United States Tax Forms and Templates

Related Articles

Documents:

2432

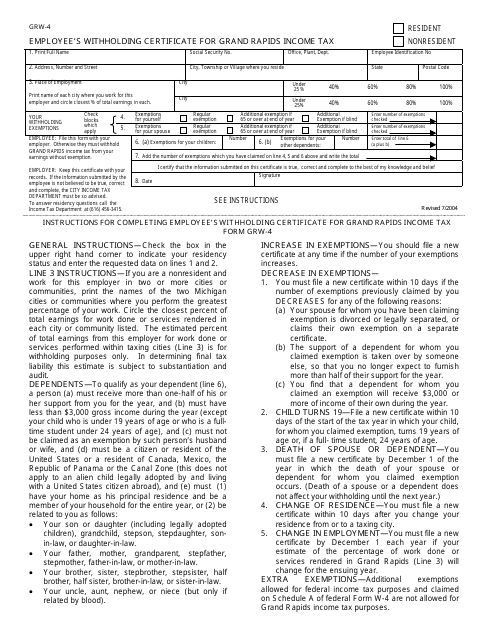

This form is used for employees in Grand Rapids, Michigan to declare their withholding certificate for Grand Rapids income tax.

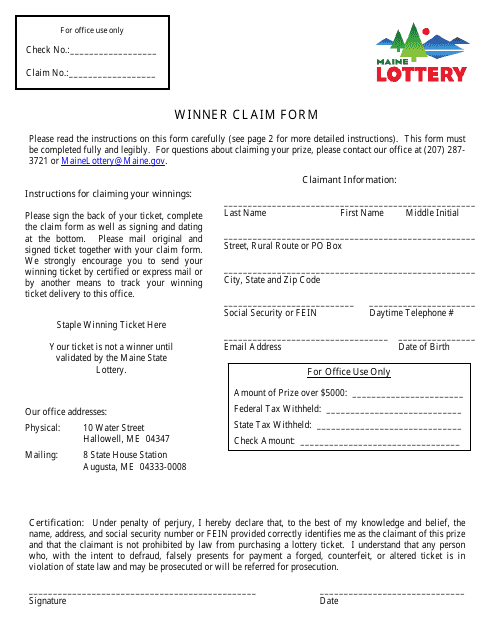

This document is used to claim winnings from the Maine State Lottery in the state of Maine.

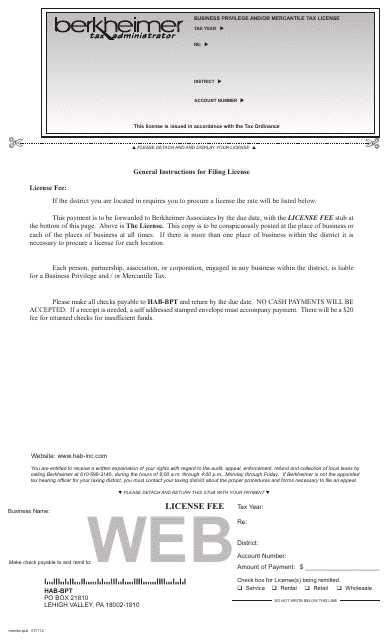

This form is used for obtaining a Business Privilege and/or Mercantile Tax License in the Lehigh Valley, Pennsylvania.

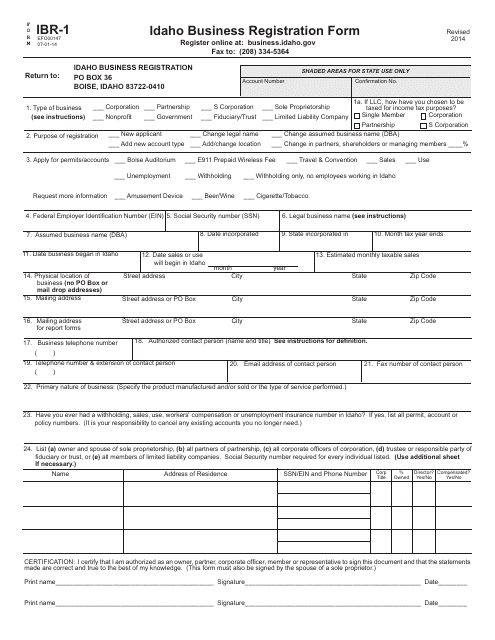

This type of document is used for registering a business in the state of Idaho.

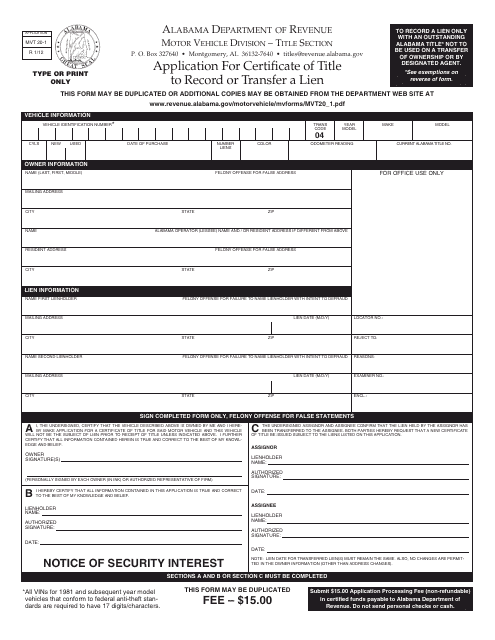

This form is used for applying for a certificate of title in Alabama, in order to record or transfer a lien on a vehicle.

