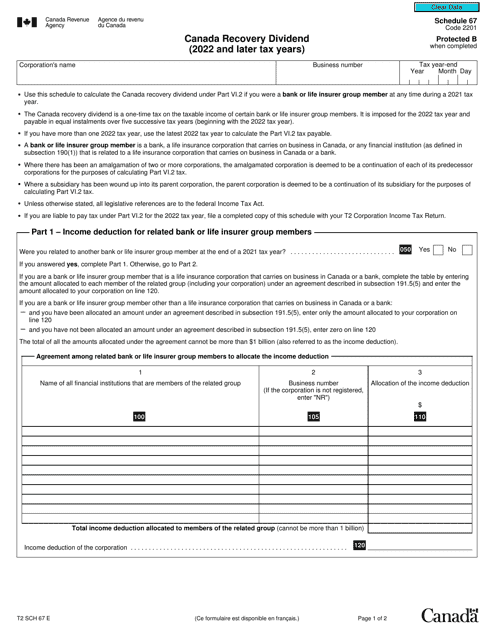

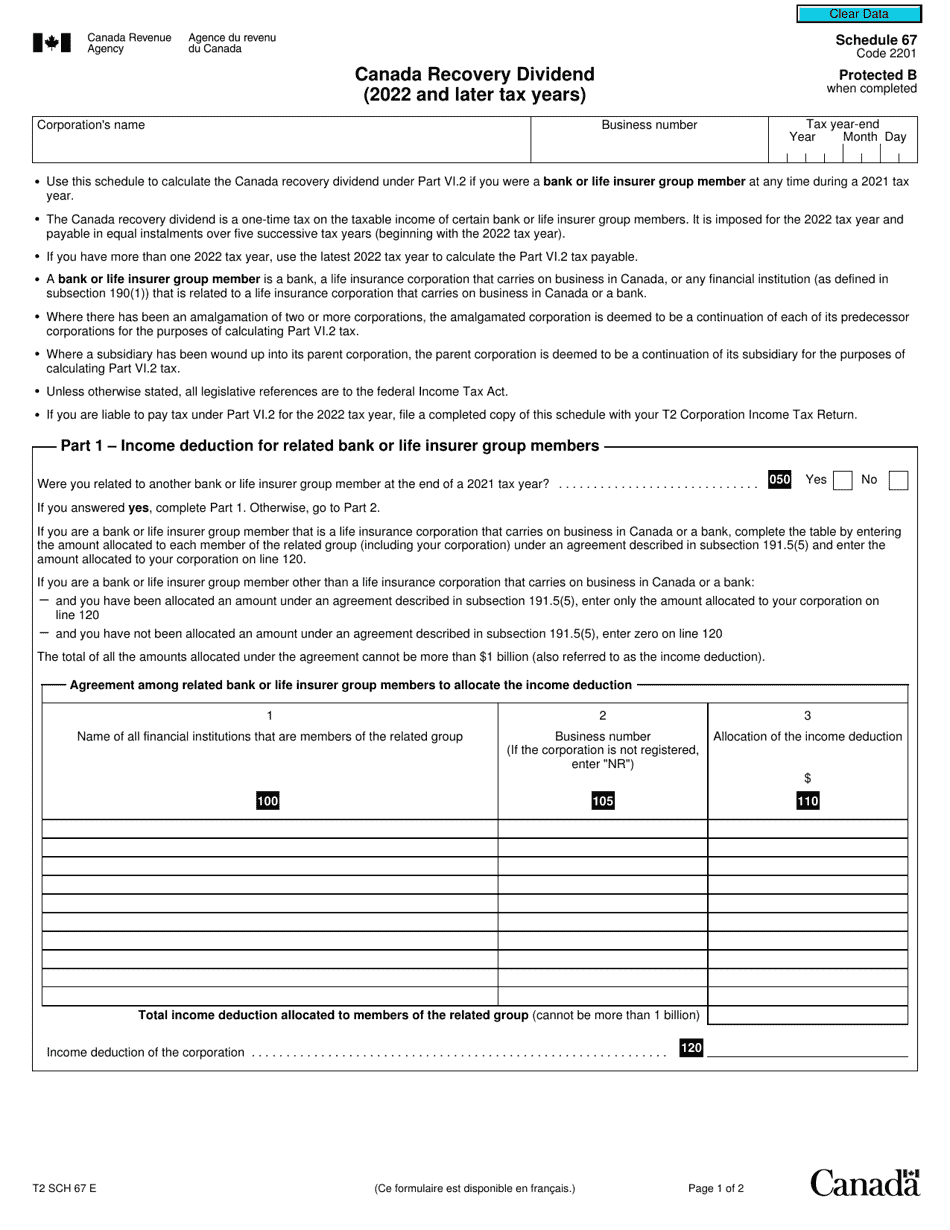

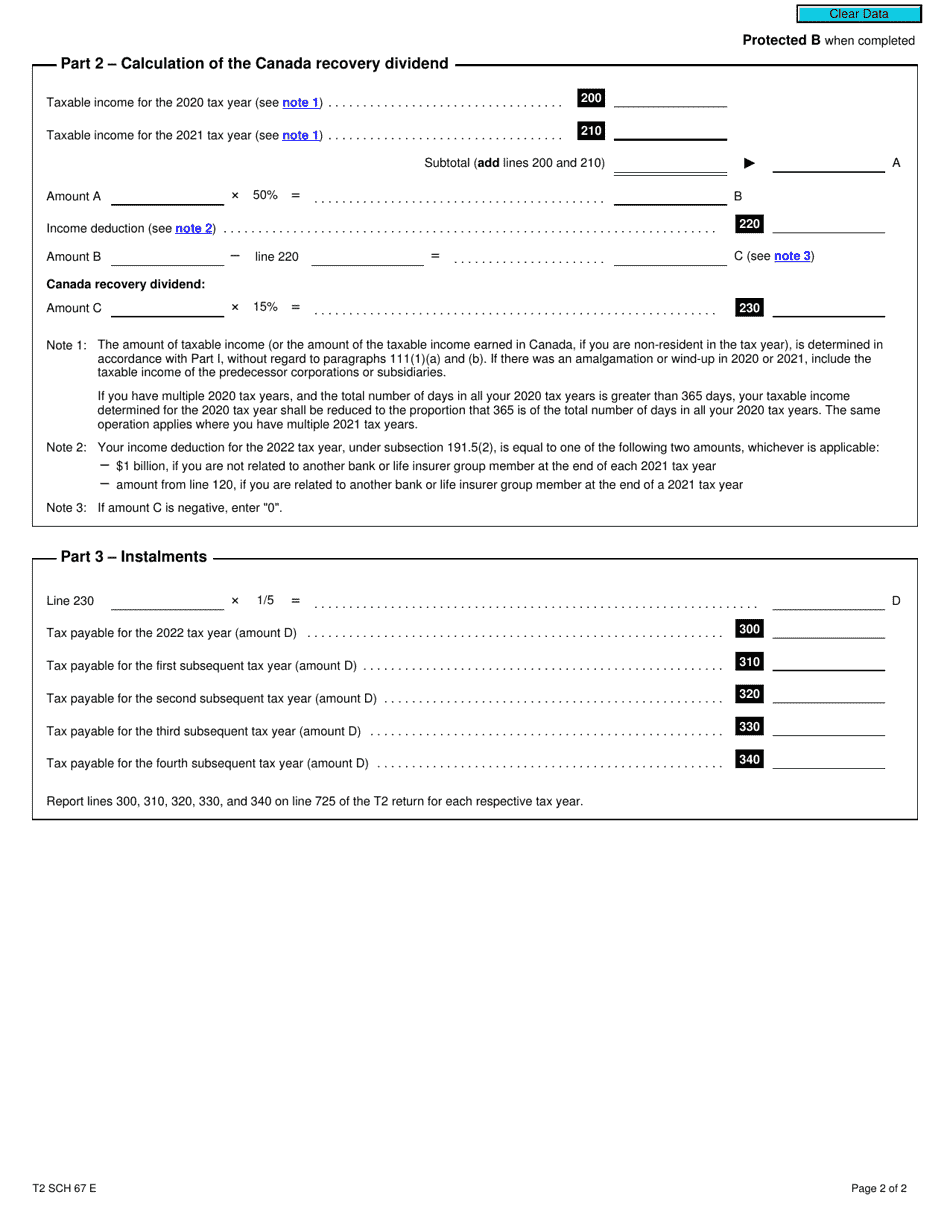

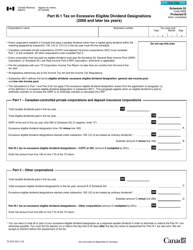

Form T2 Schedule 67 Canada Recovery Dividend (2022 and Later Tax Years) - Canada

The corporation filing its Canadian tax return would generally file the Form T2 Schedule 67 for the Canada Recovery Dividend.

FAQ

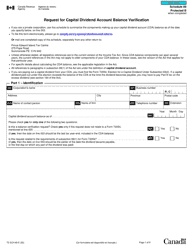

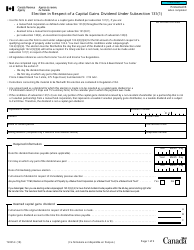

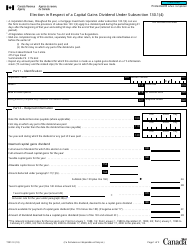

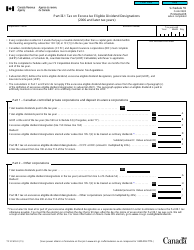

Q: What is the T2 Schedule 67?

A: The T2 Schedule 67 is a form used in Canada for reporting the Canada Recovery Dividend for tax years 2022 and later.

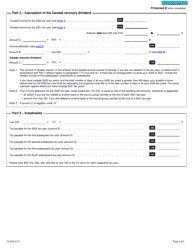

Q: What is the Canada Recovery Dividend?

A: The Canada Recovery Dividend is a program in Canada designed to provide financial support to eligible businesses that have experienced a significant decline in revenue due to COVID-19.

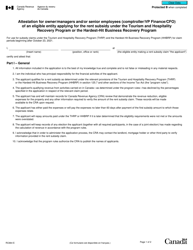

Q: Who is eligible for the Canada Recovery Dividend?

A: Eligibility for the Canada Recovery Dividend is determined by specific criteria set by the Canadian government. It is generally available to businesses that meet certain revenue decline thresholds.

Q: How do I report the Canada Recovery Dividend on the T2 Schedule 67?

A: To report the Canada Recovery Dividend, you need to complete the T2 Schedule 67 and include it with your corporate income tax return (T2) for the applicable tax year.