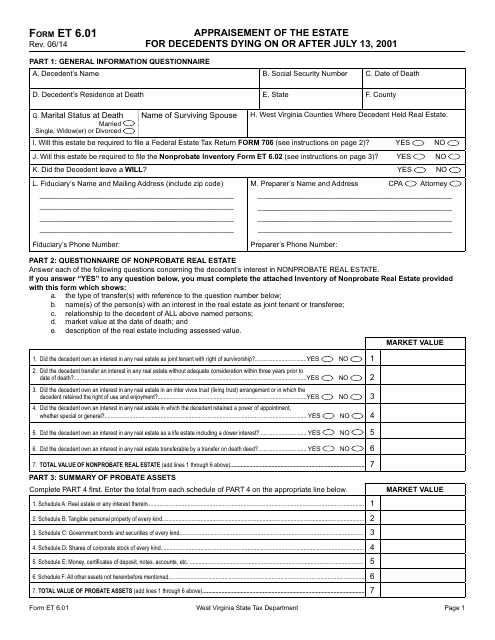

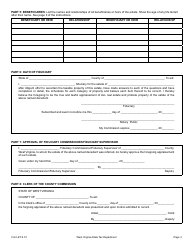

Form ET6.01 Appraisement of the Estate for Decedents Dying on or After July 13, 2001 - West Virginia