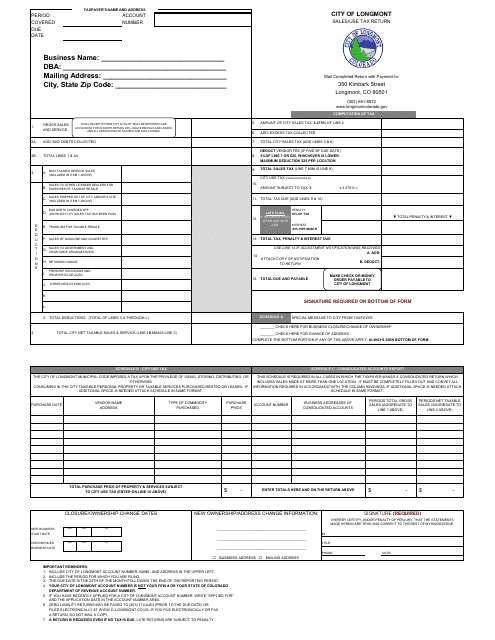

This form is used to report and pay sales and use taxes to the City of Longmont, Colorado. It is used by businesses and individuals who have made taxable sales or purchases within the city.

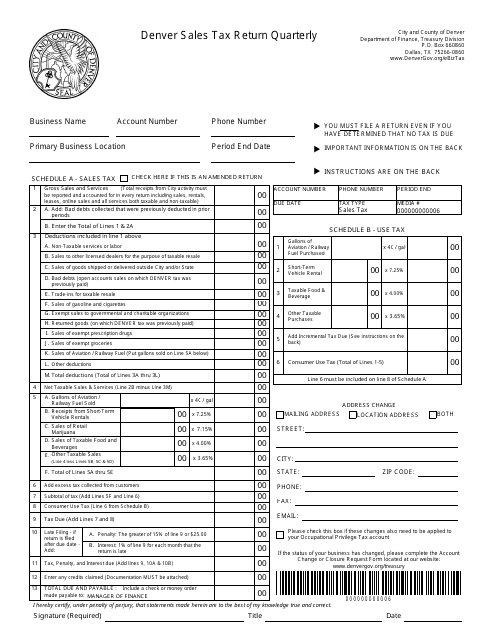

This document is used for reporting and paying sales tax on a quarterly basis for businesses operating in the City and County of Denver, Colorado.

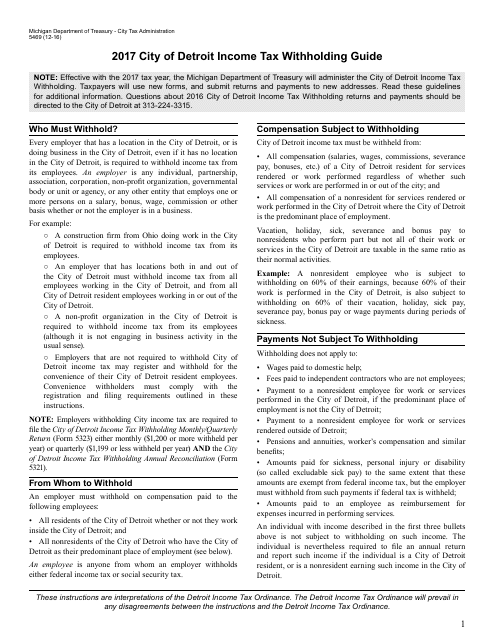

This Form is used for withholding income tax in the City of Detroit, Michigan. It provides instructions on how to correctly complete Form 5489 and comply with the city's tax regulations.

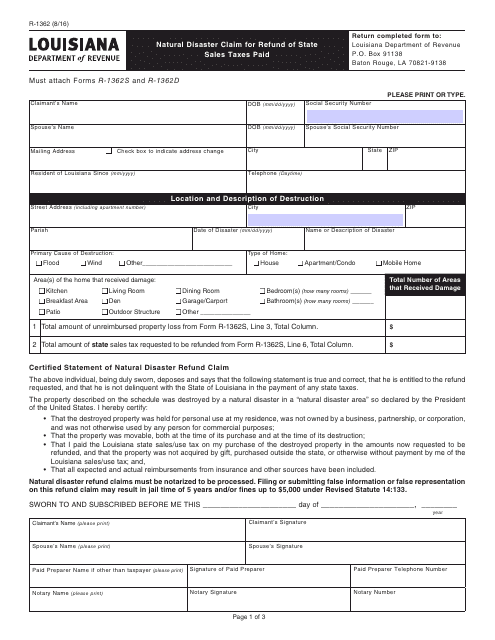

This form is used for filing a claim to receive a refund on state sales taxes paid in Louisiana due to a natural disaster.

