Fill and Sign Internal Revenue Service (IRS) Forms

The Internal Revenue Service (usually referred to as the IRS) is a federal agency under the control of the U.S. Department of Treasury that handles the collection of federal income taxes from individuals and organizations alike. Being the major source of funding for the federal government, this agency has issued multiple IRS fillable forms you can fill out and send along with the money you owe. The IRS makes sure everyone pays their fair share of taxes, so you must be prepared to submit the required documentation and the accurate amount of payment on time.

Popular Internal Revenue Service (IRS) Forms

With the help of our guide, you will know more about the most widely used IRS tax forms, their purpose, and particular characteristics. Whether you need to file taxes for yourself and your family or you represent a business or a government entity, current documentation, as well as IRS prior-year forms, can be useful not only for reporting income but also for retaining proper records in case of an audit and any disputes with the IRS. You can download IRS free fillable forms and comply with present laws and regulations that govern mandatory tax filing.

- IRS Form 1040, U.S. Individual Income Tax Return, is the default tax return used by taxpayers to report their annual income;

- IRS Form 1040-SR, U.S. Tax Return for Seniors, is a simplified tax return that was designed for senior citizens (age 65 and older) to facilitate tax filing for them;

- IRS Form 1040-ES, Estimated Tax for Individuals, is a document completed by individuals to calculate and pay tax on income not withheld at its source (for instance, income from self-employment, dividends, interest, etc.);

- IRS Form W-4, Employee's Withholding Allowance Certificate, is prepared by the employee once they start their new job to let the employer know how much tax must be withheld from future paychecks;

- IRS Form W-9, Request for Taxpayer Identification Number and Certification, is used by employers and various entities to request verification of the individual's personal information, including their taxpayer identification number;

- IRS Form 4506-T, Request For Transcript of Tax Return, is filed when you need to access a copy of a previously submitted tax return - usually, to provide a lender or financial institution with this financial information.

- IRS Form 941, Employer's Quarterly Federal Tax Return, used by most employers contains a report of the total amount of tax withheld from employees' paychecks during the reporting period.

- IRS Form W-2, Wage and Tax Statement, is sent by employers to the IRS and employees to confirm annual wages received by each employee and the amount of taxes deducted from salaries

- IRS Form 9465, Installment Agreement Request, is used by taxpayers who cannot pay all taxes at once and need to ask for an installment plan to deal with their obligations one step at a time.

- IRS Form SS-4, Application for Employer Identification Number, can be completed by organizations that need to obtain an Employer Identification Number (EIN) so that tax records for their business are created and they can file taxes.

- IRS Form W-7, Application for IRS Individual Taxpayer Identification Number, is typically filled out by taxpayers without a social security number to identify themselves and report taxes to the IRS.

Below you can find different IRS 1099 Forms used to report income that does not include typical wages and salaries - they are known as information returns as opposed to traditional tax returns:

- IRS Form 1099-MISC, Miscellaneous Income, contains information about business payments received by self-employed individuals and independent contractors, as well as various compensation (awards, prizes, royalties, etc.).

- IRS Form 1099-NEC, Nonemployee Compensation, is generally prepared by businesses that report nonemployee payments - for example, if the company had to pay an independent contractor for their services, the information about this transaction must be sent to the IRS.

- IRS Form 1099-DIV, Dividends and Distributions, is filled out by financial institutions to inform the IRS and their clients about the total amount of distributions and dividends received during the reporting period.

- IRS Form 1099-INT, Interest Income, is given by payers of interest (banks, funds, etc.) to the IRS and all investors to indicate all types of interest income received during the reporting period.

- If you have original issue discount interest of at least $10 included in your income, report interest and investment income you have received from bonds, notes, debentures, and certificates on IRS Form 1099-OID, Original Issue Discount.

Browse IRS Forms by Number

You are welcome to use our wide-ranging library of fillable IRS Forms. With the help of our website, you can download the latest editions of documentation that must be filed in 2022 and 2023, read the instructions that show all aspects of the filing process, learn when and where to file IRS returns and applications, and maintain proper records for your company or personal use.

IRS Forms — 0-500

- IRS Form 11-C, Occupational Tax and Registration Return for Wagering;

- IRS Form 23, Application for Enrollment to Practice Before the Internal Revenue Service;

- IRS Form 56, Notice Concerning Fiduciary Relationship;

- IRS Form 56-F, Notice Concerning Fiduciary Relationship of Financial Institution;

- IRS Form 211, Application for Reward for Original Information;

- IRS Form 211-A, State or Local Law Enforcement;

- IRS Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals;

- IRS Form 433-A, (OIC) Collection Information Statement for Wage Earners and Self-Employed Individuals;

- IRS Form 433-A, (SP) Collection Information Statement for Wage Earners and Self-Employed Individuals (Spanish);

- IRS Form 433-B, Collection Information Statement for Businesses;

- IRS Form 433-B, (OIC) Collection Information Statement for Businesses;

- IRS Form 433-B, (SP) Collection Information Statement for Businesses (Spanish);

- IRS Form 433-D, Installment Agreement;

- IRS Form 433-D, (SP) Installment Agreement (Spanish);

- IRS Form 433-F, Collection Information Statement;

- IRS Form 433-F, (SP) Collection Information Statement (Spanish);

- IRS Form 433-H, Installment Agreement Request and Collection Information Statement;

- IRS Form 433-H, (SP) Installment Agreement Request and Collection Information Statement (Spanish);

- IRS Form 461, Limitation on Business Losses.

IRS Forms — 500-1000

- IRS Form 637, Application for Registration (For Certain Excise Tax Activities);

- IRS Form 656, Offer in Compromise;

- IRS Form 656-L, Offer in Compromise (Doubt as to Liability);

- IRS Form 656-PPV, Offer in Compromise - Periodic Payment Voucher;

- IRS Form 673, Statement for Claiming Exemption from Withholding on Foreign Earned Income Eligible for the Exclusion(s) Provided by Section 911;

- IRS Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return;

- IRS Form 706 (Schedule R-1), Generating-Skipping Transfer Tax;

- IRS Form 706-A, United States Additional Estate Tax Return;

- IRS Form 706-CE, Certification of Payment of Foreign Death Tax;

- IRS Form 706-GS(D), Generation-Skipping Transfer Tax Return for Distributions;

- IRS Form 706-GS(D-1), Notification of Distribution From a Generation-Skipping Trust;

- IRS Form 706-GS(T), Generation Skipping Transfer Tax Return for Terminations;

- IRS Form 706-NA, United States Estate (and Generation-Skipping Transfer) Tax Return Estate of nonresident not a citizen of the United States;

- IRS Form 706-QDT, U.S. Estate Tax Return for Qualified Domestic Trusts;

- IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return;

- IRS Form 712, Life Insurance Statement;

- IRS Form 720, Quarterly Federal Excise Tax Return;

- IRS Form 720-CS, Carrier Summary Report;

- IRS Form 720-TO, Terminal Operator Report;

- IRS Form 720-X, Amended Quarterly Federal Excise Tax Return;

- IRS Form 730, Monthly Tax Return for Wagers;

- IRS Form 843, Claim for Refund and Request for Abatement;

- IRS Form 851, Affiliations Schedule;

- IRS Form 886-H-DEP, Supporting Documents for Dependency Exemptions;

- IRS Form 886-H-DEP (SP), Supporting Documents for Dependency Exemptions;

- IRS Form 886-H-EIC, Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children;

- IRS Form 886-H-EIC (SP), Documents You Need to Provide So You Can Claim the Earned Income Credit on the Basis of a Qualifying Child or Children;

- IRS Form 886-H-HOH, Supporting Documents to Prove Head of Household Filing Status;

- IRS Form 886-H-HOH (SP), Supporting Documents To Prove Head of Household Filing Status;

- IRS Form 907, Agreement to Extend the Time to Bring Suit;

- IRS Form 911, Request for Taxpayer Advocate Service Assistance (And Application for Taxpayer Assistance Order);

- IRS Form 911 (SP), Request for Taxpayer Advocate Service Assistance (And Application for Taxpayer Assistance Order);

- IRS Form 921, Consent to Extend the Time to Assess Income Tax;

- IRS Form 921-A, Consent Fixing Period of Limitation on Assessment of Income and Profits Tax;

- IRS Form 921-I, Consent Fixing Period of Limitation on Assessment of Income and Profits Tax;

- IRS Form 921-P, Consent Fixing Period of Limitation on Assessment of Income and Profits Tax;

- IRS Form 926, Return by a U.S. Transferor of Property to a Foreign Corporation;

- IRS Form 928, Taxable Fuel Bond;

- IRS Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return;

- IRS Form 940 (PR), Employer's Annual Federal Unemployment (FUTA) Tax Return;

- IRS Form 940 (PR) (Schedule A), Multi-State Employer and Credit Reduction Information;

- IRS Form 940 (Schedule A), Multi-State Employer and Credit Reduction Information;

- IRS Form 940 (Schedule R), Allocation Schedule for Aggregate Form 940 Filers;

- IRS Form 940-B, Request for Verification of Credit Information Shown on Form 940;

- IRS 941 Forms, Schedules, and Instructions;

- IRS Form 943, Employer's Annual Federal Tax Return for Agricultural Employees;

- IRS Form 943 (PR), Employer's Annual Federal Tax Return for Agricultural Employees;

- IRS Form 943 (Schedule R), Allocation Schedule for Aggregate Form 943 Filers;

- IRS Form 943-A, Agricultural Employer's Record of Federal Tax Liability;

- IRS Form 943-A (PR), Agricultural Employer's Record of Federal Tax Liability;

- IRS Form 943-X, Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund;

- IRS Form 943-X (PR), Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund;

- IRS 944 Forms, Schedules, and Instructions;

- IRS 945 Forms, Schedules, and Instructions;

- IRS Form 952, Consent to Extend Period of Limitation on Assessment of Income Taxes;

- IRS Form 965, Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System;

- IRS Form 965 (Schedule D), U.S. Shareholder's Aggregate Foreign Cash Position;

- IRS Form 965 (Schedule F), Foreign Taxes Deemed Paid by Domestic Corporation;

- IRS Form 965 (Schedule H), Amounts Reported on Forms 1116 and 1118 and Disallowed Foreign Taxes;

- IRS Form 965-A, Individual Report of Net 965 Tax Liability;

- IRS Form 965-B, Corporate and Real Estate Investment Trust (REIT) Report of Net 965 Tax Liability and Electing REIT Report of 965 Amounts;

- IRS Form 965-C, Transfer Agreement Under Section 965(h)(3);

- IRS Form 965-D, Transfer Agreement Under Section 965(i)(2);

- IRS Form 965-E, Consent Agreement Under Section 965(i)(4)(D);

- IRS Form 966, Corporate Dissolution or Liquidation;

- IRS Form 970, Application to Use Lifo Inventory Method;

- IRS Form 972, Consent of Shareholder to Include Specific Amount in Gross Income Form 973 Corporation Claim for Deduction for Consent Dividends;

- IRS Form 976, Claim for Deficiency Dividends Deductions by a Personal Holding Company, Regulated Investment Company, or Real Estate Investment Trust;

- IRS Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment);

- IRS 990 Forms, Schedules, and Instructions.

IRS Forms — 1000-1500

- IRS Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code;

- IRS Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code;

- IRS Form 1023-Interactive, Interactive version of Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code;

- IRS Form 1024, Application for Recognition of Exemption Under Section 501(a);

- IRS Form 1024-A, Application for Recognition of Exemption Under Section 501(c)(4) of the Internal Revenue Code;

- IRS Form 1028, Application for Recognition of Exemption Under Section 521 of the Internal Revenue Code;

- IRS 1040 Forms, Schedules, and Instructions;

- IRS Form 1041, U.S. Income Tax Return for Estates and Trusts;

- IRS Form 1041 (Schedule D), Capital Gains and Losses;

- IRS Form 1041 (Schedule I), Alternative Minimum Tax - Estates and Trusts;

- IRS Form 1041 (Schedule J), Accumulation Distribution for Certain Complex Trusts;

- IRS Form 1041 (Schedule K-1), Beneficiary's Share of Income, Deductions, Credits, etc.;

- IRS Form 1041-A, U.S. Information Return Trust Accumulation of Charitable Amounts;

- IRS Form 1041-ES, Estimated Income Tax for Estates and Trusts;

- IRS Form 1041-N, U.S. Income Tax Return for Electing Alaska Native Settlement Trusts;

- IRS Form 1041-QFT, U.S. Income Tax Return for Qualified Funeral Trusts;

- IRS Form 1041-T, Allocation of Estimated Tax Payments to Beneficiaries;

- IRS Form 1041-V, Payment Voucher;

- IRS Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons;

- IRS Form 1042 (Schedule Q), Tax Liability of Qualified Derivatives Dealer (QDD);

- IRS Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding;

- IRS Form 1042-T, Annual Summary and Transmittal of Forms 1042-S;

- IRS Form 1045, Application for Tentative Refund;

- IRS 1065 Forms, Schedules, and Instructions;

- IRS Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return;

- IRS Form 1066 (Schedule Q), Quarterly Notice to Residual Interest Holder of REMIC Taxable Income or Net Loss Allocation;

- IRS 1094 Forms, Schedules, and Instructions;

- IRS 1095 Forms, Schedules, and Instructions;

- IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns (Info Copy Only);

- IRS Form 1097-BTC, Bond Tax Credit;

- IRS 1098 Forms, Schedules, and Instructions;

- IRS 1099 Forms, Schedules, and Instructions;

- IRS Form 1116, Foreign Tax Credit (Individual, Estate, or Trust);

- IRS Form 1117, Income Tax Surety Bond;

- IRS Form 1118, Foreign Tax Credit - Corporations;

- IRS Form 1118 (Schedule I), Reduction of Foreign Oil and Gas Taxes;

- IRS Form 1118 (Schedule J), Adjustments to Separate Limitation Income (Loss) Categories for Determining Numerators of Limitation Fractions, Year-End Recharacterization Balances, and Overall Foreign and Domestic Loss Account Bala;

- IRS Form 1118, (Schedule K) Foreign Tax Carryover Reconciliation Schedule;

- IRS 1120 Forms, Schedules, and Instructions;

- IRS Form 1122, Authorization and Consent of Subsidiary Corporation to be Included in a Consolidated Income Tax Return;

- IRS Form 1125-A, Cost of Goods Sold;

- IRS Form 1125-E, Compensation of Officers;

- IRS Form 1127, Application for Extension of Time for Payment of Tax Due to Undue Hardship;

- IRS Form 1128, Application to Adopt, Change or Retain a Tax Year;

- IRS Form 1138, Extension of Time For Payment of Taxes By a Corporation Expecting a Net Operating Loss Carryback;

- IRS Form 1139, Corporation Application for Tentative Refund;

- IRS Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer;

- IRS Form 1363, Export Exemption Certificate.

