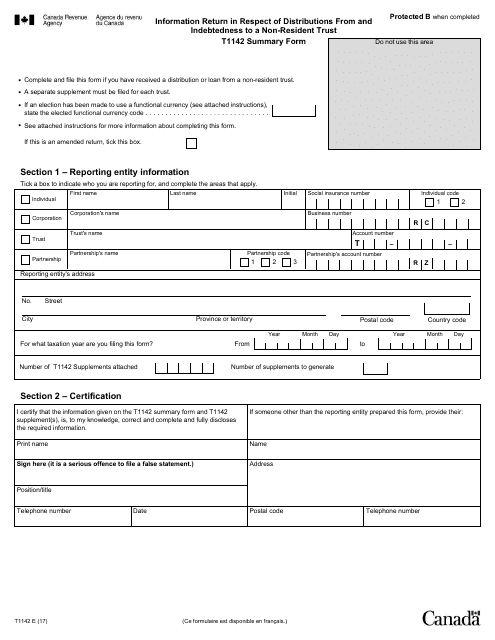

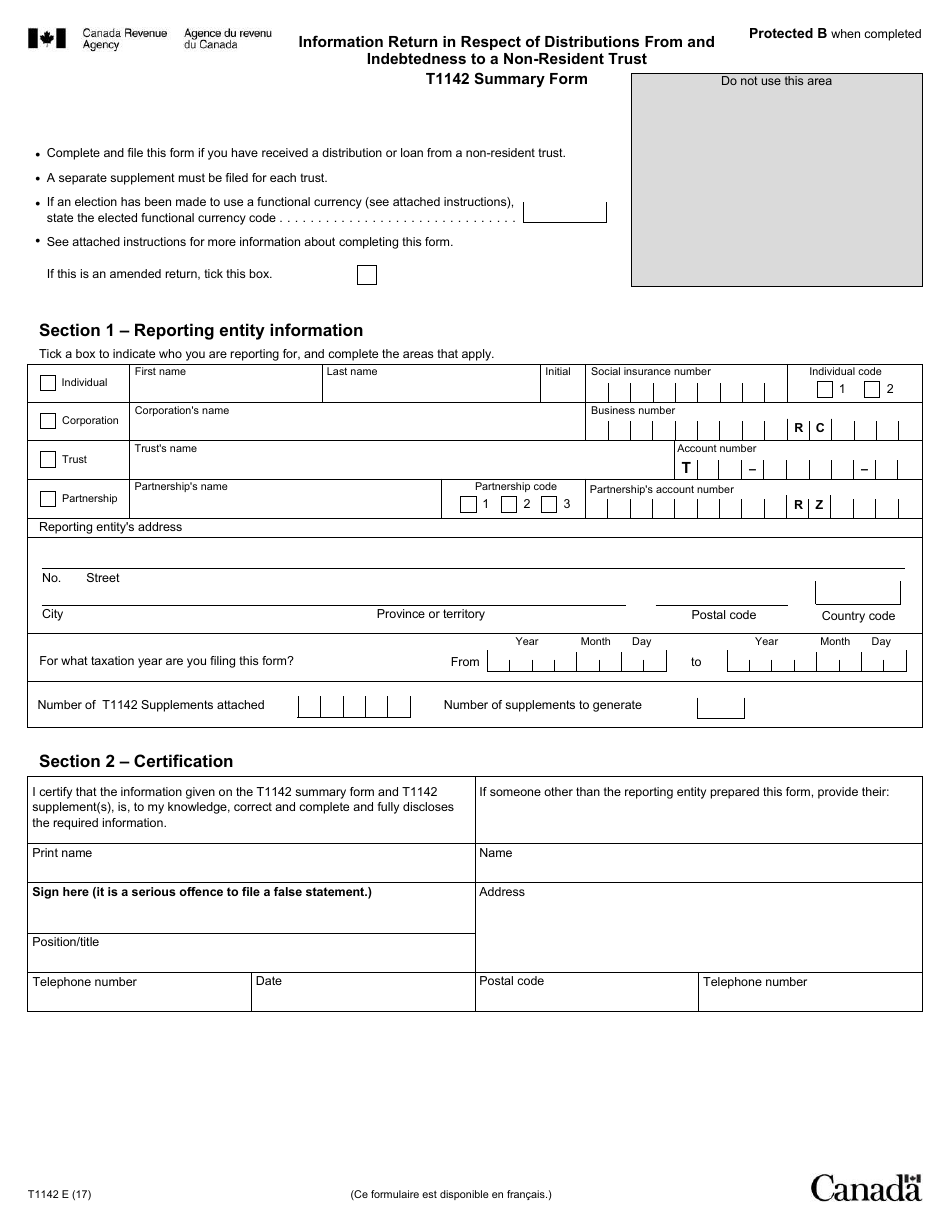

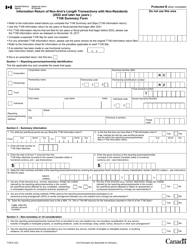

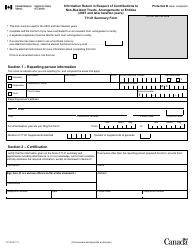

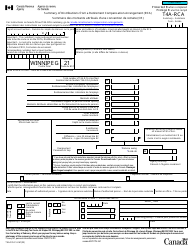

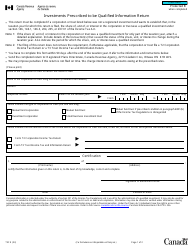

Form T1142 Information Return in Respect of Distributions From and Indebtedness to a Non-resident Trust - Canada