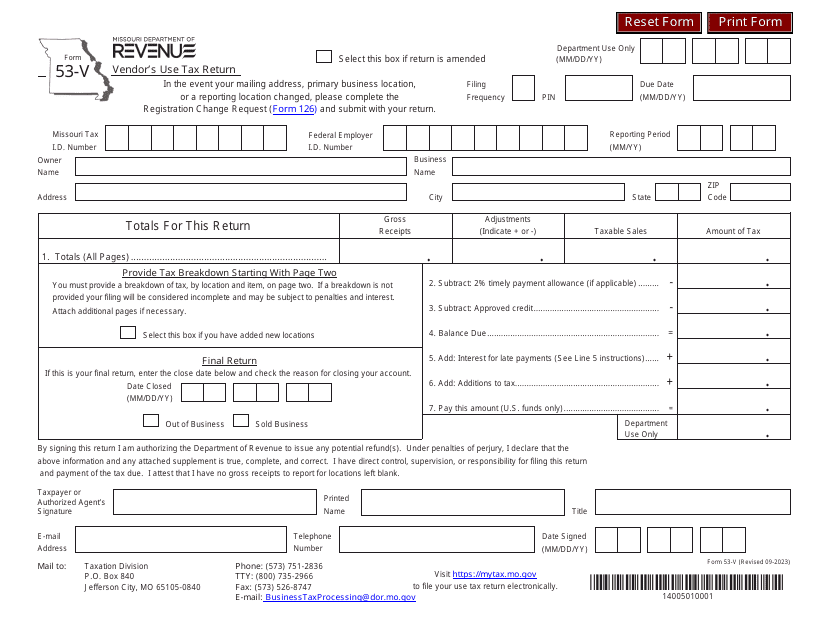

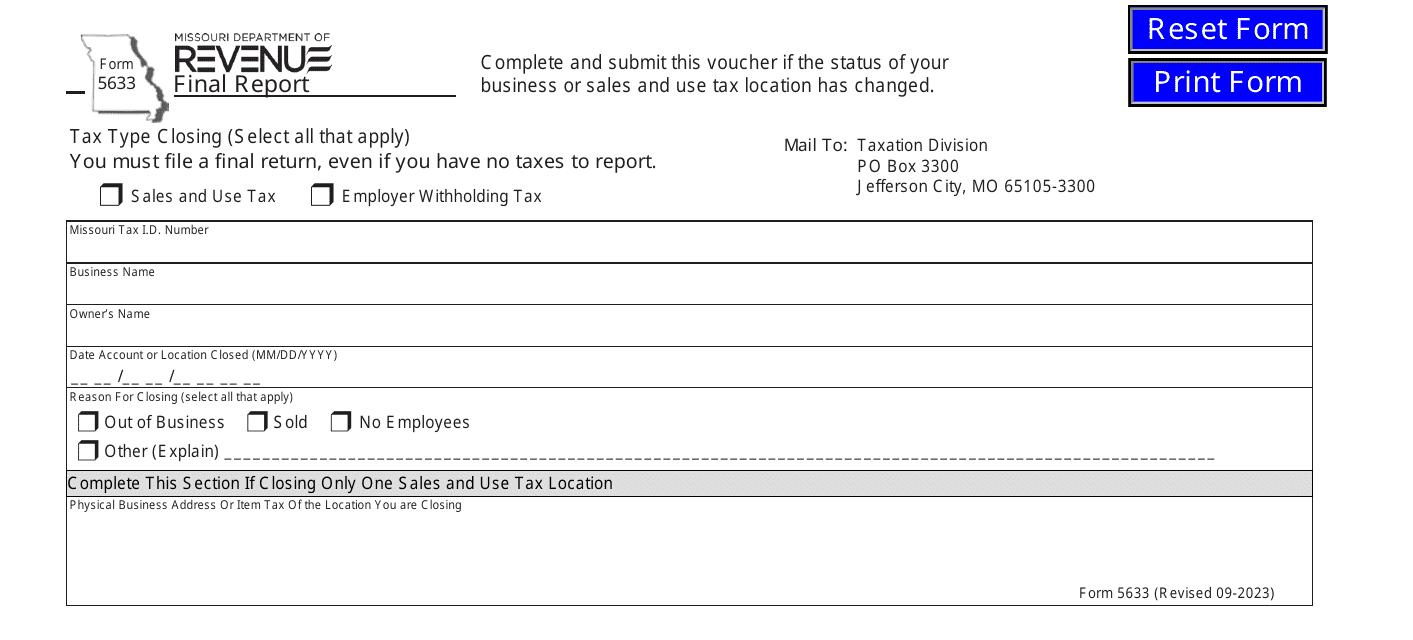

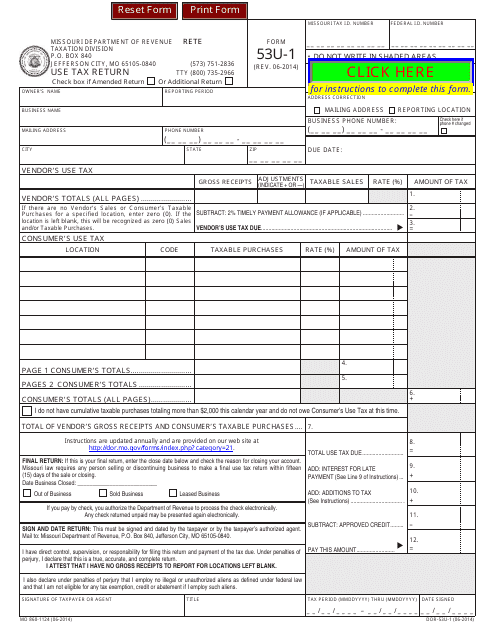

This Form is used for reporting and paying use tax in the state of Missouri. Use tax is owed on taxable items that were purchased tax-free and used in Missouri. The Form 53U-1 is used to calculate the use tax owed and submit it to the Missouri Department of Revenue.