What Is Form ET6.01?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

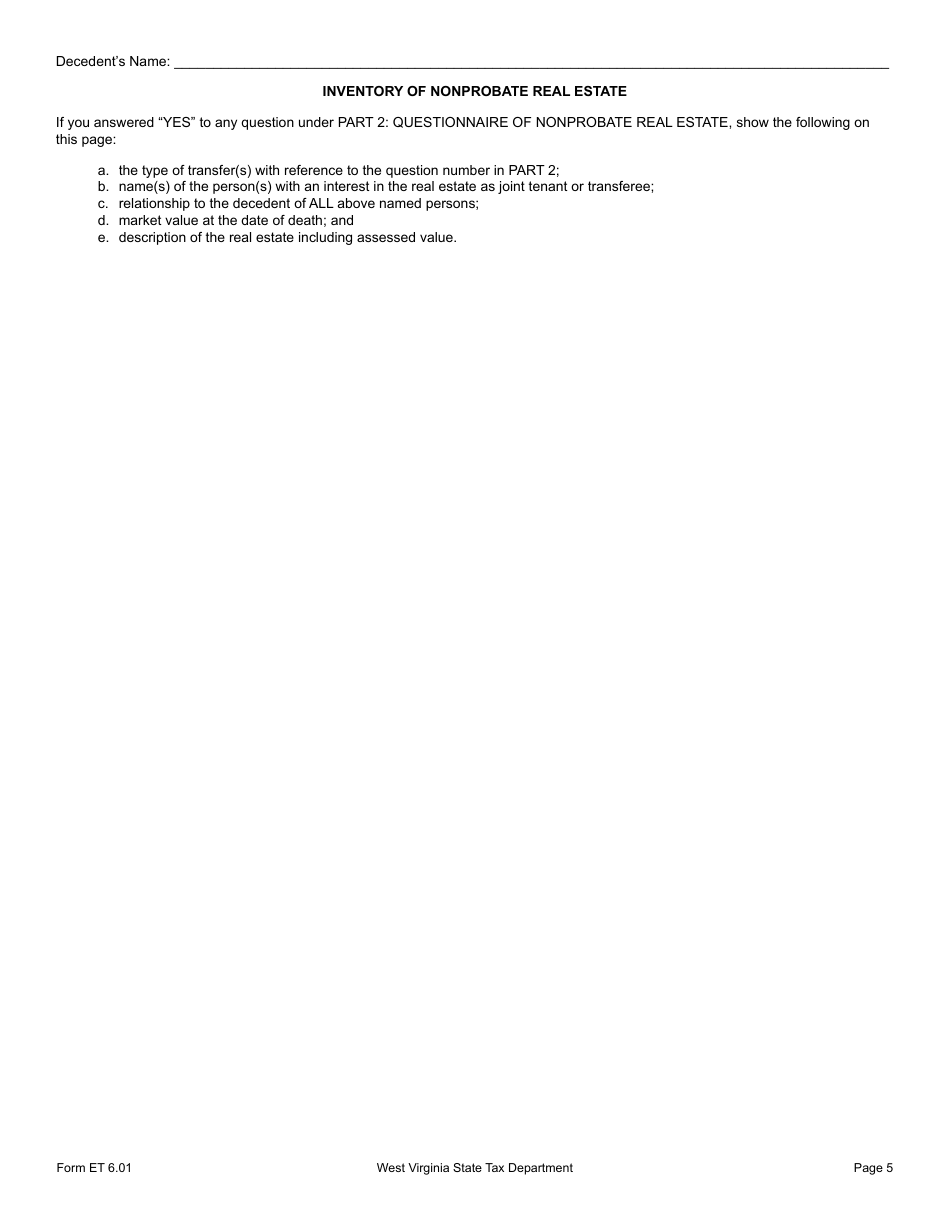

Q: What is Form ET6.01 used for?

A: Form ET6.01 is used for appraisement of the estate for decedents who died on or after July 13, 2001 in West Virginia.

Q: Who needs to fill out Form ET6.01?

A: The executor or personal representative of the decedent's estate is responsible for filling out Form ET6.01.

Q: When should Form ET6.01 be filed?

A: Form ET6.01 should be filed within nine months from the date of the decedent's death, or within 18 months if the estate is subject to federal estate tax.

