United States Tax Forms and Templates

United States Tax Forms are documents that individuals and businesses use to report their income and calculate the amount of taxes they owe to the federal government. These forms are used to provide the necessary information to the Internal Revenue Service (IRS) to determine an individual's or business's tax liability for a given tax year. The forms cover various aspects of taxation, including income, deductions, credits, and tax payments.

Related Articles

Documents:

2432

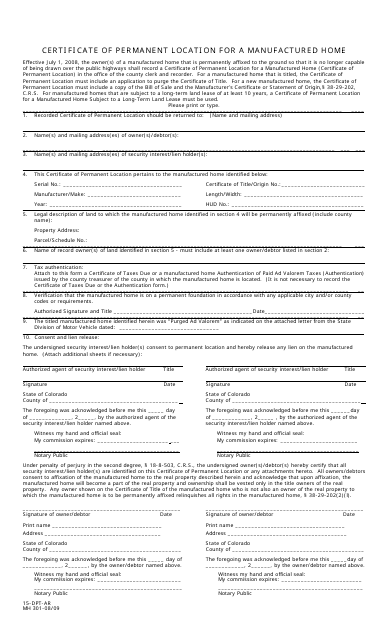

This form is used for declaring the permanent location of a manufactured home in Colorado.

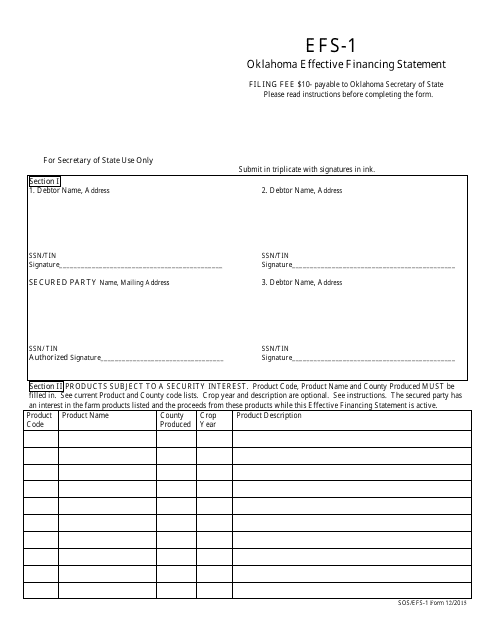

This form is used for filing an effective financing statement in Oklahoma. It is commonly known as the SOS Form EFS-1. This document provides information about a secured interest in personal property.

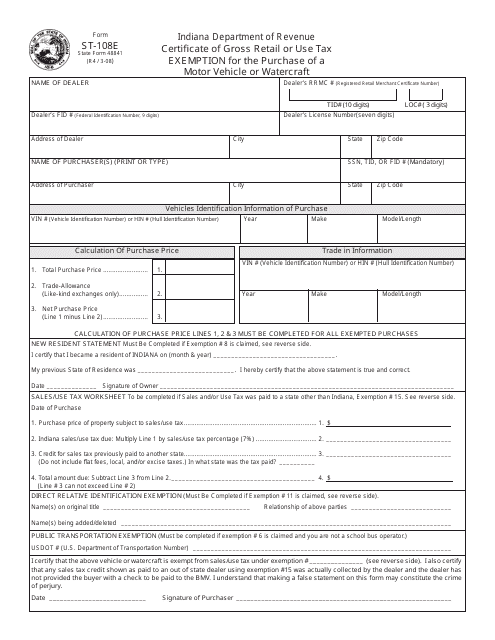

This form is used for claiming exemption from paying gross retail or use tax while purchasing a motor vehicle or watercraft in Indiana.

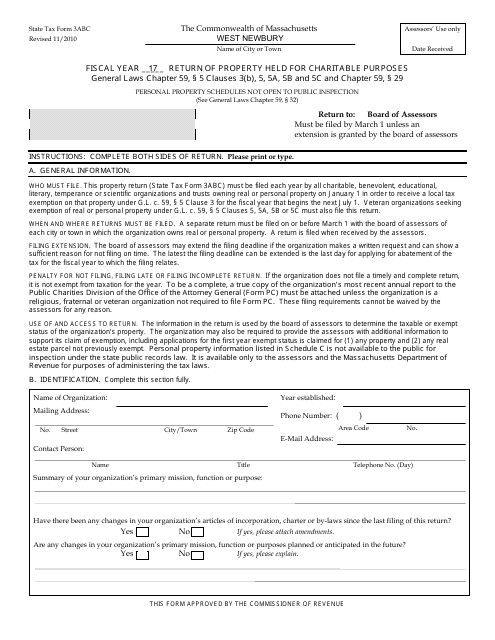

This form is used for submitting the Return of Property Held for Charitable Purposes in Massachusetts. It is required for organizations that hold property for charitable purposes in the state.

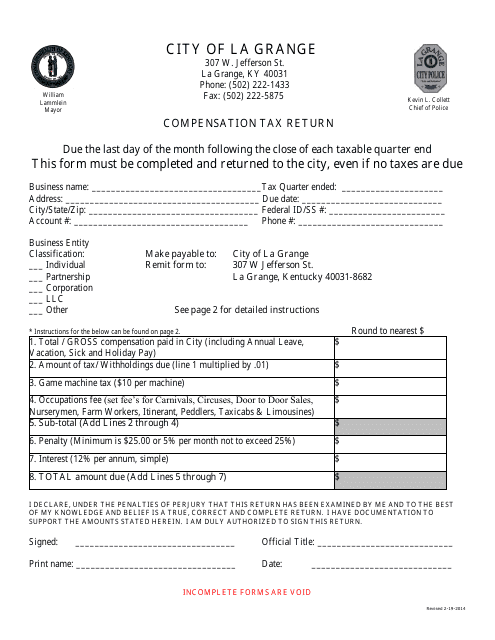

This document is used for reporting compensation tax returns to the City of La Grange, Kentucky.

