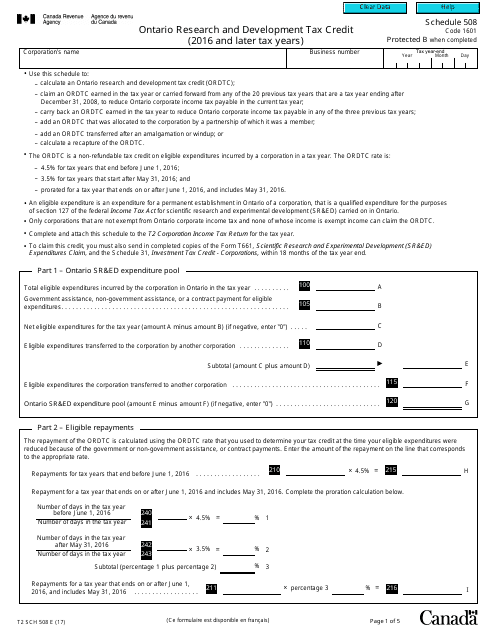

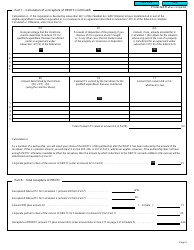

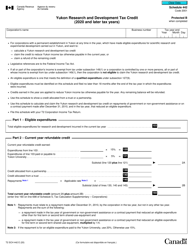

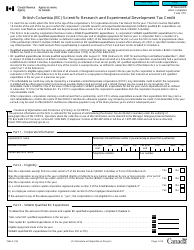

Form T2 Schedule 508 Ontario Research and Development Tax Credit (2016 and Later Tax Years) - Canada

