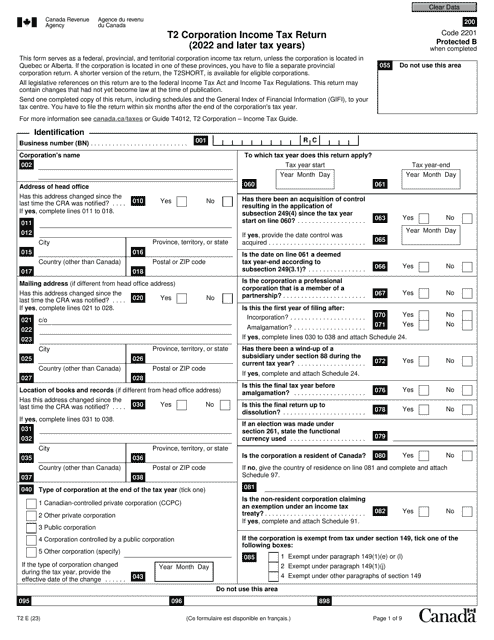

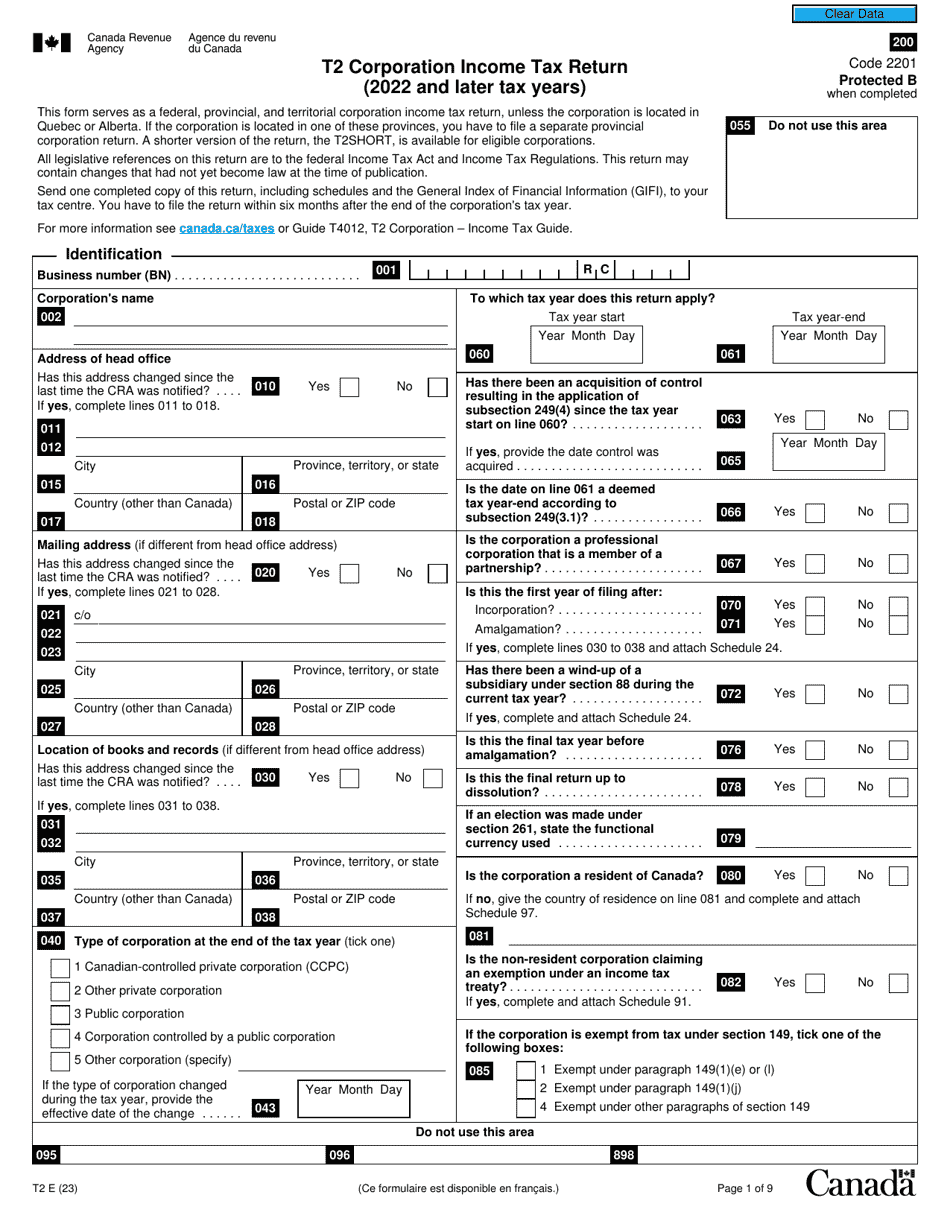

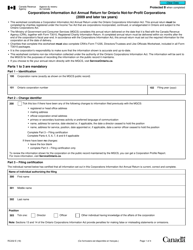

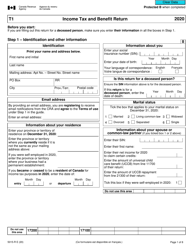

Form T2 Corporation Income Tax Return (2022 and Later Tax Years) - Canada

What Is T2 Corporation Income Tax Return?

