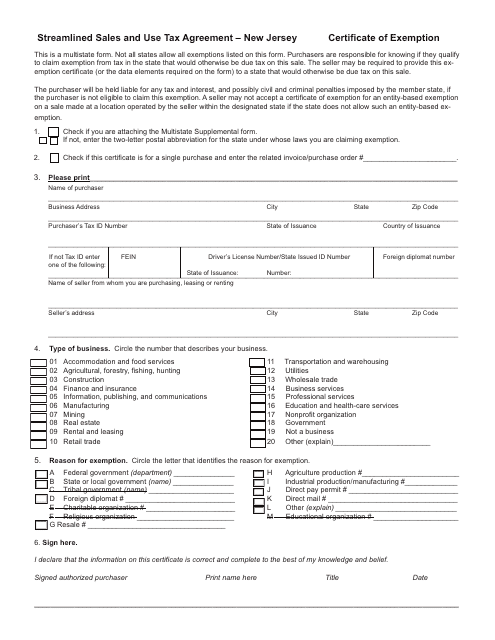

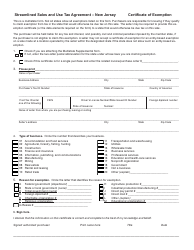

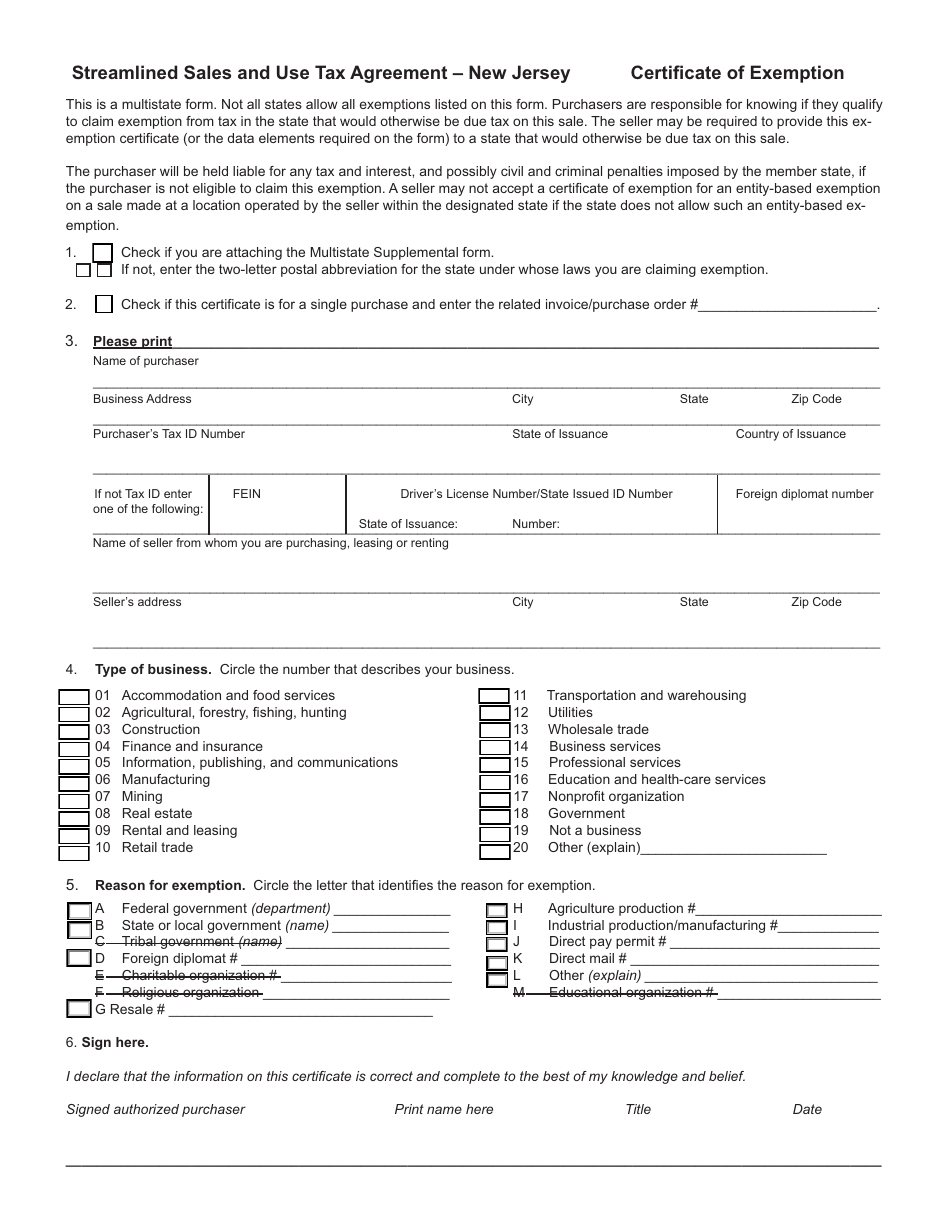

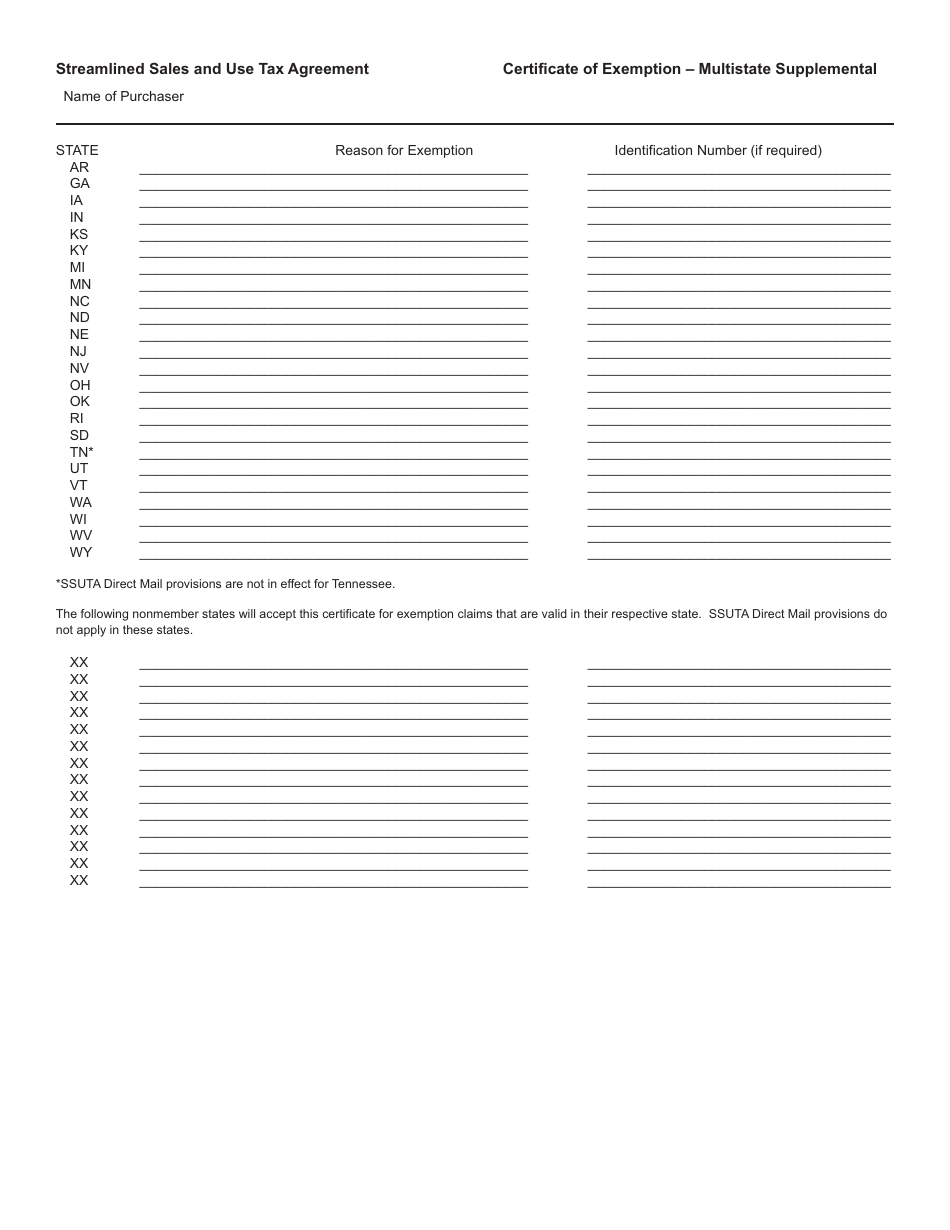

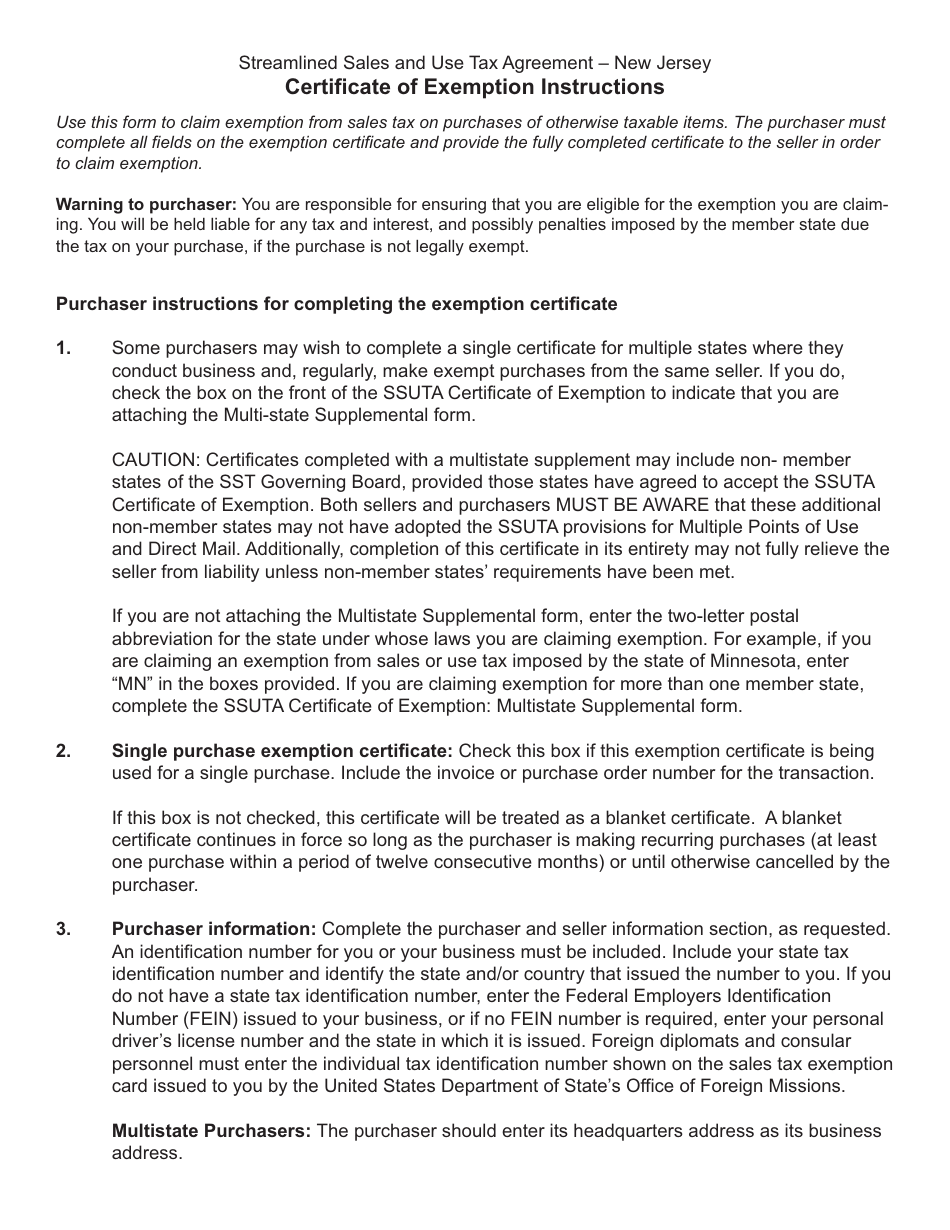

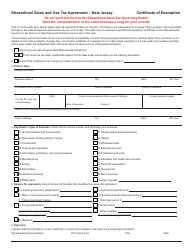

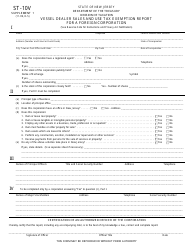

Form ST-SST Streamlined Sales and Use Tax Agreement - Certificate of Exemption - New Jersey

What Is Form ST-SST?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-SST?

A: Form ST-SST is the Streamlined Sales and Use Tax Agreement - Certificate of Exemption.

Q: What is the purpose of Form ST-SST?

A: The purpose of Form ST-SST is to certify that a purchase qualifies for exemption from sales or use tax under the Streamlined Sales and Use Tax Agreement.

Q: Which state uses Form ST-SST?

A: Form ST-SST is used by the state of New Jersey.

Q: What is the Streamlined Sales and Use Tax Agreement?

A: The Streamlined Sales and Use Tax Agreement is an effort to simplify and modernize sales and use tax administration in order to reduce costs and improve compliance.

Q: When should Form ST-SST be filled out?

A: Form ST-SST should be filled out when making a purchase that qualifies for exemption from sales or use tax in New Jersey under the Streamlined Sales and Use Tax Agreement.

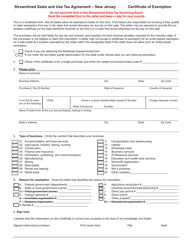

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-SST by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.