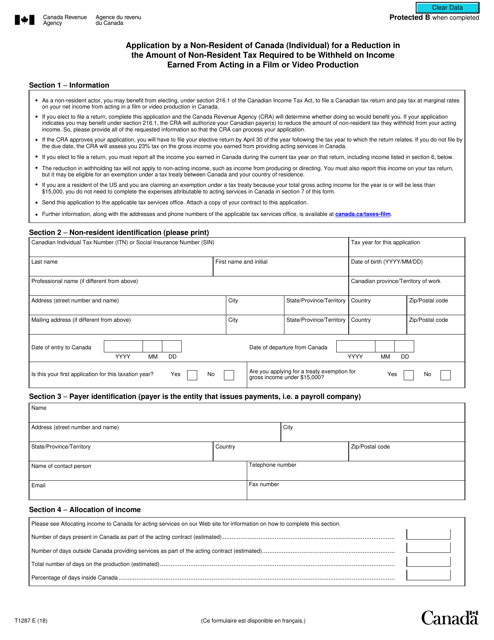

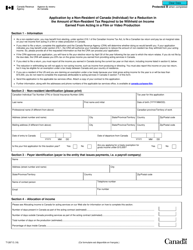

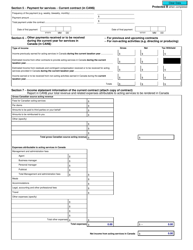

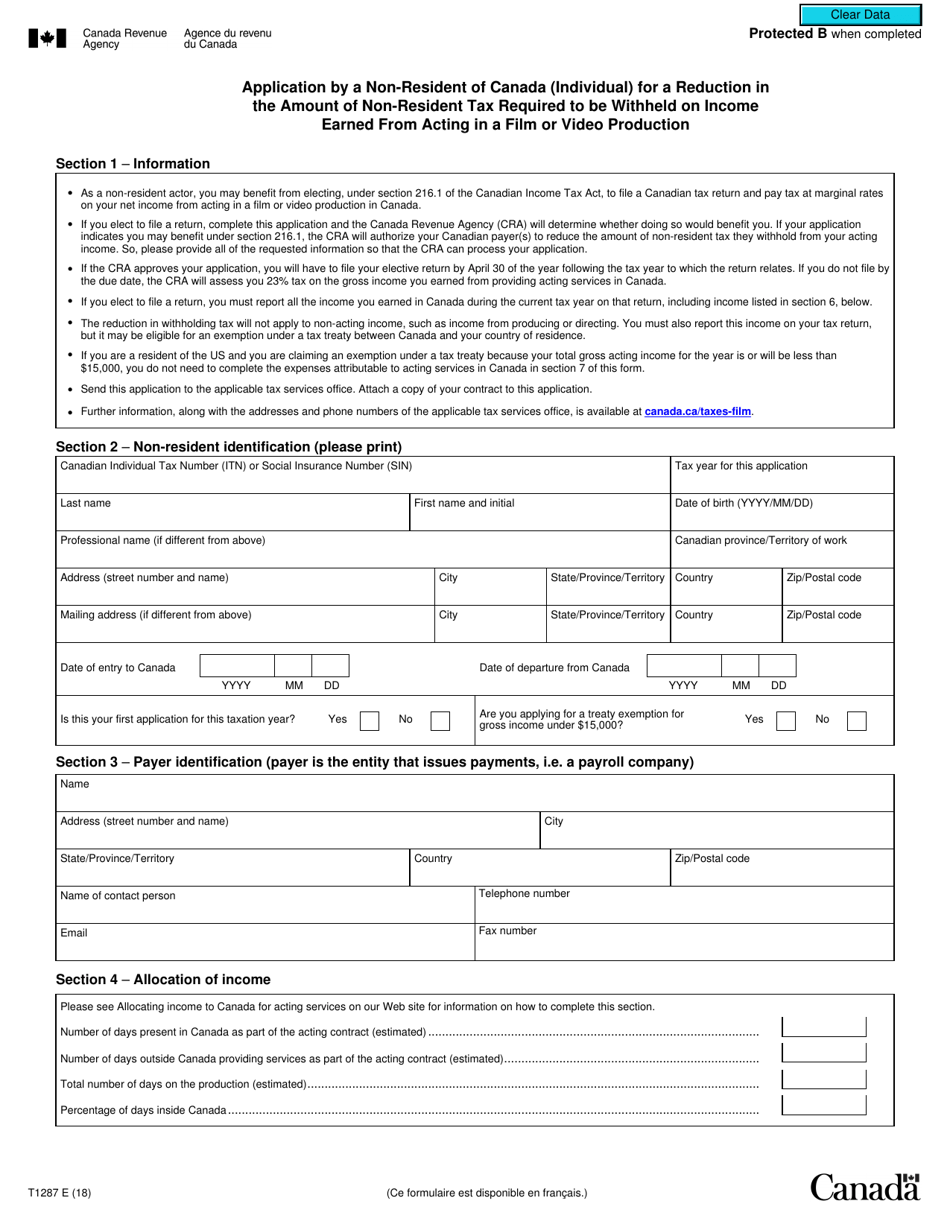

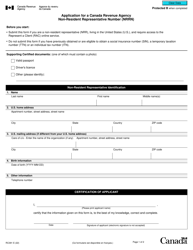

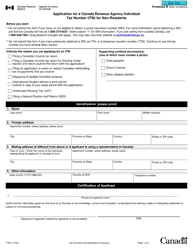

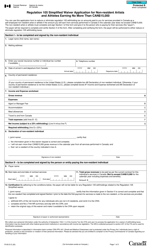

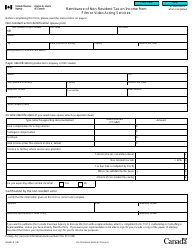

Form T1287 Application by a Non-resident of Canada (Individual) for a Reduction in the Amount of Non-resident Tax Required to Be Withheld on Income Earned From Acting in a Film or Video Production - Canada

