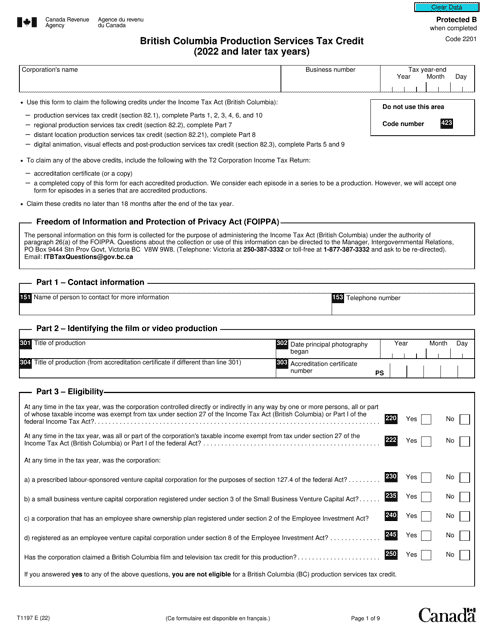

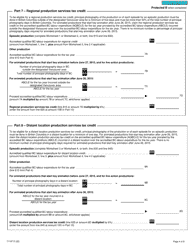

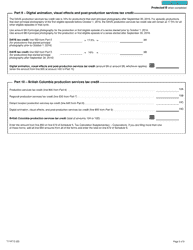

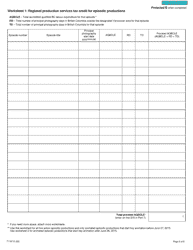

