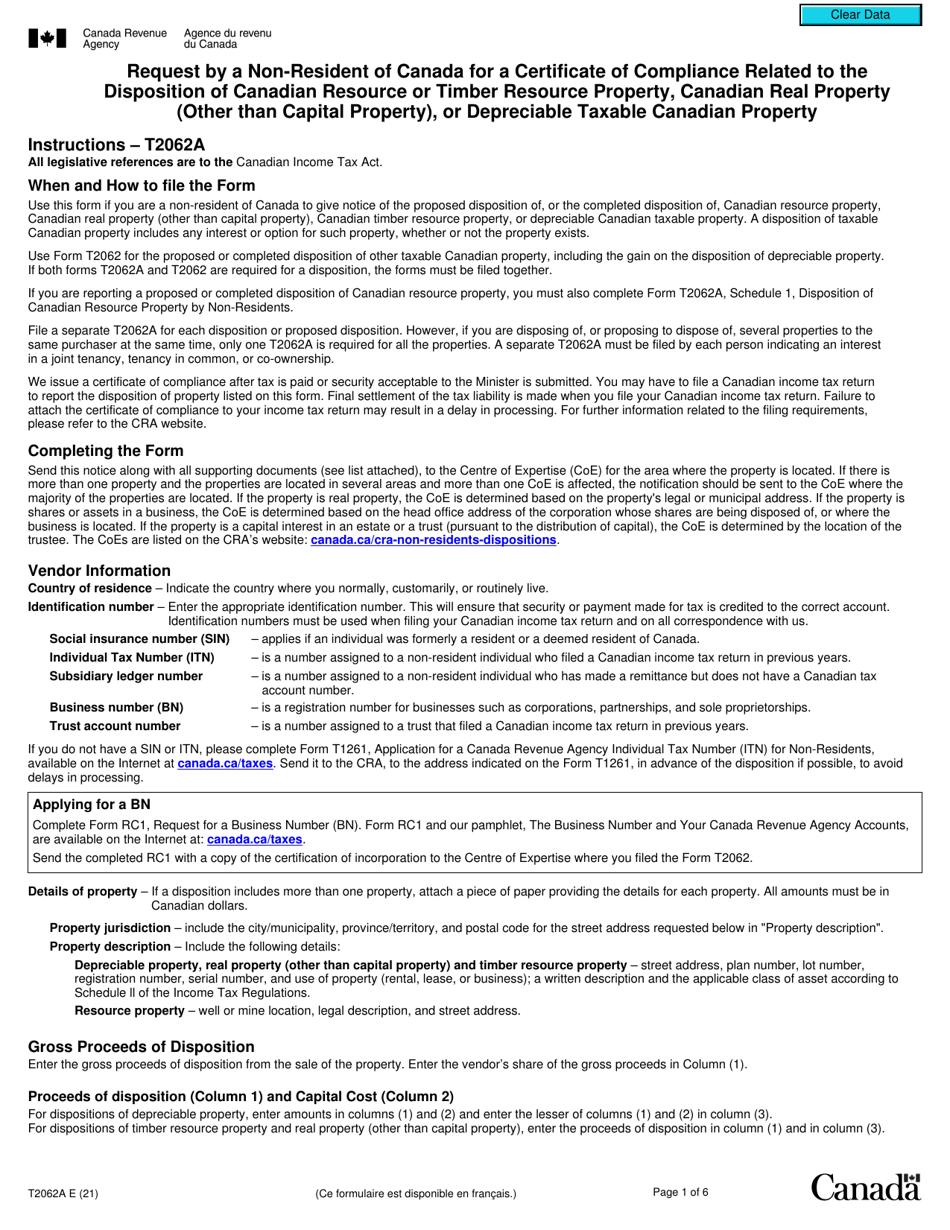

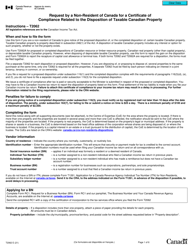

Form T2062A Request by a Non-resident of Canada for a Certificate of Compliance Related to the Disposition of Canadian Resource or Timber Resource Property, Canadian Real Property (Other Than Capital Property), or Depreciable Taxable Canadian Property - Canada