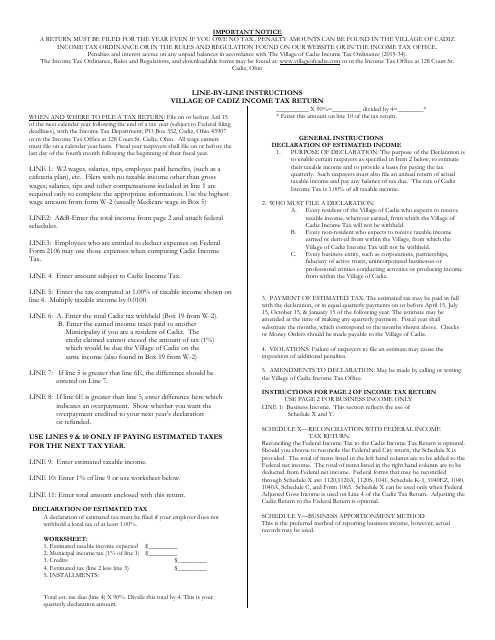

This document provides instructions for completing the Village of Cadiz Income Tax Return form in Cadiz, Ohio. It guides residents on how to accurately report their income and calculate their tax liabilities for the village.

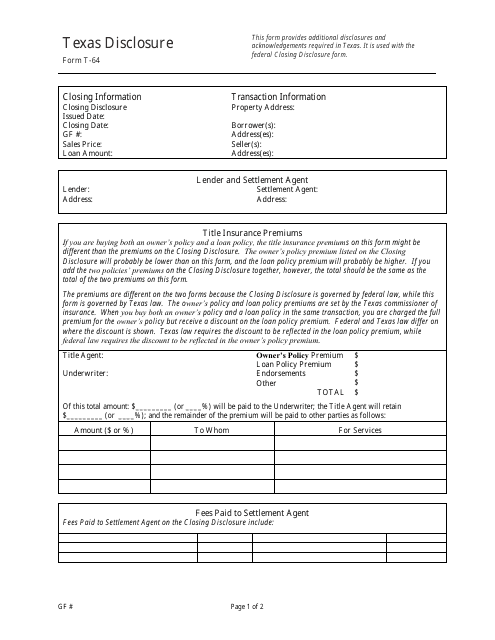

This form is used for disclosing certain information related to a vehicle transaction in the state of Texas. It provides details about the vehicle's history and any known issues or damages.

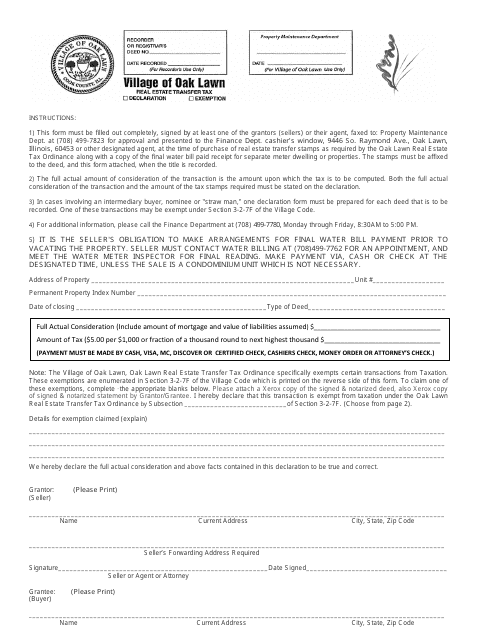

This form is used for reporting and paying the real estate transfer tax in Oak Lawn, Illinois. The tax is levied on the transfer of real property within the city limits.

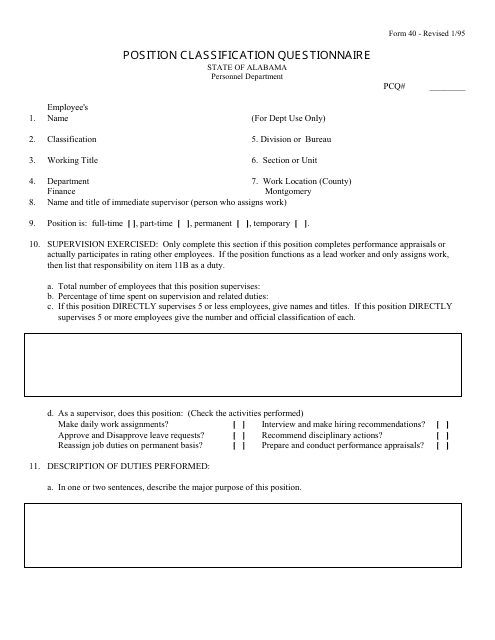

This Form is used for the Position Classification Questionnaire in Alabama.

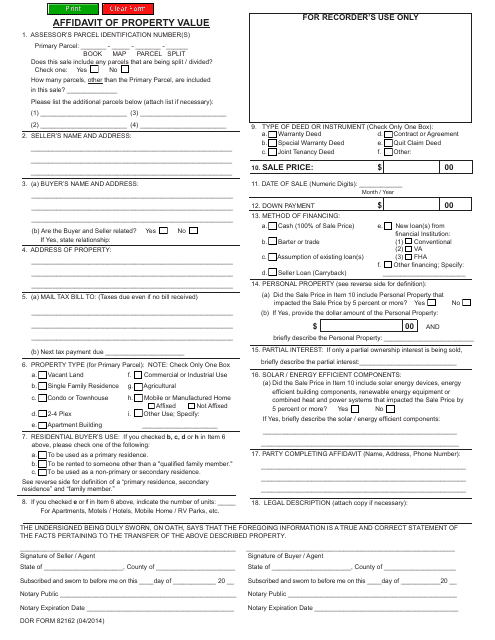

This form is used for declaring the value of property in the state of Arizona. It is an affidavit that provides information about the property and its estimated value.