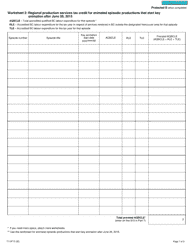

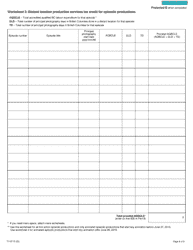

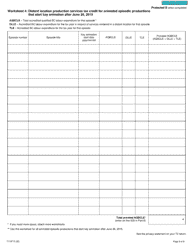

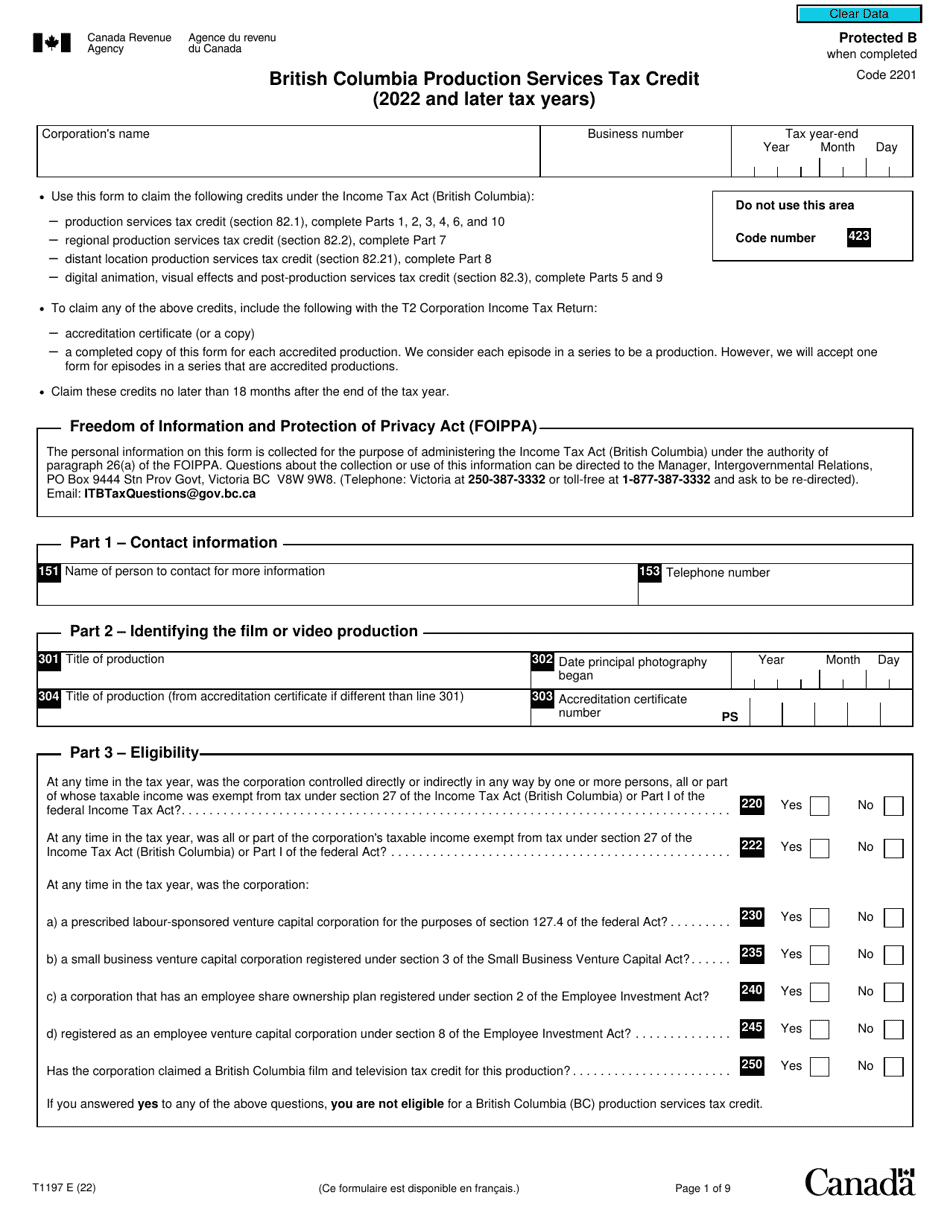