IRS Forms — 2000-2500

- IRS Form 2032, Contract Coverage Under Title II of the Social Security Act;

- IRS Form 2063, U.S. Departing Alien Income Tax Statement;

- IRS Form 2106, Employee Business Expenses;

- IRS Form 2120, Multiple Support Declaration;

- IRS Form 2159, Payroll Deduction Agreement;

- IRS Form 2159 (SP), Payroll Deduction Agreement;

- IRS Form 2210, Underpayment of Estimated Tax by Individuals, Estates and Trusts;

- IRS Form 2210-F, Underpayment of Estimated Tax By Farmers and Fishermen;

- IRS Form 2220, Underpayment of Estimated Tax By Corporations;

- IRS Form 2290, Heavy Highway Vehicle Use Tax Return;

- IRS Form 2290 (SP), Declaracion del Impuesto sobre el Uso de Vehiculos Pesados en las Carreteras;

- IRS Form 2350, Application for Extension of Time to File U.S. Income Tax Return;

- IRS Form 2350 (SP), Application for Extension of Time to File U.S. Income Tax Return;

- IRS Form 2438, Undistributed Capital Gains Tax Return;

- IRS Form 2439, Notice to Shareholder of Undistributed Long-Term Capital Gains;

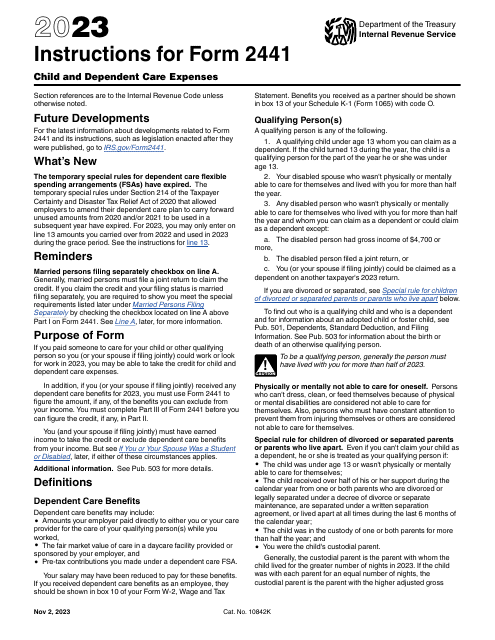

- IRS Form 2441, Child and Dependent Care Expenses.

IRS Forms — 2500-3000

- IRS Form 2553, Election by a Small Business Corporation;

- IRS Form 2555, Foreign Earned Income;

- IRS Form 2587, Application for Special Enrollment Examination;

- IRS Form 2624, Consent for Third Party Contact;

- IRS Form 2678, Employer/Payer Appointment of Agent;

- IRS Form 2848, Power of Attorney and Declaration of Representative;

- IRS Form 2848 (SP), Power of Attorney and Declaration of Representative.

IRS Forms — 3000-3500

- IRS Form 3115, Application for Change in Accounting Method;

- IRS Form 3468, Investment Credit;

- IRS Form 3491, Consumer Cooperative Exemption Application.

IRS Forms — 3500-4000

- IRS 3520 Forms, Schedules, and Instructions;

- IRS Form 3881, ACH Vendor Miscellaneous Payment Enrollment;

- IRS Form 3881-A, ACH Vendor/Miscellaneous Payment Enrollment - HCTC;

- IRS Form 3903, Moving Expenses;

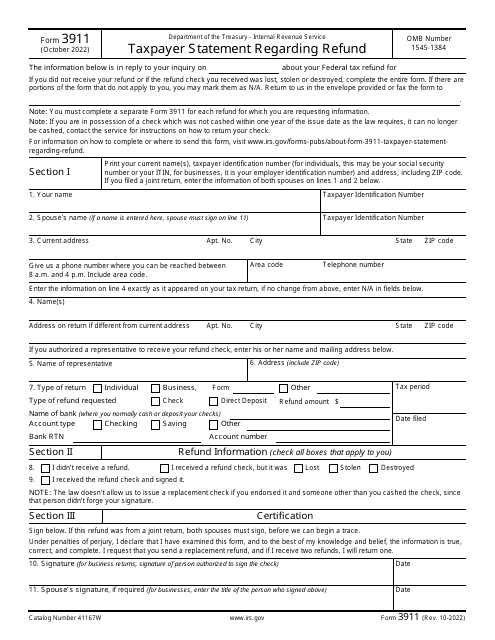

- IRS Form 3911, Taxpayer Statement Regarding Refund;

- IRS Form 3911 (SP), Taxpayer Statement Regarding Refund;

- IRS Form 3921, Exercise of an Incentive Stock Option Under Section 422(b);

- IRS Form 3922, Transfer of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(c);

- IRS Form 3949-A, Information Referral.

IRS Forms — 4000-4500

- IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits;

- IRS 4070 Forms, Schedules, and Instructions;

- IRS Form 4089, Notice of Deficiency - Waiver;

- IRS Form 4136, Credit For Federal Tax Paid On Fuels;

- IRS Form 4137, Social Security and Medicare Tax On Unreported Tip Income;

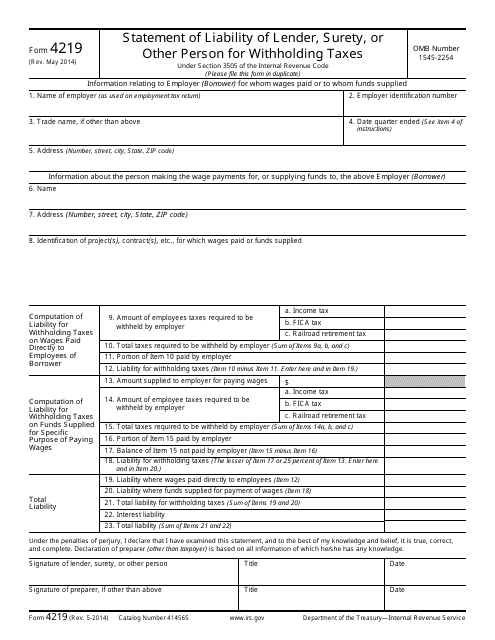

- IRS Form 4219, Statement of Liability of Lender, Surety, or Other Person for Withholding Taxes;

- IRS Form 4255, Recapture of Investment Credit;

- IRS Form 4361, Application for Exemption From Self-Employment Tax for Use By Ministers, Members of Religious Orders and Christian Science Practitioners;

- IRS Form 4419, Application for Filing Information Returns Electronically (FIRE);

- IRS Form 4421, Declarations - Executor's Commissioner's and Attorney's Fees;

- IRS Form 4422, Application for Certificate Discharging Property Subject To Estate Tax Lien;

- IRS Form 4423, Application for Filing Affordable Care Act (ACA) Information Returns;

- IRS Form 4461, Application for Approval of Master or Prototype or Volume Submitter Defined Contribution Plans;

- IRS Form 4461-A, Application for Approval of Master or Prototype or Volume Submitter Defined Benefit Plan;

- IRS Form 4461-B, Application for Approval of Master or Prototype or Volume Submitter Plans;

- IRS Form 4466, Corporation Application for Quick Refund of Overpayment of Estimated Tax.

IRS Forms — 4500-5000

- IRS Form 4506, Request for Copy of Tax Return;

- IRS Form 4506 (SP), Request for Copy of Tax Return;

- IRS Form 4506-A, Request for Public Inspection or Copy of Exempt or Political Organization;

- IRS Form 4506-C, IVES Request for Transcript of Tax Return;

- IRS Form 4506-F, Request for Copy of Fraudulent Tax Return;

- IRS Form 4506-T, Request for Transcript of Tax Return;

- IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript;

- IRS Form 4506T-EZ (SP), Short Form Request for Individual Tax Return Transcript;

- IRS Form 4562, Depreciation and Amortization (Including Information on Listed Property);

- IRS Form 4563, Exclusion of Income for Bona Fide Residents of American Samoa;

- IRS Form 4669, Statement of Payments Received;

- IRS Form 4670, Request for Relief of Payment of Certain Withholding Taxes;

- IRS Form 4684, Casualties and Thefts;

- IRS Form 4720, Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code;

- IRS Form 4768, Application for Extension of Time To File a Return and/or Pay U.S. Estate (and Generation-Skipping Transfer) Taxes;

- IRS Form 4797, Sales of Business Property;

- IRS Form 4808, Computation of Credit for Gift Tax;

- IRS Form 4810, Request for Prompt Assessment Under Internal Revenue Code Section 6501(d);

- IRS Form 4835, Farm Rental Income and Expenses;

- IRS Form 4852, Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.;

- IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return;

- IRS Form 4868 (SP), Application for Automatic Extension of Time to File U.S. Individual Income Tax Return;

- IRS Form 4876-A, Election to Be Treated as an Interest Charge DISC;

- IRS Form 4952, Investment Interest Expense Deduction;

- IRS Form 4970, Tax on Accumulation Distribution of Trusts;

- IRS Form 4972, Tax on Lump-Sum Distributions;

- IRS Form 4977, Schedule of Tax Liability.

IRS Forms — 5000-5500

- IRS Form 5074, Allocation of Individual Income Tax to Guam or the Commonwealth of the Northern Mariana Islands (CNMI);

- IRS Form 5129, Questionnaire-Filing Status, Exemptions, and Standard Deduction;

- IRS Form 5213, Election to Postpone Determination As To Whether the Presumption Applies That an Activity is Engaged in for Profit;

- IRS Form 5227, Split-Interest Trust Information Return;

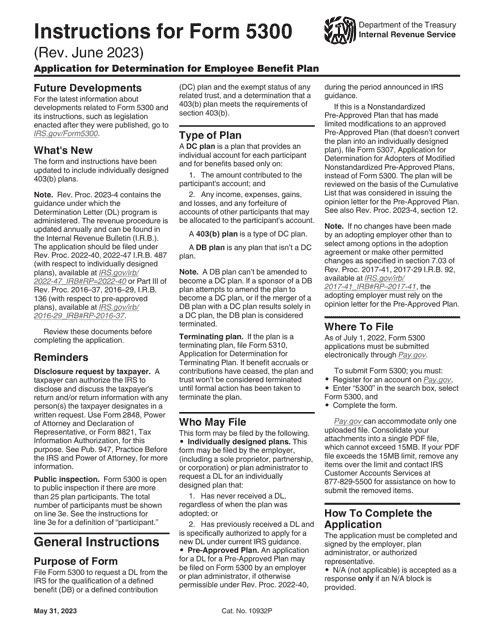

- IRS Form 5300, Application for Determination for Employee Benefit Plan;

- IRS Form 5304-SIMPLE, Savings Incentive Match Plan for Employees of Small Employers (SIMPLE) - Not for Use With a Designated Financial Institution;

- IRS Form 5305, Traditional Individual Retirement Trust Account;

- IRS Form 5305-A, Traditional Individual Retirement Custodial Account;

- IRS Form 5305-A-SEP, Salary Reduction and Other Elective Simplified Employee Pension - Individual Retirement AccountsContribution Agreement;

- IRS Form 5305-B, Health Savings Trust Account;

- IRS Form 5305-C, Health Savings Custodial Account;

- IRS Form 5305-E, Coverdell Education Savings Trust Account (Under section 530 of the Internal Revenue Code);

- IRS Form 5305-EA, Coverdell Education Savings Custodial Account (Under section 530 of the Internal Revenue Code);

- IRS Form 5305-R, Roth Individual Retirement Trust Account;

- IRS Form 5305-RA, Roth Individual Retirement Custodial Account;

- IRS Form 5305-RB, Roth Individual Retirement Annuity Endorsement;

- IRS Form 5305-S SIMPLE, Individual Retirement Trust Account;

- IRS Form 5305-SA SIMPLE, Individual Retirement Custodial Account;

- IRS Form 5305-SEP, Simplified Employee Pension - Individual Retirement Accounts Contribution Agreement;

- IRS Form 5305-SIMPLE, Savings Incentive Match Plan for Employees of Small Employers (SIMPLE) - for Use With a Designated Financial Institution;

- IRS Form 5306, Application for Approval of Prototype or Employer Sponsored Individual Retirement Arrangement (IRA);

- IRS Form 5306-A, Application for Approval of Prototype Simplified Employee Pension (SEP) or Savings Incentive Match Plan for Employees of Small Employers (SIMPLE IRA Plan);