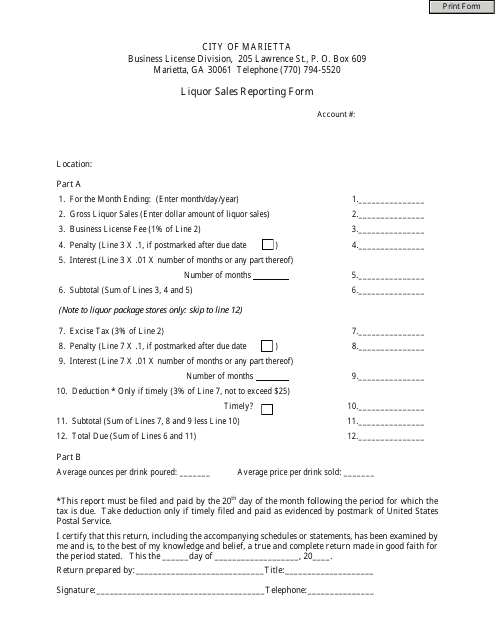

This Form is used for reporting liquor sales in the City of Marietta, Georgia, United States. It is required by the city to track and monitor liquor sales within its jurisdiction.

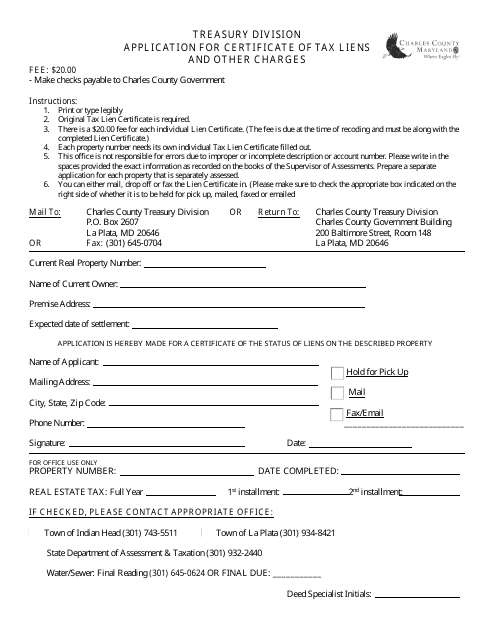

This document is used for applying for a certificate of tax liens and other charges in Charles County, Maryland. It is necessary for individuals or businesses who owe unpaid taxes or other outstanding charges to the county. The certificate serves as proof of the outstanding debts and is often required in real estate transactions or loan applications.

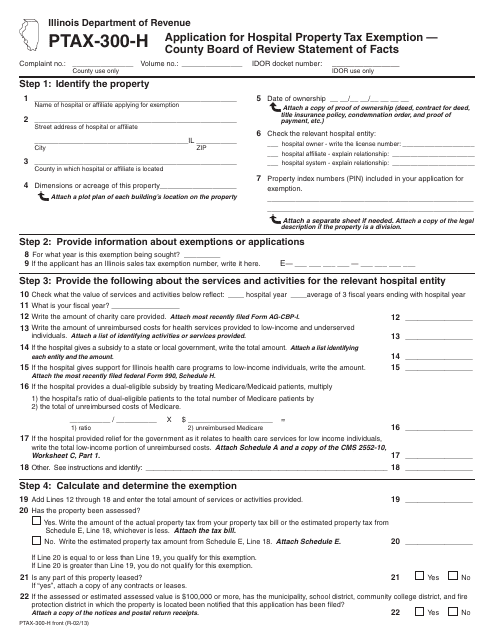

This form is used for applying for hospital property tax exemption in Illinois. It includes a statement of facts that must be submitted to the County Board of Review.

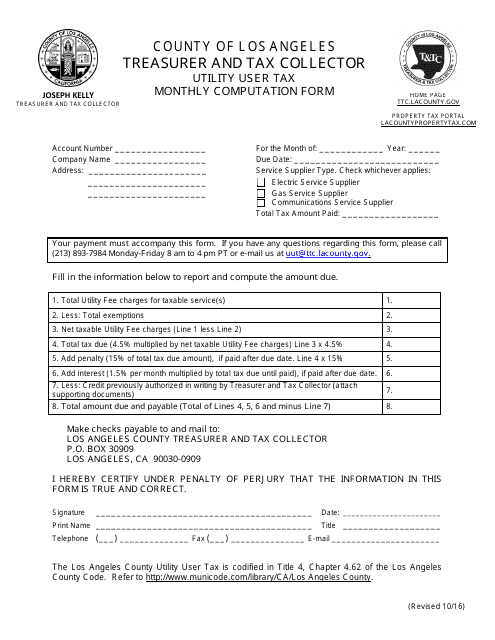

This document is used for calculating the monthly utility user tax in Los Angeles County, California. It is necessary for individuals and businesses to pay this tax based on their utility usage.

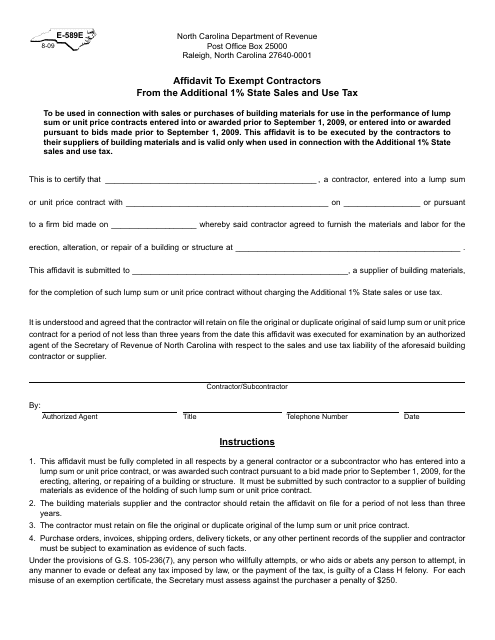

This form is used for contractors in North Carolina to request exemption from the additional 1% state sales and use tax.