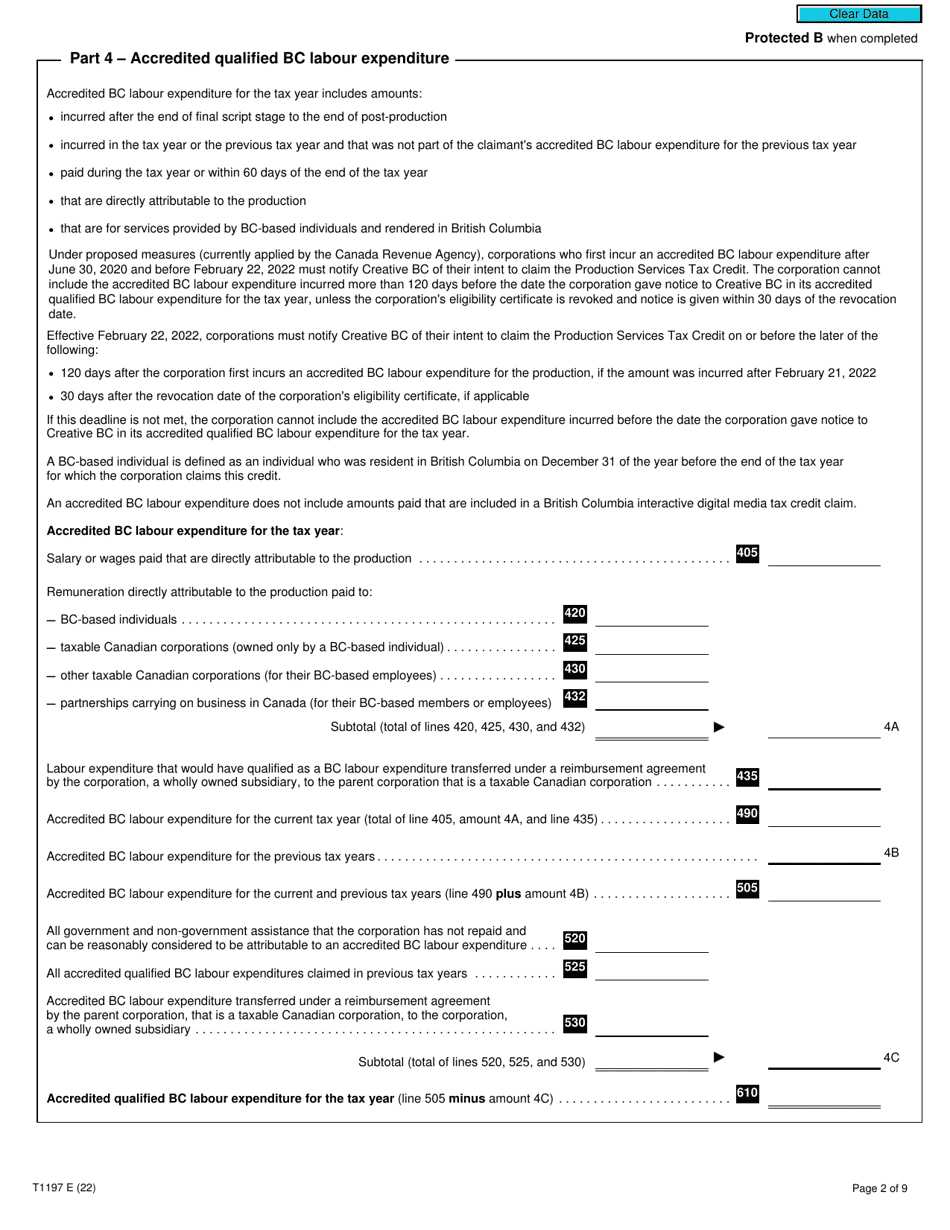

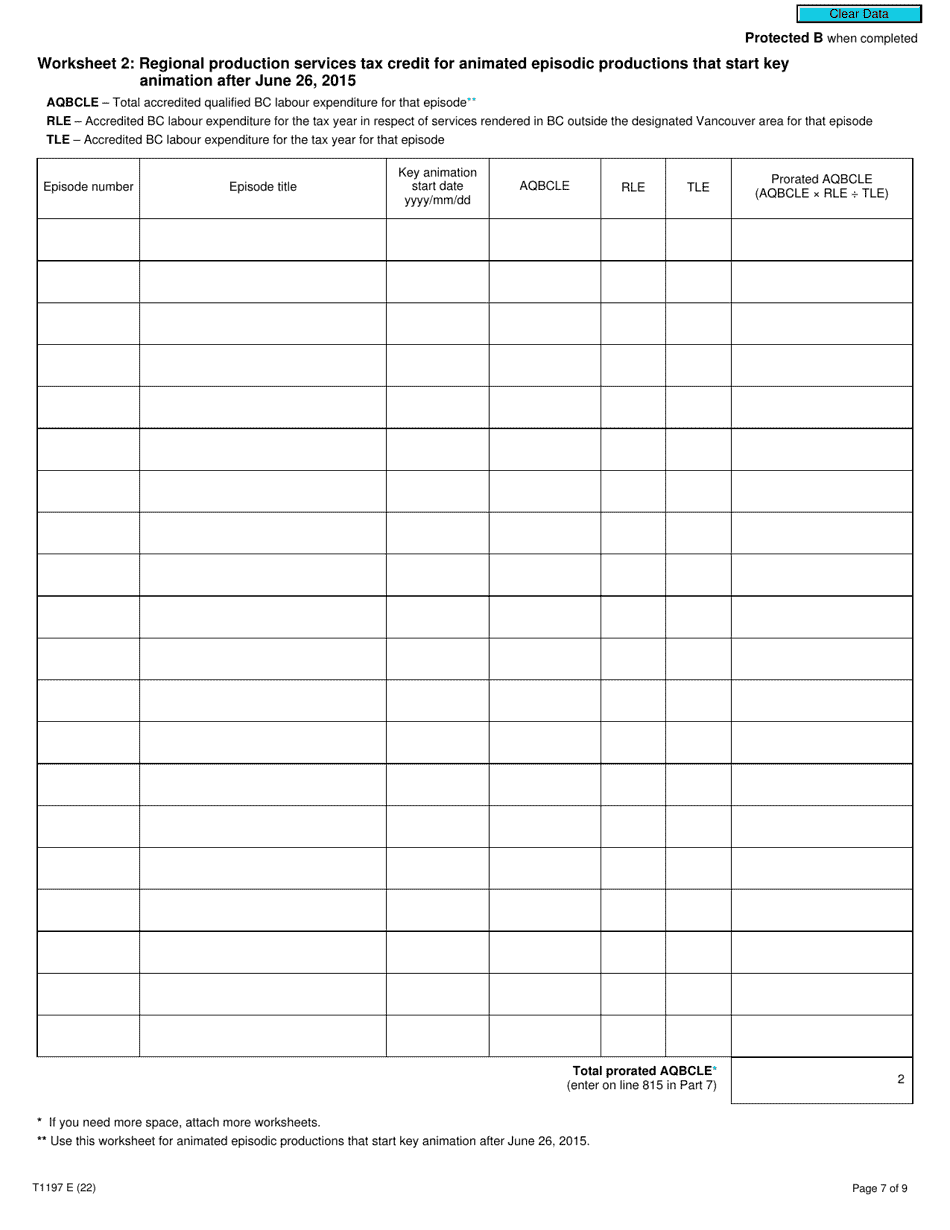

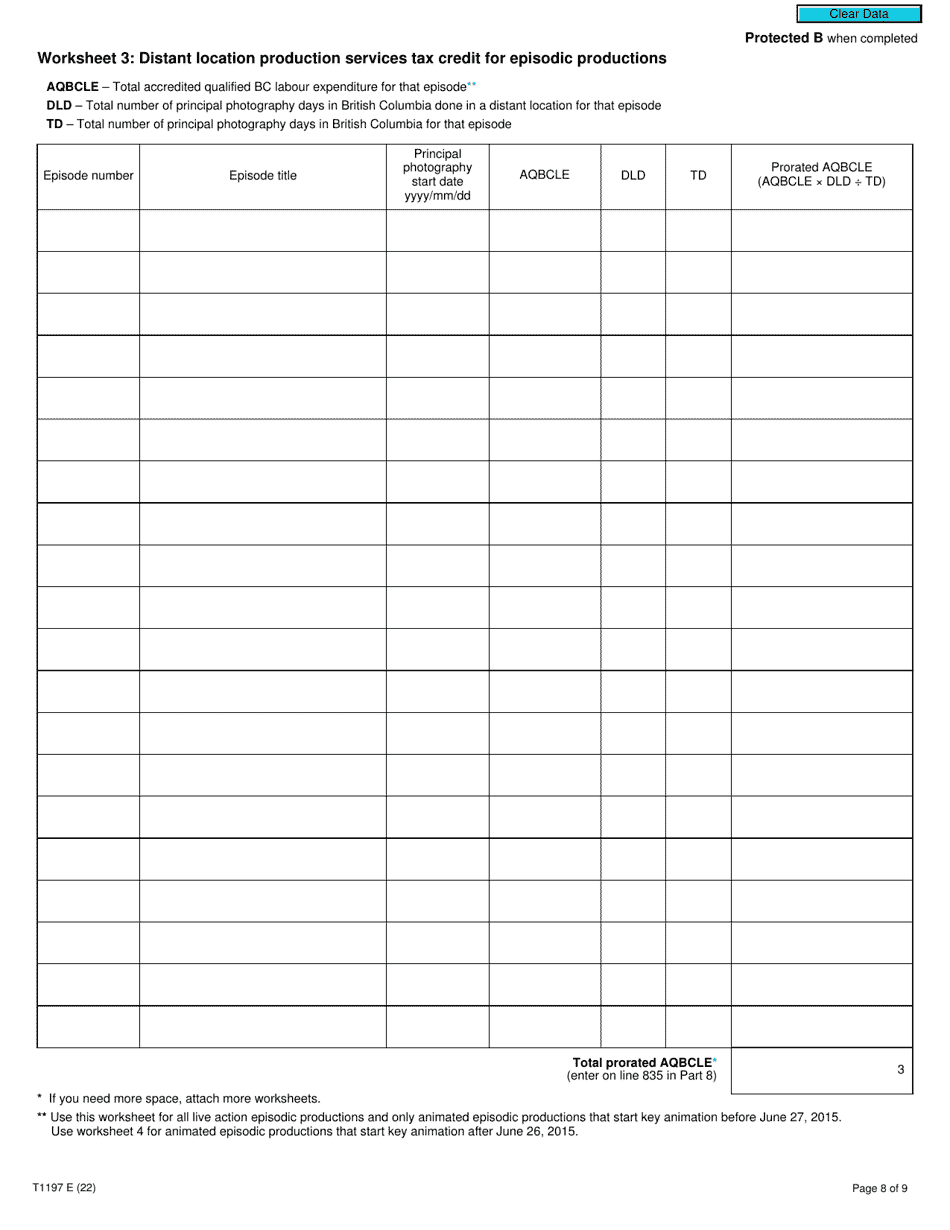