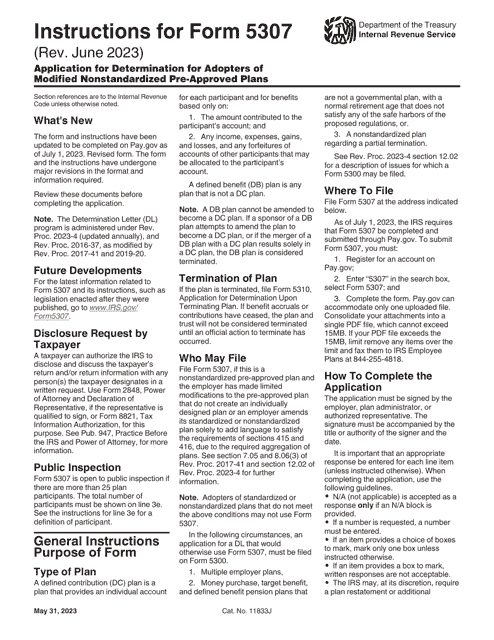

- IRS Form 5307, Application for Determination for Adopters of Modified Volume Submitter Plans;

- IRS Form 5308, Request for Change in Plan/Trust Year;

- IRS Form 5309, Application for Determination of Employee Stock Ownership Plan;

- IRS Form 5310, Application for Determination Upon Termination;

- IRS Form 5310-A, Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan Assets or Liabilities; Notice of Qualified Separate Lines of Business;

- IRS Form 5316, Application for Group or Pooled Trust Ruling;

- IRS Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts;

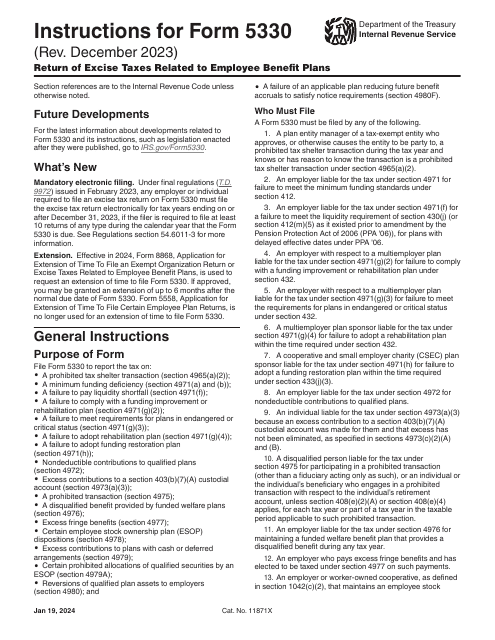

- IRS Form 5330, Return of Excise Taxes Related to Employee Benefit Plans;

- IRS Form 5405, Repayment of the First-Time Homebuyer Credit;

- IRS Form 5434, Joint Board for the Enrollment of Actuaries - Application for Enrollment;

- IRS Form 5434-A, Joint Board for the Enrollment of Actuaries - Application for Renewal of Enrollment;

- IRS Form 5452, Corporate Report of Nondividend Distributions;

- IRS Form 5471, Information Return of U.S. Persons With Respect To Certain Foreign Corporations;

- IRS Form 5471 (Schedule E), Income, War Profits, and Excess Profits Taxes Paid or Accrued;

- IRS Form 5471 (Schedule H), Current Earnings and Profits;

- IRS Form 5471 (Schedule I-1), Information for Global Intangible Low-Taxed Income;

- IRS Form 5471 (Schedule J), Accumulated Earnings and Profits (E&P) of Controlled Foreign Corporation;

- IRS Form 5471 (Schedule M), Transactions Between Controlled Foreign Corporation and Shareholders or Other Related Persons;

- IRS Form 5471 (Schedule O), Organization or Reorganization of Foreign Corporation, and Acquisitions and Dispositions of Its Stock;

- IRS Form 5471 (Schedule P), Previously Taxed Earnings and Profits of U.S. Shareholder of Certain Foreign Corporations;

- IRS Form 5471 (Schedule Q), CFC Income by CFC Income Groups;

- IRS Form 5471 (Schedule R), Distributions From a Foreign Corporation;

- IRS Form 5472, Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business;

- IRS Form 5495, Request for Discharge from Personal Liability Under Internal Revenue Code Section 2204 or 6905;

- IRS 5498 Forms, Schedules, and Instructions.

IRS Forms — 5500-6000

- IRS 5500 Forms, Schedules, and Instructions;

- IRS Form 5558, Application for Extension of Time to File Certain Employee Plan Returns;

- IRS Form 5578, Annual Certification of Racial Nondiscrimination for a Private School Exempt From Federal Income Tax;

- IRS Form 5646, Claim for Damage, Injury, or Death;

- IRS Form 5695, Residential Energy Credits;

- IRS Form 5713, International Boycott Report;

- IRS Form 5713 (Schedule A), International Boycott Factor (Section 999(c)(1));

- IRS Form 5713 (Schedule B), Specifically Attributable Taxes and Income (Section 999(c)(2));

- IRS Form 5713 (Schedule C), Tax Effect of the International Boycott Provisions;

- IRS Form 5735, American Samoa Economic Development Credit;

- IRS Form 5754, Statement by Person(s) Receiving Gambling Winnings;

- IRS Form 5768, Election/Revocation of Election By an Eligible Section 501(c)(3) Organization to Make Expenditures To Influence Legislation;

- IRS Form 5884, Work Opportunity Credit;

- IRS Form 5884-A, Employee Retention Credit;

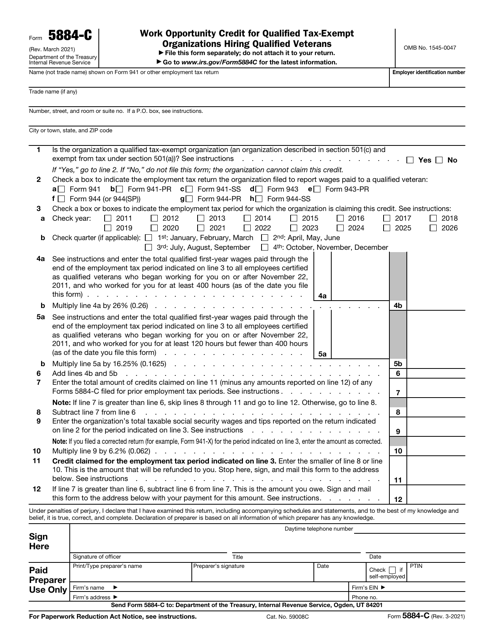

- IRS Form 5884-C, Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans.

IRS Forms — 6000-6500

- IRS Form 6069, Return of Excise Tax on Excess Contributions to Black Lung Benefit Trust Under Section 4953 and Computation of Section 192 Deduction;

- IRS Form 6088, Distributable Benefits From Employee Pension Benefit Plans;

- IRS Form 6118, Claim for Refund of Income Tax Return Preparer and Promoter Penalties;

- IRS Form 6197, Gas Guzzler Tax;

- IRS Form 6198, At-Risk Limitations;

- IRS Form 6251, Alternative Minimum Tax - Individuals;

- IRS Form 6252, Installment Sale Income;

- IRS Form 6478, Biofuel Producer Credit;

- IRS Form 6497, Information Return of Nontaxable Energy Grants or Subsidized Energy Financing.

IRS Forms — 6500-7000

- IRS Form 6524, Chief Counsel Application Honors/Summer;

- IRS Form 6627, Environmental Taxes;

- IRS Form 6729, QSS Site Review Sheet;

- IRS Form 6729-D, Site Review Sheet;

- IRS Form 6729-P, Partner Return Review Sheet;

- IRS Form 6729-R, QSS Return Review Sheet;

- IRS Form 6744, VITA/TCE Volunteer Assistor's Test/Retest;

- IRS Form 6765, Credit for Increasing Research Activities;

- IRS Form 6781, Gains and Losses From Section 1256 Contracts and Straddles.

IRS Forms — 7000-8000

- IRS Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns

- IRS Form 7036, Election under Section 1101(g)(4) of the Bipartisan Budget Act of 2015;

- IRS Form 7200, Advance Payment of Employer Credits Due to Covid-19;

- IRS Form 7200(SP), Anticipo De Pago De Creditos Del Empleador Debido Al Covid-19;

- IRS Form 7202, Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals;

- IRS Form 7202 (SP), Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals.

IRS Forms — 8000-8500

- IRS Form 8023, Elections Under Section 338 for Corporations Making Qualified Stock Purchases;

- IRS 8027 Forms, Schedules, and Instructions;

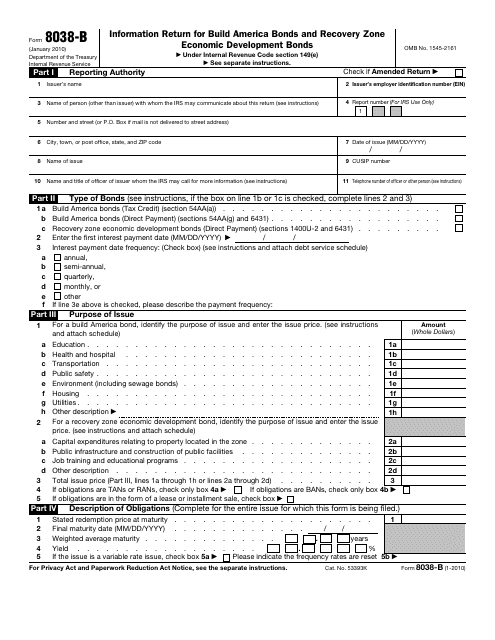

- IRS Form 8038, Information Return for Tax-Exempt Private Activity Bond Issues Form 8038-B Information Return for Build America Bonds and Recovery Zone Economic Development Bonds;

- IRS Form 8038-CP, Return for Credit Payments to Issuers of Qualified Bonds;

- IRS Form 8038-G, Information Return for Tax-Exempt Governmental Obligations;

- IRS Form 8038-GC, Information Return for Small Tax-Exempt Governmental Bond Issues, Leases, and Installment Sales;

- IRS Form 8038-R, Request for Recovery of Overpayments Under Arbitrage Rebate Provisions;

- IRS Form 8038-T, Arbitrage Rebate, Yield Reduction and Penalty in Lieu of Arbitrage Rebate;

- IRS Form 8038-TC, Information Return for Tax Credit Bonds and Specified Tax Credit Bonds;

- IRS Form 8050, Direct Deposit of Corporate Tax Refund Form 8082 Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR);

- IRS Form 8233, Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual;

- IRS Form 8274, Certification by Churches and Qualified Church-Controlled Organizations Electing Exemption From Employer Social Security and Medicare Taxes;

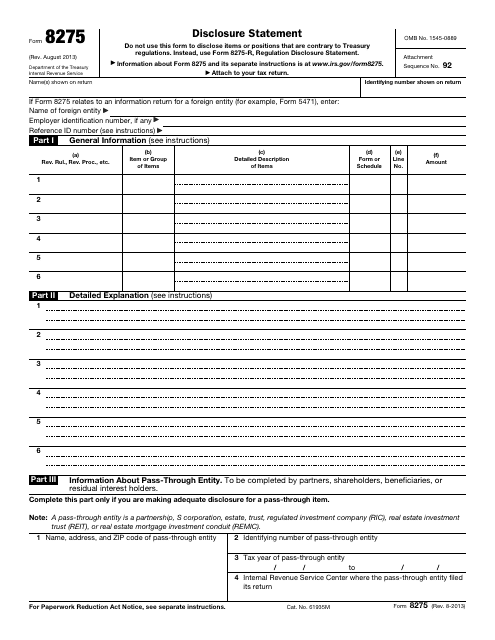

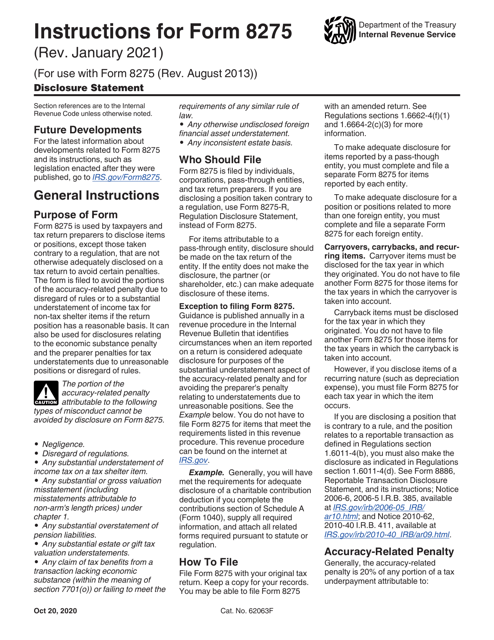

- IRS Form 8275, Disclosure Statement;

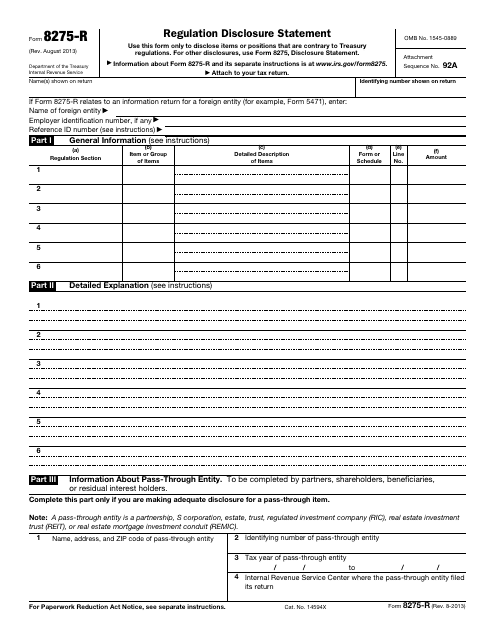

- IRS Form 8275-R, Regulation Disclosure Statement;

- IRS Form 8281, Information Return for Publicly Offered Original Issue Discount Instruments

