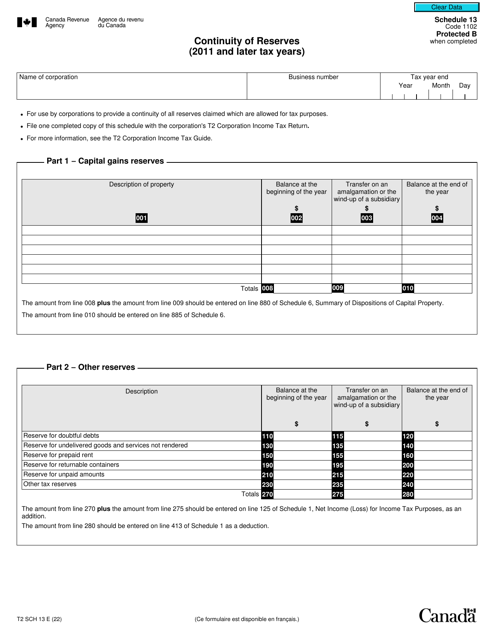

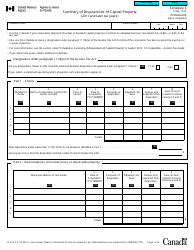

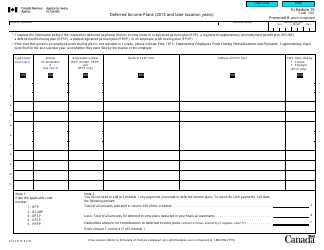

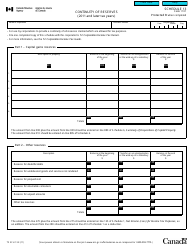

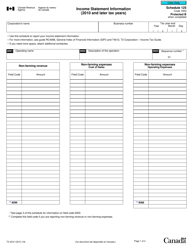

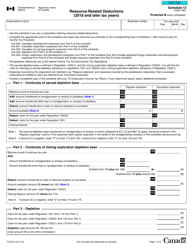

Form T2 Schedule 13 Continuity of Reserves (2011 and Later Tax Years) - Canada

Form T2 Schedule 13 Continuity of Reserves is used in Canada for businesses to calculate and report changes in their reserve balances from one tax year to another, starting from 2011 onwards. It helps businesses keep track of their reserve funds and provides information relevant to their tax obligations.

The Form T2 Schedule 13 Continuity of Reserves is filed by corporations in Canada for the 2011 and later tax years.

Form T2 Schedule 13 Continuity of Reserves (2011 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 13?

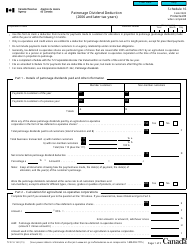

A: Form T2 Schedule 13 is a tax form used in Canada for reporting the continuity of reserves for tax years after 2011.

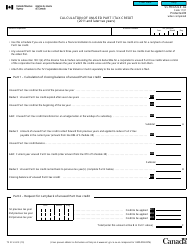

Q: What does Form T2 Schedule 13 calculate?

A: Form T2 Schedule 13 calculates the changes in reserves over the course of the tax year.

Q: Why is it important to report the continuity of reserves?

A: Reporting the continuity of reserves is important for accurately calculating taxable income and ensuring compliance with tax regulations.

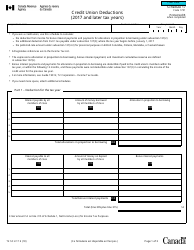

Q: Who should file Form T2 Schedule 13?

A: Corporations in Canada that have reserves and are filing a tax return for tax years after 2011 should file Form T2 Schedule 13.

Q: Is there a deadline for filing Form T2 Schedule 13?

A: The deadline for filing Form T2 Schedule 13 is generally the same as the deadline for filing the corporation's tax return, which is usually six months after the end of the tax year.