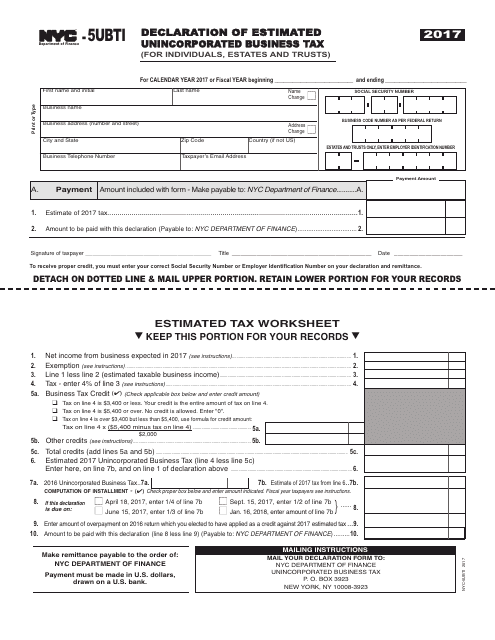

This Form is used for individuals, estates, and trusts in New York City to declare their estimated unincorporated business tax.

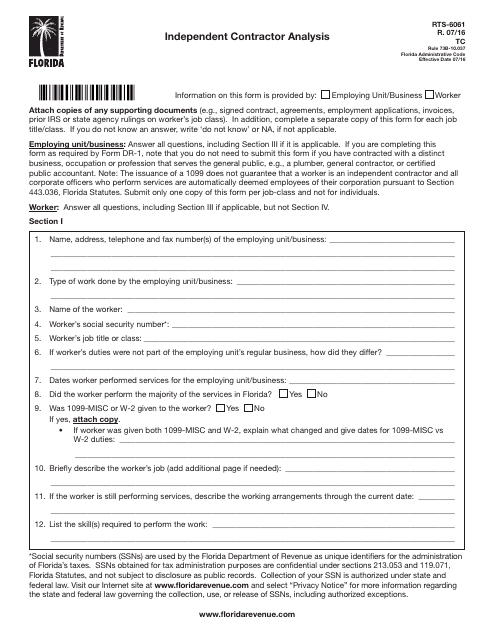

This form is used for conducting an independent contractor analysis in the state of Florida.

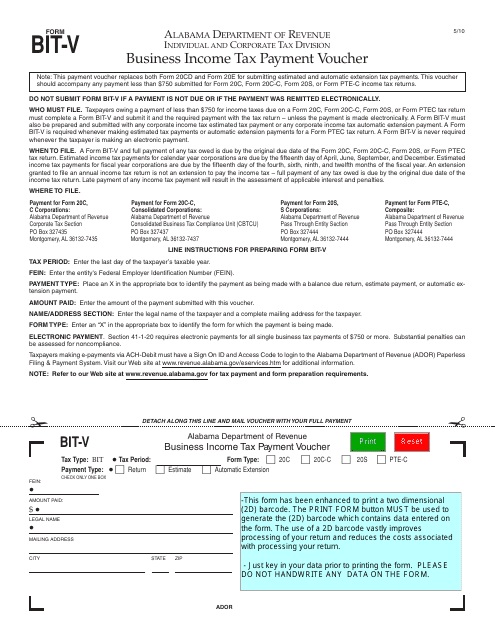

This Form is used for submitting business income tax payment in the state of Alabama.

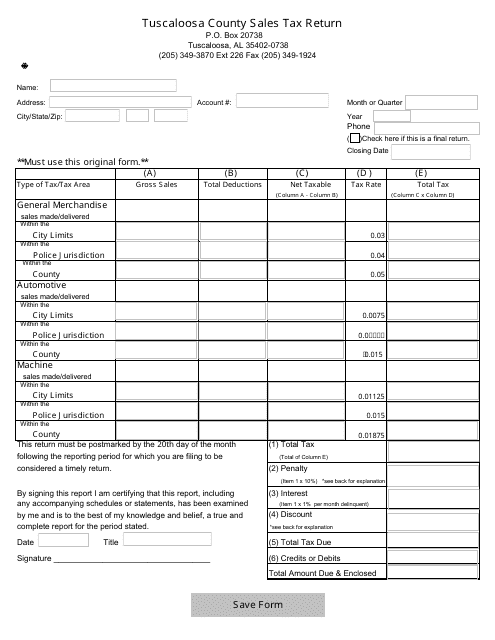

This form is used for submitting sales tax returns to the City of Tuscaloosa, Alabama.