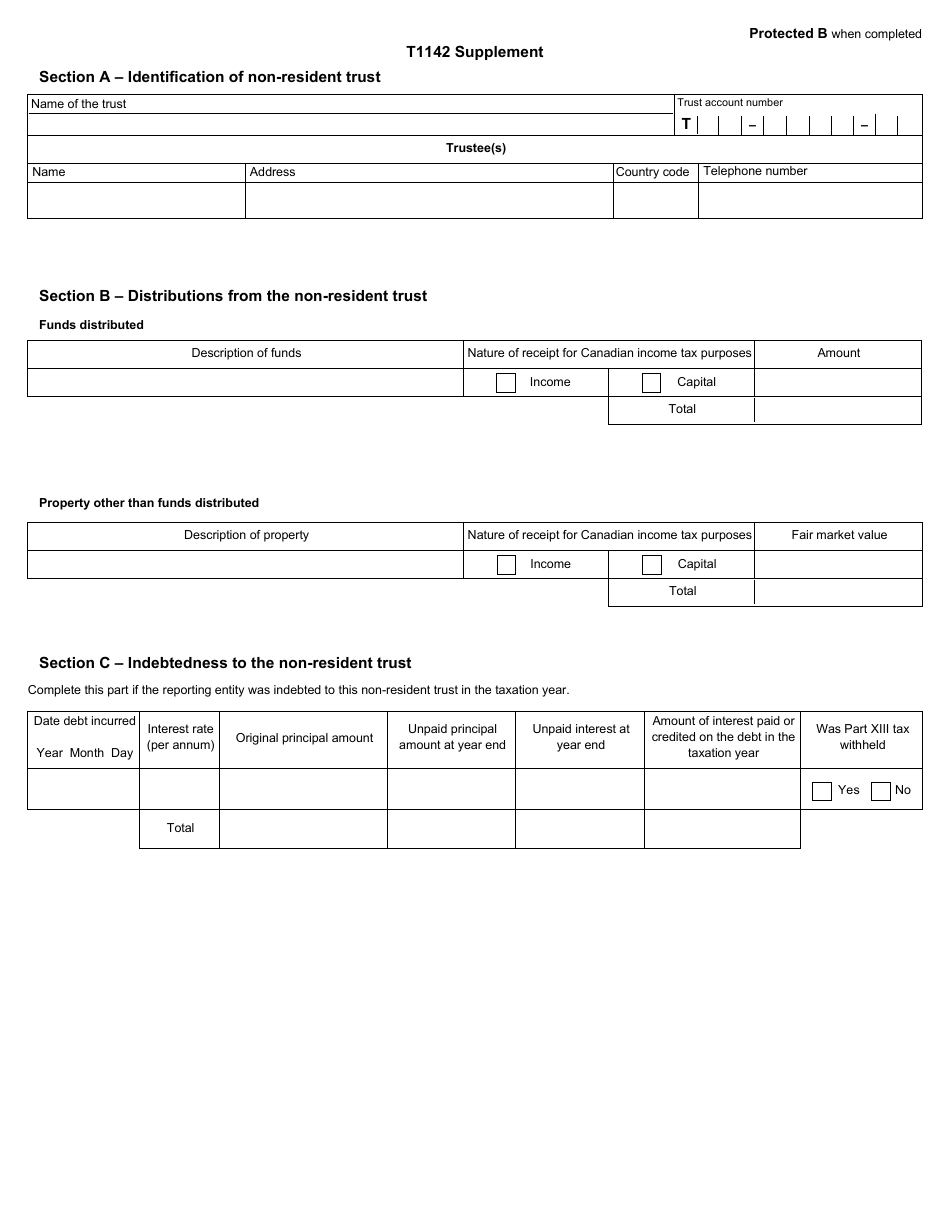

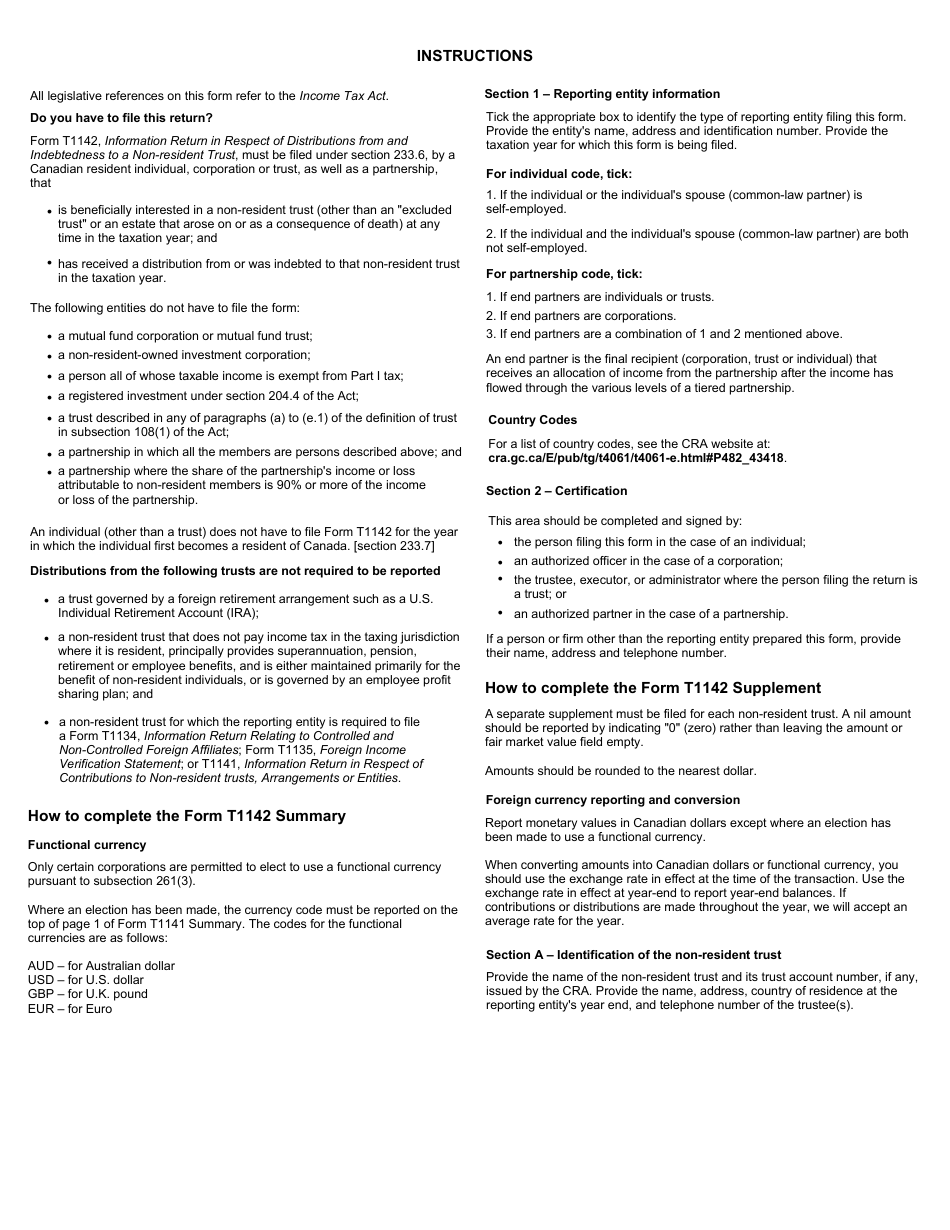

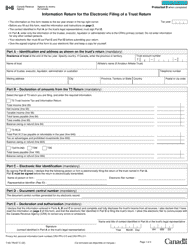

Form T1142 Information Return in Respect of Distributions From and Indebtedness to a Non-resident Trust in Canada is used to report certain transactions and amounts related to non-resident trusts. This form is filed by Canadian residents who are beneficiaries or receive distributions from a non-resident trust, or who owe certain amounts to a non-resident trust. It is used to provide the Canada Revenue Agency with information about these transactions.

The person or entity making distributions from or having indebtedness to a non-resident trust is required to file Form T1142 Information Return in Respect of Distributions From and Indebtedness to a Non-resident Trust in Canada.

FAQ

Q: What is Form T1142?

A: Form T1142 is an information return that is used in Canada to report distributions from and indebtedness to a non-resident trust.

Q: Who is required to file Form T1142?

A: Individuals, corporations, and partnerships that are residents of Canada and have made distributions from or have indebtedness to a non-resident trust are required to file Form T1142.

