United States Tax Forms and Templates

Related Articles

Documents:

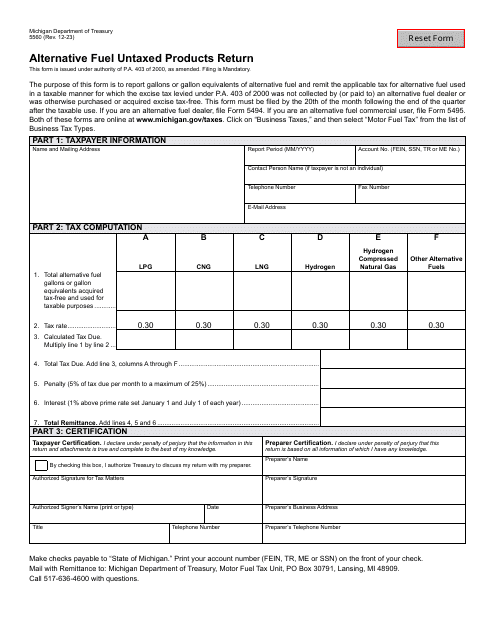

2432

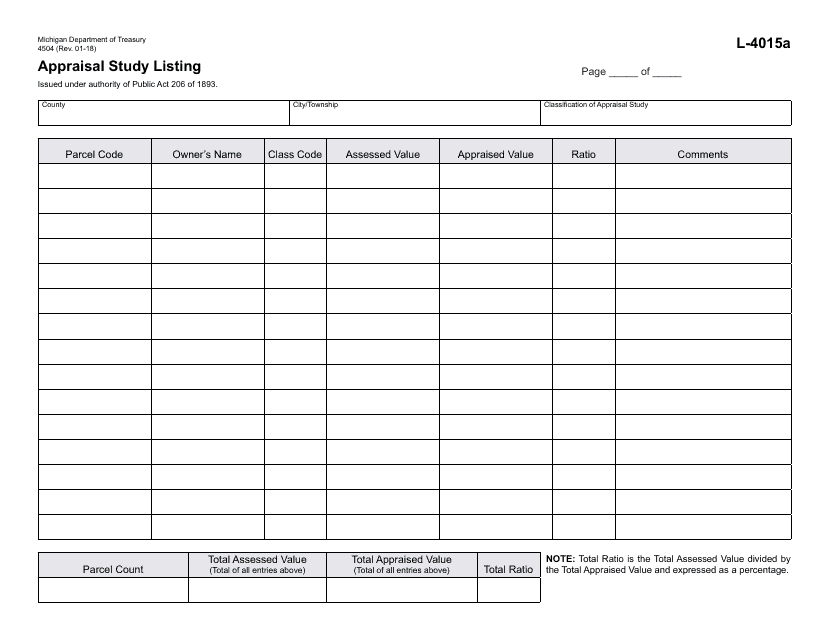

This form is used for listing appraisal studies in the state of Michigan. It provides a comprehensive record of different appraisals conducted within the state.

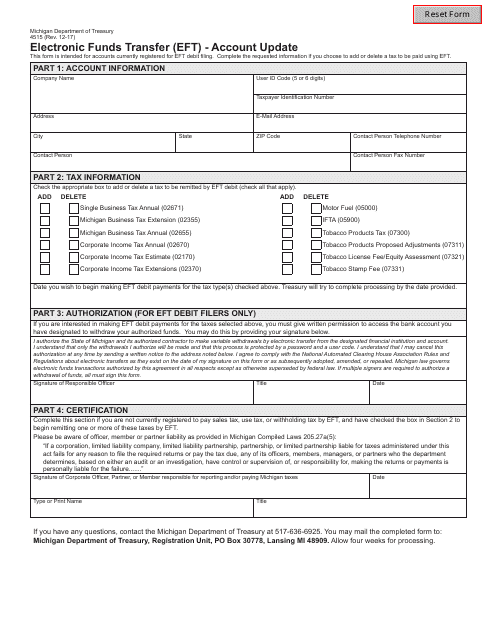

This form is used for updating account information for electronic funds transfers in Michigan.