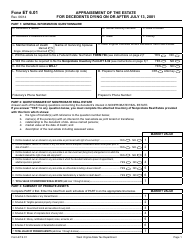

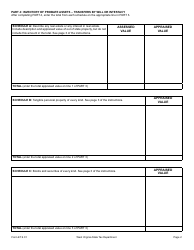

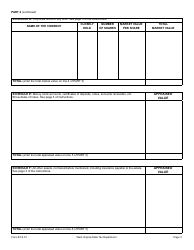

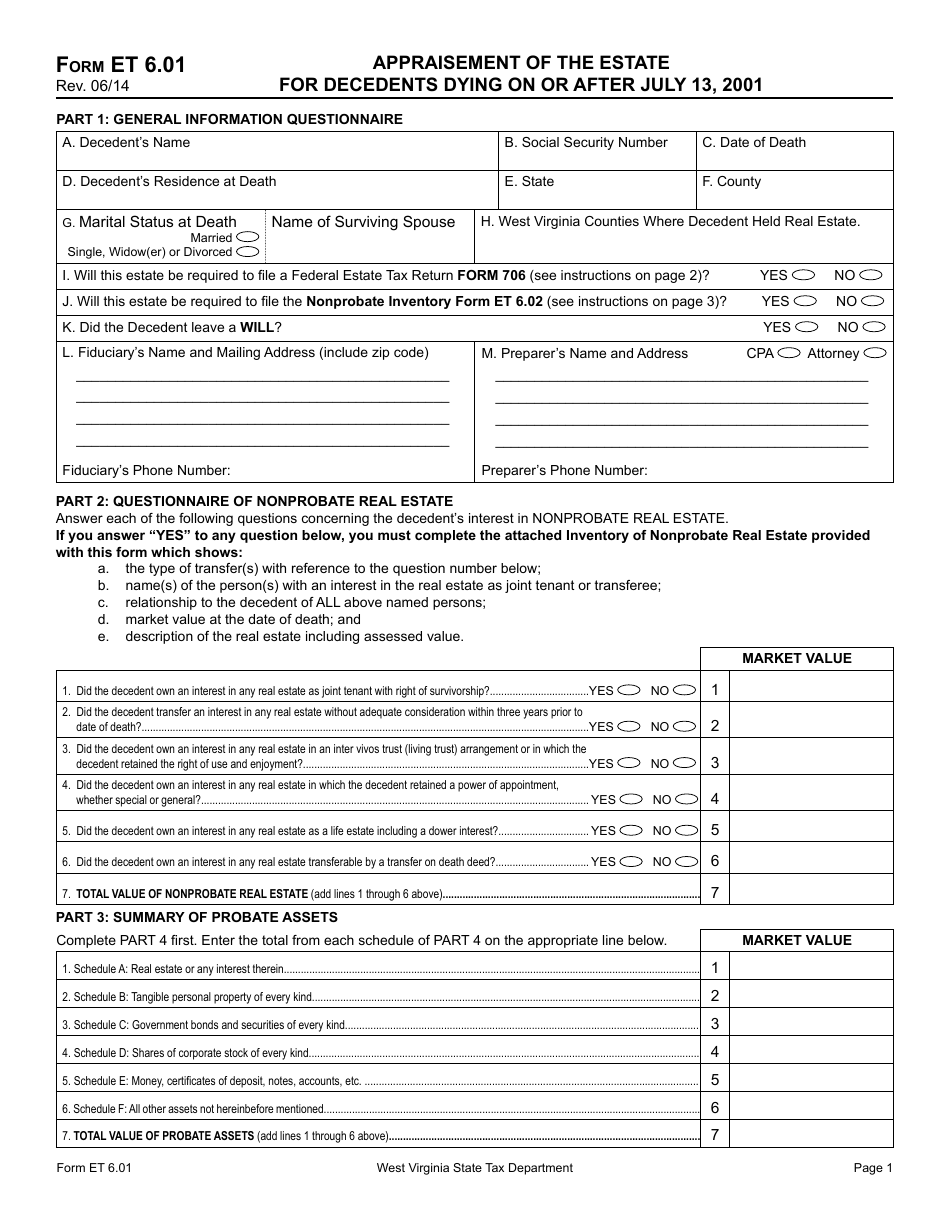

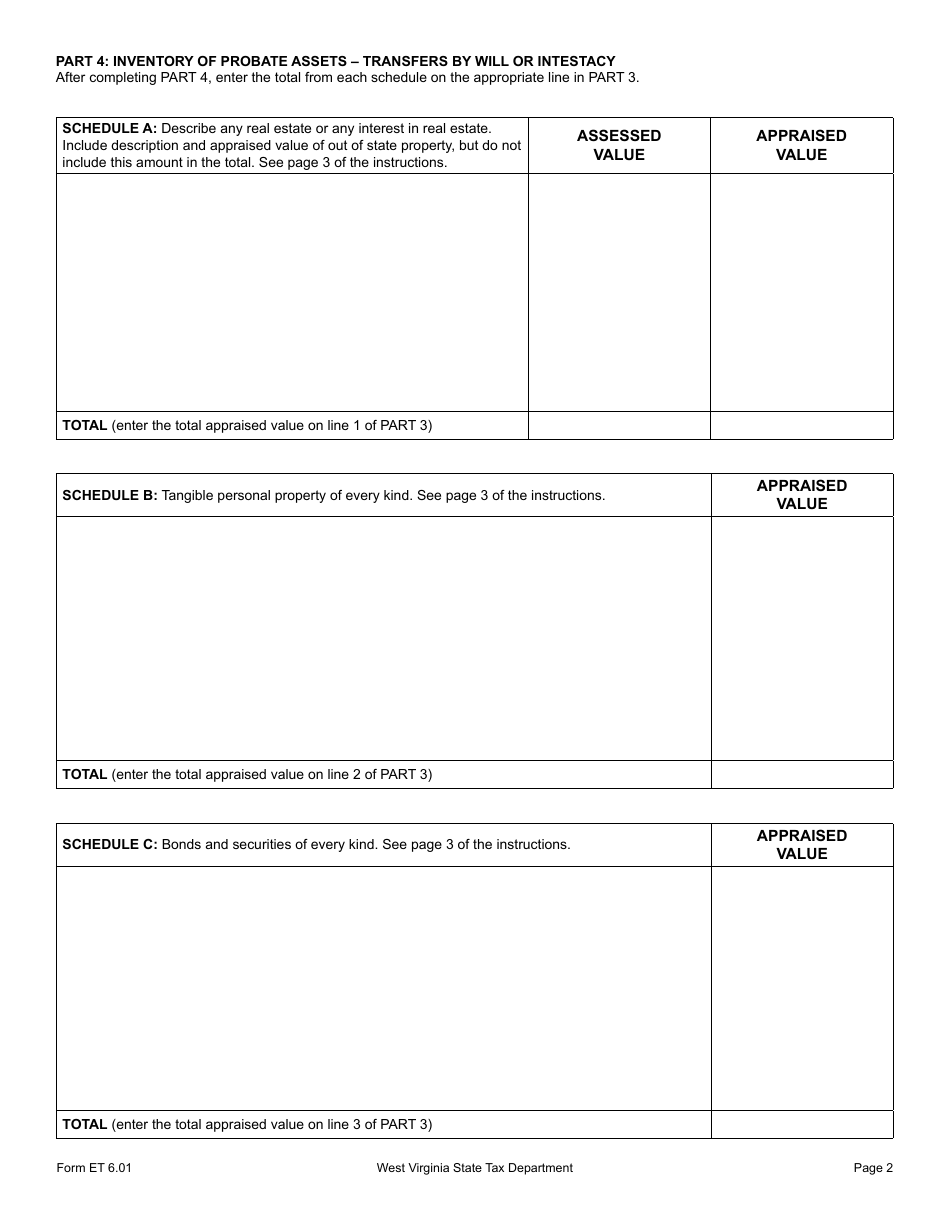

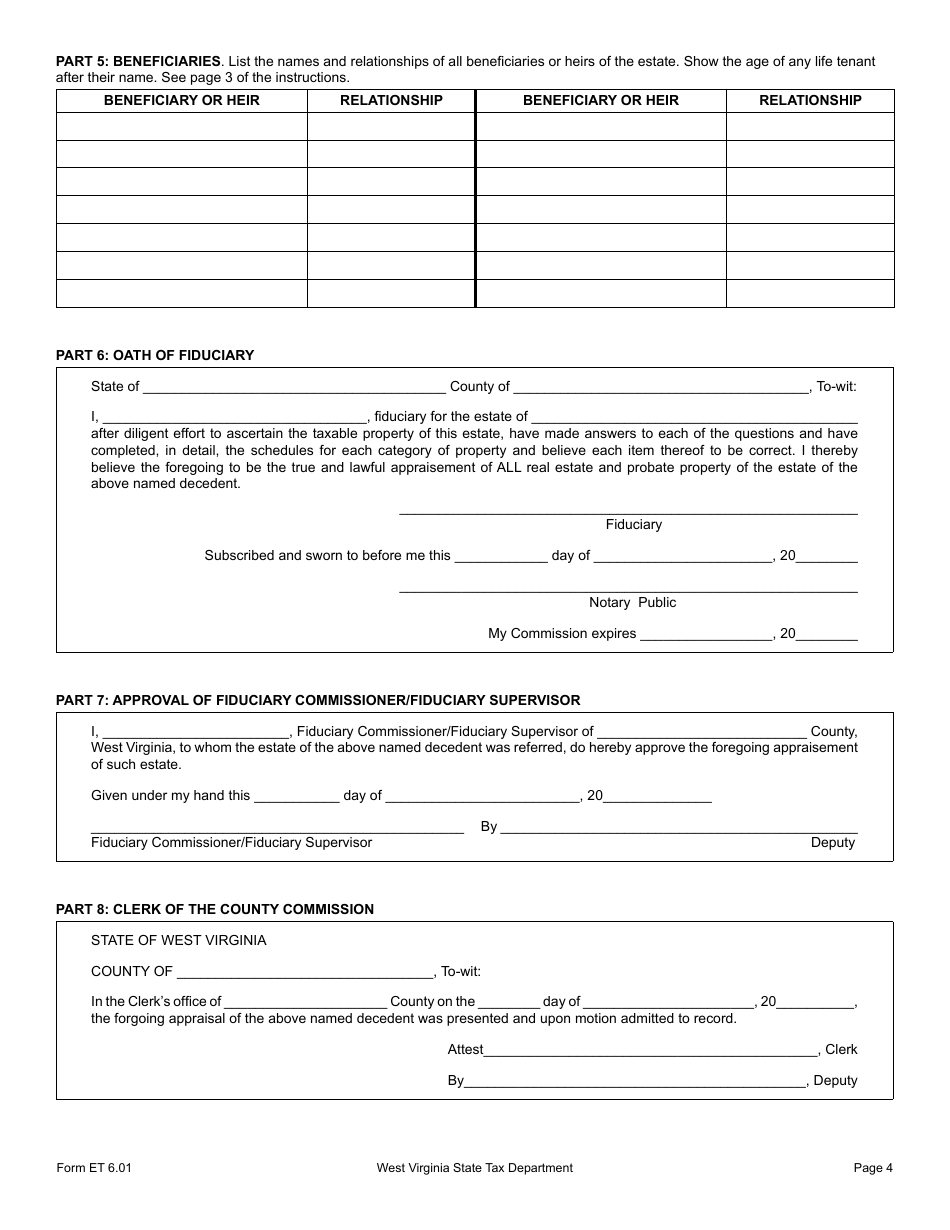

Q: What information is required on Form ET6.01?

A: Form ET6.01 requires information about the decedent's assets, liabilities, and beneficiaries, as well as any applicable deductions or exemptions.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ET6.01 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.