United States Tax Forms and Templates

Related Articles

Documents:

2432

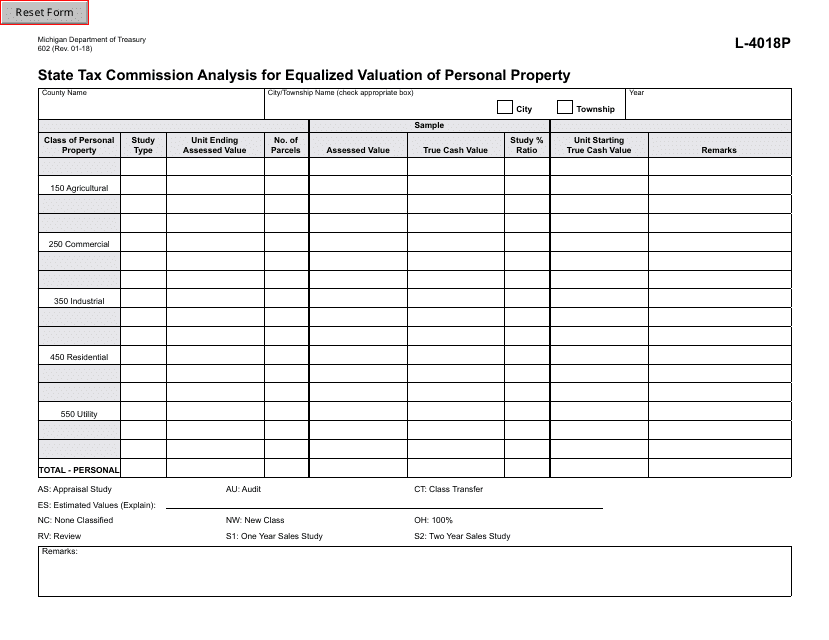

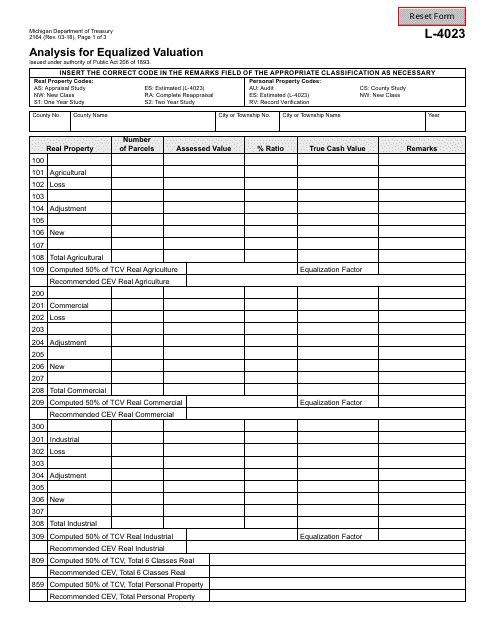

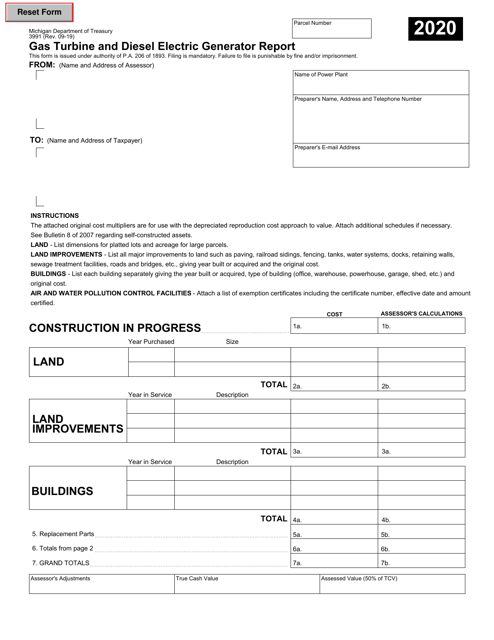

This form is used by the State Tax Commission in Michigan to analyze the equalized valuation of personal property for tax purposes. It helps determine the value of personal property owned by individuals and businesses in Michigan.