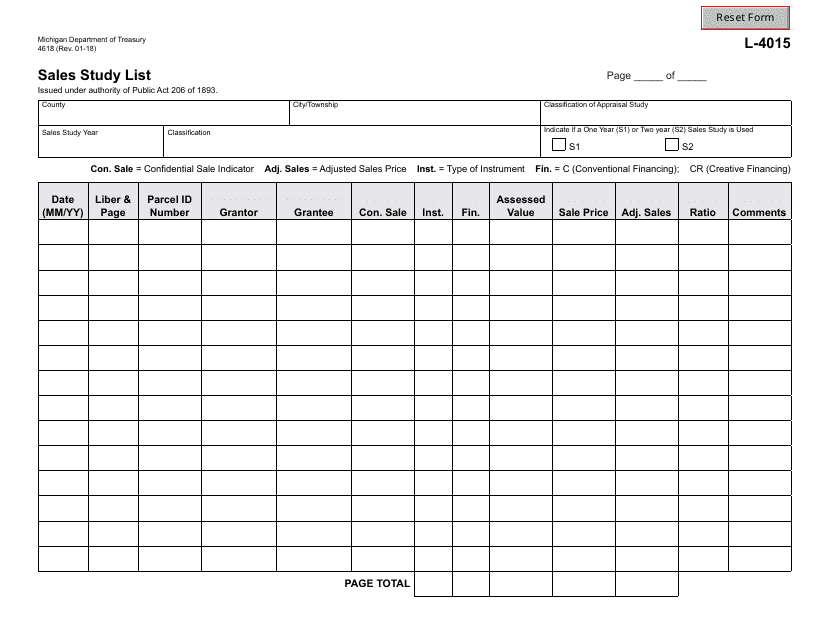

This form is used for submitting a sales study list in the state of Michigan.

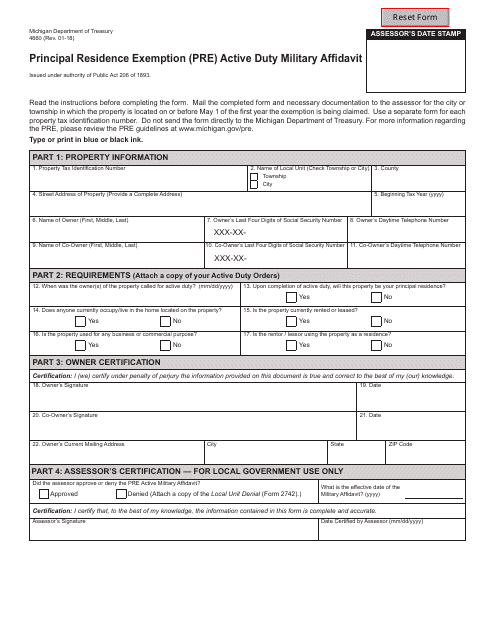

This form is used for applying for a Principal Residence Exemption (PRE) for active duty military members in Michigan. It is an affidavit that helps military personnel receive property tax exemptions for their primary residence while they are serving.

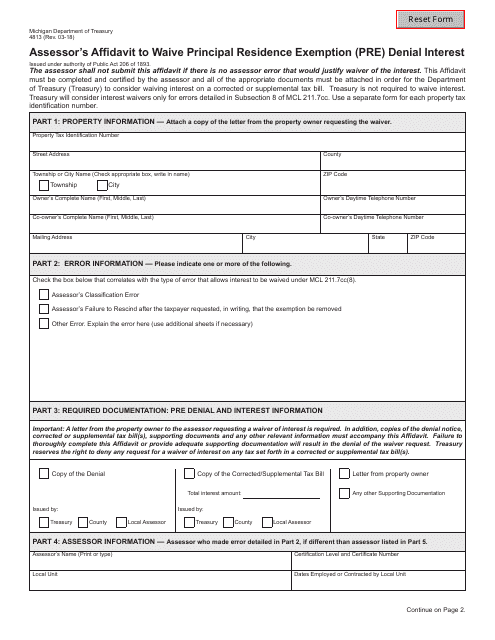

This form is used for Assessor's Affidavit to waive Principal Residence Exemption (PRE) Denial Interest in Michigan.

