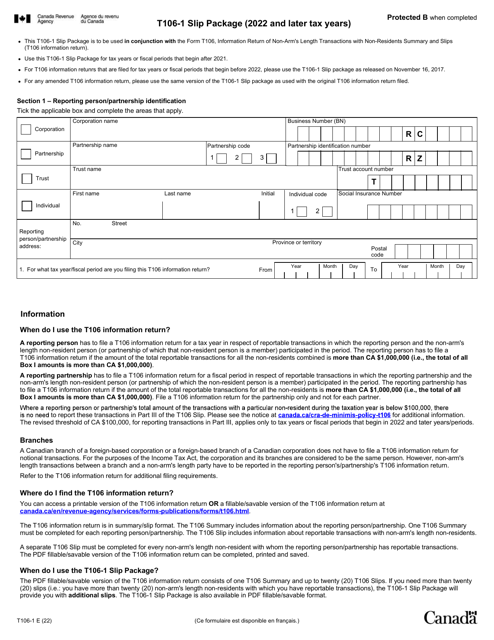

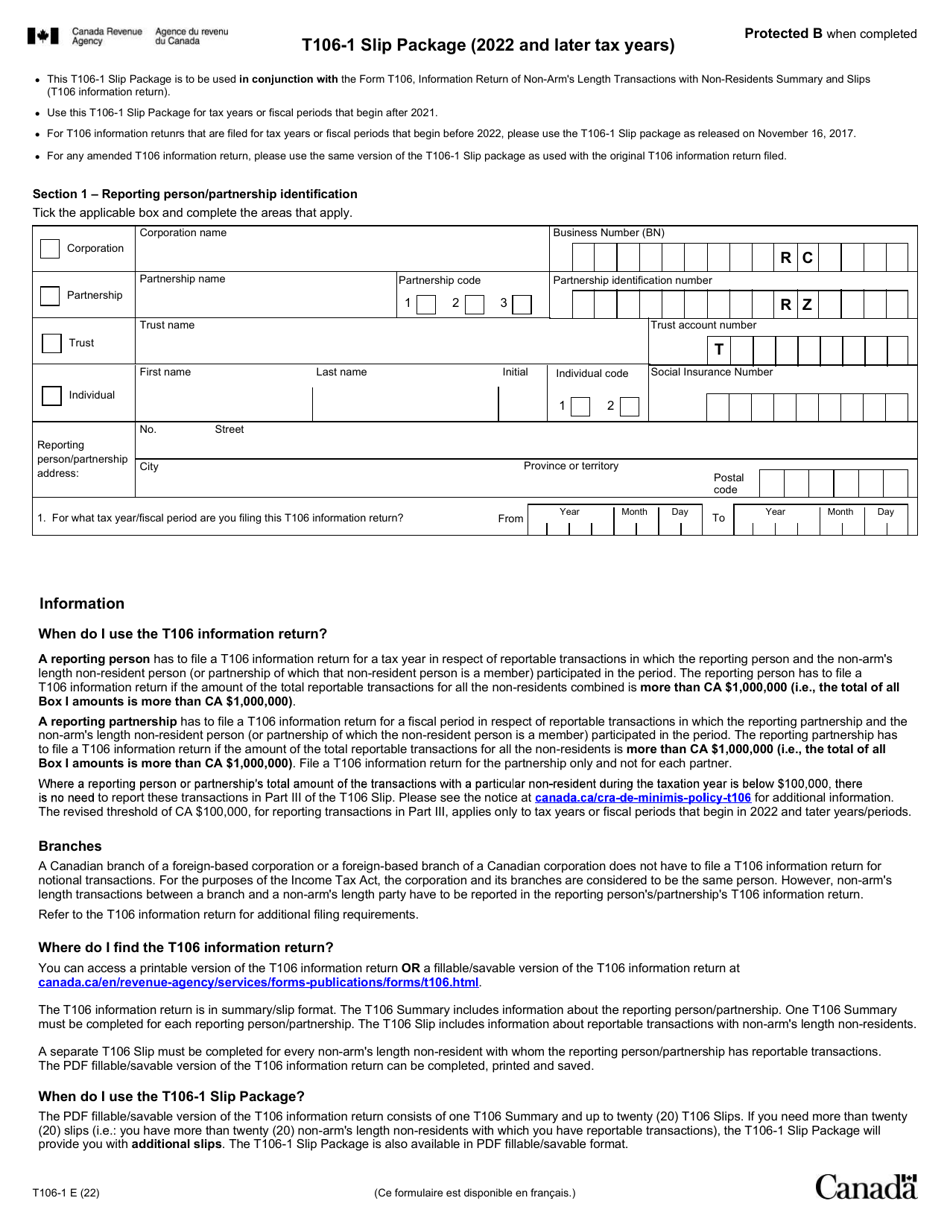

Form T106-1 Slip Package (2022 and Later Tax Years) - Canada

The Form T106-1 Slip Package (2022 and Later Tax Years) in Canada is used to report specified foreign property owned by Canadian residents. It is part of the annual tax filing process.

The Form T106-1 Slip Package for the tax years 2022 and later in Canada is filed by individuals or entities who have to report specified foreign property holdings on their tax return.

Form T106-1 Slip Package (2022 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

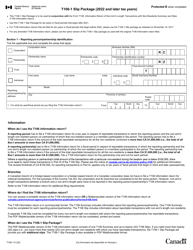

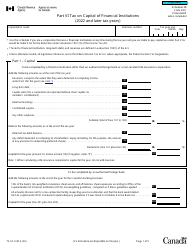

Q: What is the Form T106-1 Slip Package?

