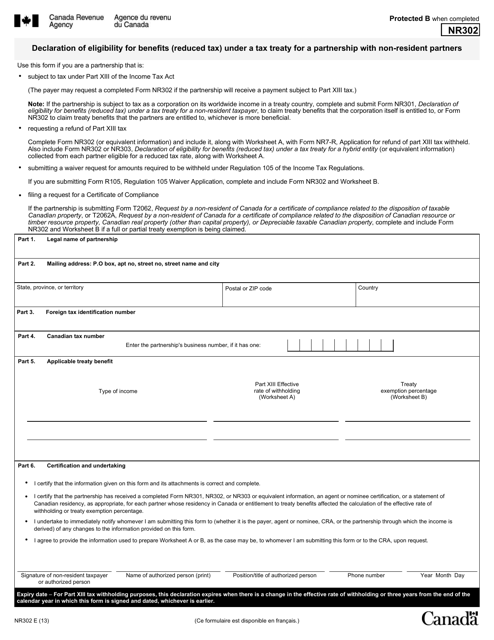

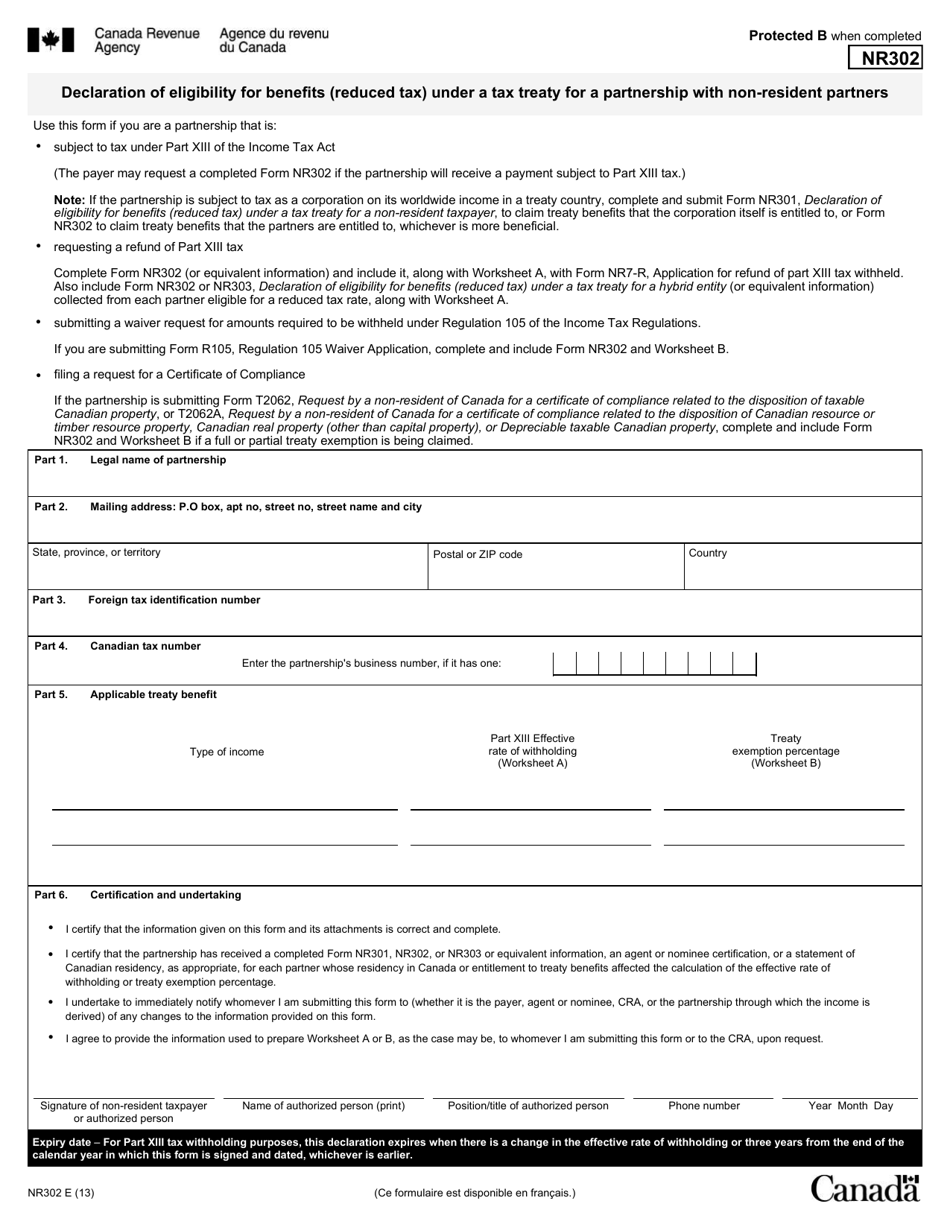

Form NR302 Declaration of Eligibility for Benefits (Reduced Tax) Under a Tax Treaty for a Partnership With Non-resident Partners - Canada

