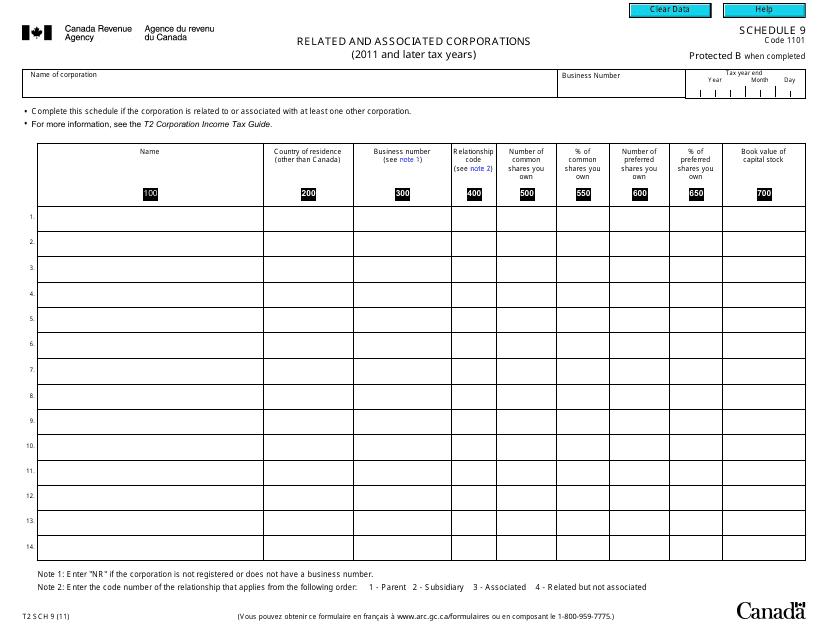

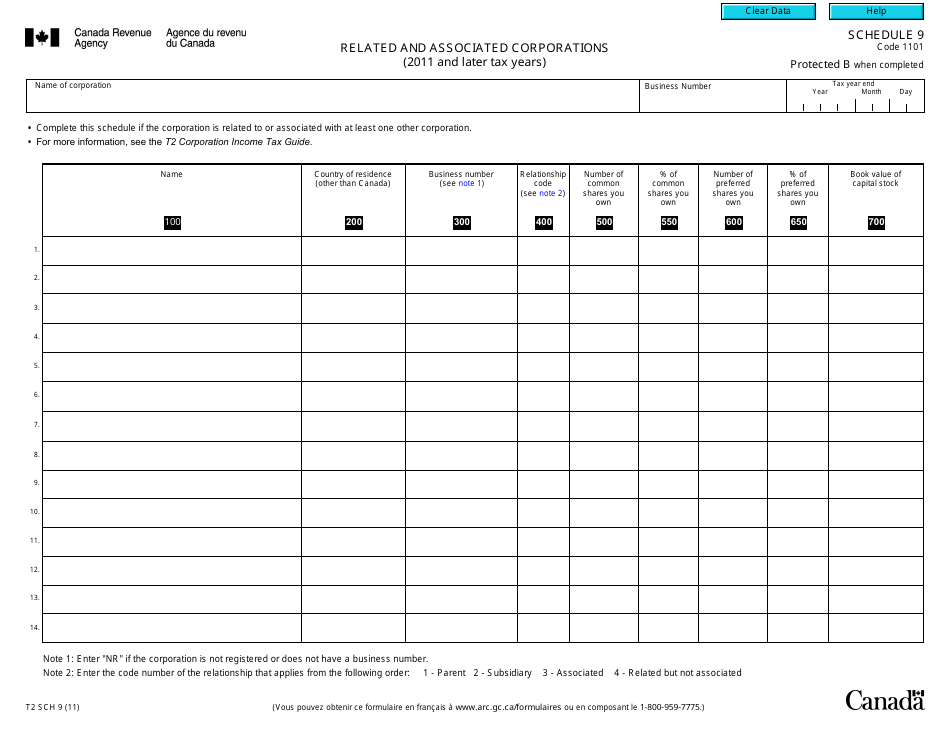

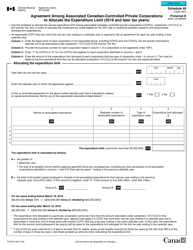

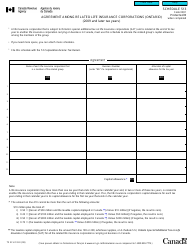

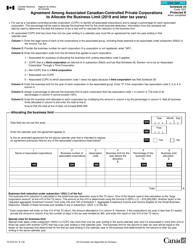

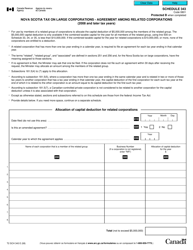

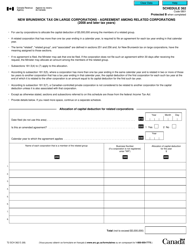

Form T2 Schedule 9 Related and Associated Corporations (2011 and Later Tax Years) - Canada

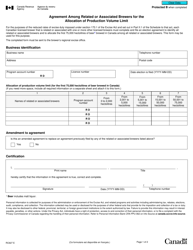

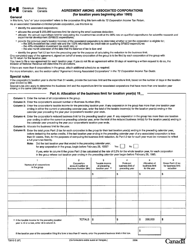

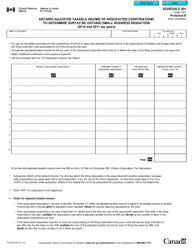

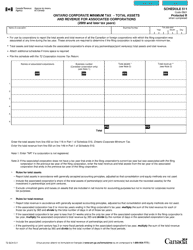

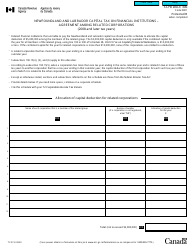

Form T2 Schedule 9 Related and Associated Corporations is used in Canada for reporting information about corporations that are related or associated with the filing corporation for tax purposes. This form helps the Canada Revenue Agency (CRA) to determine the taxation and financial relationships between these corporations.

The Form T2 Schedule 9 Related and Associated Corporations (2011 and Later Tax Years) in Canada is filed by corporations that have related and associated corporations.

FAQ

Q: What is the Form T2 Schedule 9?

A: Form T2 Schedule 9 is a tax form used in Canada for reporting related and associated corporations.

Q: Who needs to file Form T2 Schedule 9?

A: Corporations in Canada that have related or associated corporations need to file Form T2 Schedule 9.

Q: What is the purpose of Form T2 Schedule 9?

A: The purpose of Form T2 Schedule 9 is to determine the income tax consequences of transactions between related and associated corporations.

Q: What is meant by related corporations?

A: Related corporations are corporations that are connected through control by another corporation, certain individuals, or a combination of both.

Q: What is meant by associated corporations?

A: Associated corporations are corporations that are related and share some significant degree of common ownership and control.

Q: Are there any penalties for not filing Form T2 Schedule 9?

A: Yes, there can be penalties for not filing Form T2 Schedule 9 or for providing false or misleading information on the form.

Q: Is Form T2 Schedule 9 only for corporations in Canada?

A: Yes, Form T2 Schedule 9 is specifically for corporations in Canada.