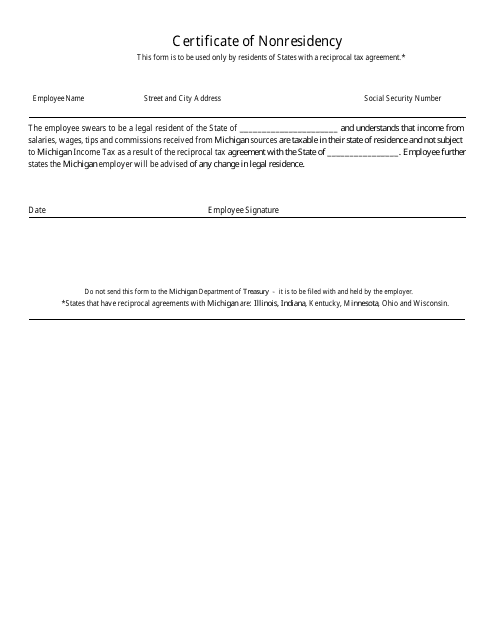

This document certifies that an individual does not reside in Michigan. It may be required for tax purposes or to show their nonresident status for certain benefits or privileges.

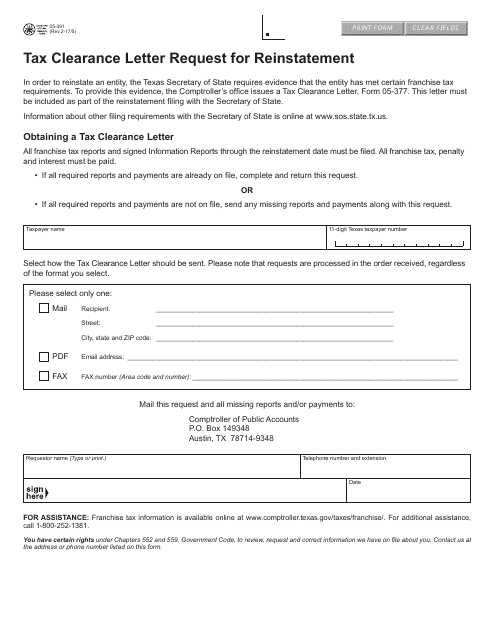

This form is used for requesting a tax clearance letter for reinstatement in the state of Texas.

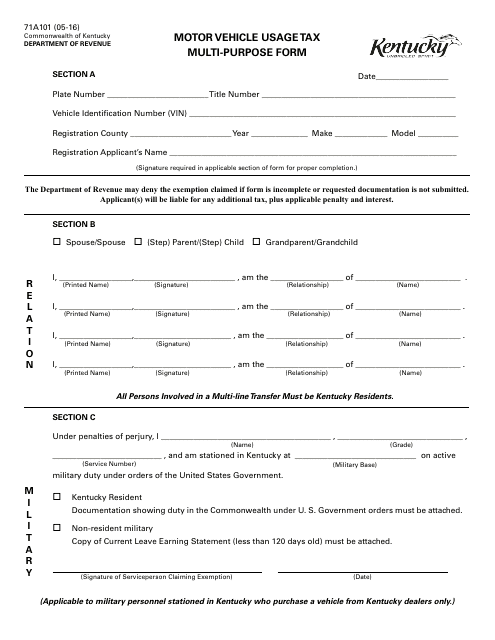

This form is used for reporting and paying motor vehicle usage tax in Kentucky. It is a multipurpose form that can be used for various purposes related to motor vehicle taxation.

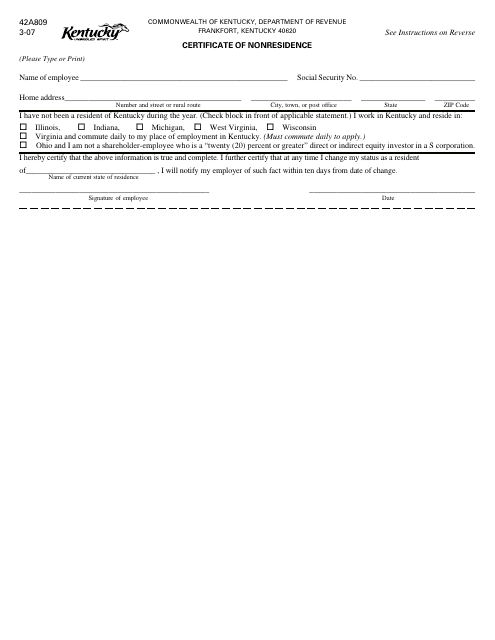

This document is used for obtaining a Certificate of Nonresidence in the state of Kentucky. It is typically required for individuals who are claiming nonresident status for tax or other purposes.