Form T2, Corporation Income Tax Return , is the main statement Canadian corporations complete every year to report their income even if they eventually do not pay any tax. Whatever area of business your company is involved in and whatever sources of income you have had, you need to file this document on time either in paper form or electronically.

Alternate Names:

- T2 Corporate Income Tax Return;

- T2 Income Tax Return.

This form was issued by the Canadian Revenue Agency (CRA) on January 1, 2023 , with all previous editions obsolete. Download a fillable Corporation Income Tax Return via the link below. If your corporation has a loss or nil net income or you are eligible for tax exemption because it is a non-profit organization, you need to submit a simplified version of the general return: Form T2, Short Return.

How to Fill Out T2 Corporation Income Tax Return?

Follow these steps to prepare the T2 Form:

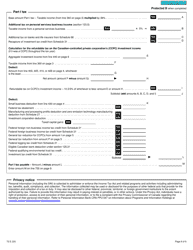

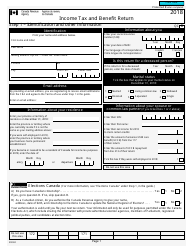

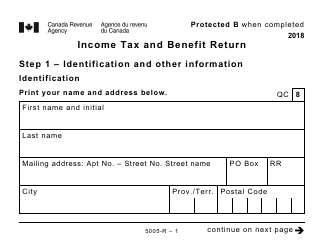

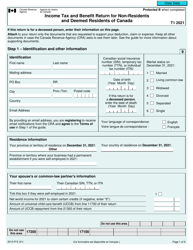

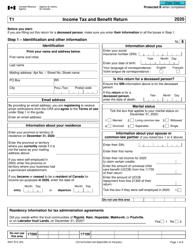

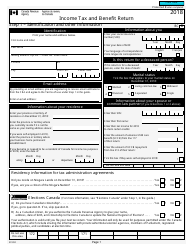

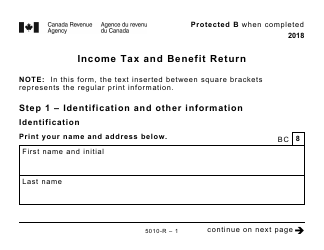

- Provide information about your business - its name, number, addresses, location of records and books, corporation type. Indicate which tax year you will describe in the return and answer whether there have been any drastic changes in the life of your company - for instance, you are filing for the first time after amalgamation or incorporation.

