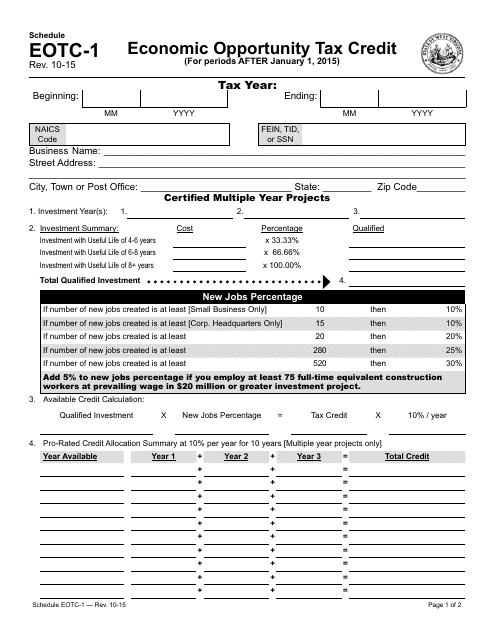

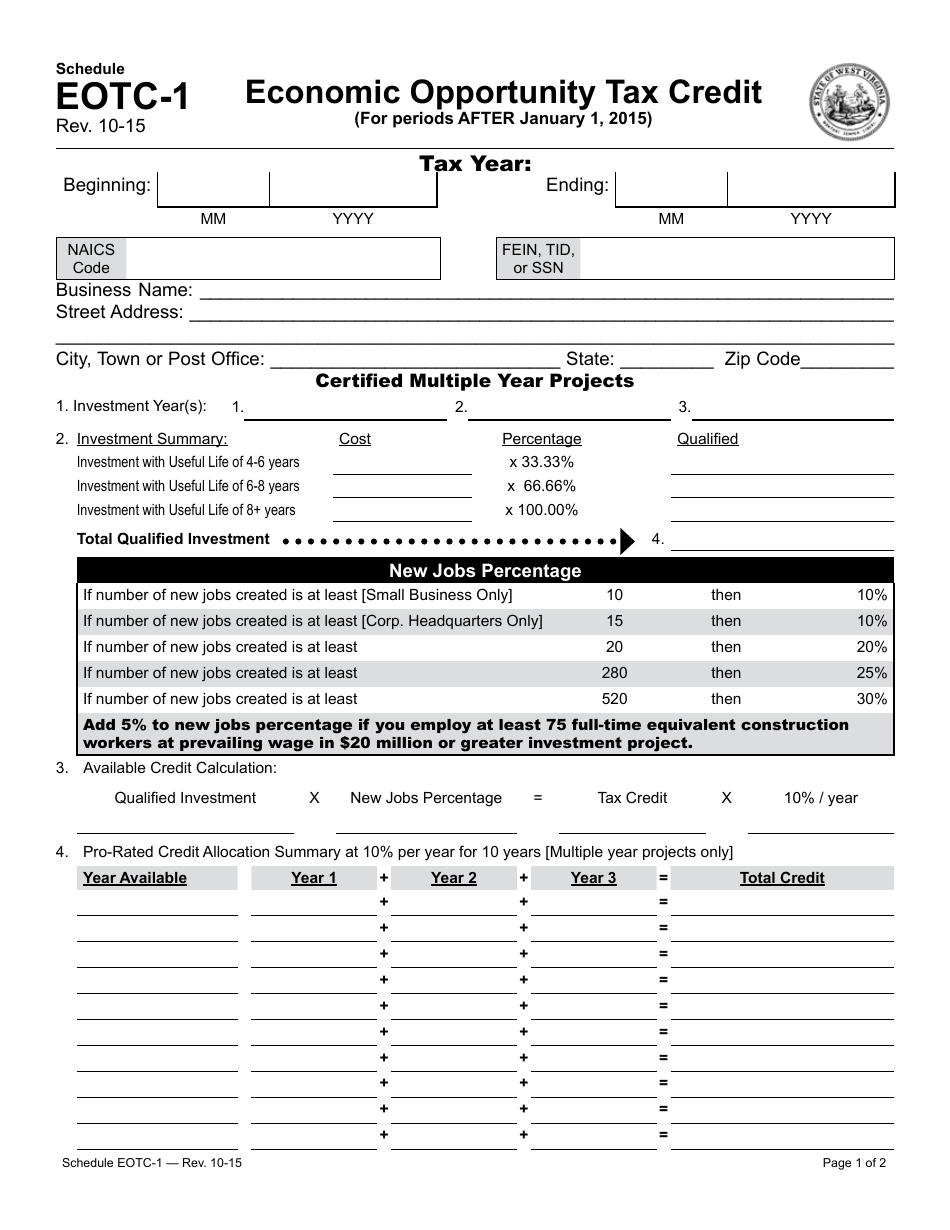

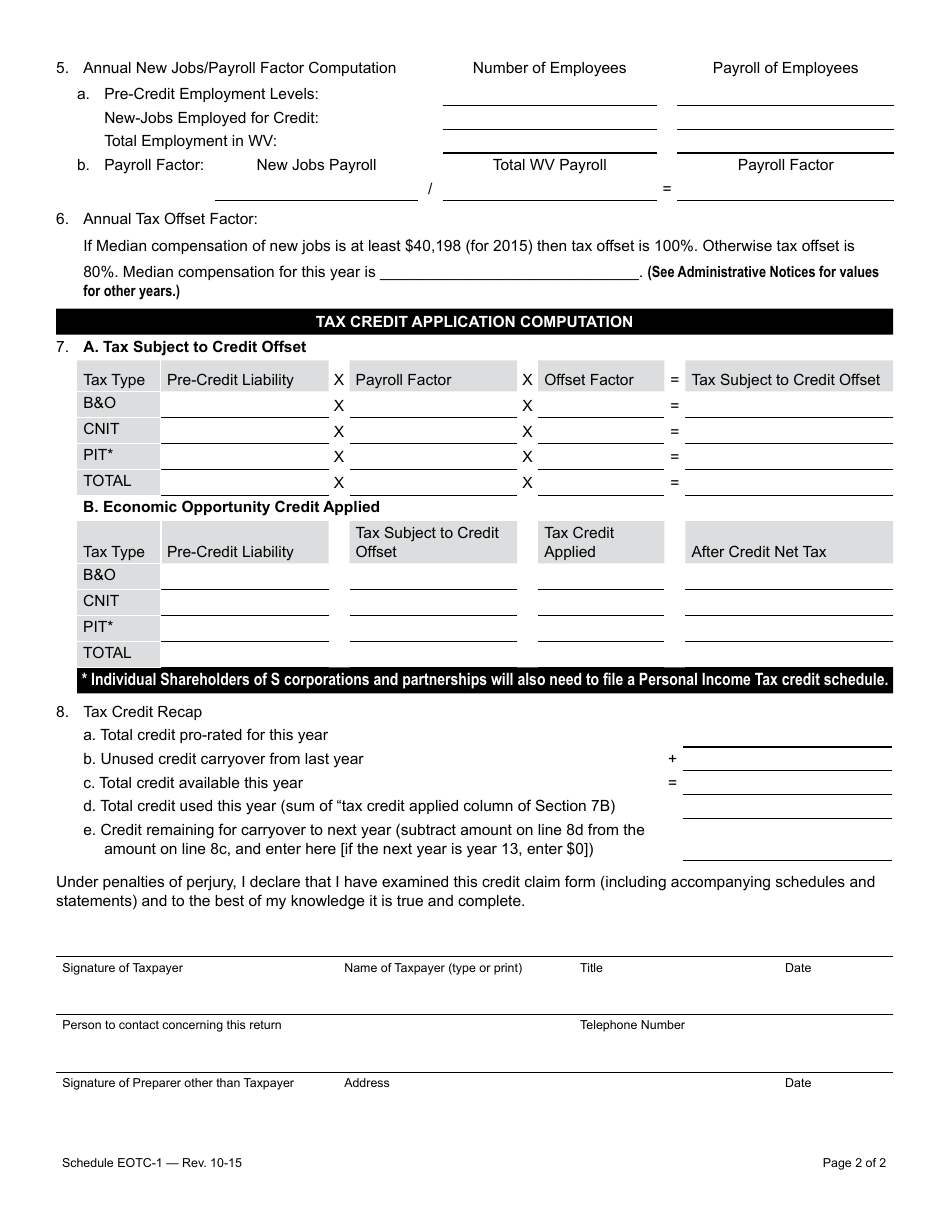

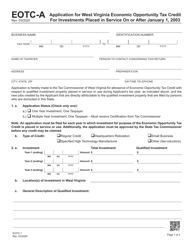

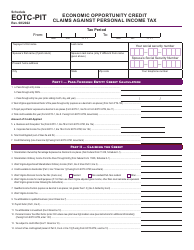

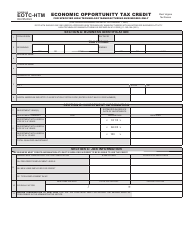

Schedule EOTC-1 Economic Opportunity Tax Credit - West Virginia

What Is Schedule EOTC-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule EOTC-1?

A: Schedule EOTC-1 is a form used to claim the Economic Opportunity Tax Credit (EOTC) in West Virginia.

Q: What is the Economic Opportunity Tax Credit?

A: The Economic Opportunity Tax Credit is a tax credit program in West Virginia that provides incentives for businesses to invest and create jobs in economically distressed areas.

Q: Who is eligible for the EOTC?

A: Businesses that invest in qualified projects located in certain designated geographical areas of West Virginia may be eligible for the EOTC.

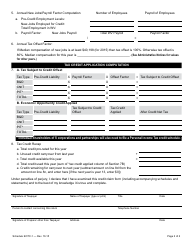

Q: How much is the tax credit?

A: The amount of the tax credit varies based on the investment and the number of new jobs created, but it can be up to 80% of the eligible project costs.

Q: Are there any job creation requirements?

A: Yes, businesses must create a certain number of new full-time jobs to be eligible for the tax credit. The specific requirements vary based on the project and can be found in the EOTC program guidelines.

Q: How do I claim the EOTC?

A: To claim the EOTC, businesses need to complete Schedule EOTC-1 and include it with their West Virginia tax return.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule EOTC-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.