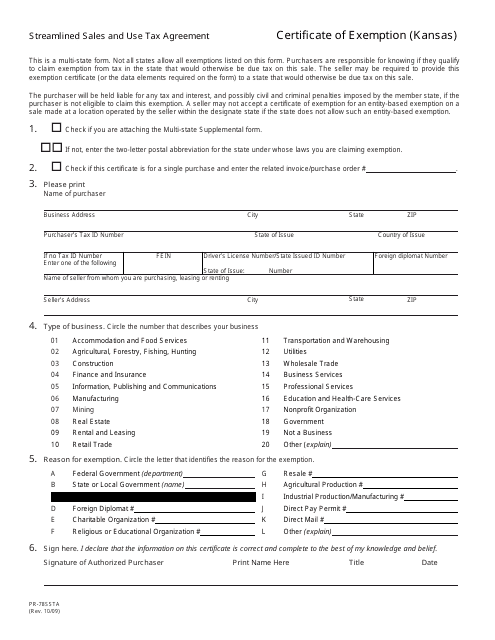

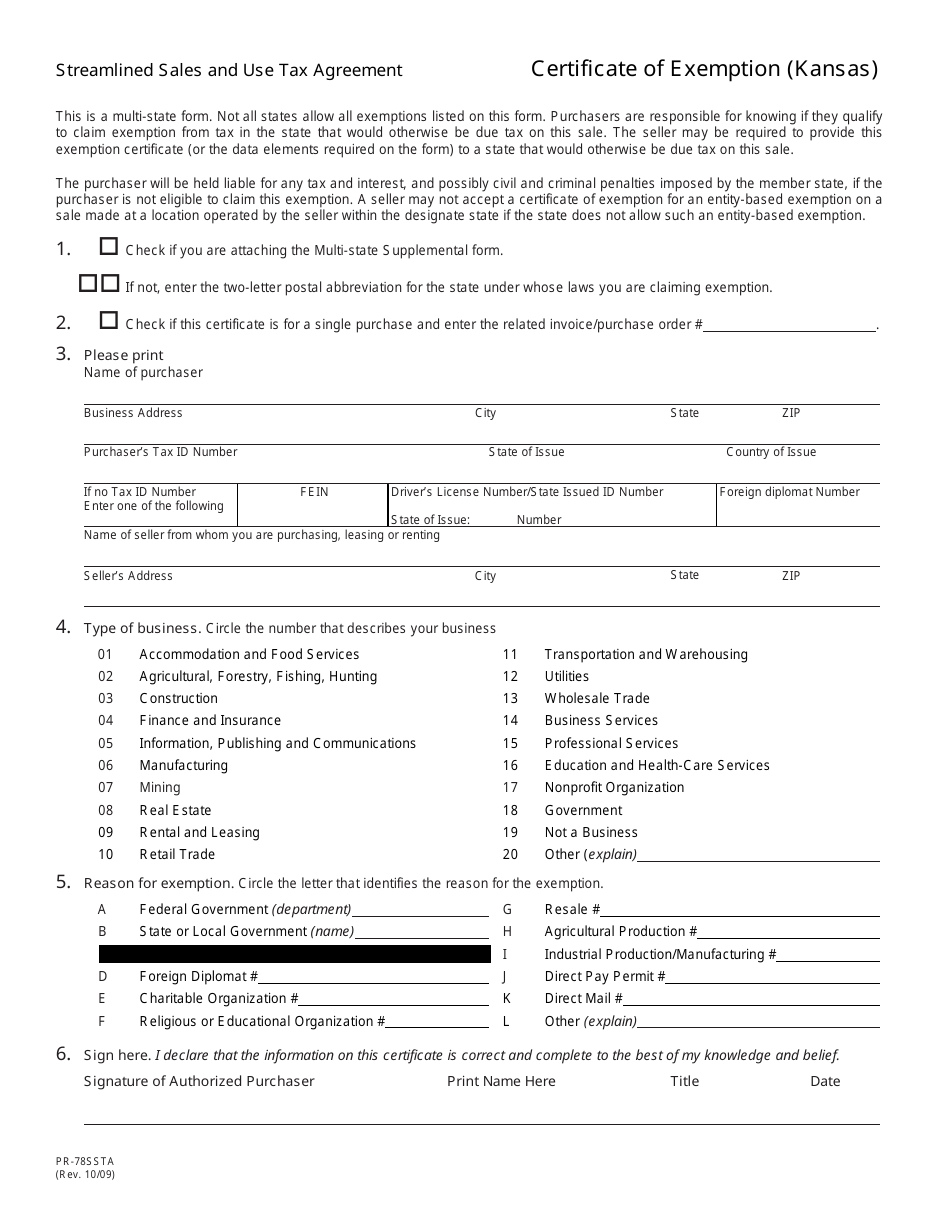

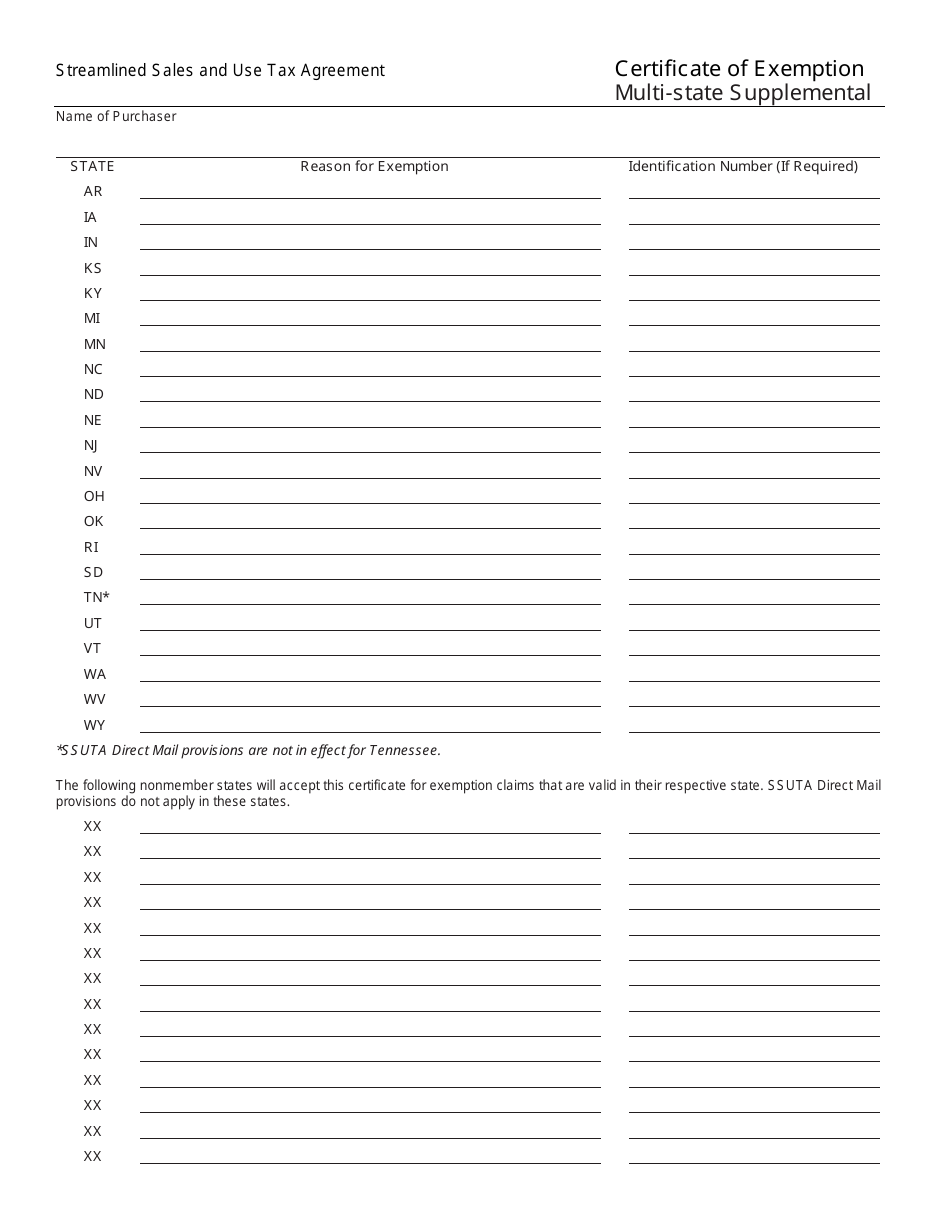

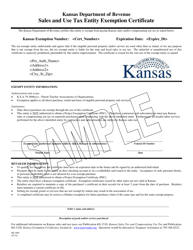

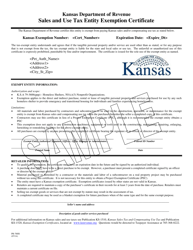

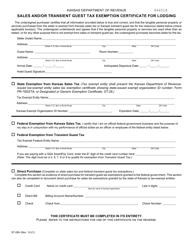

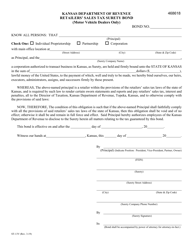

Form PR-78SSTA Streamlined Sales and Use Tax Agreement Certificate of Exemption (Kansas) - Kansas

What Is Form PR-78SSTA?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form PR-78SSTA?

A: Form PR-78SSTA is the Streamlined Sales and Use Tax Agreement Certificate of Exemption for the state of Kansas.

Q: What is the purpose of form PR-78SSTA?

A: The purpose of form PR-78SSTA is to claim exemption from sales and use taxes in Kansas.

Q: Who should use form PR-78SSTA?

A: This form should be used by individuals or businesses who qualify for exemption from sales and use taxes in Kansas.

Q: What information is required on form PR-78SSTA?

A: The form requires the applicant to provide their personal or business information, the reason for exemption, and any supporting documentation.

Q: Are there any fees associated with form PR-78SSTA?

A: No, there are no fees associated with submitting form PR-78SSTA.

Q: Is form PR-78SSTA specific to businesses only?

A: No, form PR-78SSTA can be used by both individuals and businesses to claim exemption from sales and use taxes in Kansas.

Q: How often should form PR-78SSTA be renewed?

A: Form PR-78SSTA does not need to be renewed unless there are changes to the applicant's exemption status.

Form Details:

- Released on October 1, 2009;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PR-78SSTA by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.