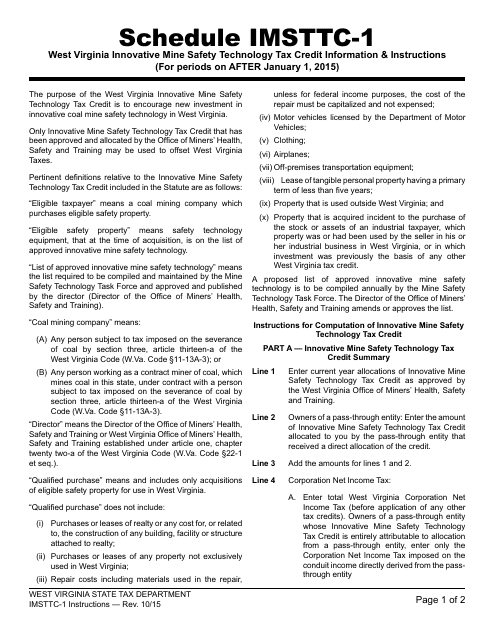

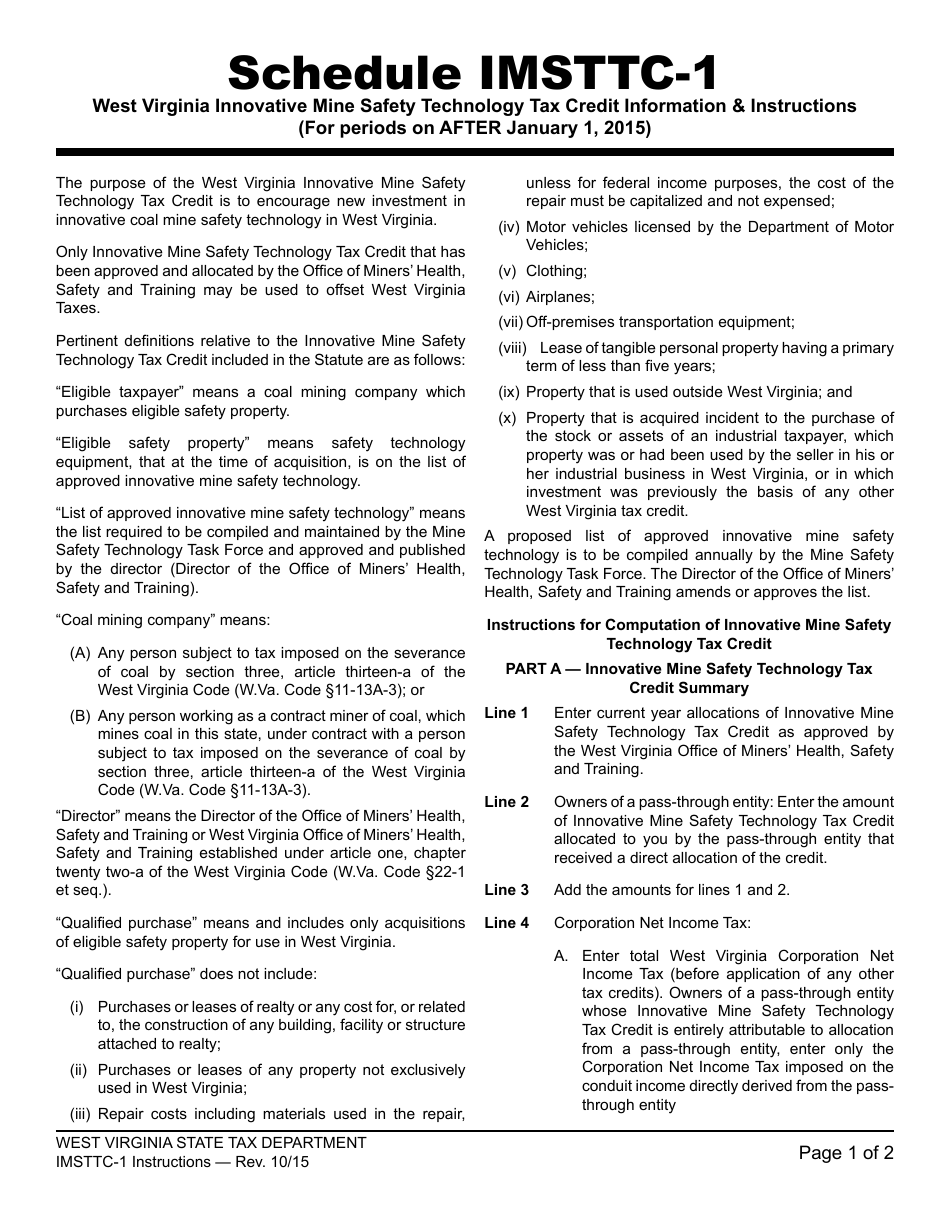

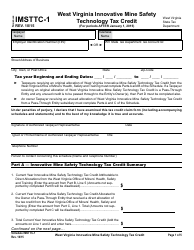

Instructions for Schedule IMSTTC-1 West Virginia Innovative Mine Safety Technology Tax Credit - West Virginia

This document contains official instructions for Schedule IMSTTC-1 , West Virginia Innovative Mine Safety Technology Tax Credit - a form released and collected by the West Virginia State Tax Department.

