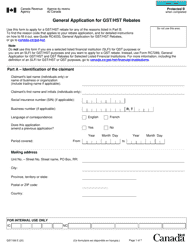

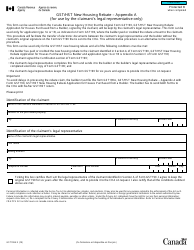

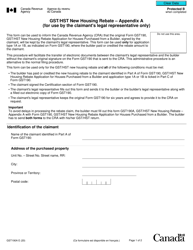

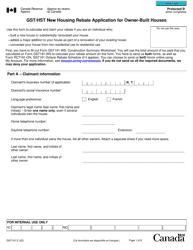

Form GST190 Gst / Hst New Housing Rebate Application for Houses Purchased From a Builder - Large Print - Canada

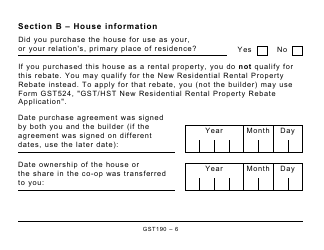

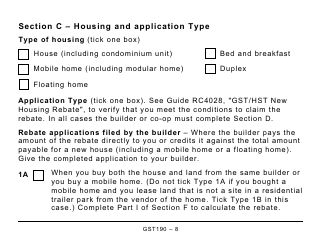

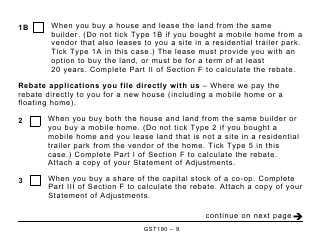

