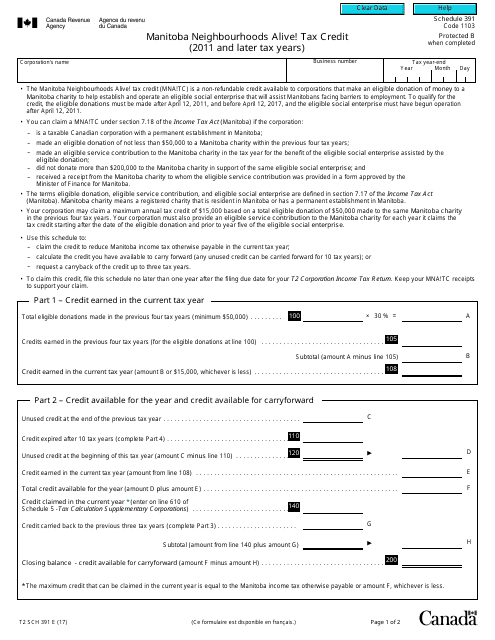

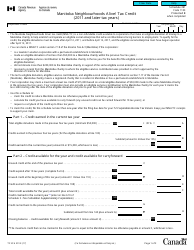

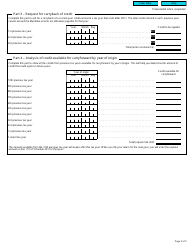

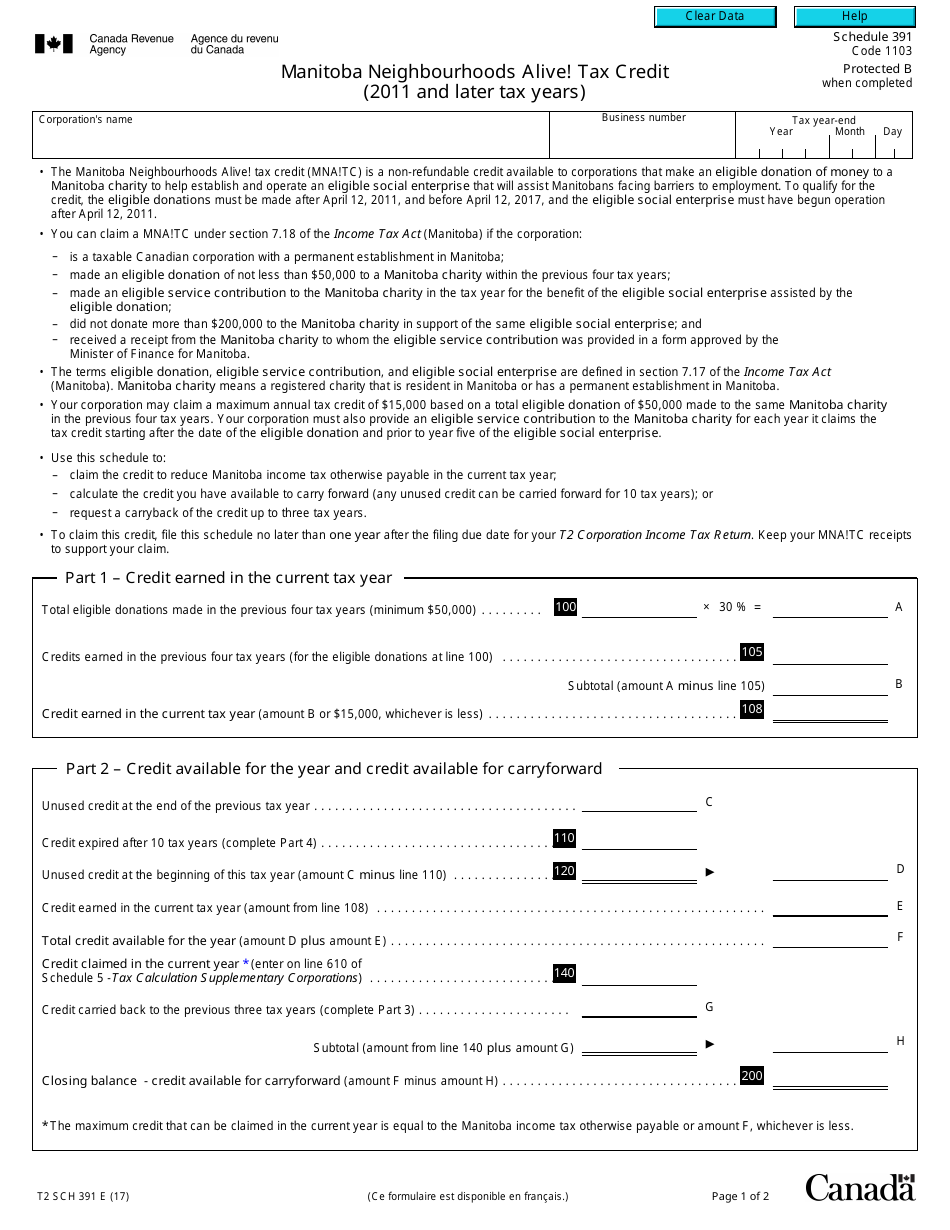

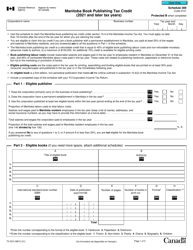

Form T2 Schedule 391 Manitoba Neighbourhoods Alive! Tax Credit (2011 and Later Tax Years) - Canada

The Form T2 Schedule 391 Manitoba Neighbourhoods Alive! Tax Credit (2011 and Later Tax Years) is filed by Canadian corporations that are eligible for this tax credit.

FAQ

Q: What is the T2 Schedule 391?

A: The T2 Schedule 391 is a form used to claim the Manitoba Neighbourhoods Alive! Tax Credit.

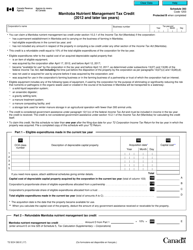

Q: What is the Manitoba Neighbourhoods Alive! Tax Credit?

A: The Manitoba Neighbourhoods Alive! Tax Credit is a tax credit available in Manitoba, Canada.

Q: Who can claim the Manitoba Neighbourhoods Alive! Tax Credit?

A: Businesses that meet the eligibility criteria set by the Manitoba government can claim this tax credit.

Q: What is the purpose of the Manitoba Neighbourhoods Alive! Tax Credit?

A: The purpose of this tax credit is to support businesses that invest in designated neighbourhoods in Manitoba to stimulate economic growth and community development.

Q: What are the eligible expenses for the Manitoba Neighbourhoods Alive! Tax Credit?

A: Eligible expenses include wages and salaries paid to employees who perform eligible activities within designated neighbourhoods in Manitoba.

Q: How much is the Manitoba Neighbourhoods Alive! Tax Credit?

A: The tax credit amount is calculated based on eligible expenses and the tax credit rate determined by the Manitoba government.