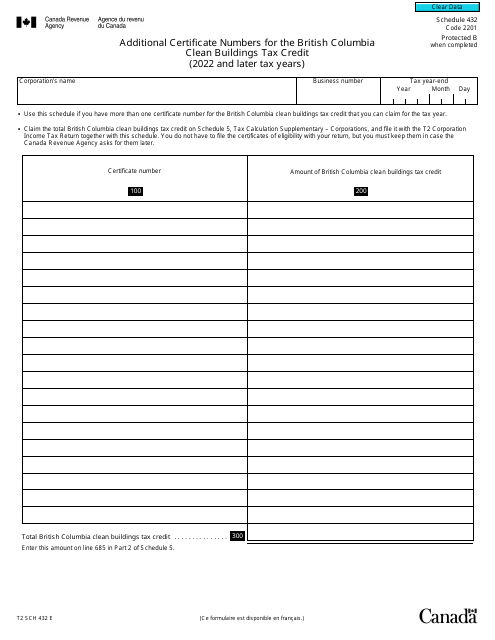

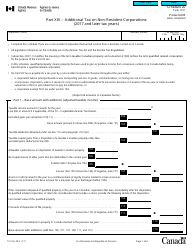

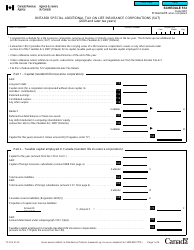

Form T2 Schedule 432 Additional Certificate Numbers for the British Columbia Clean Buildings Tax Credit (2022 and Later Tax Years) - Canada

Form T2 Schedule 432 is used in Canada for reporting additional certificate numbers related to the British Columbia Clean Buildings Tax Credit for the tax years 2022 and later. This form allows businesses to claim the tax credit for eligible energy-efficient buildings in British Columbia.

The Form T2 Schedule 432 for the British Columbia Clean Buildings Tax Credit is filed by corporations in Canada.

FAQ

Q: What is Form T2 Schedule 432?

A: Form T2 Schedule 432 is used for reporting additional certificate numbers for the British Columbia Clean Buildings Tax Credit in Canada for the tax years 2022 and later.

Q: What is the British Columbia Clean Buildings Tax Credit?

A: The British Columbia Clean Buildings Tax Credit is a tax credit in Canada that promotes energy efficiency improvements in buildings.

Q: Who needs to file Form T2 Schedule 432?

A: Taxpayers who have additional certificate numbers for the British Columbia Clean Buildings Tax Credit in Canada for the tax years 2022 and later need to file Form T2 Schedule 432.

Q: How do I complete Form T2 Schedule 432?

A: You should enter the additional certificate numbers for the British Columbia Clean Buildings Tax Credit in the appropriate sections of the form.