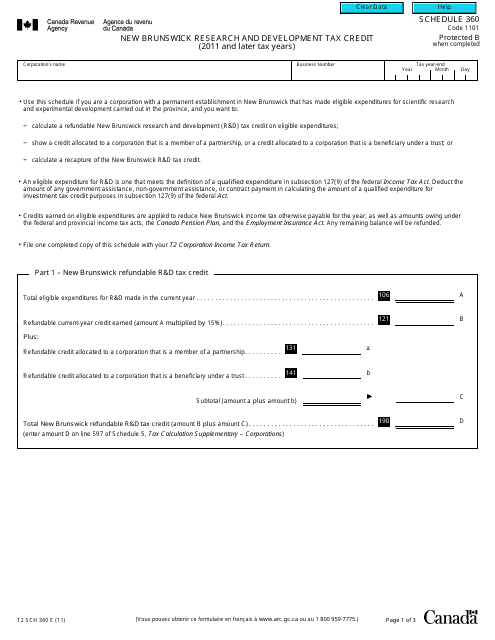

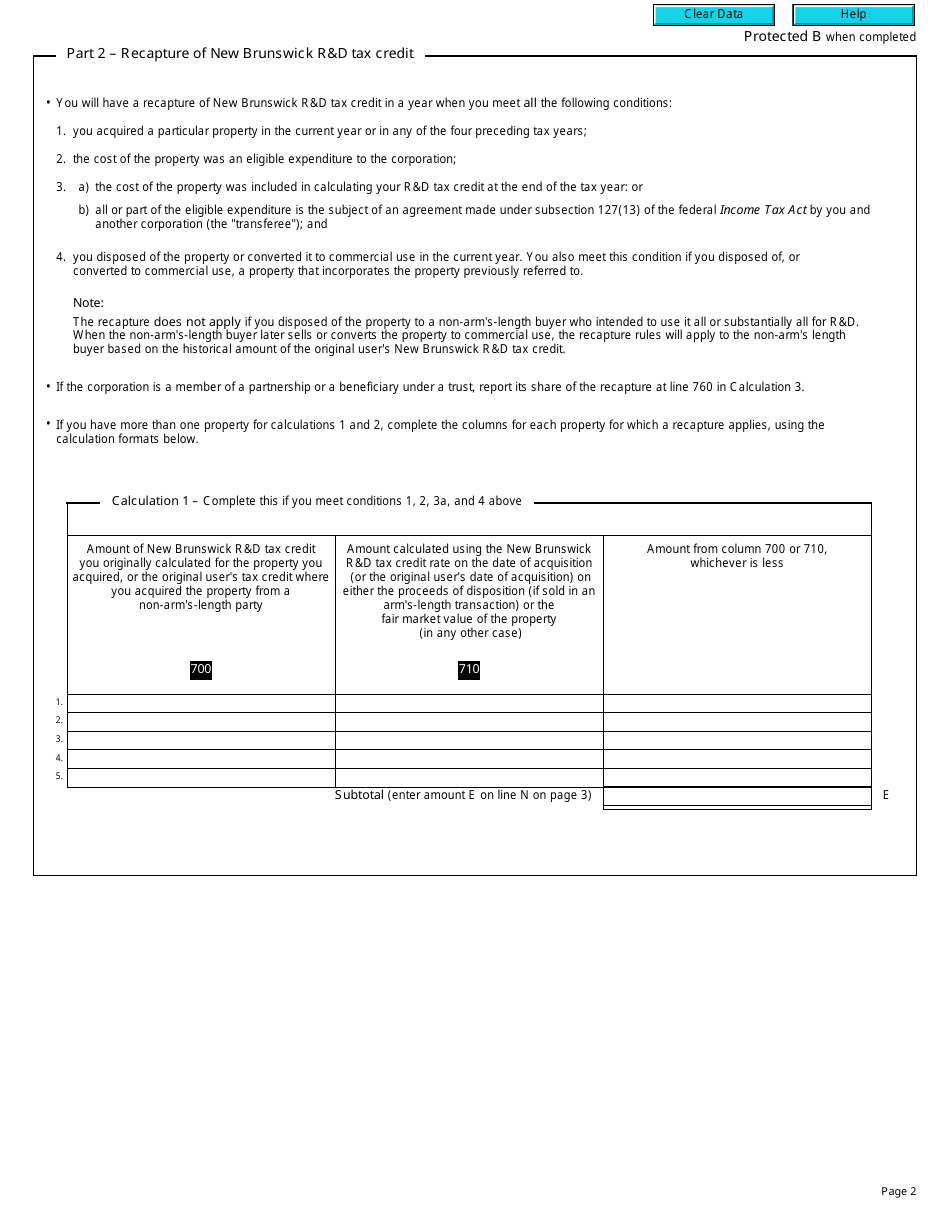

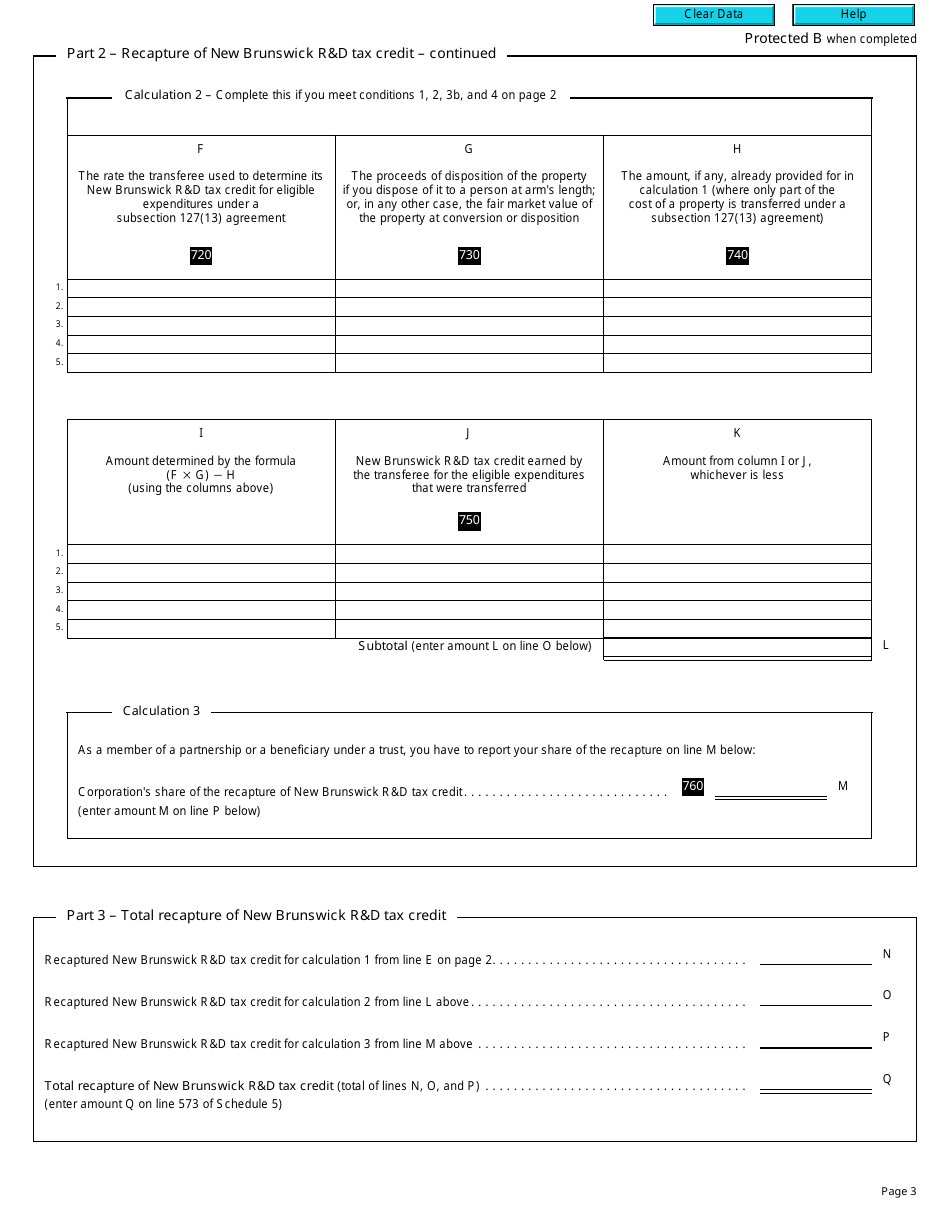

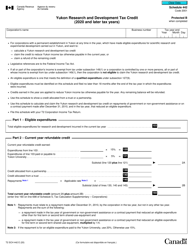

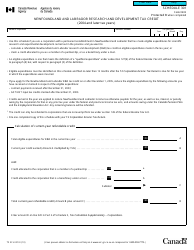

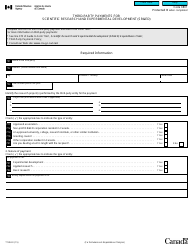

Form T2 Schedule 360 New Brunswick Research and Development Tax Credit (2011 and Later Tax Years) - Canada