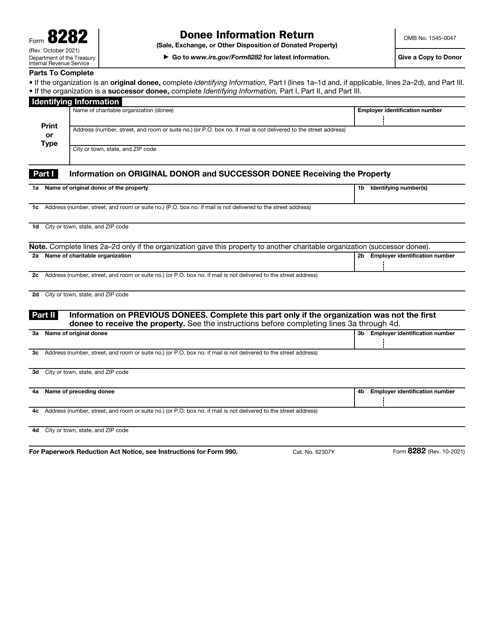

- IRS Form 8282, Donee Information Return (Sale, Exchange or Other Disposition of Donated Property);

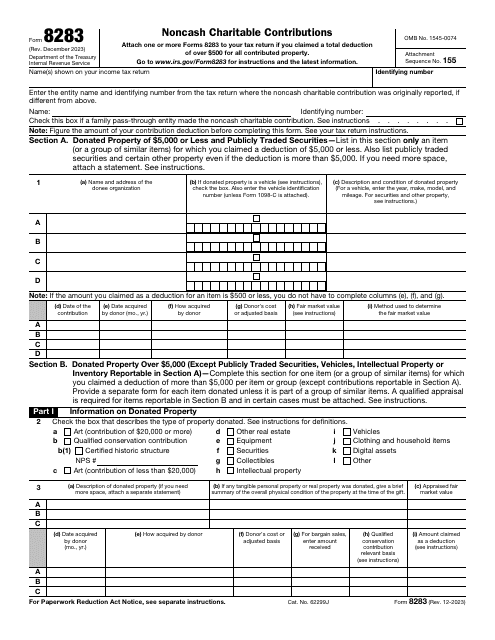

- IRS Form 8283, Noncash Charitable Contributions;

- IRS Form 8283-V, Payment Voucher for Filing Fee Under Section 170(f)(13);

- IRS Form 8288, U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests;

- IRS Form 8288-A, Statement of Withholding on Dispositions by Foreign Persons of U.S. Real Property Interests;

- IRS Form 8288-B, Application for Withholding Certificate for Dispositions by Foreign Persons of U.S. Real Property Interests;

- IRS Form 8300, Report of Cash Payments Over $10,000 Received In a Trade or Business;

- IRS Form 8300 (SP), Informe de Pagos en Efectivo en Exceso de $10,000 Recibidos en Una Ocupacion o Negocio;

- IRS Form 8302, Direct Deposit of Tax Refund of $1 Million or More;

- IRS Form 8308, Report of a Sale or Exchange of Certain Partnership Interests;

- IRS Form 8316, Information Regarding Request for Refund of Social Security Tax Erroneously Withheld on Wages Received by a Nonresident Alien on an F, J, or M Type Visa;

- IRS Form 8328, Carryforward Election of Unused Private Activity Bond Volume Cap;

- IRS Form 8329, Lender's Information Return for Mortgage Credit Certificates (MCCs);

- IRS Form 8330, Issuer's Quarterly Information Return for Mortgage Credit Certificates (MCCs);

- IRS Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent;

- IRS Form 8379, Injured Spouse Allocation;

- IRS Form 8396, Mortgage Interest Credit;

- IRS Form 8404, Interest Charge on DISC-Related Deferred Tax Liability;

- IRS Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return;

- IRS Form 8453 (SP), U.S. Individual Income Tax Declaration for an IRS e-file Return;

- IRS Form 8453-C, U.S. Corporation Income Tax Declaration for an IRS e-file Return;

- IRS Form 8453-EMP, Employment Tax Declaration for an IRS e-file Return;

- IRS Form 8453-EO, Exempt Organization Declaration and Signature for Electronic Filing;

- IRS Form 8453-EX, Excise Tax Declaration for an IRS e-file Return;

- IRS Form 8453-FE, U.S. Estate or Trust Declaration for an IRS e-file Return;

- IRS Form 8453-I, Foreign Corporation Income Tax Declaration for an IRS e-file Return;

- IRS Form 8453-PE, U.S. Partnership Declaration for an IRS e-file Return;

- IRS Form 8453-R, Electronic Filing Declaration for Form 8963;

- IRS Form 8453-S, U.S. S Corporation Income Tax Declaration for an IRS e-file Return;

- IRS Form 8453-X, Political Organization Declaration for Electronic Filing of Notice of Section 527 Status;

- IRS Form 8498, Continuing Education Provider Application and Request for Provider Number.

IRS Forms — 8500-9000

- IRS Form 8508, Request for Waiver From Filing Information Returns Electronically;

- IRS Form 8508-I, Request for Waiver From Filing Information Returns Electronically;

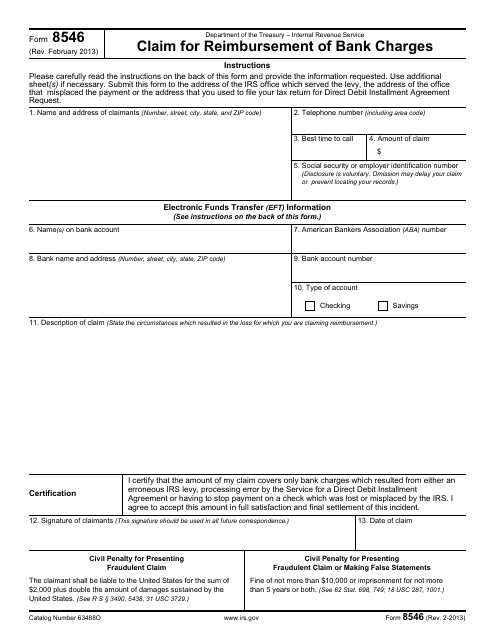

- IRS Form 8546, Claim for Reimbursement of Bank Charges Incurred Due to Erroneous Service Levy or Misplaced Payment Check;

- IRS Form 8554, Application for Renewal of Enrollment to Practice Before the Internal Revenue Service;

- IRS Form 8554-EP, Application for Renewal of Enrollment to Practice Before the Internal Revenue Service as an Enrolled Retirement Plan Agent (ERPA);

- IRS Form 8569, Geographic Availability Statement;

- IRS Form 8582, Passive Activity Loss Limitations;

- IRS Form 8582-CR, Passive ActivityCredit Limitations;

- IRS Form 8586, Low-Income Housing Credit;

- IRS Form 8594, Asset Acquisition Statement Under Section 1060;

- IRS Form 8596, Information Return for Federal Contracts;

- IRS Form 8596-A, Quarterly Transmittal of Information Returns for Federal Contracts;

- IRS Form 8606, Nondeductible IRAs;

- IRS Form 8609, Low-Income Housing Credit Allocation and Certification;

- IRS Form 8609-A, Annual Statement for Low-Income Housing Credit;

- IRS Form 8610, Annual Low-Income Housing Credit Agencies Report;

- IRS Form 8610 (Schedule A), Carryover Allocation of Low-Income Housing Credit;

- IRS Form 8611, Recapture of Low-Income Housing Credit;

- IRS Form 8612, Return of Excise Tax on Undistributed Income of Real Estate Investment Trusts;

- IRS Form 8613, Return of Excise Tax on Undistributed Income of Regulated Investment Companies;

- IRS Form 8615, Tax for Certain Children Who Have Unearned Income;

- IRS Form 8621, Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund;

- IRS Form 8621-A, Return by a Shareholder Making Certain Late Elections To End Treatment as a Passive Foreign Investment Company;

- IRS Form 8653, Tax Counseling for the Elderly Program Application Plan;

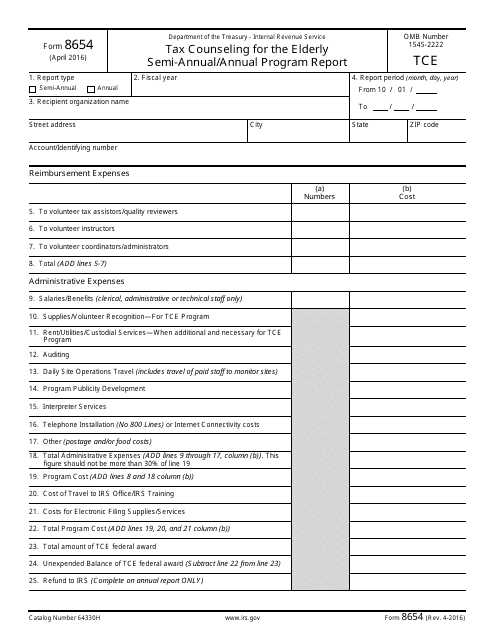

- IRS Form 8654, Tax Counseling for the Elderly Program Semi-Annual/Annual Program Report;

- IRS Form 8655, Reporting Agent Authorization;

- IRS Form 8689, Allocation of Individual Income Tax to the U.S. Virgin Islands;

- IRS Form 8697, Interest Computation Under the Look-Back Method for Completed Long-Term Contracts;

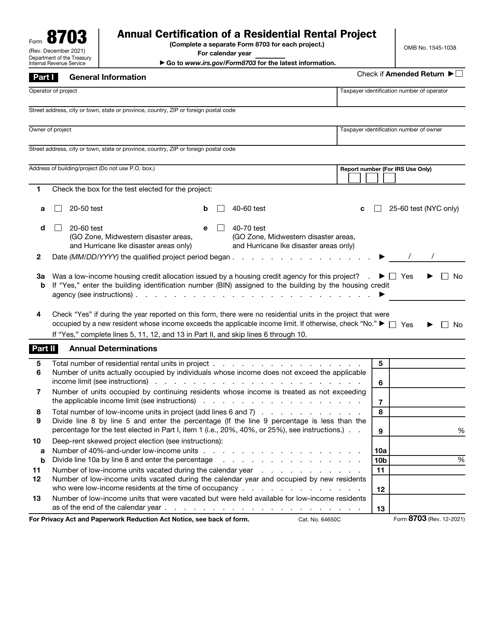

- IRS Form 8703, Annual Certification of a Residential Rental Project;

- IRS Form 8716, Election to Have a Tax Year Other Than a Required Tax Year;

- IRS Form 8717, User Fee for Employee Plan Determination Letter Request;

- IRS Form 8717-A, User Fee for Employee Plan Opinion or Advisory Letter Request;

- IRS Form 8718, User Fee for Exempt Organization Determination Letter Request;

- IRS Form 8725, Excise Tax on Greenmail;

- IRS Form 8752, Required Payment or Refund Under Section 7519;

- IRS Form 8796-A, Request for Return/Information (Federal/State Tax Exchange Program - State and Local Government Use Only);

- IRS Form 8801, Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts;

- IRS Form 8802, Application for U.S. Residency Certification;

- IRS Form 8804, Annual Return for Partnership Withholding Tax (Section 1446);

- IRS Form 8804 (Schedule A), Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships;

- IRS Form 8804-C, Certificate of Partner-Level Items to Reduce Section 1446 Withholding;

- IRS Form 8804-W, Installment Payments of Section 1446 Tax for Partnerships;

- IRS Form 8805, Foreign Partner's Information Statement of Section 1446 Withholding Tax;

- IRS Form 8806, Information Return for Acquisition of Control or Substantial Change in Capital Structure;

- IRS Form 8809, Application for Extension of Time to File Information Returns;

- IRS Form 8809-EX, Request for Extension of Time To File an ExSTARS Information Return (For Form 720TO or Form 720CS);

- IRS Form 8809-I, Application for Extension of Time to File FATCA Form 8966;

- IRS Form 8810, Corporate Passive Activity Loss and Credit Limitations;

- IRS Form 8811, Information Return for Real Estate Mortgage Investment Conduits (REMICs) and Issuers of Collateralized Debt Obligations;

- IRS Form 8813, Partnership Withholding Tax Payment Voucher (Section 1446);

- IRS Form 8814, Parents' Election to Report Child's Interest and Dividends;

- IRS Form 8815, Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989;

- IRS Form 8818, Optional Form To Record Redemption of Series EE and I U.S. Savings Bonds Issued After 1989;

- IRS Form 8819, Dollar Election Under Section 985;

- IRS Form 8820, Orphan Drug Credit;

- IRS Form 8821, Tax Information Authorization;

- IRS Form 8821 (SP), Tax Information Authorization;

- IRS Form 8821-A, IRS Disclosure Authorization for Victims of Identity Theft;

- IRS Form 8822, Change of Address;

- IRS Form 8822-B, Change of Address or Responsible Party - Business;

- IRS Form 8823, Low-Income Housing Credit Agencies Report of Noncompliance or Building Disposition;

- IRS Form 8824, Like-Kind Exchanges;

- IRS Form 8825, Rental Real Estate Income and Expenses of a Partnership or an S Corporation;

- IRS Form 8826, Disabled Access Credit;

- IRS Form 8827, Credit for Prior Year Minimum Tax - Corporations;

- IRS Form 8828, Recapture of Federal Mortgage Subsidy;

- IRS Form 8829, Expenses for Business Use of Your Home;

- IRS Form 8831, Excise Taxes on Excess Inclusions of REMIC Residual Interests;

- IRS Form 8832, Entity Classification Election;

- IRS Form 8833, Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b);

- IRS Form 8834, Qualified Electric Vehicle Credit;

- IRS Form 8835, Renewable Electricity, Refined Coal, and Indian Coal Production Credit;

- IRS Form 8838, Consent to Extend the Time to Assess Tax Under Section 367 - Gain Recognition Agreement;

- IRS Form 8838-P, Consent to Extend the Time to Assess Tax Pursuant to the Gain Deferral Method (Section 721(c));

- IRS Form 8839, Qualified Adoption Expenses;

