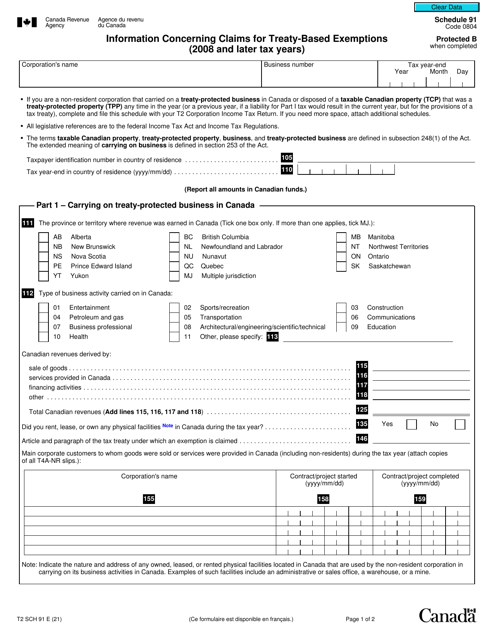

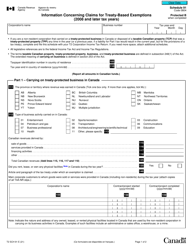

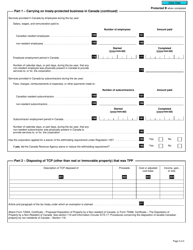

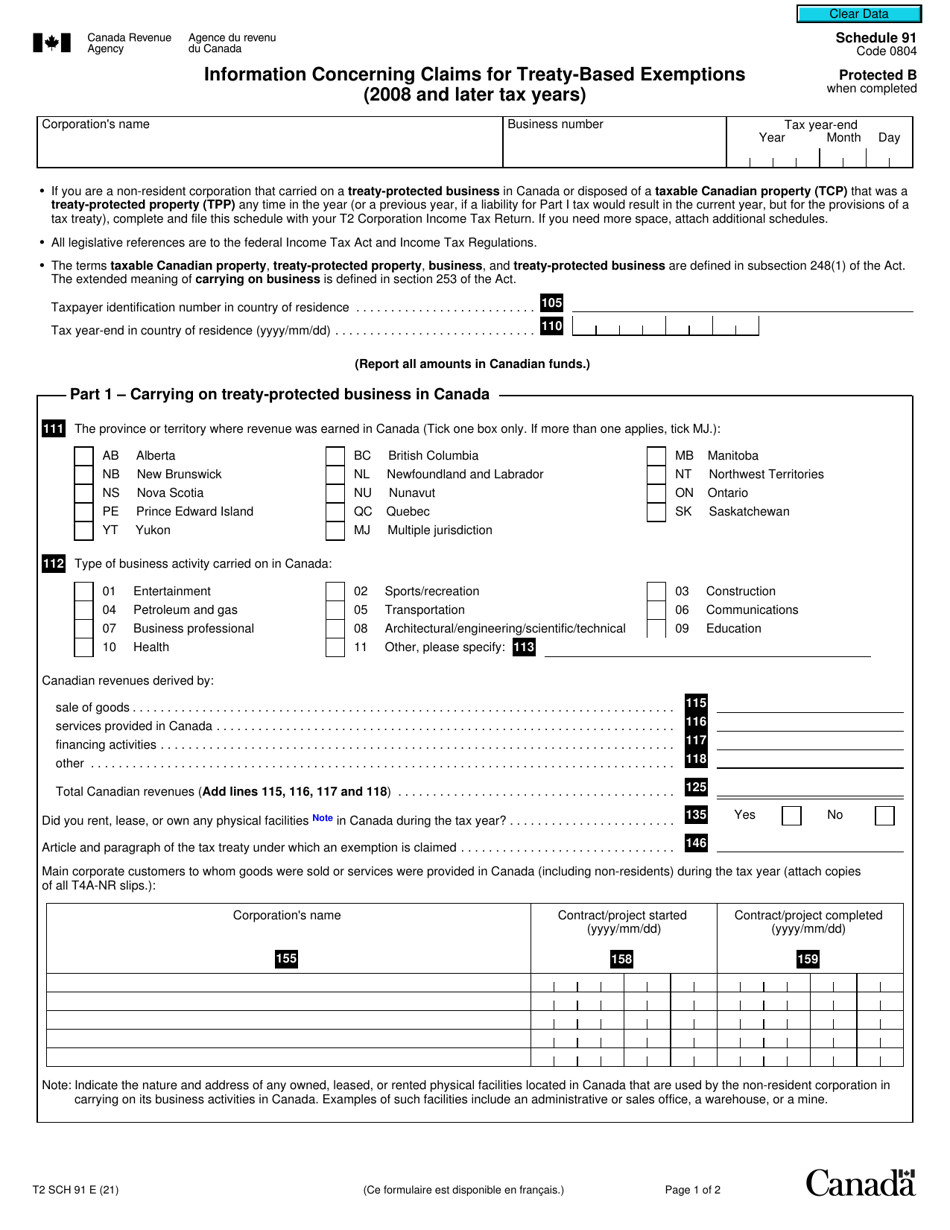

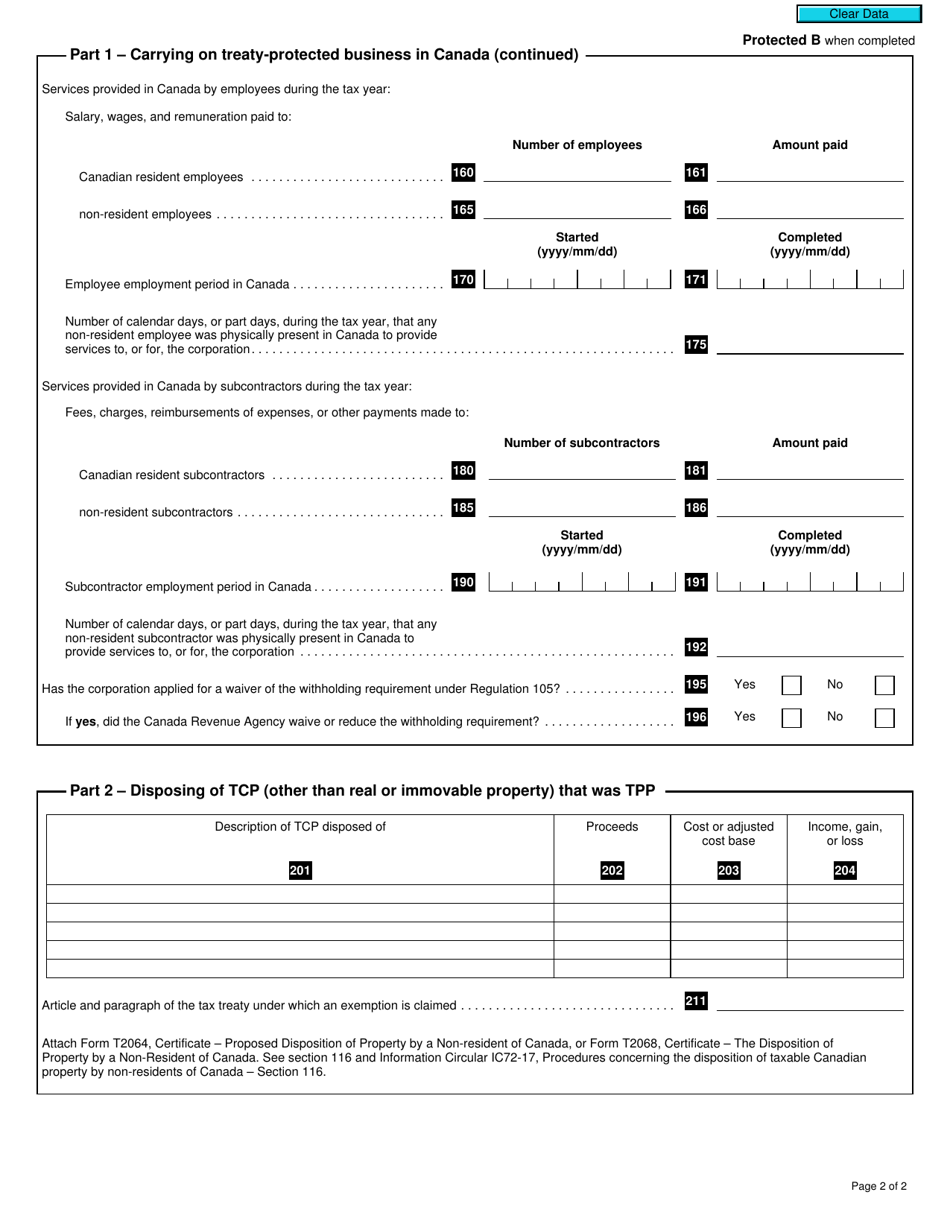

Form T2 Schedule 91 Information Concerning Claims for Treaty-Based Exemptions (2008 and Later Tax Years) - Canada

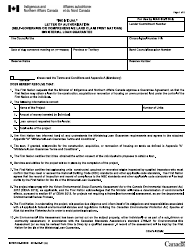

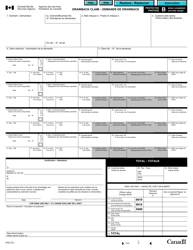

Form T2 Schedule 91 is used in Canada to provide information concerning claims for treaty-based exemptions for the tax years 2008 and later. It helps taxpayers report any exemptions they may be eligible for under international tax treaties.

Form T2 Schedule 91 Information Concerning Claims for Treaty-Based Exemptions (2008 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 91?