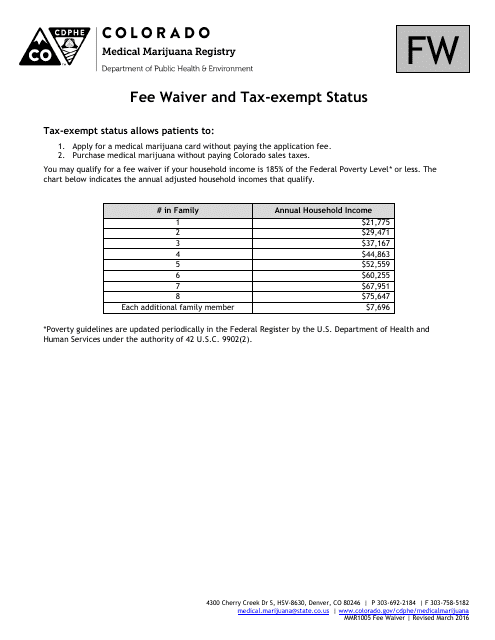

This document is used to request a fee waiver or tax-exempt status in the state of Colorado.

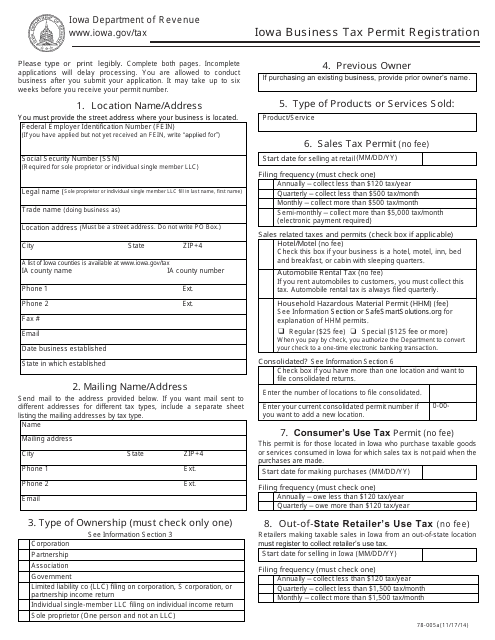

This form is used for business owners in Iowa to register for a tax permit.

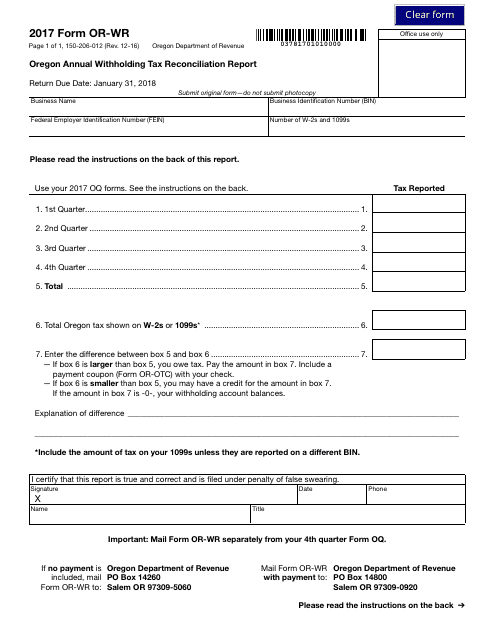

This Form is used for reporting annual withholding tax in Oregon.

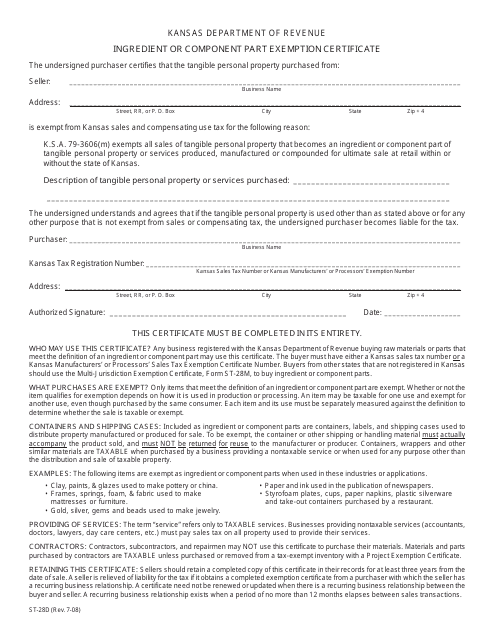

This document is used for claiming an exemption on certain ingredients or component parts in Kansas.

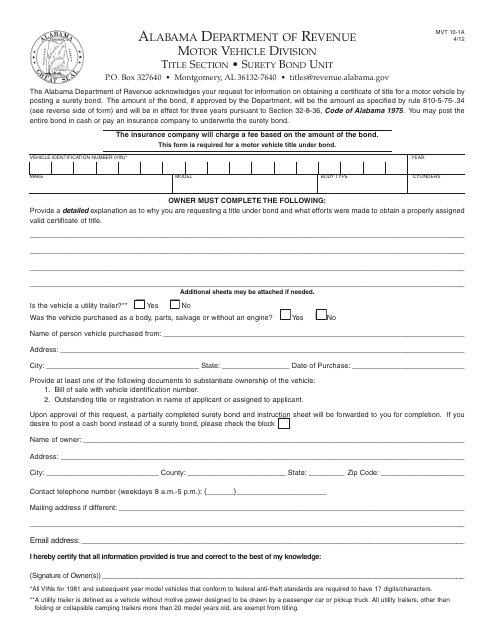

This form is used for requesting a surety bond in Alabama.