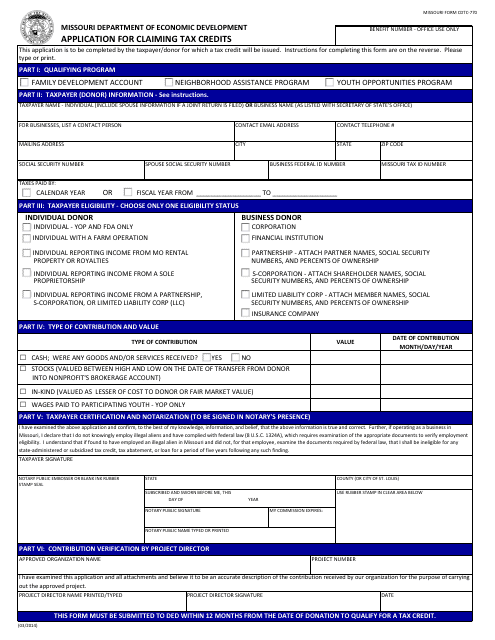

This Form is used for applying for tax credits in the state of Missouri.

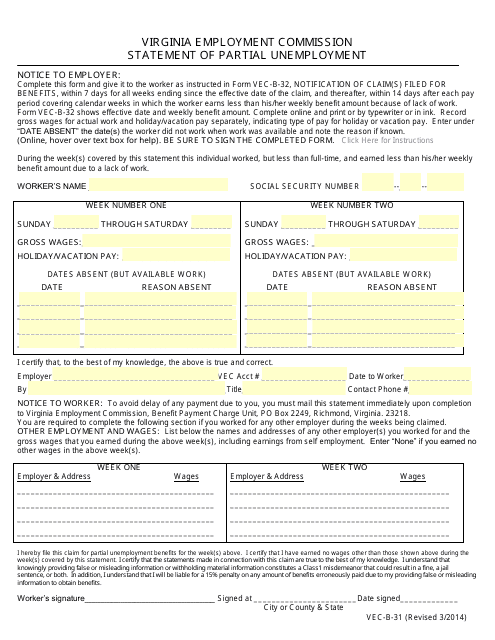

This form is used for reporting partial unemployment in the state of Virginia. It is used to provide information about your work hours and earnings when you are working part-time while collecting unemployment benefits.

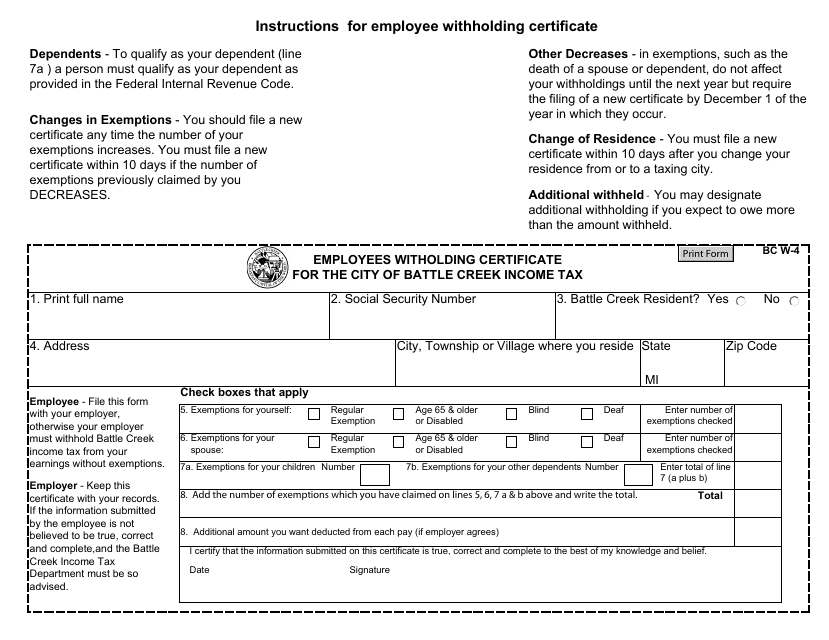

This form is used for employees in Battle Creek, Michigan to declare their withholding for the City of Battle Creek Income Tax.

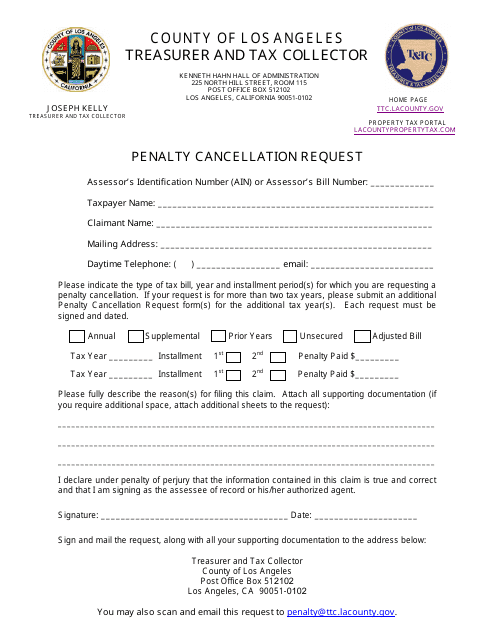

This type of document is used for requesting the cancellation of penalties in Los Angeles County, California.

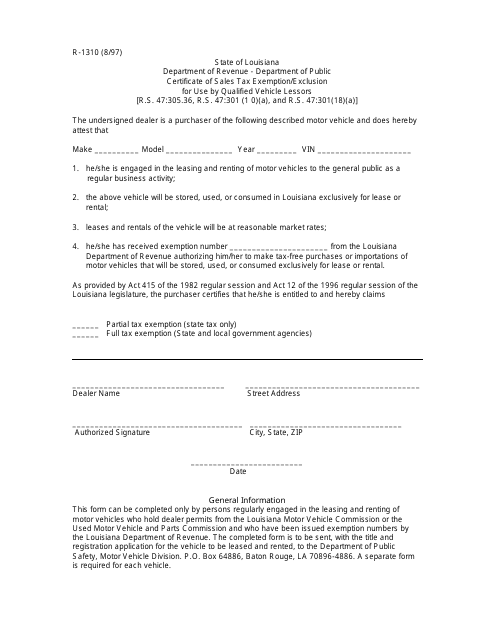

This form is used for obtaining a certificate of sales tax exemption exclusion in Louisiana for qualified vehicle lessors.

