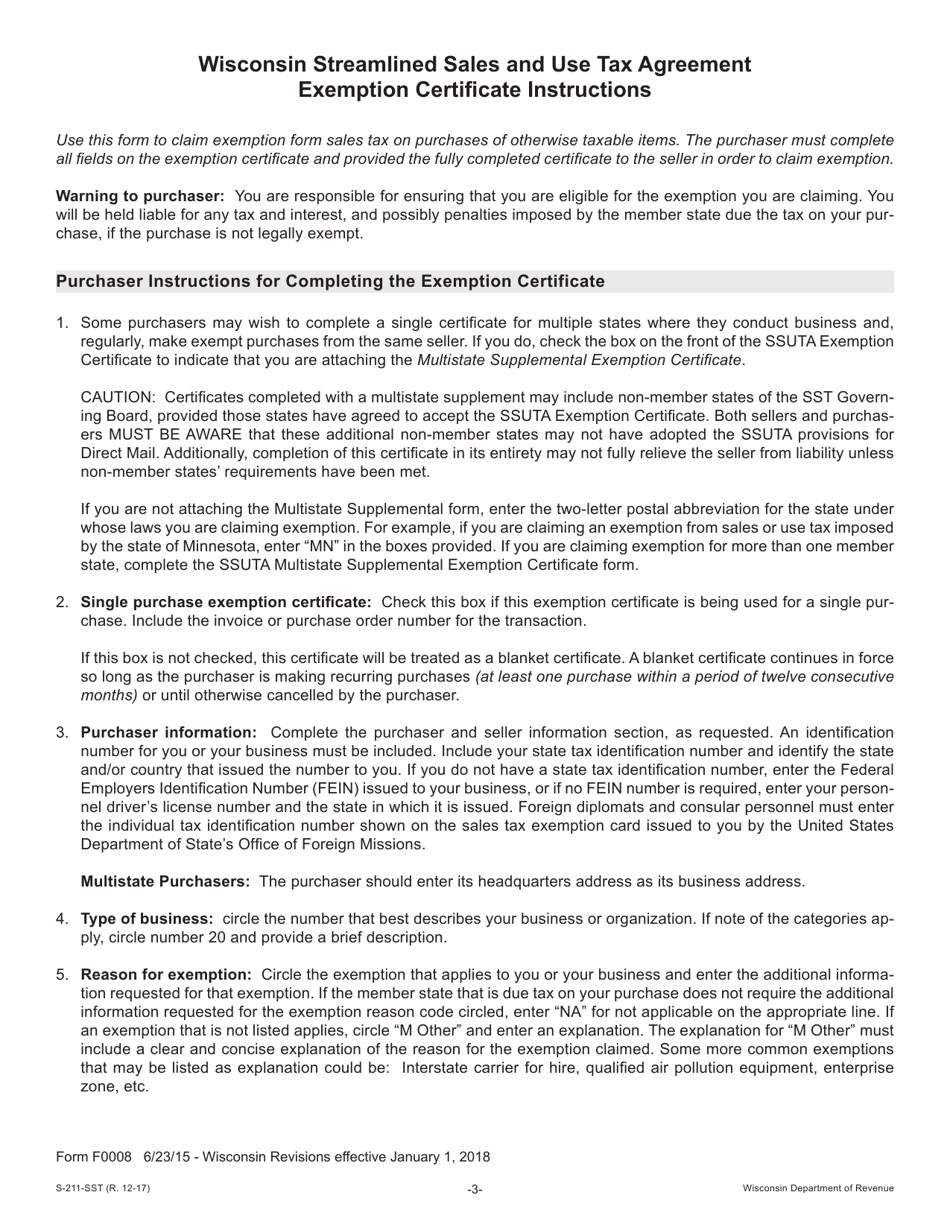

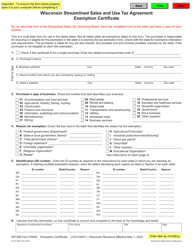

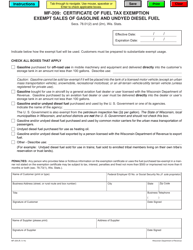

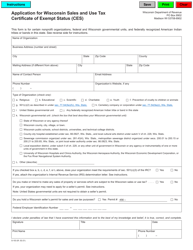

Form S-211-SST (SSTGB Form F0003) Wisconsin Streamlined Sales and Use Tax Agreement Exemption Certificate - Wisconsin

What Is Form S-211-SST (SSTGB Form F0003)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S-211-SST?

A: Form S-211-SST is the Wisconsin Streamlined Sales and Use Tax Agreement Exemption Certificate.

Q: What is the purpose of Form S-211-SST?

A: The purpose of Form S-211-SST is to claim an exemption from sales and use tax in Wisconsin under the Streamlined Sales and Use Tax Agreement.

Q: Who should use Form S-211-SST?

A: Form S-211-SST should be used by businesses and individuals who qualify for a sales and use tax exemption in Wisconsin under the Streamlined Sales and Use Tax Agreement.

Q: Is Form S-211-SST applicable only to Wisconsin?

A: Yes, Form S-211-SST is specific to Wisconsin and is used to claim a sales and use tax exemption in the state.

Q: Can I use Form S-211-SST for all types of exemptions?

A: No, Form S-211-SST is only used for exemptions that qualify under the Streamlined Sales and Use Tax Agreement in Wisconsin.

Q: Are there any specific requirements for using Form S-211-SST?

A: Yes, you must meet the criteria outlined in the Streamlined Sales and Use Tax Agreement to use Form S-211-SST and claim an exemption.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S-211-SST (SSTGB Form F0003) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.