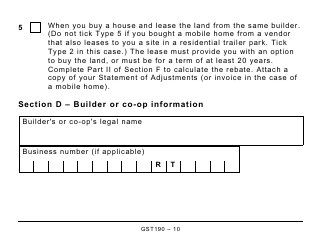

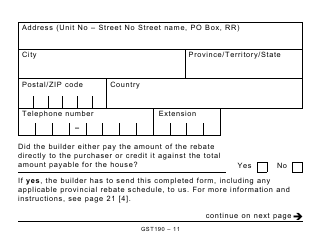

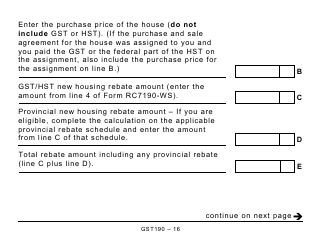

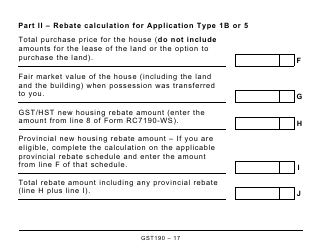

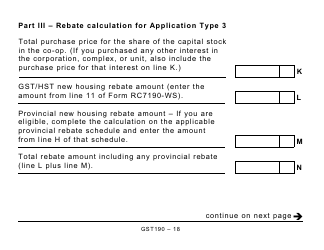

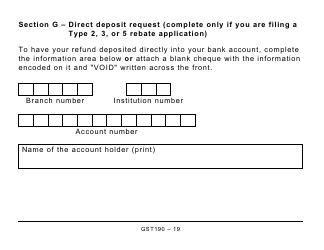

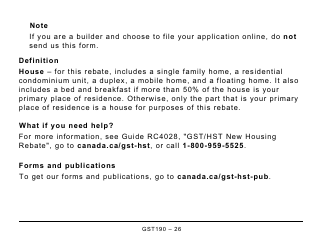

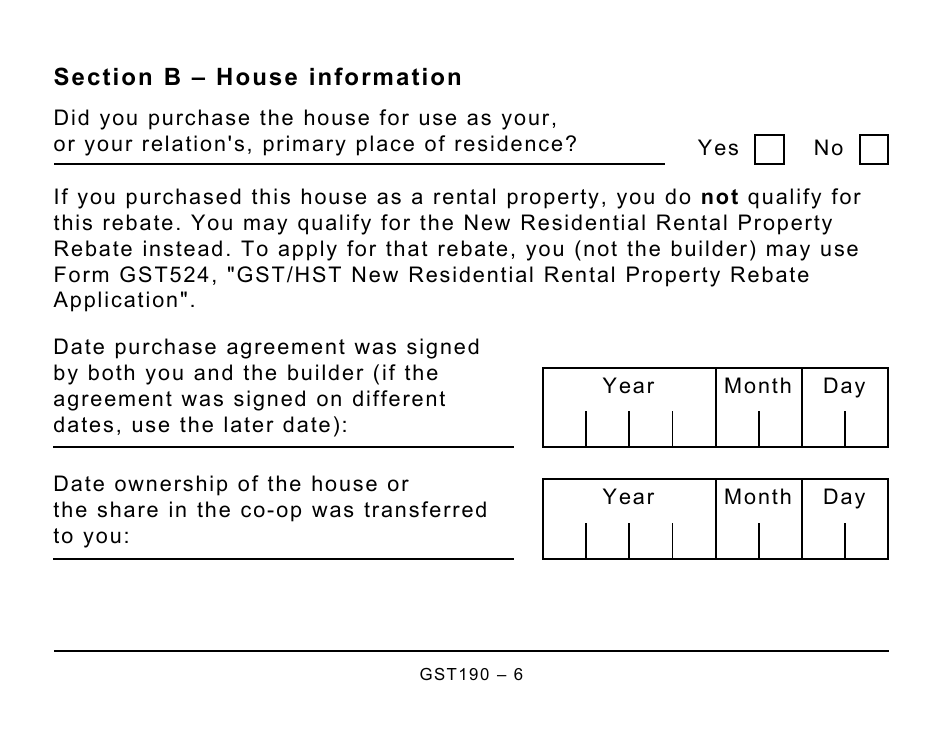

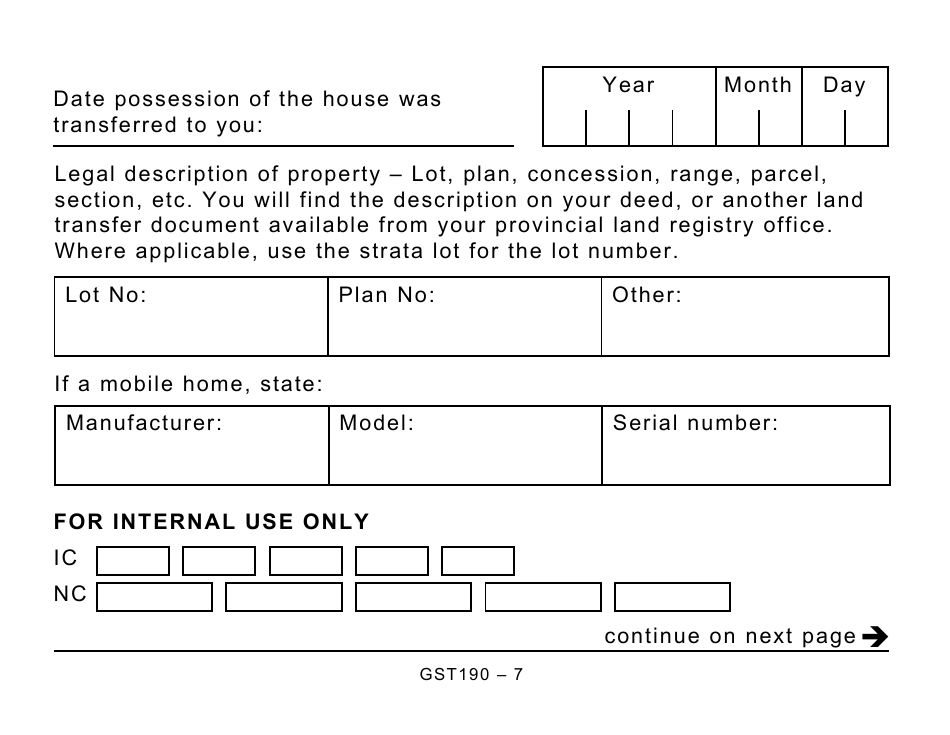