- IRS Form 8840, Closer Connection Exception Statement for Aliens;

- IRS Form 8842, Election to Use Different Annualization Periods for Corporation Estimated Tax;

- IRS Form 8843, Statement for Exempt Individuals and Individuals with a Medical Condition;

- IRS Form 8844, Empowerment ZoneEmployment Credit;

- IRS Form 8845, Indian Employment Credit;

- IRS Form 8846, Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips;

- IRS Form 8848, Consent to Extend the Time to Assess the Branch Profits Tax Under Regulations Sections 1.884-2T(a) and (c);

- IRS Form 8849, Claim for Refund of Excise Taxes;

- IRS Form 8849 (Schedule 1), Nontaxable Use of Fuels;

- IRS Form 8849 (Schedule 2), Sales by Registered Ultimate Vendors;

- IRS Form 8849 (Schedule 3), Certain Fuel Mixtures and the Alternative Fuel Credit;

- IRS Form 8849 (Schedule 5), Section 4081(e) Claims;

- IRS Form 8849 (Schedule 6), Other Claims;

- IRS Form 8849 (Schedule 8), Registered Credit Card Issuers;

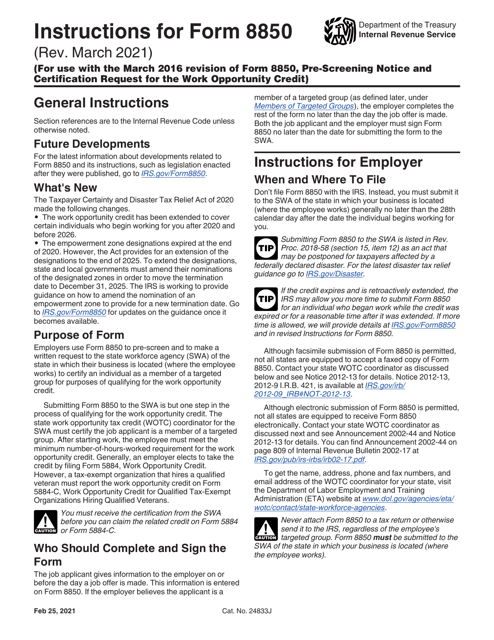

- IRS Form 8850, Pre-Screening Notice and Certification Request for the Work Opportunity Credit;

- IRS Form 8851, Summary of Archer MSAs;

- IRS Form 8853, Archer MSAs and Long-Term Care Insurance Contracts;

- IRS Form 8854, Initial and Annual Expatriation Statement;

- IRS Form 8855, Election to Treat a Qualified Revocable Trust as Part of an Estate;

- IRS Form 8857, Request for Innocent Spouse Relief;

- IRS Form 8857 (SP), Solicitud para Alivio del Conyuge Inocente;

- IRS Form 8858, Information Return of U.S. Persons With Respect to Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs);

- IRS Form 8858 (Schedule M), Transactions Between Foreign Disregarded Entity (FDE) or Foreign Branch (FB) and the Filer or Other Related Entities;

- IRS Form 8859, Carryforward of the District of Columbia First-Time Homebuyer Credit;

- IRS Form 8862, Information To Claim Earned Income Credit After Disallowance;

- IRS Form 8862 (SP), Information to Claim Earned Income Credit After Disallowance;

- IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits);

- IRS Form 8864, Biodiesel and Renewable Diesel Fuels Credit;

- IRS Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships;

- IRS Form 8865 (Schedule G), Statement of Application of the Gain Deferral Method Under Section 721(c);

- IRS Form 8865 (Schedule H), Acceleration Events and Exceptions Reporting Relating to Gain Deferral Method Under Section 721(c);

- IRS Form 8865 (Schedule K-1), Partner's Share of Income, Deductions, Credits, etc.;

- IRS Form 8865 (Schedule O), Transfer of Property to a Foreign Partnership (under section 6038B);

- IRS Form 8865 (Schedule P), Acquisitions, Dispositions, and Changes of Interests in a Foreign Partnership (Under Section 6046A);

- IRS Form 8866, Interest Computation Under the Look-Back Method for Property Depreciated Under the Income Forecast Method;

- IRS Form 8867, Paid Preparer's Due Diligence Checklist;

- IRS Form 8868, Application for Automatic Extension of Time To File an Exempt Organization Return;

- IRS Form 8869, Qualified Subchapter S Subsidiary Election;

- IRS Form 8870, Information Return for Transfers Associated With Certain Personal Benefit Contracts;

- IRS Form 8872, Political Organization Report of Contributions and Expenditures;

- IRS Form 8873, Extraterritorial Income Exclusion;

- IRS Form 8874, New Markets Credit;

- IRS Form 8874-A, Notice of Qualified Equity Investment for New Markets Credit;

- IRS Form 8874-B, Notice of Recapture Event for New Markets Credit;

- IRS Form 8875, Taxable REIT Subsidiary Election;

- IRS Form 8876, Excise Tax on Structured Settlement Factoring Transactions;

- IRS Form 8878, IRS e-file Signature Authorization for Form 4868 or Form 2350;

- IRS Form 8878 (SP), IRS e-file Signature Authorization for Form 4868 (SP) or Form 2350;

- IRS Form 8878-A, IRS e-file Electronic Funds Withdrawal Authorization for Form 7004;

- IRS Form 8879, IRS e-file Signature Authorization;

- IRS Form 8879 (SP), IRS e-file Signature Authorization;

- IRS Form 8879-C, IRS e-file Signature Authorization for Form 1120;

- IRS Form 8879-EMP, IRS e-file Signature Authorization for Forms 940, 940 (PR), 941, 941 (PR), 941-SS, 943, 943 (PR), 944, and 945;

- IRS Form 8879-EO, IRS e-file Signature Authorization for an Exempt Organization;

- IRS Form 8879-EX, IRS e-file Signature Authorization for Forms 720, 2290, and 8849;

- IRS Form 8879-F, IRS e-file Signature Authorization for Form 1041;

- IRS Form 8879-I, IRS e-file Signature Authorization for Form 1120-F;

- IRS Form 8879-PE, IRS e-file Signature Authorization for Form 1065;

- IRS Form 8879-S, IRS e-file Signature Authorization for Form 1120-S;

- IRS Form 8880, Credit for Qualified Retirement Savings Contributions;

- IRS Form 8881, Credit for Small Employer Pension Plan Startup Costs;

- IRS Form 8882, Credit for Employer-Provided Child Care Facilities and Services;

- IRS Form 8883, Asset Allocation Statement Under Section 338;

- IRS Form 8885, Health Coverage Tax Credit;

- IRS Form 8886, Reportable Transaction Disclosure Statement;

- IRS Form 8886-T, Disclosure by Tax Exempt Entity Regarding Prohibited Tax Shelter Transaction;

- IRS Form 8888, Allocation of Refund (Including Savings Bond Purchases);

- IRS Form 8889, Health Savings Accounts (HSAs);

- IRS Form 8892, Application for Automatic Extension of Time To File Form 709 and/or Payment of Gift/Generation-Skipping Transfer Tax;

- IRS Form 8896, Low Sulfur Diesel Fuel Production Credit;

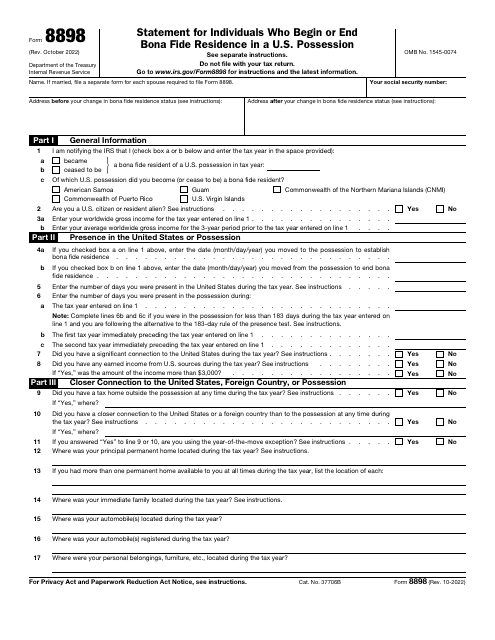

- IRS Form 8898, Statement for Individuals Who Begin or End Bona Fide Residence in a U.S. Possession;

- IRS Form 8899, Notification of Income from Donated Intellectual Property;

- IRS Form 8900, Qualified Railroad Track Maintenance Credit;

- IRS Form 8902, Alternative Tax on Qualifying Shipping Activities;

- IRS Form 8903, Domestic Production Activities Deduction;

- IRS Form 8904, Marginal Wells Oil and Gas Production Credit;

- IRS Form 8905, Certification of Intent to Adopt a Pre-Approved Plan;

- IRS Form 8906, Distilled Spirits Credit;

- IRS Form 8908, Energy Efficient Home Credit;

- IRS Form 8910, Alternative Motor Vehicle Credit;

- IRS Form 8911, Alternative Fuel Vehicle Refueling Property Credit;

- IRS Form 8912, Credit to Holders of Tax Credit Bonds;

- IRS Form 8915-A, Qualified 2016 Disaster Retirement Plan Distributions and Repayments;

- IRS Form 8915-B, Qualified 2017 Disaster Retirement Plan Distributions and Repayments;

- IRS Form 8915-C, Qualified 2018 Disaster Retirement Plan Distributions and Repayments;

- IRS Form 8915-D, Qualified 2019 Disaster Retirement Plan Distributions and Repayments;

- IRS Form 8915-E, Qualified 2020 Disaster Retirement Plan Distributions and Repayments;

- IRS Form 8916, Reconciliation of Schedule M-3 Taxable Income with Tax Return Taxable Income for Mixed Groups;

- IRS Form 8916-A, Supplemental Attachment to Schedule M-3;

- IRS Form 8917, Tuition and Fees Deduction;

- IRS Form 8918, Material Advisor Disclosure Statement Form 8919 Uncollected Social Security and Medicare Tax on Wages;

- IRS Form 8922, Third-Party Sick Pay Recap Form 8923 Mine Rescue Team Training Credit;

- IRS Form 8924, Excise Tax on Certain Transfers of Qualifying Geothermal or Mineral Interests;

- IRS Form 8925, Report of Employer-Owned Life Insurance Contracts;

- IRS Form 8927, Determination Under Section 860(e)(4) by a Qualified Investment Entity;

- IRS Form 8928, Return of Certain Excise Taxes Under Chapter 43 of the Internal Revenue Code;

- IRS Form 8932, Credit for Employer Differential Wage Payments;

- IRS Form 8933, Carbon Oxide Sequestration Credit;

- IRS Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit;

- IRS Form 8937, Report of Organizational Actions Affecting Basis of Securities;

- IRS Form 8938, Statement of Specified Foreign Financial Assets;

- IRS Form 8940, Request for Miscellaneous Determination;

- IRS Form 8941, Credit for Small Employer Health Insurance Premiums;

- IRS Form 8944, Preparer e-file Hardship Waiver Request;

- IRS Form 8945, PTIN Supplemental Application For U.S. Citizens Without a Social Security Number Due To Conscientious Religious Objection;

- IRS Form 8946, PTIN Supplemental Application For Foreign Persons Without a Social Security Number;

- IRS Form 8947, Report of Branded Prescription Drug Information;

- IRS Form 8948, Preparer Explanation for Not Filing Electronically;

- IRS Form 8949, Sales and Other Dispositions of Capital Assets;

- IRS Form 8950, Application for Voluntary Correction Program (VCP);

- IRS Form 8951, User Fee for Application for Voluntary Correction Program (VCP);

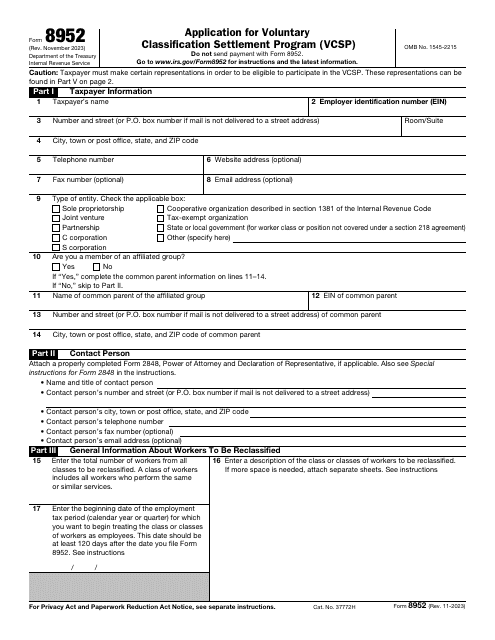

- IRS Form 8952, Application for Voluntary Classification Settlement Program (VCSP);

- IRS Form 8955-SSA, Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits;

- IRS Form 8957, Foreign Account Tax Compliance Act (FATCA) Registration;

- IRS Form 8958, Allocation of Tax Amounts Between Certain Individuals in Community Property States;

- IRS Form 8959, Additional Medicare Tax;

- IRS Form 8960, Net Investment Income Tax Individuals, Estates, and Trusts;

- IRS Form 8962, Premium Tax Credit (PTC);

- IRS Form 8963, Report of Health Insurance Provider Information Form 8966 FATCA Report Form 8966-C Cover Sheet for Form 8966 Paper Submissions;

- IRS Form 8971, Information Regarding Beneficiaries Acquiring Property From a Decedent;

- IRS Form 8973, Certified Professional Employer Organization Customer Reporting Agreement;

- IRS Form 8974, Qualified Small BusinessPayroll Tax Credit for Increasing Research Activities;

- IRS Form 8975, Country by Country Report;

- IRS Form 8975 (Schedule A), Tax Jurisdiction and Constituent Entity Information;

- IRS Form 8978, Partner's Additional Reporting Year Tax;

