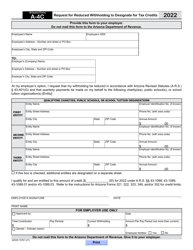

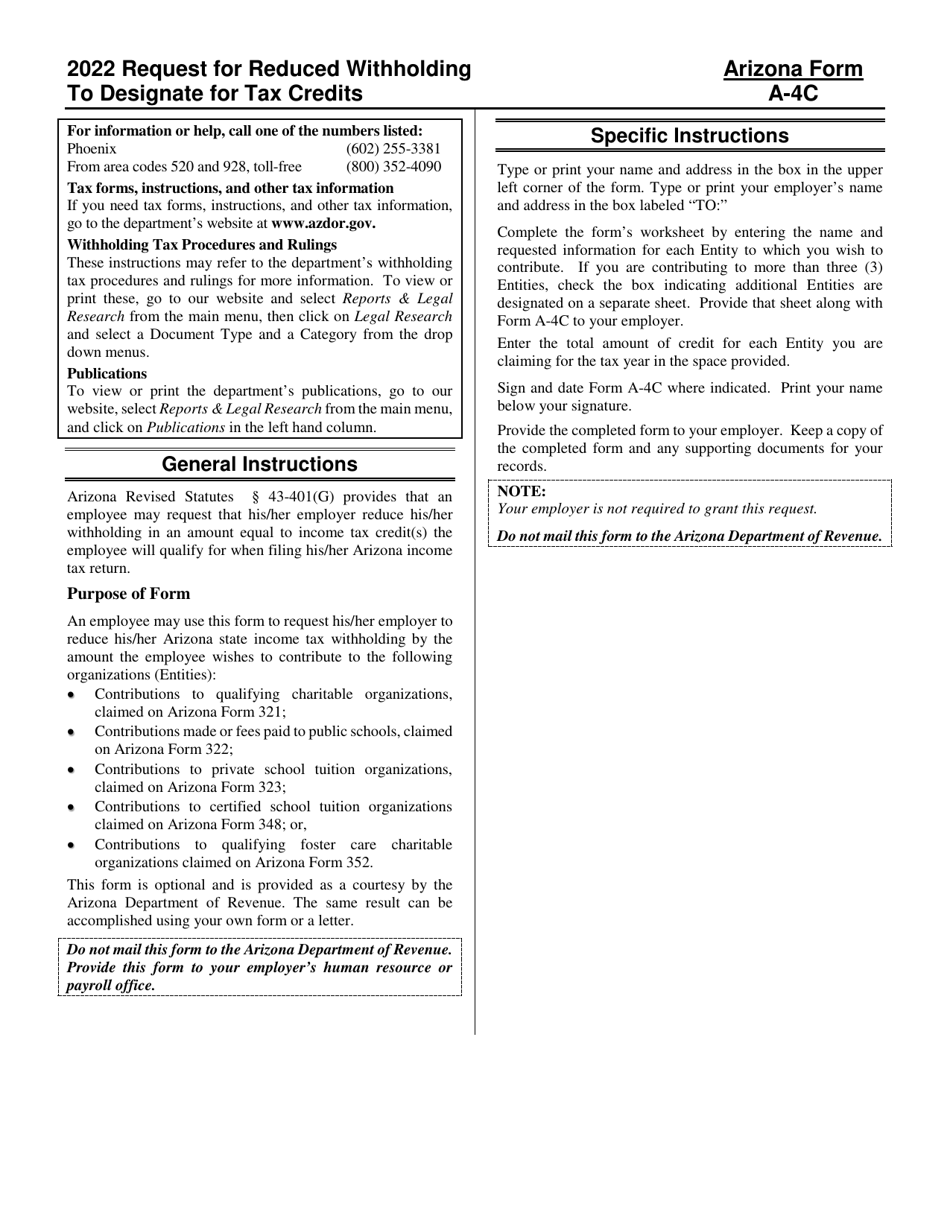

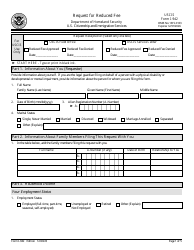

Instructions for Arizona Form A-4C, ADOR10761 Request for Reduced Withholding to Designate for Tax Credits - Arizona

This document contains official instructions for Arizona Form A-4C , and Form ADOR10761 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form A-4C (ADOR10761) is available for download through this link.

FAQ

Q: What is Arizona Form A-4C?

A: Arizona Form A-4C is a form used to request reduced withholding for tax credits in Arizona.

Q: What is the purpose of Arizona Form A-4C?

A: The purpose of Arizona Form A-4C is to allow taxpayers to designate a portion of their withholding to tax credits.

Q: Who should complete Arizona Form A-4C?

A: Arizona Form A-4C should be completed by taxpayers who want to designate a portion of their withholding for tax credits.

Q: Are there any eligibility requirements for using Arizona Form A-4C?

A: Yes, taxpayers must meet certain eligibility requirements to use Arizona Form A-4C. These requirements are outlined in the instructions for the form.

Q: What tax credits can be designated using Arizona Form A-4C?

A: Arizona Form A-4C can be used to designate withholding for tax credits such as the Charitable Tax Credit, the Public School Tax Credit, and the Military Family Relief Fund Tax Credit, among others.

Q: When should I submit Arizona Form A-4C?

A: Arizona Form A-4C should be submitted to your employer as soon as possible. It is recommended to submit the form at the beginning of the year or whenever you want to make changes to your withholding.

Q: Can I designate my entire withholding for tax credits using Arizona Form A-4C?

A: No, you cannot designate your entire withholding for tax credits using Arizona Form A-4C. There are limits on the amount that can be designated for each tax credit.

Q: Is Arizona Form A-4C only for Arizona residents?

A: Yes, Arizona Form A-4C is specifically for Arizona residents and taxpayers.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.