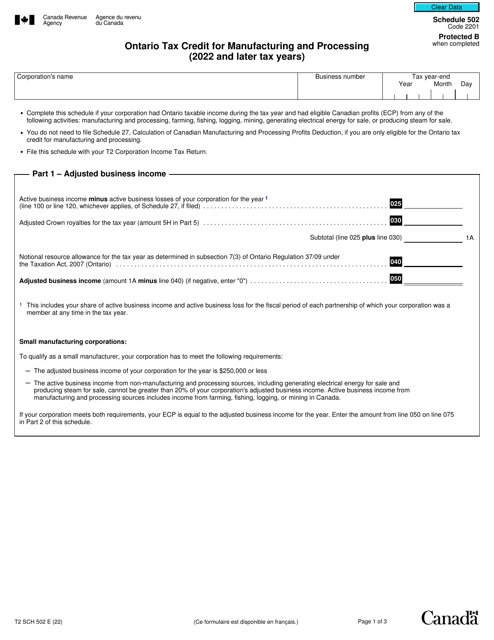

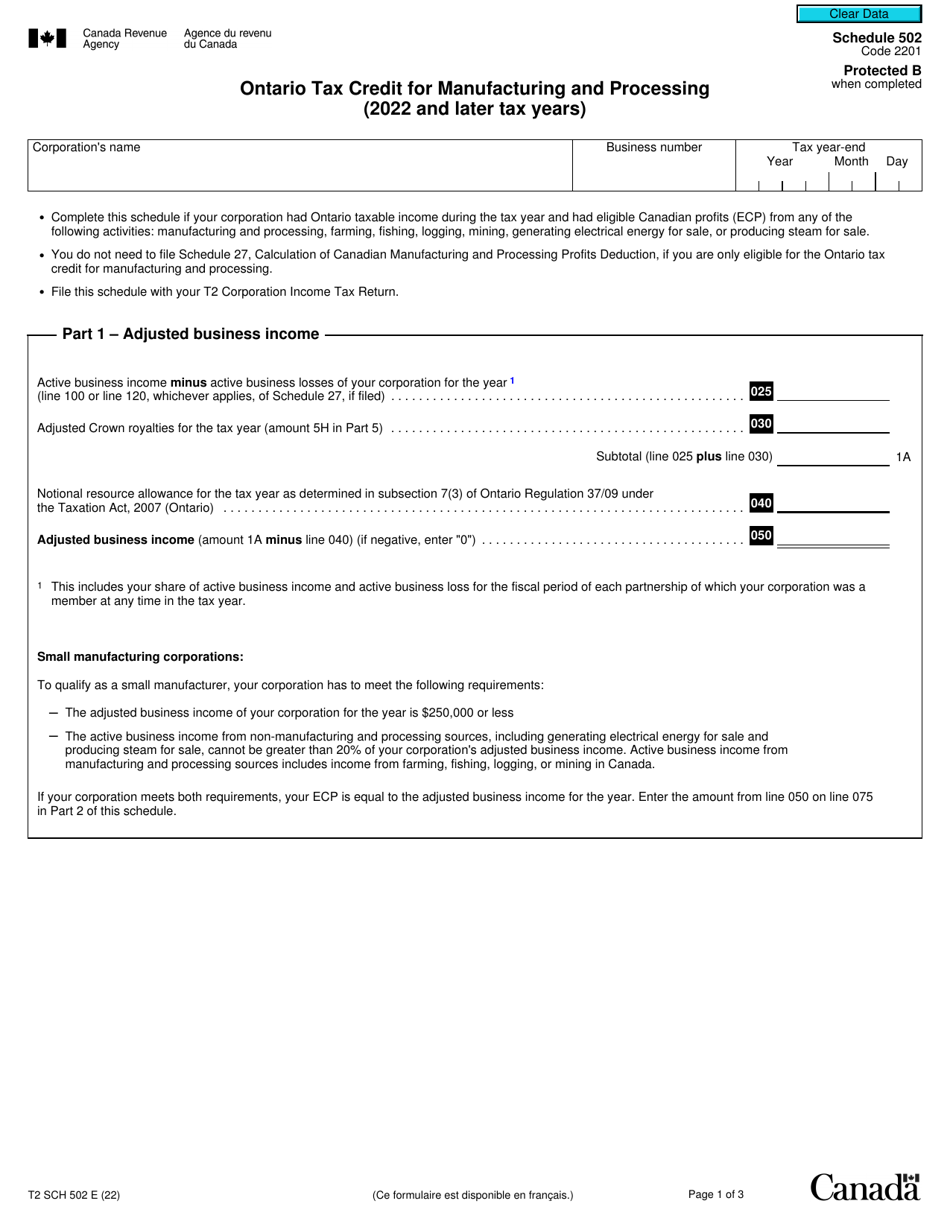

Form T2 Schedule 502 Ontario Tax Credit for Manufacturing and Processing (2022 and Later Tax Years) - Canada