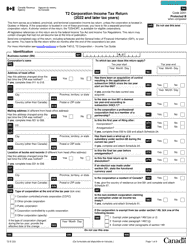

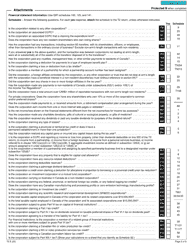

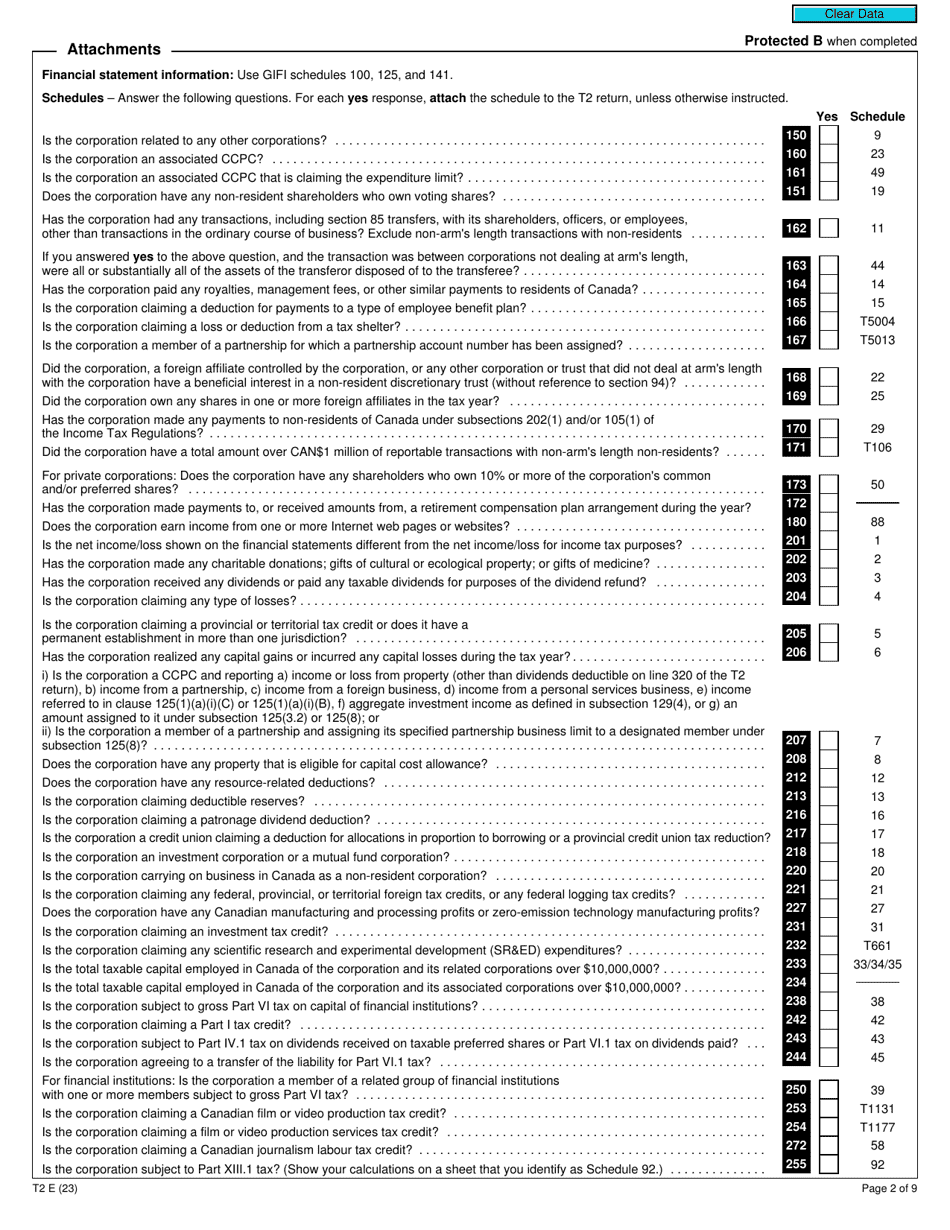

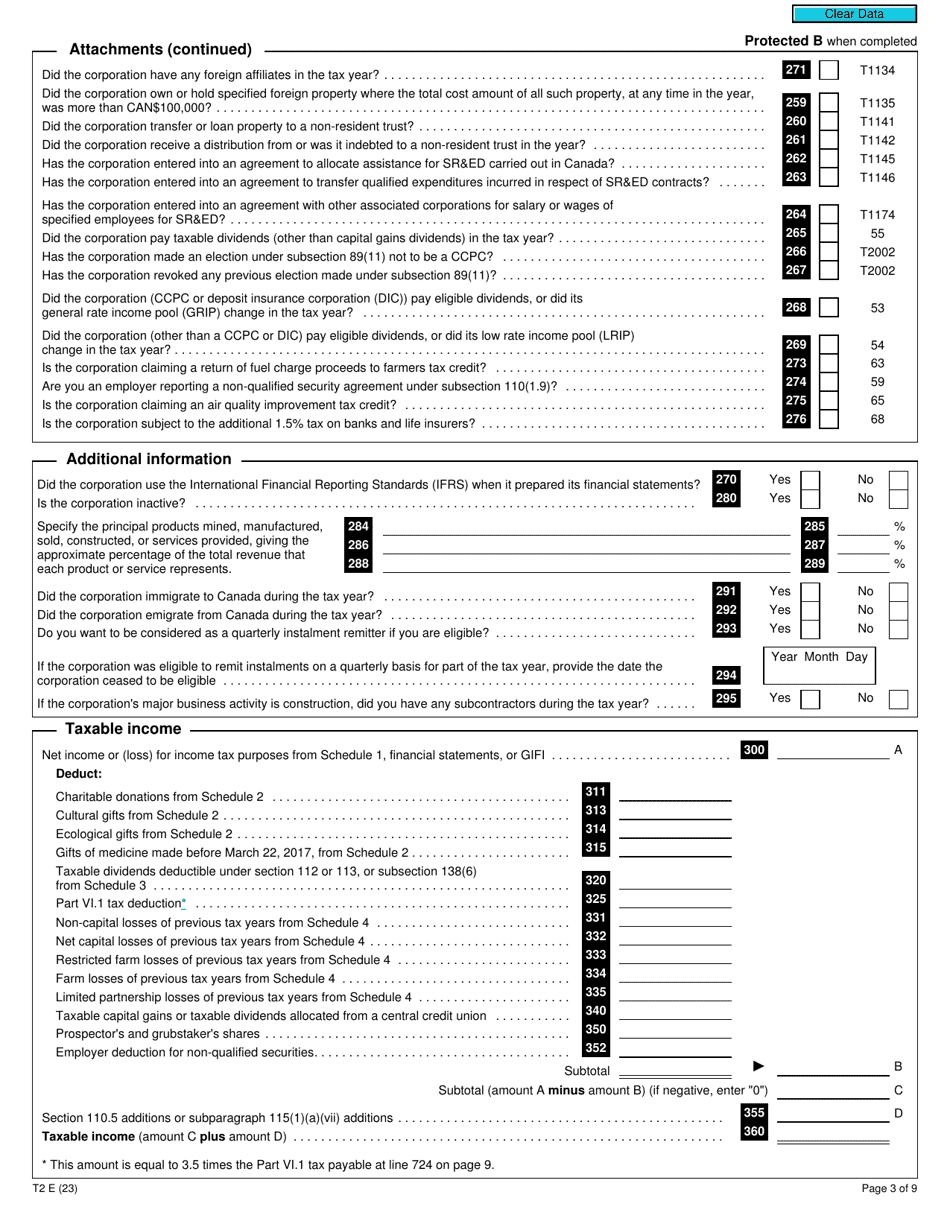

- Check the appropriate boxes to show whether you are eligible for various deductions and credits. If you had any agreements with other corporations or foreign affiliates in the reporting year, these facts must be reflected in the form. These answers depend on the type of business you are conducting - for example, if you have done scientific research, you may claim applicable expenditures on your return.