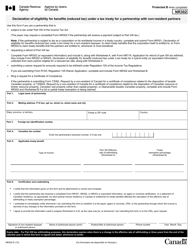

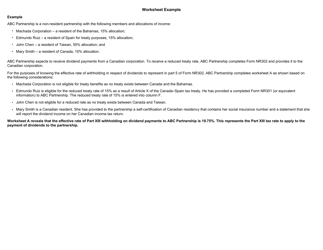

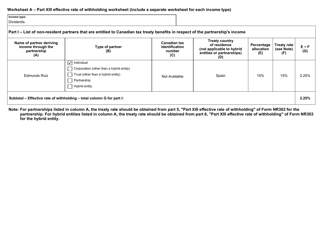

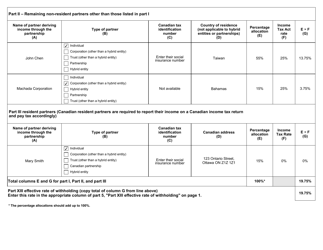

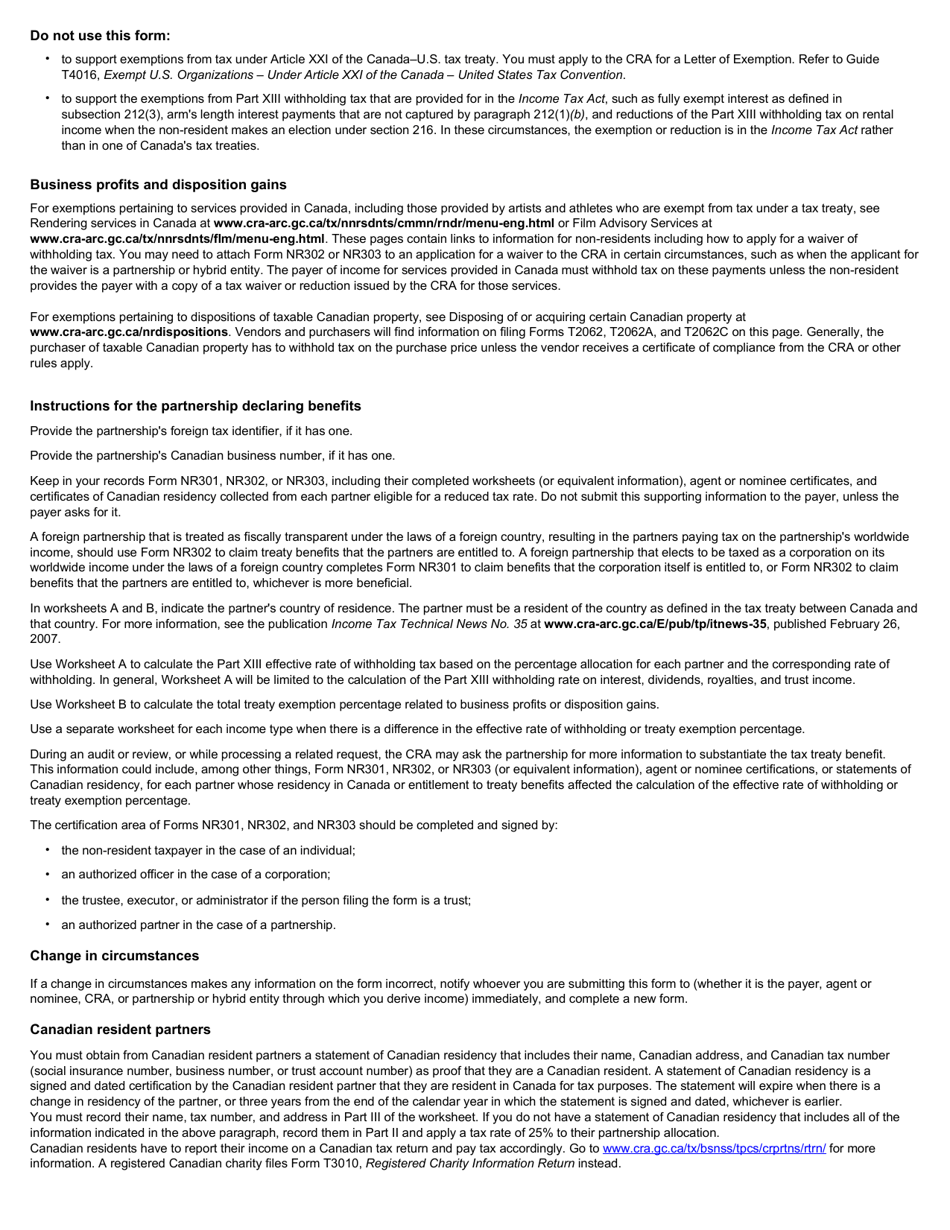

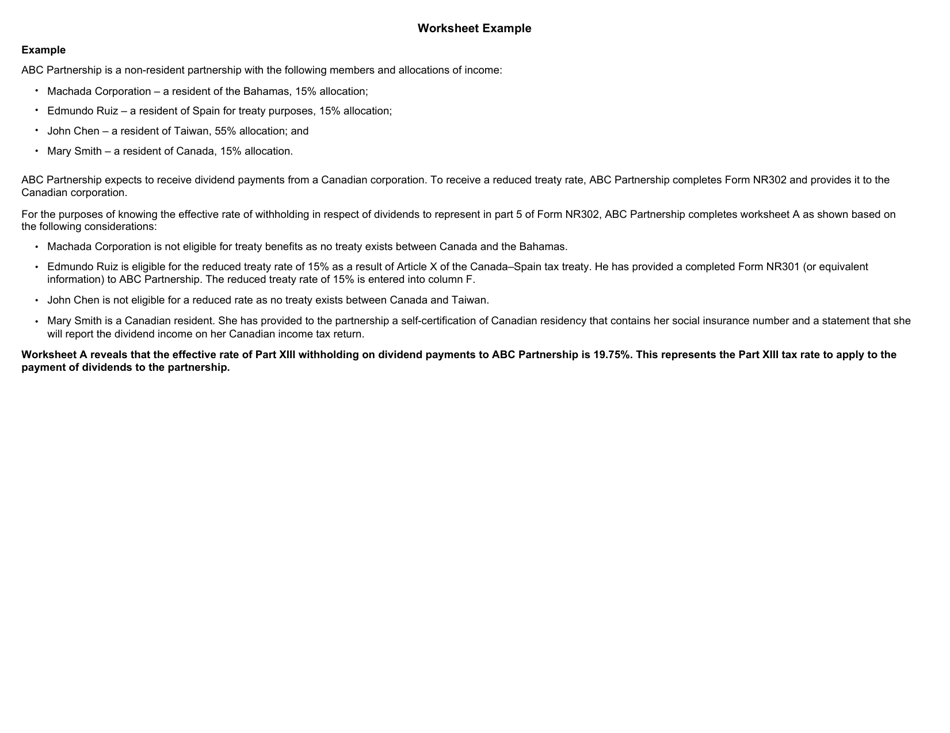

The Form NR302 Declaration of Eligibility for Benefits (Reduced Tax) Under a Tax Treaty for a Partnership With Non-resident Partners - Canada is used by a partnership with non-resident partners in Canada to claim reduced tax benefits under a tax treaty between the United States and Canada.

The Form NR302 Declaration of Eligibility for Benefits (Reduced Tax) Under a Tax Treaty for a Partnership With Non-resident Partners - Canada is filed by the partnership itself.

FAQ

Q: What is Form NR302?

A: Form NR302 is the Declaration of Eligibility for Benefits (Reduced Tax) Under a Tax Treaty for a Partnership With Non-resident Partners - Canada.

Q: Who should file Form NR302?

A: The partnership with non-resident partners who are eligible for tax treaty benefits with Canada should file Form NR302.

Q: What is the purpose of Form NR302?

A: The purpose of Form NR302 is to claim reduced tax benefits under a tax treaty for a partnership with non-resident partners from Canada.

