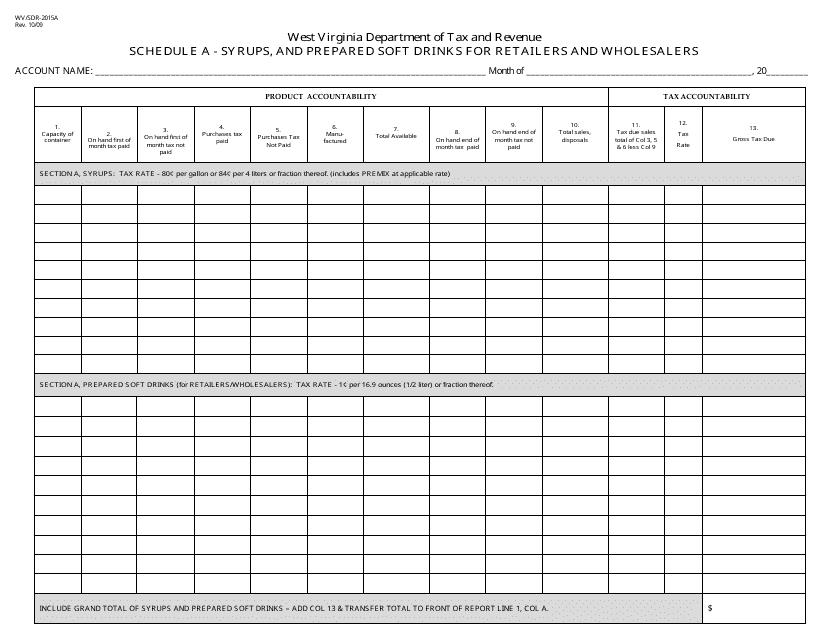

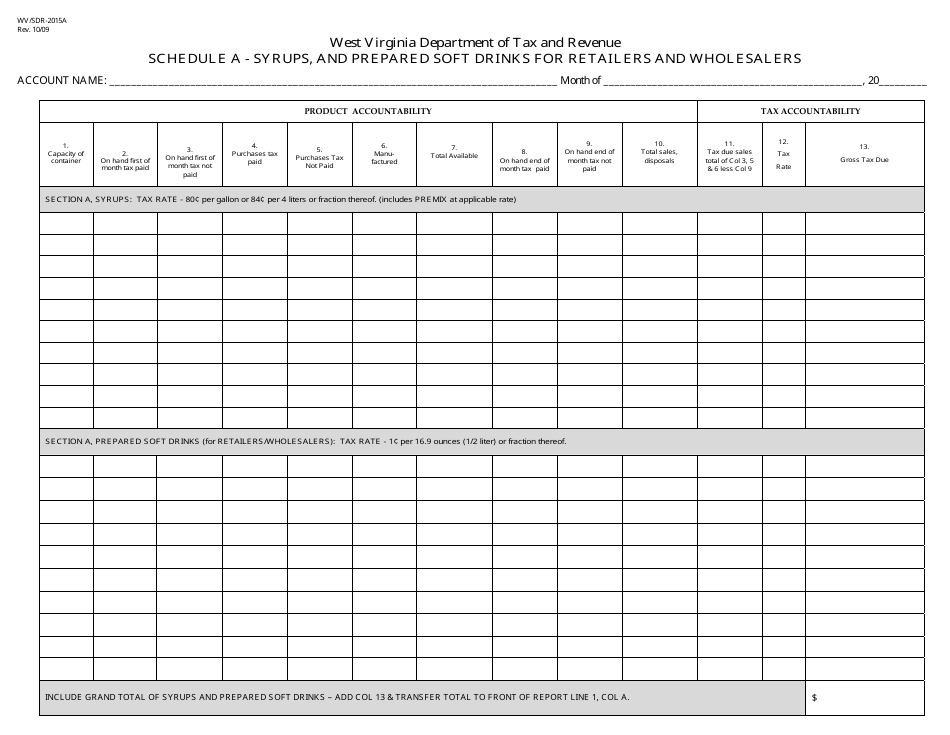

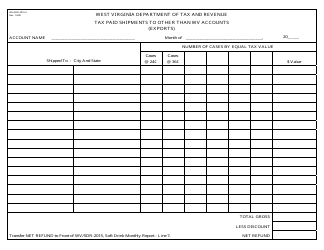

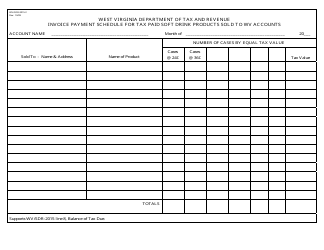

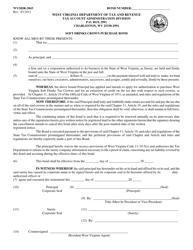

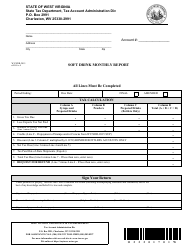

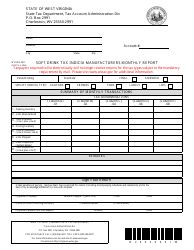

Form WV / SDR-2015A Schedule A Syrups, and Prepared Soft Drinks for Retailers and Wholesalers - West Virginia

What Is Form WV/SDR-2015A Schedule A?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WV/SDR-2015A Schedule A?

A: The WV/SDR-2015A Schedule A is a form specifically for Syrups and Prepared Soft Drinks for Retailers and Wholesalers in West Virginia.

Q: Who is required to fill out the WV/SDR-2015A Schedule A?

A: Retailers and wholesalers of syrups and prepared soft drinks in West Virginia are required to fill out the WV/SDR-2015A Schedule A.

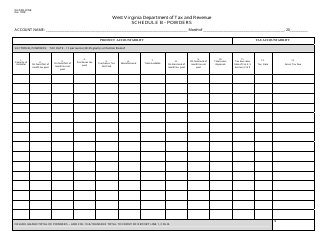

Q: What information is needed on the WV/SDR-2015A Schedule A?

A: The WV/SDR-2015A Schedule A requires information such as product description, brand name, package size, and taxable sales price.

Q: When is the deadline to submit the WV/SDR-2015A Schedule A?

A: The deadline to submit the WV/SDR-2015A Schedule A is determined by the West Virginia State Tax Department and may vary each year.

Q: Are there any penalties for not filing the WV/SDR-2015A Schedule A?

A: Yes, failing to file the WV/SDR-2015A Schedule A or filing it late may result in penalties and/or interest.

Q: Do I need to keep a copy of the WV/SDR-2015A Schedule A after filing?

A: Yes, it is recommended to keep a copy of the WV/SDR-2015A Schedule A for your records.

Form Details:

- Released on October 1, 2009;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/SDR-2015A Schedule A by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.