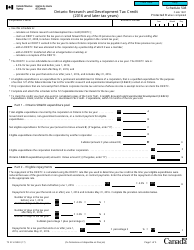

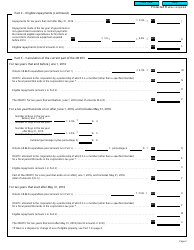

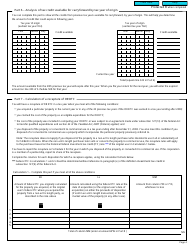

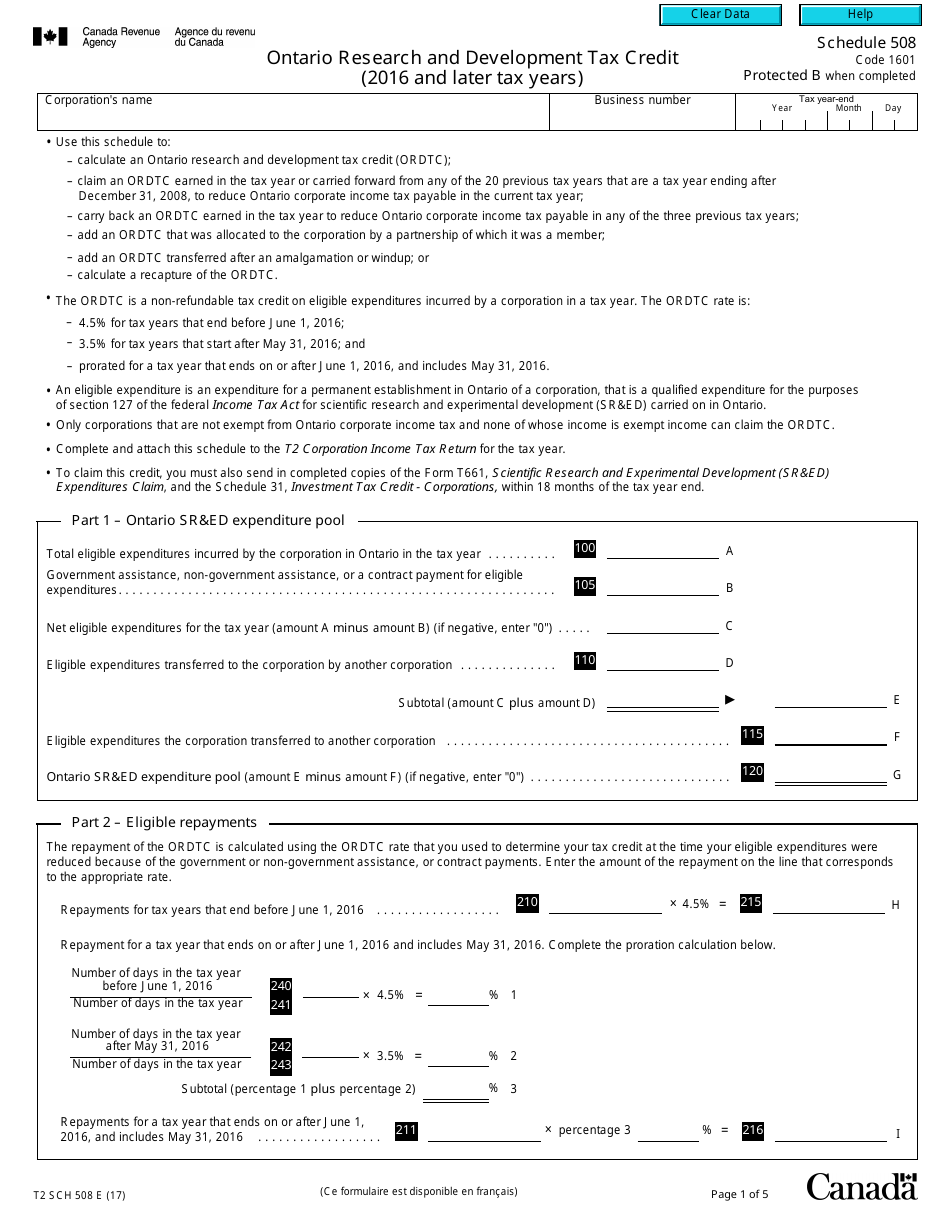

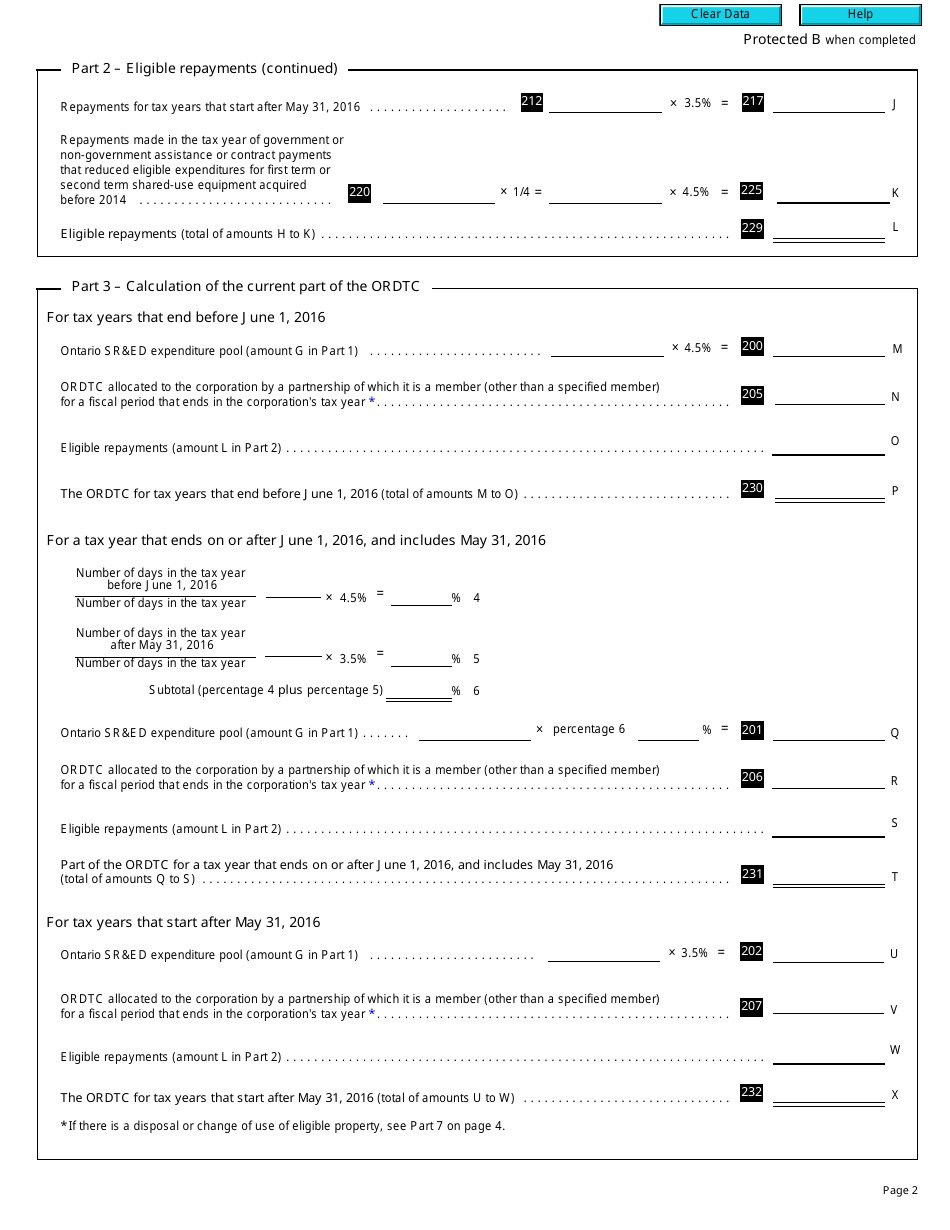

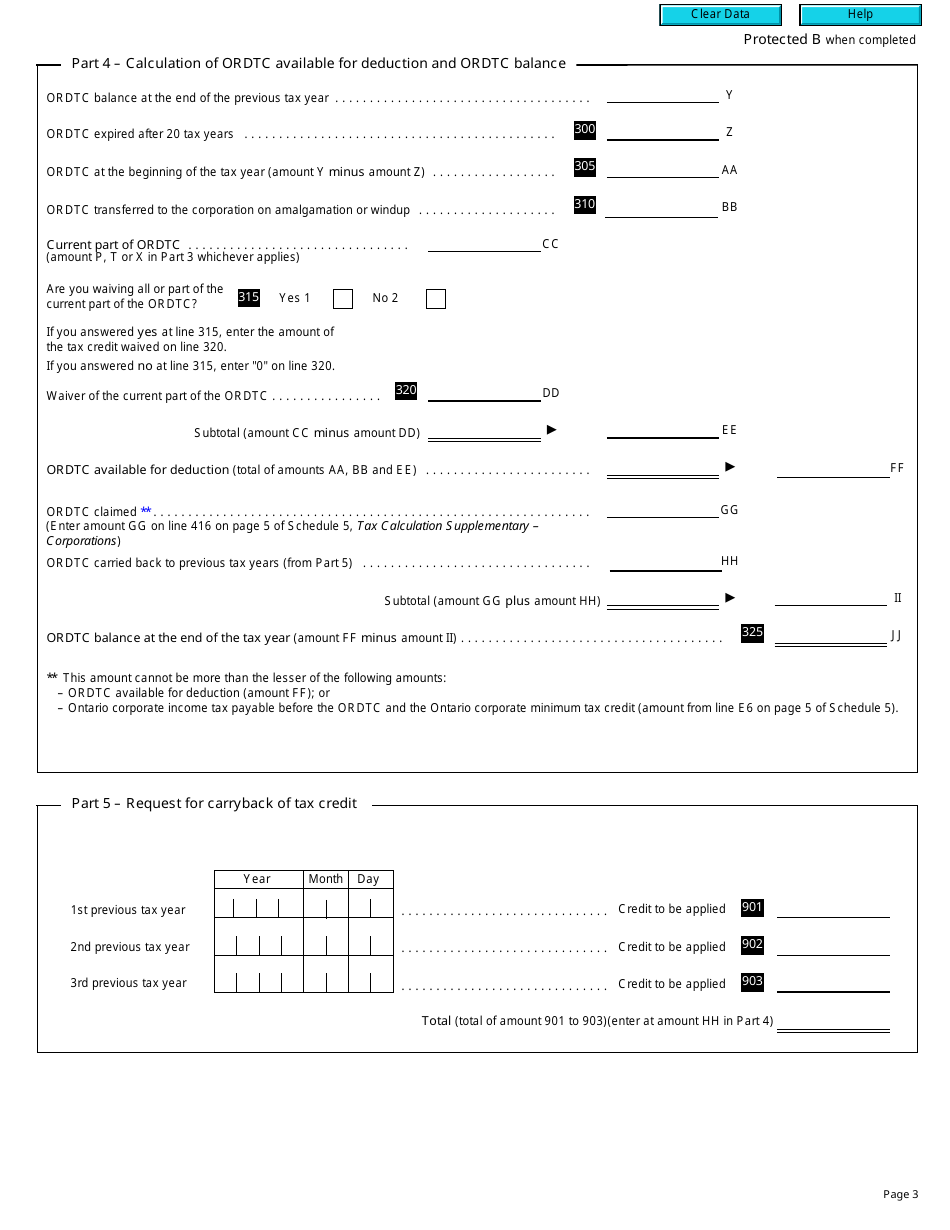

Form T2 Schedule 508 is used in Canada for reporting and claiming the Ontario Research and Development Tax Credit. This tax credit is available to corporations that carry out eligible research and development activities in Ontario. The schedule helps businesses calculate the amount of tax credit they can claim based on their R&D expenditures in the province. It is to be filled out and submitted along with the T2 Corporation Income Tax Return form for the relevant tax year.

The Form T2 Schedule 508 - Ontario Research and Development Tax Credit for the tax years 2016 and onwards in Canada is filed by corporations that are eligible for this tax credit in the province of Ontario. This tax credit is specifically designed to support and encourage research and development activities conducted by corporations in Ontario. Therefore, only corporations operating within Ontario and meeting the eligibility criteria can file this form.

FAQ

Q: What is Form T2 Schedule 508?

A: Form T2 Schedule 508 is a tax form used in Canada by corporations to claim the Ontario Research and Development Tax Credit for tax years 2016 and later.

Q: Who can use Form T2 Schedule 508?

A: Corporations operating in Ontario that have eligible research and development expenses can use Form T2 Schedule 508 to claim the Ontario Research and Development Tax Credit.

Q: What is the Ontario Research and Development Tax Credit?

