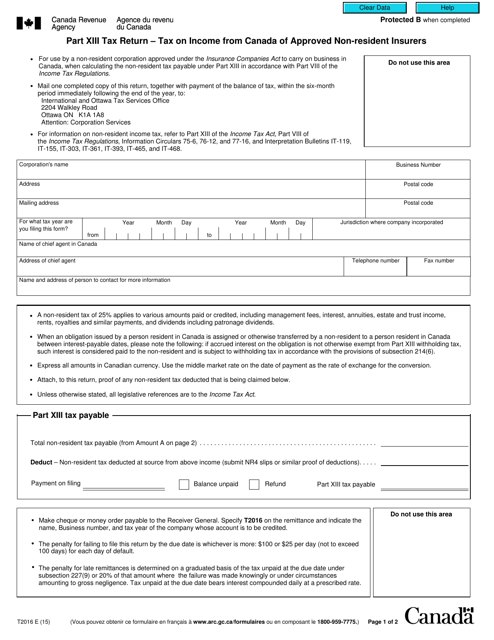

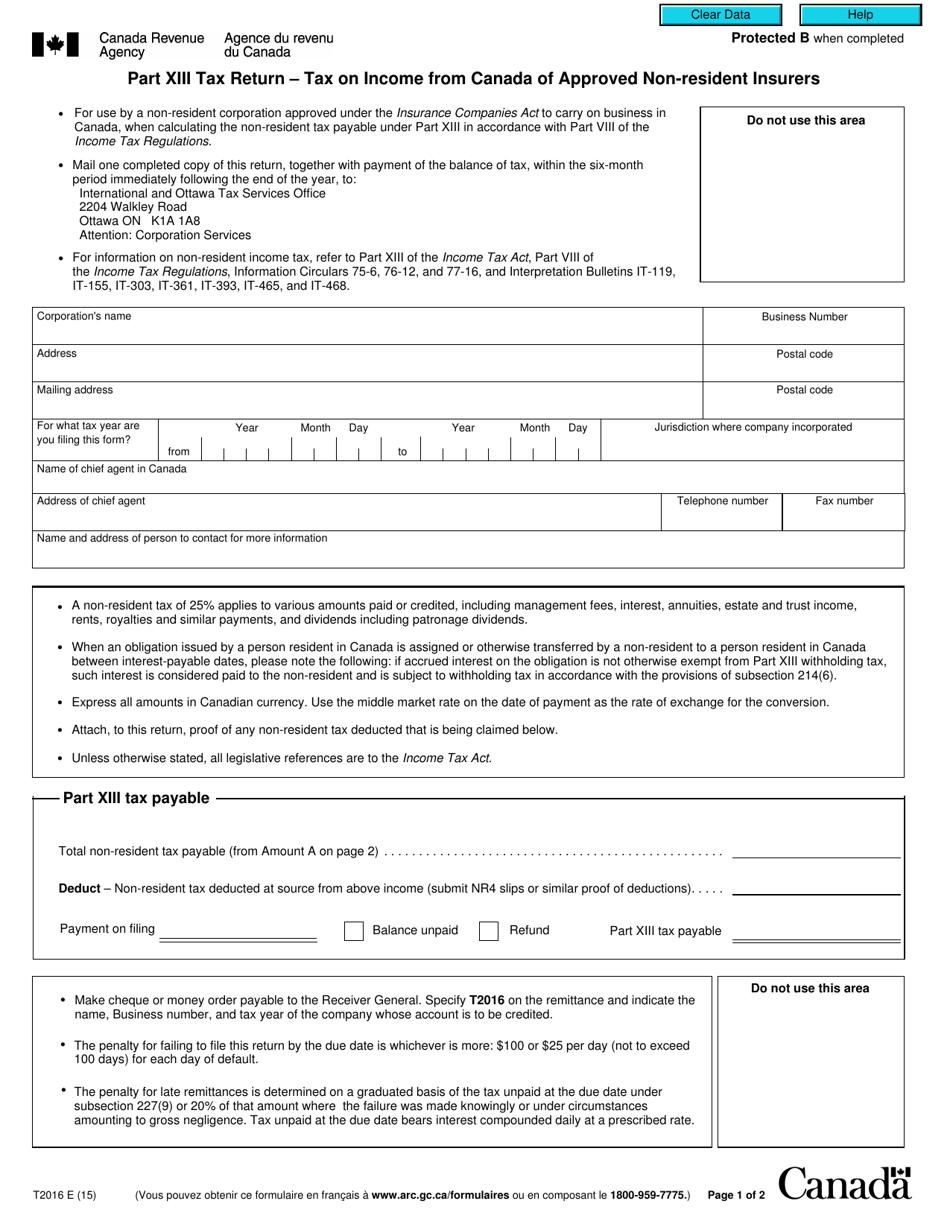

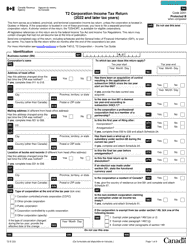

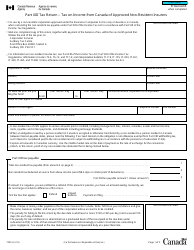

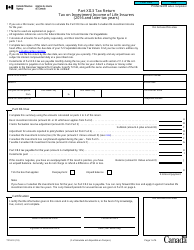

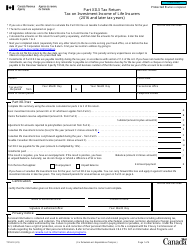

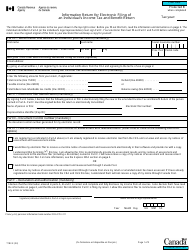

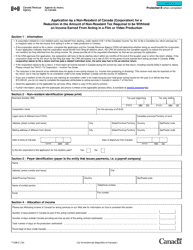

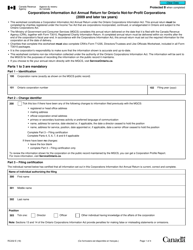

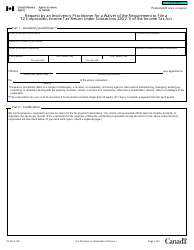

Form T2016 Part Xiii Tax Return - Tax on Income From Canada of Approved Non-resident Insurers - Canada