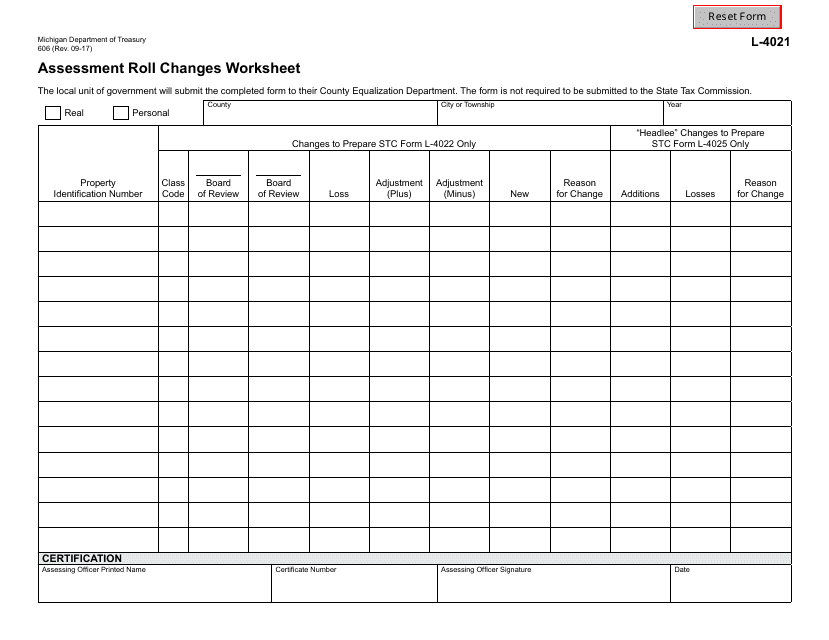

This document is used for recording changes made to the assessment roll in the state of Michigan. It is a worksheet that helps assessors track and document any modifications made to the property assessments.

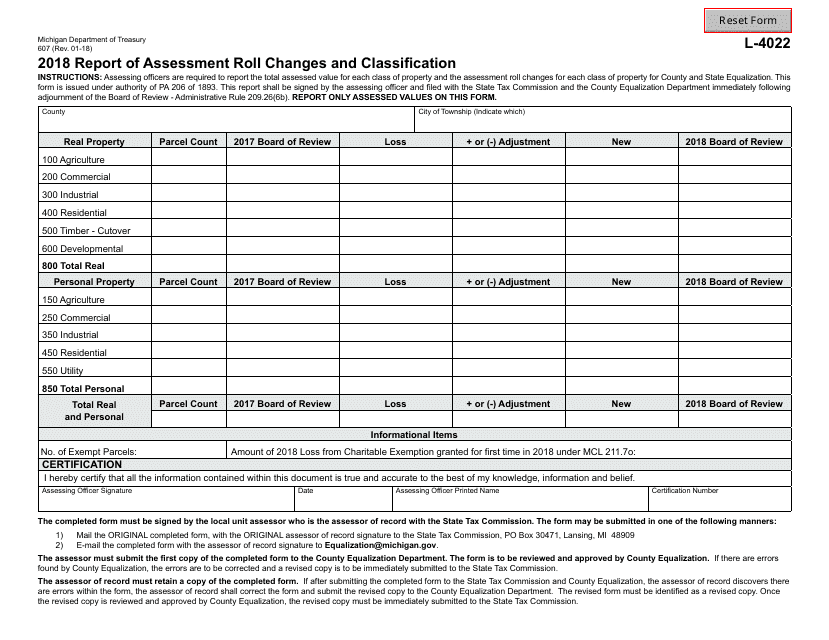

This Form is used for reporting assessment roll changes and classification in the state of Michigan.

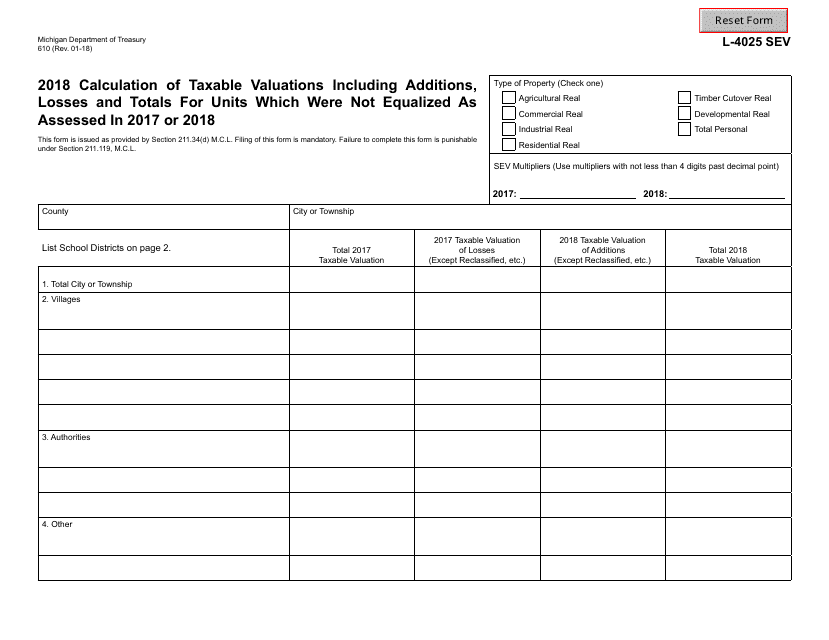

This Form is used for calculating the taxable valuations of units that were not equalized as assessed in 2017 or 2018 in the state of Michigan.