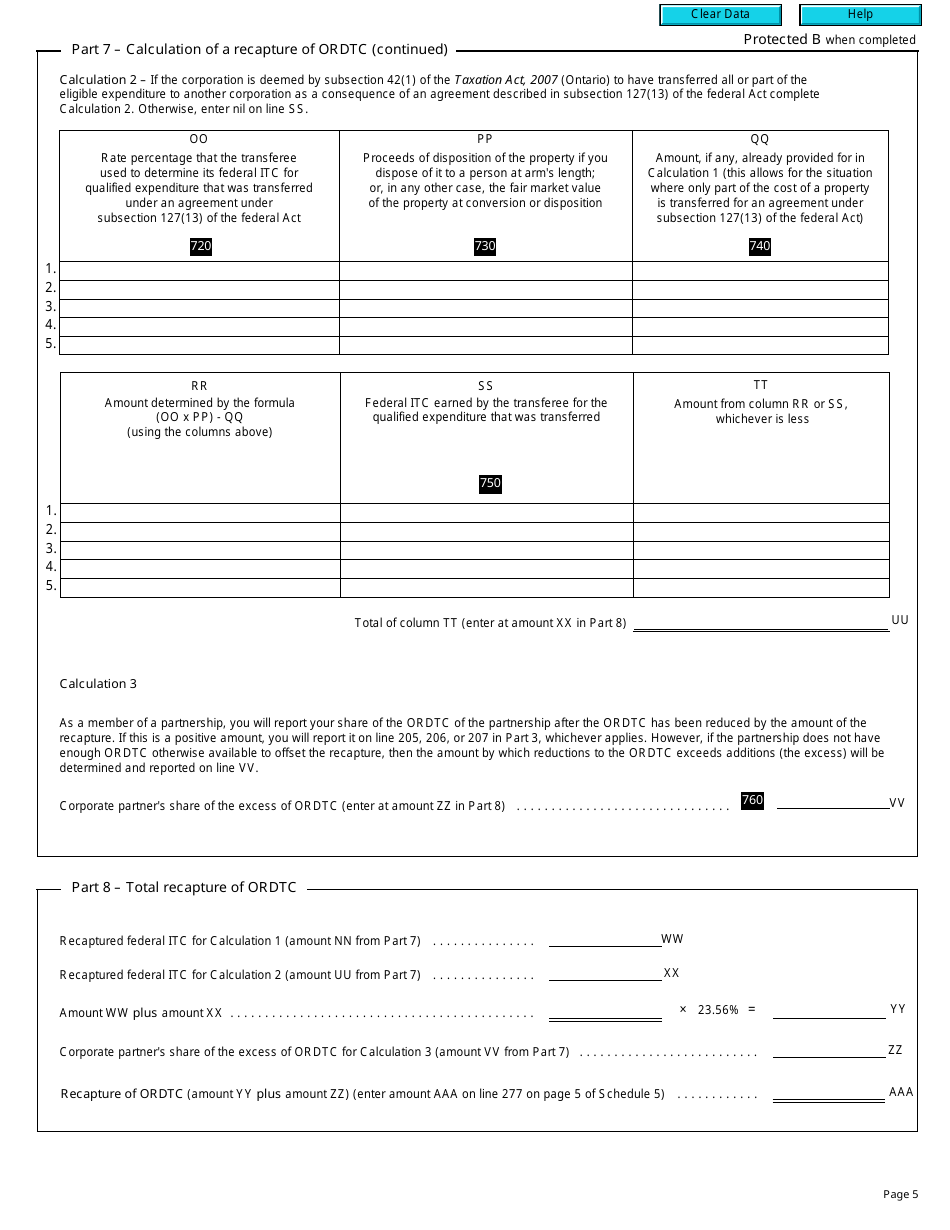

A: The Ontario Research and Development Tax Credit is a provincial tax credit that provides financial incentives to corporations engaging in research and development activities in Ontario.

Q: What are eligible research and development expenses?

A: Eligible research and development expenses include expenses incurred for scientific research and experimental development performed in Ontario, as well as salaries and wages paid to eligible employees engaged in research and development activities.

Q: How do I complete Form T2 Schedule 508?

A: To complete Form T2 Schedule 508, you'll need to provide information about your corporation, including its business number and fiscal period. You'll also need to calculate your eligible research and development expenses and fill in the appropriate lines on the form.

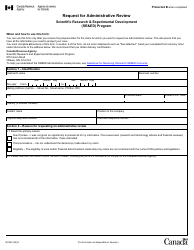

Q: When is the deadline to file Form T2 Schedule 508?

A: The deadline to file Form T2 Schedule 508 depends on your corporation's fiscal period. Generally, it should be filed along with your T2 corporate income tax return, which is due six months after the end of your fiscal period.

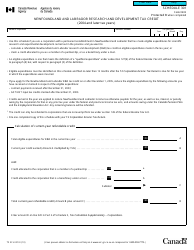

Q: Is there a limit to the amount of the Ontario Research and Development Tax Credit?

A: Yes, there is a limit to the amount of the Ontario Research and Development Tax Credit that you can claim. The credit is calculated based on a percentage of your eligible research and development expenses, up to a maximum amount determined by the Ontario government.