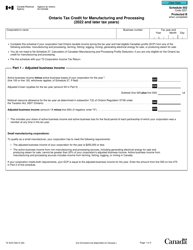

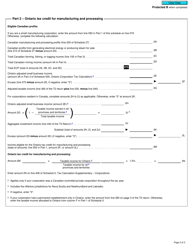

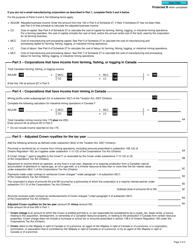

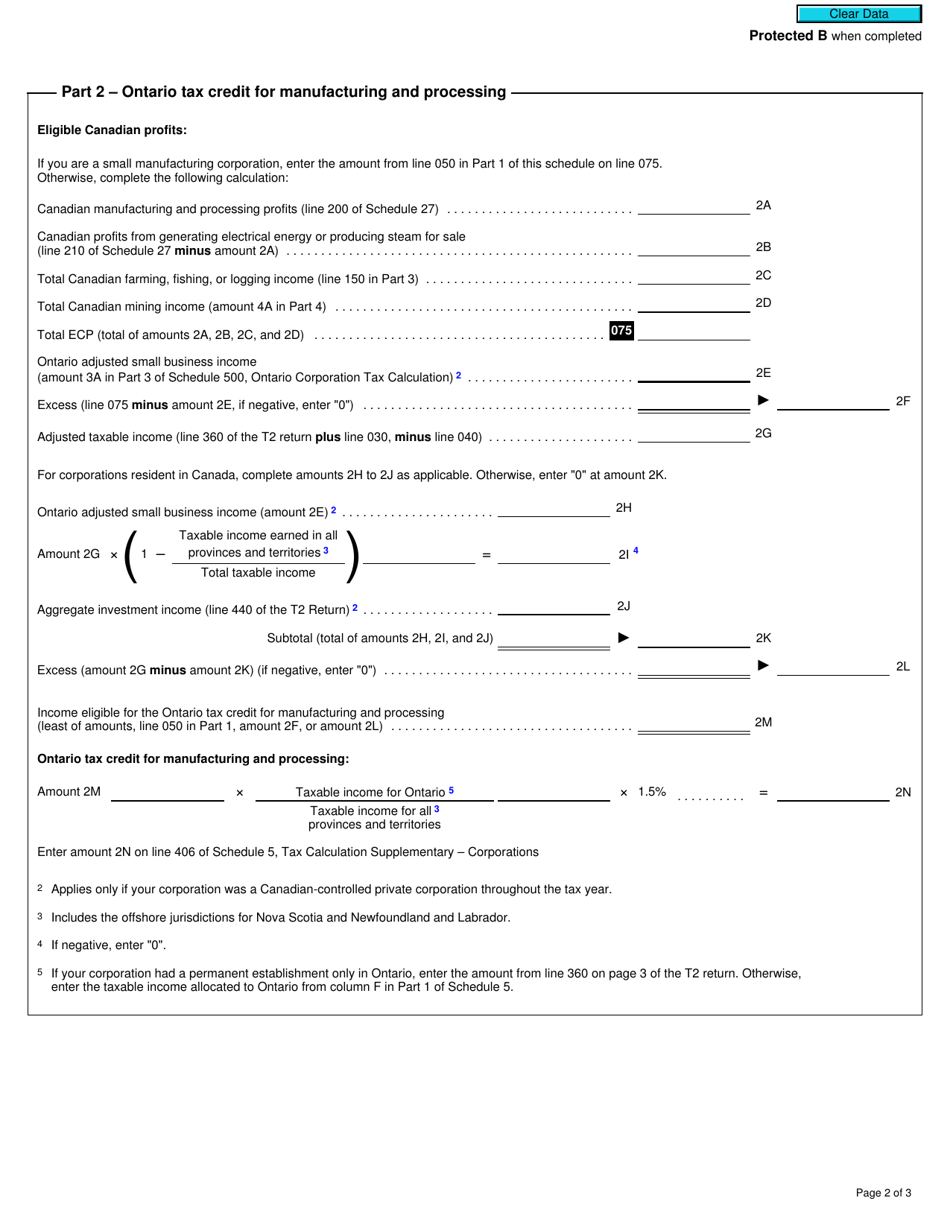

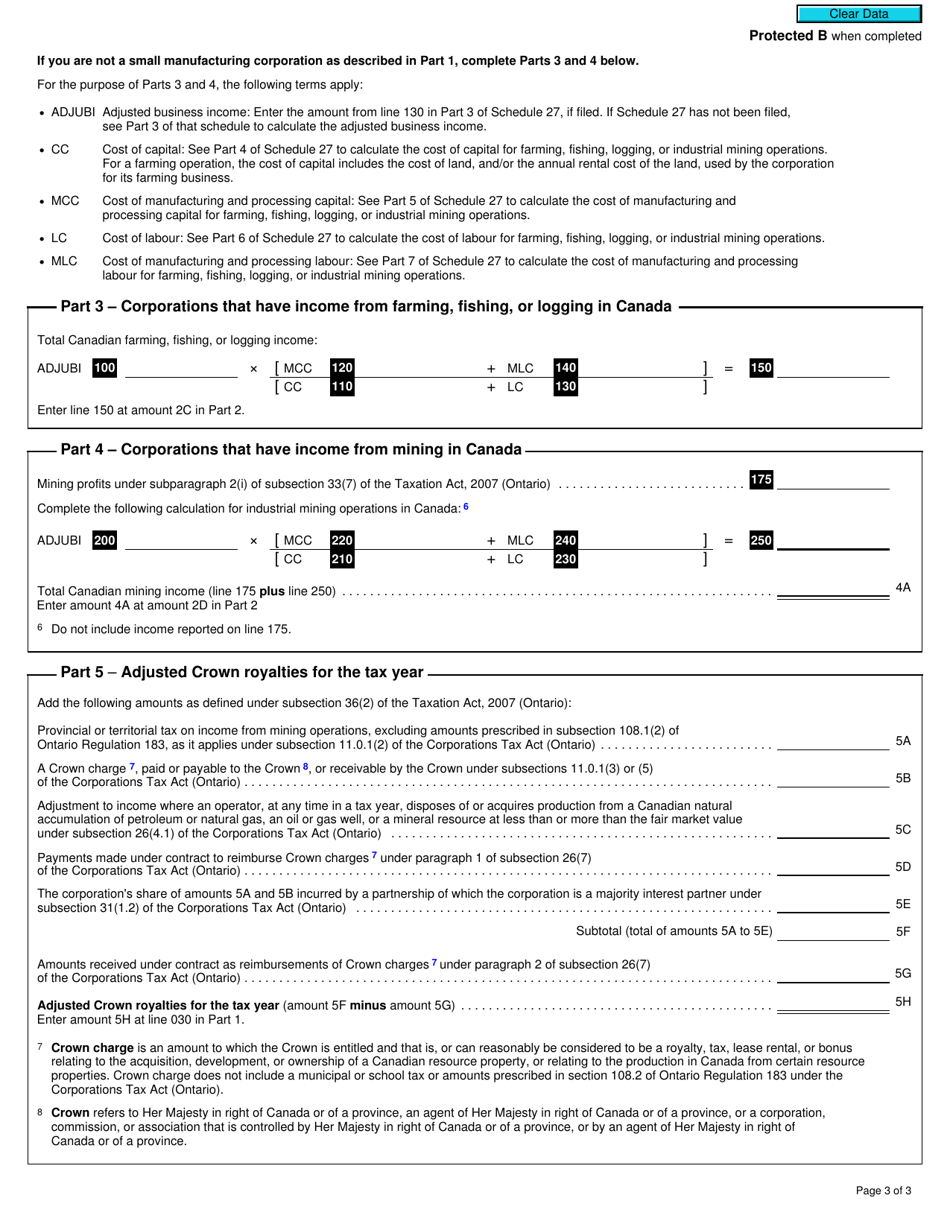

Form T2 Schedule 502 is a tax credit form in Canada specifically designed for the Ontario province. It is utilized by businesses engaged in manufacturing and processing activities to claim tax credits for eligible expenses incurred during the tax year. This form provides details about the expenses incurred and calculates the applicable tax credit.

The Form T2 Schedule 502 Ontario Tax Credit for Manufacturing and Processing is filed by corporations operating in Ontario, Canada.

Form T2 Schedule 502 Ontario Tax Credit for Manufacturing and Processing (2022 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 502?

A: Form T2 Schedule 502 is a tax form in Canada that allows businesses to claim the Ontario Tax Credit for Manufacturing and Processing.

Q: What is the Ontario Tax Credit for Manufacturing and Processing?

A: The Ontario Tax Credit for Manufacturing and Processing is a tax credit available to businesses in Ontario, Canada that are engaged in manufacturing or processing activities.

Q: Who is eligible for the Ontario Tax Credit for Manufacturing and Processing?

A: Businesses in Ontario that are engaged in eligible manufacturing or processing activities may be eligible for the Ontario Tax Credit for Manufacturing and Processing.

Q: What are eligible manufacturing or processing activities?

A: Eligible manufacturing or processing activities include activities such as assembling, fabricating, processing, or refining goods, as well as certain research and development activities.

Q: How do I claim the Ontario Tax Credit for Manufacturing and Processing?

A: To claim the Ontario Tax Credit for Manufacturing and Processing, businesses must complete and file Form T2 Schedule 502 with their corporate tax return.

Q: What tax years does Form T2 Schedule 502 apply to?

A: Form T2 Schedule 502 applies to tax years starting in 2022 and later.

Q: Are there any deadlines for filing Form T2 Schedule 502?

A: The deadline for filing Form T2 Schedule 502 is the same as the deadline for filing your corporate tax return, which is generally within six months of the end of your tax year.

Q: Does the Ontario Tax Credit for Manufacturing and Processing have any limitations?

A: Yes, there are limitations on the Ontario Tax Credit for Manufacturing and Processing, including restrictions on the types of eligible activities and a maximum credit amount that can be claimed.

Q: Is the Ontario Tax Credit for Manufacturing and Processing refundable?

A: No, the Ontario Tax Credit for Manufacturing and Processing is a non-refundable tax credit, meaning it can only be used to reduce the amount of taxes owed.