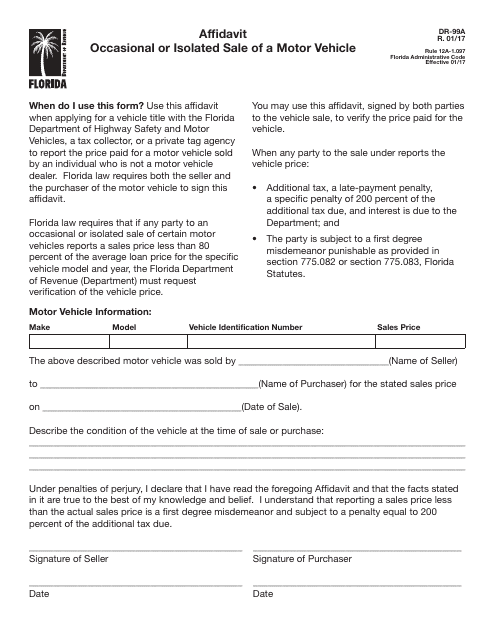

This form is used for reporting the occasional or isolated sale of a motor vehicle in Florida.

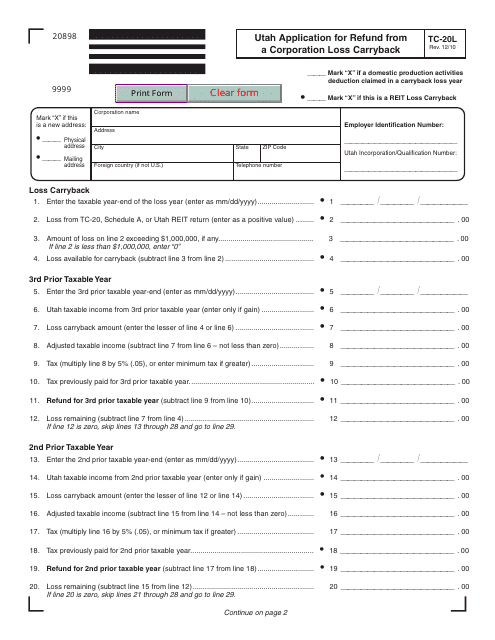

This form is used for corporations in Utah to apply for a refund of taxes from a loss carryback.

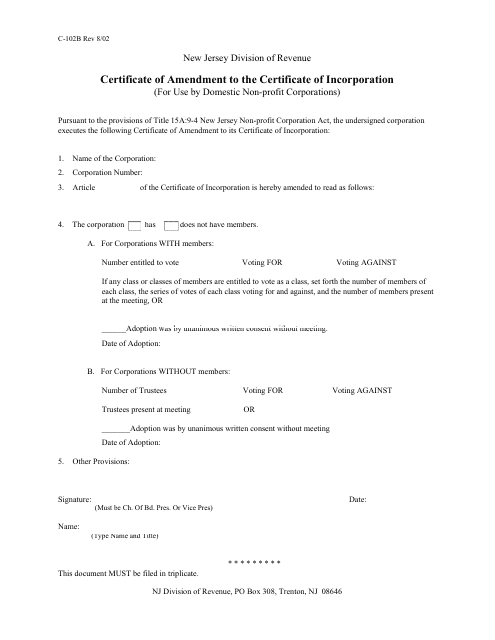

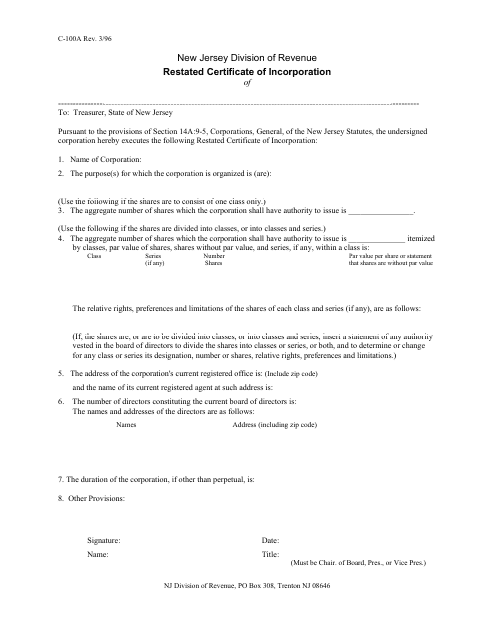

This Form is used for making amendments to a company's Certificate of Incorporation in the state of New Jersey. It provides a template for easily completing the necessary changes to the official documentation.

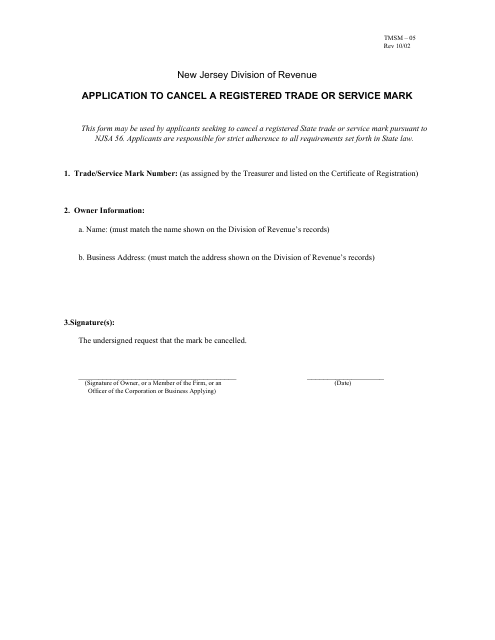

This Form is used for submitting an application to cancel a registered trade or service mark in the state of New Jersey.