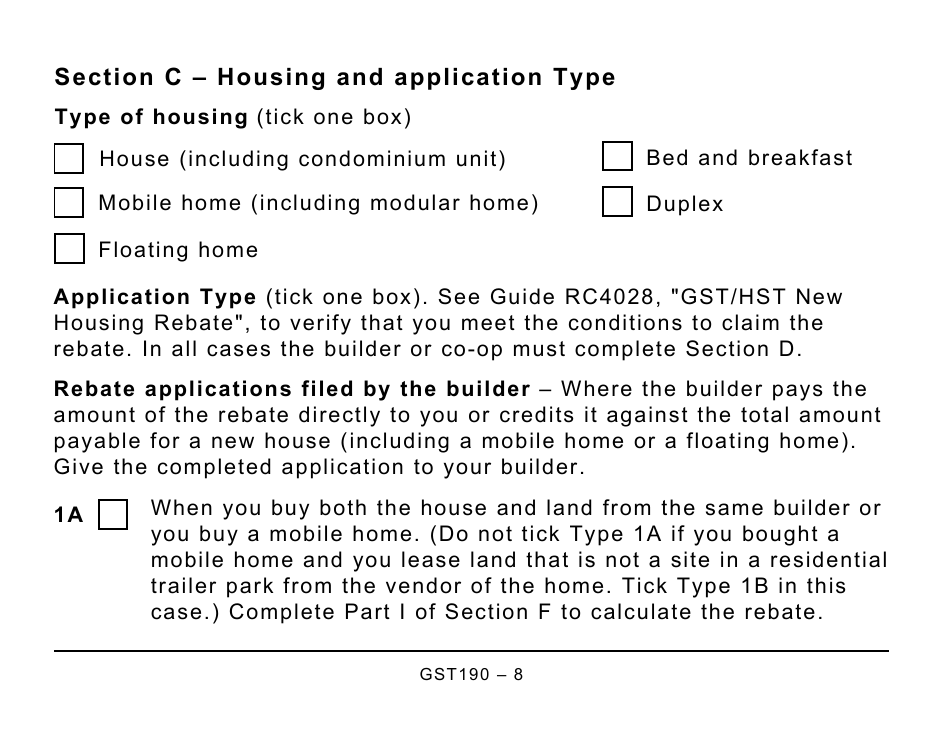

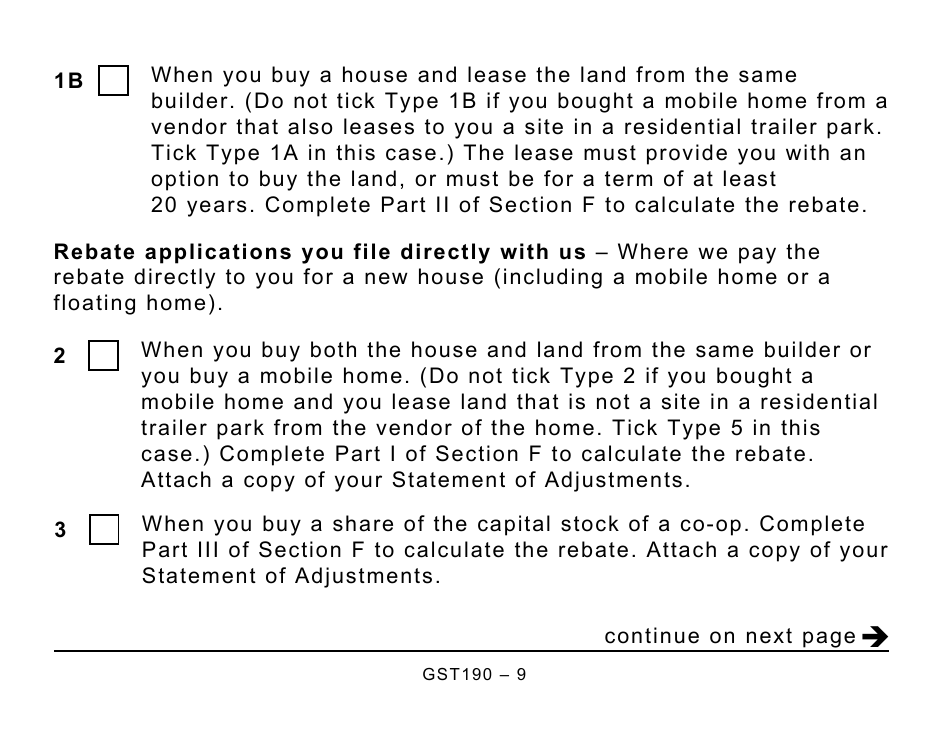

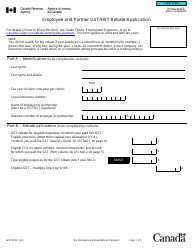

The Form GST190 GST/HST New Housing Rebate Application for Houses Purchased From a Builder - Large Print - Canada is used to apply for a rebate on the Goods and Services Tax/Harmonized Sales Tax (GST/HST) for newly purchased houses from a builder in Canada.

