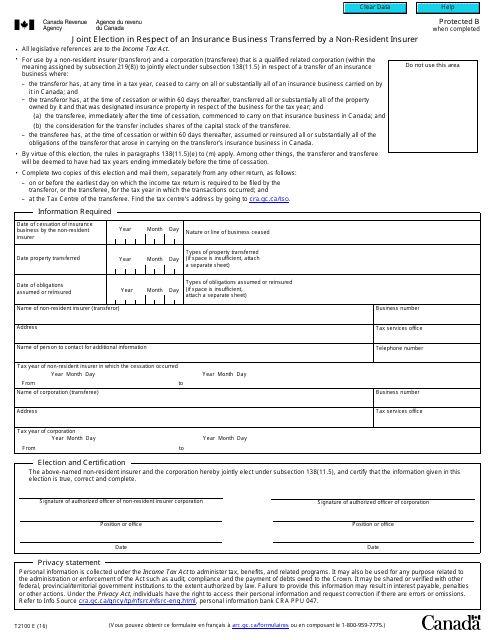

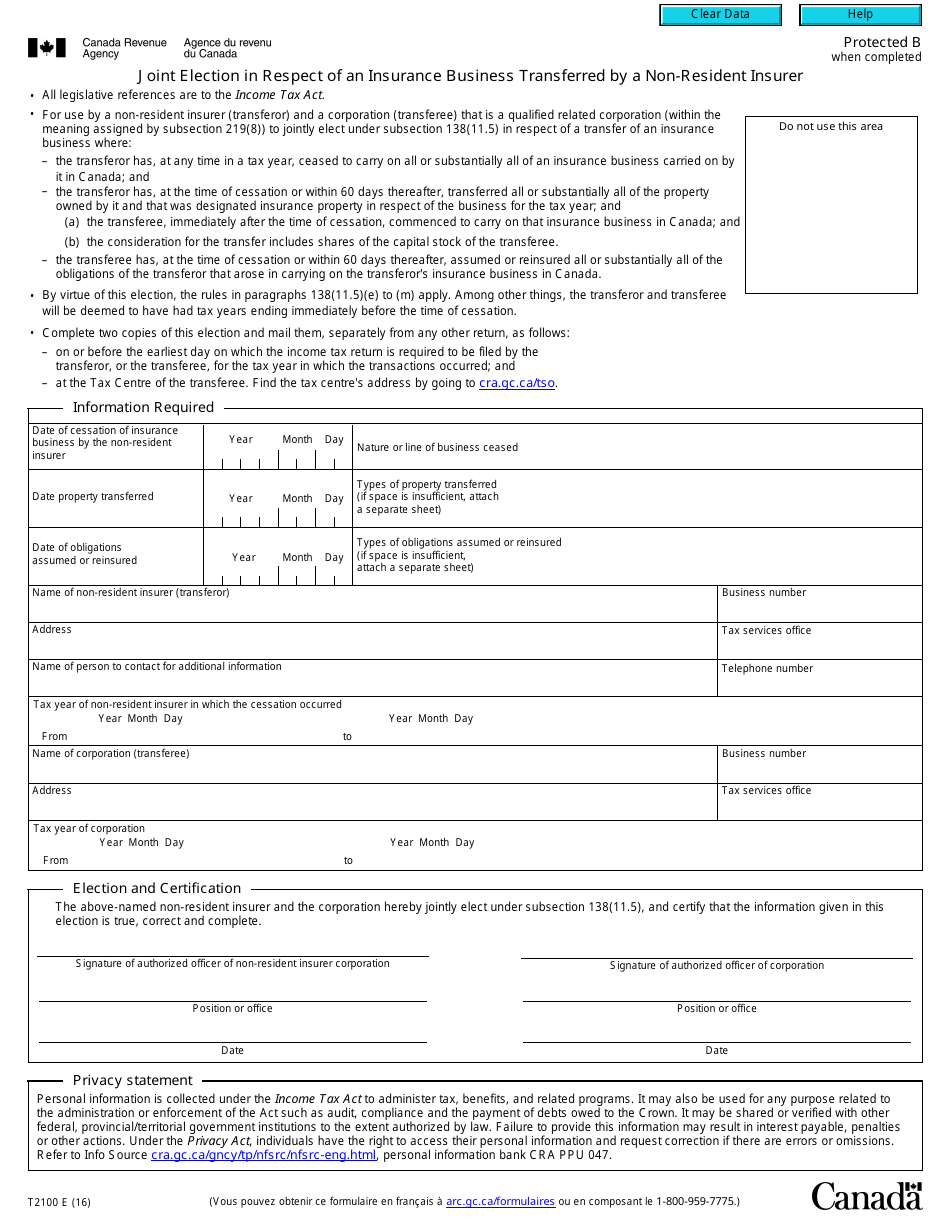

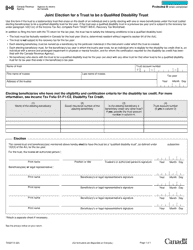

Form T2100 Joint Election in Respect of an Insurance Business Transferred by a Non-resident Insurer - Canada

Form T2100 or the "Form T2100 "joint Election In Respect Of An Insurance Business Transferred By A Non-resident Insurer" - Canada" is a form issued by the Canadian Revenue Agency .

The form was last revised in January 1, 2016 and is available for digital filing. Download an up-to-date Form T2100 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2100?

A: Form T2100 is a form used for making a joint election in respect of an insurance business transferred by a non-resident insurer in Canada.

Q: What is a joint election?

A: A joint election is a formal agreement between the non-resident insurer and the policyholder to jointly elect for certain tax consequences.

Q: Who can use Form T2100?

A: Form T2100 is used by non-resident insurers and policyholders in Canada who are transferring an insurance business.

Q: What is the purpose of making a joint election?

A: The purpose of making a joint election is to determine the tax consequences for both the non-resident insurer and the policyholder in relation to the transferred insurance business.

Q: Are there any deadlines for filing Form T2100?

A: Yes, there are deadlines for filing Form T2100. It must be filed within a certain time period specified by the CRA.

Q: What information is required on Form T2100?

A: Form T2100 requires information such as the names and addresses of the non-resident insurer and the policyholder, details of the insurance business being transferred, and signatures of both parties.

Q: Is there a fee for filing Form T2100?

A: There is no fee for filing Form T2100.

Q: What happens after filing Form T2100?

A: After filing Form T2100, the CRA will review the form and determine the tax consequences based on the joint election made by the non-resident insurer and the policyholder.