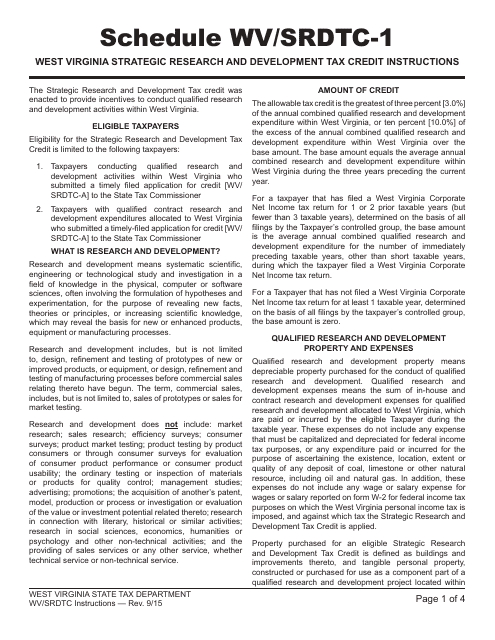

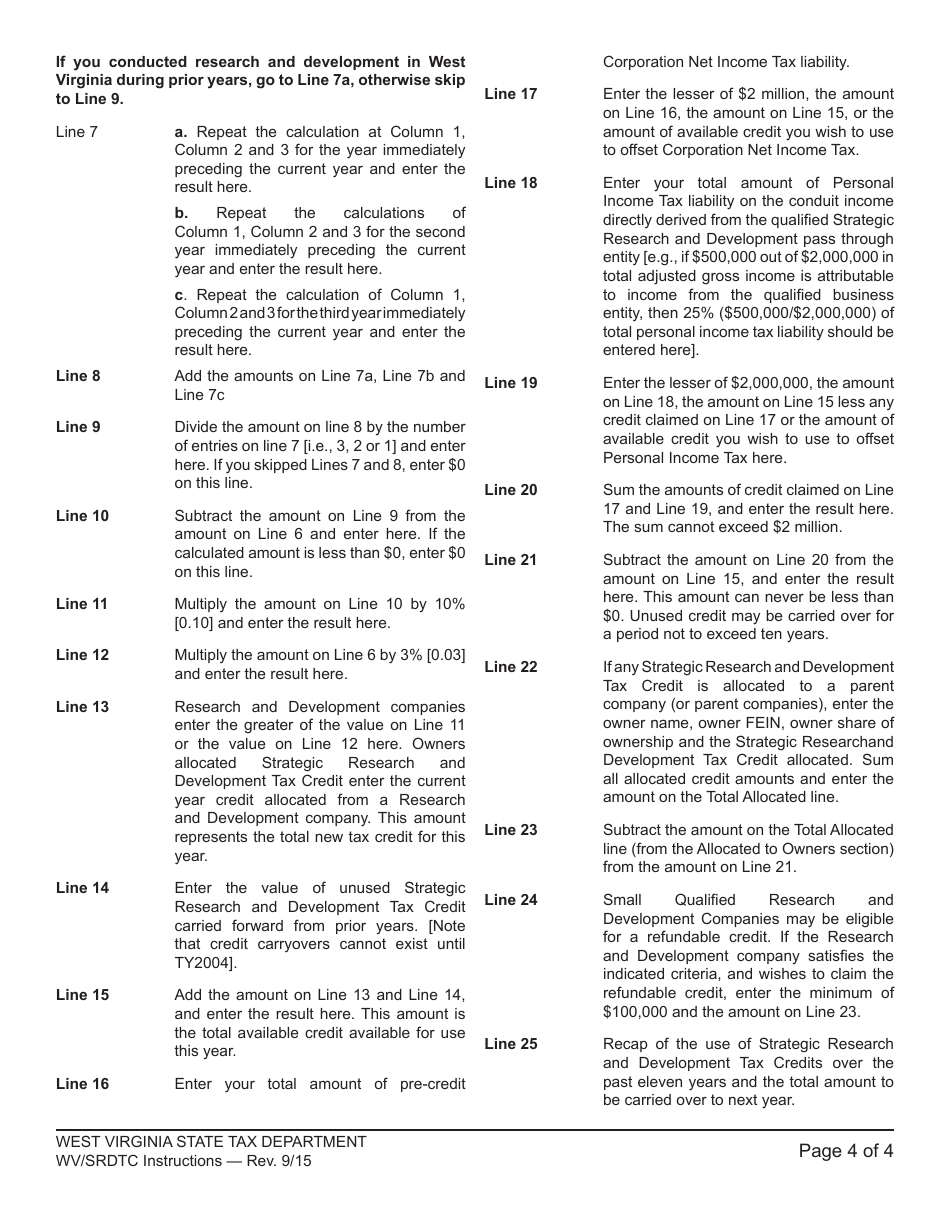

Instructions for Form WV / SRDTC-1 West Virginia Strategic Research and Development Tax Credit - West Virginia

This document contains official instructions for Form WV/SRDTC-1 , West Virginia Strategic Research and Development Tax Credit - a form released and collected by the West Virginia State Tax Department.