- If you used International Financial Reporting Standards to complete your financial statements, immigrated to or emigrated from Canada during the tax year, check the "yes" box.

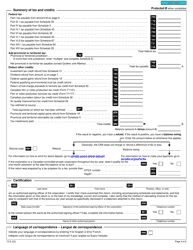

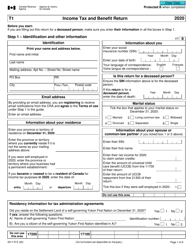

- Enter the taxable income you have received - you have to deduct donations, gifts, losses, capital gains, and shares from the amount you report.

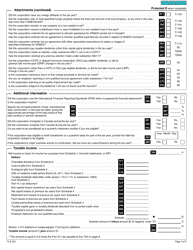

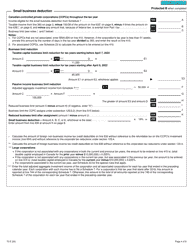

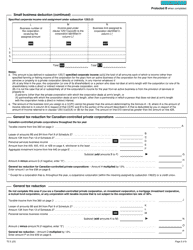

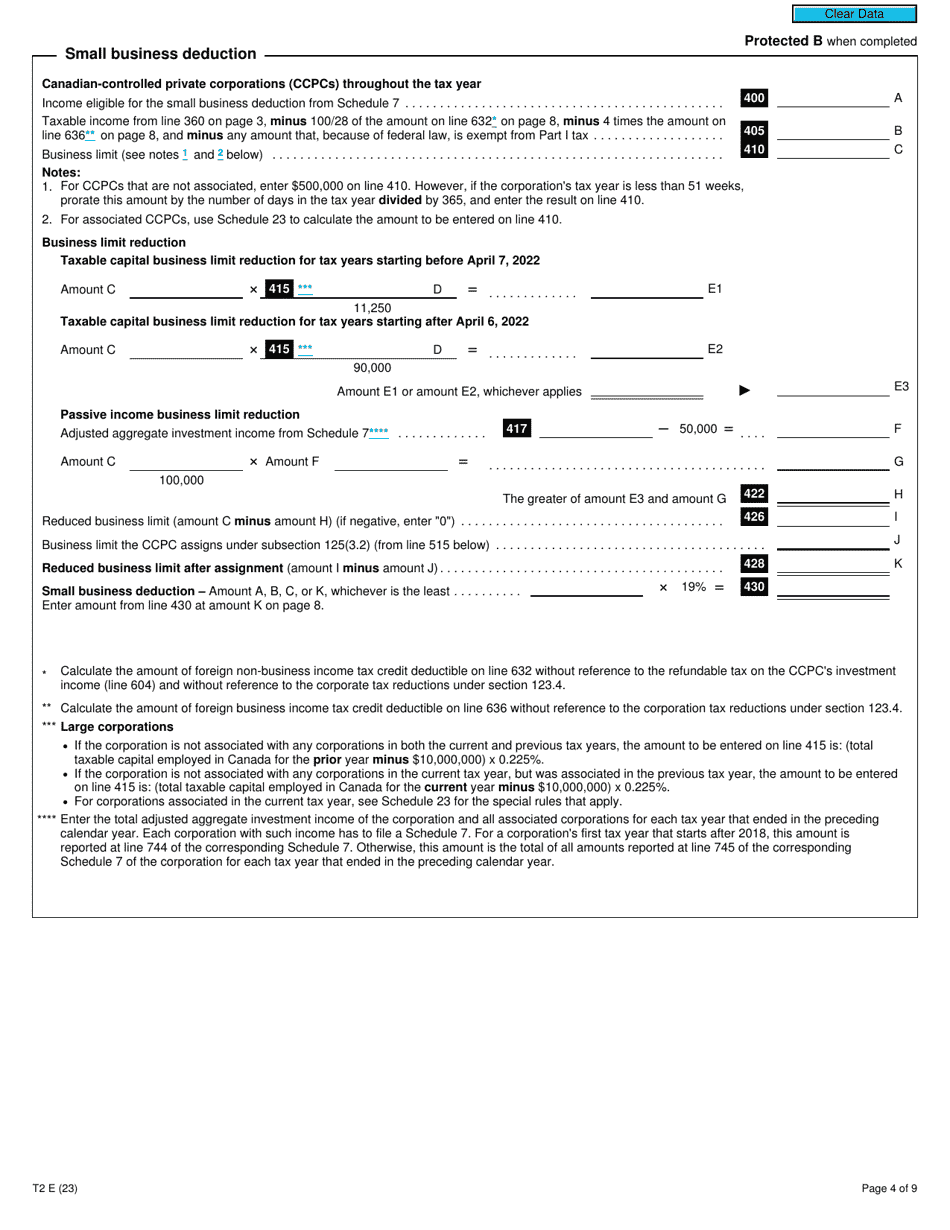

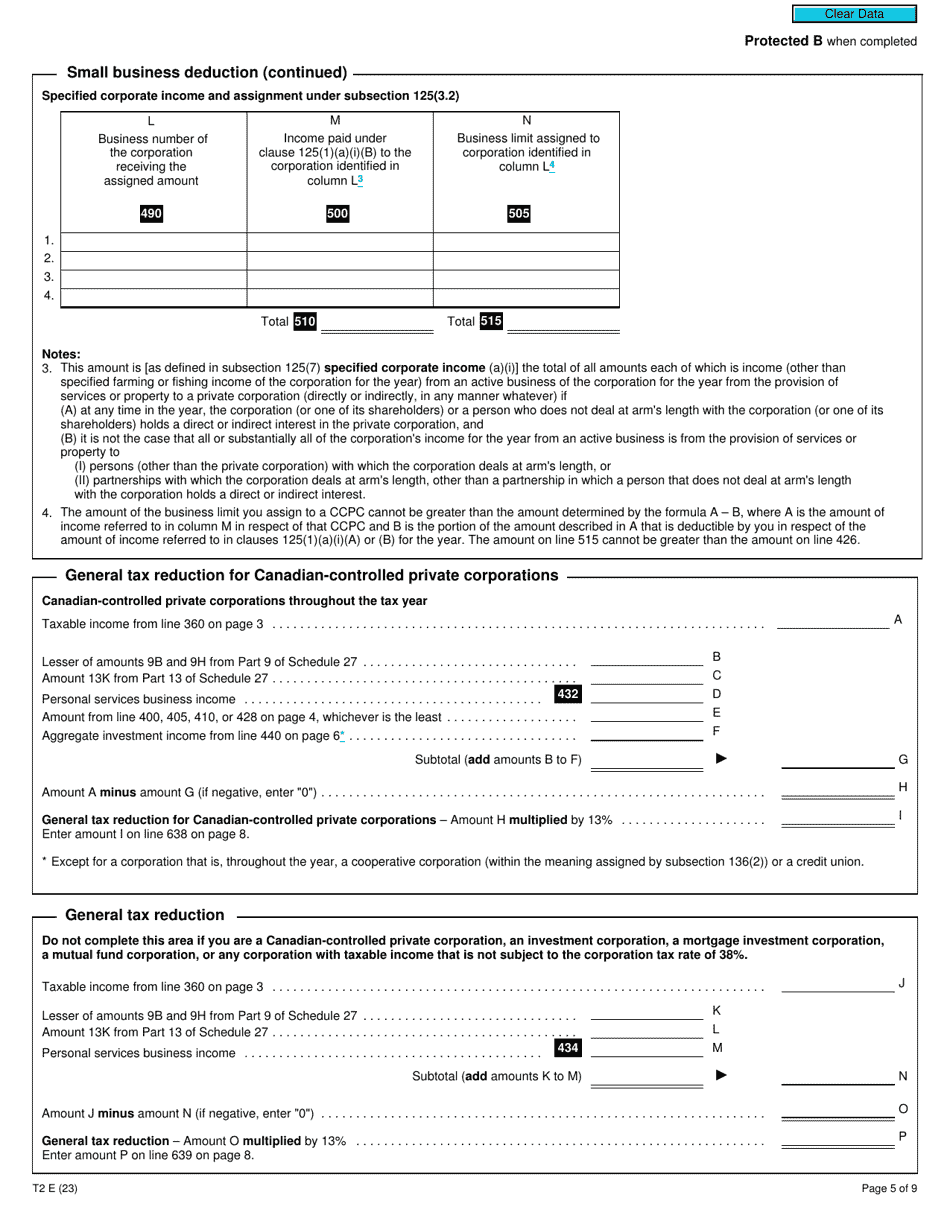

- Calculate the deduction if you own a small business. There are multiple formulas in the return - you need to record the numbers and compute the deduction amount yourself following the instructions.

