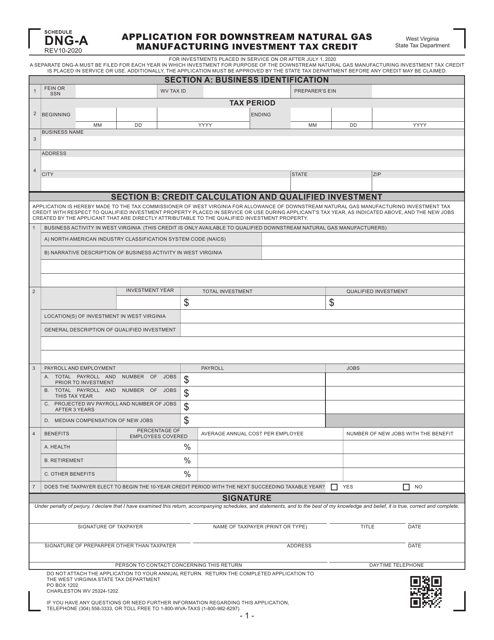

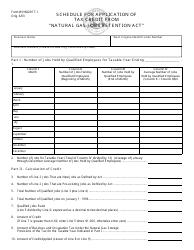

Schedule DNG-A Application for Downstream Natural Gas Manufacturing Investment Tax Credit - West Virginia

What Is Schedule DNG-A?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Schedule DNG-A application?

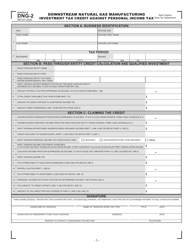

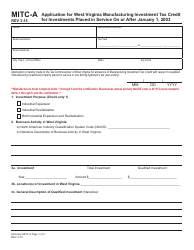

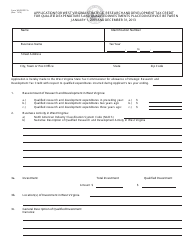

A: The Schedule DNG-A application is an application for claiming the Downstream Natural Gas Manufacturing Investment Tax Credit in West Virginia.

Q: What is the Downstream Natural Gas Manufacturing Investment Tax Credit?

A: The Downstream Natural Gas Manufacturing Investment Tax Credit is a tax credit available to businesses in West Virginia that make qualifying investments in downstream natural gas manufacturing.

Q: Who is eligible to apply for the tax credit?

A: Businesses that make qualifying investments in downstream natural gas manufacturing in West Virginia are eligible to apply for the tax credit.

Q: What is the purpose of the tax credit?

A: The tax credit is intended to promote investment in downstream natural gas manufacturing in West Virginia, creating jobs and boosting economic growth.

Q: How do I apply for the tax credit?

A: To apply for the tax credit, you need to complete the Schedule DNG-A application form and submit it to the West Virginia State Tax Department.

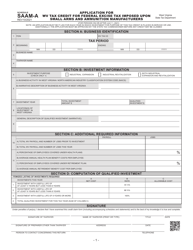

Q: What information is required in the application form?

A: The application form requires information about your business, the investment you have made in downstream natural gas manufacturing, and supporting documentation.

Q: When is the application deadline?

A: The application deadline for the Downstream Natural Gas Manufacturing Investment Tax Credit is typically April 15th of the year following the tax year in which the investment was made.

Q: Is there a limit to the amount of tax credit I can claim?

A: Yes, the amount of tax credit you can claim is subject to a cap set by the West Virginia Legislature.

Q: Can I carry forward any unused tax credit?

A: Yes, unused tax credits can be carried forward for up to five years.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule DNG-A by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.