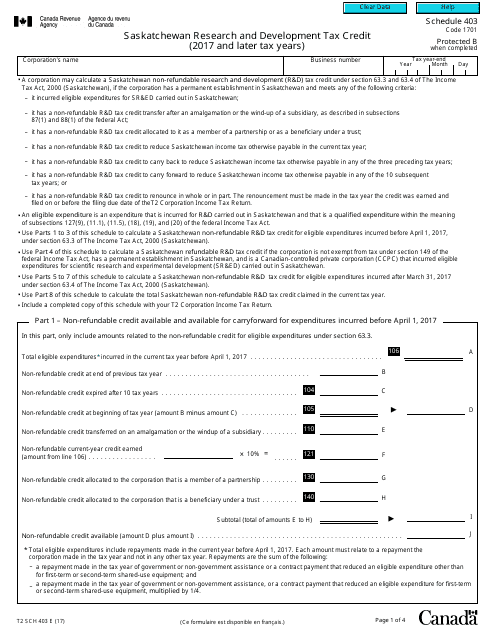

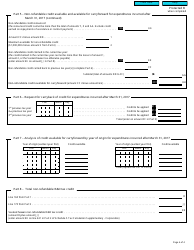

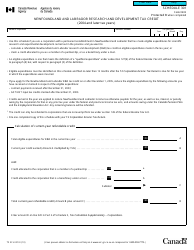

Form T2 Schedule 403 Saskatchewan Research and Development Tax Credit (2017 and Later Tax Years) - Canada

