This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 13

for the current year.

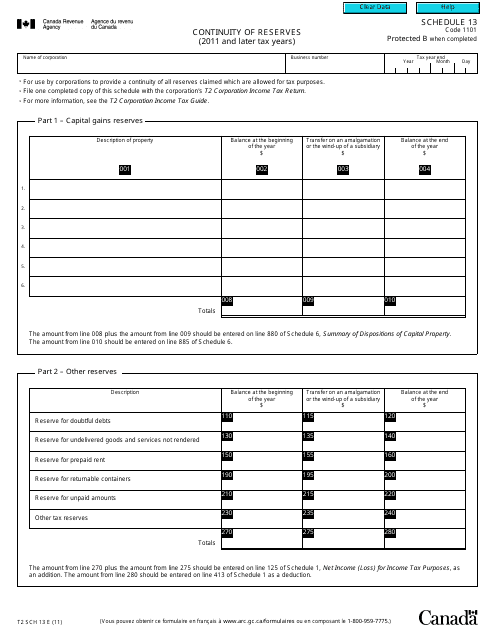

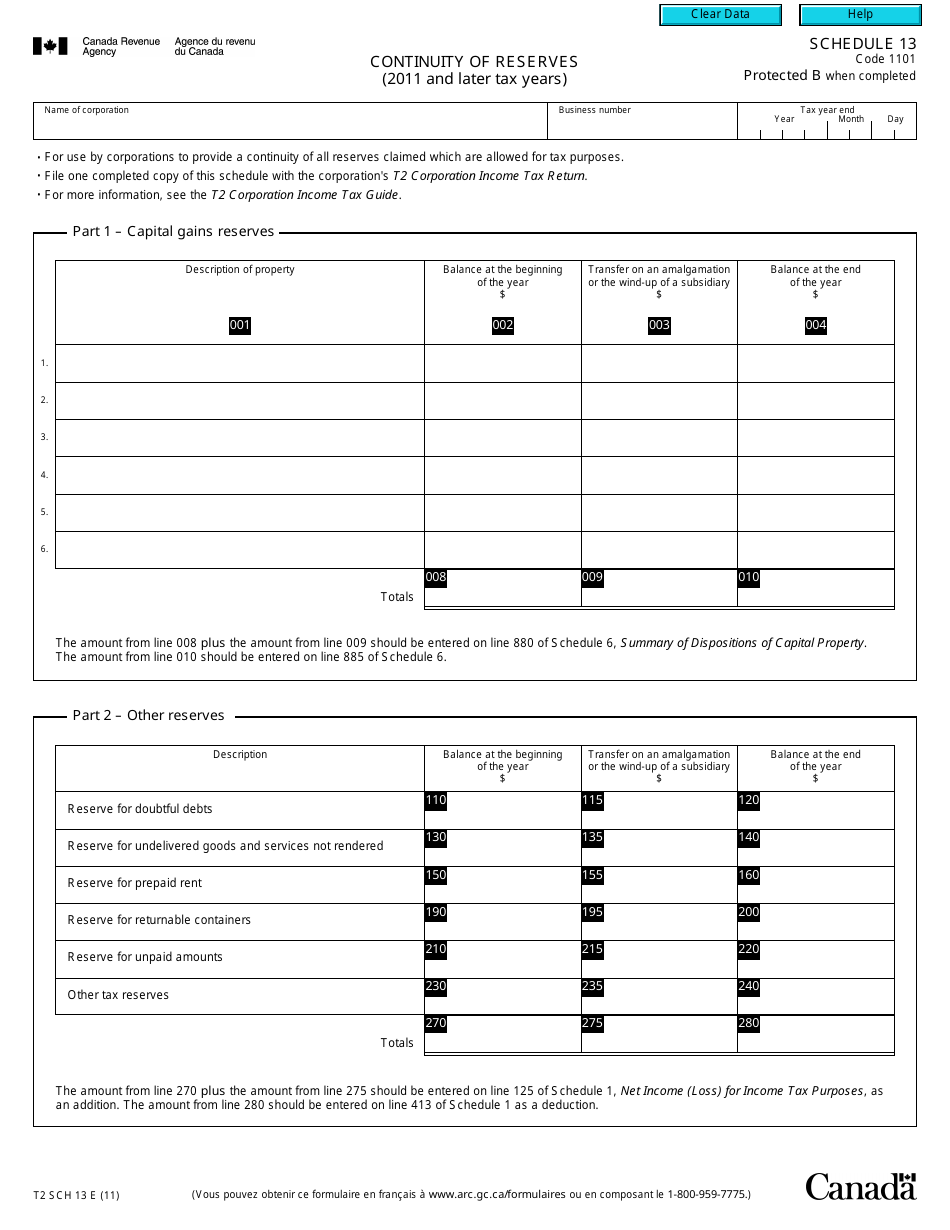

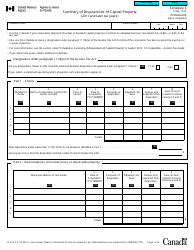

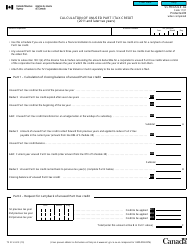

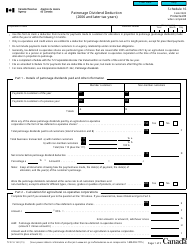

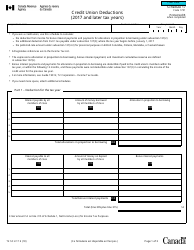

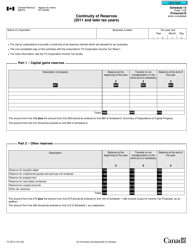

Form T2 Schedule 13 Continuity of Reserves (2011 and Later Tax Years) - Canada

Form T2 Schedule 13 Continuity of Reserves (2011 and Later Tax Years) in Canada is used by corporations to calculate and report their tax reserves. It helps companies maintain accurate records of their reserves from one tax year to another.

The corporation files the Form T2 Schedule 13 Continuity of Reserves in Canada.

FAQ

Q: What is Form T2 Schedule 13?

A: Form T2 Schedule 13 is a tax form used in Canada to report the continuity of reserves from 2011 and later tax years.

Q: What is meant by continuity of reserves?

A: Continuity of reserves refers to the changes in a company's reserve balances from one tax year to another.

Q: Who needs to file Form T2 Schedule 13?

A: Companies in Canada that have reserves and are filing their tax returns for 2011 and later tax years need to file Form T2 Schedule 13.

Q: What information is required on Form T2 Schedule 13?

A: Form T2 Schedule 13 requires companies to provide details of their reserve balances at the beginning and end of the tax year, as well as any changes that occurred during the year.

Q: When is Form T2 Schedule 13 due?

A: Form T2 Schedule 13 is typically due with the company's tax return, which is generally due within six months after the end of the tax year.

Q: Are there any penalties for not filing Form T2 Schedule 13?

A: Yes, failure to file Form T2 Schedule 13 or providing false information can result in penalties imposed by the CRA.