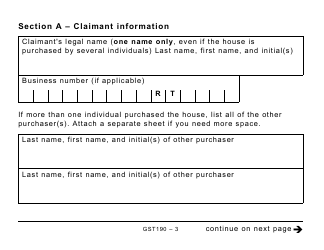

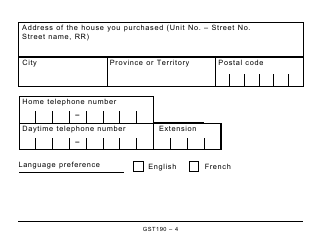

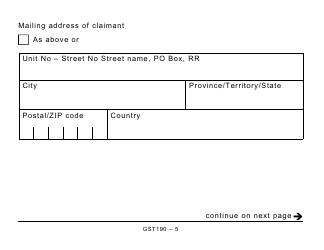

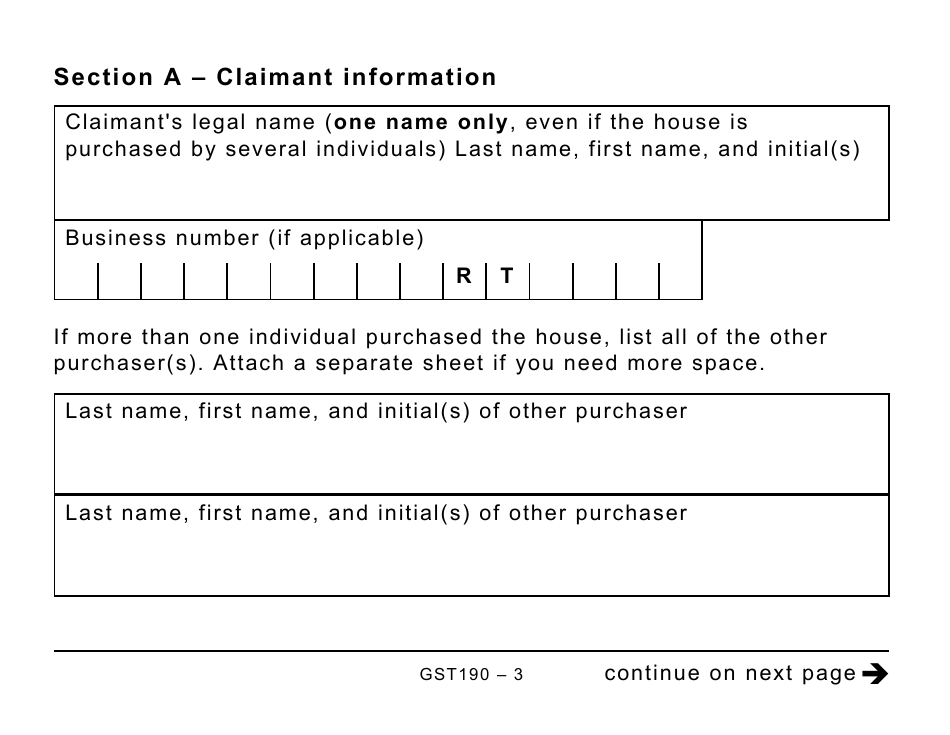

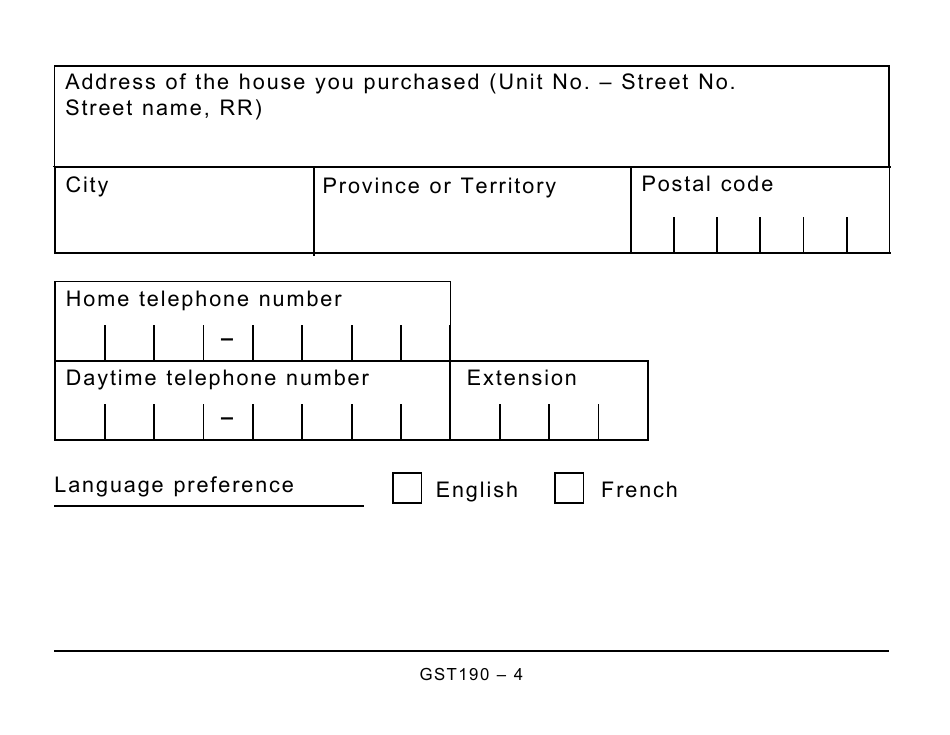

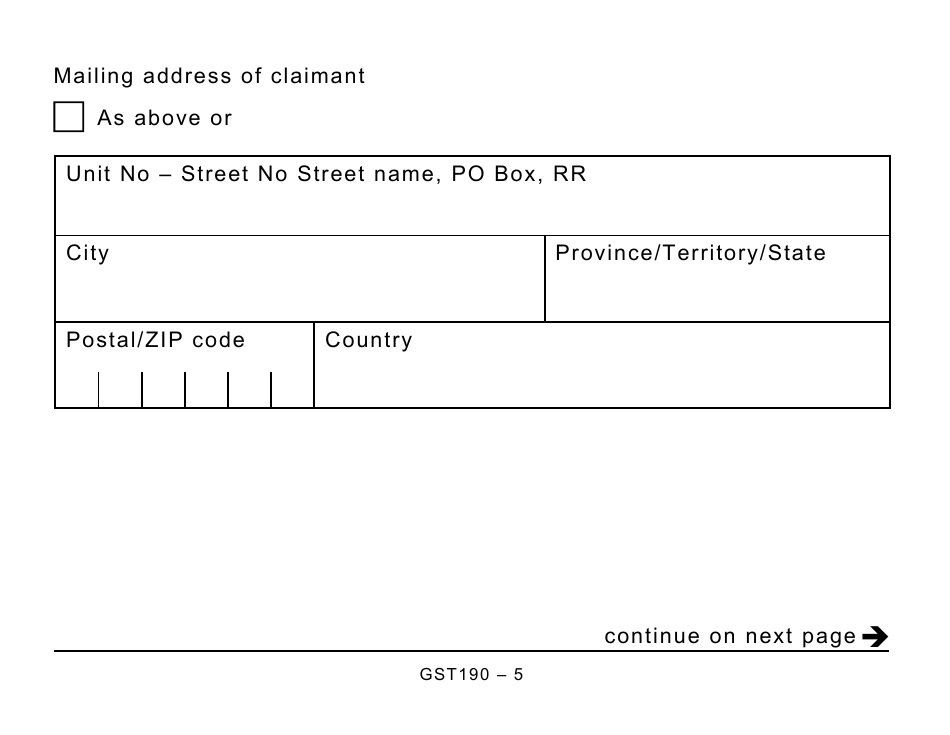

The form GST190 GST/HST New Housing Rebate Application for houses purchased from a builder - Large Print is filed by the individual who purchased the new house from the builder in Canada.

FAQ

Q: What is the GST/HST New Housing Rebate?

