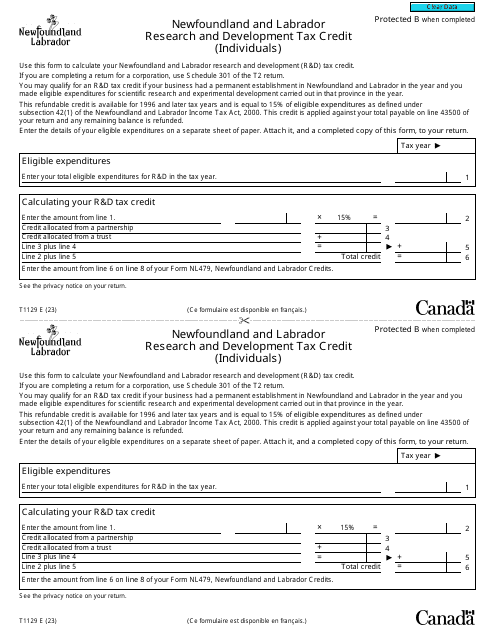

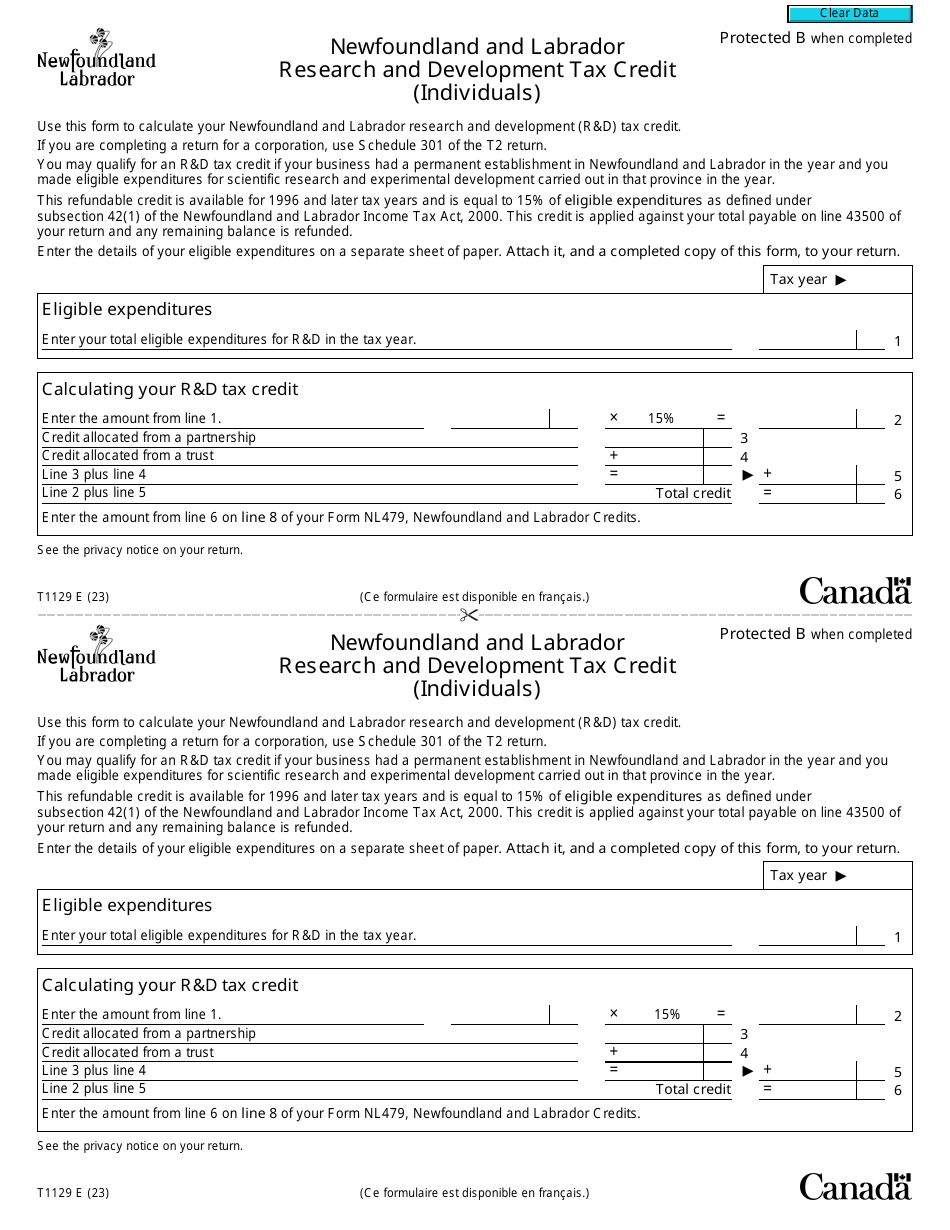

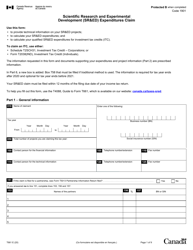

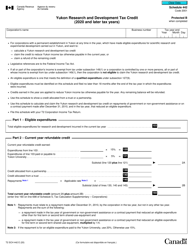

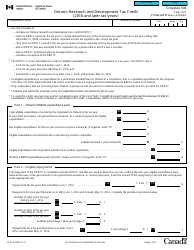

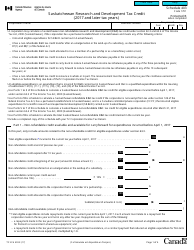

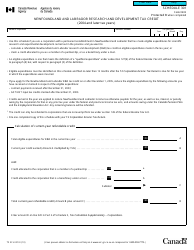

Form T1129 Newfoundland and Labrador Research and Development Tax Credit (Individuals) - Canada

Form T1129 is used to claim the Newfoundland and Labrador Research and Development (R&D) Tax Credit for individuals in Canada. This tax credit is designed to encourage and support research and development activities conducted in Newfoundland and Labrador. It allows eligible individuals to reduce their provincial tax payable by claiming a credit for qualifying R&D expenditures.

The Form T1129 Newfoundland and Labrador Research and Development Tax Credit (Individuals) is filed by individuals in Canada who are claiming the research and development tax credit in the province of Newfoundland and Labrador.

Form T1129 Newfoundland and Labrador Research and Development Tax Credit (Individuals) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1129?

A: Form T1129 is the Newfoundland and Labrador Research and Development Tax Credit (Individuals) form in Canada.

Q: Who is eligible to claim the Newfoundland and Labrador Research and Development Tax Credit?

A: Individuals who have incurred eligible research and development expenditures in Newfoundland and Labrador can claim this tax credit.

Q: What types of expenses can be claimed through this tax credit?

A: Eligible expenses include salaries and wages, materials and supplies, and payments to contractors for research and development activities.

Q: How much is the tax credit?

A: The tax credit is equal to 15% of eligible expenses, up to a maximum credit of $50,000 per year.

Q: How do I claim the Newfoundland and Labrador Research and Development Tax Credit?

A: You need to complete Form T1129 and include it with your personal income tax return.

Q: Is there a deadline for claiming this tax credit?

A: Yes, the deadline for claiming this tax credit is the same as the deadline for filing your personal income tax return, which is usually April 30th.