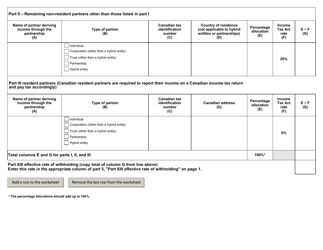

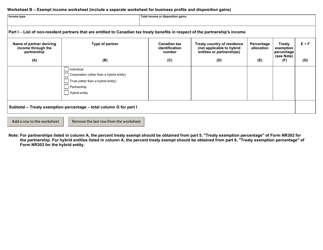

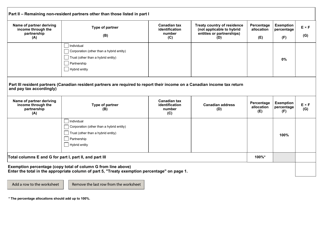

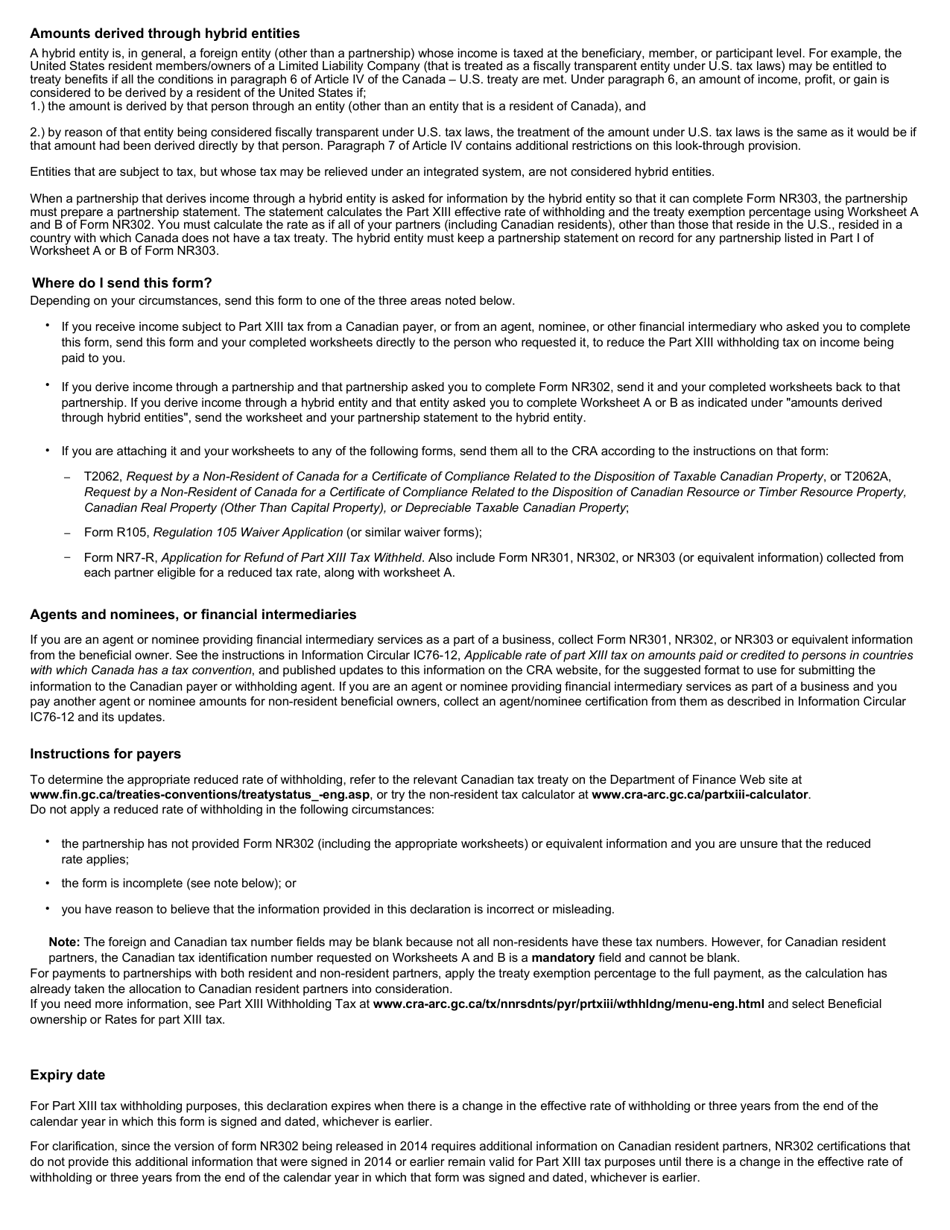

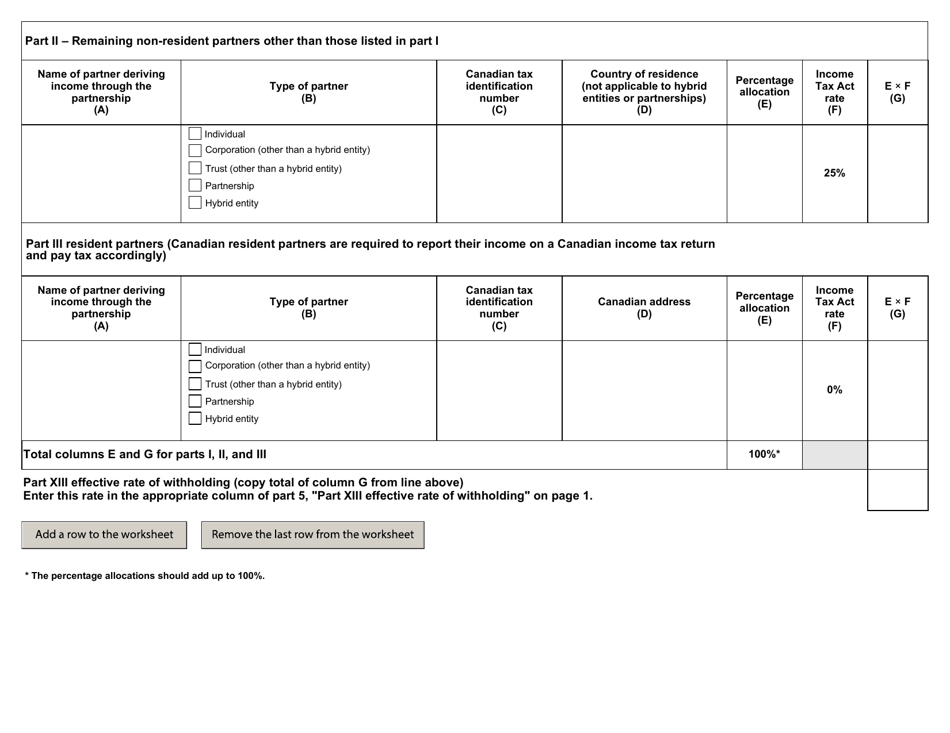

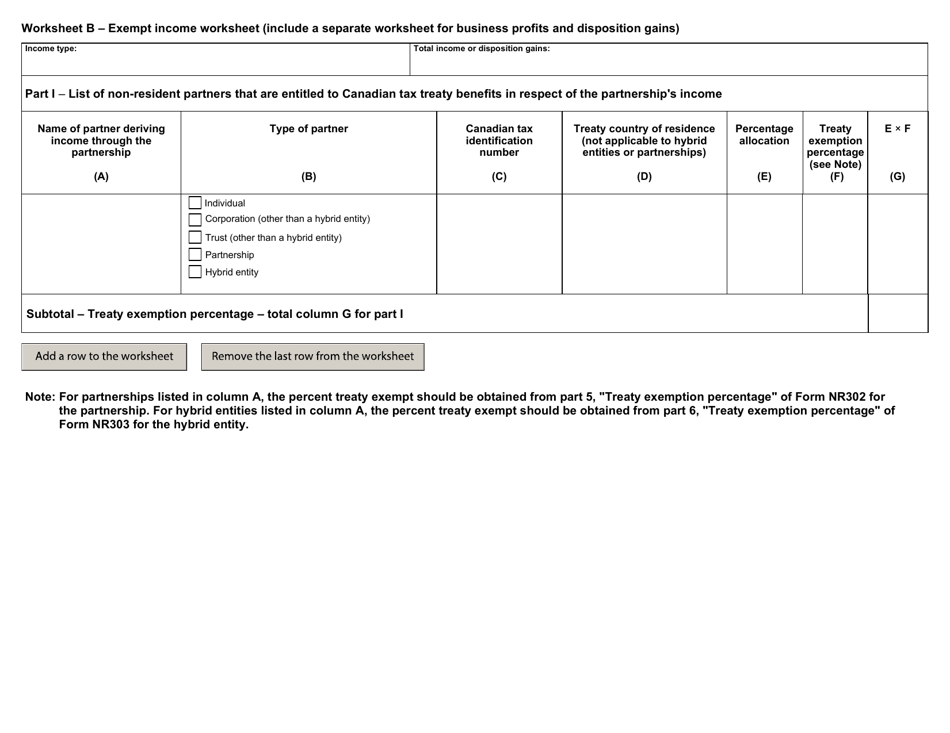

Q: What information is required to be reported on Form NR302?

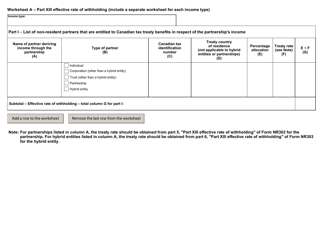

A: Form NR302 requires information about the partnership, partners, and the tax treaty benefits being claimed.

Q: Is there a deadline for filing Form NR302?

A: Yes, Form NR302 should be filed by the due date of the partnership tax return, including extensions.

Q: Are there any penalties for not filing Form NR302?

A: Failure to file Form NR302 may result in the denial of tax treaty benefits and potential penalties.

Q: Can Form NR302 be filed electronically?

A: Yes, Form NR302 can be filed electronically if the partnership is using the appropriate electronic filing method.

Q: Can a completed Form NR302 be amended?

A: Yes, a completed Form NR302 can be amended by filing a new Form NR302 with the correct information.