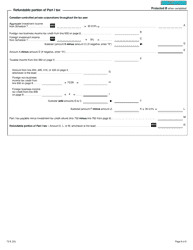

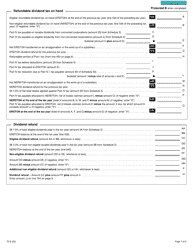

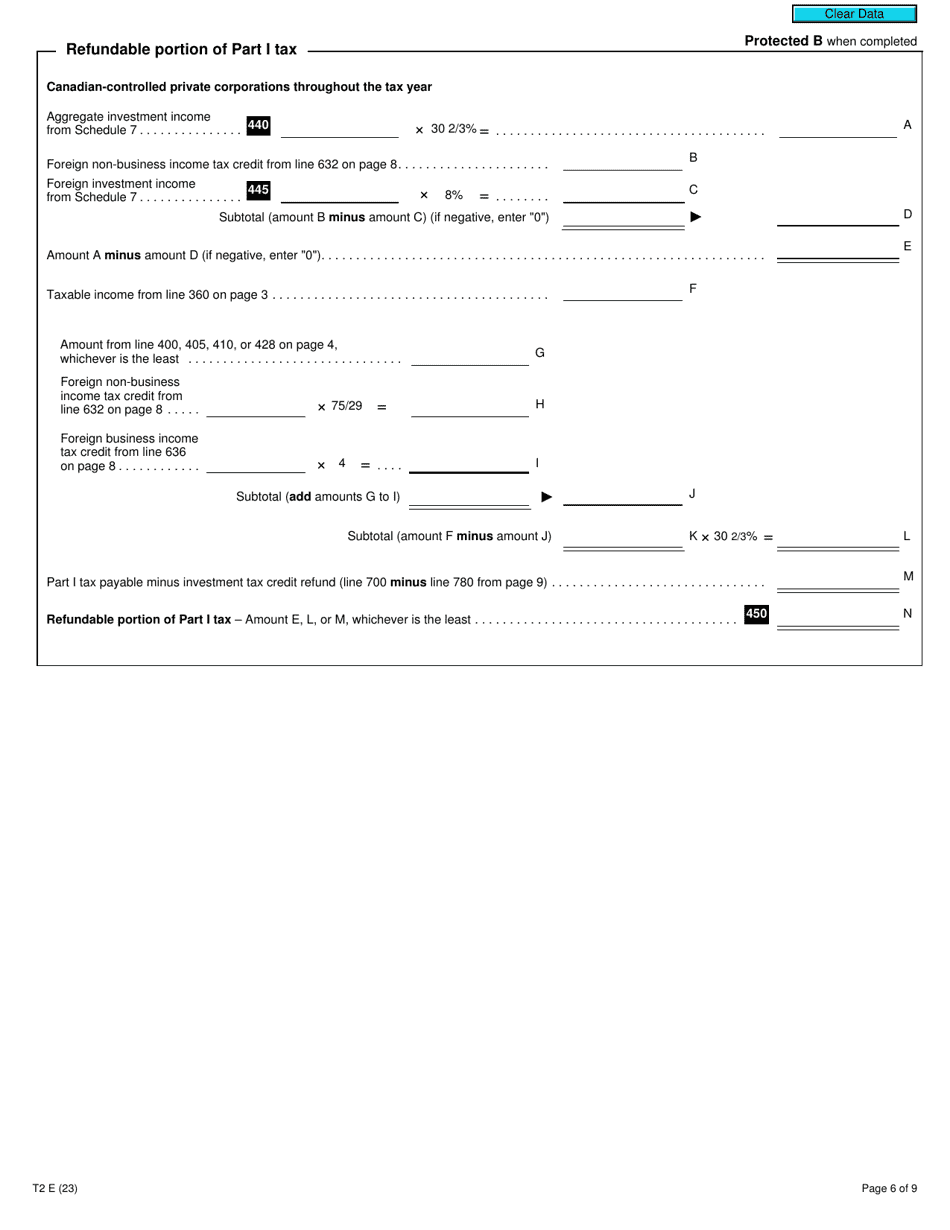

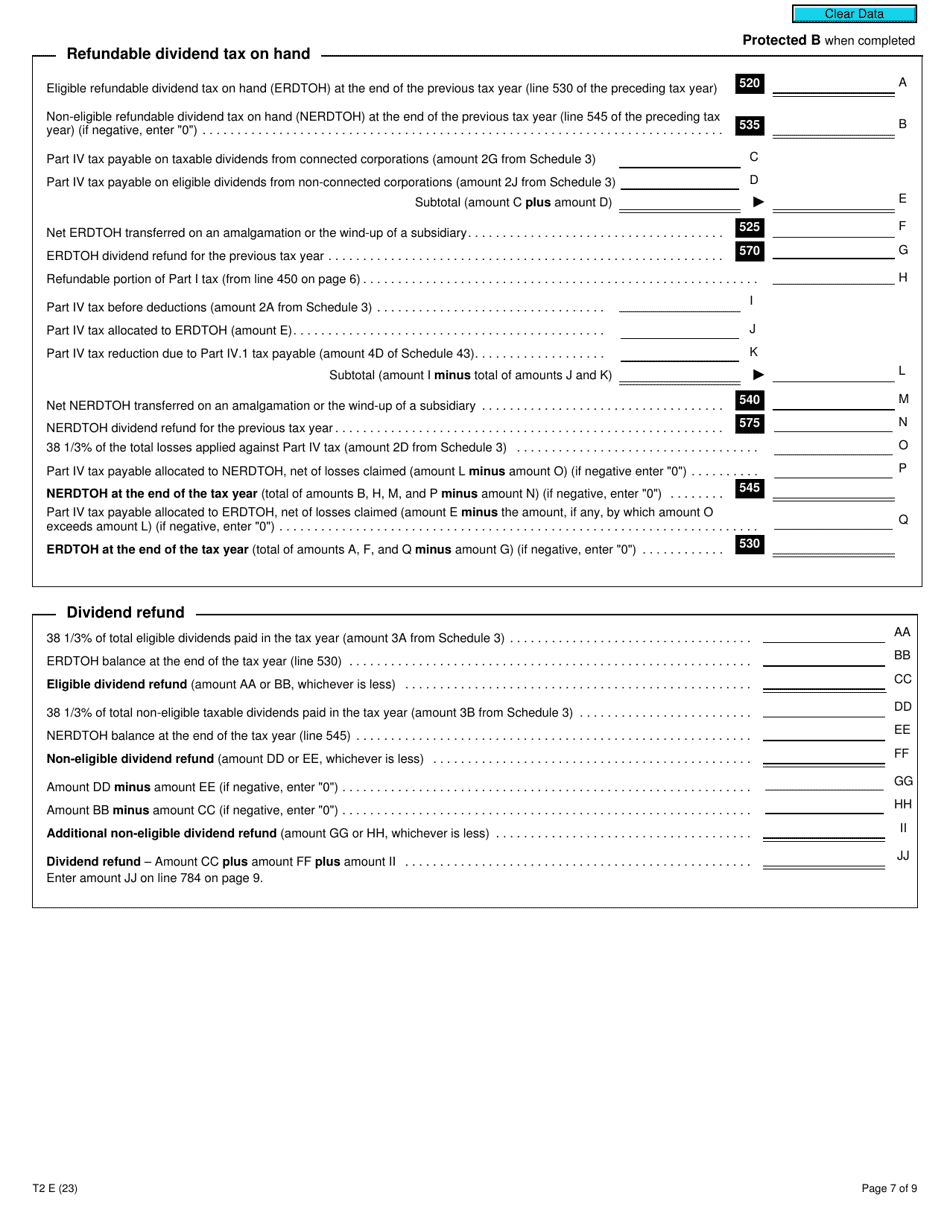

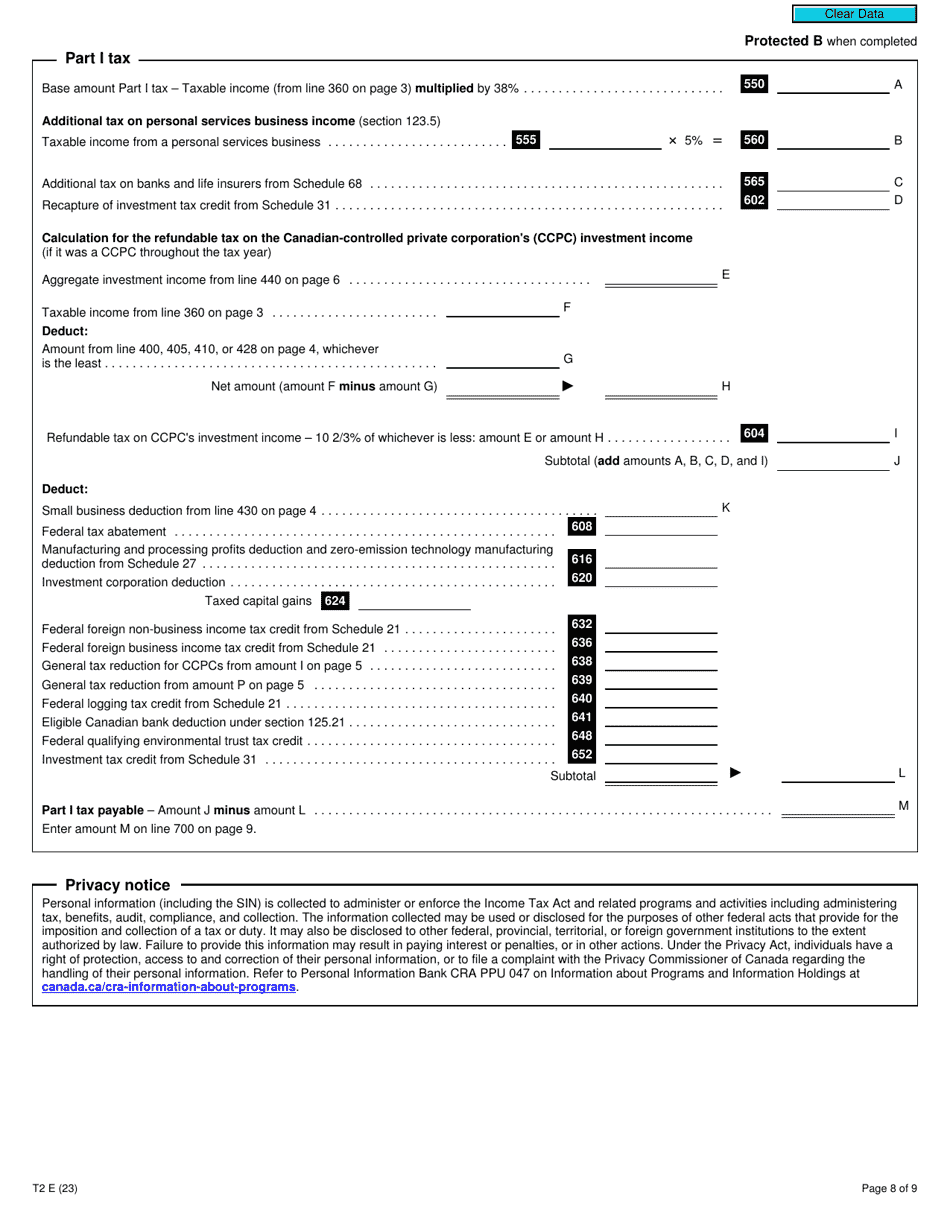

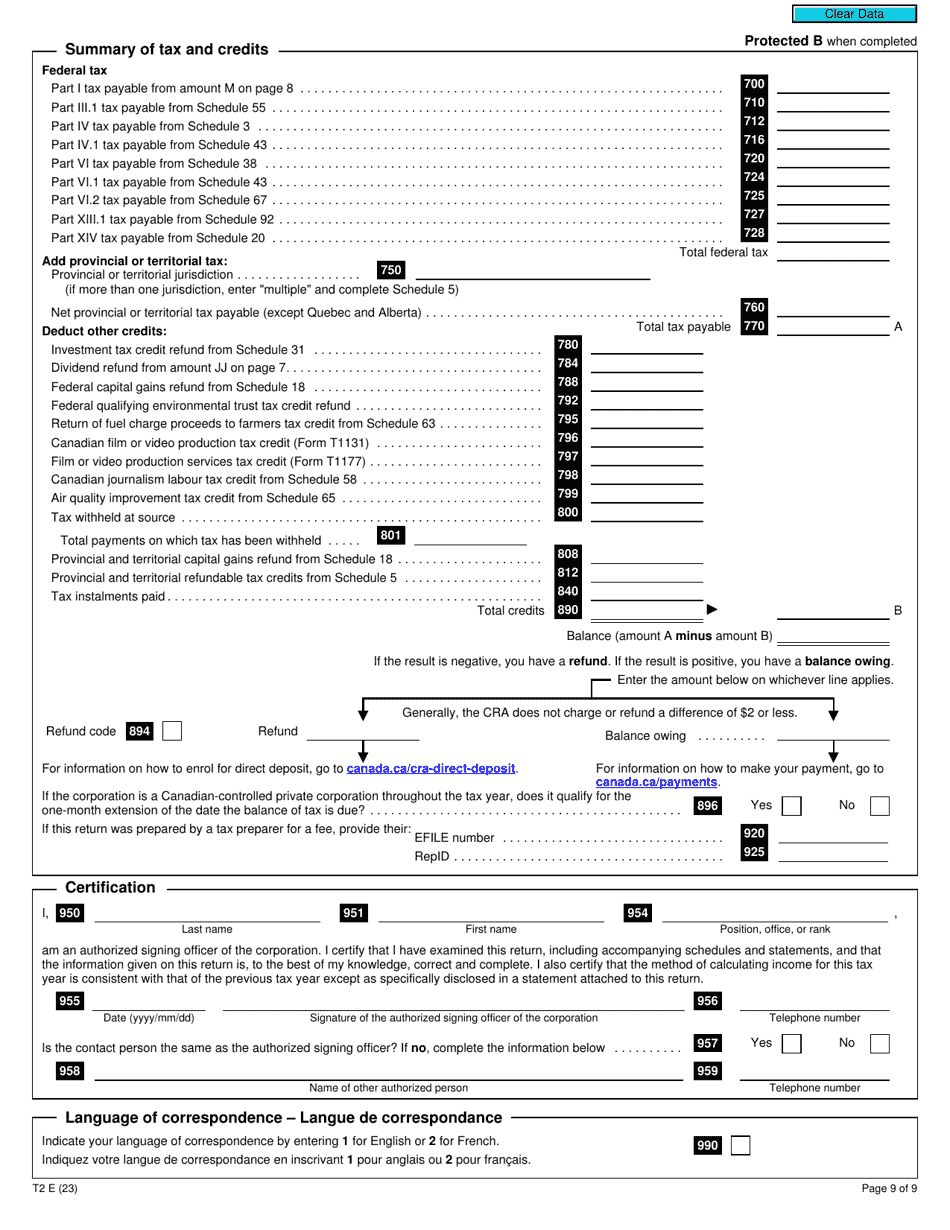

- Enter the amount of general tax reduction. Figure out the refundable portion of Part I tax if you manage a private corporation. Compute the refundable dividend tax on hand and the dividend refund for previous years. Calculate the Part I tax by multiplying your taxable income by 38%, apply the deductions, and find out the payable amount of Part I tax. Provide a summary of credits and tax. You need to enter the total federal tax, the amount of tax you will be paying, and the credits you are claiming.

- Confirm the statements in the return are true and complete, indicate your full name and position, add your contact details, sign and date the form.