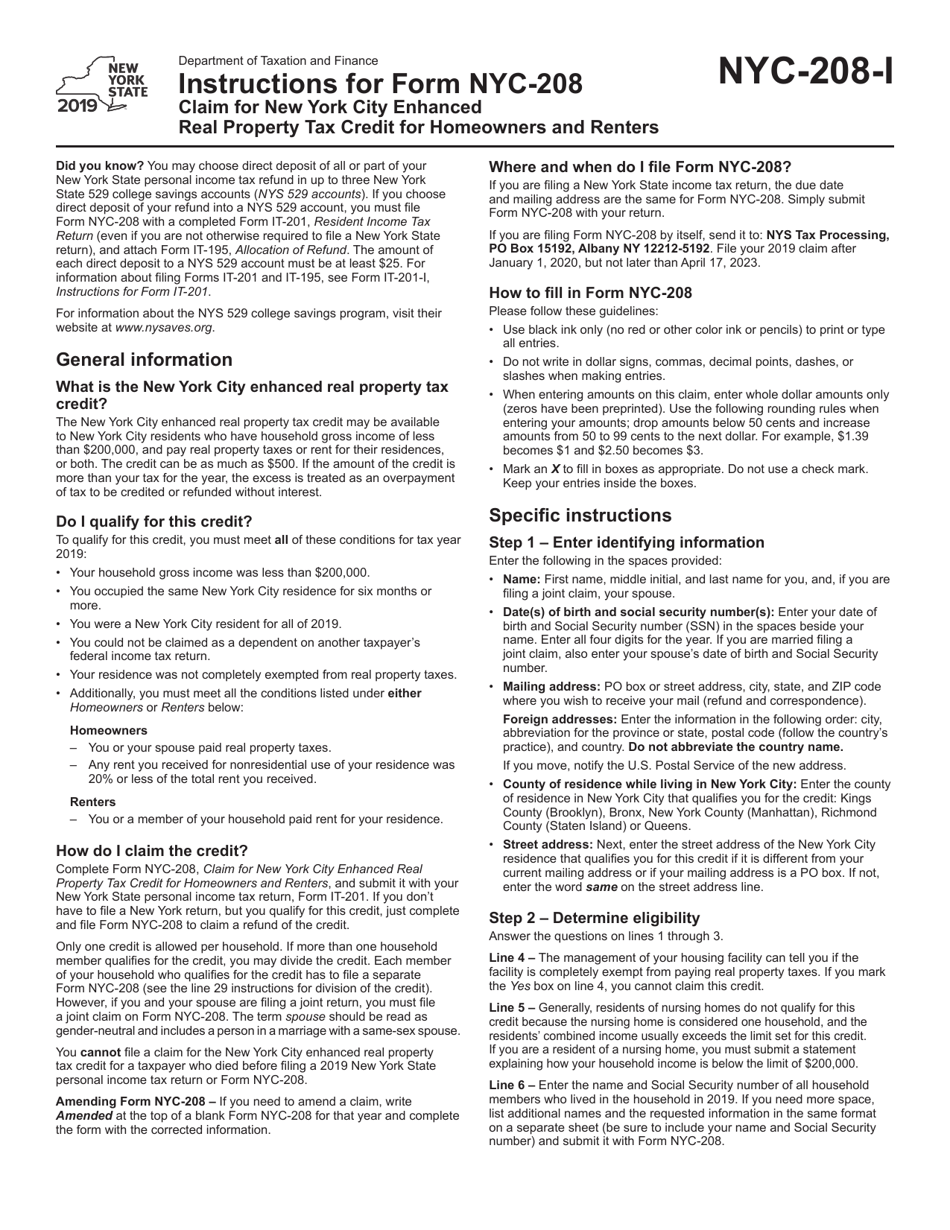

Instructions for Form NYC-208 Claim for New York City Enhanced Real Property Tax Credit for Homeowners and Renters - New York

This document contains official instructions for Form NYC-208 , Claim for New York City Enhanced Real Property Tax Credit for Homeowners and Renters - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

Q: What is Form NYC-208?

A: Form NYC-208 is a document used to claim the New York City Enhanced Real Property Tax Credit for Homeowners and Renters.

Q: Who can use Form NYC-208?

A: Form NYC-208 can be used by homeowners and renters in New York City who meet certain eligibility criteria.

Q: What is the purpose of the New York City Enhanced Real Property Tax Credit?

A: The purpose of the New York City Enhanced Real Property Tax Credit is to provide financial assistance to eligible homeowners and renters in New York City.

Q: How can I qualify for the New York City Enhanced Real Property Tax Credit?

A: To qualify for the New York City Enhanced Real Property Tax Credit, you must meet certain income and residency requirements set by the New York City Department of Finance.

Q: What documents do I need to submit with Form NYC-208?

A: You may be required to submit supporting documents such as proof of residency, proof of income, and documentation related to your property taxes or rent payments.

Q: When is the deadline to file Form NYC-208?

A: The deadline to file Form NYC-208 varies each year. It is important to check the specific deadline for the tax year you are filing for.

Q: Can I e-file Form NYC-208?

A: No, Form NYC-208 cannot be e-filed. It must be filed by mail or in person.

Q: Is there a fee to file Form NYC-208?

A: No, there is no fee to file Form NYC-208.

Q: Can I claim the New York City Enhanced Real Property Tax Credit if I rent a property?

A: Yes, eligible renters in New York City can claim the New York City Enhanced Real Property Tax Credit.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.