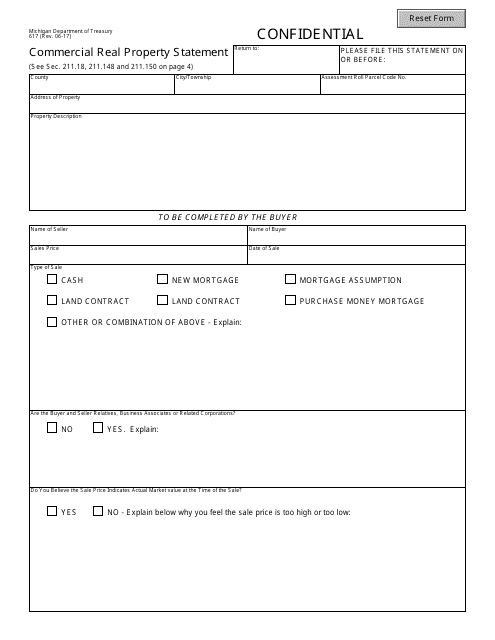

This Form is used for providing a statement of commercial real property in the state of Michigan. It is required for assessment and taxation purposes.

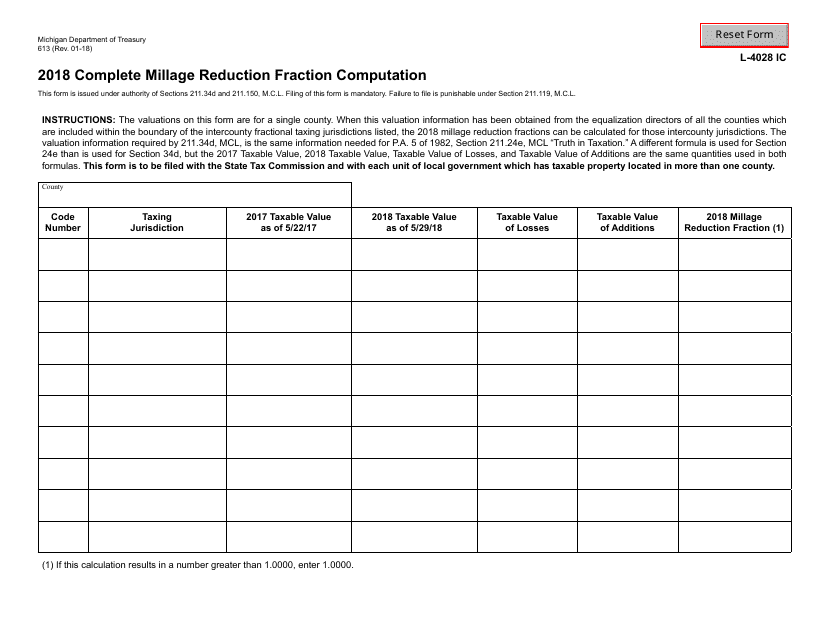

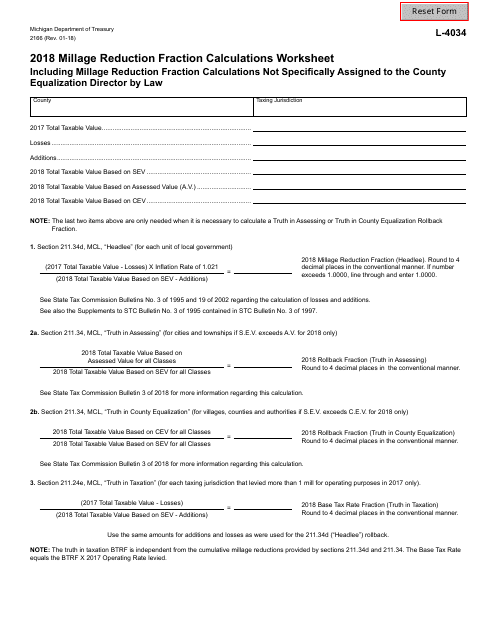

This form is used for completing the millage reduction fraction computation in the state of Michigan. It is used to calculate the reduction in property taxes for eligible taxpayers.

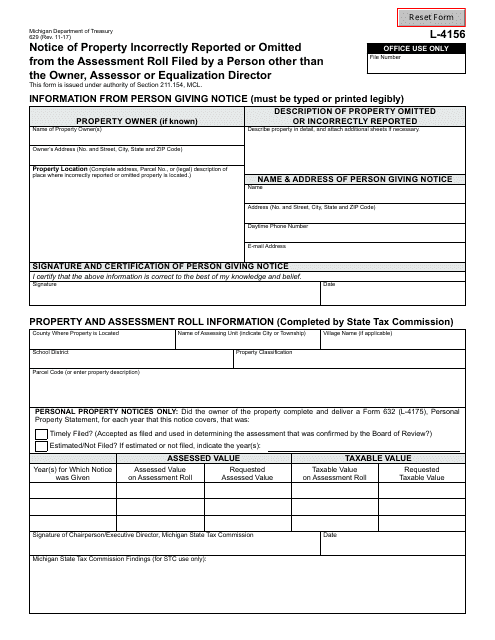

This form is used for notifying the Michigan assessor about incorrectly reported or omitted property on the assessment roll. This form can only be filed by someone other than the owner, assessor, or equalization director.