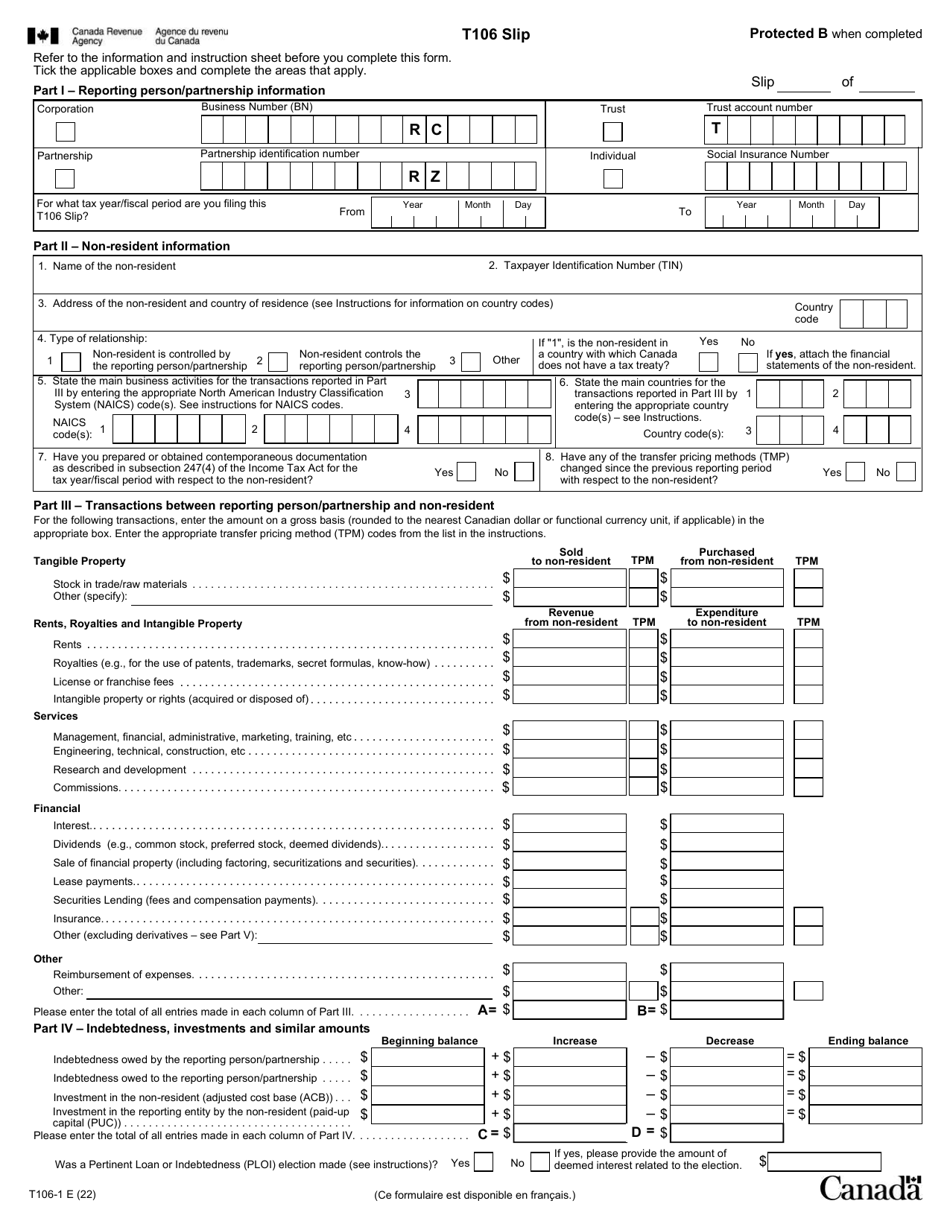

A: The Form T106-1 Slip Package is a set of forms used for reporting information related to foreign non-affiliated corporations (FNAC) by Canadian taxpayers.

Q: Who needs to use the Form T106-1 Slip Package?

A: Canadian taxpayers who have investments or business dealings with foreign non-affiliated corporations (FNAC) need to use the Form T106-1 Slip Package.

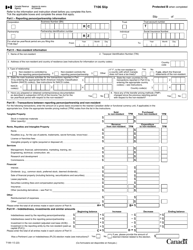

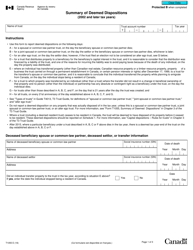

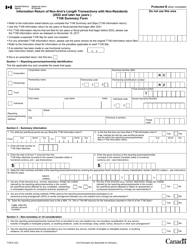

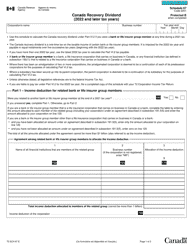

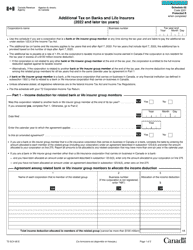

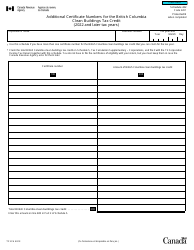

Q: What information is reported on the Form T106-1 Slip Package?