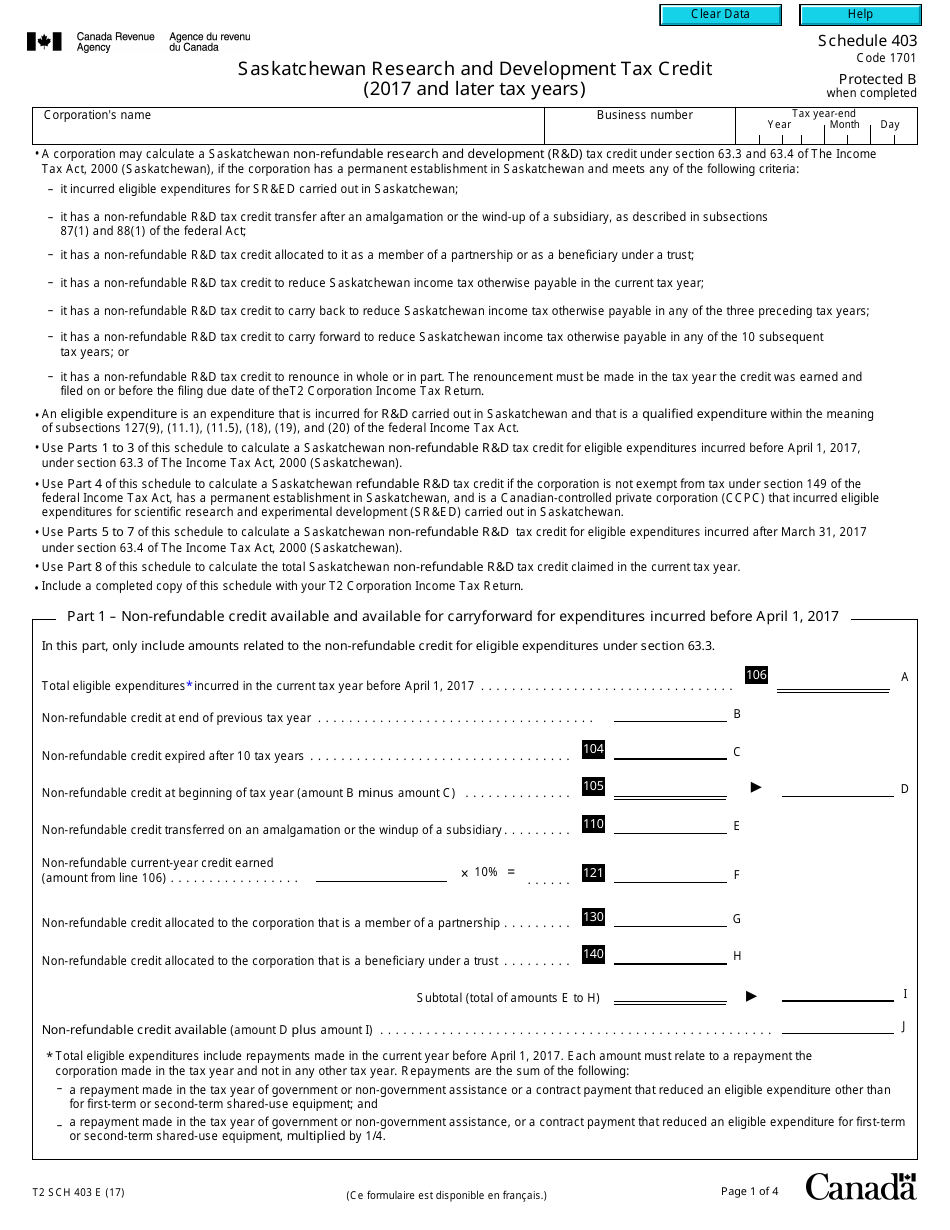

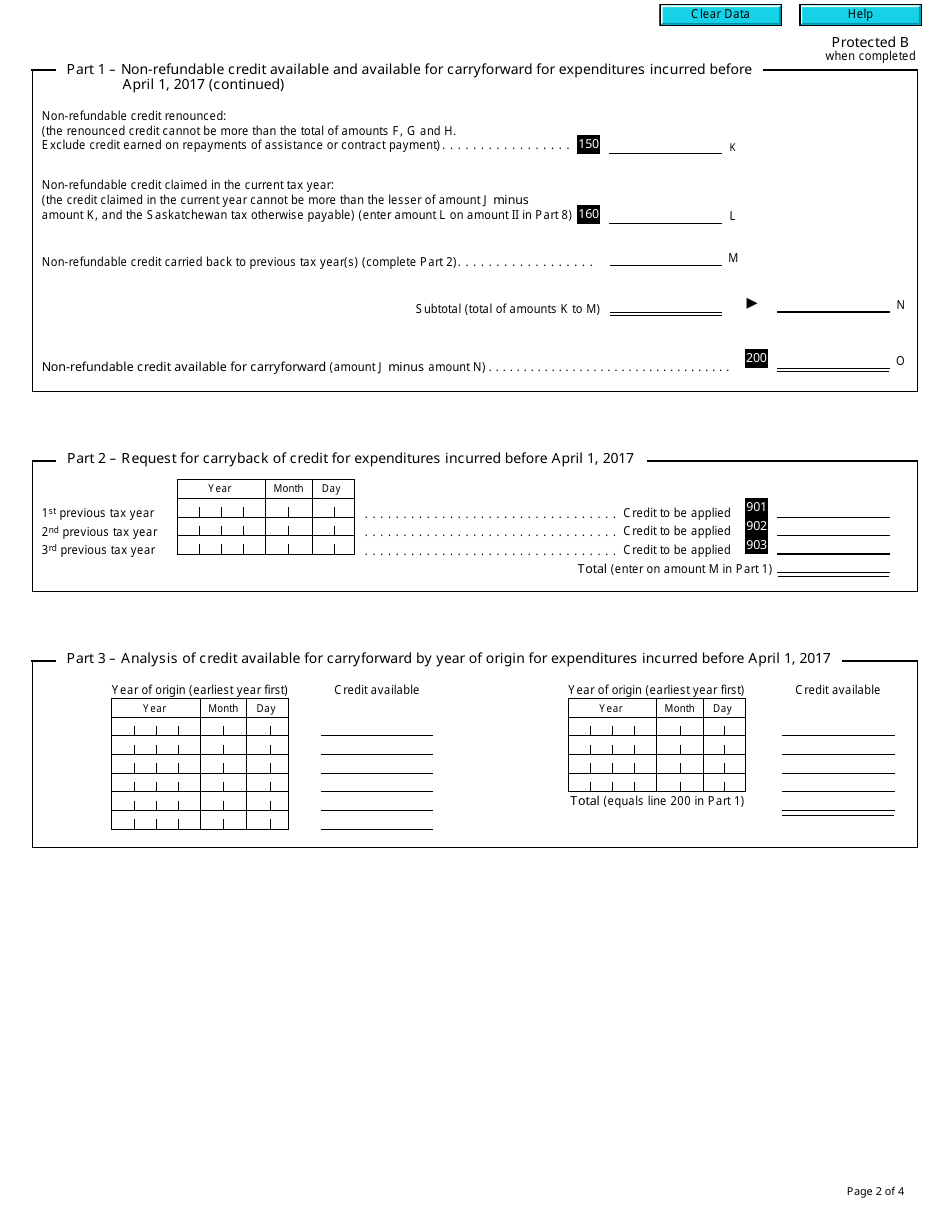

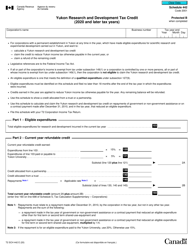

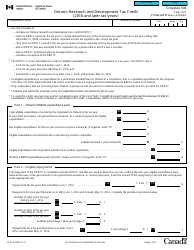

Form T2 Schedule 403 is used in Canada for claiming the Saskatchewan Research and Development Tax Credit for the tax years 2017 and later. This credit is available to corporations that incur eligible research and development expenses in Saskatchewan.

The Form T2 Schedule 403 is filed by businesses in Canada who want to claim the Saskatchewan Research and Development Tax Credit for the tax years 2017 and later.

FAQ

Q: What is Form T2 Schedule 403?

A: Form T2 Schedule 403 is the Saskatchewan Research and Development Tax Credit form for businesses.

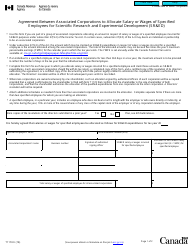

Q: Who can claim the Saskatchewan Research and Development Tax Credit?

A: Businesses in Saskatchewan engaged in qualifying research and development activities can claim this tax credit.

Q: What is the purpose of the Saskatchewan Research and Development Tax Credit?

A: The purpose of this tax credit is to encourage businesses in Saskatchewan to engage in research and development activities.

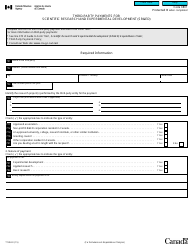

Q: What are qualifying research and development activities?

