This version of the form is not currently in use and is provided for reference only. Download this version of

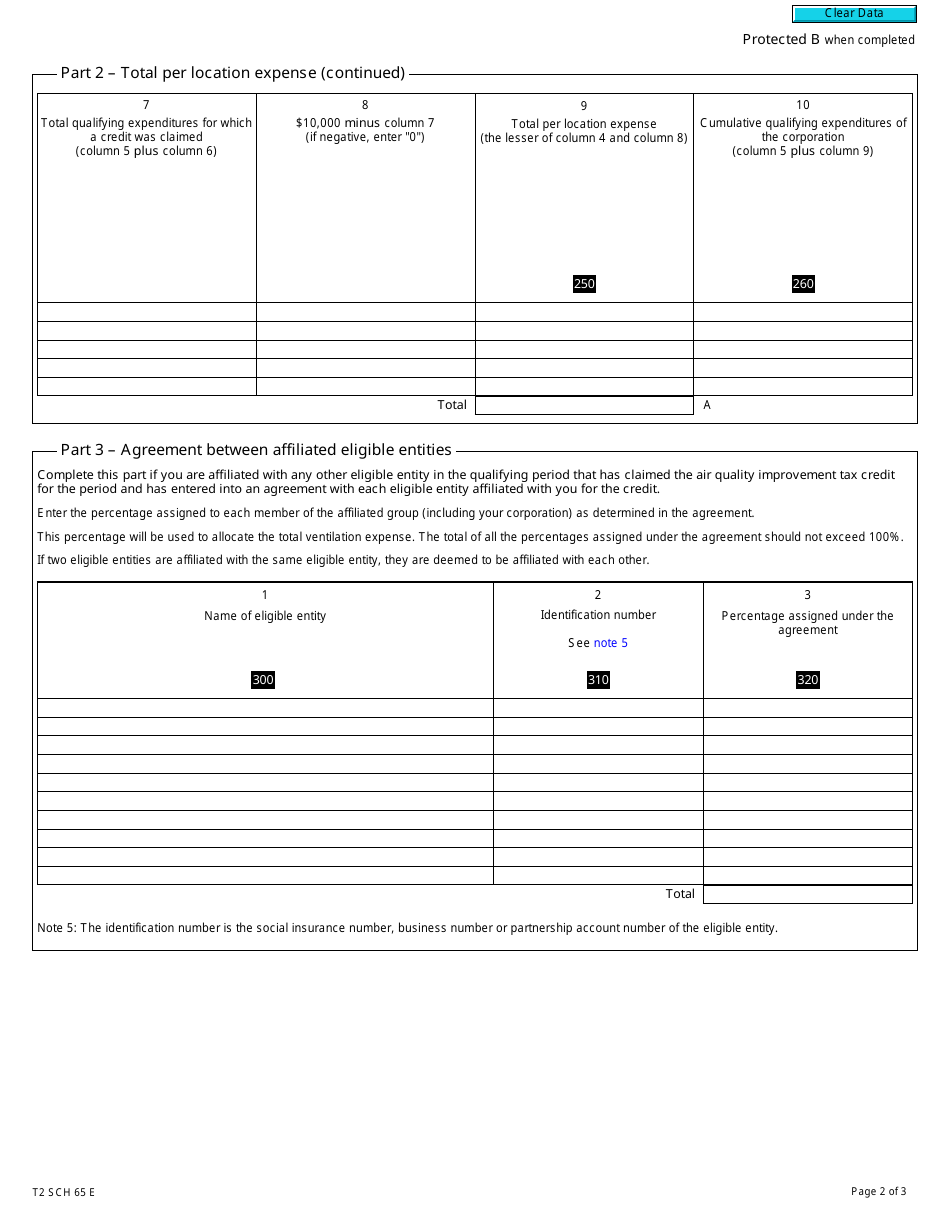

