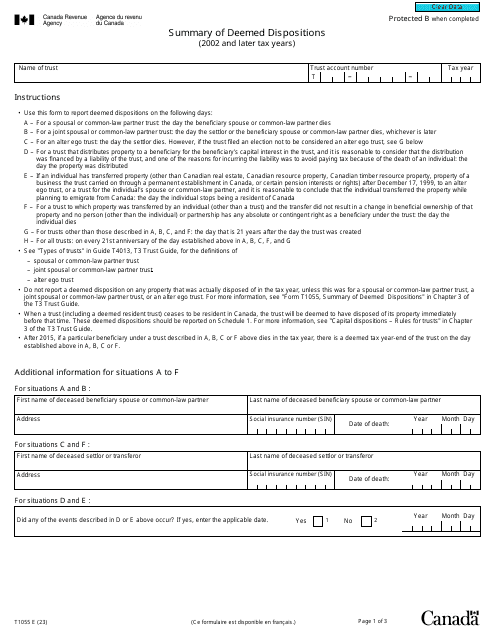

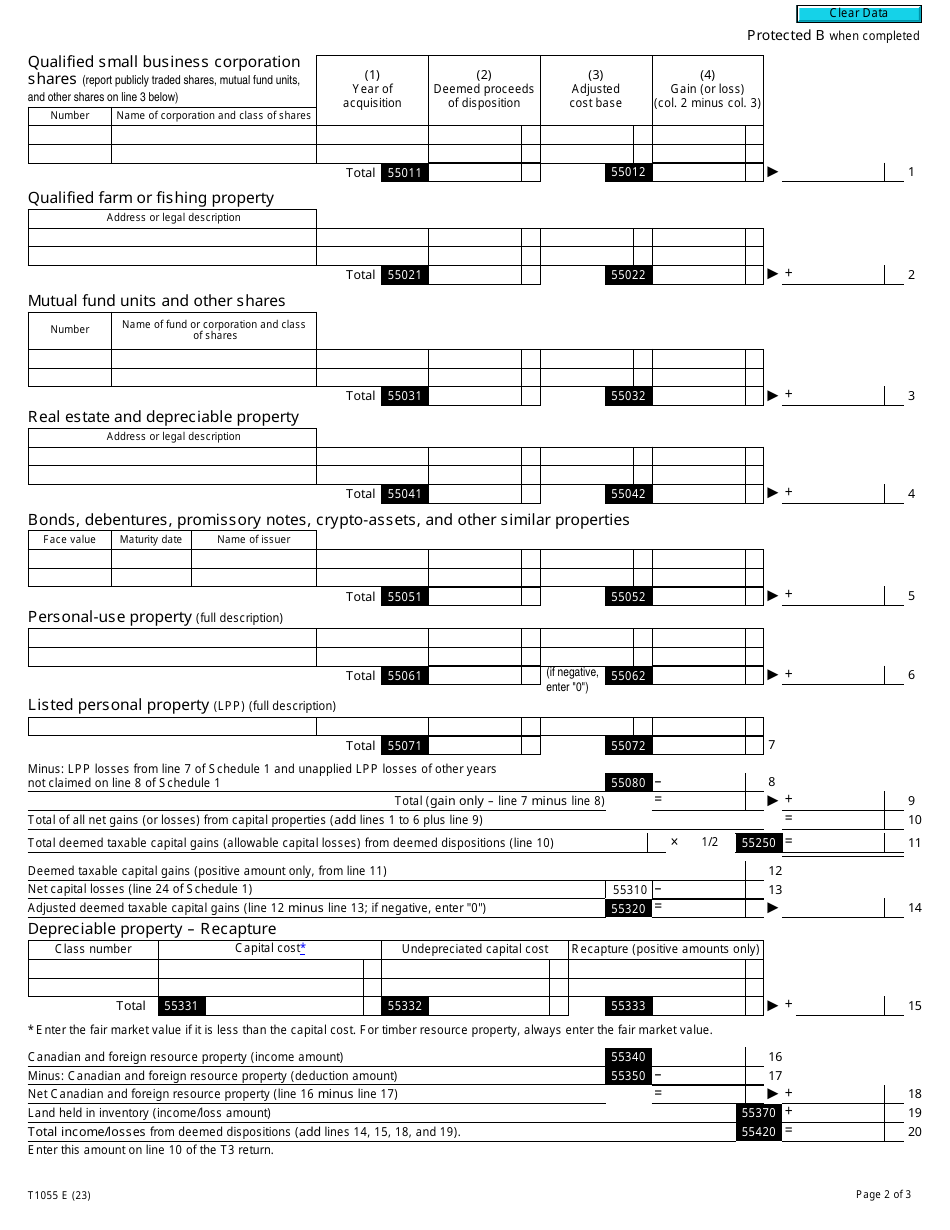

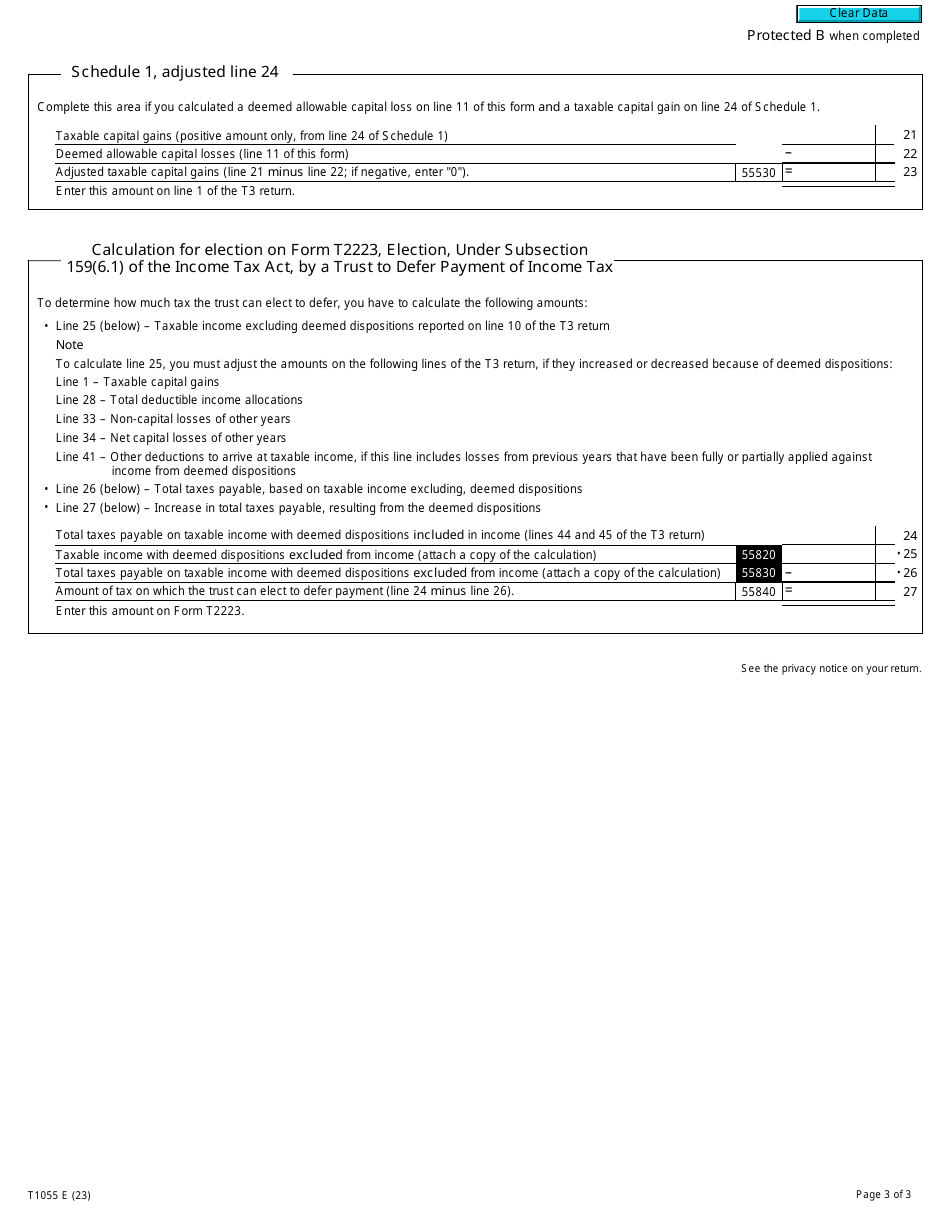

Form T1055 Summary of Deemed Dispositions (2002 and Later Tax Years) - Canada

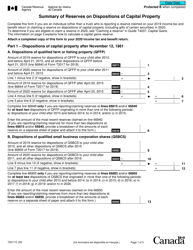

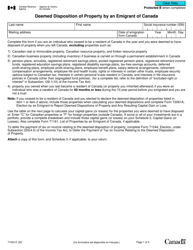

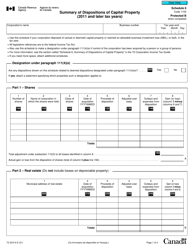

Form T1055 Summary of Deemed Dispositions (2002 and Later Tax Years) in Canada is used to report any deemed dispositions of property for tax purposes. A deemed disposition occurs when you are considered to have sold a property, even if you haven't actually sold it. This form helps you calculate and report any gains or losses resulting from these deemed dispositions.