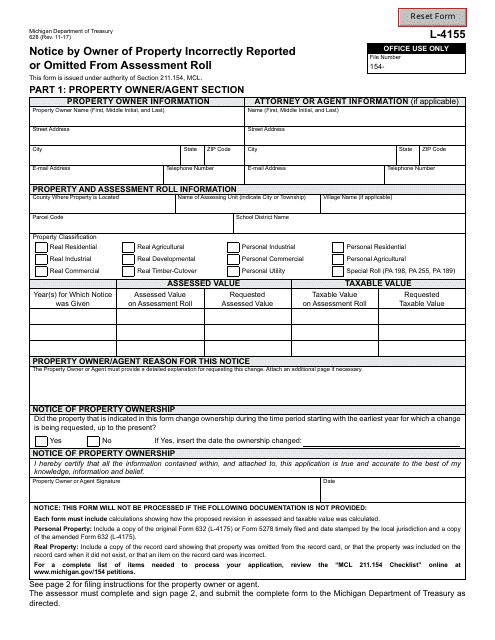

Form 628 Notice by Owner of Property Incorrectly Reported or Omitted From Assessment Roll - Michigan

This form is used for notifying the owner of a property in Michigan if it has been incorrectly reported or omitted from the assessment roll.

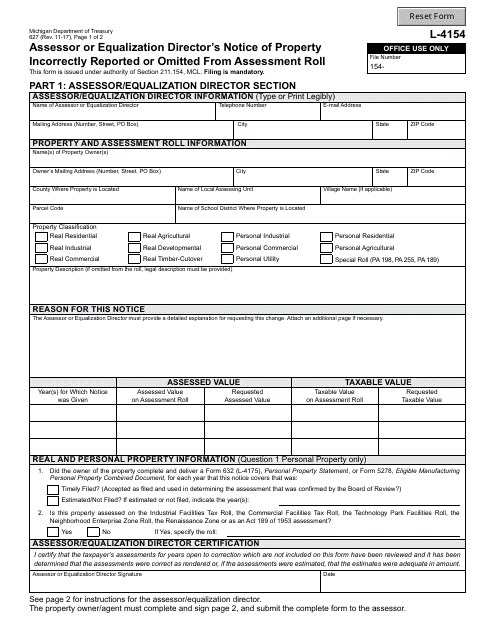

This Form is used for Michigan Assessor or Equalization Director to notify property owners of incorrect reporting or omission from the assessment roll.

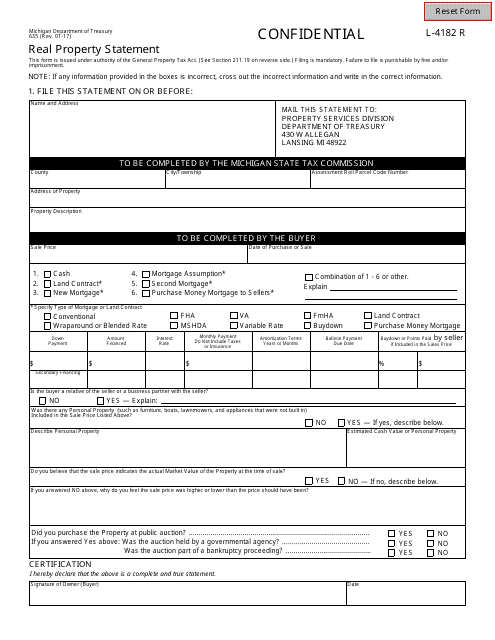

This document is used for providing a statement of real property in the state of Michigan. It is used to report the value of real property for tax assessment purposes.

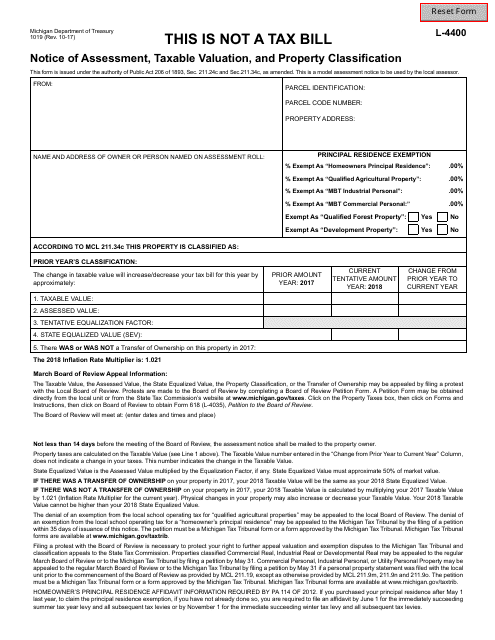

This form is used for notifying taxpayers in Michigan about the assessment, taxable valuation, and classification of their property for tax purposes. It provides information about the tax amount owed based on the property's value and classification.