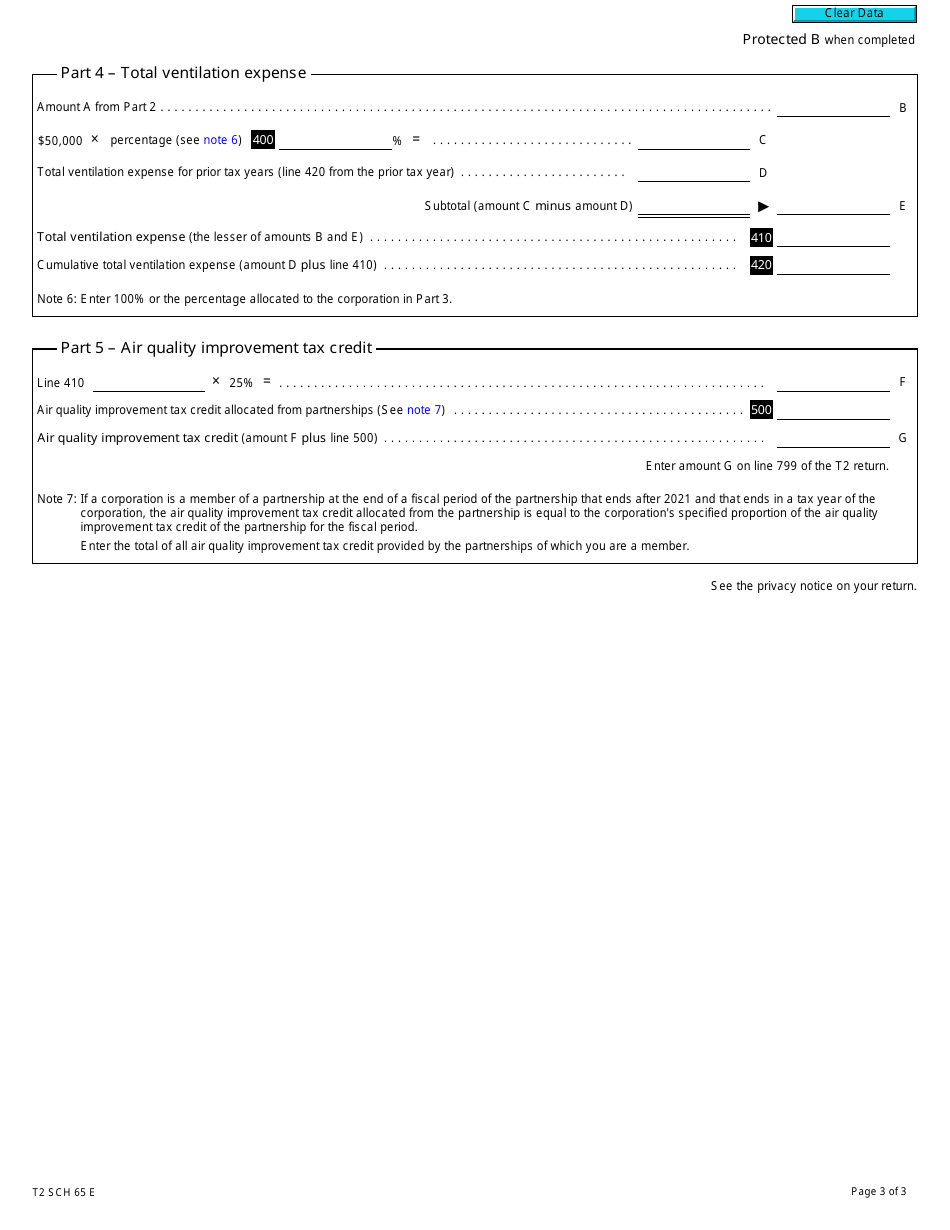

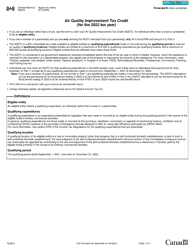

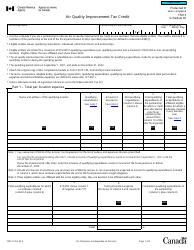

Form T2 Schedule 65

for the current year.