A: The GST/HST New Housing Rebate is a rebate provided by the Canadian government to individuals who purchase newly constructed or substantially renovated homes.

Q: Who is eligible for the GST/HST New Housing Rebate?

A: Individuals who have purchased a new or substantially renovated home from a builder may be eligible for the rebate if certain criteria are met.

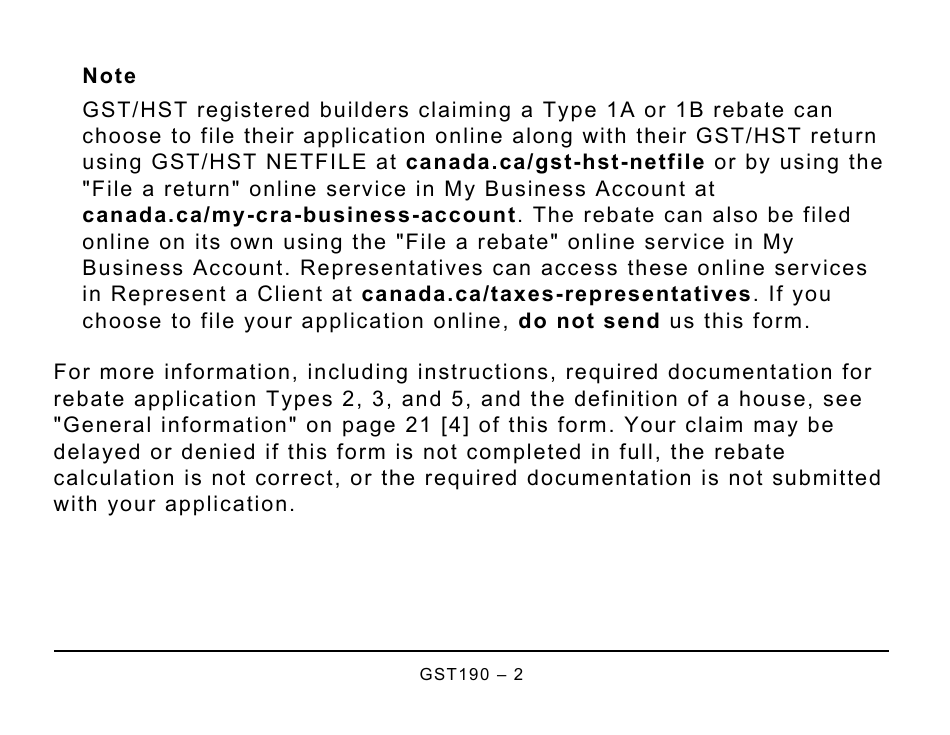

Q: How do I apply for the GST/HST New Housing Rebate?