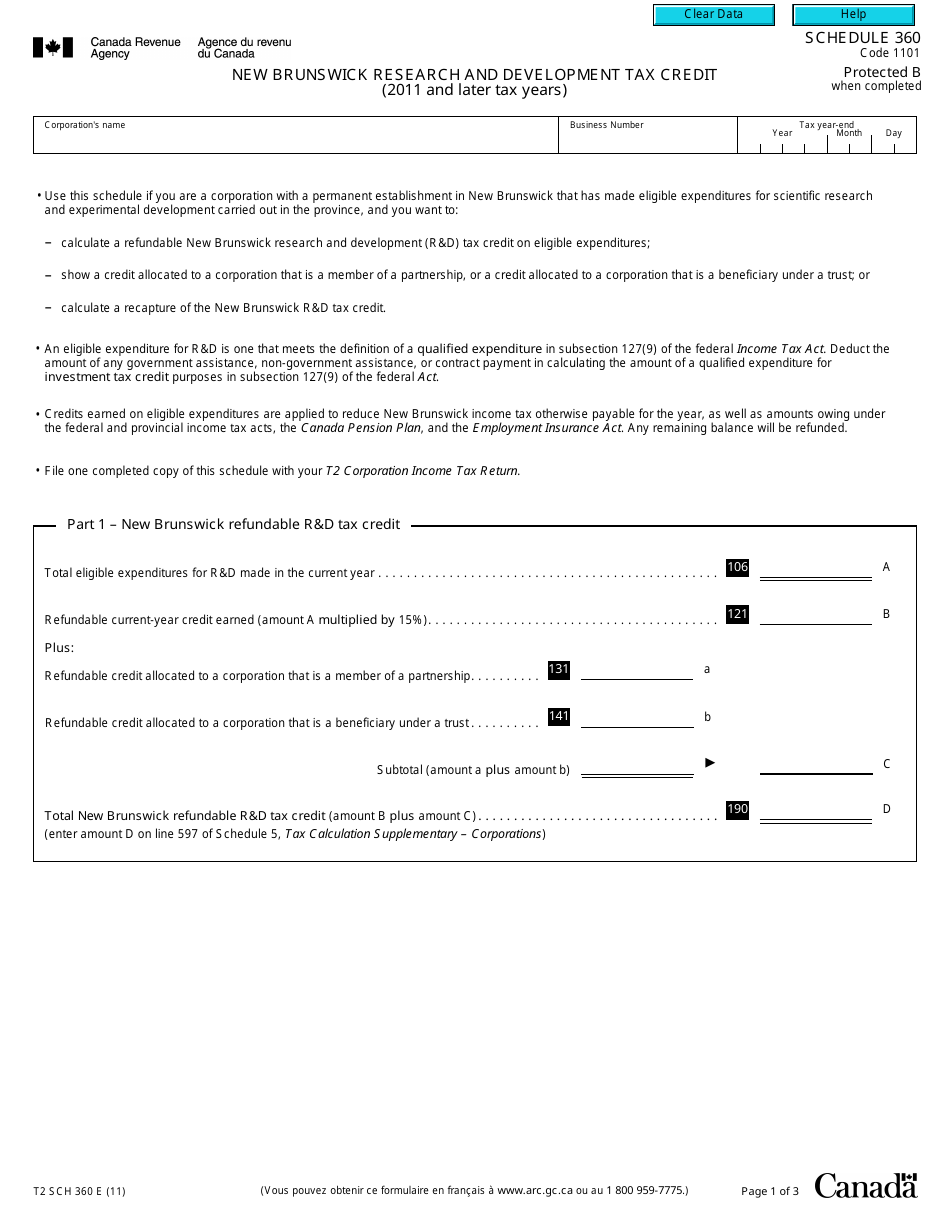

Form T2 Schedule 360 is used by Canadian corporations to claim the New Brunswick Research and Development Tax Credit for the tax years 2011 and later. This credit encourages businesses to conduct research and development activities in New Brunswick by providing them with a tax reduction or refund.

The Form T2 Schedule 360 for the New Brunswick Research and Development Tax Credit is filed by corporations in Canada.

FAQ

Q: What is Form T2 Schedule 360?

A: Form T2 Schedule 360 is a tax form used in Canada for claiming the New Brunswick Research and Development Tax Credit.

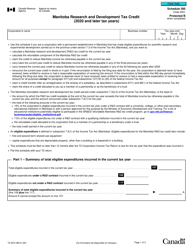

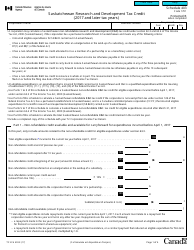

Q: What is the purpose of the New Brunswick Research and Development Tax Credit?

A: The purpose of the New Brunswick Research and Development Tax Credit is to incentivize businesses in New Brunswick to engage in research and development activities.

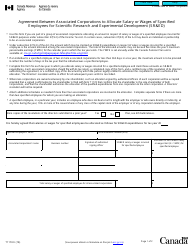

Q: Who is eligible to claim the New Brunswick Research and Development Tax Credit?

A: Businesses conducting eligible research and development activities in New Brunswick may be eligible to claim this tax credit.

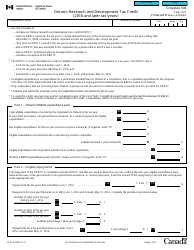