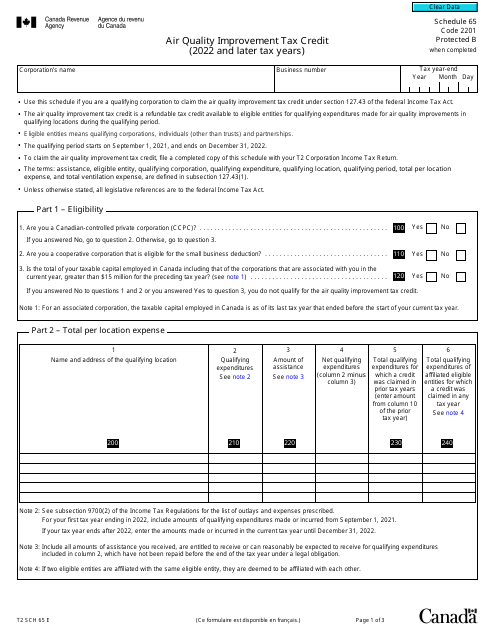

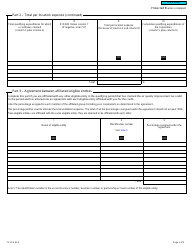

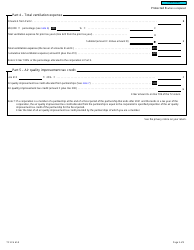

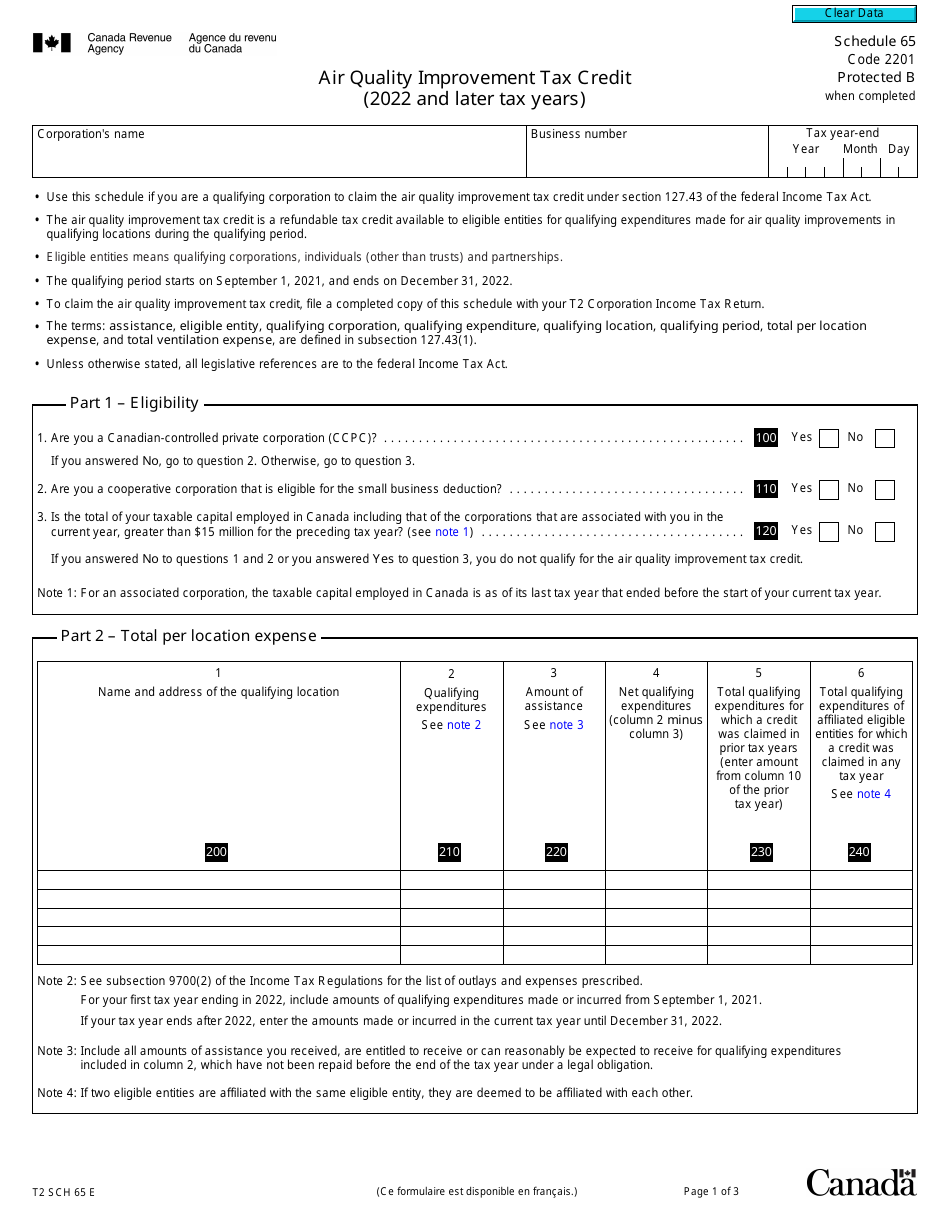

Form T2 Schedule 65 Air Quality Improvement Tax Credit (2022 and Later Tax Years) - Canada

Form T2 Schedule 65 is used in Canada to calculate the Air Quality ImprovementTax Credit for tax years 2022 and later. This credit is aimed at promoting environmentally friendly practices and reducing air pollution.

The Form T2 Schedule 65 Air Quality Improvement Tax Credit in Canada is filed by corporations that are eligible for the tax credit.

FAQ

Q: What is Form T2 Schedule 65?

A: Form T2 Schedule 65 is a form used in Canada for claiming the Air Quality Improvement Tax Credit.

Q: What is the Air Quality Improvement Tax Credit?

A: The Air Quality Improvement Tax Credit is a tax credit that encourages eligible businesses to make investments in air quality improvement equipment.

Q: Who is eligible for the Air Quality Improvement Tax Credit?

A: Eligible businesses in Canada that have made investments in air quality improvement equipment are eligible to claim this tax credit.

Q: What are the requirements for claiming the Air Quality Improvement Tax Credit?

A: To claim the tax credit, businesses must complete Form T2 Schedule 65 and include it with their corporate tax return. They must also meet certain criteria, such as having acquired eligible equipment and obtaining certification.

Q: What expenses are eligible for the Air Quality Improvement Tax Credit?

A: Expenses related to the acquisition, lease, or installation of eligible air quality improvement equipment are eligible for the tax credit.

Q: How much is the Air Quality Improvement Tax Credit?

A: The tax credit is equal to a specified percentage of eligible expenses. The exact percentage may vary depending on the tax year.

Q: When should Form T2 Schedule 65 be filed?

A: Form T2 Schedule 65 should be filed with the corporate tax return for the relevant tax year.

Q: Are there any deadlines for claiming the Air Quality Improvement Tax Credit?

A: The specific deadlines for claiming the tax credit may vary depending on the tax year. It is important to consult the CRA's guidelines and deadlines.

Q: Can individuals claim the Air Quality Improvement Tax Credit?

A: No, the tax credit is only available to eligible businesses.