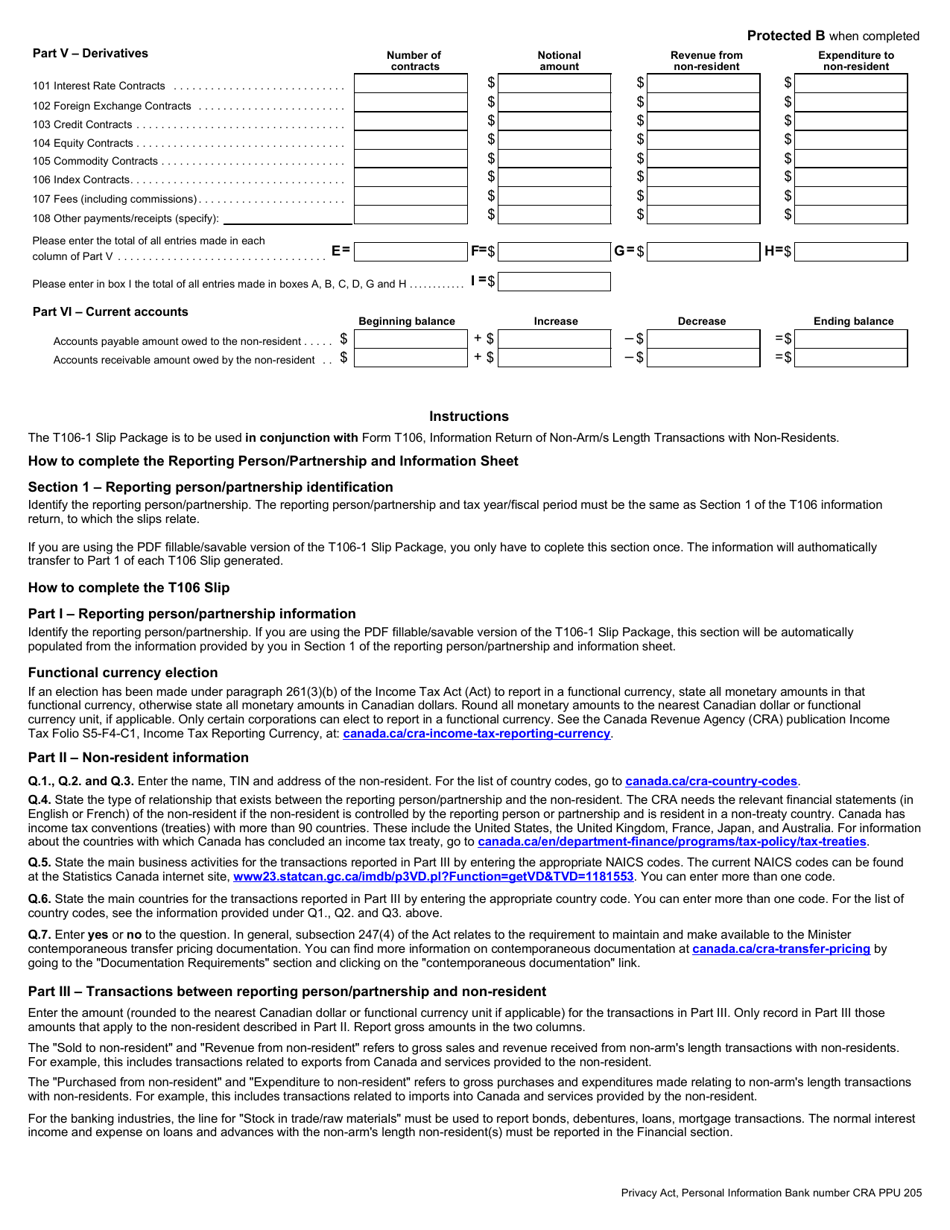

A: The Form T106-1 Slip Package reports various information related to foreign non-affiliated corporations (FNAC), such as dividends received, shares held, loans given, and other transactions.

Q: Is the Form T106-1 Slip Package required for all foreign investments or business dealings?

A: No, the Form T106-1 Slip Package is specifically for reporting information related to foreign non-affiliated corporations (FNAC). Other types of foreign investments may require different reporting forms.