FAQ

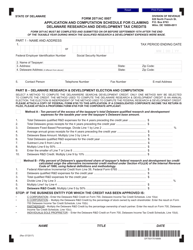

Q: What is Form WV/SRDTC-1?

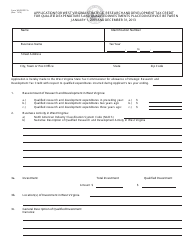

A: Form WV/SRDTC-1 is the application form for the West Virginia Strategic Research and Development Tax Credit.

Q: What is the West Virginia Strategic Research and Development Tax Credit?

A: The West Virginia Strategic Research and Development Tax Credit is a tax credit provided to eligible businesses in West Virginia for qualified research and development expenses.

Q: Who is eligible for the West Virginia Strategic Research and Development Tax Credit?

A: Eligible businesses, including C corporations and pass-through entities, engaged in qualified research and development activities in West Virginia may be eligible for the tax credit.

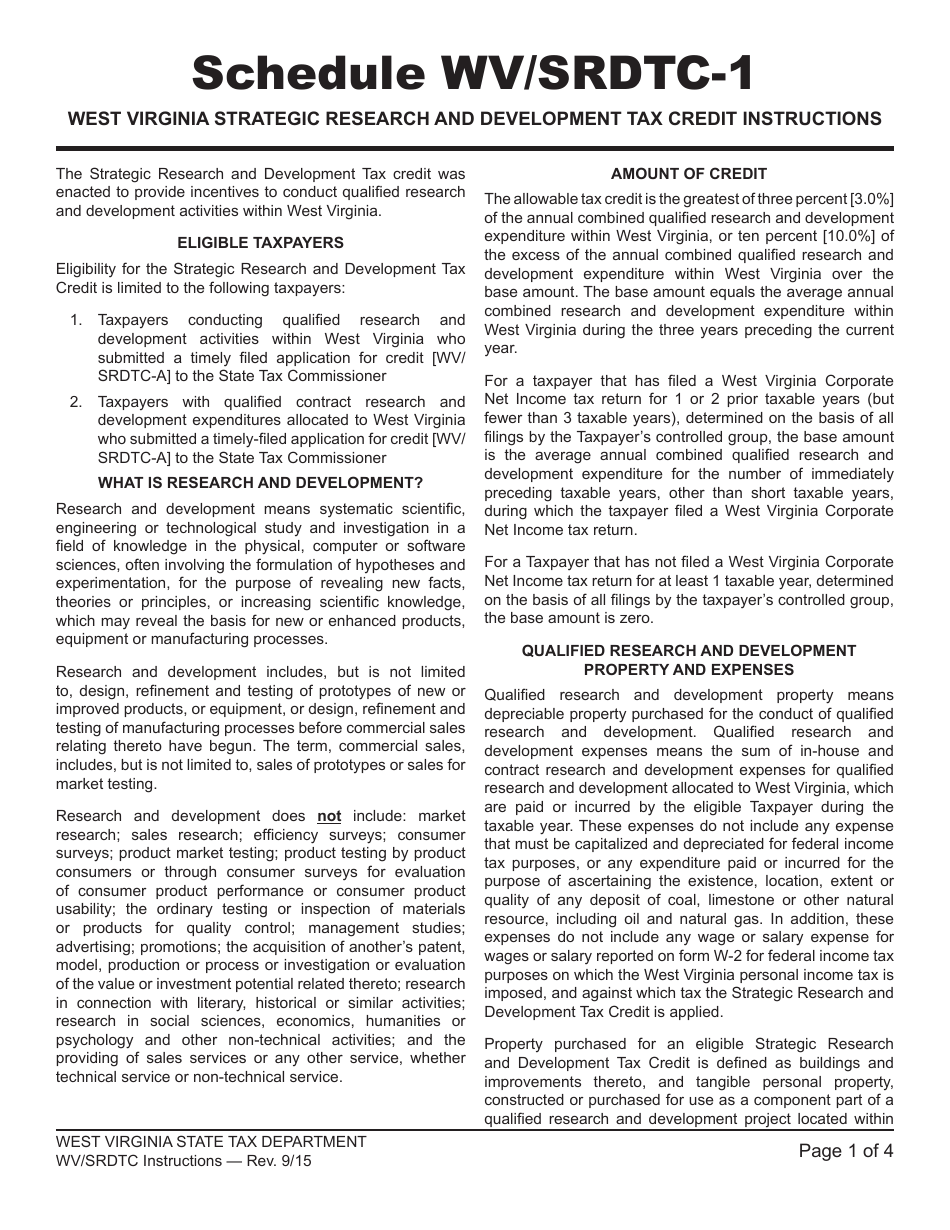

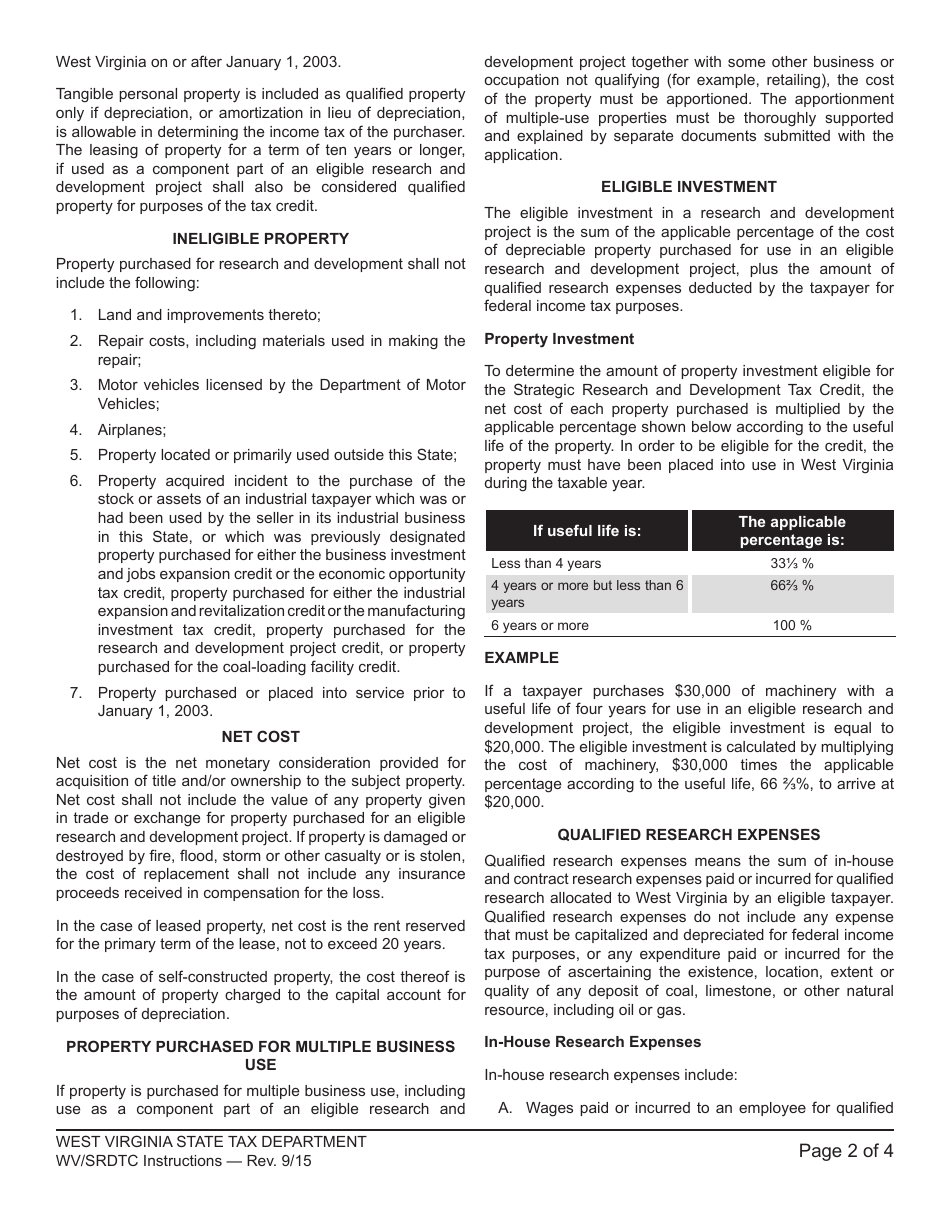

Q: What expenses are considered qualified research and development expenses?