A: Form T2 Schedule 91 is a form used in Canada to report information concerning claims for treaty-based exemptions for tax years 2008 and later.

Q: What is a treaty-based exemption?

A: A treaty-based exemption is a provision in an international tax treaty that allows certain income to be exempt from taxation or to be taxed at a reduced rate.

Q: Who needs to file Form T2 Schedule 91?

A: Canadian corporations that have claimed treaty-based exemptions for tax years 2008 and later need to file Form T2 Schedule 91.

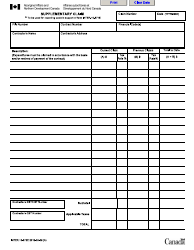

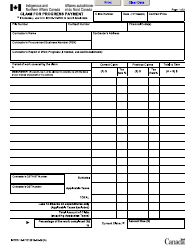

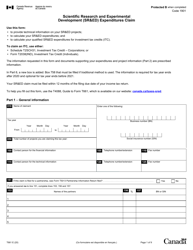

Q: What information is required on Form T2 Schedule 91?

A: Form T2 Schedule 91 requires information about the treaty-based exemptions claimed, including the treaty article and country, the amount exempted, and any supporting documents.

Q: What is the purpose of Form T2 Schedule 91?

A: The purpose of Form T2 Schedule 91 is to provide the Canada Revenue Agency with information about treaty-based exemptions claimed by Canadian corporations.

Q: Is there a deadline for filing Form T2 Schedule 91?

A: Yes, Canadian corporations must file Form T2 Schedule 91 with their annual tax return by the filing deadline.

Q: Are there any penalties for not filing Form T2 Schedule 91?

A: Yes, failure to file Form T2 Schedule 91 may result in penalties imposed by the Canada Revenue Agency.

Q: Can I claim treaty-based exemptions for tax years before 2008?

A: Form T2 Schedule 91 is specifically for tax years 2008 and later. Different forms or procedures may apply for earlier tax years.