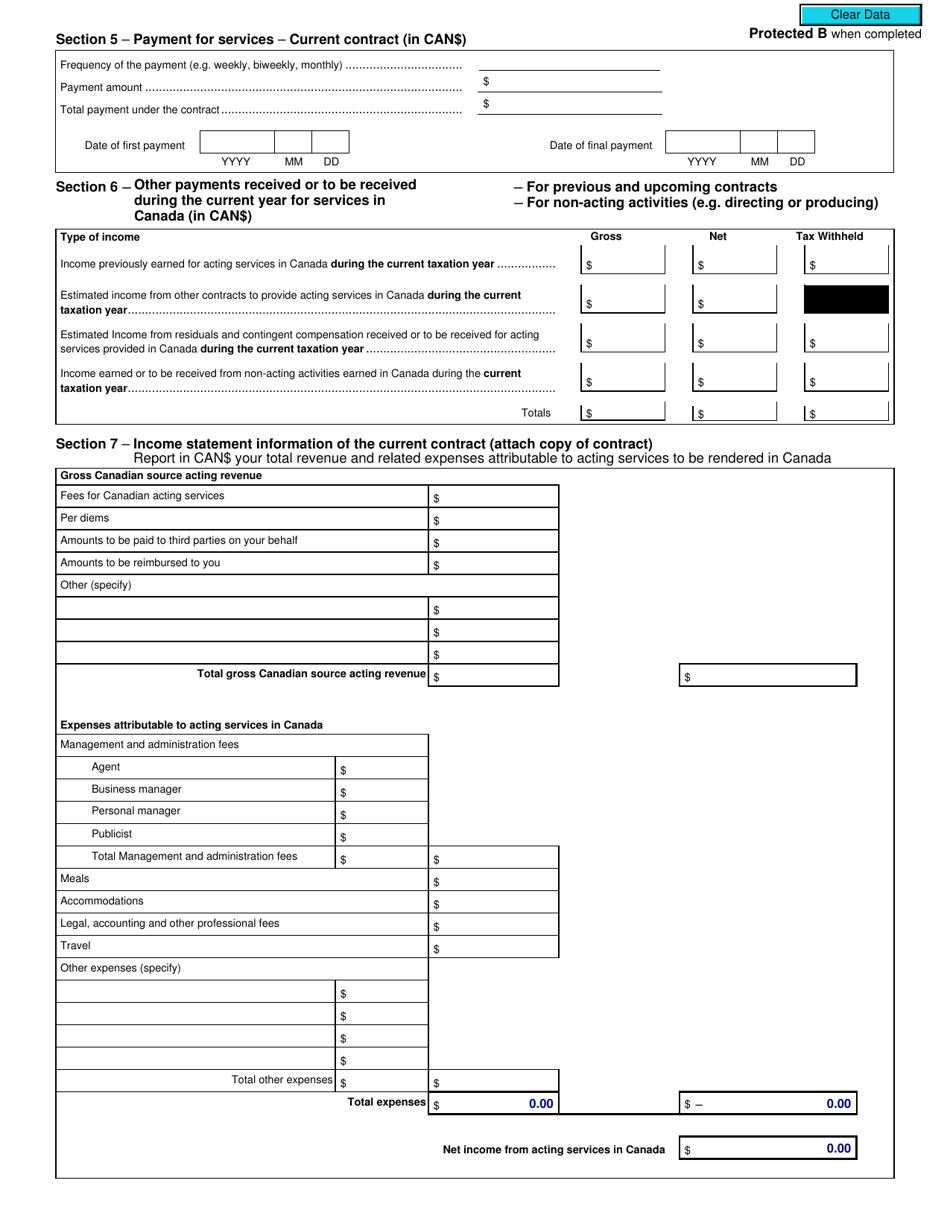

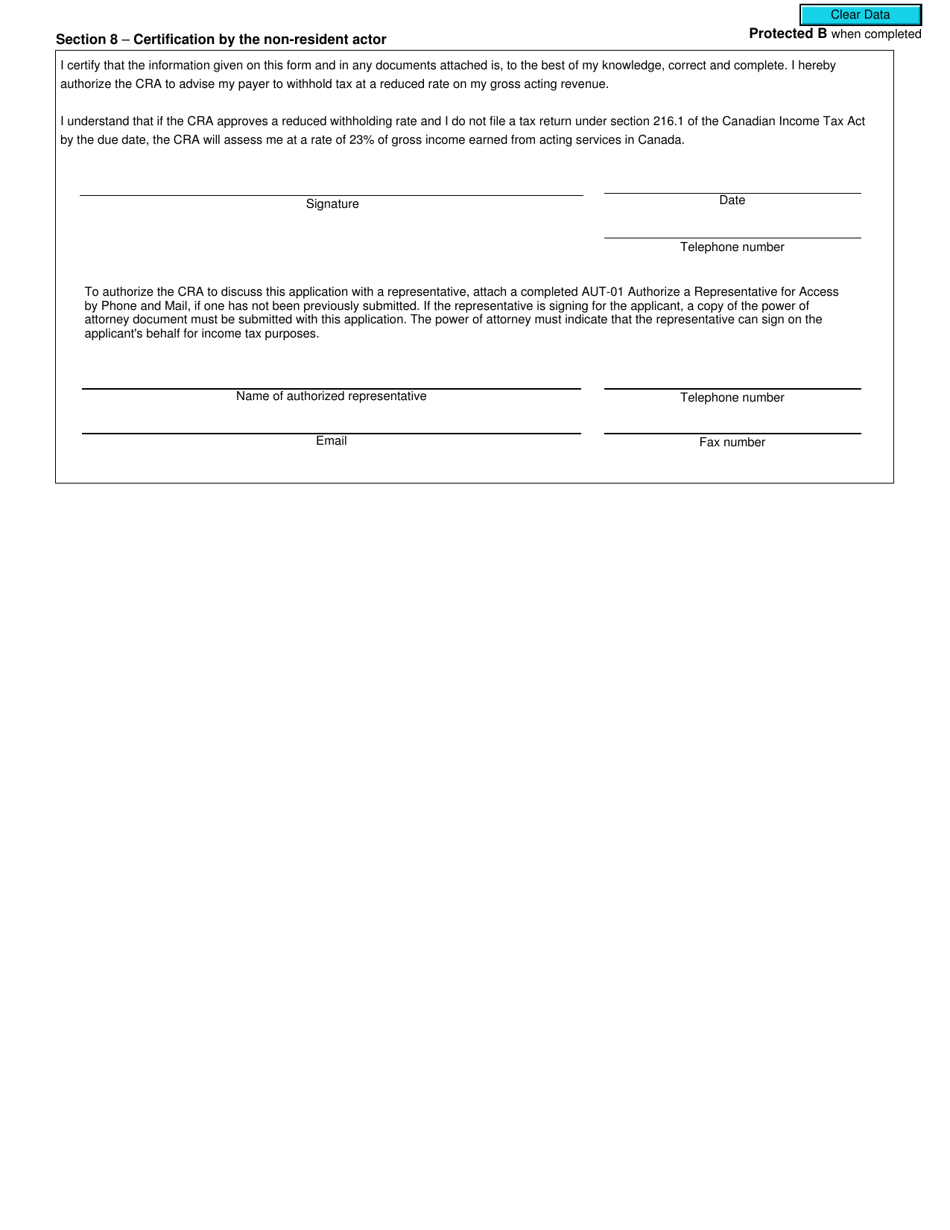

Form T1287 is used by non-residents of Canada who earned income from acting in a film or video production in Canada. It is used to apply for a reduction in the amount of non-resident tax that is required to be withheld from their income.

The form T1287 is filed by non-resident individuals who wish to apply for a reduction in the amount of non-resident tax withheld on income earned from acting in a film or video production in Canada.

FAQ

Q: What is Form T1287?

A: Form T1287 is an application form for non-residents of Canada (individuals) who want to request a reduction in the amount of non-resident tax required to be withheld on income earned from acting in a film or video production in Canada.

Q: Who can use Form T1287?

A: Non-residents of Canada (individuals) who have income from acting in a film or video production in Canada can use Form T1287.

Q: What is the purpose of Form T1287?

A: The purpose of Form T1287 is to allow non-residents of Canada to apply for a reduction in the amount of non-resident tax withheld on their income earned from acting in a film or video production in Canada.

Q: How can I submit Form T1287?

A: Form T1287 can be submitted by mail to the International and Ottawa Tax Services Office in Canada. The address to send the form is provided on the form itself.

Q: What supporting documents are required with Form T1287?

A: Along with Form T1287, you will need to provide a completed Part B of the form, a letter of intent or employment contract, and any other supporting documentation required by the Canada Revenue Agency (CRA).