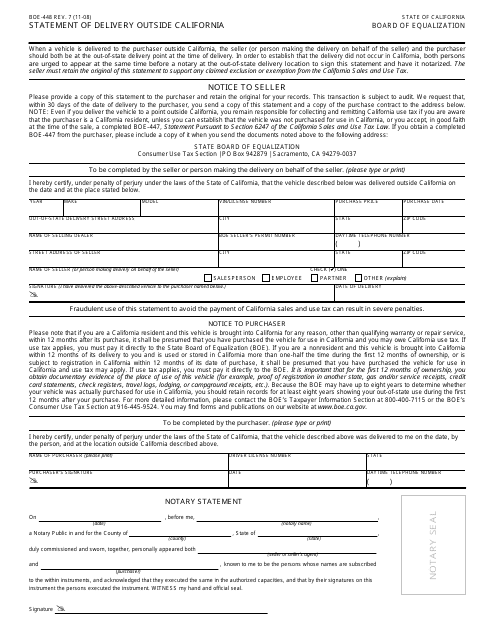

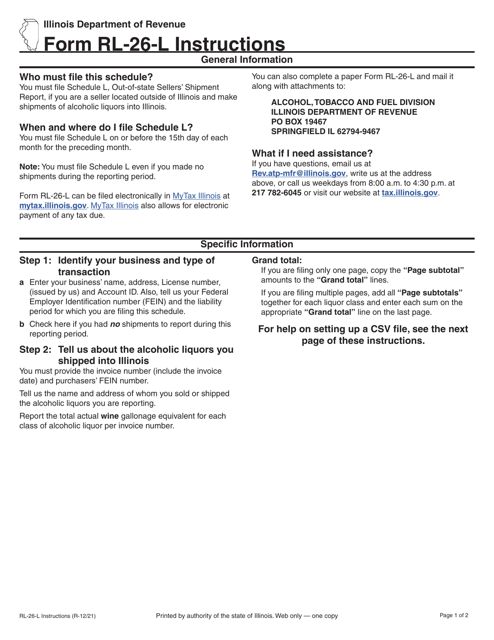

This form is used for reporting deliveries made outside of California for businesses based in California.

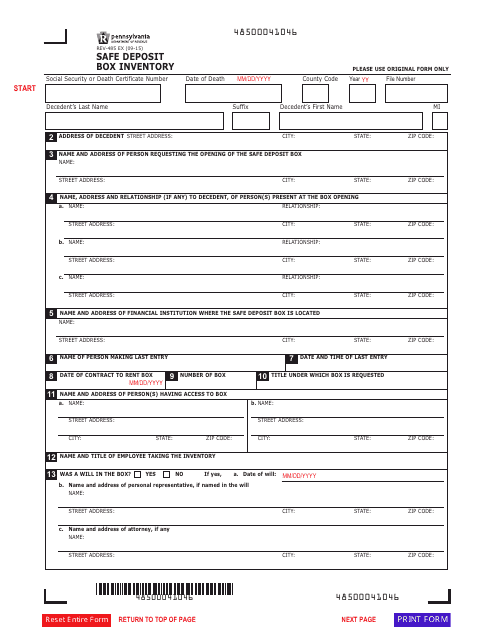

This Form is used for creating an inventory of items stored in a safe deposit box in Pennsylvania. It helps the owner keep track of their belongings and provides security.

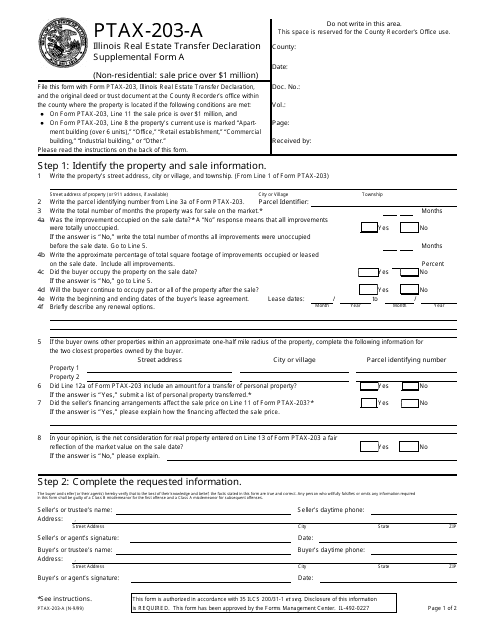

This Form is used for providing additional information for the Real Estate Transfer Declaration in Illinois.

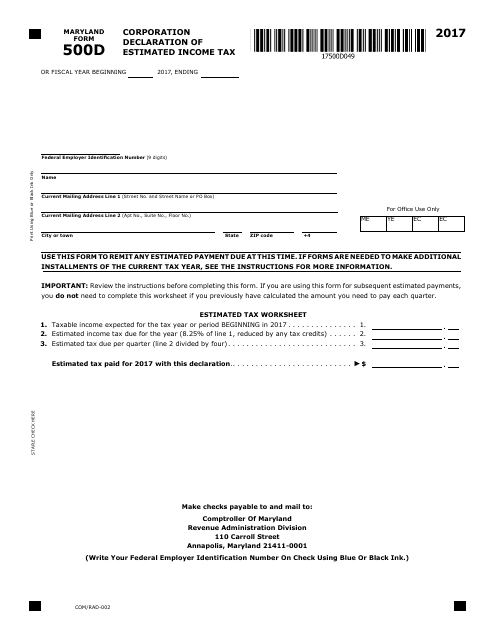

This form is used for Maryland corporations to declare their estimated income tax for the year.

