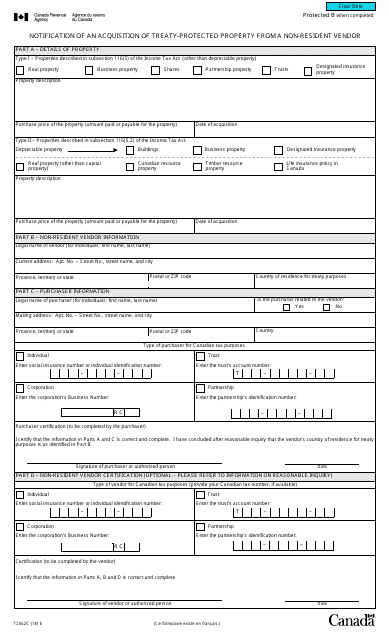

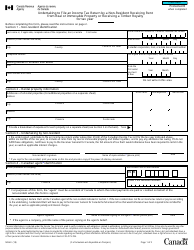

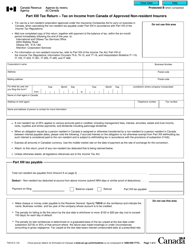

Form T2062C Notification of an Acquisition of Treaty-Protected Property From a Non-resident Vendor - Canada

Form T2062C is a Canadian Revenue Agency form also known as the "Form T2062c "notification Of An Acquisition Of Treaty-protected Property From A Non-resident Vendor" - Canada" . The latest edition of the form was released in January 1, 2018 and is available for digital filing.

Download an up-to-date Form T2062C in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2062C?

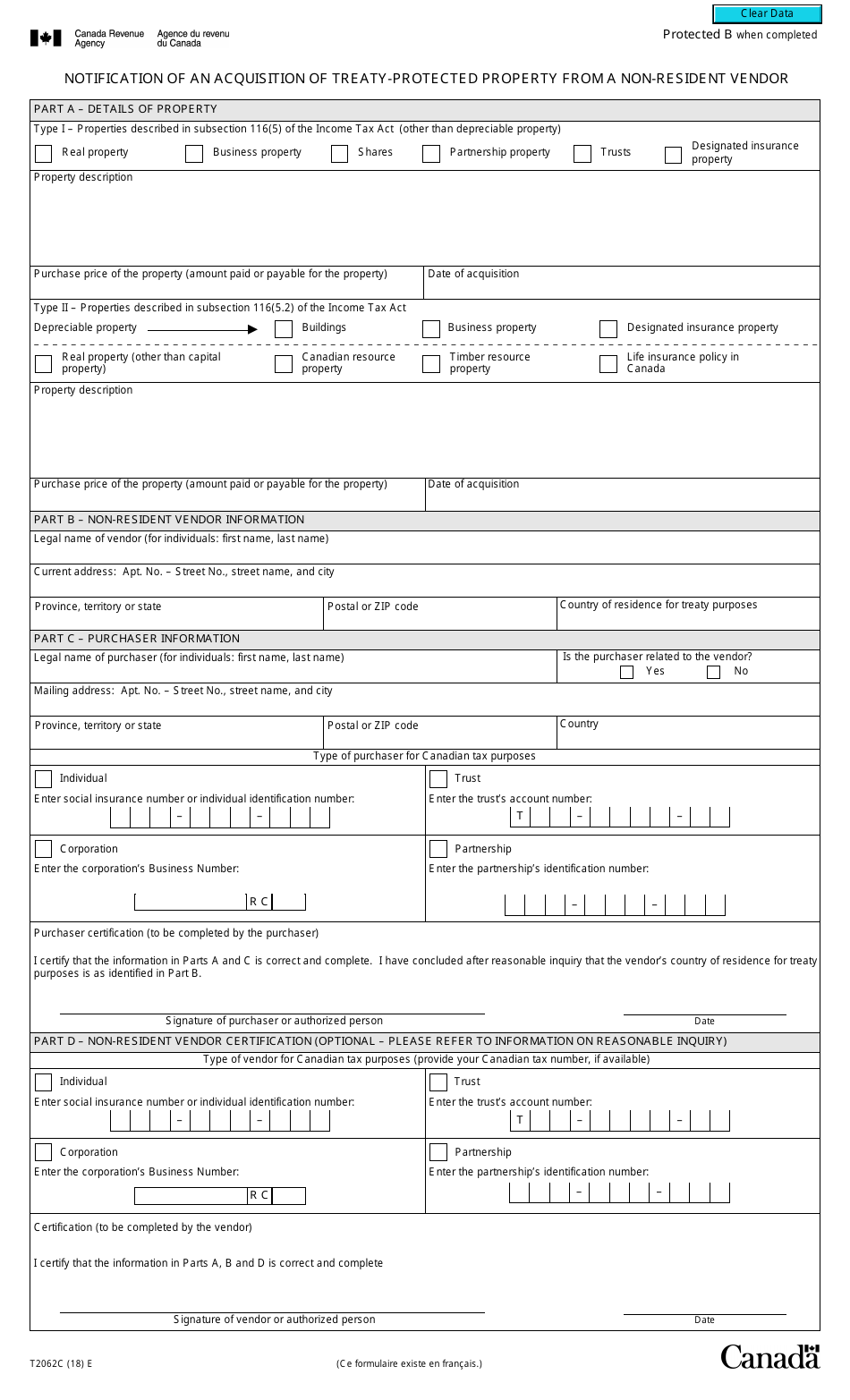

A: Form T2062C is a notification form used for reporting the acquisition of treaty-protected property from a non-resident vendor in Canada.