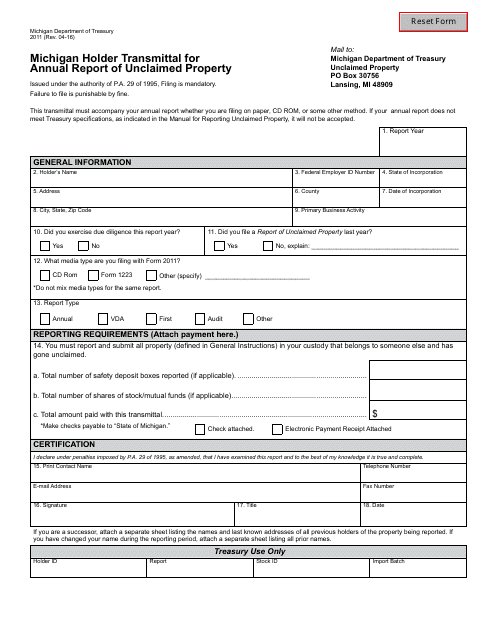

This form is used for transmitting the annual report of unclaimed property by holders in the state of Michigan.

This document is used for calculating the millage reduction fraction in the state of Michigan. It helps determine the amount of property tax reduction eligible for certain individuals or businesses.

This form is used for analyzing the equalized valuation of properties in Michigan. It helps in determining the fair market value of properties for tax purposes.

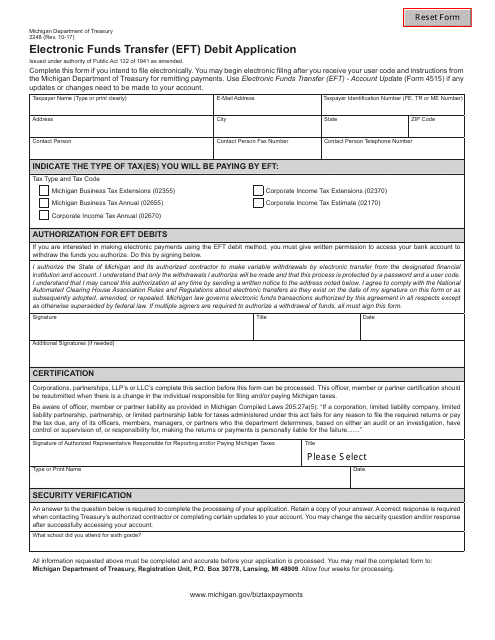

This Form is used for applying for electronic funds transfer (EFT) debit in the state of Michigan.

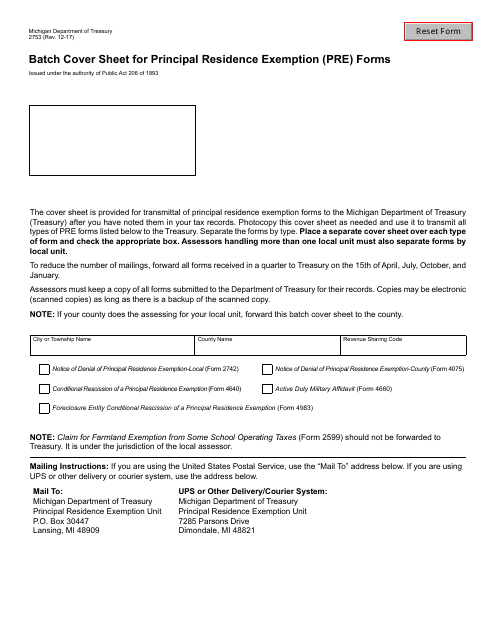

This form is used for submitting Principal Residence Exemption (PRE) Forms in bulk to the state of Michigan. It serves as a cover sheet for the batch submission.

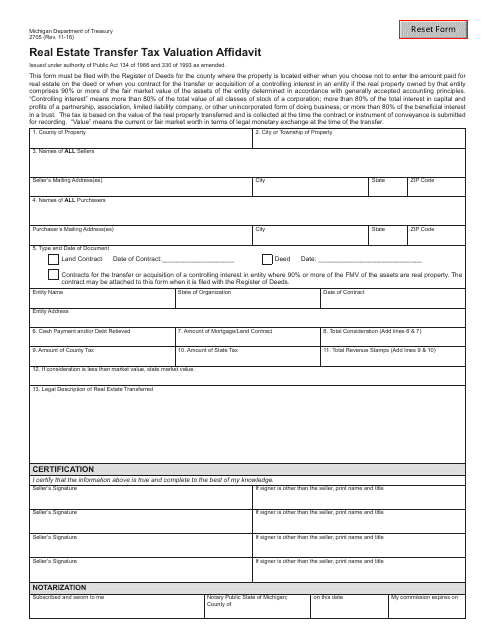

This Form is used for reporting the value of real estate transfers in Michigan and calculating the applicable transfer tax.

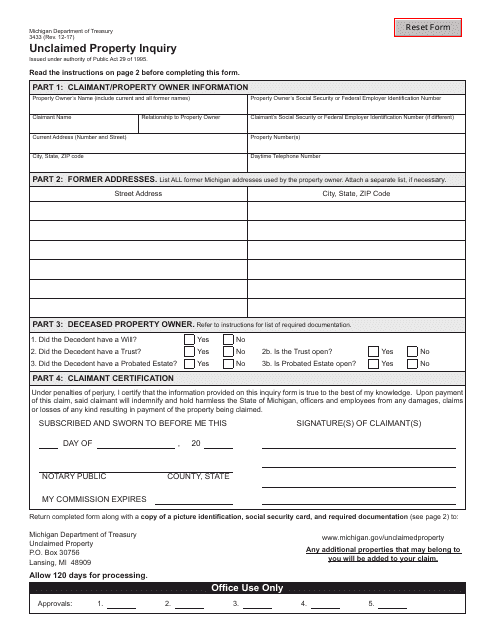

This form is used for making an inquiry about unclaimed property in Michigan.