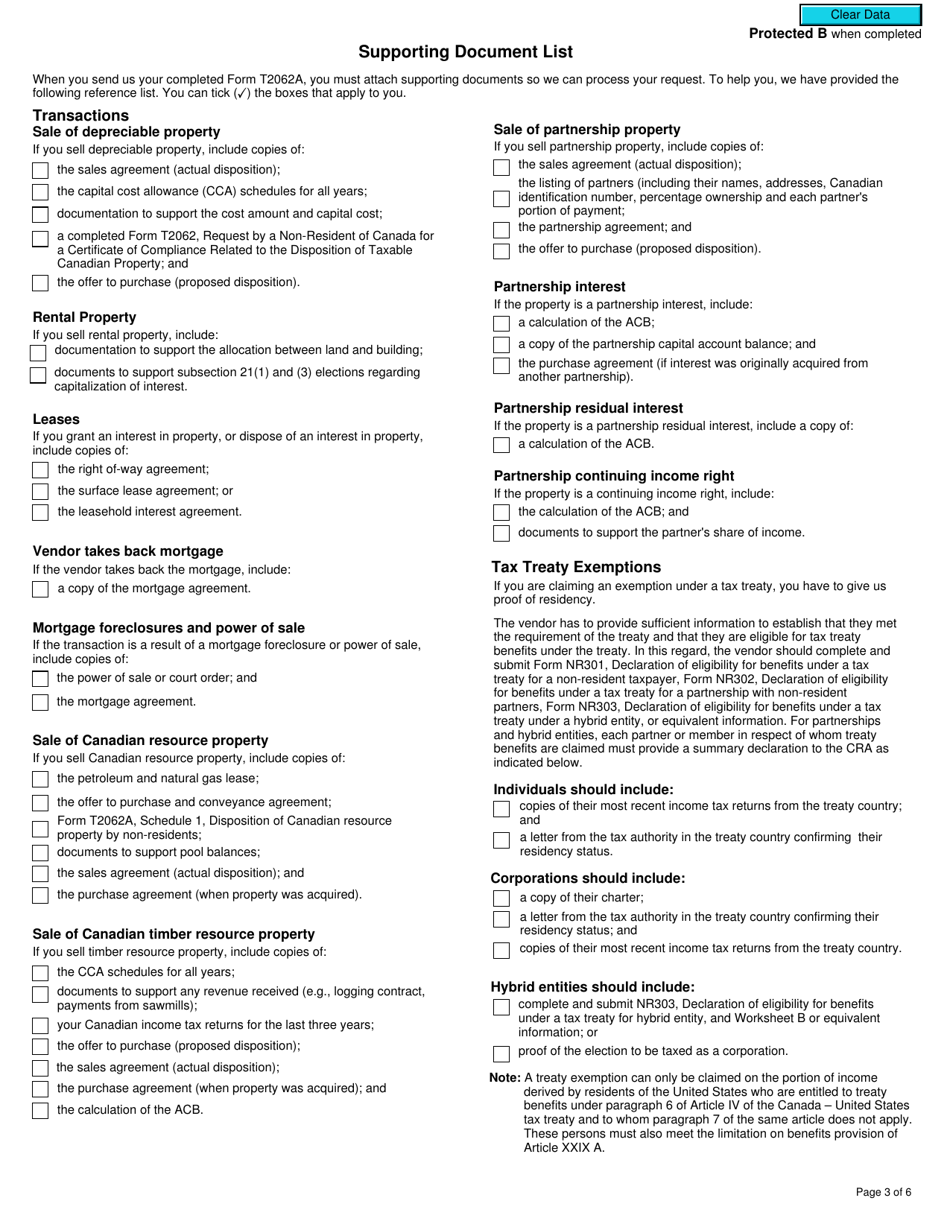

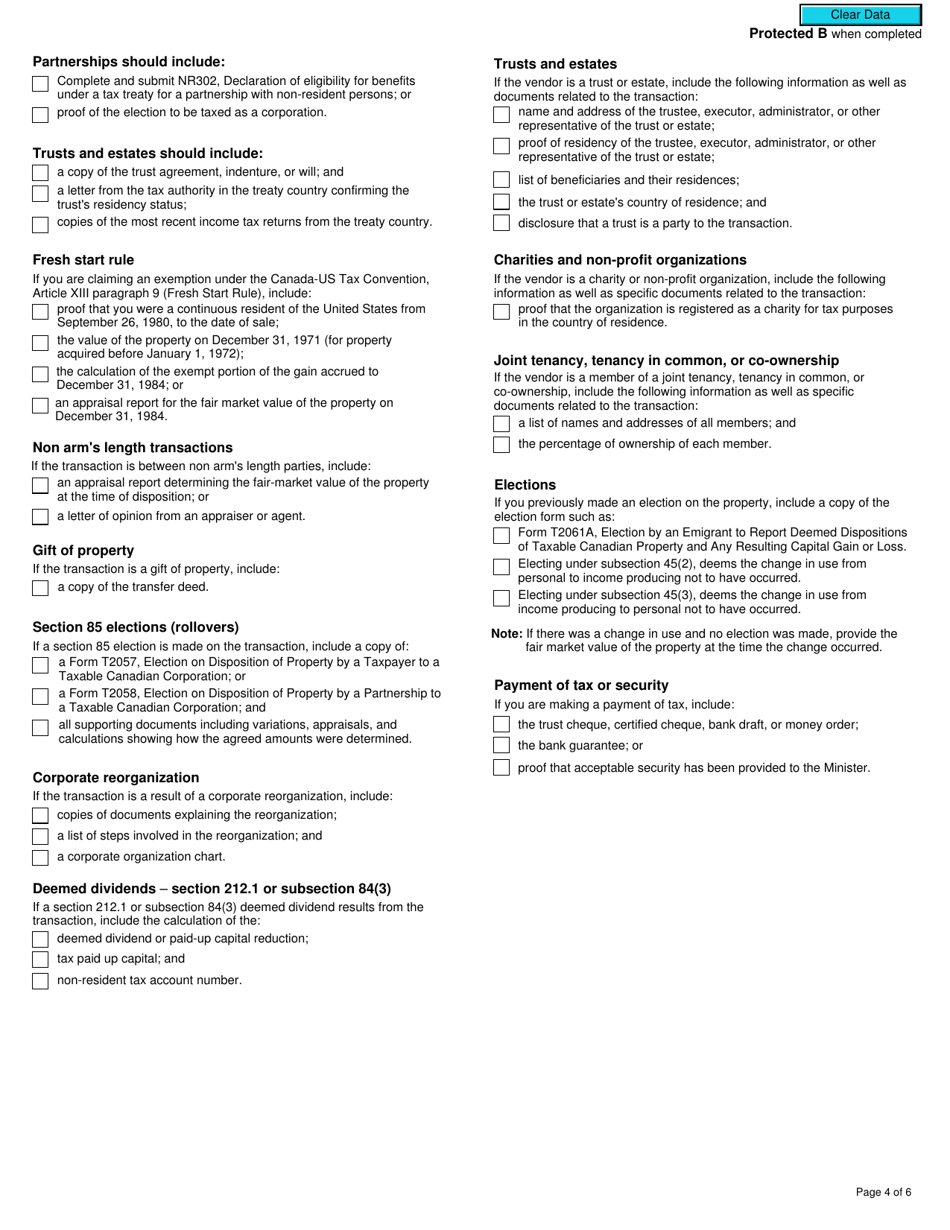

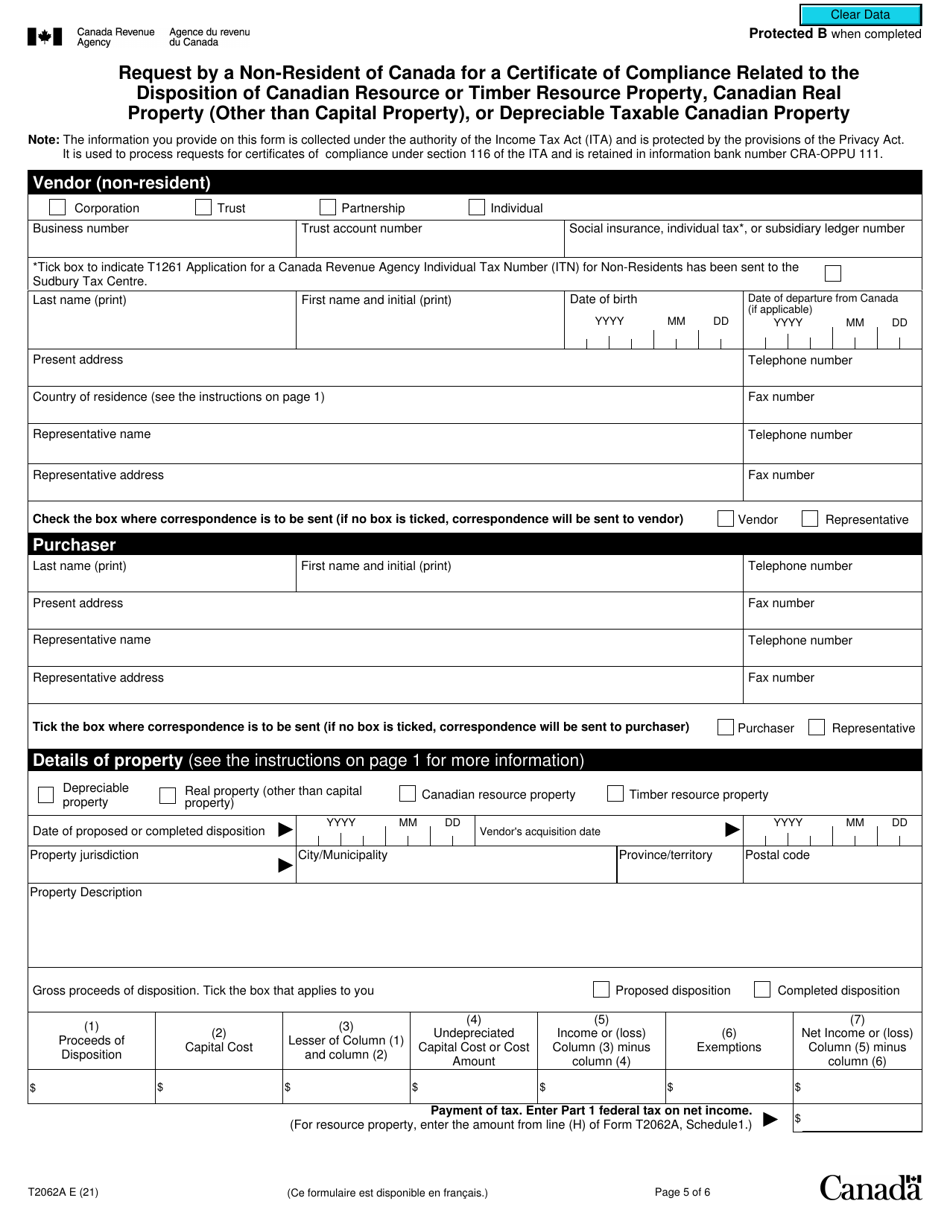

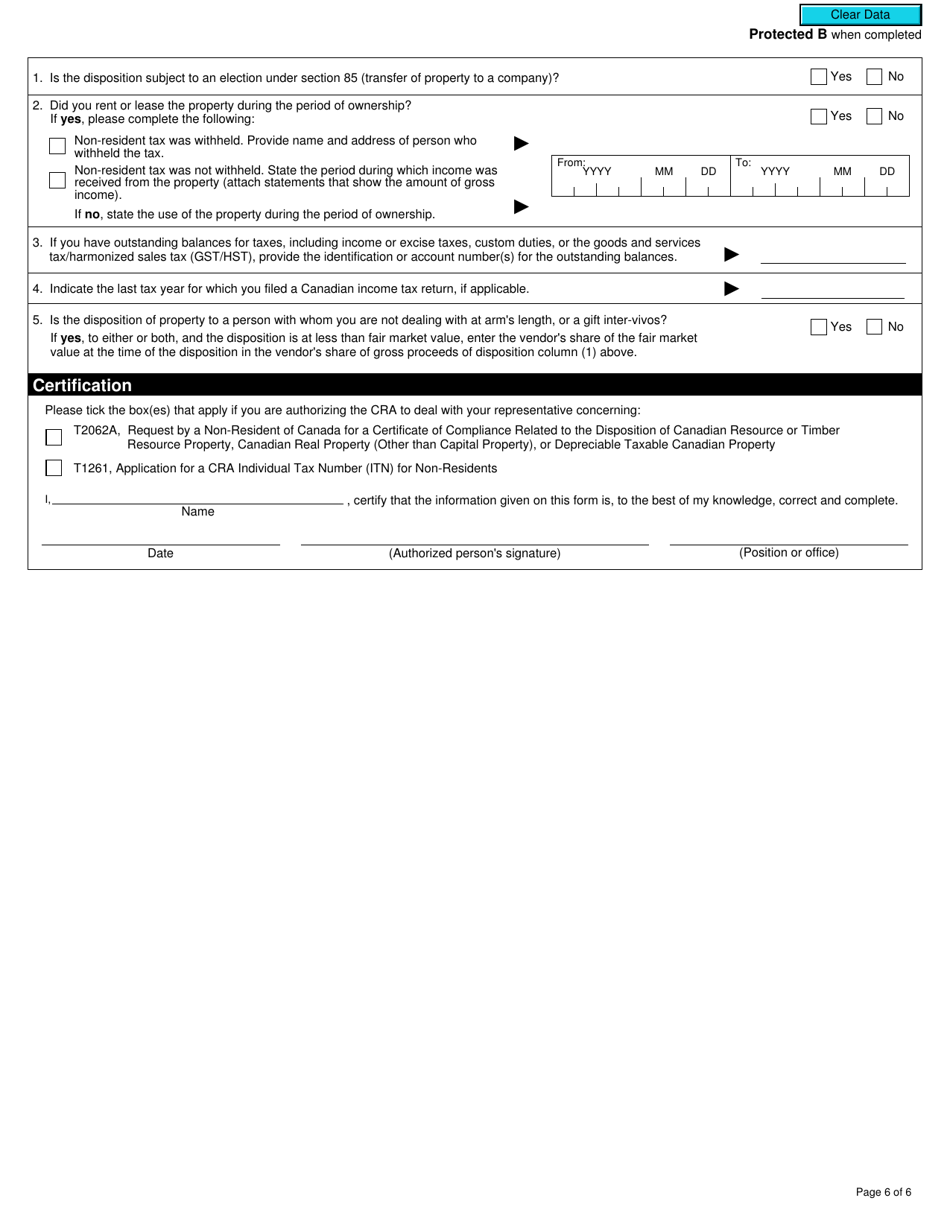

Form T2062A is used by non-residents of Canada to request a Certificate of Compliance related to the disposition of Canadian resource or timber resource property, Canadian real property (other than capital property), or depreciable taxable Canadian property. This form ensures that the non-resident complies with Canadian tax laws when selling or disposing of these types of properties.

The non-resident of Canada files the Form T2062A.