FAQ

Q: What is Schedule IMSTTC-1?

A: Schedule IMSTTC-1 is a form used for claiming the West Virginia Innovative Mine Safety Technology Tax Credit.

Q: What is the West Virginia Innovative Mine Safety Technology Tax Credit?

A: The West Virginia Innovative Mine Safety Technology Tax Credit is a tax credit available to businesses that invest in innovative mine safety technologies.

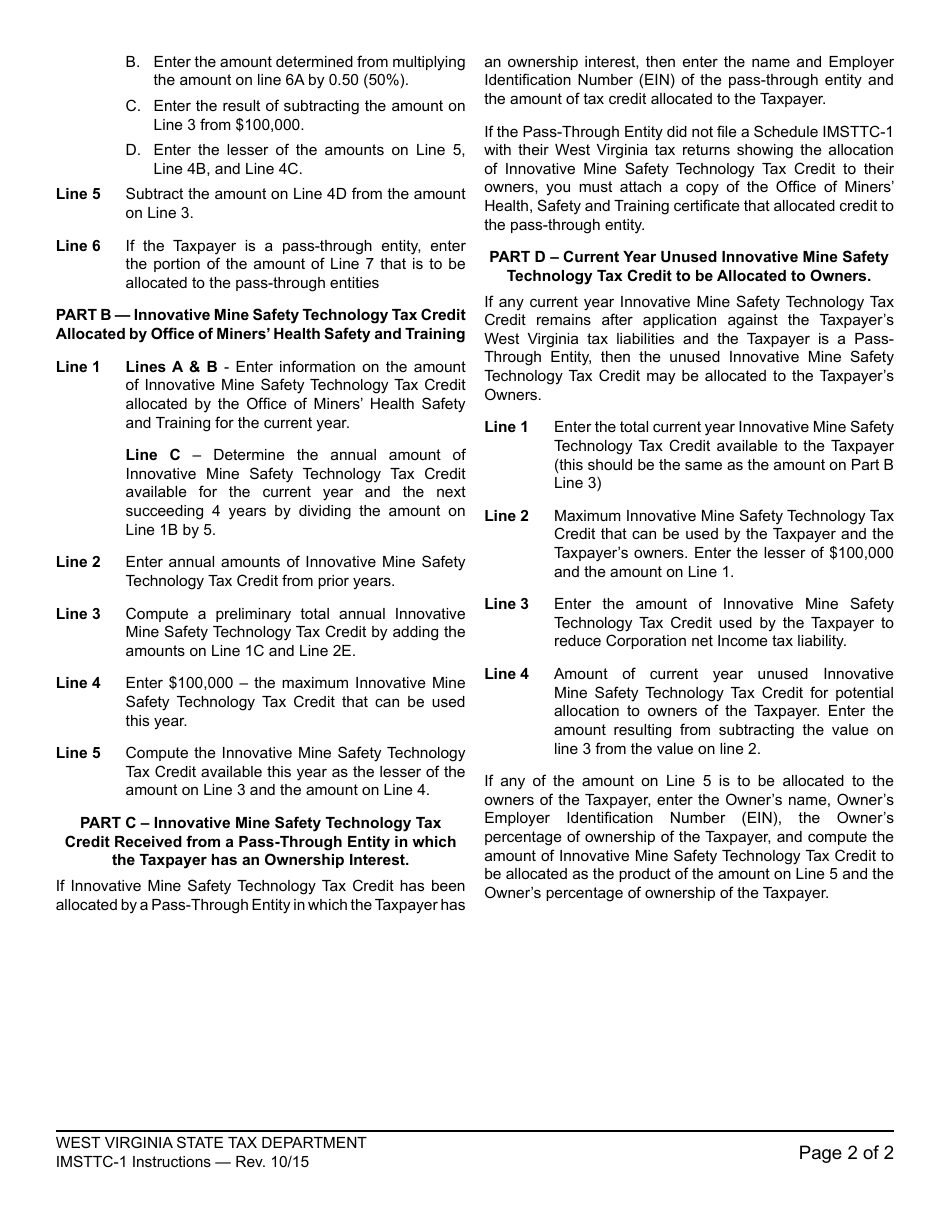

Q: How can I claim the tax credit?

A: You need to fill out and submit the Schedule IMSTTC-1 form along with your tax return to claim the West Virginia Innovative Mine Safety Technology Tax Credit.

Q: What types of mine safety technologies qualify for the tax credit?

A: Innovative mine safety technologies such as equipment, devices, systems, or methods that improve mine safety and health and reduce the risk of mine accidents may qualify for the tax credit.

Q: Are there any limitations to the tax credit?

A: Yes, the credit is limited to 50% of the eligible investment in qualified mine safety technologies, and the total amount of credits that can be claimed by all taxpayers is capped at $2 million per year.

Q: Who is eligible to claim the tax credit?

A: Businesses engaged in coal mining operations in West Virginia are eligible to claim the West Virginia Innovative Mine Safety Technology Tax Credit.

Q: Is there a deadline for claiming the tax credit?

A: Yes, the deadline for claiming the West Virginia Innovative Mine Safety Technology Tax Credit is the same as the deadline for filing your annual tax return.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.