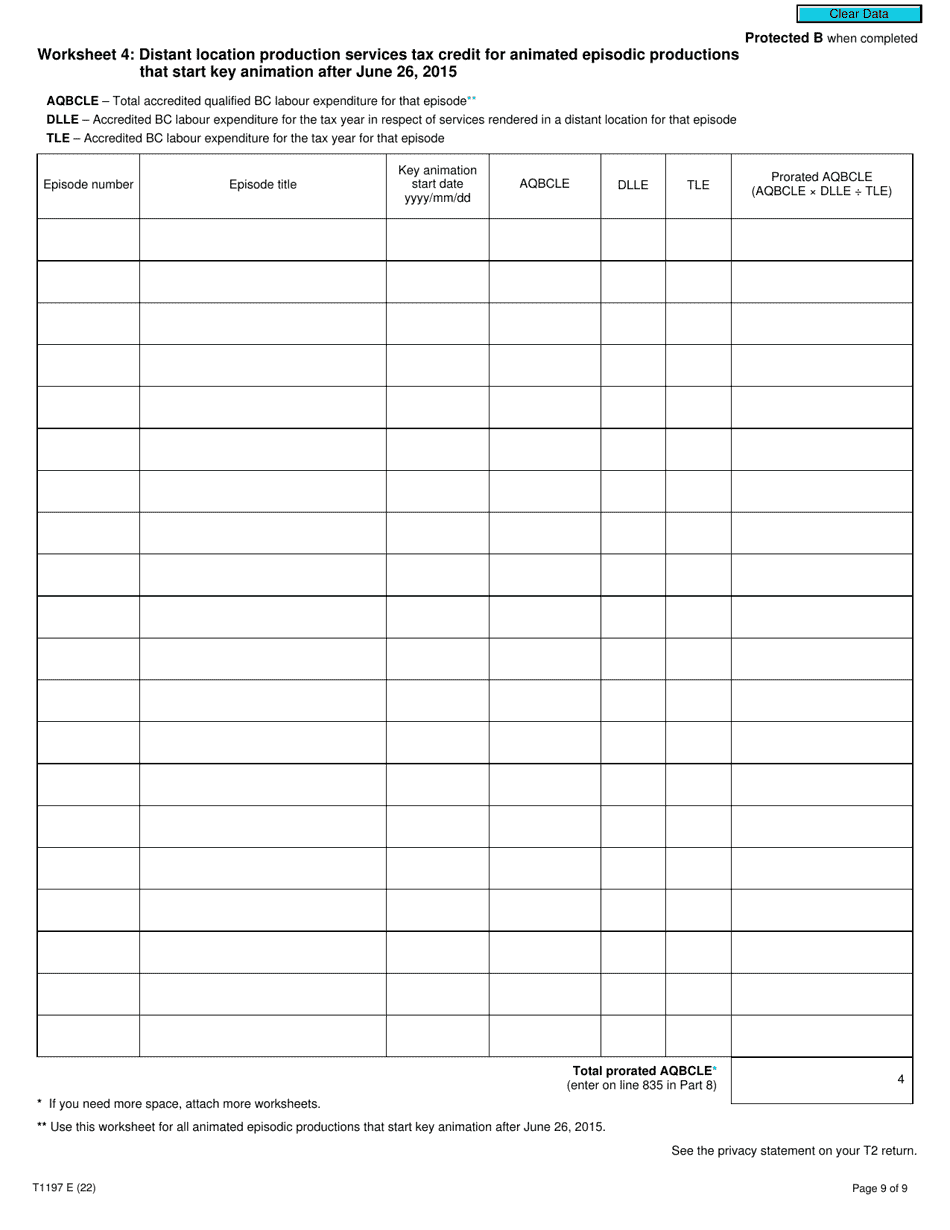

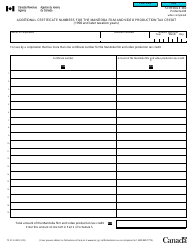

Form T1197 British Columbia Production Services Tax Credit (2022 and Later Tax Years) - Canada