Q: What is treaty-protected property?

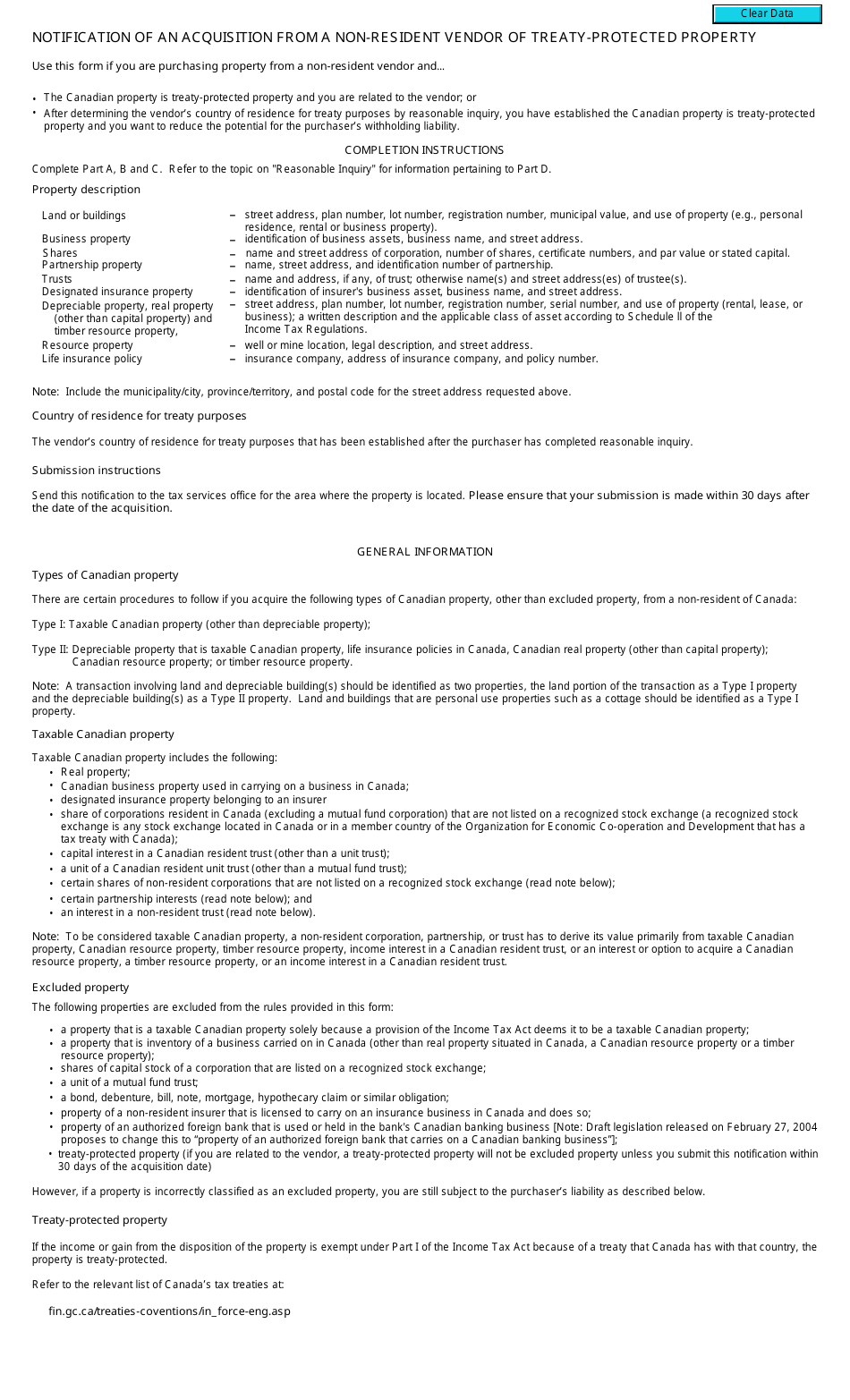

A: Treaty-protected property refers to real property or shares in the capital stock of a corporation that is protected by a tax treaty between Canada and another country.

Q: Who needs to file Form T2062C?

A: Any person, resident or non-resident, who acquires treaty-protected property from a non-resident vendor in Canada needs to file Form T2062C.

Q: What information is required on Form T2062C?

A: Form T2062C requires detailed information about the property, parties involved, and the transaction, including the purchase price, vendor's name, and address.

Q: When should Form T2062C be filed?

A: Form T2062C should be filed with the Canada Revenue Agency (CRA) and the relevant tax office within 30 days of the date of the acquisition of the treaty-protected property.

Q: What happens if Form T2062C is not filed?

A: Failure to file Form T2062C or providing false or misleading information on the form may result in penalties and other consequences as determined by the CRA.

Q: Is Form T2062C only applicable to non-resident vendors?

A: No, Form T2062C is also applicable to resident vendors who are not Canadian citizens or permanent residents of Canada.