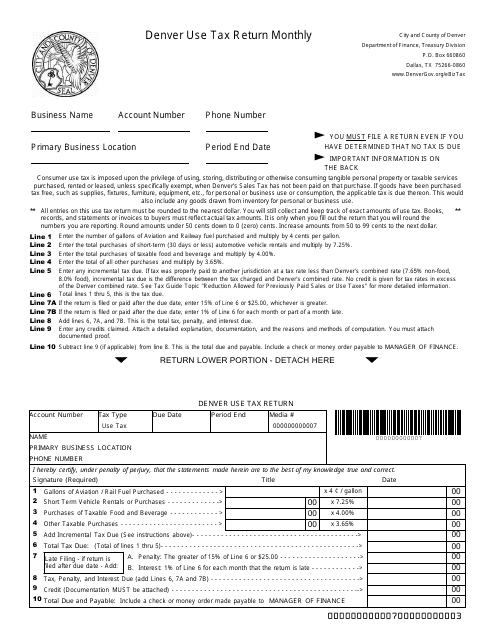

This Form is used for reporting and paying monthly use tax to the City and County of Denver, Texas.

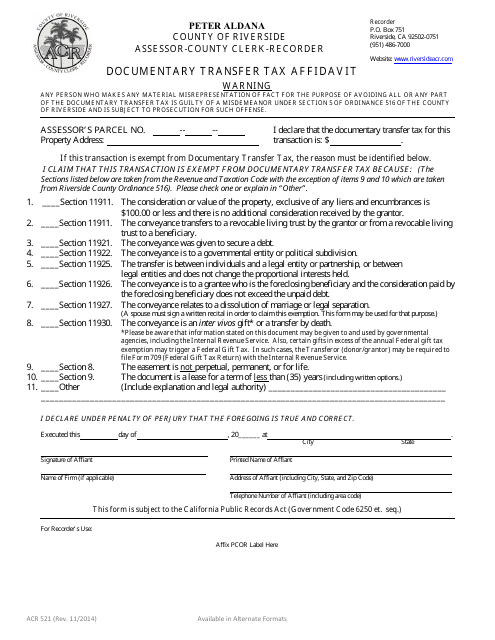

This Form is used for filing a Documentary Transfer Tax Affidavit in Riverside County, California. It is required when transferring real property and helps the county assess the appropriate transfer tax.

This Form is used for reconciling withholding taxes for the City of Vandalia, Ohio.

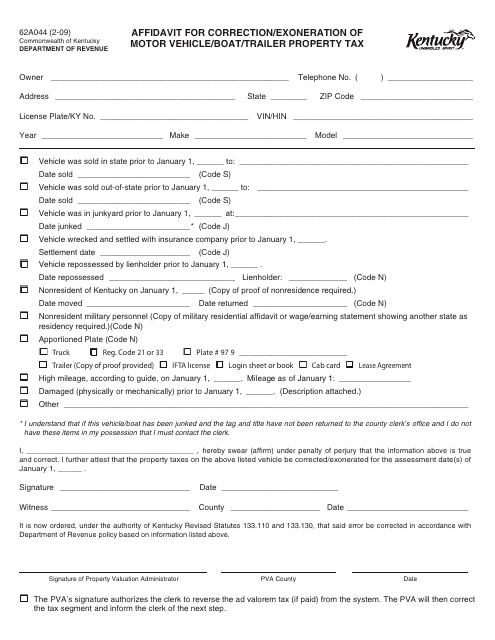

This form is used for correcting or requesting exemption from property tax for motor vehicles, boats, or trailers in Kentucky.

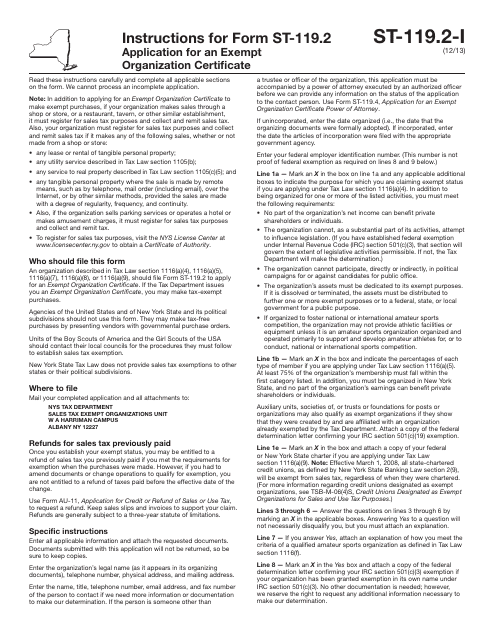

This document is used for applying for an Exempt Organization Certificate in New York.

This Form is used for submitting quarterly occupational privilege tax return to the City and County of Denver, Texas.