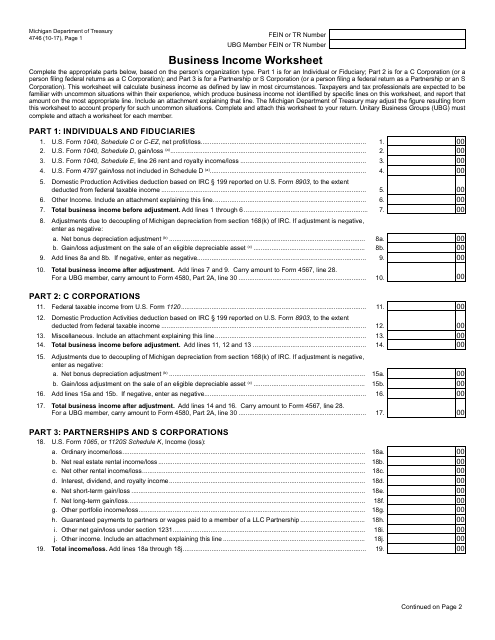

This document is used for calculating business income in the state of Michigan. It helps business owners organize their financial information and determine their taxable income.

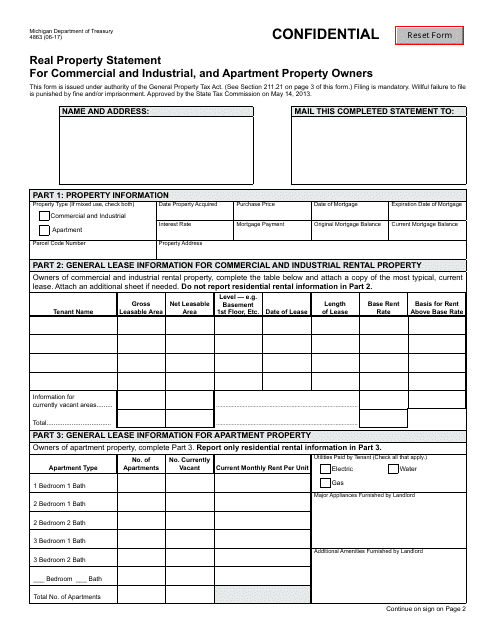

This form is used for commercial and industrial, and apartment property owners in Michigan to provide a statement about their real property.

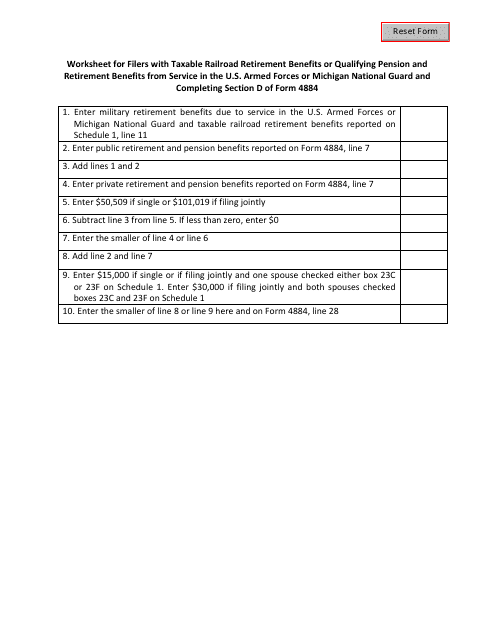

This document is a worksheet for individuals who have taxable railroad retirement benefits or qualifying pension and retirement benefits from service in the U.S. Armed Forces or Michigan National Guard. It is used for completing Section D of Form 4884 in the state of Michigan.

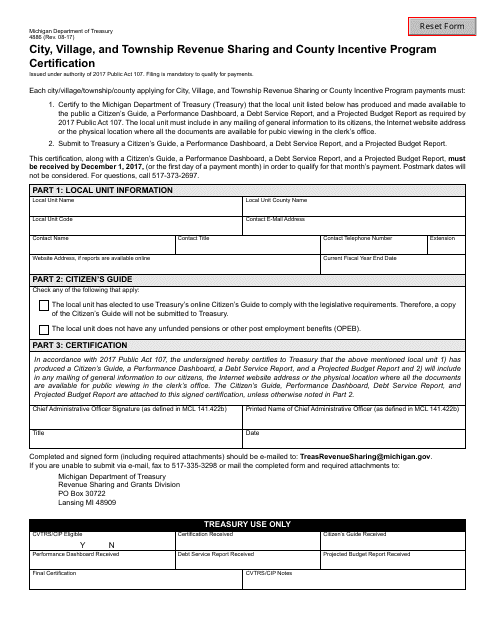

This form is used for certifying revenue sharing and county incentive programs for cities, villages, townships in Michigan.