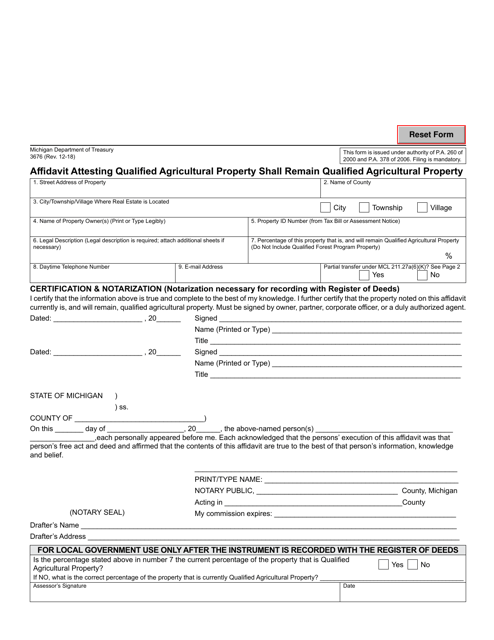

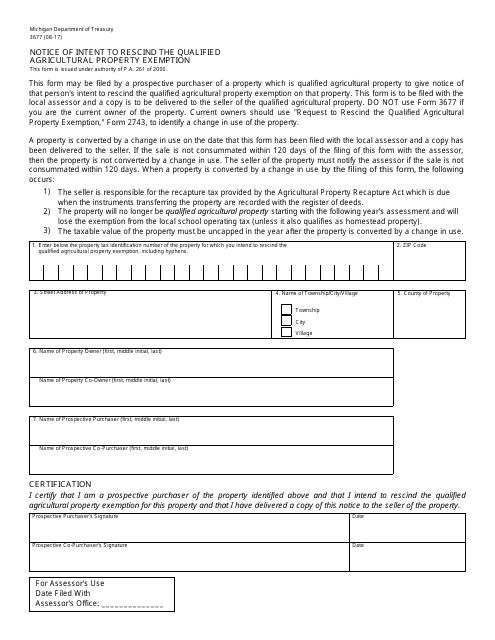

This form is used for notifying the Michigan government of the intent to rescind the qualified agricultural property exemption.

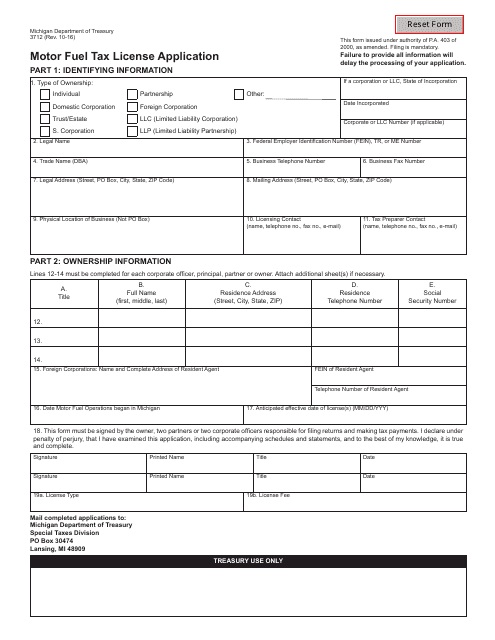

This form is used for applying for a Motor Fuel Tax License in the state of Michigan.

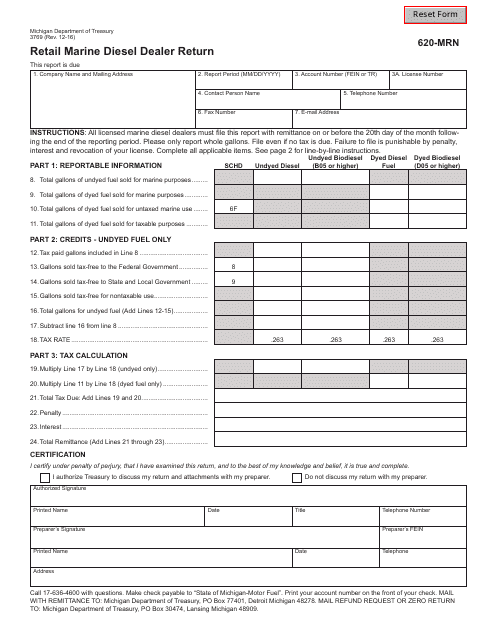

This form is used for retail marine diesel dealers in Michigan to report their sales and taxes.