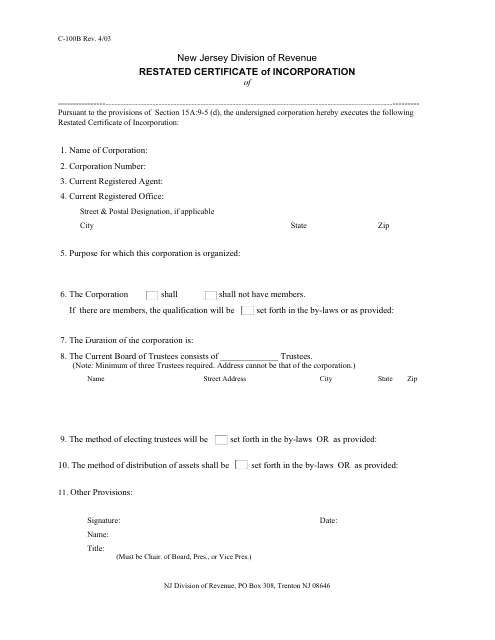

This form is used for restating the certificate of incorporation for a company registered in New Jersey.

This Form is used for restating the certificate of incorporation for a company in New Jersey. It allows for updating or amending the original document.

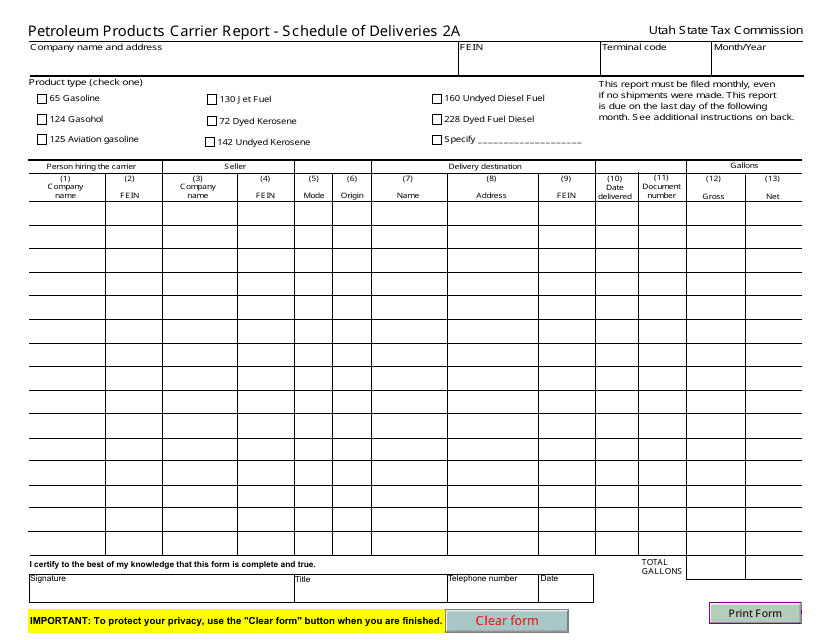

This document is a report that provides a schedule of petroleum product deliveries in Utah.

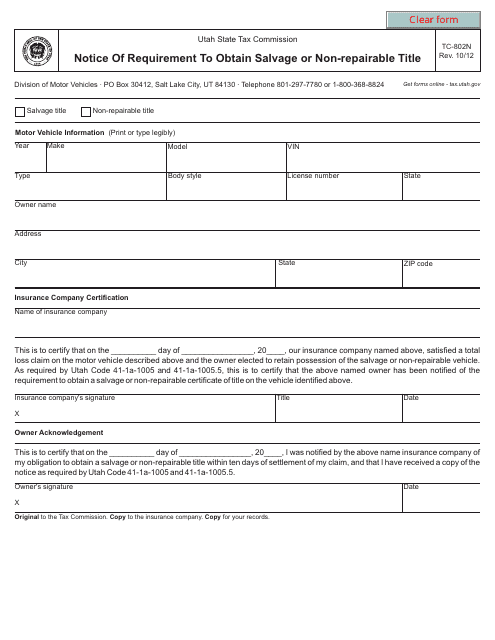

This Form is used for notifying vehicle owners in Utah about the requirement to obtain a salvage or non-repairable title for their vehicle.

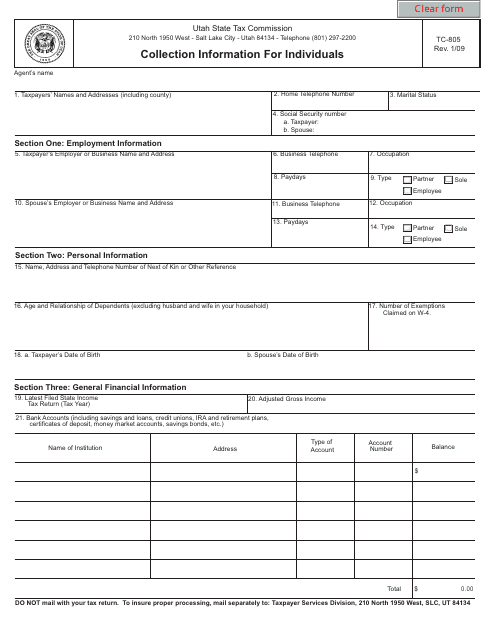

This form is used for collecting information from individuals in Utah for tax purposes. It helps the government determine an individual's ability to pay their taxes.