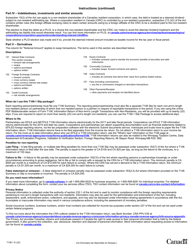

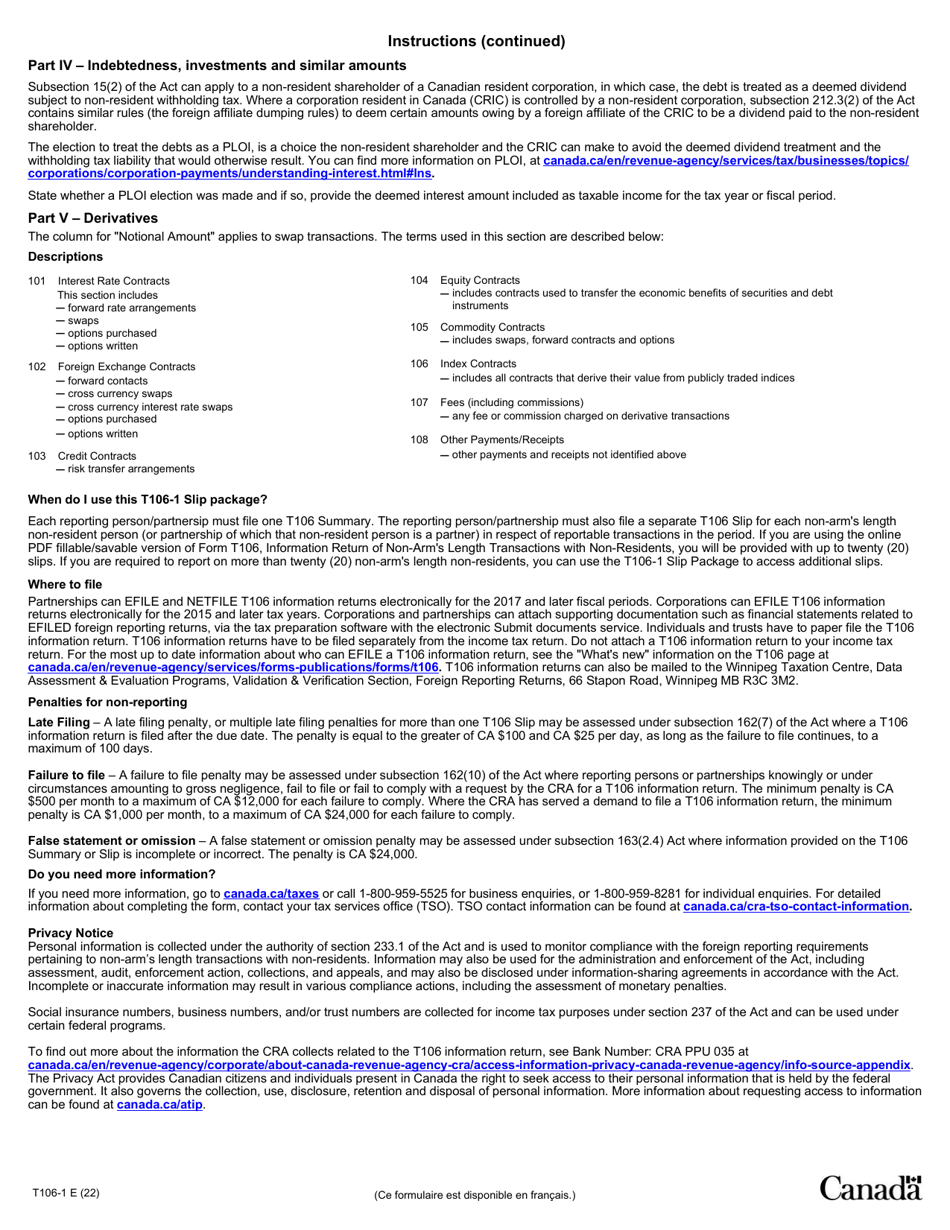

Q: Are there any penalties for not filing the Form T106-1 Slip Package?

A: Yes, there are penalties for not filing the Form T106-1 Slip Package or for filing it late. It's important to comply with the reporting requirements to avoid penalties.

Q: When is the deadline for filing the Form T106-1 Slip Package?

A: The deadline for filing the Form T106-1 Slip Package is the same as the deadline for filing your income tax return, which is generally April 30th of the following year.

Q: Can I file the Form T106-1 Slip Package electronically?

A: Yes, you can file the Form T106-1 Slip Package electronically through the CRA's My Business Account or Represent a Client services.

Q: Can I amend the Form T106-1 Slip Package after filing?

A: Yes, you can amend the Form T106-1 Slip Package after filing if you need to correct any errors or provide additional information. You would need to file an amended slip package.