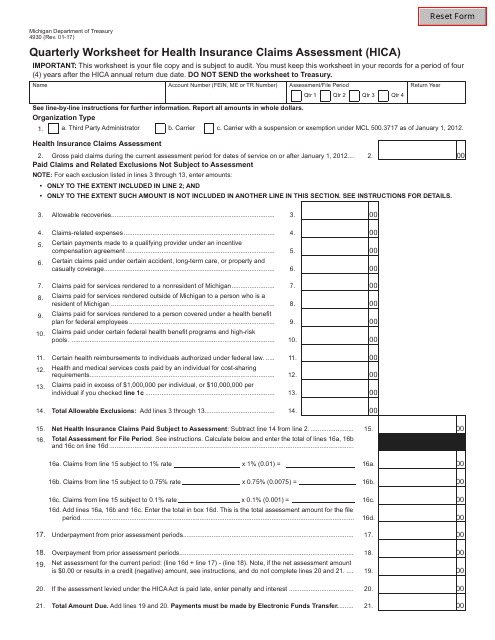

This form is used for the quarterly assessment of health insurance claims in Michigan. It is used to calculate the amount owed for the Health Insurance Claims Assessment (HICA).

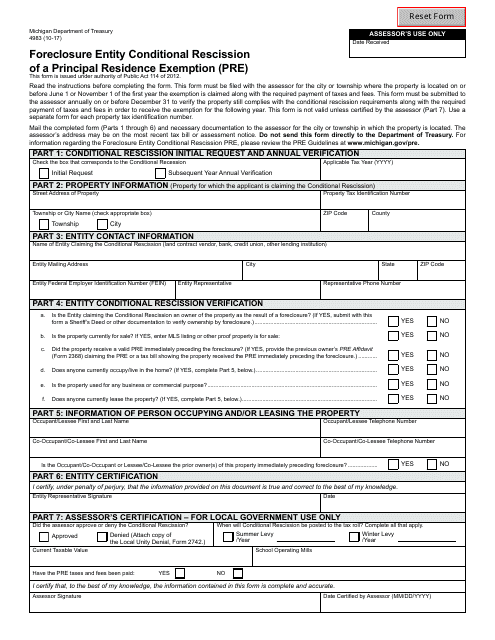

This Form is used for requesting the conditional rescission of a principal residence exemption for foreclosure entities in the state of Michigan.

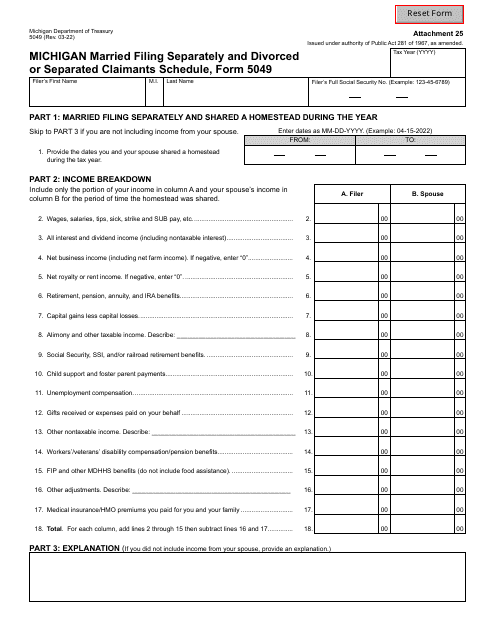

Form 5049 Michigan Married Filing Separately and Divorced or Separated Claimants Schedule - Michigan