A: Qualifying research and development activities include scientific research, experimental development, and certain other activities as defined by the tax laws.

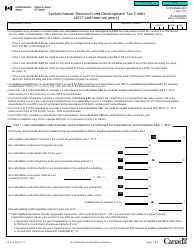

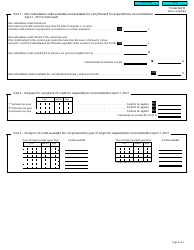

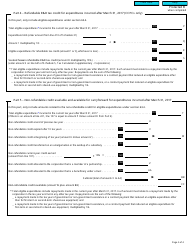

Q: How is the Saskatchewan Research and Development Tax Credit calculated?

A: The tax credit is calculated as a percentage of eligible expenditures incurred for qualified research and development activities.

Q: Can small businesses claim this tax credit?

A: Yes, small businesses can claim this tax credit if they meet the eligibility criteria and have incurred eligible expenditures for research and development activities.

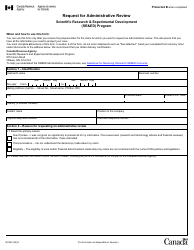

Q: Are there any restrictions or limitations on claiming this tax credit?

A: Yes, there are certain restrictions and limitations on claiming this tax credit, such as a maximum amount of tax credit that can be claimed in a given tax year.

Q: How can businesses claim the Saskatchewan Research and Development Tax Credit?

A: Businesses can claim this tax credit by completing Form T2 Schedule 403 and including it with their corporate tax return.

Q: Are there any deadlines for claiming this tax credit?

A: Yes, businesses must claim the Saskatchewan Research and Development Tax Credit within the prescribed time limits set by the tax authorities.