A: Qualified research and development expenses include wages, supplies, and contract research expenses incurred in West Virginia for qualified research activities.

Q: How do I apply for the West Virginia Strategic Research and Development Tax Credit?

A: You can apply for the tax credit by completing and submitting Form WV/SRDTC-1 to the West Virginia Development Office.

Q: When is the deadline to submit Form WV/SRDTC-1?

A: The deadline to submit Form WV/SRDTC-1 is generally April 15th of the year following the tax year in which the qualified expenses were incurred.

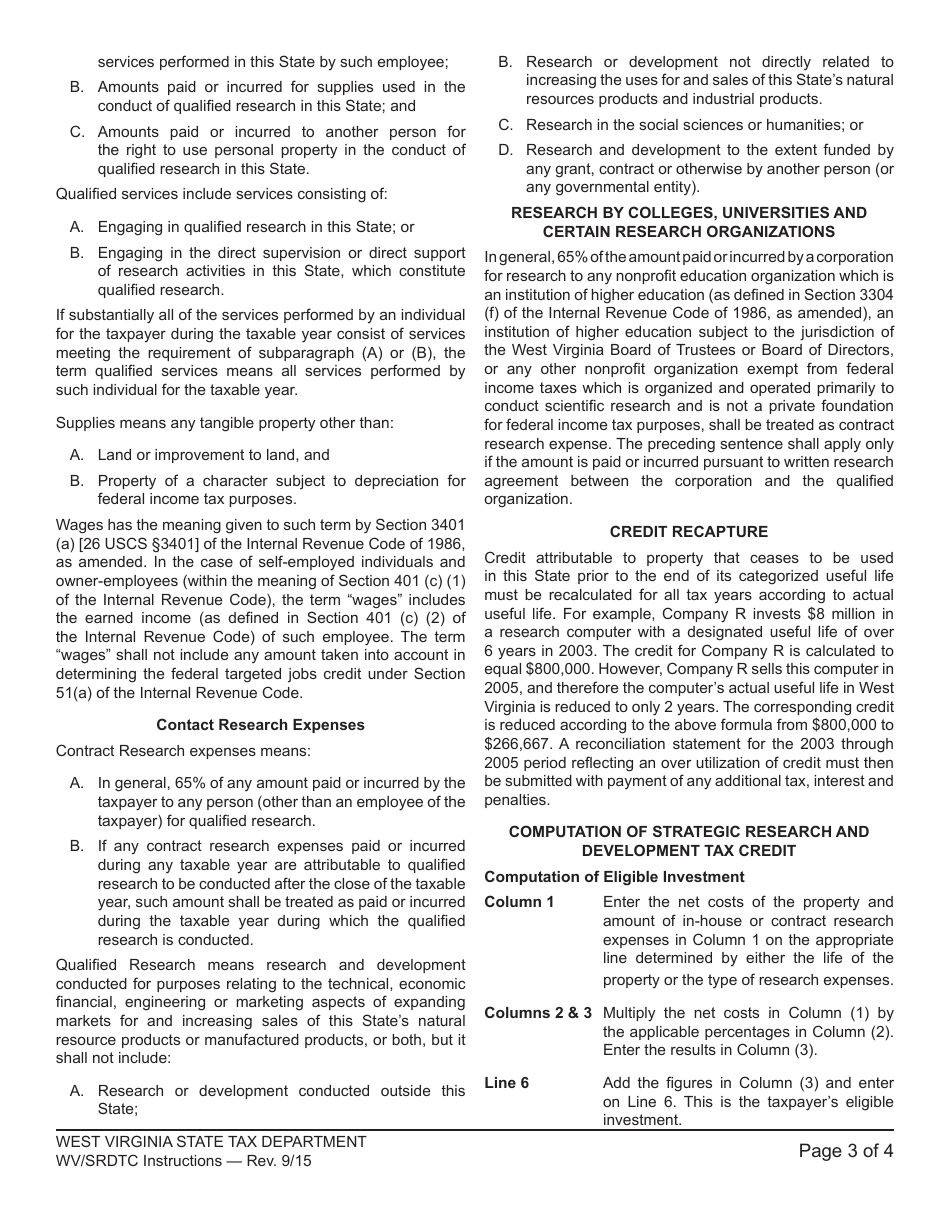

Q: Are there any limitations on the amount of the tax credit?

A: Yes, the tax credit is subject to certain limitations based on the amount of qualified research and development expenses and available tax credits.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.