Q: What are the qualifying criteria for the New Brunswick Research and Development Tax Credit?

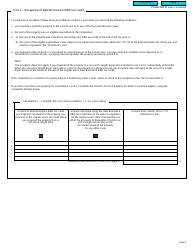

A: The qualifying criteria include conducting eligible research and development activities within New Brunswick and meeting certain expenditure thresholds.

Q: What is the benefit of claiming the New Brunswick Research and Development Tax Credit?

A: Claiming this tax credit can result in a reduction in the overall tax liability for businesses engaged in research and development activities in New Brunswick.

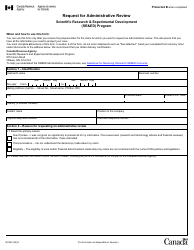

Q: Are there any specific rules or limitations for claiming the New Brunswick Research and Development Tax Credit?

A: Yes, there are specific rules and limitations outlined in the tax form instructions. It is important to review these instructions to ensure eligibility and accurate filing.

Q: Is Form T2 Schedule 360 only applicable for the 2011 and later tax years?

A: Yes, Form T2 Schedule 360 is specifically for the 2011 and later tax years in Canada.

Q: Is the New Brunswick Research and Development Tax Credit available in the United States?

A: No, the New Brunswick Research and Development Tax Credit is specific to businesses operating in New Brunswick, Canada. It is not available to businesses in the United States.