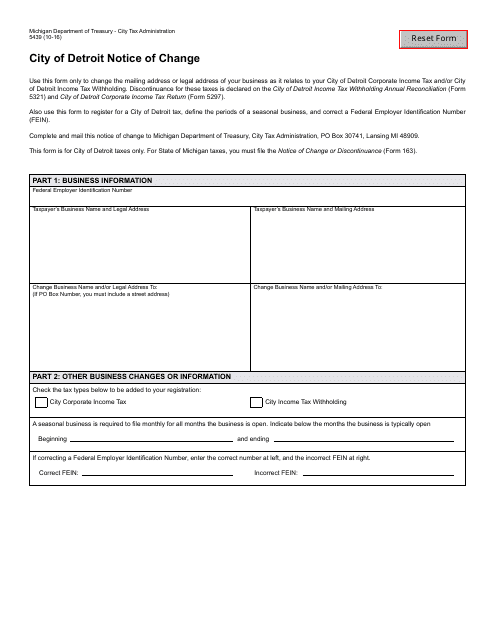

This document is used for notifying the City of Detroit about a change in a person's information in the state of Michigan.

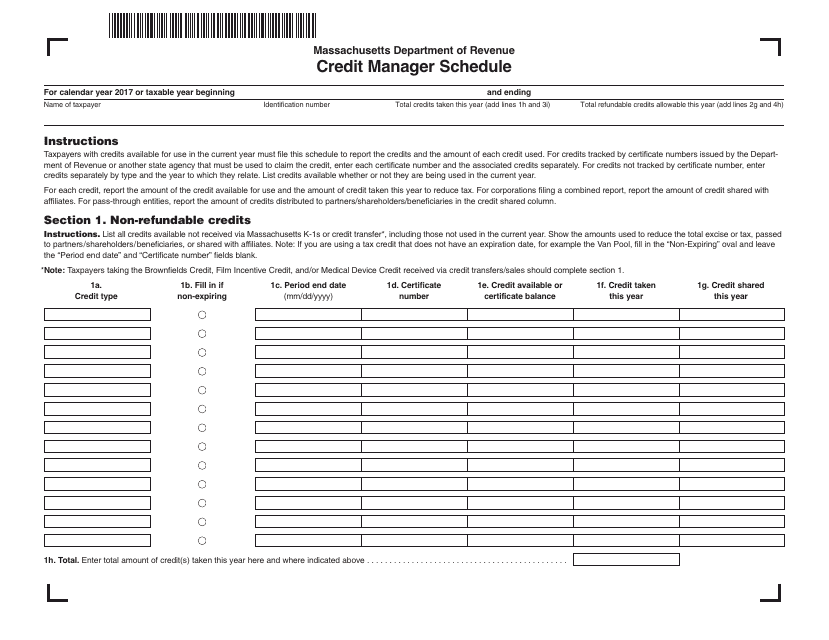

This document is a schedule for the Credit Manager in the state of Massachusetts. It outlines the specific tasks and responsibilities of the Credit Manager in managing credit operations.

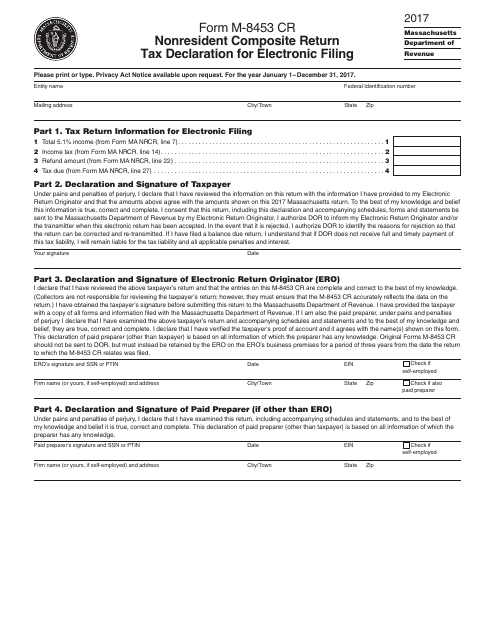

This Form is used for nonresident individuals in Massachusetts to declare their tax information for electronic filing.