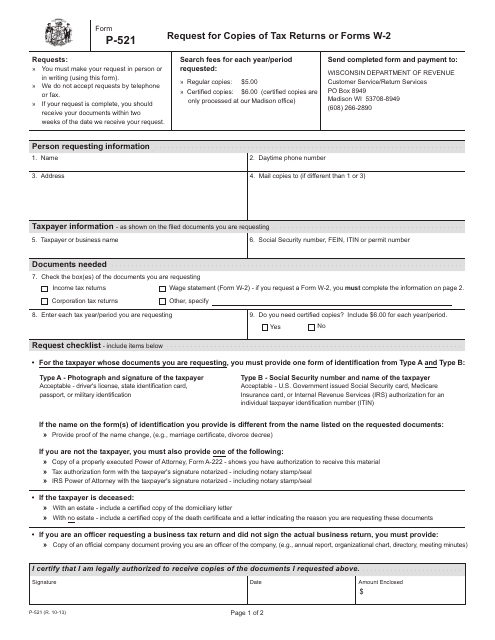

This Form is used for requesting copies of tax returns or Forms W-2 in the state of Wisconsin.

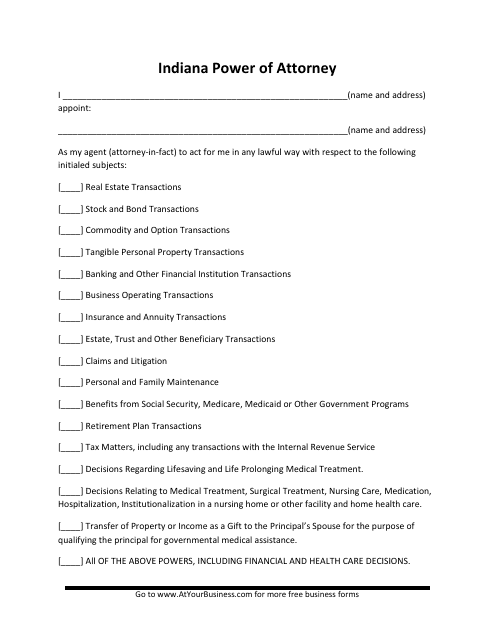

This Form is used for granting someone else the legal authority to make decisions on your behalf in the state of Indiana.

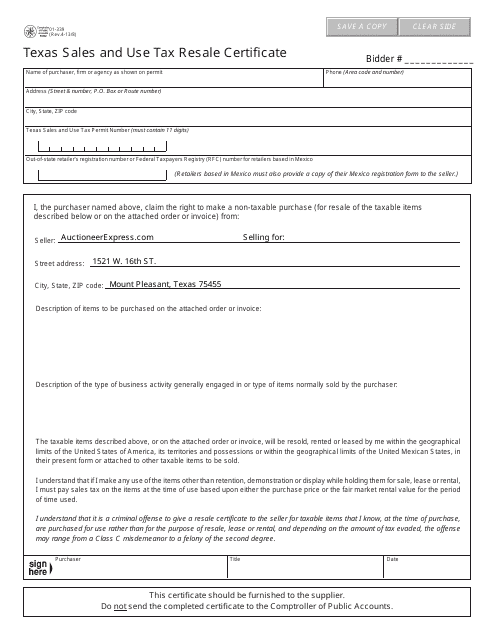

This is a legal form presented by a purchaser to a seller from whom the purchaser buys the goods with the purpose of resale in the state of Texas.

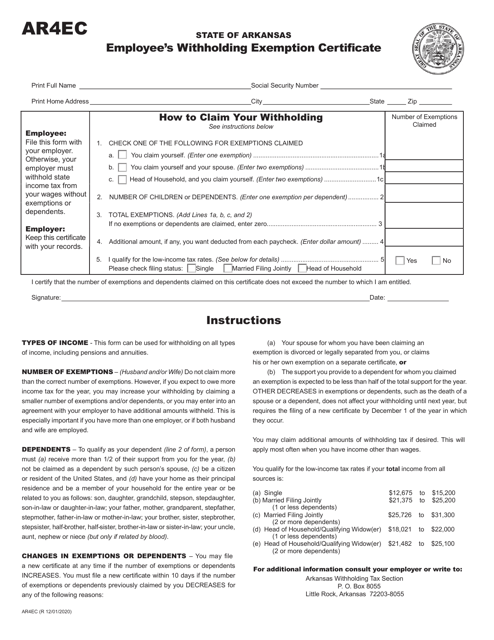

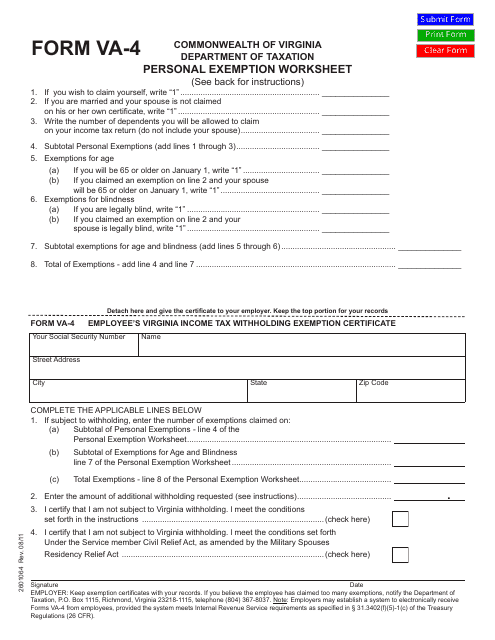

This form is used for calculating personal exemptions for tax purposes in the state of Virginia.

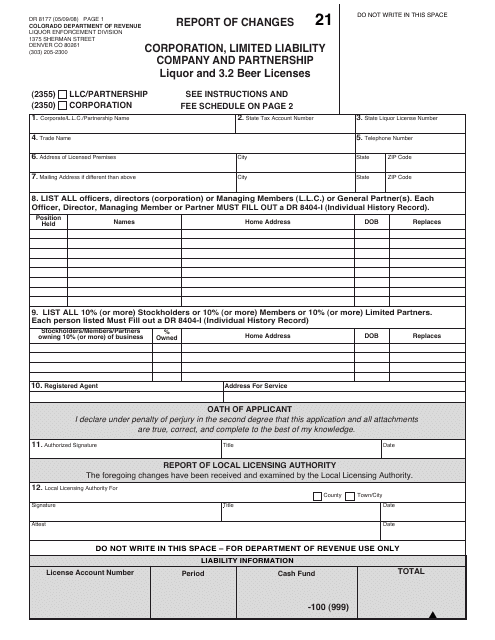

This form is used for reporting changes in liquor and beer licenses for corporations, limited liability companies, and partnerships in the state of Colorado.