The Form T1055 Summary of Deemed Dispositions in Canada is typically filed by individuals or businesses who have experienced a significant change in their property ownership or who may be subject to deemed dispositions for tax purposes.

Form T1055 Summary of Deemed Dispositions (2002 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1055?

A: Form T1055 is a tax form used in Canada to report deemed dispositions of certain property.

Q: Who needs to complete Form T1055?

A: Individuals or businesses who have experienced a deemed disposition of certain property in Canada need to complete Form T1055.

Q: What is a deemed disposition?

A: A deemed disposition is when the tax law treats a property as if it has been sold, even if no actual sale has taken place.

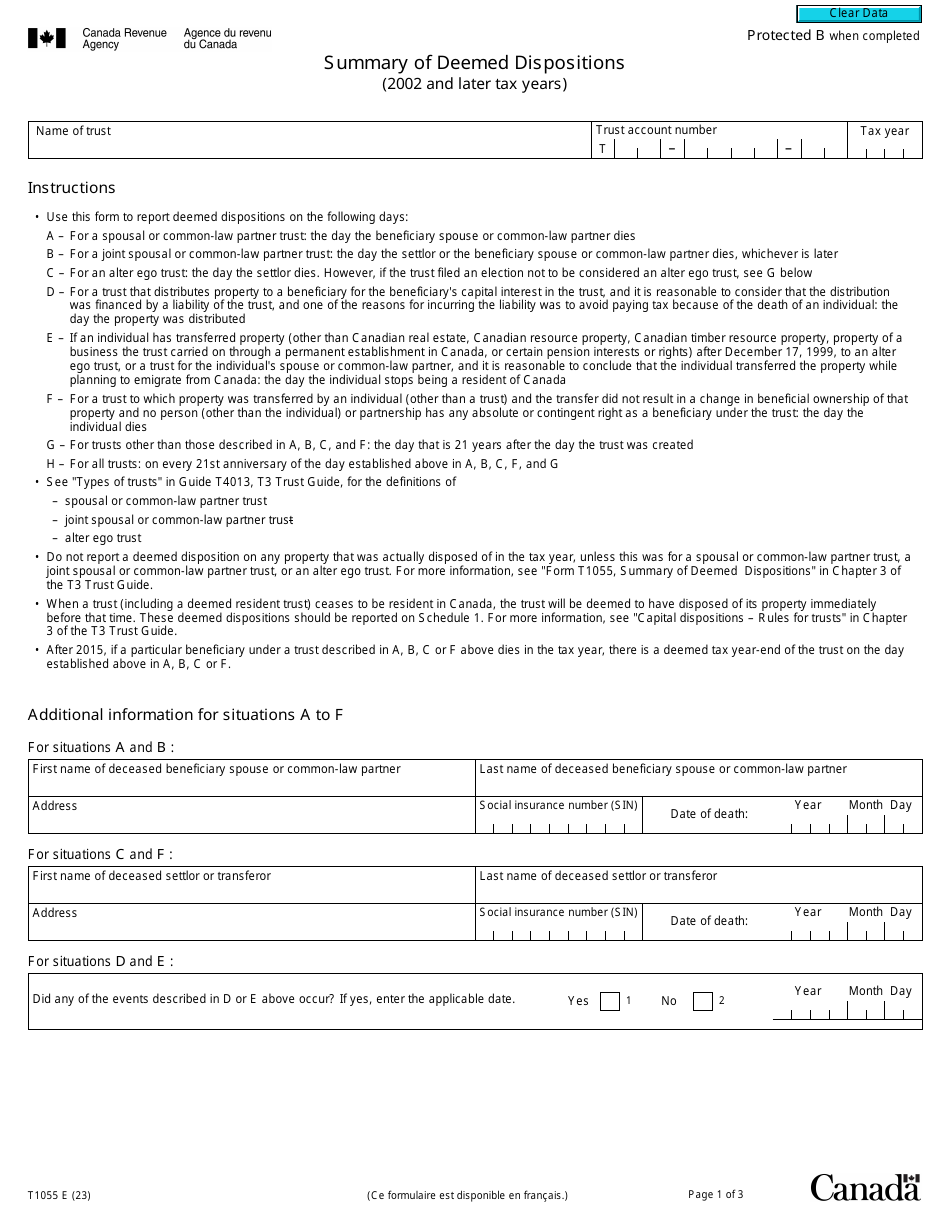

Q: What types of property are subject to deemed dispositions?

A: Several types of property can be subject to deemed dispositions, including real estate, stocks, and certain investments.

Q: When is Form T1055 due?

A: Form T1055 is generally due when you file your tax return for the year in which the deemed disposition occurred.

Q: Do I need to include supporting documents with Form T1055?

A: Yes, you may need to include supporting documents such as property valuation reports or purchase agreements when submitting Form T1055.