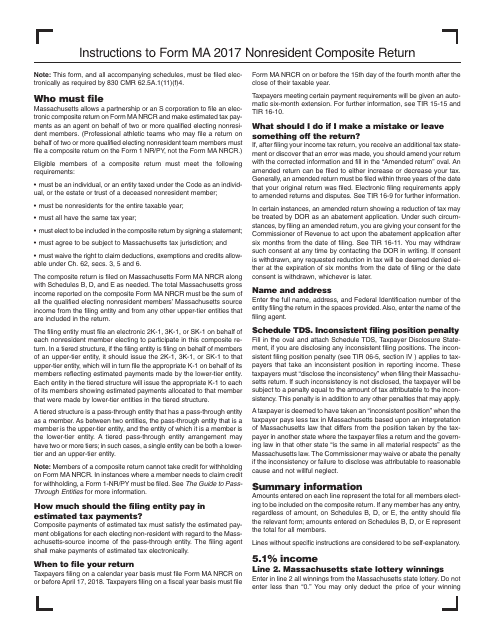

This form is used for filing a nonresident composite return in Massachusetts. It provides instructions for completing and submitting the Form MA Nonresident Composite Return.

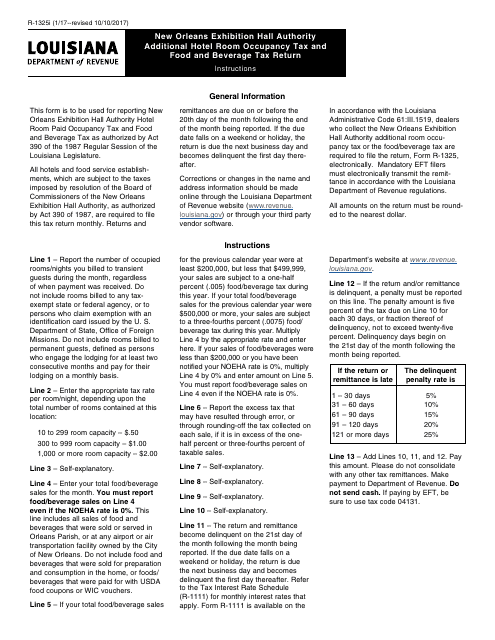

This Form is used for filing additional hotel room occupancy tax and food and beverage tax returns in Louisiana.