Form T2062A Request by a Non-resident of Canada for a Certificate of Compliance Related to the Disposition of Canadian Resource or Timber Resource Property, Canadian Real Property (Other Than Capital Property), or Depreciable Taxable Canadian Property - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2062A?

A: Form T2062A is a tax form used by non-residents of Canada to request a Certificate of Compliance related to the disposition of certain Canadian properties.

Q: Who needs to fill out Form T2062A?

A: Non-residents of Canada who have disposed of Canadian resource or timber resource property, Canadian real property (excluding capital property), or depreciable taxable Canadian property need to fill out Form T2062A.

Q: What is the purpose of Form T2062A?

A: The purpose of Form T2062A is to request a Certificate of Compliance to ensure that non-residents have met their tax obligations when disposing of certain Canadian properties.

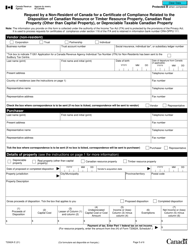

Q: What information is required on Form T2062A?

A: Form T2062A requires information about the non-resident, the property being disposed of, the purchase details, and any applicable taxes.

Q: Are there any fees associated with submitting Form T2062A?

A: Yes, there are fees associated with submitting Form T2062A. The exact amount depends on the value of the property being disposed of.

Q: What is the deadline for submitting Form T2062A?

A: Form T2062A should be submitted to the CRA within 10 days of the property disposition.

Q: What happens after submitting Form T2062A?

A: After submitting Form T2062A, the CRA will review the form and issue a Certificate of Compliance if all requirements are met. Non-compliance may result in penalties or further actions by the CRA.