- IRS Form 8978 (Schedule A), Partner's Additional Reporting Year Tax (Schedule of Adjustments);

- IRS Form 8979, Partnership Representative Revocation/Designation and Resignation Form;

- IRS Form 8980, Partnership Request for Modification of Imputed Underpayments Under IRC Section 6225(c);

- IRS Form 8981, Waiver of the Period Under IRC Section 6231(b)(2)(A) and Expiration of the Period for Modification Submissions Under IRC Section 6225(c)(7);

- IRS Form 8982, Affidavit for Partner Modification Amended Return Under IRC Section 6225(c)(2)(A) or Partner Alternative Procedure Under IRC Section 6225(c)(2)(B);

- IRS Form 8983, Certification of Partner Tax-Exempt Status for Modification Under IRC Section 6225(c)(3);

- IRS Form 8984, Extension of the Taxpayer Modification Submission Period Under Section 6225(c)(7);

- IRS Form 8985, Pass-Through Statement - Transmittal/Partnership Adjustment Tracking Report (Required Under Sections 6226 and 6227);

- IRS Form 8985-V, Tax Payment by a Pass-Through Partner;

- IRS Form 8986, Partner's Share of Adjustment(s) to Partnership-Related Item(s) (Required Under Sections 6226 and 6227);

- IRS Form 8988, Election for Alternative to Payment of the Imputed Underpayment - IRC Section 6226;

- IRS Form 8989, Request to Revoke the Election for Alternative to Payment of the Imputed Underpayment;

- IRS Form 8990, Limitation on Business Interest Expense Under Section 163(j);

- IRS Form 8991, Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts;

- IRS Form 8992, U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI);

- IRS Form 8992 (Schedule B), Calculation of Global Intangible Low-Taxed Income (GILTI) for Members of a U.S. Consolidated Group Who Are U.S. Shareholders of a CFC;

- IRS Form 8993, Section 250 Deduction for Foreign Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI);

- IRS Form 8994, Employer Credit for Paid Family and Medical Leave;

- IRS Form 8995, Qualified BusinessIncome Deduction Simplified Computation;

- IRS Form 8995-A, Qualified Business Income Deduction;

- IRS Form 8995-A (Schedule A), Specified Service Trades or Businesses Form 8995-A (Schedule B) Aggregation of Business Operations;

- IRS Form 8995-A (Schedule C), Loss Netting And Carryforward;

- IRS Form 8995-A (Schedule D), Special Rules for Patrons of Agricultural or Horticultural Cooperatives Form 8996 Qualified Opportunity Fund;

- IRS Form 8997, Initial and Annual Statement of Qualified Opportunity Fund (QOF) Investments.

IRS Forms — 9000-9500

- IRS Form 9210, Alien Status Questionnaire;

- IRS Form 9325, Acknowledgement and General Information for Taxpayers Who File Returns Electronically;

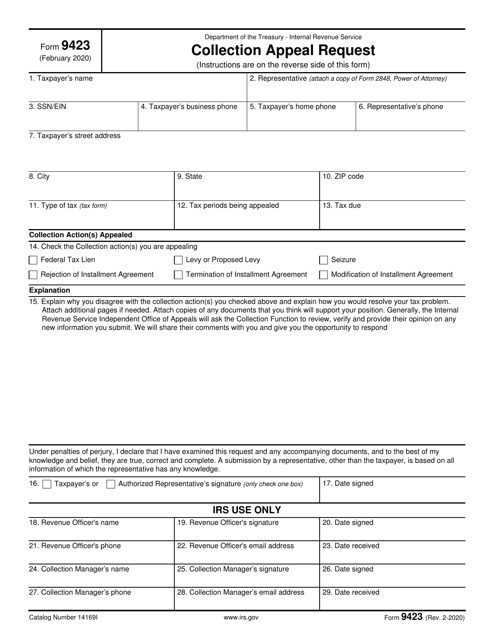

- IRS Form 9423, Collection Appeal Request;

- IRS Form 9465, Installment Agreement Request;

- IRS Form 9465 (SP), Installment Agreement Request.

IRS Forms — 9500-10000

- IRS Form 9661, Cooperative Agreement;

- IRS Form 9779, EFTPS Business Enrollment Form;

- IRS Form 9783, EFTPS Individual Enrollment Form.

IRS Forms — 10000-12000

- IRS Form 10301, CD Encryption Code Authorization For CP2100 972CG Notices;

- IRS Form 10837, Request for Weather and Safety Leave Due to Emergency Conditions.

IRS Forms — 12000-12500

- IRS Form 12009, Request for an Informal Conference and Appeals Review;

- IRS Form 12153, Request for a Collection Due Process or Equivalent Hearing;

- IRS Form 12153 (SP), Request for a Collection Due Process or Equivalent Hearing;

- IRS Form 12203, Request for Appeals Review;

- IRS Form 12203 (SP), Request for Appeals Review;

- IRS Form 12203-A, Request for Appeal;

- IRS Form 12256, Withdrawal of Request for Collection Due Process or Equivalent Hearing;

- IRS Form 12257, Summary Notice of Determination, Waiver of Right to Judicial Review of a Collection Due Process Determination, Waiver of Suspension of Levy Action, and Waiver of Periods of Limitation in Section 6330;

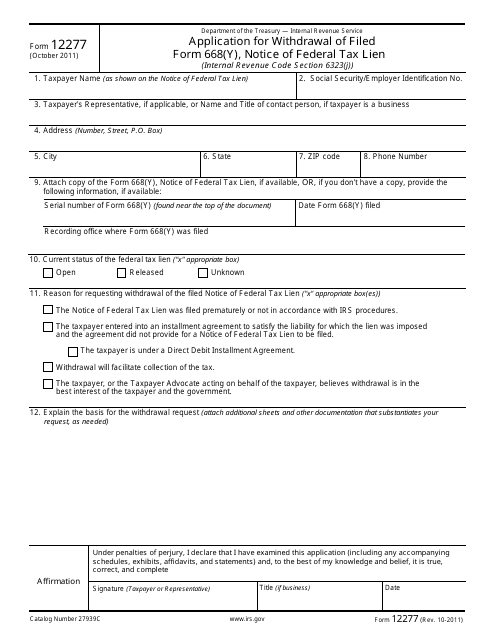

- IRS Form 12277, Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien (Internal Revenue Code Section 6323(j);

- IRS Form 12339, Internal Revenue Service Advisory Council Membership Application;

- IRS Form 12339-B, Information Reporting Program Advisory Committee Membership Application;

- IRS Form 12339-C, Advisory Committee on Tax Exempt and Government Entities Membership Application;

- IRS Form 12451, Request for Relocation Expenses Allowance.

IRS Forms — 12500-13000

- IRS Form 12508, Questionnaire for Non-Requesting Spouse;

- IRS Form 12509, Innocent Spouse Statement of Disagreement;

- IRS Form 12661, Disputed Issue Verification Form 12673 Agreement to Bid.

IRS Forms — 13000-13500

- IRS Form 13072, Victim Witness Assistance Brochure;

- IRS Form 13206, Volunteer Assistance Summary Report;

- IRS Form 13285-A, Reducing Tax Burden on America's Taxpayers;

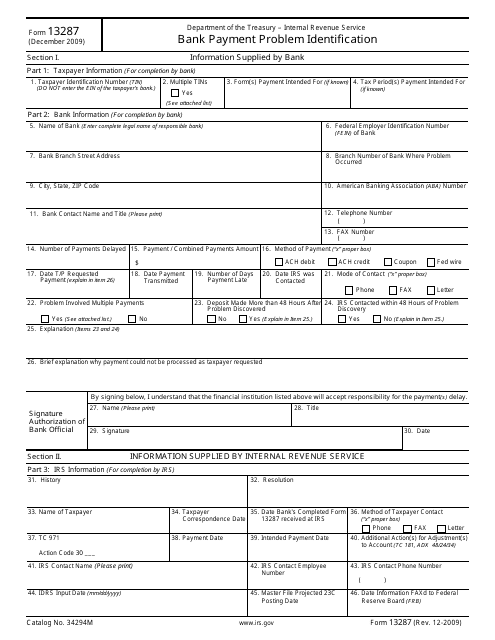

- IRS Form 13287, Bank Payment Problem Identification;

- IRS Form 13369, Agreement to Mediate;

- IRS Form 13424, Low Income Taxpayer Clinic (LITC) Application Information;

- IRS Form 13424-A, Low Income Taxpayer Clinic (LITC) General Information Report;

- IRS Form 13424-B, Low Income Taxpayer Clinic (LITC) Case Issues Report;

- IRS Form 13424-C, Low Income Taxpayer Clinic (LITC) Advocacy Information Report;

- IRS Form 13424-F, Volunteer/Pro Bono Time Reporting;

- IRS Form 13424-J, Detailed Budget Worksheet;

- IRS Form 13424-K, Low Income Taxpayer Clinic (LITC) Case Information Report;

- IRS Form 13424-L, Statement of Grant Expenditures;

- IRS Form 13424-M, Low Income Taxpayer Clinic (LITC) Application Narrative;

- IRS Form 13424-N, Low Income Taxpayer Clinic (LITC) Program Narrative Report;

- IRS Form 13441-A, Health Coverage Tax Credit (HCTC) Monthly Registration and Update.

IRS Forms — 13500-14000

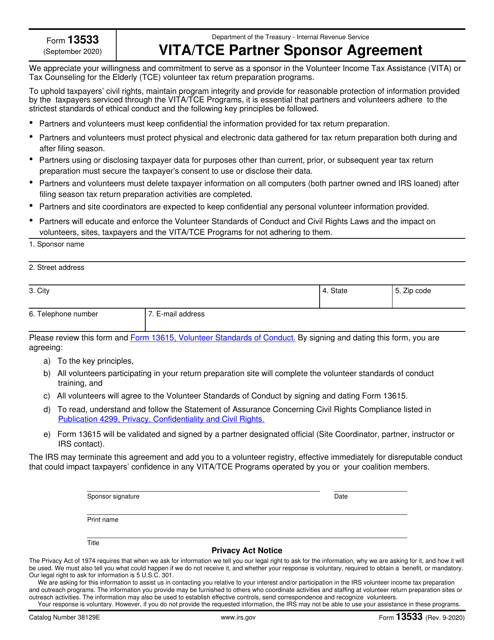

- IRS Form 13533, VITA - TCE Partner Sponsor Agreement;

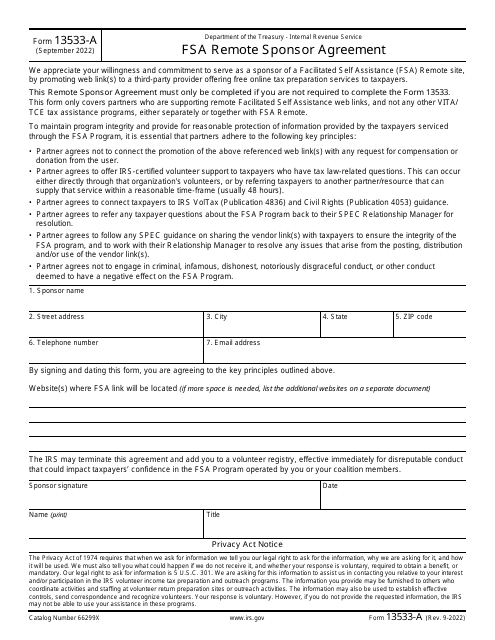

- IRS Form 13533-A, FSA Remote Sponsor Agreement;

- IRS Form 13551, Application to Participate in the IRS Acceptance Agent Program;

- IRS Form 13560, Health Plan Administrator (HPA) Return of Funds;

- IRS Form 13614-C, Intake/Interview & Quality Review Sheet;

- IRS Form 13614-C (AR), Intake/Interview & Quality Review Sheet;

- IRS Form 13614-C (CN-S), Intake/Interview & Quality Review Sheet;

- IRS Form 13614-C (CN-T), Intake/Interview & Quality Review Sheet;

- IRS Form 13614-C (HT), Intake/Interview & Quality Review Sheet;

- IRS Form 13614-C (KR), Intake/Interview & Quality Review Sheet;

- IRS Form 13614-C (PL), Intake/Interview & Quality Review Sheet;

- IRS Form 13614-C (PT), Intake/Interview & Quality Review Sheet;

- IRS Form 13614-C (RU), Intake/Interview & Quality Review Sheet;

- IRS Form 13614-C (SP), Intake/Interview & Quality Review Sheet;

- IRS Form 13614-C (TL), Intake/Interview & Quality Review Sheet;

- IRS Form 13614-C (VN), Intake/Interview & Quality Review Sheet;

- IRS Form 13614-NR, Nonresident Alien Intake and Interview Sheet;

- IRS Form 13615, Volunteer Standards of Conduct Agreement - VITA/TCE Programs;

- IRS Form 13690 (EN-SP), Income and Deductions Checklist;

- IRS Form 13691 (EN-SP), Where is My Refund?;

- IRS Form 13711, Request for Appeal of Offer in Compromise;

- IRS Form 13715, Volunteer Site Information Sheet;

- IRS Form 13748, Event Registration Form;

- IRS Form 13750, Election to Participate in Announcement 2005-80 Settlement Initiative;

- IRS Form 13751, Waiver of Right to Consistent Agreement of Partnership Items and Partnership-Level Determinations as to Penalties, Additions to Tax, and Additional Amounts;

- IRS Form 13768, Electronic Tax Administration Advisory Committee Membership Application;

- IRS Form 13797, Compliance Check Report;

- IRS Form 13803, Income Verification Express Service (IVES) Application;

- IRS Form 13844, Application For Reduced User Fee For Installment Agreements;

- IRS Form 13844 (SP), Application For Reduced User Fee For Installment Agreements;

- IRS Form 13909, Tax-Exempt Organization Complaint (Referral) Form 13930 Application for Central Withholding Agreement;

- IRS Form 13973, Health Coverage Tax Credit (HCTC) Blank Payment Coupon;

- IRS Form 13976, Itemized Statement Component of Advisee List;

- IRS Form 13977, VITA Grant Program Budget Plan;

- IRS Form 13978, Projected Operations VITA Grant Program Application Plan;

- IRS Form 13989, IRS Tax Forum Case Resolution Data Sheet;

- IRS Form 13997, Validating Your TIN and Reasonable Cause.