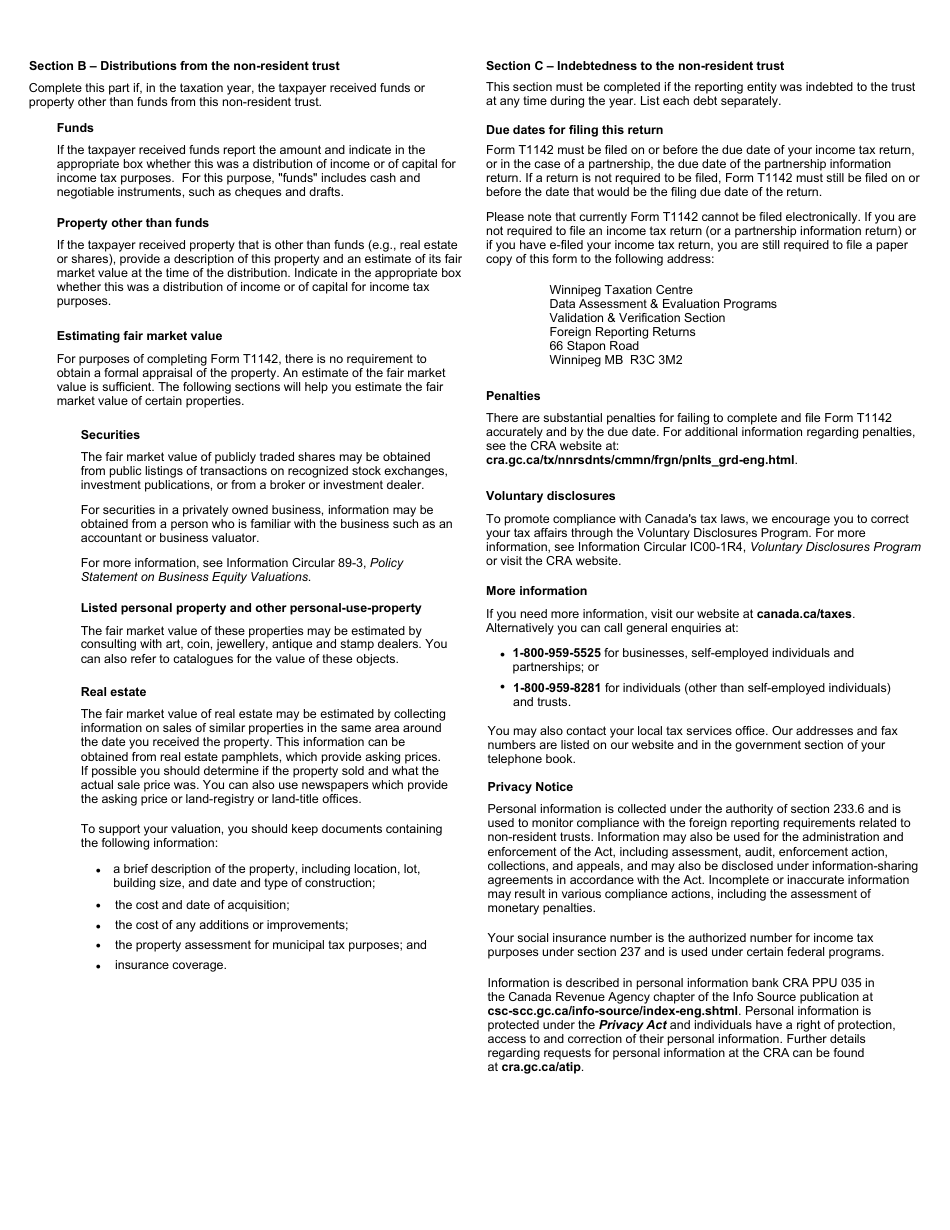

Q: What information needs to be provided on Form T1142?

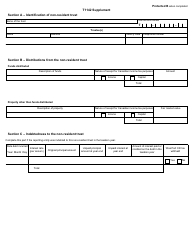

A: Form T1142 requires the filer to provide information about the non-resident trust, details of the distributions made or indebtedness incurred, and any applicable waivers or agreements.

Q: When is the deadline to file Form T1142?

A: Form T1142 must be filed within 90 days after the end of the taxation year in which the distributions were made or the indebtedness was incurred.

Q: What are the consequences of not filing Form T1142?

A: Failure to file Form T1142 or providing false or misleading information may result in penalties and consequences under Canadian tax law.

Q: Is Form T1142 applicable only for non-resident trusts in Canada?

A: Yes, Form T1142 is specifically designed to report distributions from and indebtedness to a non-resident trust in Canada.

Q: Are there any exceptions or exemptions to filing Form T1142?

A: Certain exceptions and exemptions may apply, such as when the total amount of distributions or indebtedness is below a certain threshold. It is recommended to consult the CRA or a tax professional for specific guidance on exemptions.