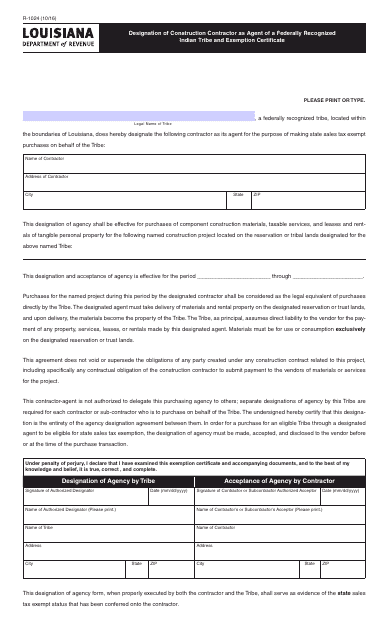

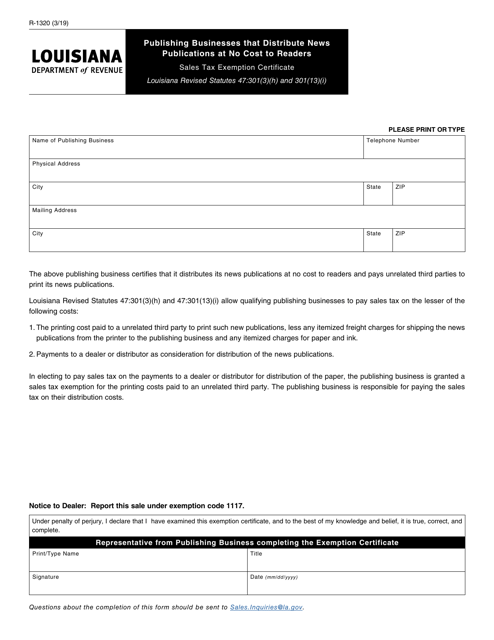

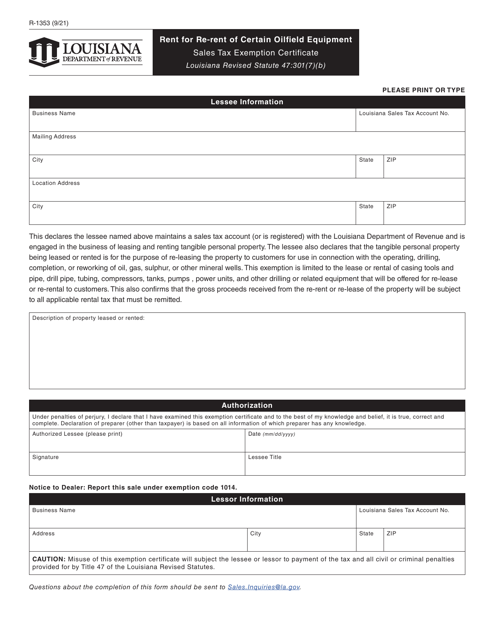

This type of document is used for designating a construction contractor as an agent of a federally recognized Indian tribe in Louisiana and for obtaining an exemption certificate.

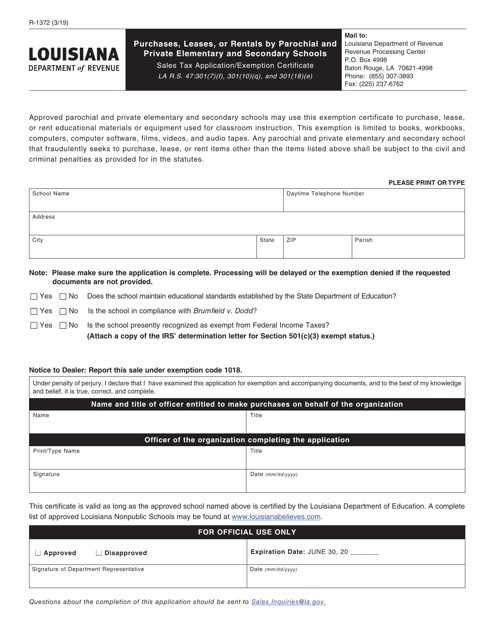

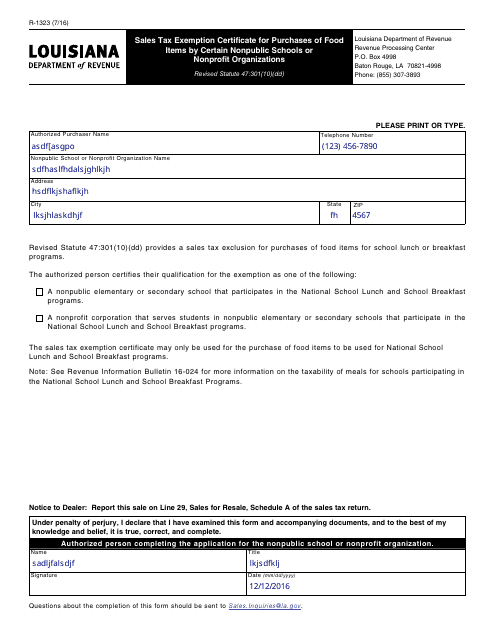

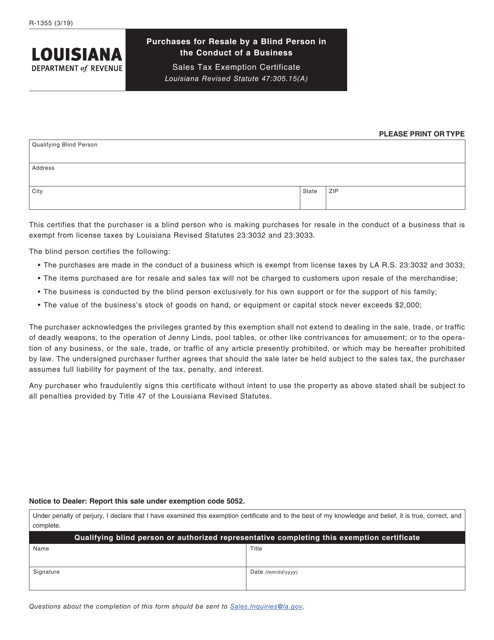

This form is used for obtaining a sales tax exemption certificate in Louisiana for the purchase of food items by certain nonpublic schools or nonprofit organizations.