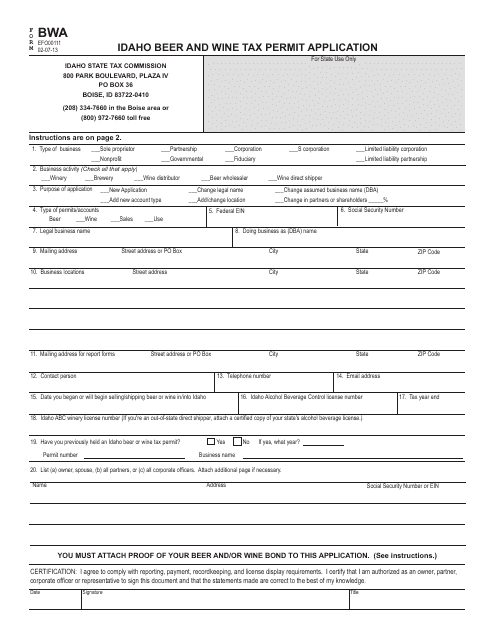

This Form is used for obtaining a beer and wine tax permit in the state of Idaho. It allows individuals or businesses to legally sell beer and wine and comply with the tax regulations in Idaho.

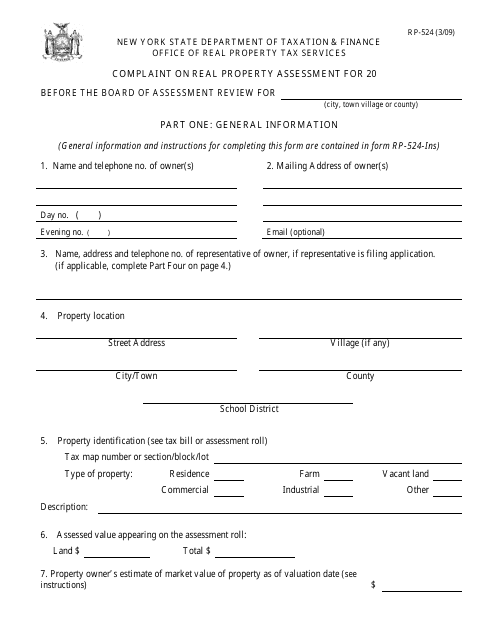

This Form is used for filing a complaint regarding real property assessment in New York. It allows property owners to challenge the assessed value of their property for tax purposes.

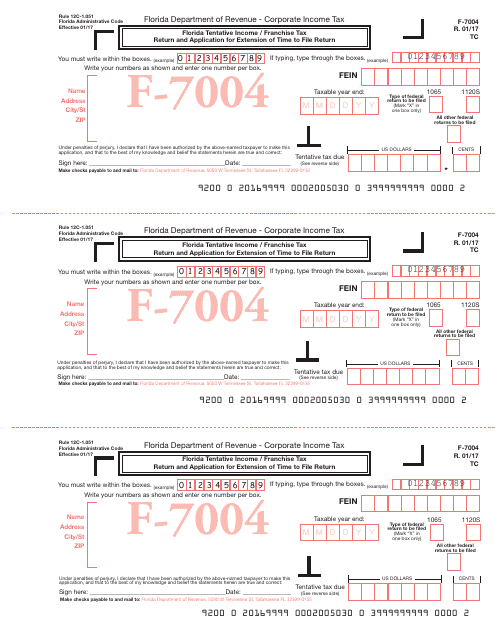

This Form is used for filing the Florida Tentative Income/Franchise Tax Return and applying for an extension of time to file the return in Florida.

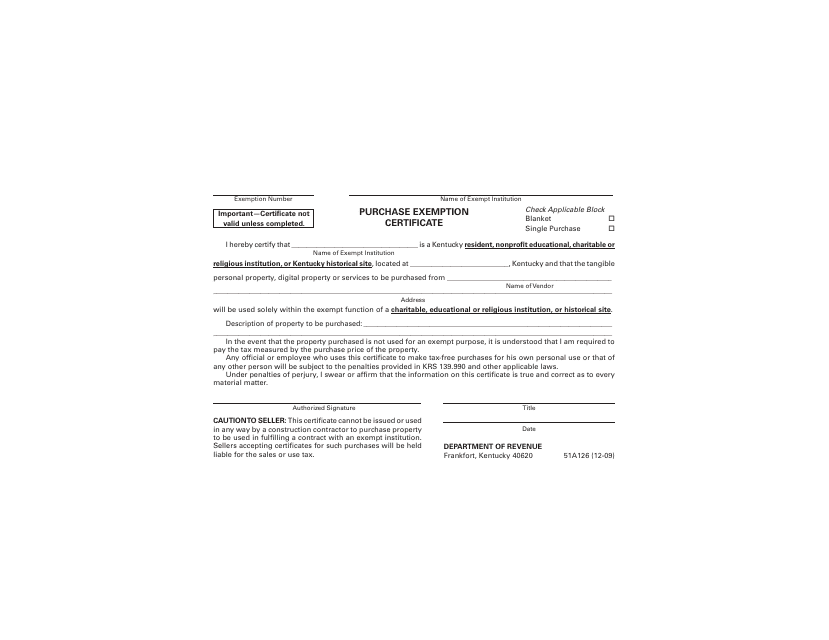

This form is used for requesting a purchase exemption certificate in the state of Kentucky. It allows individuals or businesses to claim an exemption from paying sales tax on specified purchases.