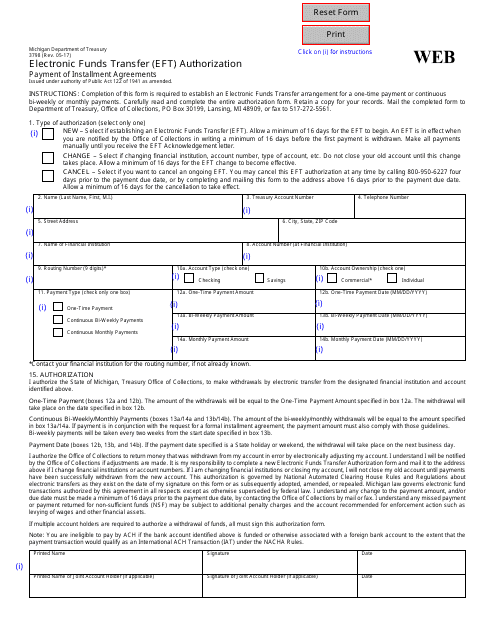

This form is used for authorizing electronic funds transfers (EFT) in the state of Michigan.

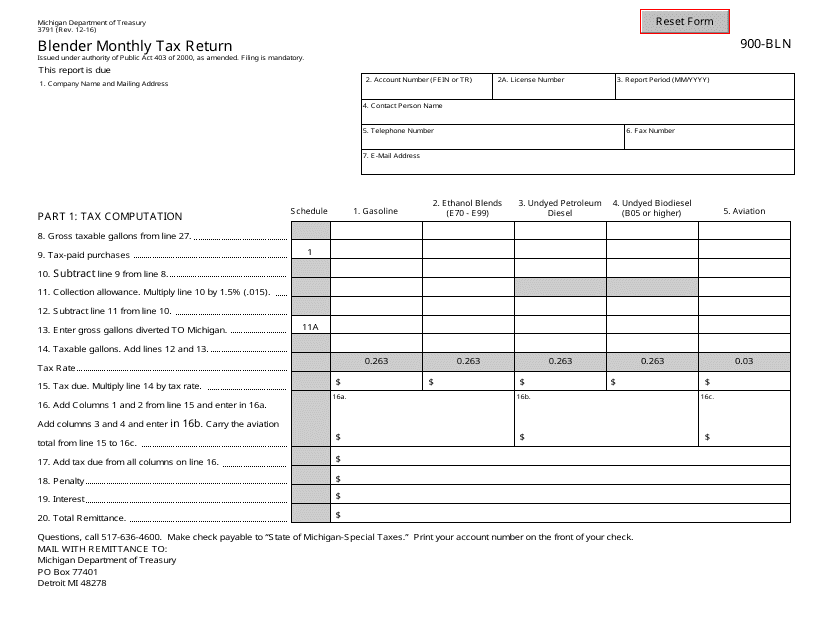

This form is used for filing the monthly tax return for blenders in the state of Michigan.

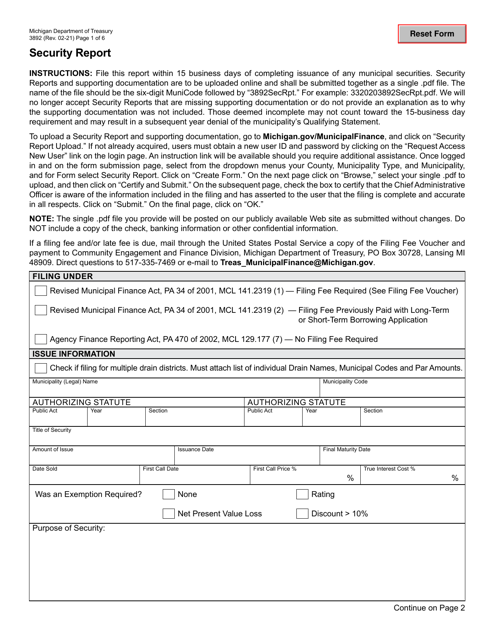

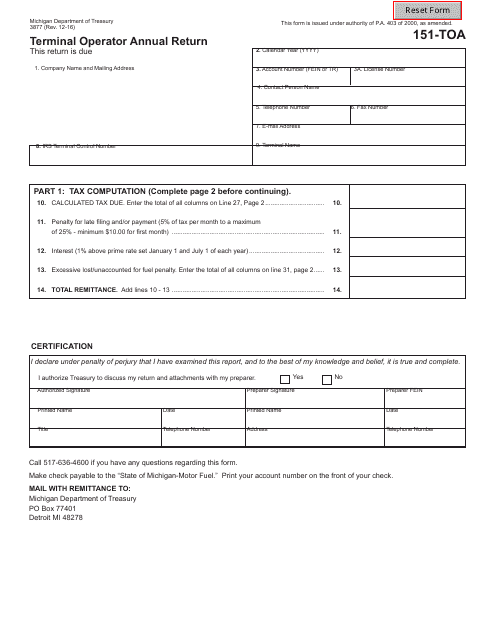

This form is used for terminal operators in Michigan to submit their annual return.