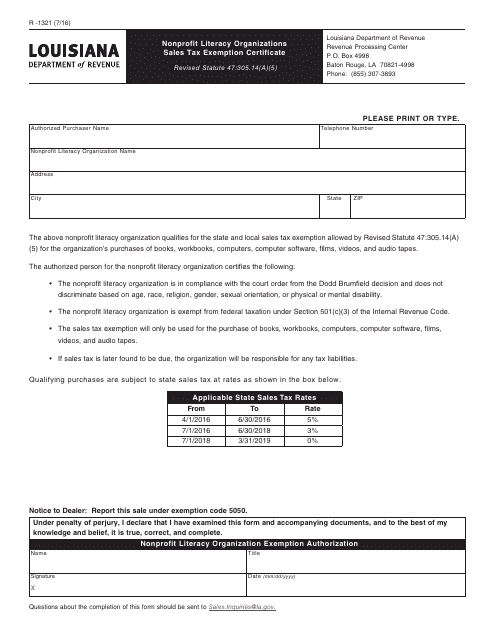

This form is used for nonprofit literacy organizations in Louisiana to request a sales tax exemption certificate.

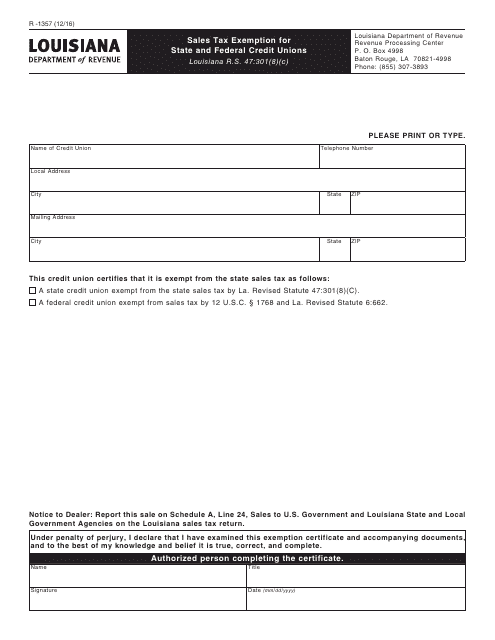

This form is used for state and federal credit unions in Louisiana to claim an exemption from sales tax.

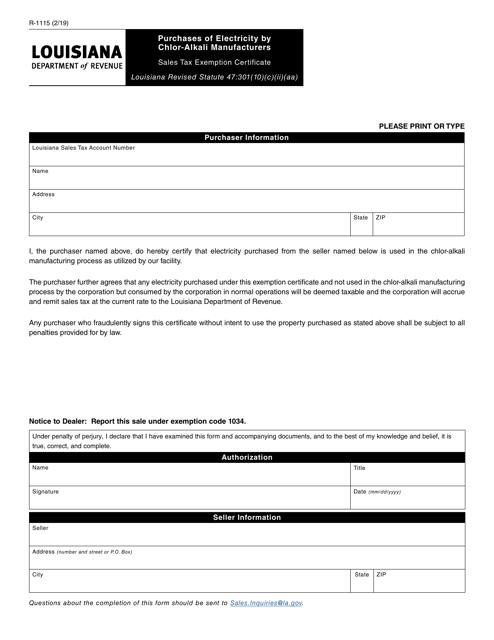

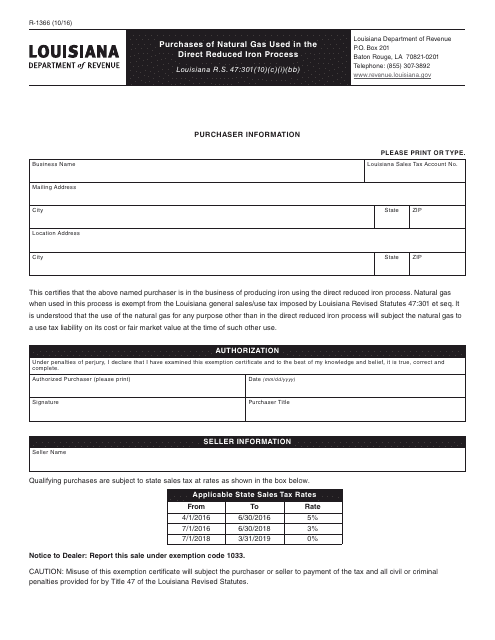

This form is used for reporting the purchases of natural gas that is used in the direct reduced iron process in the state of Louisiana.