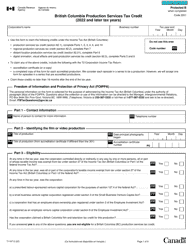

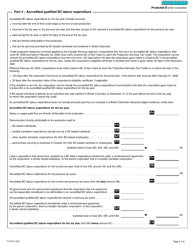

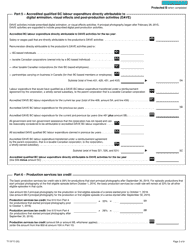

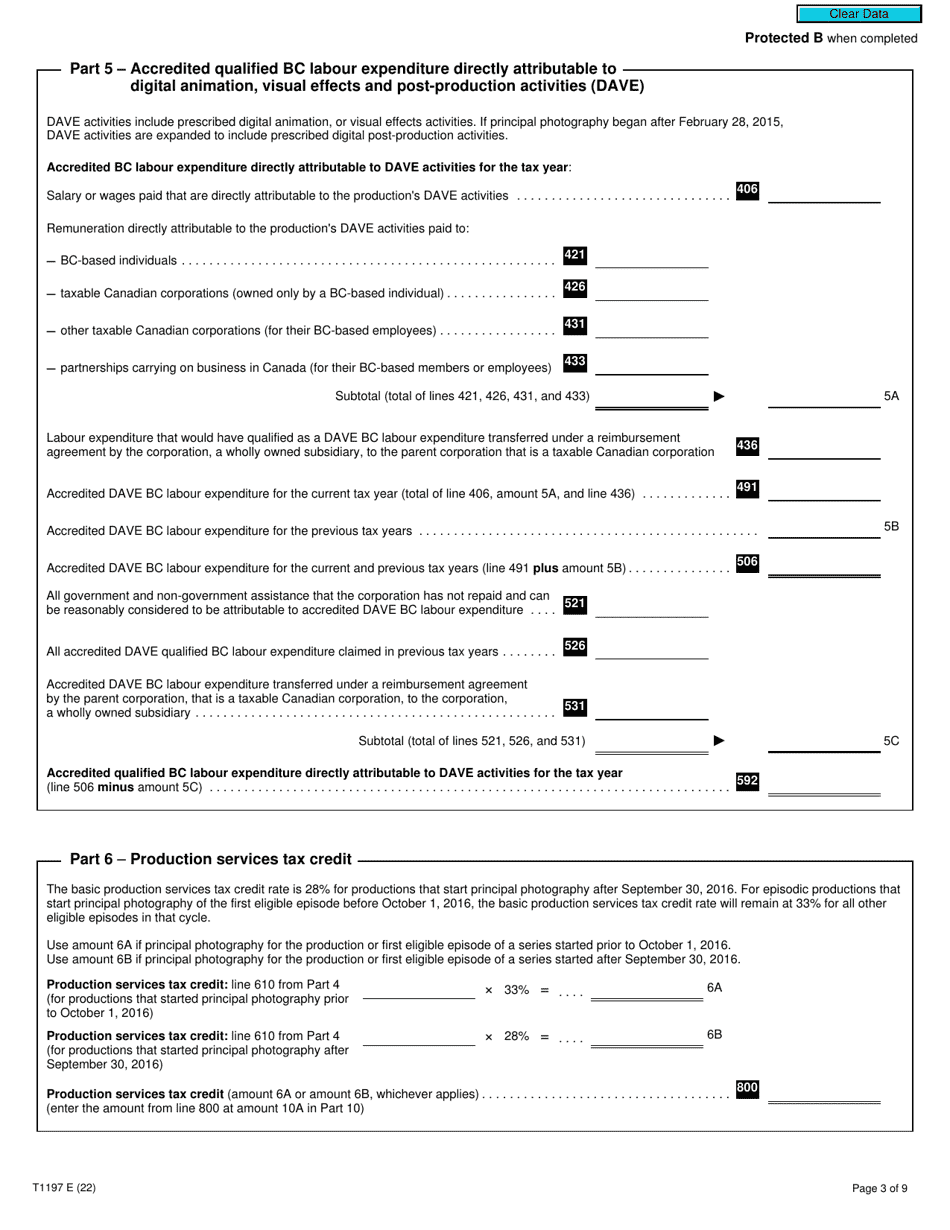

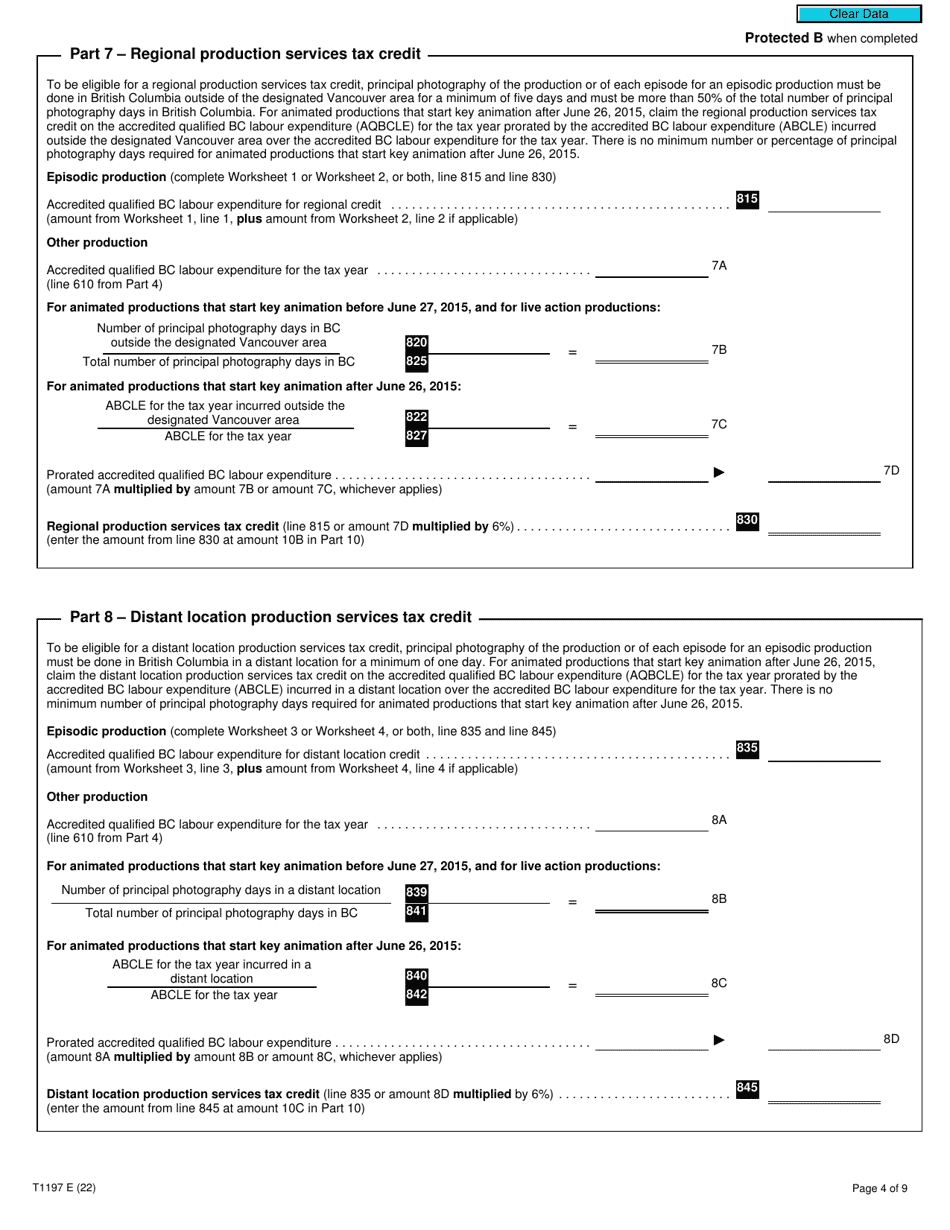

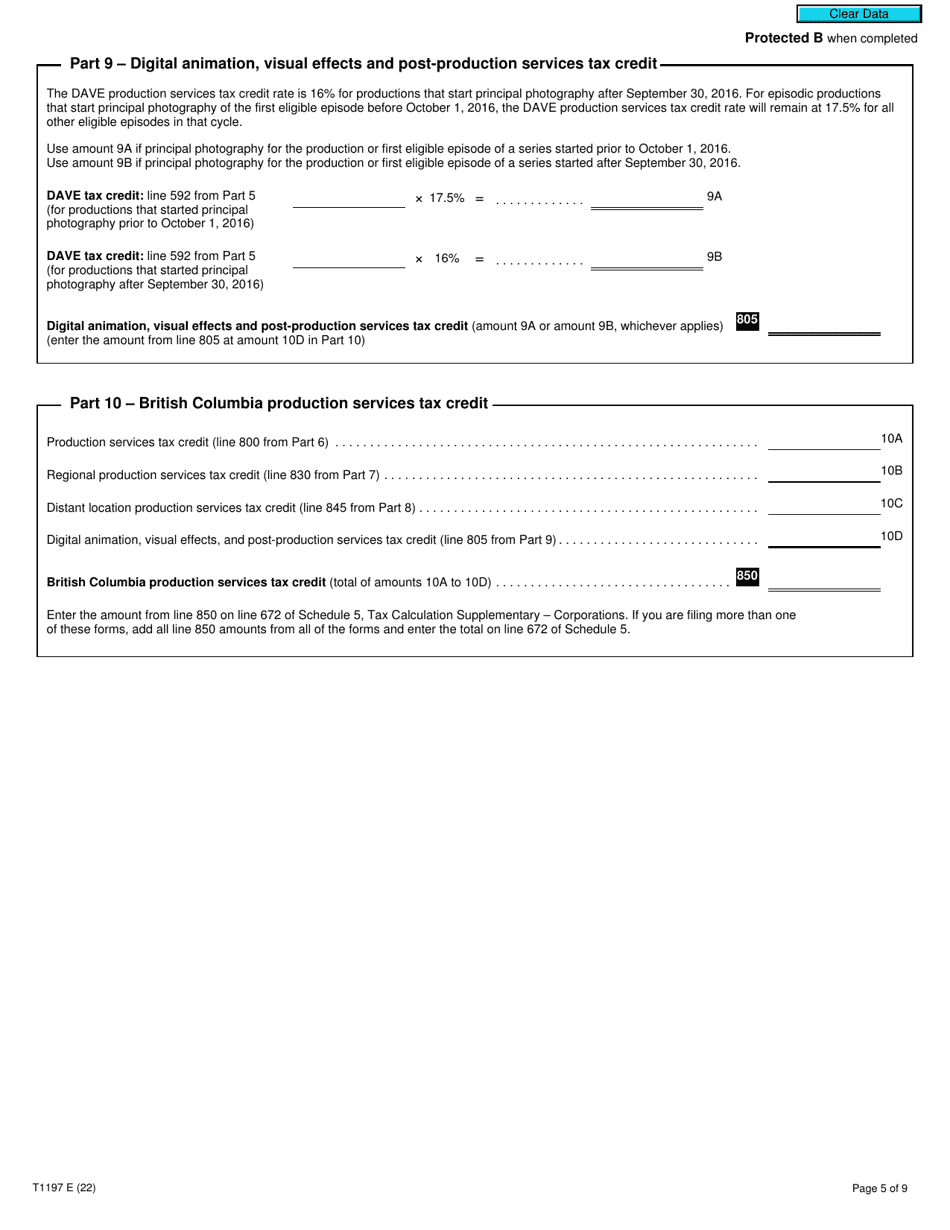

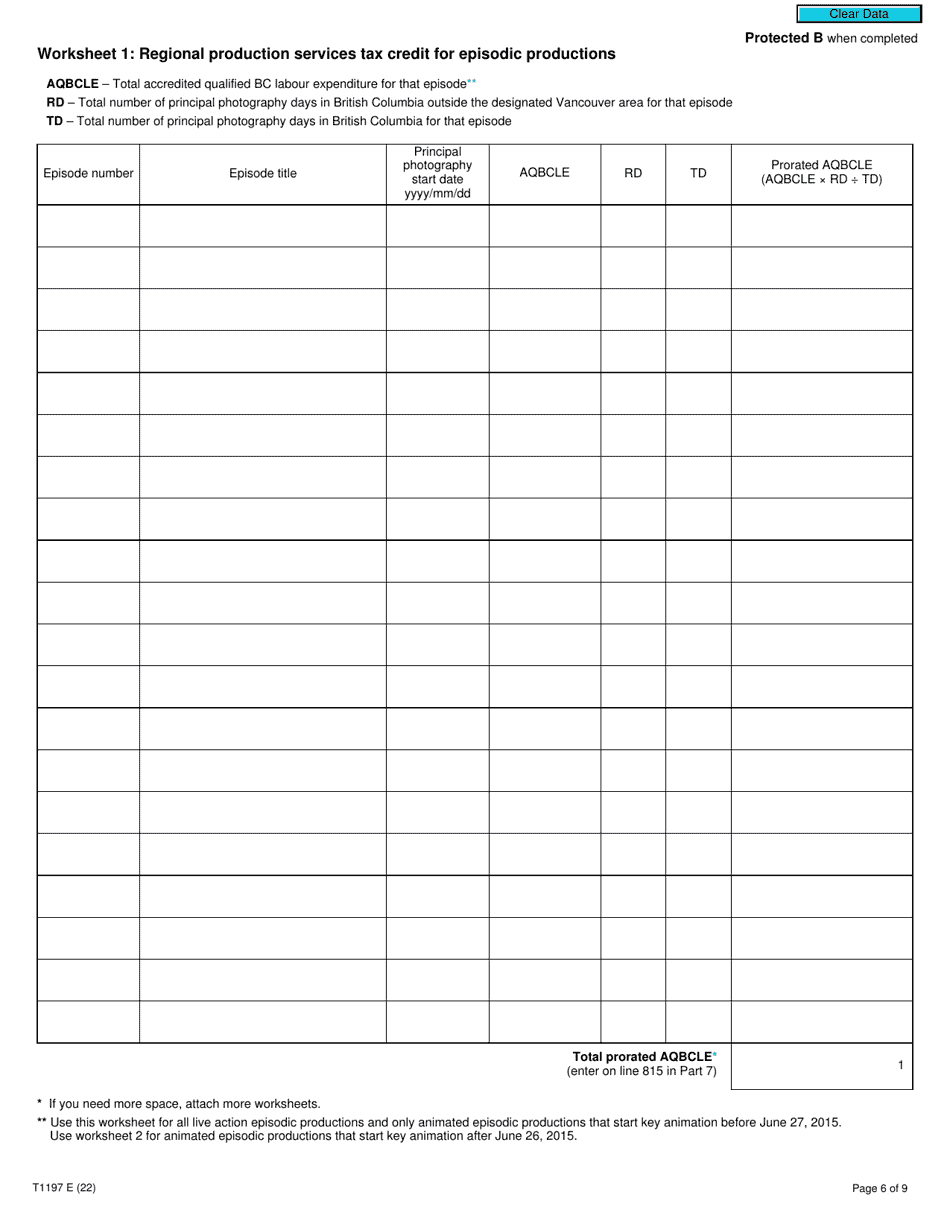

The Form T1197 British Columbia Production Services Tax Credit in Canada is used to claim tax credits related to production activities in the province of British Columbia. It is applicable for the tax years 2022 and later.

The production company or applicant files the Form T1197 British Columbia Production Services Tax Credit in Canada.

FAQ

Q: What is Form T1197?

A: Form T1197 is the British Columbia Production Services Tax Credit form.

Q: What does the British Columbia Production Services Tax Credit provide?

A: The tax credit provides incentives for film and television production companies who undertake eligible activities in British Columbia.

Q: Who is eligible for the British Columbia Production Services Tax Credit?

A: Film and television production companies that meet certain criteria are eligible for the tax credit.

Q: What activities qualify for the tax credit?

A: Eligible activities include production services, visual effects or animation services, and post-production services.

Q: What is the purpose of the tax credit?

A: The tax credit aims to attract film and television production activities to British Columbia, which can contribute to the local economy and create jobs.

Q: Are there any deadlines for filing Form T1197?

A: Yes, there are specific deadlines for filing the form. It is important to review the official guidelines and instructions for the tax credit for the most up-to-date information.