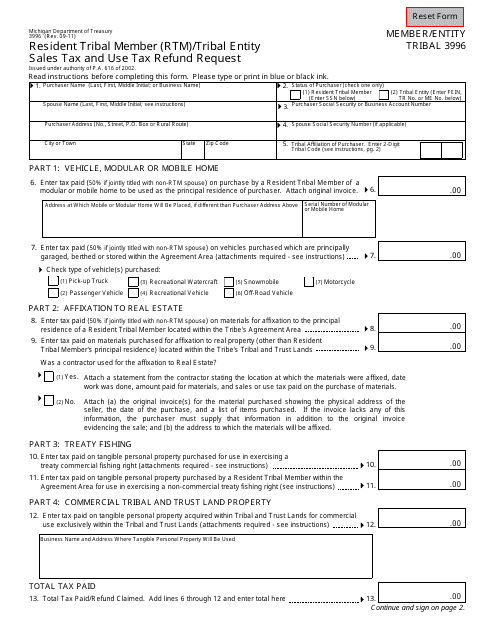

Form 3996 Resident Tribal Member (Rtm)/Tribal Entity Sales Tax and Use Tax Refund Request - Michigan

This Form is used for requesting a sales tax and use tax refund for residents who are tribal members or tribal entities in Michigan.

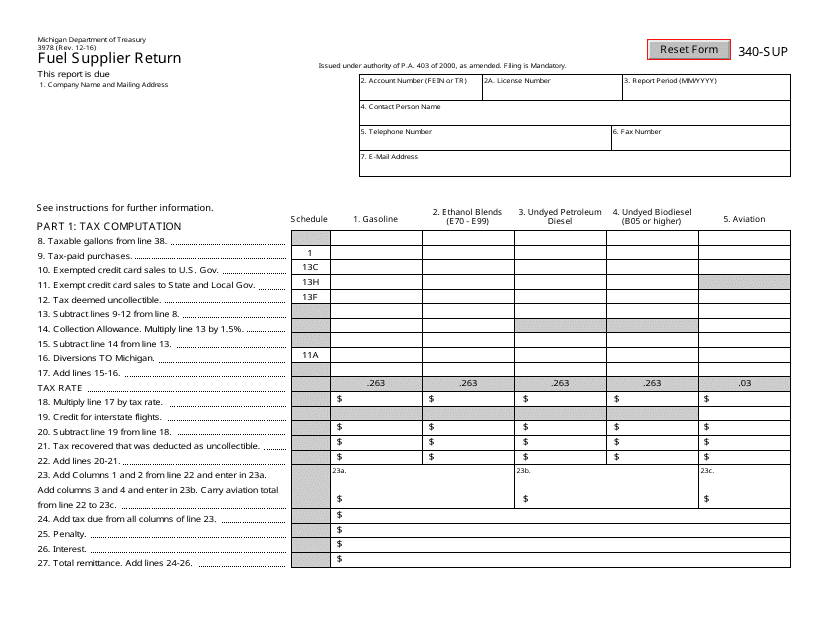

This form is used for fuel suppliers in the state of Michigan to report their activities and comply with tax regulations.

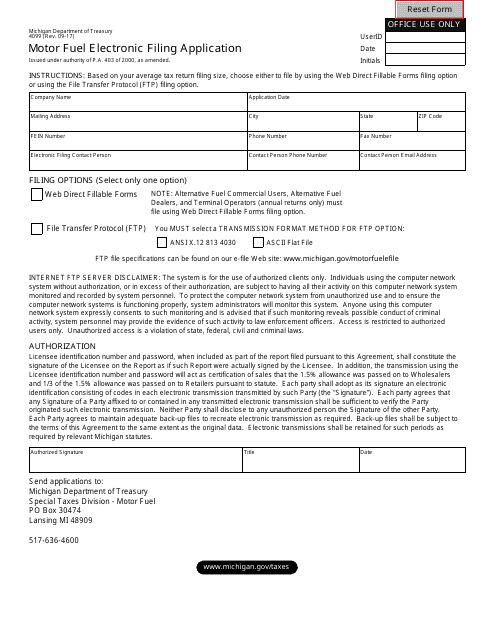

This form is used for electronically filing motor fuel applications in the state of Michigan.

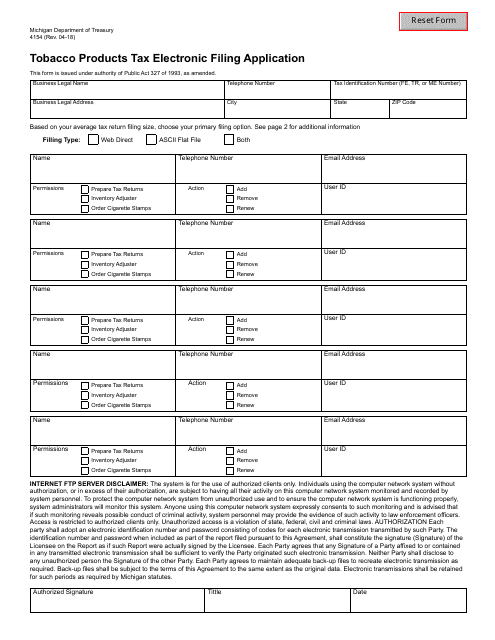

This form is used for electronic filing of tobacco products tax in the state of Michigan.