IRS Forms — 14000-14500

- IRS Form 14017, Application for Fast Track Settlement;

- IRS Form 14039, Identity Theft Affidavit;

- IRS Form 14039 (SP), Identity Theft Affidavit;

- IRS Form 14039-B, Business Identity Theft Affidavit;

- IRS Form 14039-B (SP), Business Identity Theft Affidavit;

- IRS Form 14095, The Health Coverage Tax Credit (HCTC) Reimbursement Request;

- IRS Form 14134, Application for Certificate of Subordination of Federal Tax Lien;

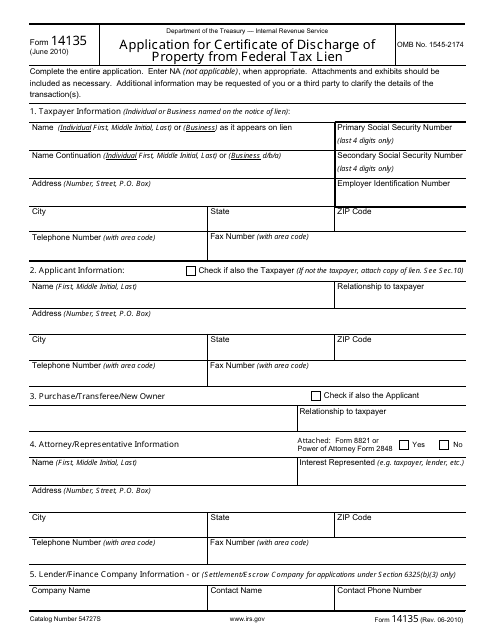

- IRS Form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien;

- IRS Form 14154 (EN-SP), Form W-7 Checklist;

- IRS Form 14157, Complaint: Tax Return Preparer;

- IRS Form 14157-A, Tax Return Preparer Fraud or Misconduct Affidavit;

- IRS Form 14199, COBRA Recapture Statement;

- IRS Form 14204, Tax Counseling for the Elderly (TCE) Program Application Checklist and Contact Sheet;

- IRS Form 14234, Compliance Assurance Process (CAP) Application;

- IRS Form 14234-A, Compliance Assurance Process (CAP) Research Credit Questionnaire (CRCQ);

- IRS Form 14234-B, Material Intercompany Transactions Template (MITT);

- IRS Form 14234-C, Taxpayer Initial Issues List;

- IRS Form 14234-D, Tax Control Framework Questionnaire;

- IRS Form 14242, Reporting Abusive Tax Promotions and/or Promoters;

- IRS Form 14242 (CN), Report Suspected Abusive Tax Promotions or Preparers (Mandarin Version);

- IRS Form 14242 (SP), Reporting Abusive Tax Promotions and/or Promoters (Spanish Version);

- IRS Form 14310, Partner and Volunteer Sign Up;

- IRS Form 14335, Primary Contact Information for VITA/TCE Grant Programs;

- IRS Form 14345, Application for Qualified Intermediary, Withholding Foreign Partnership, or Withholding Foreign Trust Status;

- IRS Form 14360, Continuing Education Provider Complaint Referral;

- IRS Form 14364, Continuing Education Evaluation;

- IRS Form 14392, Continuing Education Waiver Request;

- IRS Form 14402, Internal Revenue Code (IRC) Section 6702(d) Frivolous Return Submissions Penalty Reduction;

- IRS Form 14411, Systemic Advocacy Issue Submission Form;

- IRS Form 14414, Group Ruling Questionnaire;

- IRS Form 14417, Reimbursable Agreement - Non-Federal Entities (State and Local Governments, Foreign Governments, Commercial Organizations, and Private Businesses);

- IRS Form 14429, Tax Exempt Bonds Voluntary Closing Agreement Program Request;

- IRS Form 14446, Virtual VITA/TCE Taxpayer Consent;

- IRS Form 14446 (AR), Virtual VITA/TCE Taxpayer Consent;

- IRS Form 14446 (CN-S), Virtual VITA/TCE Taxpayer Consent;

- IRS Form 14446 (CN-T), Virtual VITA/TCE Taxpayer Consent;

- IRS Form 14446 (HT), Virtual VITA/TCE Taxpayer Consent;

- IRS Form 14446 (KR), Virtual VITA/TCE Taxpayer Consent;

- IRS Form 14446 (PL), Virtual VITA/TCE Taxpayer Consent;

- IRS Form 14446 (PT), Virtual VITA/TCE Taxpayer Consent;

- IRS Form 14446 (RU), Virtual VITA/TCE Taxpayer Consent;

- IRS Form 14446 (SP), Virtual VITA/TCE Taxpayer Consent;

- IRS Form 14446 (TL), Virtual VITA/TCE Taxpayer Consent;

- IRS Form 14446 (VN), Virtual VITA/TCE Taxpayer Consent;

- IRS Form 14452, Foreign Account or Asset Statement;

- IRS Form 14453, Penalty Computation Worksheet;

- IRS Form 14454, Attachment to Offshore Voluntary Disclosure Letter;

- IRS Form 14457, Voluntary Disclosure Practice Preclearance Request and Application;

- IRS Form 14462, Authorization for Disclosure of Information - IRS Return Preparer Office;

- IRS Form 14467, Statement on Abandoned Entities;

- IRS Form 14497, Notice of Nonjudicial Sale of Property;

- IRS Form 14498, Application for Consent to Sale of Property Free of the Federal Tax Lien.

IRS Forms — 14500-15000

- IRS Form 14534, Intake/Interview and Quality Review Certificate;

- IRS Form 14568, Model VCP Compliance Statement;

- IRS Form 14568-A, Model VCP Compliance Statement Schedule 1 Interim Nonamender Failures;

- IRS Form 14568-B, Model VCP Compliance Statement Schedule 2 Other Nonamender Failures and Failure to Adopt a 403(b) Plan Timely;

- IRS Form 14568-C, Model VCP Compliance Statement Schedule 3 SEPs and SARSEPs;

- IRS Form 14568-D, Model VCP Compliance Statement Schedule 4 SIMPLE IRAs;

- IRS Form 14568-E, Model VCP Compliance Statement Schedule 5 Plan Loan Failures (Qualified Plans and 403(b) Plans);

- IRS Form 14568-F, Model VCP Compliance Statement Schedule 6 Employer Eligibility Failure (401(k) and 403(b) Plans only);

- IRS Form 14568-G, Model VCP Compliance Statement Schedule 7 Failure to Distribute Elective Deferrals in Excess of the 402(g) Limit;

- IRS Form 14568-H, Model VCP Compliance Statement Schedule 8 Failure to Pay Required Minimum Distributions Timely;

- IRS Form 14568-I, Model VCP Compliance Statement Schedule 9 Limited Safe Harbor Correction by Plan Amendment;

- IRS Form 14581-A, Fringe Benefits Compliance Self-Assessment For Public Employers;

- IRS Form 14581-B, International Issues Compliance Self-Assessment For Public Employers;

- IRS Form 14581-C, Medicare Coverage Compliance Self-Assessment For State and Local Government Employers;

- IRS Form 14581-D, Other Tax Issues Compliance Self-Assessment For Public Employers;

- IRS Form 14581-E, Retirement Plan Coverage Compliance Self-Assessment For State and Local Government Entities;

- IRS Form 14581-F, Social Security Coverage Compliance Self-Assessment For State and Local Government Entities;

- IRS Form 14581-G, Employee or Independent Contractor Compliance Self-Assessment For Public Employers;

- IRS Form 14652 (CN), Civil Rights Complaint;

- IRS Form 14652 (EN-SP), Civil Rights Complaint;

- IRS Form 14652 (KR), Civil Rights Complaint;

- IRS Form 14652 (RU), Civil Rights Compliant;

- IRS Form 14652 (VN), Civil Rights Compliant;

- IRS Form 14653, Certification by U.S. Person Residing Outside of the United States for Streamlined Foreign Offshore Procedures;

- IRS Form 14654, Certification by U.S. Person Residing in the United States for Streamlined Domestic Offshore Procedures;

- IRS Form 14693, Application for Reduced Rate of Withholding on Whistleblower Award Payment;

- IRS Form 14704, Transmittal Schedule;

- IRS Form 5500-EZ, Delinquent Filer Penalty Relief Program (Revenue Procedure 2015-32);

- IRS Form 14708, Streamlined Domestic Penalty Reconsideration Request Related to Canadian Retirement Plans;

- IRS Form 14726, Waiver of the Notice of Final Partnership Adjustment (FPA);

- IRS Form 14751, Certified Professional Employer Organization Surety Bond;

- IRS Form 14764, ESRP Response;

- IRS Form 14765, Employee Premium Tax Credit (PTC) Listing;

- IRS Form 14773, Offer in Compromise Withdrawal;

- IRS Form 14773-A, Offer in Compromise Withdrawal Joint;

- IRS Form 14781, Electronic Federal Tax Payment System (EFTPS) Insolvency Registration;

- IRS Form 14815, Supporting Documents to Prove the Child Tax Credit (CTC) and Credit for Other Dependents (ODC);

- IRS Form 14950, Premium Tax Credit Verification.

IRS Forms — 15000-15500

- IRS Form 15028, Certification of Publicly Traded Partnership to Notify Specified Partners and Qualified Relevant Partners for Approved Modifications Under IRC Section 6225(c)(5);

- IRS Form 15057, Agreement to Rescind Notice of Final Partnership Adjustment;

- IRS Form 15086, Offer in Compromise Public Inspection File Request;

- IRS Form 15094, Consent to Disclose Tax Information;

- IRS Form 15100, Adoption Taxpayer Identification Number (ATIN) Extension Request;

- IRS Form 15101, Provide a Social Security Number (SSN) for Adoptive Child;

- IRS Form 15103, Form 1040 Return Delinquency;

- IRS Form 15103 (SP),

- IRS Form 15104, Status of the Taxpayer Levy;

- IRS Form 15104 (SP), Estado del Embargo del Contribuyente;

- IRS Form 15105, No Breakdown of Liability By Abstract Number on Form 720;

- IRS Form 15107, Information Request for a Deceased Taxpayer;

- IRS Form 15107 (SP), Solicitud de Información de un Contribuyente Fallecido;

- IRS Form 15109, Request for Tax Deferment;

- IRS Form 15110, Additional Child Tax Credit Worksheet;

- IRS Form 15111, Earned Income Credit Worksheet (CP 09);

- IRS Form 15112, Earned Income Credit Worksheet (CP 27);

- IRS Form 15200, Certificate of Completion (Paid Preparer Due Diligence Training);

- IRS Form 15227, Application for an Identity Protection Personal Identification Number (IP PIN);

- IRS Form 15230, Senior Executive Service Candidate Development Program Endorsement;

- IRS Form 15230-A, Mobility Statement for the Senior Executive Service Candidate Development Program;

- IRS Form 15230-B, IRS Continuing Service Agreement (for Candidate Development Program Participants);

- IRS Form 15237, Administrative Damage Claim Under Sections 7426(h), 7432, 7433(a-d);

- IRS Form 15237-A, Request for Section 7430 Recoverable Costs;

- IRS Form 15247, Product Review Feedback for SPEC Products;

- IRS Form 15250, Nonbank Trustee/Custodian Status Notification;

- IRS Form 15254, Request for Section 754 Revocation;

- IRS Form 15272, VITA/TCE Security Plan;

- IRS Form 15273, Virtual VITA/TCE Plan;

- IRS Form 15288, Request to Revoke Partnership Election under IRC Section 6221(b) or Request to Revoke Election under 1101(g)(4).

IRS CT Forms

- IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return;

- IRS Form CT-1X, Adjusted Employer's Annual Railroad Retirement Tax Return or Claim for Refund;

- IRS Form CT-2, Employee Representative's Quarterly Railroad Tax Return.

IRS SS Forms, IRS Form T

- IRS Form SS-4, Application for Employer Identification Number;

- IRS Form SS-4 (PR), Application for Employer Identification Number (EIN);

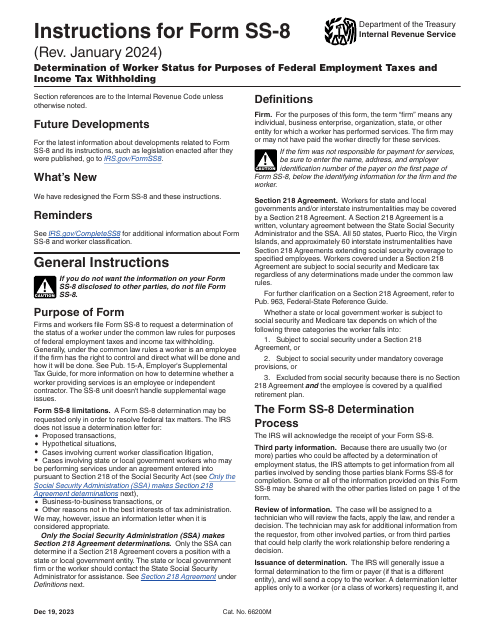

- IRS Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding;

- IRS Form SS-8 (PR), Determinacion del Estado de Empleo de un Trabajador para Propositos de Las Contribuciones Federales Sobre el Empleo;

- IRS Form SS-16, Certificate of Election of Coverage;

- IRS Form T, Forest Activities Schedule.

