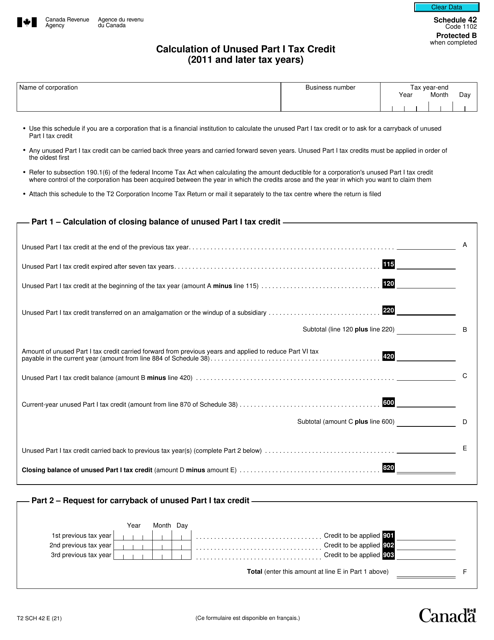

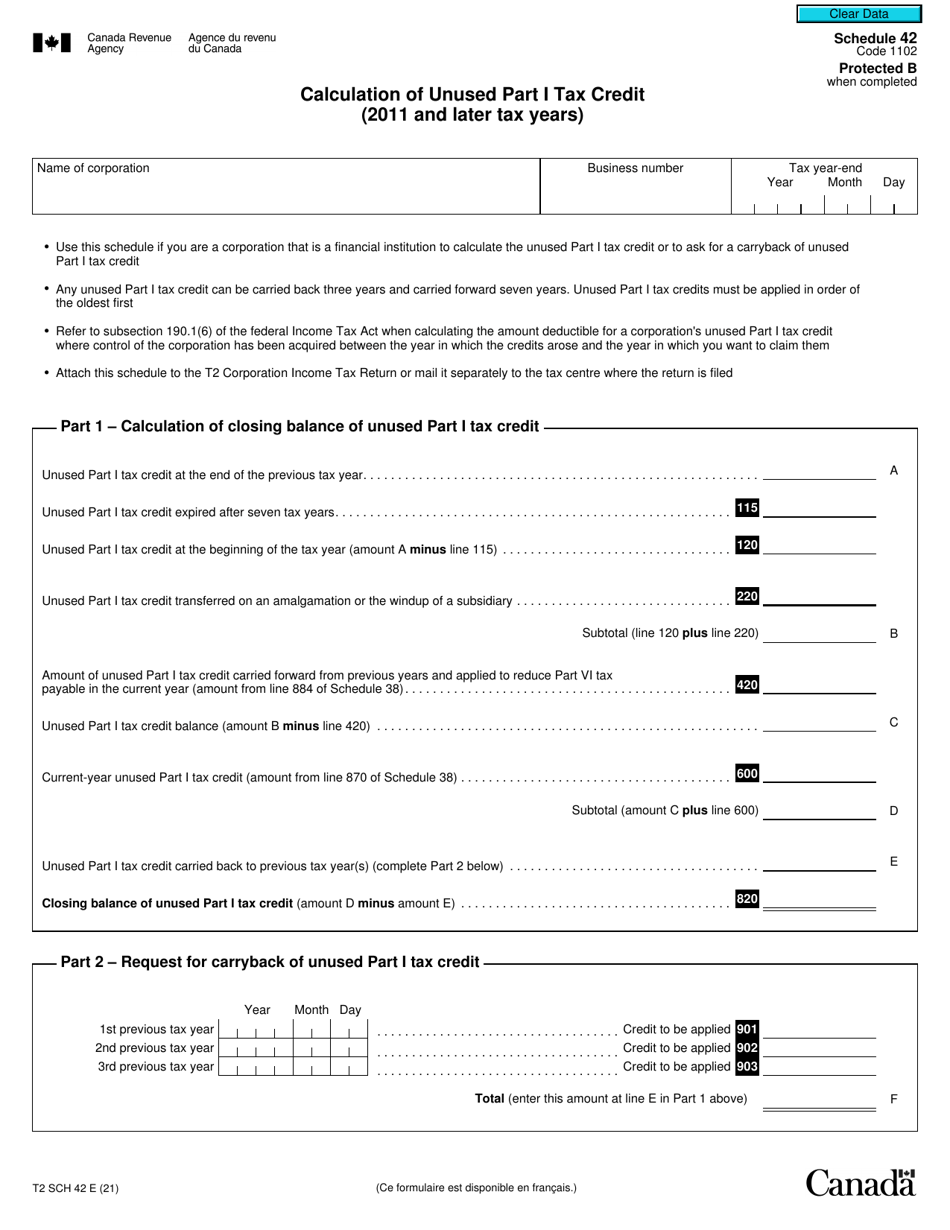

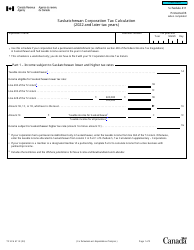

Form T2 Schedule 42 Calculation of Unused Part I Tax Credit (2011 and Later Tax Years) - Canada

Form T2 Schedule 42 - Calculation of Unused Part I Tax Credit (2011 and Later Tax Years) in Canada is used to calculate any unused tax credits from previous tax years that can be claimed and applied against your current year's taxes payable.

The corporations in Canada file Form T2 Schedule 42 Calculation of Unused Part I Tax Credit for the tax years 2011 and later.

Form T2 Schedule 42 Calculation of Unused Part I Tax Credit (2011 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 42?

A: Form T2 Schedule 42 is a form used in Canada for calculating the unused Part I tax credit for tax years 2011 and later.

Q: What is the purpose of Form T2 Schedule 42?

A: The purpose of Form T2 Schedule 42 is to calculate the unused Part I tax credit.

Q: Who needs to use Form T2 Schedule 42?

A: Corporations in Canada that have a Part I tax credit available to carry forward from previous tax years need to use Form T2 Schedule 42.

Q: When is Form T2 Schedule 42 used?

A: Form T2 Schedule 42 is used for tax years 2011 and later.

Q: How do I fill out Form T2 Schedule 42?

A: You will need to follow the instructions provided on the form to accurately fill out Form T2 Schedule 42.

Q: Is Form T2 Schedule 42 available for individuals?

A: No, Form T2 Schedule 42 is specifically for corporations in Canada.

Q: Are there any deadlines for filing Form T2 Schedule 42?

A: The deadline for filing Form T2 Schedule 42 is the same as the deadline for filing the T2 Corporation Income Tax Return, which is typically 6 months after the end of the corporation's fiscal year.