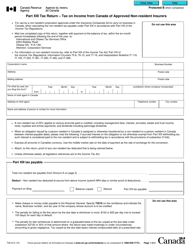

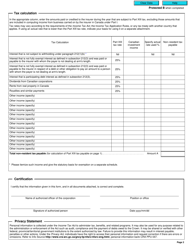

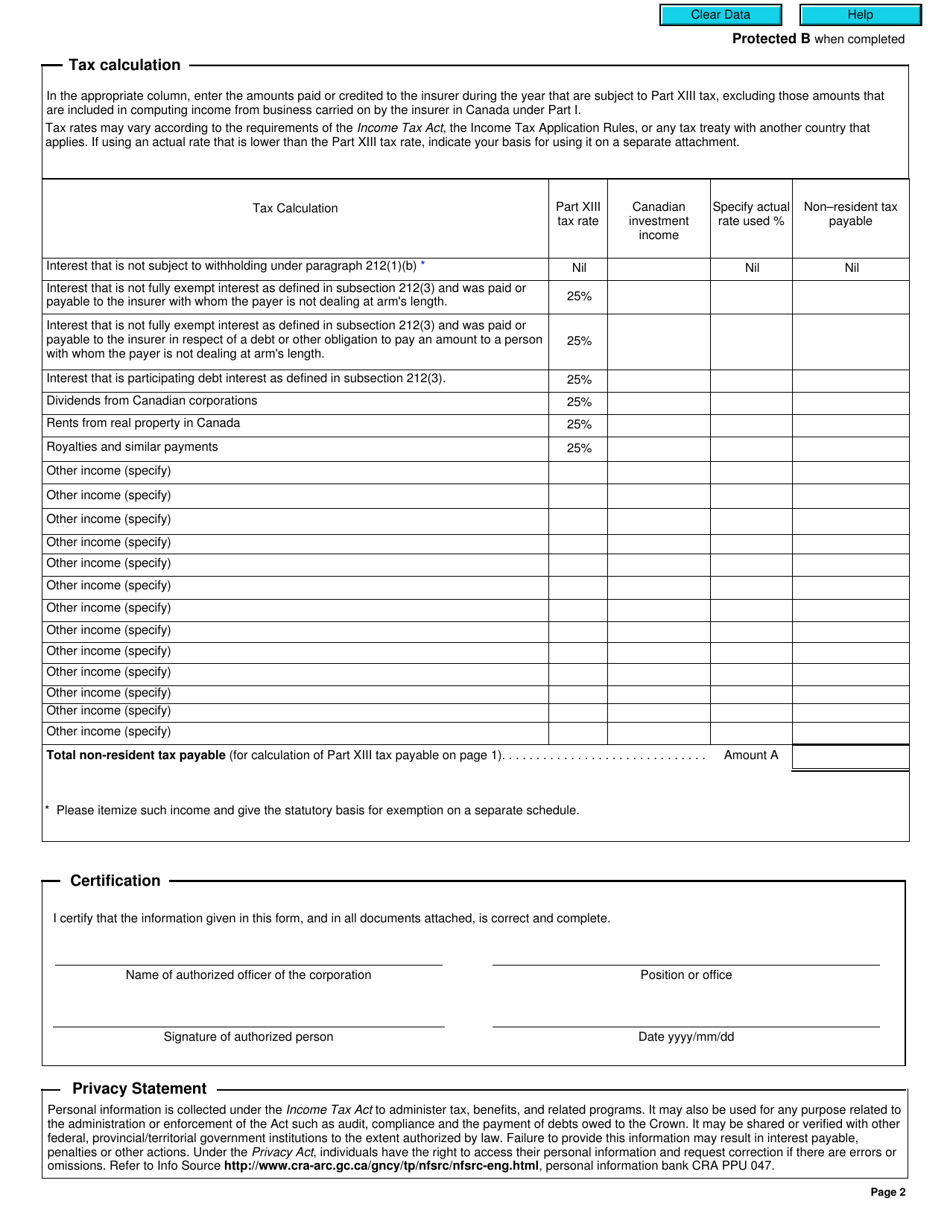

Form T2016 Part XIII Tax Return - Tax on Income from Canada of Approved Non-Resident Insurers is used by approved non-resident insurers (insurance companies from outside Canada) to report and pay Canadian income tax on their income earned from Canadian sources. This form ensures that these insurers fulfill their tax obligations in Canada.

The Form T2016 Part XIII tax return for approved non-resident insurers is filed by the non-resident insurers themselves.

FAQ

Q: What is Form T2016?

A: Form T2016 is a tax form used to report income from Canada by approved non-resident insurers.

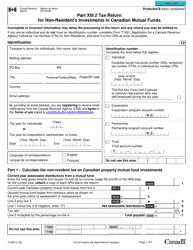

Q: What is Part XIII of the Tax Return?

A: Part XIII of the tax return refers to the section that deals with tax on income from Canada by non-resident insurers.

Q: Who needs to file Form T2016?

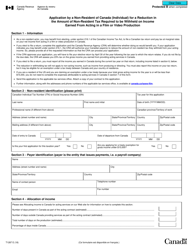

A: Approved non-resident insurers who have earned income from Canada need to file Form T2016.

Q: What is the purpose of Form T2016?

A: The purpose of Form T2016 is to calculate and report the tax on income earned from Canada by non-resident insurers.

Q: What is an approved non-resident insurer?

A: An approved non-resident insurer is an insurance company that is not a resident of Canada but has been approved by the Canadian authorities to operate in Canada.

Q: What is taxed under Part XIII of the tax return?

A: Under Part XIII, the tax is levied on the income earned by non-resident insurers in Canada.

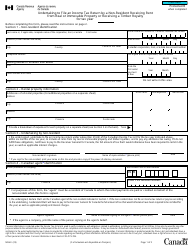

Q: Are there any exceptions or exemptions for non-resident insurers?

A: Yes, there are certain exemptions and exceptions available for non-resident insurers, which may reduce or eliminate the tax liability.

Q: Are there specific instructions for filling out Form T2016?

A: Yes, the Canada Revenue Agency (CRA) provides instructions and guidance on how to complete Form T2016.

Q: When is the deadline for filing Form T2016?

A: The deadline for filing Form T2016 is determined by the tax year of the non-resident insurer.