IRS W Forms

- IRS W-2 Forms, Schedules, and Instructions;

- IRS W-3 Forms, Schedules, and Instructions;

- IRS W-4 Forms, Schedules, and Instructions;

- IRS Form W-7, Application for IRS Individual Taxpayer Identification Number;

- IRS Form W-7 (COA), Certificate of Accuracy for IRS Individual Taxpayer Identification Number;

- IRS Form W-7 (SP), Solicitud de Numero de Identificacion Personal del Contribuyente del Servicio de Impuestos Internos;

- IRS Form W-7A, Application for Taxpayer Identification Number for Pending U.S. Adoptions;

- IRS Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals);

- IRS Form W-8BEN-E, Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities);

- IRS Form W-8CE, Notice of Expatriation and Waiver of Treaty Benefits;

- IRS Form W-8ECI, Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States;

- IRS Form W-8EXP, Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting;

- IRS Form W-8IMY, Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting;

- IRS W-9 Forms, Schedules, and Instructions;

- IRS Form W-10, Dependent Care Provider's Identification and Certification;

- IRS Form W-12, IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal;

- IRS Form W-13, ExSTARS Reporting Information Request for Taxpayer Identification Number and Certification;

- IRS Form W-14, Certificate of Foreign Contracting Party Receiving Federal Procurement Payments.

FinCEN Forms

Where to Mail IRS Forms?

Each IRS Form mailing address can be different for you depending on your taxpayer status, residence (state and county), the information you provide to the IRS, and the attachment of payment. To learn more about the filing, you can consult the instructions we provide for the IRS forms and publications.

What Forms of Payment Does the IRS Accept?

There are several options for individuals and companies who need to meet their tax obligations and pay taxes:

- Pay cash in person.

- Send a check or money order via mail.

- Send a same-day wire payment from your bank.

- Use an Electronic Funds Withdrawal when filing IRS Forms with the help of software or a tax professional.

- Pay via the Electronic Federal Tax Payment System - the fastest, most convenient, and secure way.

Not what you were looking for? Check out these related tags:

- Federal Legal Forms released by the departments of the United States Federal Government;

- United States Legal Forms by state;

- Other Legal Forms by country.

Related Articles

Documents:

4644

This form is used for reporting information related to Build America Bonds and Recovery Zone Bonds to the Internal Revenue Service (IRS). It is used by issuers of these bonds to provide details about the bonds and the related transactions.

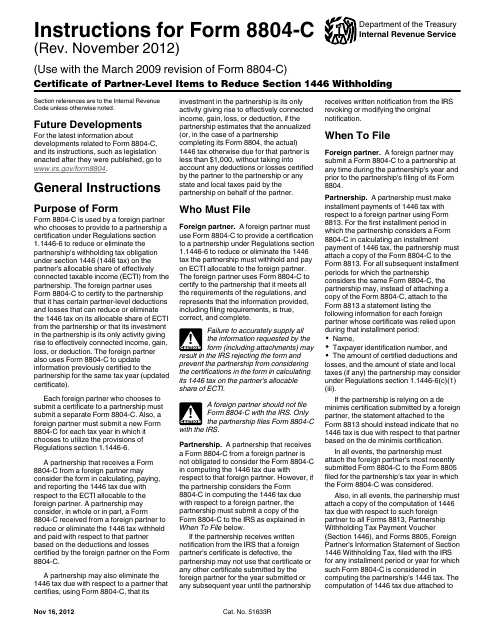

This form is used for reporting partner-level items that can reduce the amount of withholding tax under Section 1446.

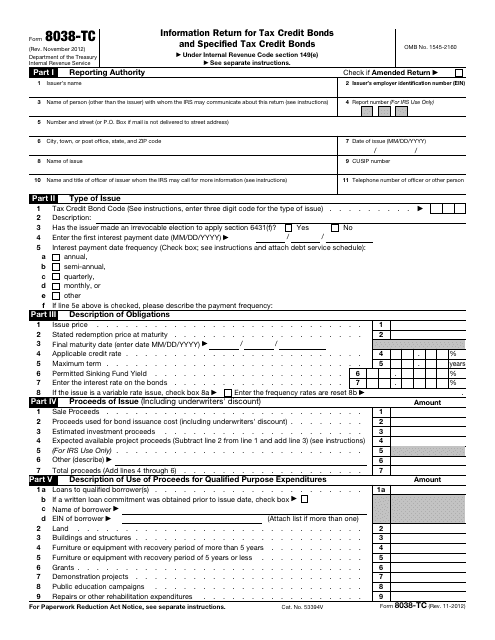

This Form is used for reporting information related to tax credit bonds to the IRS. It is used by bond issuers to report the details of the bond issuance and to claim any applicable tax credits.

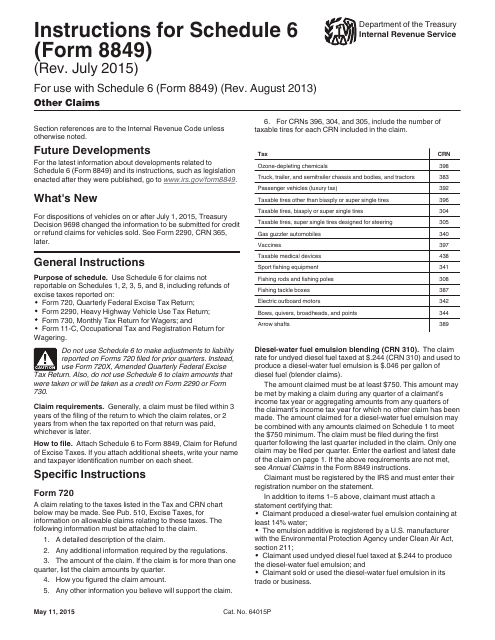

This Form is used for claiming other types of tax credits or refunds not covered in other schedules of Form 8849. It provides instructions on how to complete Schedule 6 to claim these other claims.

This document is used by taxpayers to disclose uncertain tax positions and provide an explanation for any inconsistencies on their tax returns.

This is an IRS legal document completed by individuals who want to inquire about the status of an expected tax refund.

This document is used to disclose information about the regulations that apply to a tax return.

This Form is used for applying for a certificate of discharge of property from a federal tax lien by the IRS.

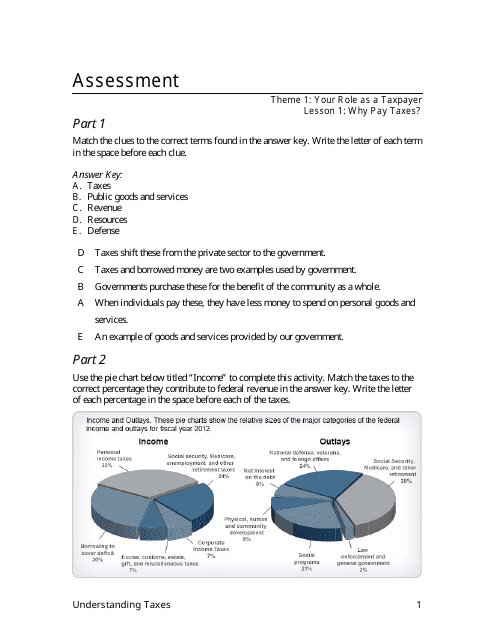

This document is a taxpayer assessment answer sheet provided by the IRS. It assists taxpayers in understanding and completing their taxes correctly.

This is a written document prepared by a taxpayer with a tax debt, if they want to prevent or stop certain fiscal enforcement actions against them due to their failure to pay tax on time.

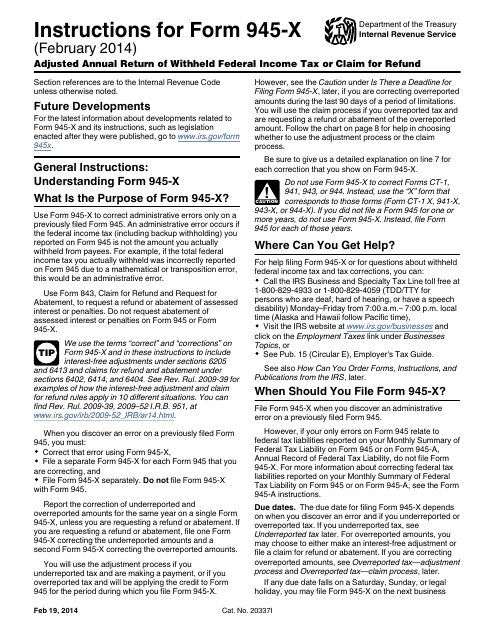

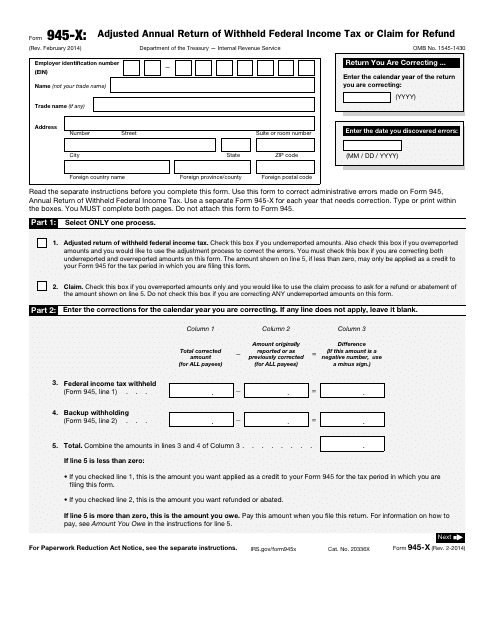

This Form is used for making adjustments to the annual return of withheld federal income tax or claiming a refund. It is specifically designed for the IRS Form 945-X.

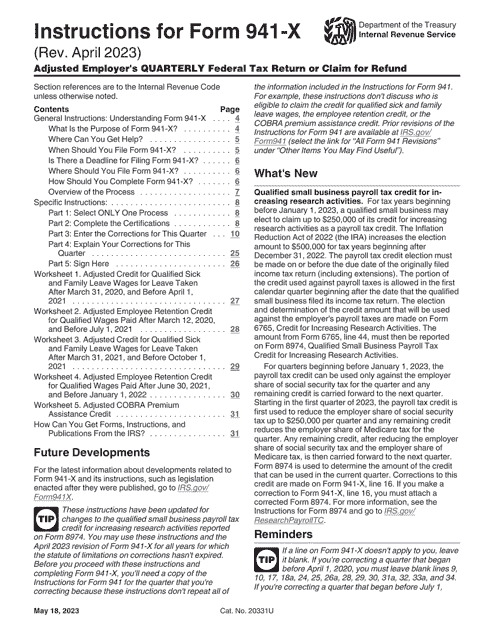

Instructions for IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

This is a fiscal form used by taxpayers to modify the information they submitted via IRS Form 945, Annual Return of Withheld Federal Income Tax.

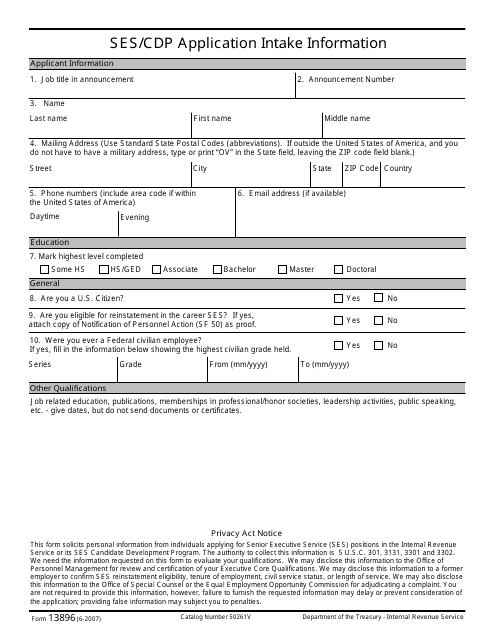

This form is used for applying for a Ses/Cdp Application Intake with the IRS.

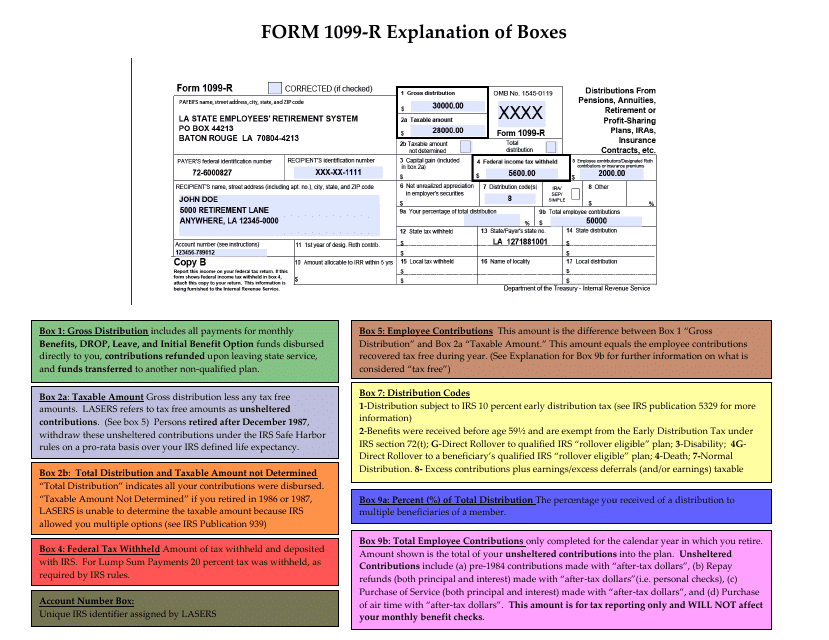

This document provides instructions for IRS Form 1099-R, which is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and other types of retirement accounts. The document explains the different boxes on the form and how to fill them out accurately.