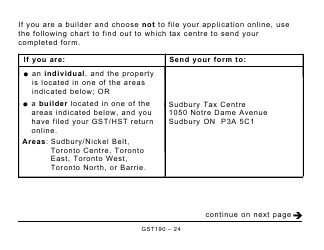

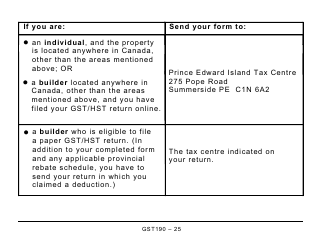

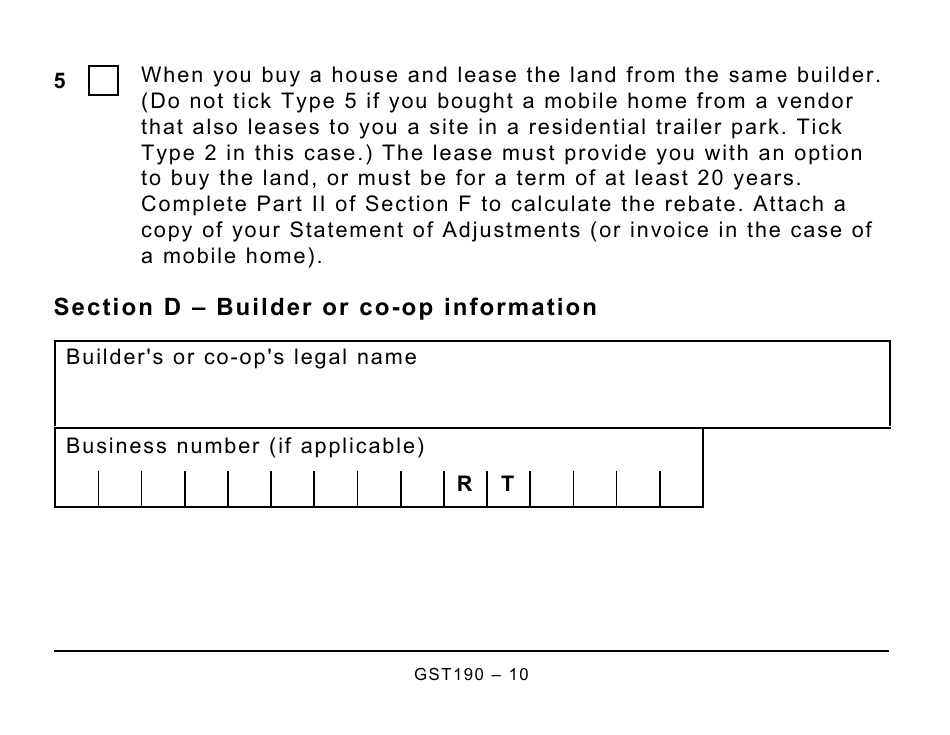

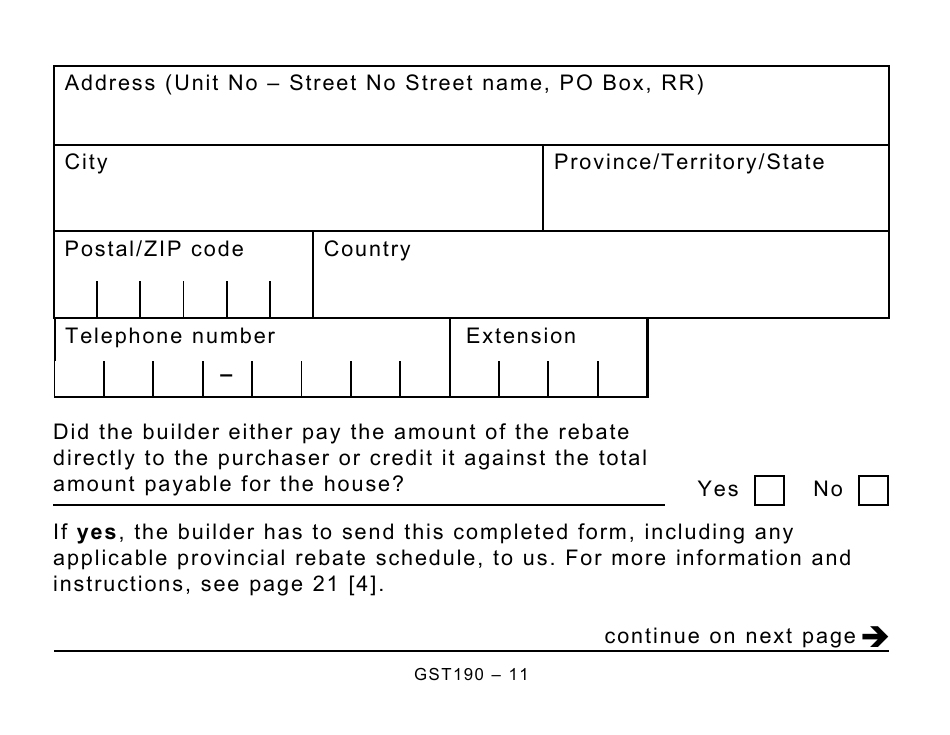

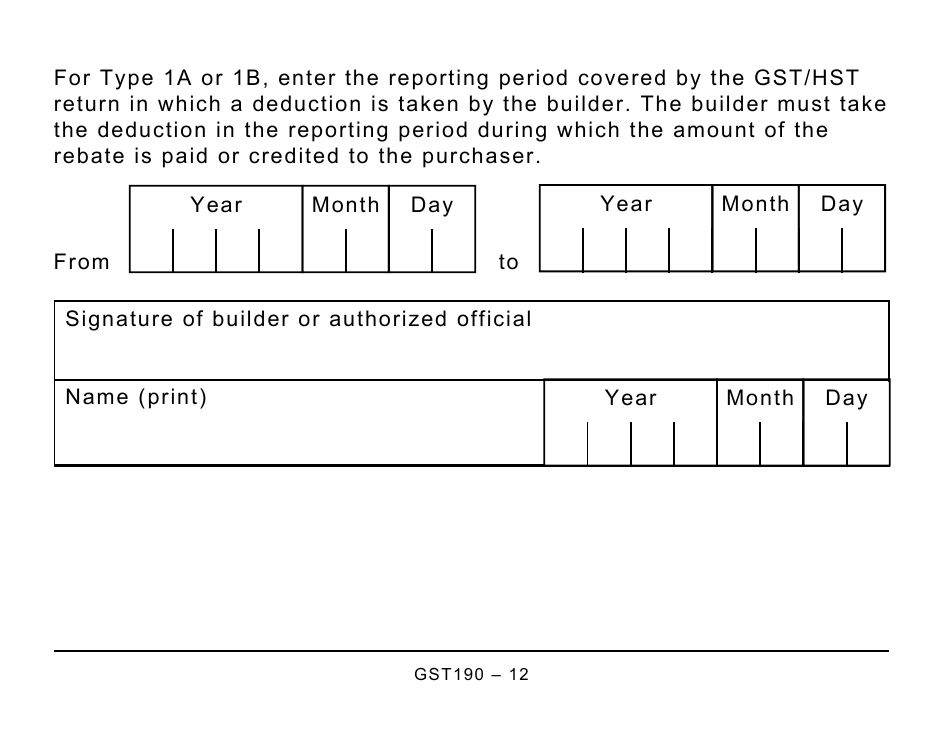

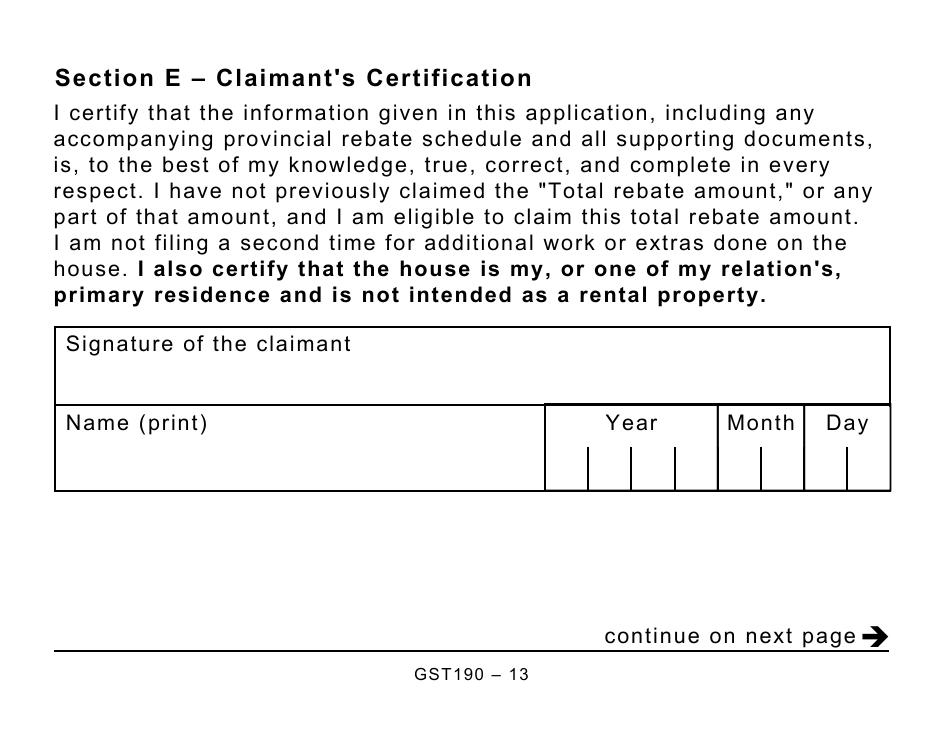

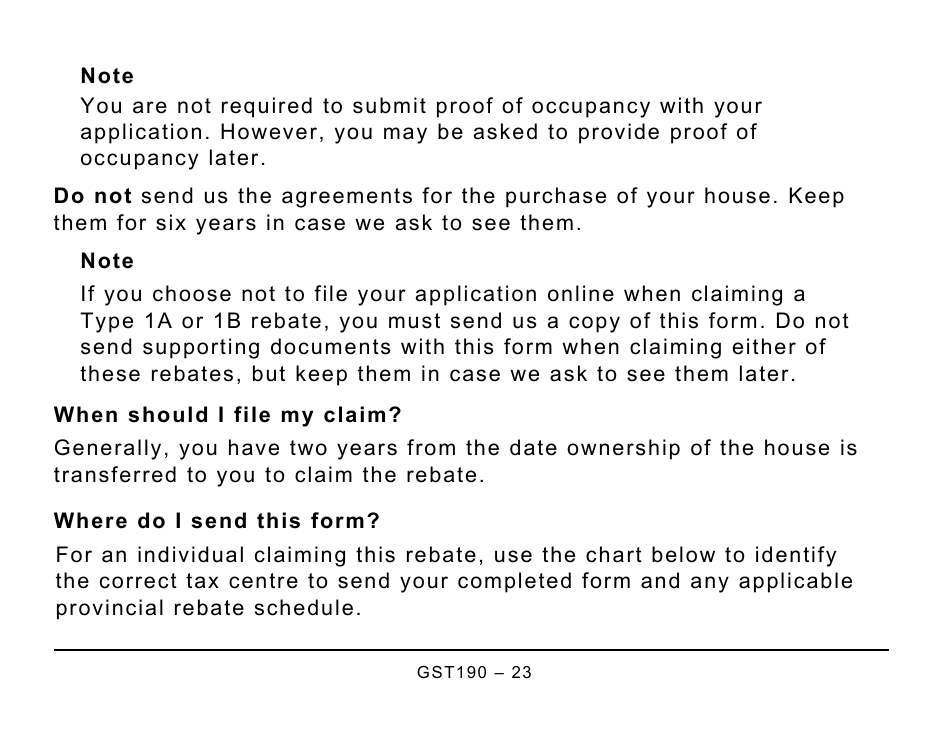

A: To apply for the rebate, you will need to complete Form GST190 and submit it to the Canada Revenue Agency (CRA).

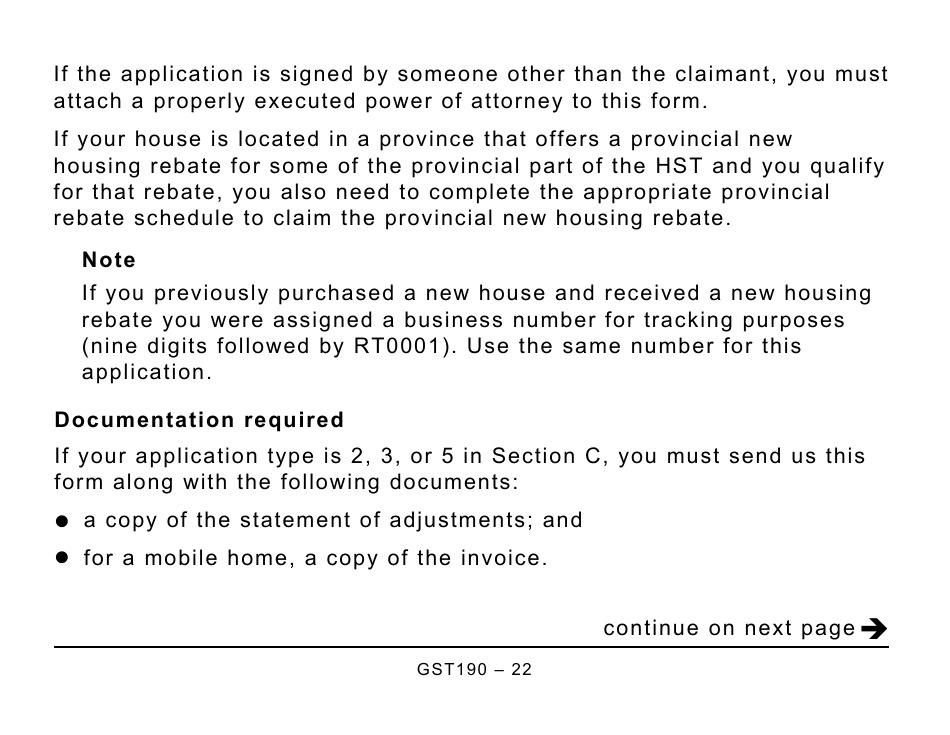

Q: What documentation do I need to include with my application?

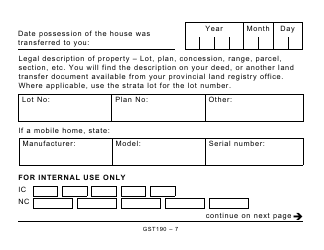

A: You will need to include the Agreement of Purchase and Sale, the Builder's Certificate, and any other supporting documents requested in the application.

Q: How much is the GST/HST New Housing Rebate?

A: The amount of the rebate can vary based on factors such as the purchase price of the home and the province in which it is located. The maximum rebate amount is $30,000.

Q: When will I receive my rebate?

A: The processing time for the rebate can vary, but you can expect to receive it within a few weeks to a few months after submitting your application.

Q: Can I claim the rebate if I'm purchasing a pre-owned home?

A: No, the GST/HST New Housing Rebate is only available for newly constructed or substantially renovated homes purchased from a builder.

Q: Are there any other rebates or incentives available for homebuyers?

A: Yes, there may be other rebates or incentives available depending on your province or territory of residence. It is recommended to check with your local government or tax authority for more information.