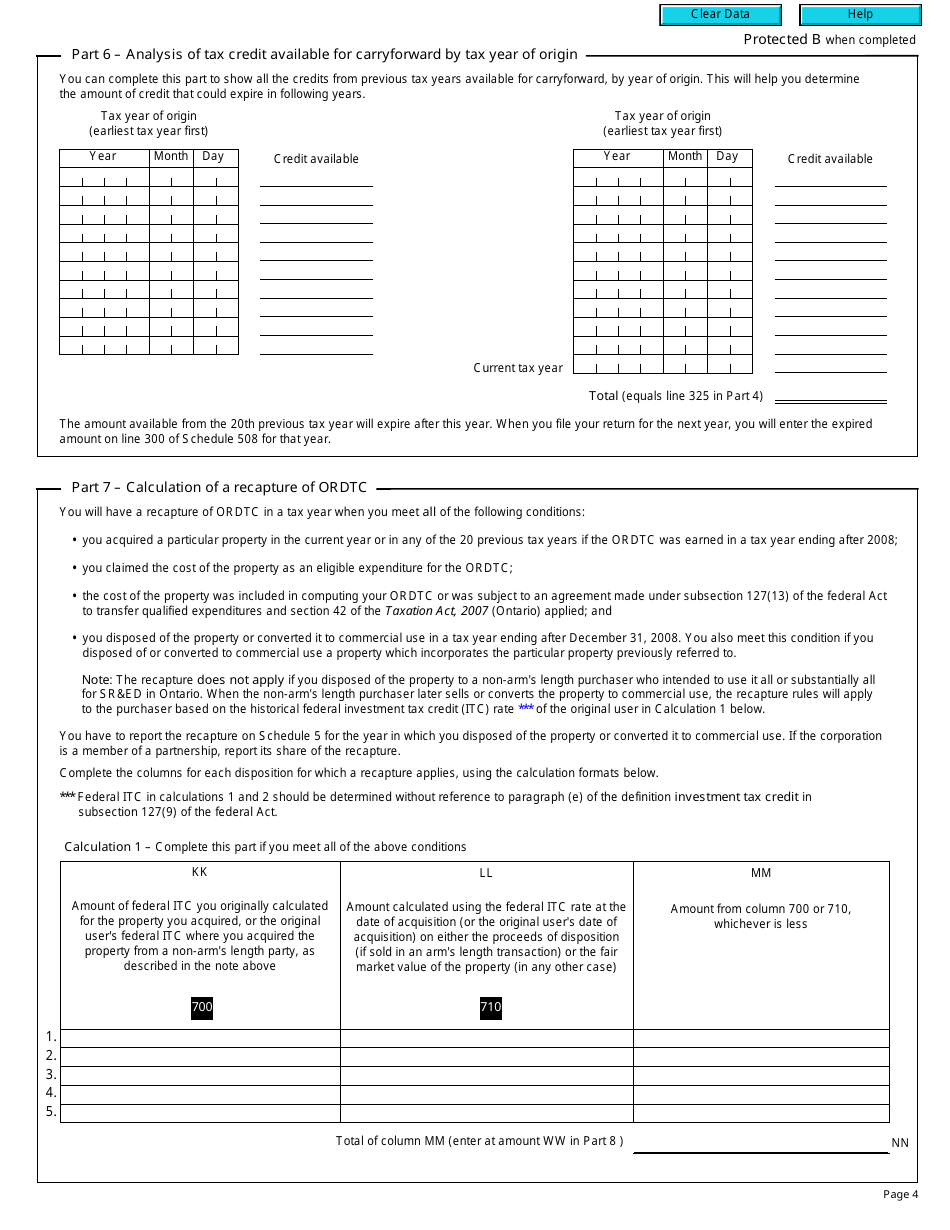

Q: Can I carry forward unused Ontario Research and Development Tax Credits?

A: Yes, unused Ontario Research and Development Tax Credits can be carried forward for up to 20 years to offset future tax liabilities.

Q: Can I claim the Ontario Research and Development Tax Credit if I have other federal or provincial research and development tax credits?

A: Yes, you can claim the Ontario Research and Development Tax Credit even if you have claimed other federal or provincial research and development tax credits. However, the total amount of credits claimed cannot exceed your total eligible research and development expenses.